Investment Banking Crash Course

February 1, 2020

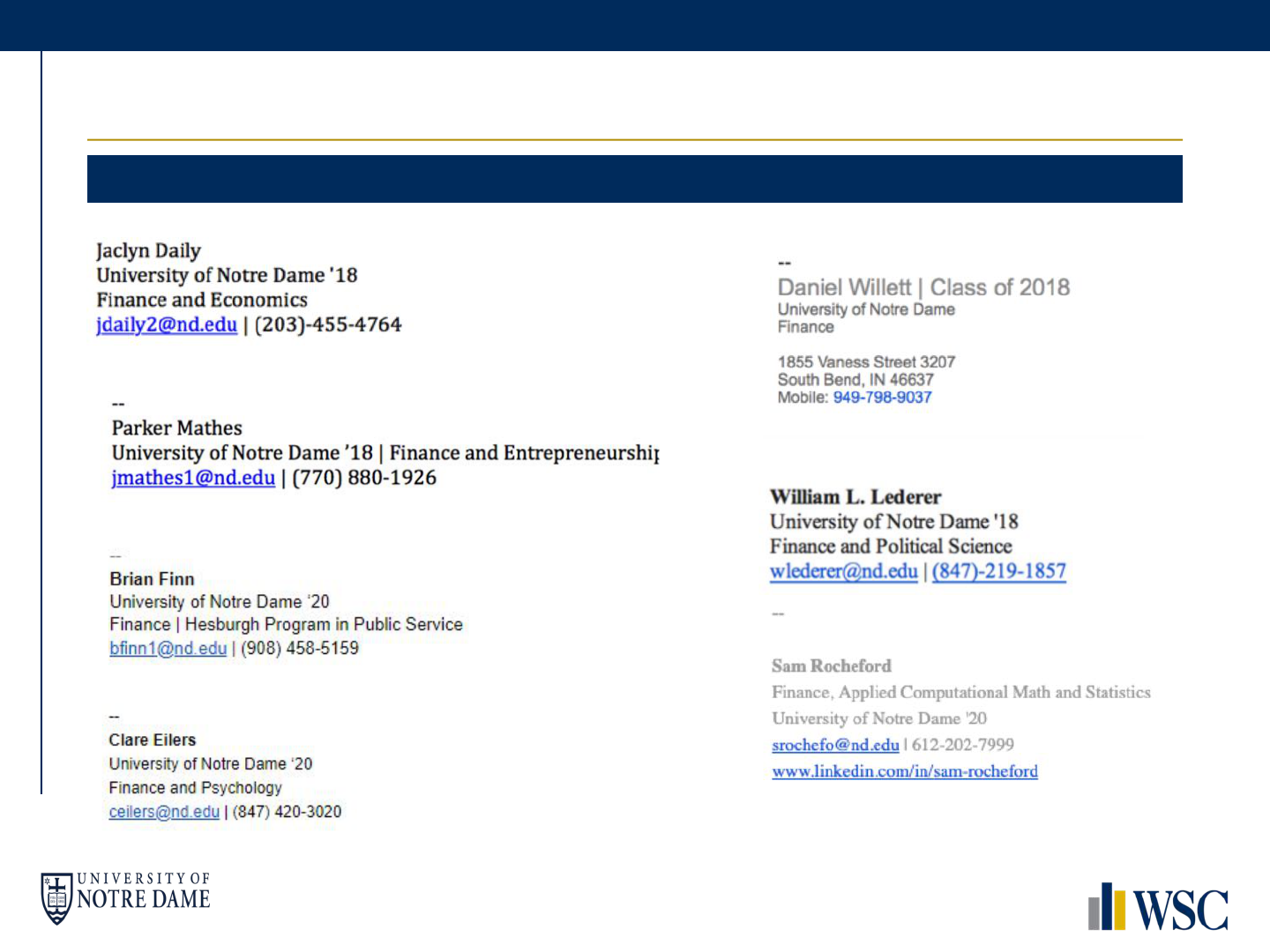

James Campion ([email protected])

Brian Finn (bfinn[email protected])

Bio – James Campion

• Senior Finance Major

• Los Alamitos, CA

• Alumni Hall

• President of Investment Club

• WSC VP of Undergraduate Outreach

• Work experience:

• Freshman year – Private Wealth Management at

Bryson Financial in Long Beach

• Sophomore Year – Private Equity / Investment

Banking Analyst at M3 Capital Partners

• Junior Year – Restructuring Investment Banking at

Lazard Chicago

• Accepted investment banking offer at Perella

Weinberg Partners in New York

Bio – Brian Finn

• Senior Finance Major, Minor: Hesburgh Program

in Public Service

• Basking Ridge, NJ

• Morrissey Manor

• WSC VP of Athletics Outreach

• Men’s Soccer Team

• Work experience:

• Freshman Year – Wealth Management at

Merrill Lynch

• Sophomore Year – Permira (private equity)

• Junior Year – Consumer & Retail Investment

Banking at J.P. Morgan

• Accepted investment banking offer at J.P. Morgan

in New York

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Agenda

• Why we are doing this?

• Overview of Investment Banking

• Overview of the recruiting process

• Recruiting tips

• Behavioral questions

• Technical questions

• Accounting

• Valuation

• Enterprise value / Equity Value

• DCF

• LBO

• Miscellaneous

Let’s Make This Interactive

• We know everyone says this but please ask

questions and make this interactive

• We are doing this to try and help all of you

• We have made our share of dumb mistakes and

want to limit the amount you will make

• There are no dumb questions!! (and if there

were it’s better to ask us)

Why IBCC?

• Pr oblem: Qualified ND students failing to secure

internship offers

• Solution: Expose them to the intricacies of the

recruiting process earlier

• Goals:

• To prepare ND students for the recruiting process and help them

obtain internships

• Address the expected timeline (Changes every year)

• Gain exposure to technicals in a classroom setting – save hours

pouring over guides

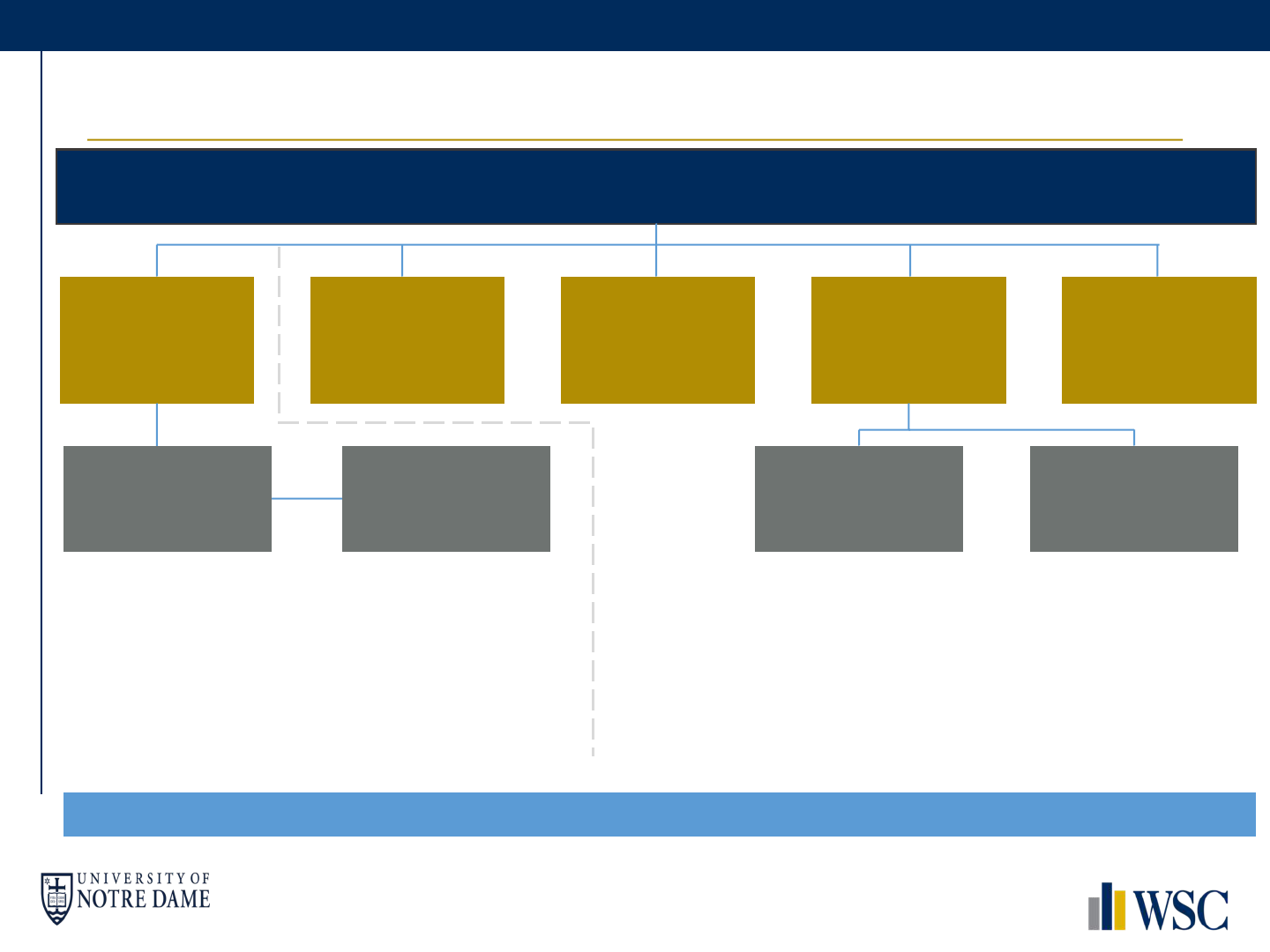

Careers on Wall Street

Typical Bulge Bracket Bank

Investment

Bank

Asset Mgt. /

Private Wealth

Research

Sales &

Trading

Corporate Bank

§ TMT

§ Industrials

§ Sponsors

§ FIG

§ Energy

§ LevFin

§ ECM

§ DCM

§ ABL

§ M&A

§ Equity

§ Investment grade debt

§ High-yield debt

§ Commodities

§ Currencies

Smaller firms will specialize in one or two of the above areas

Sales TradingProducts

Industry

Coverage

Careers on Wall Street, Continued

• Assists in large, complicated financial transactions. This may include advice as to how much a

company is worth and how best to structure a deal if the investment banker’s client is considering an

acquisition, merger or sale

• Coverage groups advise companies on a variety of strategic undertakings across a range of industries

• Private equity and hedge funds are alternative opportunities for top banking candidates

Investment Banking

• Sales works with portfolio managers and clients to pitch investment ideas and maintain relationships

• Traders act as market makers to provide liquidity in markets, while profiting on the bid-ask spread

• Capital markets is a hybrid of investment banking & Sales and Trading

Sales and Trading + Capital Markets

• Private Wealth Managers pitch investment ideas to individual investors

• Asset Managers design and execute a portfolio for individuals and institutions

Investment Management

• Provides financing for company’s operational needs

Corporate Banking

What is an Investment Bank?

§ Investment banks are agents that connect a company with the appropriate buyer, seller or

investor

§ Two main functions of an investment bank: raising capital and advisory

§ Raising capital

§ Debt issuance

§ Equity issuance, e.g. Initial Public Offerings

§ Advisory

§ Mergers & acquisitions

§ Strategic advisory

§ A coverage group works across all products, covering an industry or region

§ A product group works on specific product(s), across industries or regions

Investment Banking Groups

Product groups

• Product groups specialize in a specific

product

• Products can include equity shares,

convertible notes, high yield bonds,

investment grade bonds, loan syndications,

M&A advisory

• Common product groups include:

• Leveraged Finance (“Lev Fin”) – high-

yield bonds

• Debt Capital Markets (“DCM”) –

investment grade bonds

• Equity Capital Markets (“ECM”) –

equity shares

• Syndicate – syndicated bank loans

• Risk Management

• Mergers & Acquisitions (“M&A”)

• Restructuring

Industry groups

• Groups that cover a specific industry

• Determine the financial needs of a

company and match those needs with the

products that the bank can offer them

• Common industry groups include:

• Industrials

• Sponsors – e.g. hedge funds, private

equity firms

• Financial Institutions

• Technology, Media &

Telecommunication (“TMT”)

• Real Estate

• Consumer / Retail

• Healthcare

• Energy

Why do investment banking?

• Best way to begin your career and ‘hit the ground

running’

• Gain 5 years worth of experience in 2 years

• Phenomenal exit opportunities

• Private Equity, Hedge Funds, Venture capital

• Challenging & competitive work environment

• Work with intelligent people

Investment Banking is not for everyone

• 80-100+ hour weeks

• Often avoid having free weekends or protected

holidays

• Need to be a fast, intelligent worker with good

organization skills

• Be capable of handling multiple projects at

once

• Constant work stream

Bulge Bracket vs. Middle Market vs. Boutique

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Recruiting Basics

§ Wall Street Forum / Middle Market Banking Night / Independent Banking Day

§ Club-sponsored event in Spring to engage students and alumni across a group of major

bulge bracket, middle market, and boutique banks

§ Information sessions

§ One information session for every firm

§ Career Center website and Wall Street Club email blasts

§ Opportunities to network and learn more about firm culture

§ Networking

§ Critical to finding advocates at the firms you apply to and interview at

§ Wall Street Club provides advice and counseling on building relationships and leveraging

the Notre Dame alumni base

§ Virtual interviews

§ Wall Street Club provides interview preparation through mock interviews and technical

/ behavioral question workshops

§ Offer decision date: Late April – September

Overview of the Process

• Freshman / First Semester Sophomore

• Freshmen – get experiences outside of finance

• Build resumes

• Go on networking trips

• SIBC projects, investment club, read WSJ, morning brew, industry specific sites

• Do something (finance preferable, but going abroad and other jobs are totally cool)

• Second Semester Sophomore

• Work on interview prep (behavioral, technicals)

• Meet with juniors / seniors and start networking

• Find firms that you’re interested in and off the beaten path

• NETWORKING calls…reach out to ND alums at firms you are interested in

• Starting submitting applications

• Do an externship or internship over the summer (should be in the industry)

• Rising Juniors (Spring – Early Fall)

• Start hearing back from firms for first rounds and superdays

• Interview on campus or virtually

• Final decisions are made

Major Takeaways

• Put in the groundwork CALL!

• It’s a lot about effort - you need to make sure you network as much as

possible

• Find a point person that can help connect you to others / be your main

contact

• Ex) BAML first rounders often make > 6 calls

• Be organized

• Keep track of who you have called and who you want to call

• Reach back out to people you spoke to a long time ago to stay in touch

• The process is accelerated

• It’s going to be hard to do the work over the summer (especially with an

internship) but it will be impossible if you save it all to the end

• Procrastinating doesn’t work, start looking at the 400 question guide now

• FaceTime a friend to interview a friend if you need to

• Get a mentor that shares your interests

10 Commandments of Getting a Wall St. Job

1. Study! Keep your GPA up

a) 3.5 and above is ideal

2. Get involved in a variety of business clubs

a) SIBC, WSC, investment club

3. Do more than just finance!

a) As corny as it is, you have to be interested and interesting

4. Maintain up-to-date knowledge of markets, deals, and actually

learn

finance

a) Morning Brew, follow an M&A deal especially for networking calls

5. Make friends with upperclassmen working in finance

a) WSC mentor

6. Attend Information Sessions and visit the Career Center

7. Speak with ND Alumni or other personal contacts

8. Perfect your resume

9. Attain positions of leadership

10. Make yourself unique and perfect your story

The Notre Dame Advantage

• Resources provided through clubs

• Alumni network

• Notre Dame culture

• Humble, hardworking and easy to

get along with personality

• Strong technical skills and

internship / full-time performance

• Penn

• Harvard

• Georgetown

• Rice

• Dartmouth

• Stanford

• U Texas

• MIT

• William & Mary

• Princeton

• Northwestern

• Cornell

• Dartmouth

• Vanderbilt

• Indiana

Schools Recruited for Bulge Bracket

• Duke

• Yale

• UC Berkeley

• WashU

• NYU

• Columbia

• Michigan

• Notre Dame

• Columbia

• Brown

• UNC

• UCLA

• Williams

• John Hopkins

• U Chicago

What Makes Notre Dame Standout

Wall Street Forum + Firm events

• Most bulge bracket banks will be represented at

the WSF and similar events this semester

• Banks typically bring a few MDs, VPs, Associates,

Analysts

• Networking events will follow the WSF or a firm

event

• Talk to the analysts, try to get a business card

• Some are invite only

• Be tactful at reaching out post-event

• Everyone else will be doing the same

• Try to stand out from the pack

Dress Code for Interviews & Events

• Most events will have a dress code in the description

so follow that

• If you overdress you will stand out and if you underdress

you will stand out

• With that said, can always dress down (i.e. take off a tie)

• For interviews, you should always go business formal

• Guys: tie with matching belt color

• Girls: blazer with nice flats

• If you are confused, then ask an older person

Starting now…

• Attend as many firm recruiting events on campus as possible

• Wall Street Forum

• Meet with seniors and juniors while they are still on campus

• Set up a meeting with Bob Rischard

• Finance career advisor, helps with resumes and recruiting, and advice on where you start

• Get involved with business clubs

• WSC, SIBC, JIFFI, Unleashed investing, SWC, investment club

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Why Network?

Statistics show that only 10% to 20% of

jobs are ever published or posted—which

means that 80% to 90% of jobs remain

hidden in the job market. For this reason,

networking remains the number one job

search strategy.

Why Network?

Why Network?

Networking is complimentary to your

academic performance

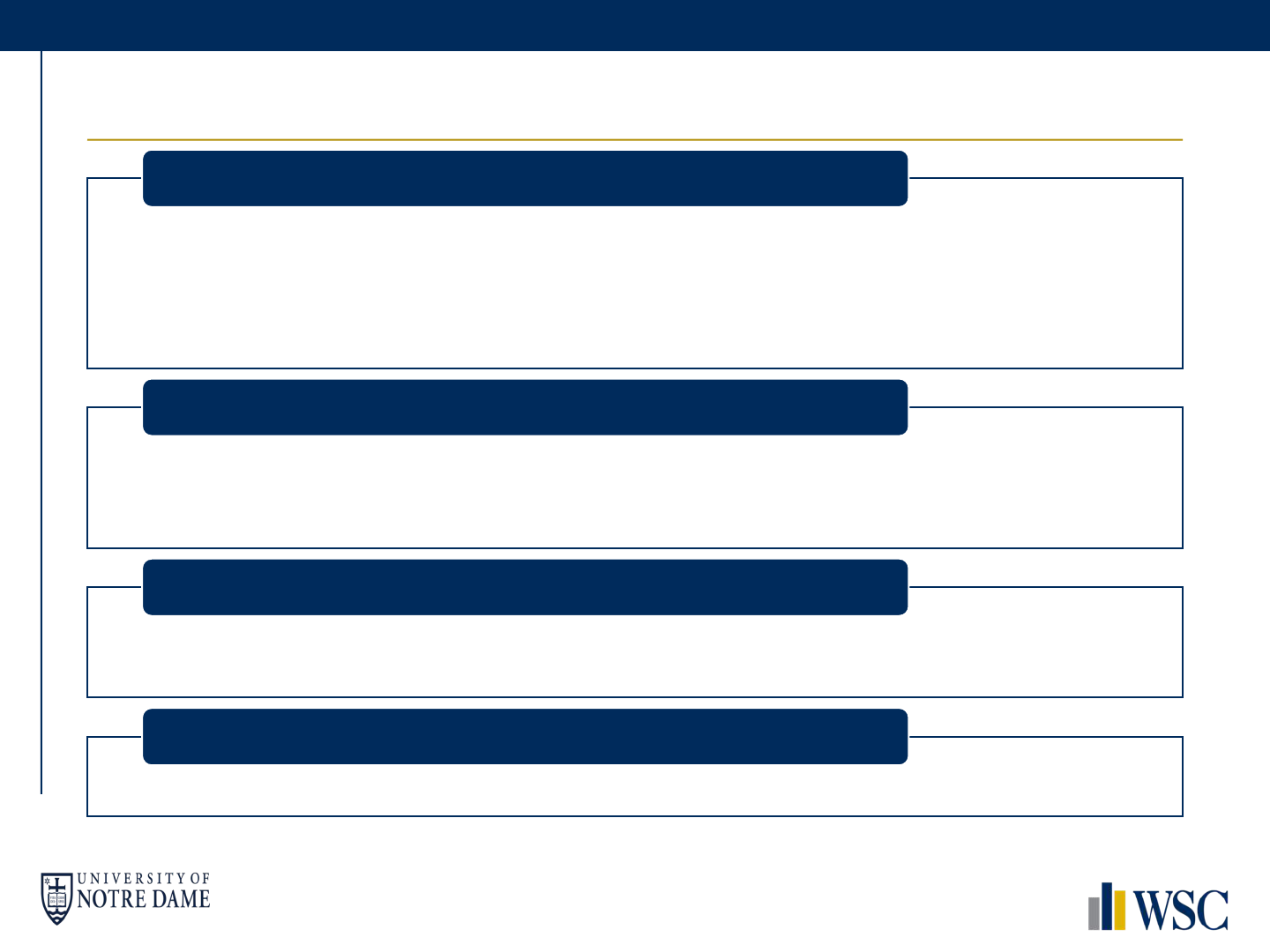

Networking

1

Be Prepared

• Define what information you need and what you are trying to accomplish

by networking

• Your purpose in networking is to get to know people who can provide

information regarding careers and leads

• Some of the many benefits of networking include increased visibility

within your field, propelling your professional development, finding suit-

able mentors, increasing your chances of promotion, and perhaps finding

your next job

Networking

2

Be Targeted

• Identify your network

• For some, “I don’t have a professional network I don’t know anyone,” may

be your first reaction

• You can start by listing everyone you know who are potential prospects:

family members, friends, faculty, neighbors, classmates, alumni, bosses, co-

workers, and community associates

• Attend meetings of organizations in your field of interest and get involved

• You never know where you are going to meet someone who could lead you

to your next job

Networking

3

Be Professional

• Ask your networking prospects for advice—not for a job

• Your networking meetings should be a source of career information,

advice, and contacts

• Start off the encounter with a firm handshake, eye contact, and a warm

smile

• Focus on asking for one thing at a time Your contacts expect you to

represent yourself with your best foot forward

Networking

4

Be Patient

• Be prepared for a slow down after you get started

• Stay politely persistent with your leads and build momentum

• Networking is like gardening: You do not plant the seed, then quickly

harvest

• Networking requires cultivation that takes time and effort for the process to

pay off

Networking

5

Be Focused on Quality—Not Quantity

• In a large group setting, circulate and meet people, but don’t try to talk to

everyone

• It’s better to have a few meaningful conversations than 50 hasty

introductions

• Don’t cling to people you already know; you’re unlikely to build new

contacts that way

• If you are at a reception, be sure to wear a nametag and collect or exchange

business cards so you can later contact the people you meet

Networking

6, 7, and 8

• Be Referral-Centered

• The key is to exchange information and then expand your network by obtaining

additional referrals each time you meet someone new

• Be sure to mention the person who referred you

• Be Proactive

• Stay organized and track your networking meetings

• Keep a list of your contacts and update it frequently with the names of any leads given

to you

• Send a thank-you note or email if appropriate

• Ask if you can follow up the conversation with a phone call

• Be Dedicated to Networking

• Most importantly, networking should be ongoing

• You will want to stay in touch with contacts over the long haul—not just when you need

something

• Make networking part of your long-term career plan

Break Time

Let’s meet back up in 5 mins

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Emails

Types of Emails

Introductory

• Key is subject line

• Be specific – “ND Sophomore Interested in BAML”

• Initial introduction sent by a Notre Dame student

• Typically sent to analysts and associates who are ND alum

• Be careful emailing higher employees like MDs or VPs

• Can be blind in nature

Follow-up

• Email sent to individuals with whom you have communicated in the past

• Can be either informative or interrogative

Thank you

• Sent to individuals after phone calls, networking events, interviews

Introductory Emails

Good or Bad?

Hi,

I am interested in working for you. What does the process look like? Let me

know

Michael Scott

Introductory Emails

Good or Bad?

John,

By way of introduction, my name is Michael Scott and I am a junior finance major at Notre

Dame. I have spoken with James Smith and Jack Marks in the past few weeks as well as other

Goldman Sachs analysts at the Wall Street Forum, and they suggested that I reach out to you. I

am very interested in investment banking at Goldman Sachs and I wanted to ask if you had time

in the next week to speak over the phone about your experience at the firm as well as the

recruiting process.

I am sure you are very busy, and I appreciate any time you may have to speak over the phone.

I have attached my resume for your reference.

Have a great rest of your week.

Best,

Michael Scott

Introductory Emails

Title

John,

Hi John,

Good Morning John,

Good Afternoon John,

Johnny,

Yo John,

Hey John,

Hi,

Hey,

Yo,

Etc……

Introductory Emails

Your Introduction

By way of introduction, my name is […….] and I am a junior finance major

at Notre Dame.

My name is [….] and I am a junior finance major at Notre Dame.

What are Good Elements in this Email?

John,

By way of introduction, my name is John Jones and I am a junior finance major at Notre Dame. I

have spoken with James Smith and Jack Marks in the past few weeks as well as other Goldman

Sachs analysts at the Wall Street Forum, and they suggested that I reach out to you. I am very

interested in investment banking at Goldman Sachs and I wanted to ask if you had time in the

next week to speak over the phone about your experience at the firm as well as the recruiting

process.

I am sure you are very busy, and I appreciate any time you may have to speak over the phone.

I have attached my resume for your reference.

Have a great rest of your week.

Best,

Michael Scott

Introductory Emails

How should they know you?

John,

By way of introduction, my name is John Jones and I am a junior finance major at Notre

Dame. I have spoken with James Smith and Jack Marks in the past few weeks as well as

other Goldman Sachs analysts at the Wall Street Forum, and they suggested that I reach

out to you. I am very interested in investment banking at Goldman Sachs and I wanted to ask if

you had time in the next week to speak over the phone about your experience at the firm as well

as the recruiting process.

I am sure you are very busy, and I appreciate any time you may have to speak over the phone.

I have attached my resume for your reference.

Have a great rest of your week.

Best,

Michael Scott

Introductory Emails

Why are you emailing them?

John,

By way of introduction, my name is John Jones and I am a junior finance major at Notre Dame. I

have spoken with James Smith and Jack Marks in the past few weeks as well as other Goldman

Sachs analysts at the Wall Street Forum, and they suggested that I reach out to you. I am very

interested in investment banking at Goldman Sachs and I wanted to ask if you had time

in the next week to speak over the phone about your experience at the firm as well as the

recruiting process.

I am sure you are very busy, and I appreciate any time you may have to speak over the phone.

I have attached my resume for your reference.

Have a great rest of your week.

Best,

Michael Scott

Introductory Emails

Resume

John,

By way of introduction, my name is John Jones and I am a junior finance major at Notre Dame. I

have spoken with James Smith and Jack Marks in the past few weeks as well as other Goldman

Sachs analysts at the Wall Street Forum, and they suggested that I reach out to you. phone. I am

very interested in investment banking at Goldman Sachs and I wanted to ask if you had time in

the next week to speak over the phone about your experience at the firm as well as the recruiting

process.

I am sure you are very busy, and I appreciate any time you may have to speak over the

I have attached my resume for your reference.

Have a great rest of your week.

Best,

Michael

Sample Emails – To an analyst/associate

Hi Victoria,

My name is Brian Finn, and I am a current sophomore Finance and Political Science major at Notre

Dame. Dan Delfico recommended that I reach out to you to connect before the J.P. Morgan firm-wide

event next week. I am interested in investment banking at J.P. Morgan, and would love to hear a little bit

about your experience working there so far. Do you have a few minutes to speak on the phone before

the event next week? If not, no worries at all.

Thanks a lot, and I look forward to hearing back from you! My resume is attached below for reference.

Best,

Brian Finn

Notre Dame Class of 2020

Introductory Emails

Sign off—VERY IMPORTANT

Thanks,

John

Best,

John

Best Regards,

John

Introductory Emails

Email Signature

Formality

• It is better to err on the side of being too formal

• Even if you have a great conversation with someone

you should not be calling them “dude” or “bro”

• Emails last forever

• You will need to be professional on the job so

practice doing so now

Review of Email

• Be formal, take it seriously

• First impressions are important- no typos

• Put in the name of the person last to the email so you do not accidentally send

• Be respectful

• Be knowledgeable about the firm and role

• Show your interest

• Try to work your way up the totem pole if given the

opportunity

• Always start with analysts

• Talk mostly to analysts where you can be slightly less

formal

IMPORTANT RE: EMAILS

• DO NOT COPY & PASTE EMAILS

• Analysts can tell when you do – fonts will be different

• Also makes you repeat mistakes

• READ & RE-READ

• Sending a glaring mistake will look bad and likely whiff your

chance of a phone call

• SPREAD OUT YOUR EMAILS

• Do not email multiple analysts at one firm at once

• They will discuss their emails — trust us

• DO NOT SEND THE SAME EMAIL

• Even if you spread out emails, sending the exact same thing to

multiple people at a firm is also risky

• Use slight variations and personalize

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Phone Call

• Sample questions (talking to analyst or associate)

• How do you like living/working in (NY/CHI/SF) ?

• What group are you in?

• Why did you choose to do IB?

• Why did you choose (insert bank) ?

• What have you enjoyed most about working at (insert bank)?

• Try to be creative and think of something others are

not asking

• This does not mean ask weird questions!

• Sample questions (talking to someone more senior)

• What has made you stay on at (insert bank)?

What to Talk About

DON’T FOCUS THE TALK

EXCLUSIVELY ON

FINANCE….THESE PEOPLE

DO THAT 24/7

Phone Call DO NOT List

• ASK HOW MUCH THEY MAKE

• ASK EXACTLY HOW MUCH THEY WORK

• Can beat around the bush and ask about work-life

balance and firm perks

• Talk about drinking and partying / incriminating

material

• Ask about the impact of interest rate hikes on

debt capital markets

• Ask incredibly specific market related questions

• The analysts already spend enough time doing

their job and would rather talk about other

more important things

Phone Interview Cheat Sheet

• Make your own prior to the call

• Some cycled questions and some personal / firm specific

• Focus on what questions you will ask

• Have some technical information if you feel necessary

• If you have SIBC on your resume, be prepared to discuss it

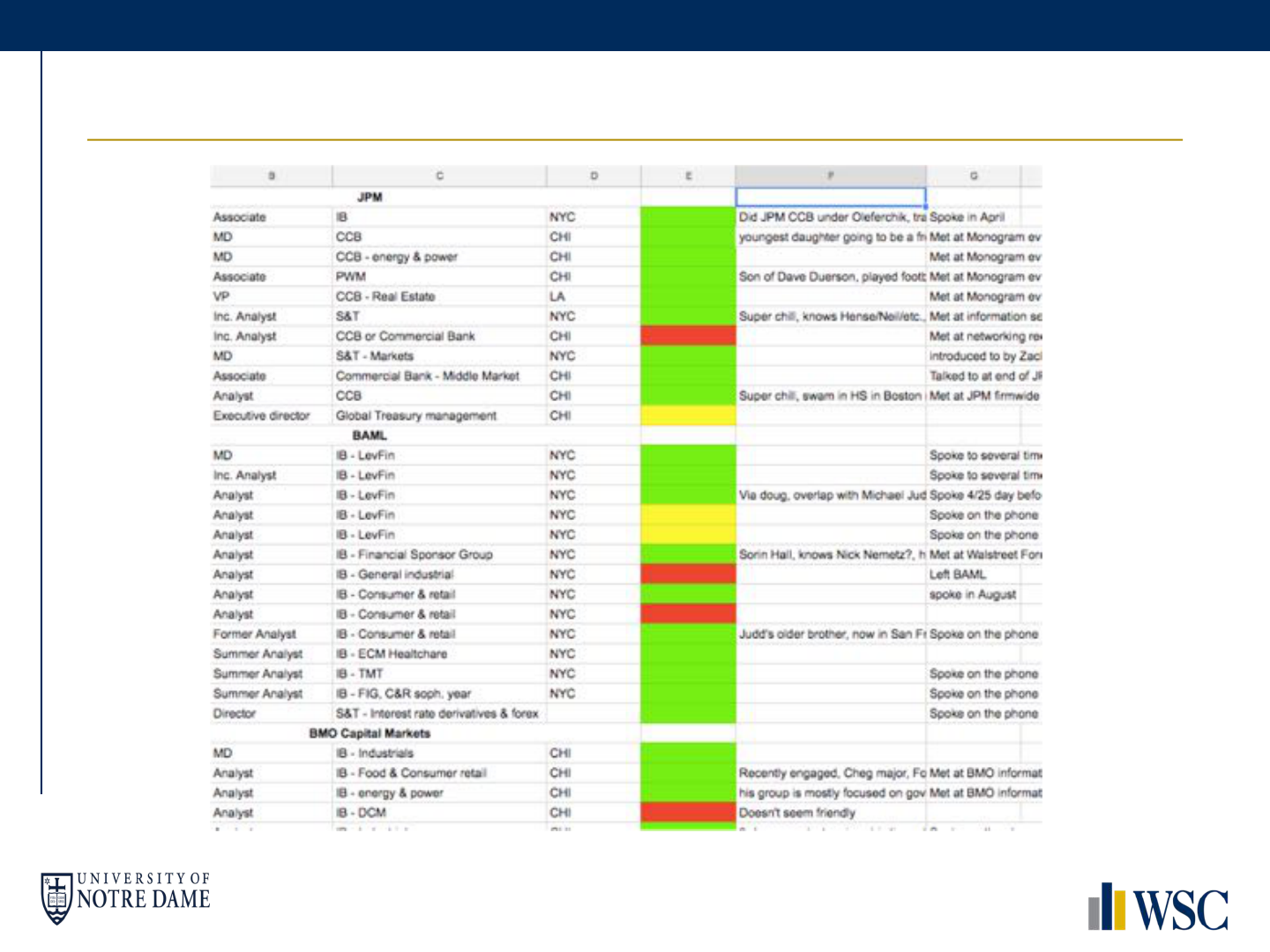

Keep an Excel Sheet of Contacts

Review of Call

• Do your research

• Know your audience

• Boutique vs bulge bracket

• Be polite

• Be personable

• Take the calls in a quiet room

• Be vigilant of time – they are busier than you are

Thank you

For speaking over the phone

Hi John,

I wanted to shoot you a note thanking you for speaking with me over the phone yesterday. I

thoroughly enjoyed our conversation especially about [……………………….] as well as your

insight into the recruiting process. I appreciate the interview advice, and look forward to keeping

in touch over the next few weeks.

Thanks,

Michael Scott

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Fine Tune Your Resume

• Reference the resumes sent out earlier this semester

• Use a separate action word to begin each line

• Do not be overly detailed on SIBC and non-

important line items

• Know how to talk about them

• Have seniors review them

• Come to WSC resume reviews

• Be unique

What Do You Look at on a Resume?

• GPA

• Major

• Maybe hometown / high school

• SIBC (if ND reviewer)

• Interesting involvements

• INTERESTS

• IF YOU PUT “STRUGGLING GOLF GAME” YOU WILL NOT

GET A JOB

Submitting Your Application

• Check your resume and check it again

• Any typos will kill your chances

• Most banks do not do cover letters

• Submitting online is a necessity but that alone will not

get you an interview

• Networking is key (as we have mentioned)

• Keep your point person in the loop

Follow-up

Keeping people in the loop

Hi Ryan,

I hope all is well. I wanted to shoot you a note letting you know I submitted my application for

Citi Investment Banking in NYC on Friday. I am very excited to apply for this opportunity, and I

am looking forward to hopefully moving forward with the process.

I hope to keep in touch with you over the next few weeks as interviews approach.

Have a nice start to your week! Go Irish!

Best,

Tony

Interviews

• After the spring and summer of networking, you will

get interviews

• You might have “Hireview” first round interviews

where you will have a virtual interview with behavioral

and technical questions where you recite your answers

into a camera and record them

• Dress business formal

• Very quiet place with white background (Duncan 5

th

floor is ideal)

• Practice before hand out loud while looking into your computer

camera

• Hireview issues are usually most behavioral or firm specific

• Ex) Why JPM?

On Campus / Over the Phone First Round Interviews

• 30 minutes

• Multiple per day

• Varies in level of difficulty depending on the firm

• Be prepared for technical but they will not be the hardest ones out there

• Structure

• Starts with “My story”

• Know everything on resume and speak to it fluently

• 3-5 behavioral questions

• 3-5 technical questions

• “Do you have any questions for me?”

• ALWAYS have a thoughtful question about the firm ready

Thank you

For interviewing

Dan,

It was a pleasure to speak with you this morning, and I want to thank you again for the

opportunity to interview with Citi. I appreciated your candid responses to my questions, and I

enjoyed hearing about your experiences with the strong Notre Dame network at Citi.

I am very excited about the possibility of joining this team, and I look forward to hearing back

from you soon.

Thanks,

Michael

Superday

• After you crush the first round - you will get a superday

• You will likely fly to NYC, Chicago, etc. and have 4-8 30 minute interviews

• Interviews can be all technical, all behavioral, mixture of both

• STUDY the firm you are going to before hand

• CEO

• Stock price

• Major news

• Be passionate about the firm

• Anecdotes from phone call

• Write down notes along the way

• You will black out and forget stuff about the interviewer that is key for follow-up emails

The Offer

• Congrats! You got the offer, now what?

• Leveraging is okay…reneging is NOT!!!!!!

• Reneging on an offer kills Notre Dame’s reputation

• We have the strength we do because years of classes have

worked hard to get to where they have

• Do not undermine this progress

• If there is some crazy reason you think you have to renege

then reach out to us or Bob

Leveraging an Offer

• Reach out to other firms ASAP

• Clearly define time constraints

• If you are time constrained, you can ask for an

extension of your offer

• Need to be careful about this and do so tactfully

• This can blow up in your face (don’t say we didn’t tell you)

• Restrict the firms you reach out to only to those you

would unequivocally take an offer from

• Otherwise, you are wasting their time and your time

• Be humble and honest in your approach

• Lying gets you nowhere

Agenda

Investment Banking Overview

Sending Your First Email

Mastering the Art of the Phone Call

Behavioral Interview Prep

Networking Basics

Recruiting Process Outline

Handling the Process

Behavioral – My Story

• Walk me through your resume/tell me about yourself

• This should answer why ND/Finance/IB/why specific firm

• Essentially how every interview begins

• Tell a story, treat it like a movie / give it a plot

• “I have been interviewing at ND for 15 years and I can tell if I’ll like a

candidate from their story alone”

• Tips

• PRACTICE… there is no excuse

• Slow

• Chronological

• 2-3 minutes

• Eye contact

Behavioral – My story

• Qualities of a good story

• Answers most important question: Why should they hire you?

• Can answer key objections – gaps in resume, lack of experience – before

interviewer can even bring them up

• Should be concise – 2-3 minutes or less – but filled with most important

qualities and achievements

• Try to make unique, ‘how you got here’

• Try to tailor it to your interviewer if possible

• Do not have a script

• You need to have a number of key points you are going to hit but never just

have a memorized verse you are going to repeat

• Odds are, the interviewer will ask you a question midway through and it is hard

to get back on track

• You will also come off as robotic

My Story – Mistakes to Avoid

• Too much “setup”

• Spend too much time explaining your background, class schedule, activities,

etc.

• Non – specific spark

• “I got interested in finance because my dad was a banker” or “because my

professor last semester was cool”

• Too many transitions and plot twists

• First, you wanted to start your own company, then you went to law school.

After an internship, you switched to business, and then wealth management.

You will lose your interviewer in these twists and turns.

Example Story

My name is Brian Finn and I am a Finance major with a minor in the Hesburgh Program in

Public Service originally from Basking Ridge, NJ. Throughout high school, I had thoughts of

playing college soccer, but I always put my academics first and wanted this to be my primary

focus going into college. In August of my freshman year at Notre Dame, I decided I wanted to

try to walk-on to the soccer team. At the time of my first practice with the team, they were

undefeated and ranked #1 in the country, so it was a little daunting. But, after a year-long walk-on

process, I was fortunate enough to be offered a full-time spot in the fall of my sophomore year.

Even though being a student-athlete at Notre Dame has been an incredible experience, I do not

think it fully defines who I am. I have done my best to have a full experience at Notre Dame.

One way that I have been able to achieve this has been through finance related extra-curricular

activities.

Example story (continued)

In December of my freshman year, I was selected to go on a Wall Street Club Networking Trek in

which we visited four banks in New York City, which was really my first experience seeing what

Wall Street is actually like. It was here that my interest was sparked in investment banking, as I was

able to interact with different people at these banks and figure out what they do on a daily basis.

This interest led me to get involved in SIBC over this past year. For example, last fall I

participated in an SIBC project in which we analyzed the potential acquisition of Canada Goose

by Nike, and presented our findings to a team of bankers in Milwaukee which was a really great

experience. After finishing up the project, I really wanted to get more experience on the technical

side of things, so this past February I completed a Wall Street Club modeling course in which we

developed our quantitative skills by building a full DCF and LBO model. I believe I am very

analytical, and that paired with my variety of experiences would lead me to be a good fit at _____

Example Story

• James Campion, from Southern California

• How did I end up at ND (longer if non-ND interviewer)

• Or if they were curious why I went from sunny SoCal to stormy SB

• Getting involved with finance clubs freshman year to discover I had

a passion for finance

• From there, went to intern last summer in PWM

• Realized I did not like it and wanted a higher-pace, more thought

provoking job, which I found in IB through SIBC

• Recently, begun getting involved with non-finance clubs, including

volunteering and hosting radio station

• Upcoming summer, I will be working for M3 in Chicago

Practice with a Neighbor

• Turn to your neighbor now and try to practice a brief

intro

• This does not need to be perfect and you need to get

comfortable with practicing

• If you don’t feel comfortable doing that, then just

quickly walk through the key points you are going to

hit

Behaviorals (Continued)

• What is Investment Banking?

• Facilitate buying and selling of companies (mergers and acquisitions)

• Assist the client with all financing needs (both equity and debt)

• Serve as an advisor to clients to help them achieve operating goals

• Why Investment Banking?

• Delving into companies, learning what makes them tick*

• Really want to learn valuation skills

• Really hard job and I always like to challenge myself

• No reference to salary or having a relative in finance

• Speak to an experience that you had (SIBC, summer, investment club)

• Be specific for certain aspects (advisory, tech)

• What are the typical responsibilities of an analyst?

• Work on marketing materials such as pitch books to win business/close deals

• Formatting

• Quantitative skills such as modeling

• Act in a supporting role

• Why NYC, Chicago, SF (mostly for non-NY)?

• If you live near the area

• Focus on the people at the firm and the quality of the firm

• If SF say you’re interested in tech or specific example of visiting city

• If Chicago say you’re interested in industrials or example of visiting city

• These show the you know the industry and are engaged…

• Why our firm?

• Mention the size of the firm

• The people you met**** - importance of networking

• Show that you are truly interested in the firm ex) Know the recent deals

• STUDY THE FIRM…DO YOUR HOMEWORK

• Talk to current ND students who interned at the bank

• Know how they staff deals, work with coverage/product groups

Behaviorals (Continued)

• What are your Strengths/Weaknesses?

• This question will be asked in a variety of ways…

• What would your friends say about you?

• Describe yourself in three words?

• Why would you be a good banker?

• What would you like to improve about yourself?

• Strengths

• Strength + anecdote + connect to IB

• Example…

• Strategy: Think of what skills it would take to be a good

investment banker and work backwards

Strengths…give it a try

• Turn to your neighbor and tell them your 3 strengths

• If your both say the same thing you are probably

being generic

Weaknesses

• Always spend more time on how you have addressed your weaknesses

• Ex) Too competitive…

• “I am incredibly competitive and after a tough test or game I sometimes

would shut down and not learn anything from my mistakes. I just read a

book called “The Art of Learning” and one of my biggest takeaways was

there are two types of learners: incremental learners and entity based

learners. Incremental learners learn from mistakes, really focus on the

process of improvement and are proven to be significantly more

successful.” Although I still have room for improvement, I think this

frame of mind has helped

Weaknesses…Give it a try

• Turn to your neighbor and tell them your 3

weaknesses

• If your both say the same thing you are probably

being generic

Behavioral (continued)

• Tell me about a time when you…

• Faced adversity/conflict

• Worked in a team

• Used quantitative skills

• Had to solve a problem quickly

• Had to work with someone you didn’t get along with

• Challenged yourself

• Dealt with ambiguity/instructions weren’t clear

• Approach: Create a list of experiences/activities you have that

would make for good answers

• 10-15 examples that can apply to any question

• The best non-finance or non-class based the better (helps you stand out)

• PRACTICE…out loud, to a real person

• Key is your anecdotes – make sure they are mixed

• You shouldn’t be with the same people in all 4-5 anecdotes

Practice

• Tell me about a time you had to work in a group?

• Tell me about a time you responded to failure?

Recap

• Get started now — reach out to seniors / analysts

and attend firm events

• Get involved in SIBC if you haven’t already and, if

you have, then keep it up or do something fun

• Be formal but personable in your approach — stand

out through your conversations not your emails /

resume

• Start practicing for interviews now — this is not a

final you can cram for

• Keep your GPA up

Questions?

We are not leaving until we get at least one

Technicals…where to start?

• Here! But you need to compliment this with further studying

• Guide examples

• Vault guide – very basic, best for non-business majors – covers what you absolutely need

but no more

• Free from Center for career development website

• iBankingFAQ.com – provides an overview of each area of technical questions and shows

how to think through them – business majors

• Free, blog-style website

• Breaking Into Wall Street – laundry list of 400 interview questions and answers, gets as

complex as you’d like

• Wall Street Oasis – a lot like BIWS but more concise

• Start with the basics

• Don’t just memorize – understand the answers that they give you

• Just as importantly – be able to

verbalize

the answers

Outline

I. Accounting

II. Valuation Overview

III. Valuation − DCF

VI. Valuation − LBO

IV. Valuation − Multiples / WACC

VII. Other

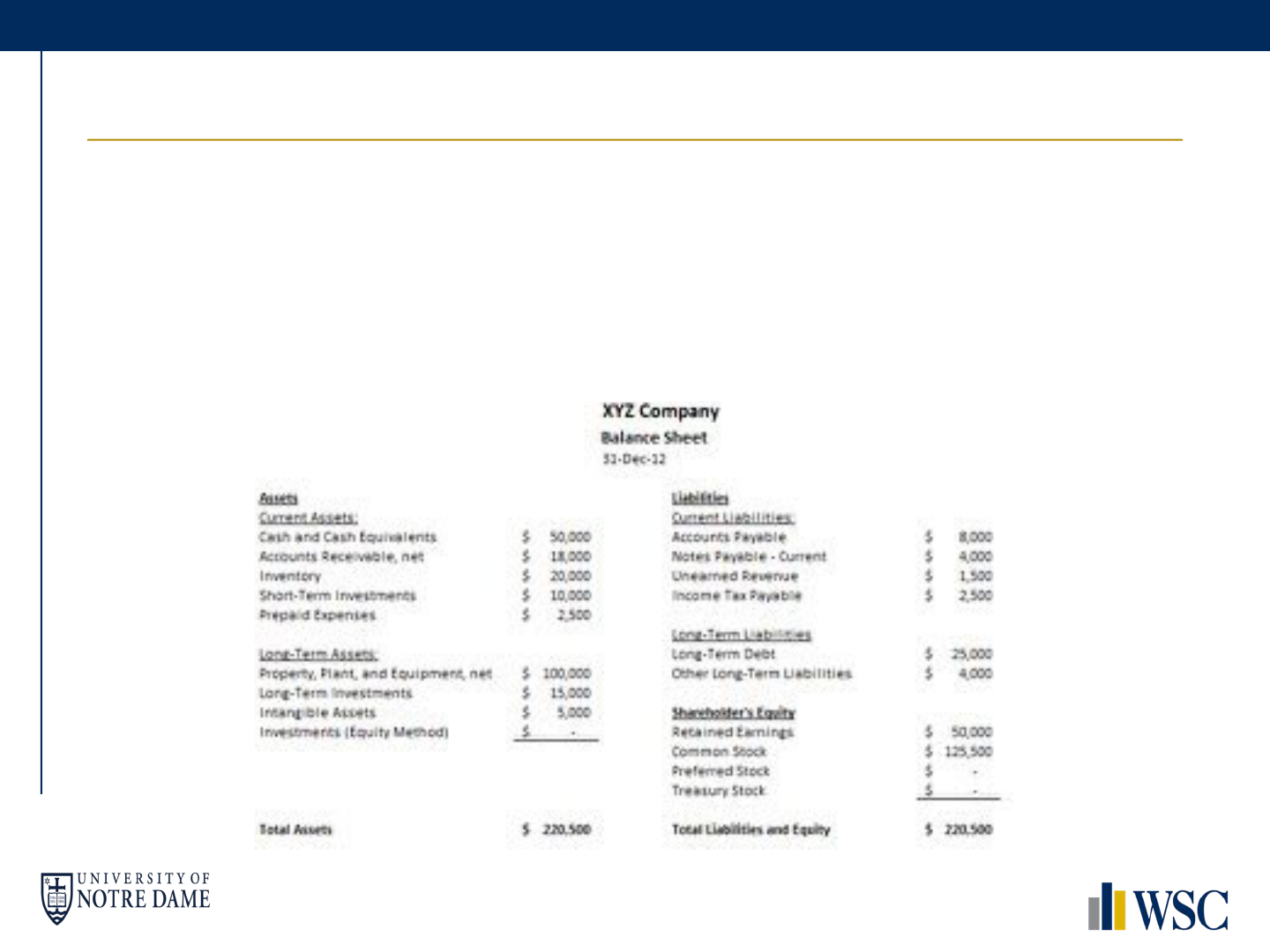

Accounting

• What are the 3 financial statements? Walk through them / how do they flow

together

• Income Statement

• Gives a company’s revenue and expenses

• Bottom line is Net Income for the period

• Statement of Cash Flows

• Top line is Net Income

• Bottom line is company’s net change in cash for the period

• Balance Sheet

• Shows the company’s assets, liabilities, and shareholders’ equity

• Change in cash from statement of cash flows incorporated into cash account in assets

(on Balance Sheet)

• Net income is included in retained earnings, a shareholders’ equity account

• What are some accounts on each statement?

• What is working capital?

• What is Net PPE?

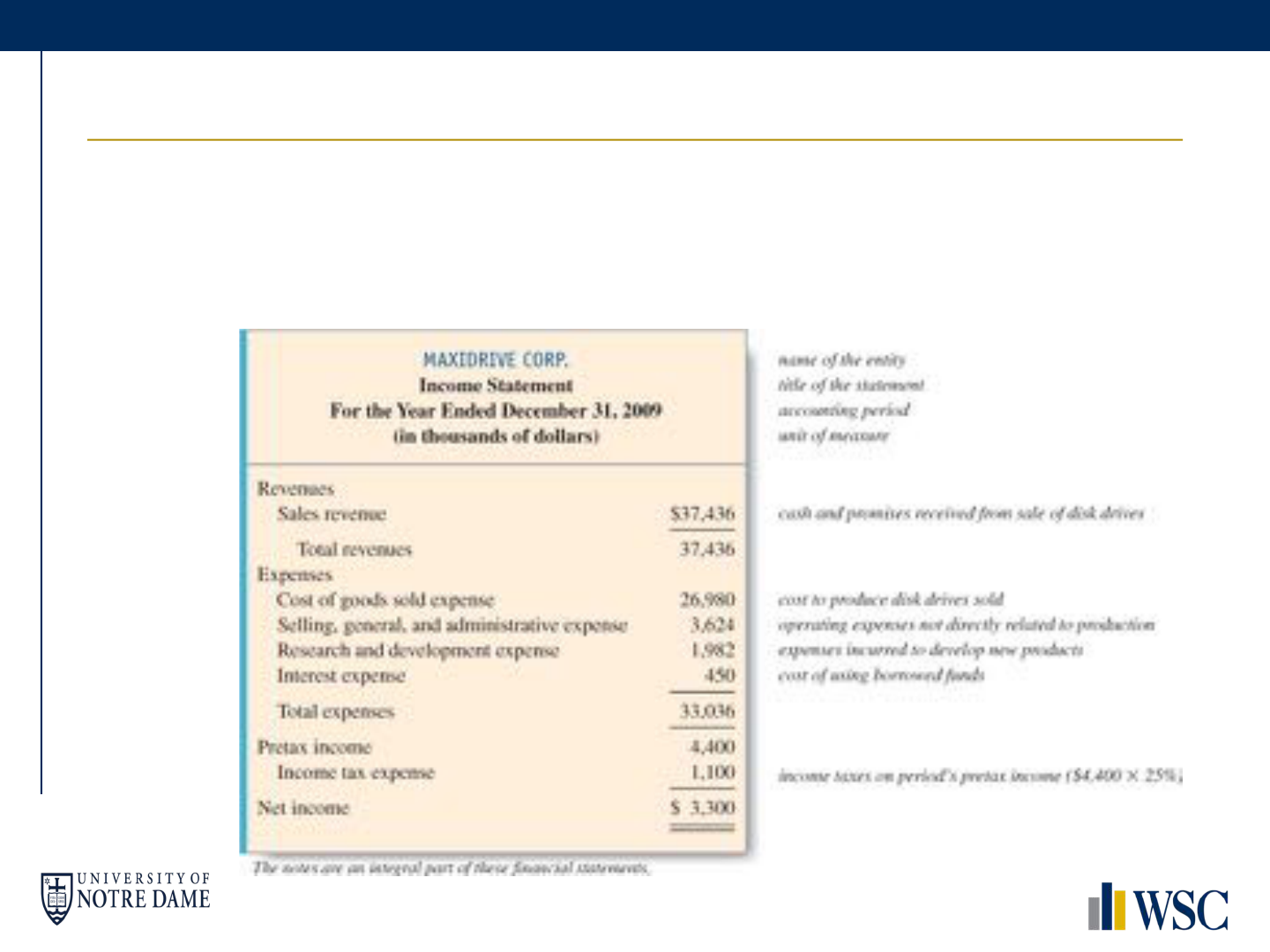

Income Statement

• Income Statement

• Reports a financial performance over a specific accounting period

• A business’ REVENUES and EXPENSES

Statement of Cash Flows

• Top line is Net Income

• Know the three types of activities

• This is the most important

financial statement “cash is

king”

• Adjusts NI for non-cash expenses

and working capital changes, then

list cash flows from investing and

financing activities

• Operating

Net Income

+ Depreciation

- Change in NWC

- Capex

= Cash from Operations

• Investing

• Financing

• END= ENDING CASH

Balance Sheet

• Golden rule: Assets = Liabilities + Stockholder Equity

• Know all the line items

• Common questions are…

• “name a few types of current assets”

• “What is unearned revenue?”

Linking the Financial Statements

• Bottom line of IS (net income) is top line of Statement of CF

• Net Income also part of Retained Earnings on BS (RE= NI-Div)

• Long term debt (BS) * interest rate = interest expense (IS)

• Bottom line of Statement of CF (change in cash) is top line of Balance

Sheet

Accounting – Sample Questions

§ If you were stranded on a desert island and could only pick 1 financial statement

to bring with you, what would it be?

§ Always the statement of cash flows. Cash flows are the best way to analyze a company’s actual

performance – income statements and balance sheets use accrual accounting, so they don’t

always show the actual health of the company and how much cash it is generating

§ Cash flows are what you care about when you’re investing

§ But what if I can bring 2 financial statements with me?

§ Income Statement and Balance sheet – you can create the cash flow statement from these two,

so you’d essentially have all 3

§ Note: Need B/S from current period and prior period

§ What is EBITDA? Why do bankers use it?

§ Earnings Before Interest, Taxes, Depreciation, and Amortization

§ Proxy for cash flow

§ Note: not a perfect proxy because it totally eliminates the cash flow that goes to capital expenditures; this

cash outflow (or inflow, if it’s a long-term asset sale) can be sizeable

Advanced Accounting Questions

• Some variation of: (walk through)

• How does $10 of depreciation flow through the three financial statements

if the tax rate is 40%?

Accounting – Sample Questions

§ What are the 3 financial statements, and how do they tie together?

§ Why is the statement of cash flows important?

§ Why isn’t EBITDA a good proxy for cash flows?

§ If I paid cash for $100 of PPE on December 31, how does that affect the 3

financial statements now? Assume that the acquisition is financed with debt

§ Assume that the acquisition is financed with debt, which includes a 10% interest rate, and that

the PPE is amortized at 10% per year

§ How does that affect the 3 financial statements one year later?

§ If I use cash to buy $100 of inventory, how does that affect the 3 financial

statements?

§ -check any of the guides or Investopedia.com for these answers

Outline

I. Accounting

II. Valuation Overview

III. Valuation − DCF

VI. Valuation − LBO

IV. Valuation − Multiples / WACC

VII. Other

What is “Value?”

• Value – what the company is worth to someone. Put another

way, for what price is someone (or some company) willing to

buy or sell the company we are valuing?

• How would you decide what you are willing to pay for this

lemonade stand?

▪ Perhaps, you might think about your

objectives: to make $$$

▪ So, what you value the lemonade stand

based on how much money you think

you will make.

▪ From this, we can conclude that the

value of a business is the sum of

the future cash flows.

But Wait…

• We just said the value of the business is the sum of the cash

flows. Is this all?

• NO!

• The value of money is time dependent. In other words, a

dollar today is worth more than a dollar today.

• Why??

• I would rather have money to go buy a new computer today than in a

year.

• If I had the dollar today, I could have more money tomorrow because

I could invest it.

• There is risk. The person might lose the dollar.

• Sooo…we need to discount future cash flows.

• We can now revise our definition: The value of a business is the

sum of the 1) discounted 2) cash flows.

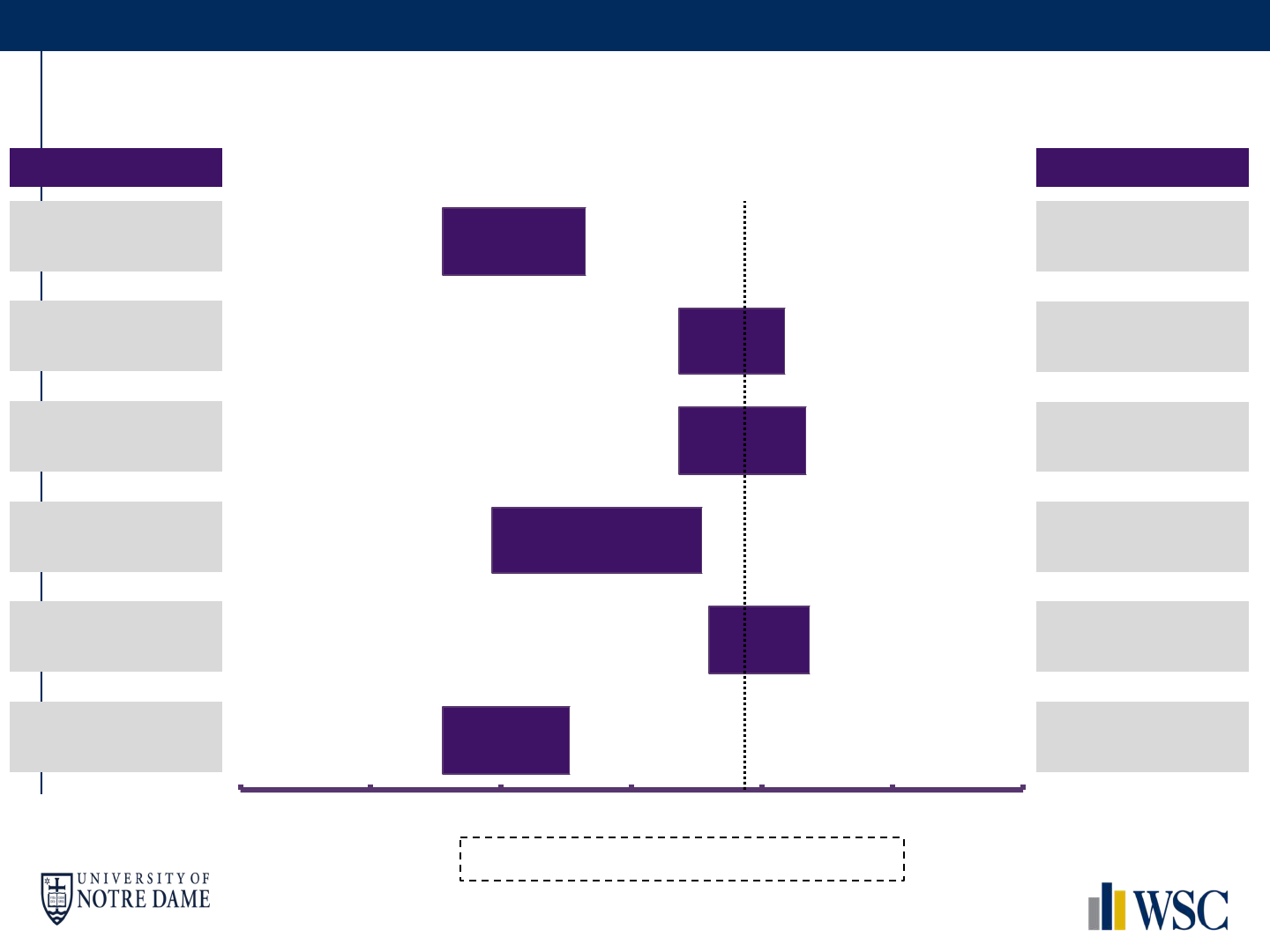

Valuation

• Here’s where you can get conceptual, sometimes strange versions of the question (i.e.

how would you value Facebook? An apple tree?)

• When do bankers use valuation?

• Pitch books and presentations, buy-side and sell-side acquisition advising, LBOs, defense

analyses

• Give the company an idea of how much outside buyers will pay for it

• Know the benefits and drawbacks to each methodology

• If you can do that, you can pretty much do all of this section

•

•

•

•

•

•

•

•

•

•

$10 $30 $50 $70 $90 $110 $130

DCF Analysis

(6.9% – 7.9% WACC)

(2.0% – 3.0% Growth)

DCF Analysis

(6.9% – 7.9% WACC)

(10.6x-13.6x Exit Multiple)

LTM 52 Week High/Low $10,733

$16,488

$9,912

$14,873

$14,462

Comparable Companies

(10.0x-16.6x EV/LTM

EBITDA)

Precedent Transactions

(16.8x-20.0x EV/ LTM

EBITDA)

Methodology Median Implied EV

$10, 831

Analyst Price Targets

Proposed Share Price: $88.80

•

•

•

•

•

•

Outline

I. Accounting

II. Valuation Overview

III. Valuation − DCF

VI. Valuation − LBO

IV. Valuation − Multiples / WACC

VII. Other

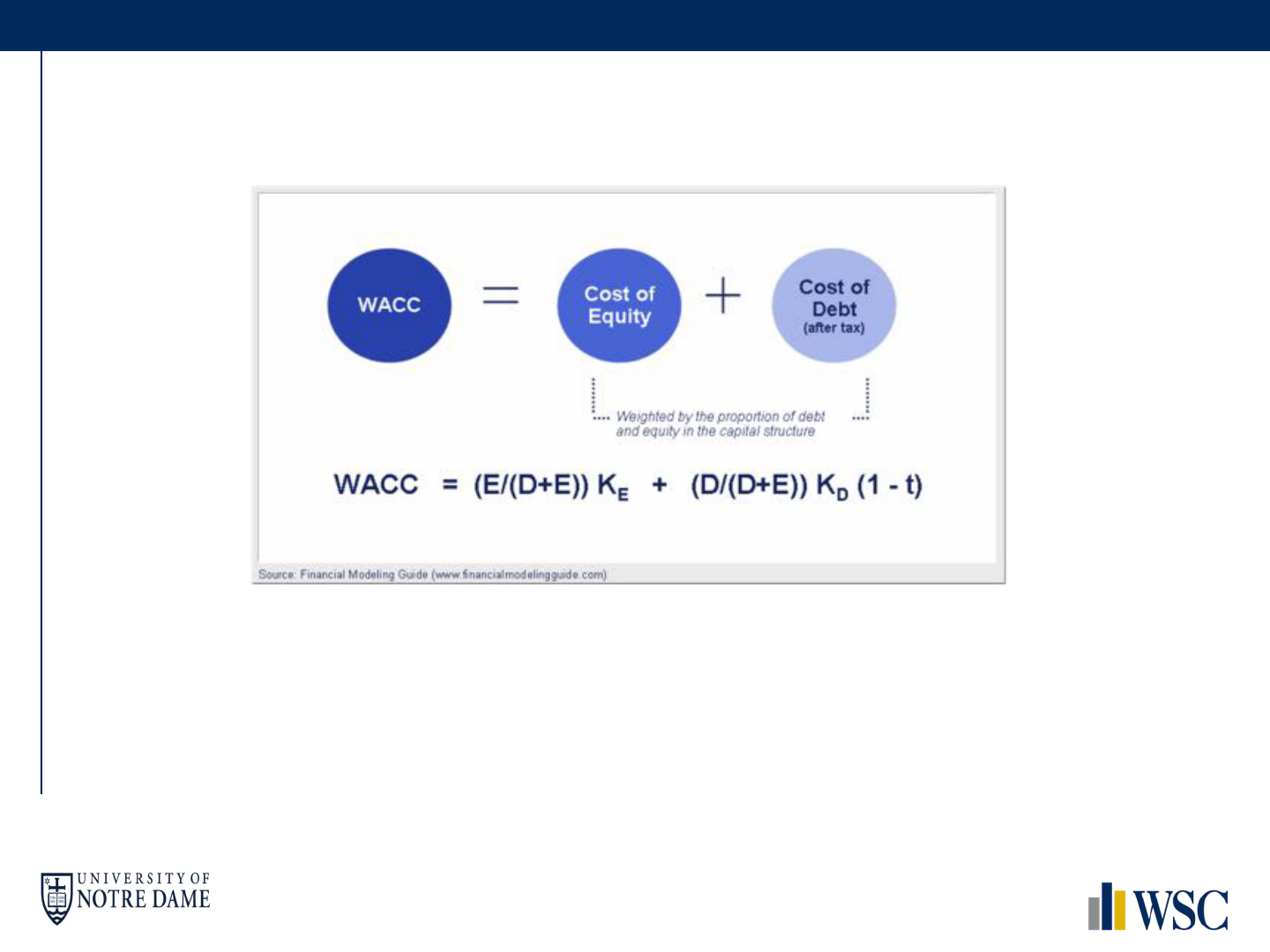

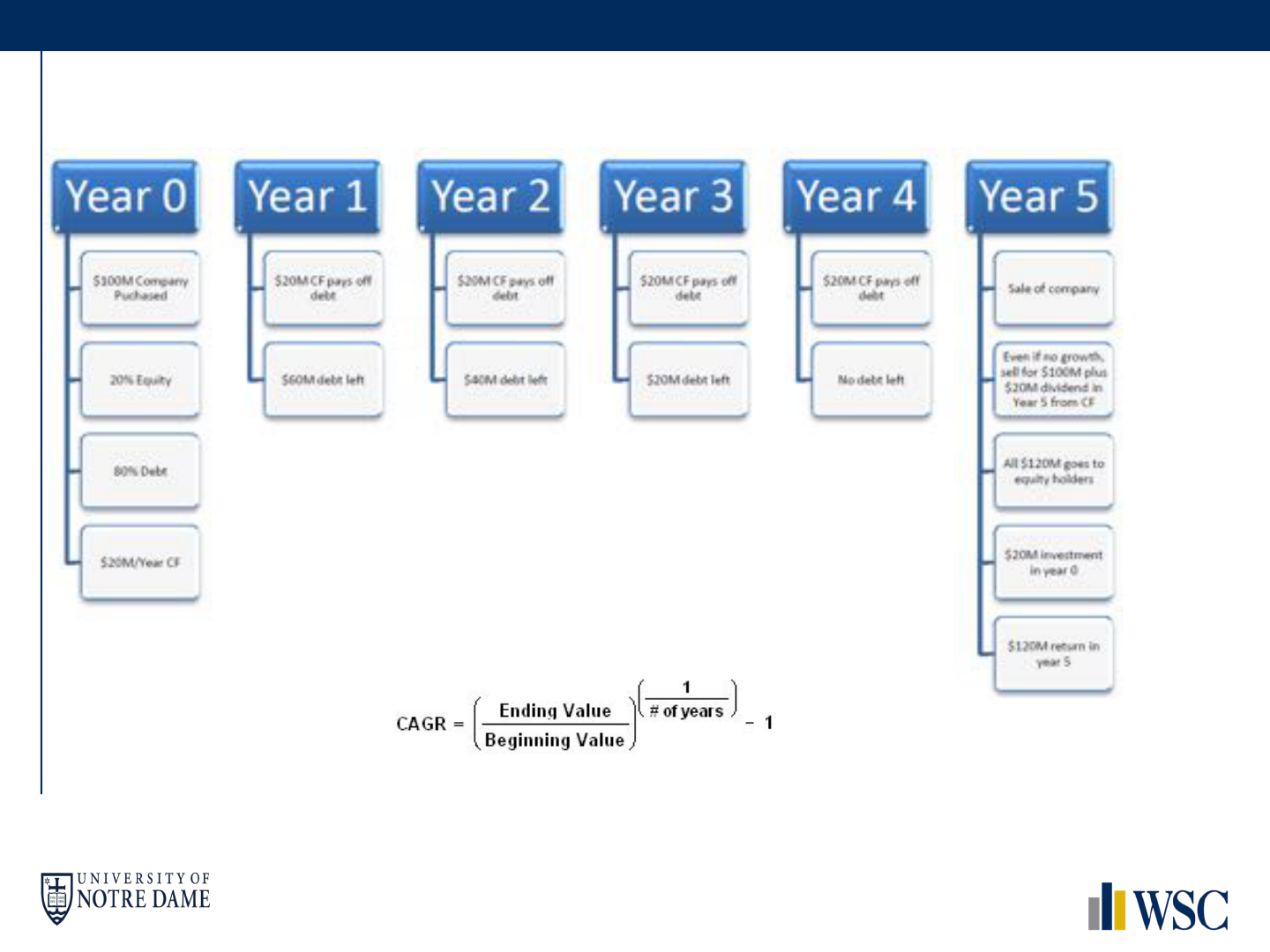

• After accounting questions, DCF-related questions are the most common:

• When you would use a DCF?

• Walk me through a DCF

• How to derive free cash flows?

• Calculating the discount rate (WACC)

• Levered / unlevered Beta

• Why would you do a DCF?

• Uses future free cash flows and discounts them at the discount rate (i.e., WACC) to

arrive at a present value

• Estimate of the cash you will receive in the future and how much you’d pay for that

right now

• Intrinsic value, not reliant upon market sentiment

• What are some of the drawbacks?

• It’s hard to make projections

§

§

§

§

§

•

•

•

•

•

•

§

•

•

•

Outline

I. Accounting

II. Valuation Overview

III. Valuation − DCF

VI. Valuation − LBO

IV. Valuation − WACC / Multiples

VII. Other

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

Answers

•

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

Outline

I. Accounting

II. Valuation Overview

III. Valuation − DCF

VI. Valuation − LBO

IV. Valuation − WACC / Multiples

VII. Other

Capital Structure Overview

• Debt vs. Equity

• Debt

• Loan someone money. No ownership claim.

• Has first claim on the cash flows until they are paid

back

• Lower risk due to contractual nature

• Equity

• Owners of the business

• Have residual claim on cash flows, i.e. they get the

cash that is left over after the debt holders are paid

• Higher risk for a potentially higher reward

Capital Structure Illustration

Different types of debt,

varying in seniority and

claim on the firm’s

assets

Enterprise

Value

Debt

Equity

Value

Illustrative Company

Either preferred or

common equity

Value of

whole firm

Value

§

§

§

§

§

§

§

Asset Management/Investment Management material is covered

§

§

§

§

§

§ à

§

§ à

Other Questions

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

§

Outline

I. Accounting

II. Valuation Overview

III. Valuation − DCF

VI. Valuation − LBO

IV. Valuation − WACC / Multiples

VII. Other

M&A

• Accretion? What does it mean? Why does it matter?

• Rationale?

§

•

•

•

•

§

§

§

§

§

§

§

§

§

§

§

§

§

Market Sizing

• How many people work in this building?

• How many tennis balls can fit in a plane?

•

How many mattresses are sold each year in the US?

•

How big is the US diapers market?

•

How many gas stations can be found in Paris?

•

How big will the market for 3D TVs be?

Other (Advanced) Wildcard Questions

• What is the beta of Starbucks? What is the beta of a

poker player? why?

• walk me through how $5 cash interest and $5 PIK

interest flow through financial statements

• plant entirely financed by equity, other one half equity

half debt. which one has a higher multiple and why

• If CAPM is wrong, how should you calculate the cost

of equity