Interview Prep Meeting

Francesca Ventura

Agenda

• Behavioral

• Accounting

• Valuation

• Enterprise value / Equity Value

• DCF

• M&A

• LBO

• Miscellaneous

Behavioral

• Walk me through your resume/tell me about yourself

• This should answer why ND/Finance/IB/why specific firm

• Essentially how everyone’s interview begins

• Tell a story, treat it like a movie / give it a plot

• Strengths/Weaknesses: have a relevant story

• Show progress in weaknesses

• Real weaknesses (“I work too hard” doesn’t count)

• What are the typical responsibilities of an analyst?

• Helpful hint: write out each line item on resume

• Interests—Make sure you can speak to each one

Other helpful behavioral tips

• Write out an answer to each behavioral question in the

guide

• Think 6 – 10 anecdotes that you can mold into an

answer for a variety of questions

• Practice your story in front of the mirror and record

yourself

• Should 2-2.5 min long (try not to go long, the best interviews

are conversational)

• Research the people you are interviewing with

beforehand

• Listen to their introductions, so you can ask them something

interesting/relevant when comes time for questions

Keep up to Date with News

• Resources

• Morning Brew

• Wall Street Journal

• Bloomberg (Gadfly)

• CNBC

• The Economist

• The more you know the better off you will be and

easier it will be to have a knowledgeable

conversation

Prep Guides and How to Use Them

▪ Guide Examples

▪ Vault guide – very basic, best for non-business majors – covers what you

absolutely need but no more

▪ Free from Career Center website

▪ iBankingFAQ.com – provides an overview of each area of technical

questions and shows how to think through them – business majors

▪ Free, blog-style website

▪ Breaking Into Wall Street – laundry list of 400 interview questions and

answers, gets as complex as you’d like

▪ Wall Street Oasis – a lot like BIWS but more concise

▪ Start with the basics

▪ Don’t just memorize – understand the answers that they give you

▪ Just as importantly – be able to verbalize the answers

Accounting Basics

▪ What are the 3 financial statements? Walk through them / how do they flow together

1. Income Statement

• Gives a company’s revenue and expenses

• Bottom line is Net Income for the period

2. Statement of Cash Flows

• Top line is Net Income

• Adjusts Net Income for non-cash expenses and working capital changes, then

lists cash flow from investing and financing activities

• Bottom line is company’s net change in cash for the period

3. Balance Sheet

• Shows the company’s assets, liabilities, and shareholders’ equity

• Change in cash from statement of cash flows incorporated into cash account

in assets

• Net income is included in retained earnings, a shareholders’ equity account

▪ What are some accounts on each statement?

▪ What is working capital?

▪ What is Net PPE?

Accounting Basics Cont’d

▪ If you were stranded on a desert island and could only pick 1 financial statement to

bring with you, what would it be?

▪ Always the statement of cash flows. Cash flows are the best way to analyze a

company’s actual performance – income statements and balance sheets use

accrual accounting, so they don’t always show the actual health of the

company and how much cash it is generating

▪ Cash flows are what you care about when you’re investing

▪ But what if I can bring 2 financial statements with me?

▪ Income Statement and Balance sheet – you can create the cash flow

statement from these two, so you’d essentially have all 3

▪ Note: Need B/S from current period and prior period

▪ What is EBITDA? Why do bankers use it?

▪ Earnings Before Interest, Taxes, Depreciation, and Amortization

▪ Proxy for cash flow

▪ Note: not a perfect proxy because it totally eliminates the cash flow that

goes to capital expenditures; this cash outflow (or inflow, if it’s a long-term

asset sale) can be sizeable

Accounting Basics Cont’d

▪ How is the Statement of Cash Flows structured? What is included in each?

▪ Cash Flow from Operating Activity

▪ Net Income

▪ + Depreciation/Amortization/non-cash gains or losses

▪ - Increase in current assets (A/R, Inv., prepaid expenses)

▪ + Increase in current liabilities (A/P, deferred rev, etc.)

▪ Cash Flow from Investing Activity (these are long-term investments, not

money from stock/bondholders)

▪ - Purchase of PPE

▪ + Sale of long-term investments

▪ Cash Flow from Financing Activities

▪ - Payment of Dividends

▪ - Debt paydown

▪ + Issuance of Common Stock / debt

Advanced Accounting Questions

▪ Some variation on:

▪ If I buy $X of PPE and the tax rate is X%, how does that affect the three

statements?

▪ What might change

▪ How do you fund the purchase of PPE? Cash/Debt? Equity? Both?

▪ What if you increase different asset accounts?

▪ What happens if the PPE breaks?

▪ What happens to the financial statements 1 or 2 years after the original

question?

▪ Do you need to include depreciation? Interest expense?

▪ Organize your thinking and prepare answers to the basic questions

Framework for Answers

▪ Hard question? Think through it (and answer it) this way

▪ Keep thoughts consistent and organized, which is good for both you and

the interviewer

▪ One statement at a time:

Income Statement

Cash Flow Statement

Balance Sheet

P Does the Balance Sheet Balance? ALWAYS check!

Net Income

Cash

Income Statement

▪ Work through the statement line by line

▪ What are the changes in revenue and costs?

▪ Only worry about what changes the statement

▪ Know what’s included and what’s not

▪ Ex: PPE is NOT an expense (remember?) but depreciation is

▪ Tax-affect any changes

▪ Always ask for tax rate, but it’s typically 40%

▪ Do these changes have a tax effect? (YES if it is included in EBIT)

▪ Ex: $10 of depreciation will decrease Net Income by $6

▪ Why? Because of the expense, firm has to pay government $4 less in taxes so

its cash position has increased $4 from what it would have been without the

depreciation

Income Statement

Cash Flow Statement

Balance Sheet

Net Income

Cash

Cash Flow Statement

▪ How has the top line (net income) changed?

▪ Think through each of the 3 sections

▪ If one section hasn’t changed, simply say “no changes in…” and move on

▪ Will often follow up with why did you make changes in cash flows?

▪ Depreciation is non-cash but it was deducted from net income and reduced taxes

▪ Interest expense not added back because it IS a cash expense

Income Statement

Cash Flow Statement

Balance Sheet

Net Income

Change in Cash

Balance Sheet

▪ How did cash balance change? Start with change in cash from CF statement

▪ Talk through the rest of the asset side

▪ Did current assets or PPE change (if you added depreciation expense, it did)?

▪ Liabilities + Shareholders’ Equity side

▪ Net Income will increase or decrease Retained Earnings

▪ Remember that this is the after-tax number

▪ Interest Expense is an expense, won’t change balance sheet

▪ Does it balance? Always check, and let them know you know it balances

Income Statement

Cash Flow Statement

Balance Sheet

Net Income

Cash

General Tips

▪ Use this method of thinking for any accounting question you come across

▪ More fool-proof than memorizing answers

▪ If you don’t know, talk through what you do know would change

▪ Ask about something you don’t know so you can continue answering the

question

▪ Don’t make it up

▪ If you screw up, say you screwed up and fix it

▪ Practice… knowing it is one thing, verbalizing it is another

Sample Accounting Questions

▪ What are the 3 financial statements, and how do they tie together?

▪ Why is the statement of cash flows important?

▪ Why isn’t EBITDA a good proxy for cash flows?

▪ If I incur $10 of depreciation expense, how does that affect the 3 financial

statements?

▪ If I paid cash for $100 of PPE on December 31, how does that affect the 3

financial statements now? Assume that the acquisition is financed with debt

▪ Assume that the acquisition is financed with debt, which includes a 10%

interest rate, and that the PPE is amortized at 10% per year

▪ How does that affect the 3 financial statements one year later?

▪ If I use cash to buy $100 of inventory, how does that affect the 3 financial

statements?

Valuation

▪ What are the ways to value a company? When do you use them?

▪ Here’s where you can get conceptual, sometimes strange versions of the

question (i.e. how would you value Facebook? An apple tree?)

▪ When do bankers use valuation?

▪ Pitch books and presentations, buy-side and sell-side acquisition advising,

LBOs, defense analyses

▪ Give the company an idea of how much outside buyers will pay for it

▪ Know the benefits and drawbacks to each methodology

▪ If you can do that, you can pretty much do all of this section

Valuation Methods

▪ Relative vs. Intrinsic methods

▪ 3 main valuation methodologies (be the most familiar with these 3)

1. DCF

2. Comparable companies

3. Precedent transactions

▪ How do you use these 3 methods to conclude value?

▪ “Football field” or “triangulate” the ranges you get for each

▪ Can put more weight on methods you prefer given a company’s profile

(example: for US Steel, more weight on DCF than multiples b/c multiples are

compressed in a recession)

▪ What are some other valuation methods you can use?

1. LBO (we’ll go over that later, but know that it will generally give you the

lowest value because a sponsor won’t pay much for a portfolio company)

2. Liquidity value (bad b/c only what you could get in a “fire sale” of all assets

– you’ll get a super low value that doesn’t include intangible assets, among

other things)

3. Replacement value (bad for similar reasons as liquidity value)

Importance of DCF

▪ After accounting questions, DCF-related questions are the most common:

▪ When you would use a DCF

▪ Walk me through a DCF

▪ How to derive free cash flows

▪ Calculating the discount rate (WACC)

▪ Levered / unlevered Beta

• Why would you do a DCF?

▪ Discounted cash flow analysis is one method of valuation

▪ Uses future free cash flows and discounts them at the WACC to arrive at a

present value

▪ Estimate of the cash you will receive in the future and how much you’d

pay for that right now

▪ Intrinsic value, not reliant upon market sentiment

Walk Me Through a DCF

▪ The stereotypical technical question

▪ If the interviewer doesn’t do this often, you will get this question

▪ Memorize the steps, formulas & how you’d say it (like your resume walk)

▪ Sample Answer

▪ The steps:

1. Project free cash flows for a given number of years

• 5 – 10 years (any more and your accuracy keeps getting worse)

• FCF = EBIT(1 - T) + D&A - Capex – ∆WC

• Unlevered Free Cash Flow – the value independent of the debt

(capital structure) because it does not include interest

2. Find the terminal value, or the value of the company beyond the projected

years in 1 of 2 ways

Walk Me Through a DCF

▪ Steps cont’d:

2. Find the terminal value, or the value of the company beyond the projected

years in 1 of 2 ways

• Gordon Growth method is just an assumption that the firm will grow

at a given rate in perpetuity

TV = [FCF

5

* (1 + g)] / (WACC – g)

• Terminal Multiple method takes a metric (usually EBITDA) from the

last projected year and multiply it by an appropriate EBITDA multiple

• Appropriate multiple found from comps, on LTM basis

3. Find the present value of the cash flows and terminal value

• Discount the cash flows at the firm’s weighted average cost of capital

4. Sum the discounted values to get the enterprise value

• Will be a follow-up question – because it includes the value available

to both equity and debt investors

• If you used levered FCF, would give you Equity Value, and you’d use

Cost of Equity as discount rate

Discount Rate

▪ WACC (Weighted Average Cost of Capital)

▪ Cost of capital is the opportunity cost to lenders and investors of a

company or a set of assets with a similar risk profile

▪ If I invest $100 in a company, I want to have a return at least as good

as the return I could get from a similar company, ETF, or index

▪ Weighted average is specific to a company’s capital structure and risk

profile

▪ WACC = k

e

(E/(E+D+P)) + k

d

(D/(E+D+P))(1 – T) + k

p

(P/(E+D+P))

▪ Know this formula!

▪ Why are things included, why aren’t they included

▪ Debt is tax deductible so don’t forget to take debt net of taxes

Components of WACC

▪ Cost of Debt

▪ Don’t forget – debt payments are tax deductible, so cost of debt is always

net of taxes

▪ Use the actual cost of debt

▪ Interest rates/yields on the company’s debt

▪ Not available or not traded? Use comp or credit rating

▪ Debt is almost always cheaper than equity

▪ Tax-deductible

▪ Debt has first claim on company’s assets – legally, debtholders are

the first to get paid in financial distress

▪ Cost of Preferred Stock

▪ Why is it separate? Not quite debt, not quite equity, so has unique cost

▪ Senior to common equity but subordinate to debt

Components of WACC Cont’d

▪ Cost of Equity

▪ How much are investors willing to pay for the equity risk of the company

▪ CAPM → Cost of Equity = Risk-free rate + (Beta) * (Market risk premium)

▪ Risk-free rate = 10-year treasury

▪ Because a treasury is the least risky asset available, you want to

see how much you could earn above that, or else you’d just put

all your money in treasuries

▪ Know current (~2.3%)

▪ http://www.treasury.gov/resource-center/data-chart-

center/interest-rates/Pages/TextView.aspx?data=yield

▪ Market proxy is S&P 500 because DJI only includes 30 largest cap;

S&P is most representative of the market

Beta

▪ Measures the riskiness of the stock relative to the broader market

▪ “Broader market” is typically the S&P 500, not the DJI

▪ Example: when Beta = 1.3, the stock will move 30% more than the market

▪ Β = 1 = market risk; B > 1 = riskier than market; B < 1 = less risky than market

▪ Beta is a historical measure – since it’s historical, it’s only an estimate of

what you’d get moving forward

▪ Levering/unlevering Beta

▪ Because the amount of debt a company has affects the riskiness of its

stock, a firm’s cost of equity is dependent on its capital structure

▪ Levered Beta is the Beta that is specific to a firm and its cap structure

▪ When using a comp’s Beta to find a firm’s k

e

you must strip out the impact

of its capital structure by unlevering Beta, then re-lever it according to the

capital structure of the firm you’re valuing

▪ B

U

= B

L

/ (1 + ((1 – T)*(Debt/Equity))

▪ You’ll be asked to repeat this formula back often

▪ If you know one, you know the other…

Questions We’ve Gotten

▪ This is where questions can start getting creative…

▪ Why do you use 5 or 10 years for DCF projections?

▪ How do you find the WACC?

▪ Why do you include preferreds?

▪ Why is debt cheaper than equity?

▪ How do you find the cost of equity? The cost of debt?

▪ How do you get to free cash flow from revenue? From cash flow from operations?

▪ Why do you have to unlever and re-lever Beta?

▪ How do you do that?

▪ Give me a company that would have a Beta > 1 and one with a Beta < 1. How about a

negative Beta?

▪ If you use levered free cash flow, what should you use as the discount rate?

▪ How do you calculate the terminal value?

▪ In the Gordon Growth method, what would be a good growth rate for a company?

▪ Would the cost of equity be higher for a small firm?

▪ How about the WACC?

▪ When does it stop being advantageous to have debt in the capital structure?

▪ What has a greater impact on a DCF valuation – a 10% change in revenue or a 1%

change in WACC?

Enterprise Value

▪ Enterprise Value (EV) is the value of the company attributable to all providers

of capital

▪ By contrast, Equity Value is the value of the company attributable to equity

holders (claims by debt holders, etc. are subtracted out)

▪ EV is not what you’d pay to acquire a company

▪ No one will accept an offer to buy their ownership in a company unless

you pay them a premium to their stake

▪ Typical premium? Depends on industry, health of the company, current

market conditions and deals going on

▪ You need to know EV b/c it’s how much an acquirer really pays for the

value of the company, including mandatory debt payments

▪ Another formula you’ll be asked a lot:

▪ EV = market cap + debt + preferred stock + minority interest – cash

▪ Know why you add or subtract each item and how to find each item

EV Components

▪ EV = market cap + debt + preferred stock + minority interest – cash

▪ How do you find market cap?

▪ Current share price times fully diluted shares outstanding

▪ Use fully diluted shares out because the market values the company based on diluted

shares

▪ How do you find fully diluted shares outstanding?

▪ “Fully diluted” includes basic shares and the dilutive effects of warrants and

options (don’t use it with convertibles b/c company doesn’t receive any cash)

▪ Use the Treasury Stock method

1. Find current options outstanding and weighted average strike price ( from 10-K)

2. For each class/group of options, subtract exercise price from current share

price, divide by share price, and multiply by options outstanding

3. If the exercise price is below the current price, add the number you get from #2

to basic shares to get diluted shares

▪ Why use the Treasury Stock method?

▪ When options are exercised, the company has to issue the set amount of

shares BUT the company will receive the exercise price from the option; will use

that to buy back some shares

▪ Company doesn’t want their stock to be too diluted

EV Components

▪ EV = market cap + debt + preferred stock + minority interest – cash

▪ How do you find the debt?

▪ Look on the balance sheet

▪ Note: PV of capitalized operating leases can be included as long as you

adjust your income statement (lease expense) accordingly

▪ Why subtract cash?

▪ Cash is a non-operating asset

▪ Cash is implicitly already included in equity value, so if you don’t subtract

▪ Note: you only subtract excess cash (up to 2% of revenue is operating

cash and is an operating asset of the company)

▪ What is minority interest and why add it?

▪ When a company owns >50% of another company, it must report the

financial performance of that other company as its own

▪ The company will fully consolidate 100% of the subsidiary’s financial

performance, even if it does not own 100%

Multiples Methods

▪ Multiples are market-based and therefore based on what people think of a

certain industry or type of company

▪ Relative measure

▪ Still have to do it because what the market thinks matters

▪ Use a multiple from a similar public company, apply it to yours to get a value

▪ In precedent transactions, use a transaction from a similar company, apply

it to yours to get a value

▪ Common multiples (can be used on almost any firm)

▪ EV / EBITDA, EV / Revenue, EV / EBIT, P / E, P / BV

▪ May be asked to use industry multiples

▪ EV / Shipment, EV / Site Visits

Multiples Methods Cont’d

▪ How would I find a good comparable company?

▪ Industry

▪ Size of company (look at financials)

▪ Profile of company (operations, can look at financial and operating ratios)

▪ How would I find a good precedent transaction?

▪ Same general criteria as comp companies

▪ Only in the last 1-2 years (multiples change over time)

▪ Difficult to find b/c not too many, but need to take into account anyways

because a buyer will definitely be paying attention to what others paid

▪ Multiples to use: Always compare apples to apples

▪ Can only compare total enterprise/unlevered values to each other and

only compare equity/levered values to each other

▪ Example: Equity Value / EBITDA can never be used because the

numerator is the value of the company available to only equity holders, but

the denominator, EBITDA, is available to all investors

▪ Same category: EBITDA, EBIT, Revenue, Enterprise Value

▪ The other category: Equity Value, earnings

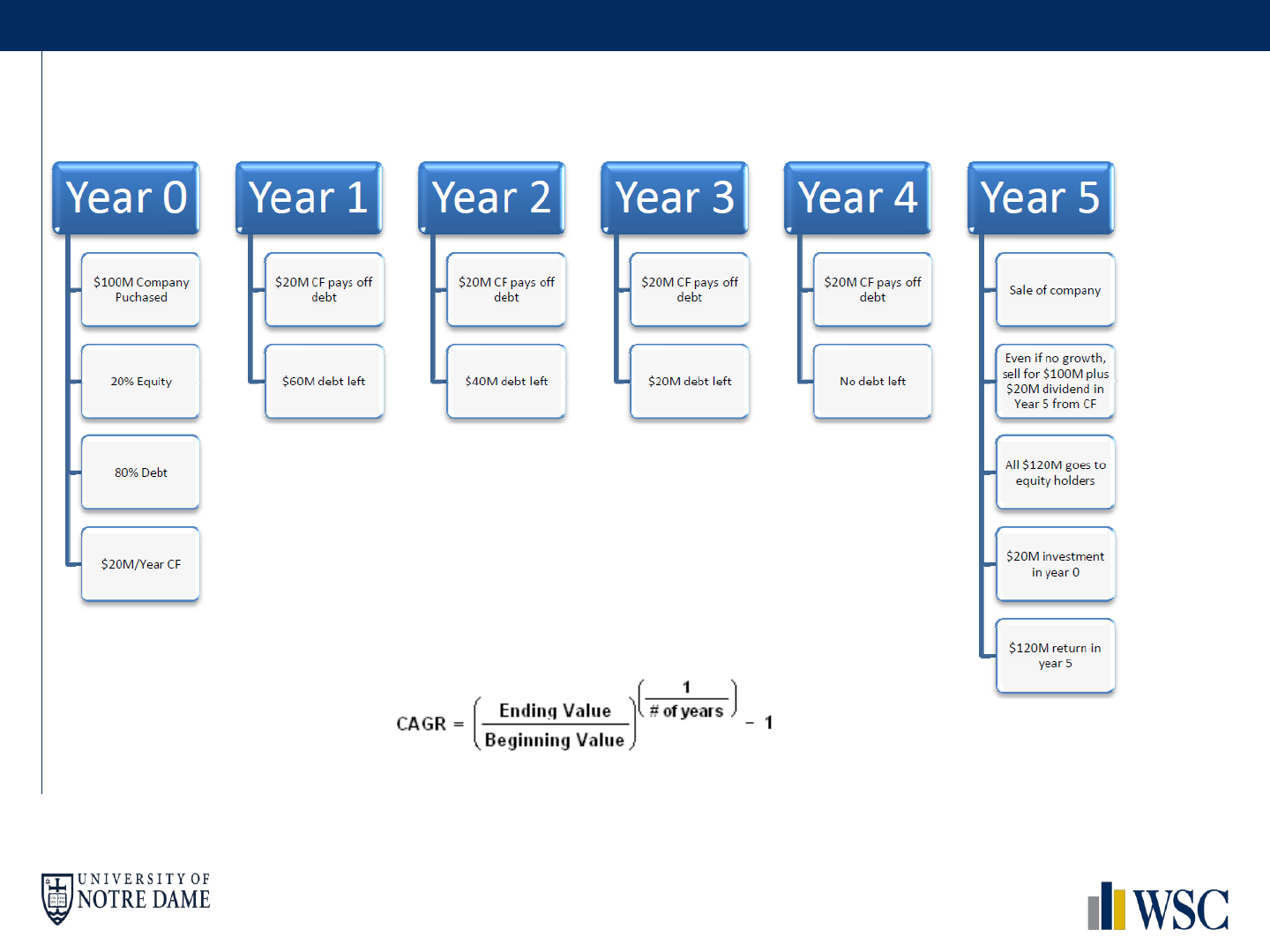

What is an LBO?

▪ LBO (leveraged buyout) is when a firm (typically a PE shop) uses a higher than

normal amount of debt to finance the purchase of a company.

▪ In current markets this mean financing with about 60-70% Debt or 6x-7x

Debt/EBITDA

▪ Normally happens with companies in the mature stage of their life-cycle

▪ Companies use the assets of the company being acquired as collateral for the

loan. When they are ready to sell the company, ideally the debt has been

partially or fully paid off.

▪ Since a smaller equity check was needed up front due to the higher level of

debt used to purchase the company, this can result in higher returns to the

original investors than if they had paid for the company with all their own equity

▪ Normally target returns around 25% → investors need to be compensated for the

illiquidity

Walk Me Through an LBO

1. Make some transaction assumptions (future operating performance, how will deal be

financed).

2. Create a table of Sources (existing cash, debt, PE equity—normally a plug) and Uses

(equity purchase price, debt refinance, refinancing fees). Sources must equal Uses.

▪ Typically, the amount of debt is assumed based on the state of the capital markets

and other factors, and the amount of equity is the difference between the Uses

(total funding required) and all of the other sources of funding

3. Change the existing balance sheet (new debt, goodwill, capitalized financing fees)

4. Create an integrated cash flow model for the company. Use EBITDA-Capex-∆NWC-

Cash Taxes-Cash Interest Expenses. This is affected by new balance sheet, debt, and

interest rate assumptions. Use Cash flow to pay down debt.

5. Make assumption about exit price (normally same multiple as entry). Calculate IRR

(Use CAGR). Also can use LBO to back out purchase price or calculate credit statistics.

Example

▪ CAGR Equation:

▪ In this case (120/20)^(1/5)-1 = 43% → Good Deal

Other LBO Questions

▪ How do you increase returns in an LBO?

▪ Entry/Exit Multiple

▪ Increase Leverage

▪ Operations (margin expansion, revenue growth)

▪ Why does increased leverage help returns?

▪ Debt cheaper than equity especially with tax shield

▪ All excess returns accrue to the equity, smaller equity value at first means greater

return at end

▪ Only amplifies magnitudes of bet doesn’t increase chance of being correct

▪ What are characteristics of a good LBO?

▪ Steady Cash Flows / Low Business Risk

▪ Limited need for ongoing Capex

▪ Opportunities for cost reductions / margin expansion

▪ High asset base (collateral for debt)

▪ Strong Management

▪ How is this different from a DCF

▪ Levered versus unlevered cash flows

▪ Intrinsic value versus return analysis

M&A and Related Questions

▪ M&A questions fall into 4 categories:

1. Recent M&A activity

• Talk about a deal that just happened

2. Motivations for acquisitions

• Why would a company acquire another, what are good

acquirers/targets

3. Accretion / Dilution

• What happens to an acquirer’s EPS and why

4. Goodwill

• What is it, how do you find it

1. Recent M&A activity – do you care about this stuff?

▪ Find a recent deal on Dealbook, etc. and know the general dynamics

going on with it and why the acquirer wanted to do the deal

▪ Know the multiples for it – total deal value ($$), type of payment (cash,

debt, stock), multiples (Xx EBITDA), and premium (x% of current share

price)

M&A and Related Questions

2. Motivations for M&A activity

▪ Synergies are the benefits that one company gets from buying another

▪ Cost synergies save you money

▪ Can close down overlapping locations/services

▪ Acquired company may have better productivity/systems

▪ Revenue synergies means that the company can make more money

with the addition of a new company

▪ Basically, combine sales of the two because you now have their

salesforce and customers

▪ In valuation, don’t put much emphasis on this – it’s too easy to

fudge

▪ When valuing, use the 3 (or 4, with LBO) valuation methods to decide

how much to pay

▪ Don’t forget to include the premium

▪ No one is going to sell their company for the current share price –

premium is like an incentive

▪ Premium is technically paying for the synergies

Questions?