WALMART 401(K) PLAN

SAFE HARBOR NOTICE - PLAN YEAR BEGINNING FEBRUARY 1, 2024

Your E

mployer, Walmart Inc. (“Walmart”), m

aintains a 401(k) defined contribution plan for its eligible associates known as the “Walmart 401(k)

Plan” (the "Plan")

. The Plan is a “safe harbor” plan, which means that certain nondiscrimination testing is not required, and all participants are

entitled to make the same level of contributions to the Plan. This Notice contains important information regarding the Plan. You should

consider the information in this Notice as you decide how much (if any) of your compensation you wish to contribute to the Plan for the

Plan year beginning February 1, 2024. This Notice describes how Walmart will match your contribution.

Plan Participation: You are entitled to begin making your own contributions to the Plan as soon as administratively feasible after your date of hire

is entered into the payroll system.

Your Contributions: You may elect to make your own contributions to the Plan from 1% to 50% of your eligible pay each pay period (up to legal

limits). If you have attained or will attain age 50 by the end of 2024, you may defer an additional amount, called a catch-up contribution. Your

contributions to the Plan may be regular pre-tax contributions and/or Roth contributions, as you elect. Pre-tax contributions (and earnings thereon)

are not subject to current federal income tax and, in most cases, state or local taxes, until distributed from the Plan. Roth contributions are made

on an after-tax basis, but the contributions and, in most cases, the earnings thereon are not subject to federal income tax when distributed to you

(as long as the distribution meets certain requirements). You can choose to convert all or any part of the vested contributions in your accounts

(other than Roth contributions and related earnings, and loan balances) to Roth contributions through an “In-Plan Roth Conversion.” The

contributions you choose to convert, along with any earnings on those contributions through the date of the conversion, will be subject to applicable

federal, state and local taxes in the year of conversion. Refer to the section of the summary plan description for the Plan entitled “How your 401(k)

contribution is determined” for a detailed explanation of the type and amount of compensation you may contribute to the Plan.

You may start or change your contribution election at any time after you become eligible by going online at One.Walmart.com, benefits.ml.com or

by calling the C

ustomer Service Center at (888) 968-4015. Your new election will become effective as soon as administratively feasible, normally

within two pay periods. The plan allows for participant-elected automatic increases as a feature to plan participants. It is your responsibility to

review your paychecks to confirm that your election was implemented. If you believe your election was not implemented, you must timely notify

the Customer Service Center, but not later than three months after your election, for corrective steps to be taken. If you do not timely notify the

Customer Service Center, the amount that is being withheld from your paycheck, if any, will be treated as your deferral election.

Safe Harbor M

atching Contribution: You will begin receiving safe harbor matching contributions on the first day of the calendar month following

your first anniversary of employment with Walmart if you are credited with at least 1,000 hours of service during the first year and if you are making

your own contributions to the Plan. (Matching contributions will not be made with respect to contributions you make before you become eligible for

matching contributions.) The safe harbor matching contribution will equal 100% of your combined pre-tax and Roth salary deferral contributions

(including catch-up contributions), up to a maximum of 6% of your eligible annual pay for the Plan year while you are eligible for matching

contributions. Eligible annual pay for this purpose has the same definition as it does for purposes of determining your contributions. This

contribution generally will be deposited into the Plan each payroll period, along with your contributions.

The Plan may be amended during the Plan year to reduce or suspend safe harbor matching contributions. However, the reduction or suspension

will not apply until at least 30 days after all eligible employees are provided notice of the reduction or suspension. If Walmart suspends or reduces

safe harbor matching contributions, you will receive a supplemental notice explaining the reduction or suspension of the safe harbor matching

contribution at least 30 days before the change is effective. Walmart will contribute any safe harbor matching contribution you have earned up to

that point.

Other Plan Contributions: At the present time, Walmart intends the safe harbor matching contribution to be the sole source of company

contributions. You may also roll over to the Plan funds owed to you from a previous employer’s plan (including a 401(k) plan, a profit sharing plan,

a 403(b) plan of a tax-exempt employer or a 457(b) plan of a governmental employer) or from an individual retirement account. For more information

on rollover contributions, see the section of the summary plan description entitled “Making a rollover from a previous employer’s plan or IRA.” Any

rollovers you make to the plan are not considered a contributio

n that is eligible for a match.

You have choices for what to do with your 401(k) or other type of

plan-sponsored accounts. Depending on your financial circumstances, needs and

goals, you may choose to roll over to an IRA or convert to a Roth IRA, roll over a 401(k) from a prior employer to a 401(k) at your new employer,

take a distribution, or leave the account where it is. Each choice may offer different investments and services, fees and expenses, withdrawal

options, required minimum distributions, tax treatment (particularly with reference to employer stock), and provide different protection from creditors

and legal judgments. These are complex choices and should be considered with care.

Vesting: Your contributions, rollover contributions and safe harbor matching contributions are 100% vested at all times. Any contributions Walmart

made to your Company-Funded 401(k) Account (generally made for Plan years beginning prior to February 1, 2011) are also 100% vested at all

times. If you have a Company-Funded Profit Sharing Account, contributions to your profit sharing account (generally made for Plan years beginning

prior to February 1, 2011) are subject to a 6-year vesting schedule. You accrue a year of service for vesting purposes by working 1,000 or more

hours during a Plan year.

Withdrawal Restrictions: Except in the circumstances described below, withdrawals from the Plan are not permitted until you terminate

employment with Walmart. You may be able to withdraw all or part of the vested portion of your Plan accounts while you are still working for

Walmart if you experience a financial hardship under IRS guidelines (as defined and permitted by the Plan) or any time after you reach age 59½,

and you can withdraw up to $5,000 within one year

of the birth or adoption of your child. You may also withdraw your rollover contributions at any

time, and you may request a loan from the vested portion of your Plan accounts. The Plan may provide for certain other in-service distributions

with respect to amounts transferred from other plans. (Note that if you make an In-Plan Roth Conversion of funds that are otherwise eligible for

distribution, the funds will be treated as though they were distributed from the Plan and then rolled back into the Plan. Thus, they will be credited to

your rollover account in the Plan.) For more information, see the section in the summary plan description entitled “Receiving a payout while working

for Walmart.”

For More Information: You ca

n learn more about the Plan by reading the summary plan description for the Plan. You can find this in the Plan’s

section of the Associate Benefits Book. To request an additional copy of the summary plan description or obtain additional Plan information, you

may contact the Plan Administrator at: Walmart Inc., Attn: Benefits Customer Service, 508 SW 8

th

St., Bentonville, AR 72716-0295, (800) 421-

1362. You may also contact the Customer Service Center at (888)-968-4015 or benefits.ml.com.

This document is being provided exclusively by your Plan, which retains responsibility for the content

US_Active\113189820\V-1 20232637-1| |5807330 09/2023

Walmart 401(k) Plan

Annual Participant Fee Disclosure Notice

Publication Date: November 1, 2023

Walmart Inc. (“Walmart”) sponsors the Walmart 401(k) Plan (“Plan”). Federal regulations require that participants

in retirement plans, such as the Plan, be provided with certain Plan and investment-related information, including

your right to direct the investment of your Plan accounts, investment options available under the Plan, and the

costs of participation. This information is intended to assist you in the management of your Plan accounts. While

there may not be a need for action right now, please keep the information furnished in this document as it is

intended to assist you in making informed investment decisions.

You should always carefully review all available information about an investment option before making a decision

about investing in that option. Additional information about each of the Plan’s investment options (such as

investment strategies and risks, portfolio holdings, and turnover ratios) can be found by logging on to

http://www.benefits.ml.com. (If this is your first time logging on, you will need to register by creating a personal

User ID and password. Just click on “Create your User ID now” and follow the instructions provided.) You may

also contact the Customer Service Center at (888) 968-4015 for additional information.

What’s Inside:

• Plan-Related Information ........................................................................................................

.............................................................................................

....................................................................................................

...............................................................

........................................................................................

...................................................................................

.......................................................................................

1

o G

eneral Pl

an Informat

ion 1

o Expense Information 3

▪ Plan-Wide Administrative Expenses 3

▪ Individual Expenses 3

▪ Asset-Based Expenses 4

• Investment-Related Information 4

Plan-Related Information

General Plan Information

Your Investment Rights

As a participant in the Plan, you have the right to direct the investment of Plan contributions (both your

contributions and Walmart’s contributions) at any time among the various investment options available under the

Plan.

Note: Walmart Inc. Common Stock (“Walmart Common Stock”) is an investment option only for

legacy Profit Sharing Accounts. Walmart Common Stock is not available for purchase through

any of your other Plan accounts; to the extent these other accounts hold shares of Walmart

Common Stock, you may always sell those shares. If you are subject to blackout periods under

Walmart’s insider trading policy, there may be certain periods during which you are not permitted

to trade in Walmart Common Stock.

You may change your investment choices by logging on to http://www.benefits.ml.com or by calling the

Customer Service Center at (888) 968-4015. For each investment option in your 401(k) account, no more than

one sale may be filed each day for your existing account balances. You may also make one change per

investment option per day for future contributions. If you have a Profit Sharing account and want to make a

change, a separate sale or transfer must also be initiated per investment option per day. Investment directions

are processed the same business day if they are received before 3 P.M. (ET); otherwise they are processed the

following business day. Except as provided below, funds will be reinvested the day your investment direction is

M609450006

- 2 -

processed. If, however, your account is invested in an investment option and you wish to transfer your money to

Walmart Common Stock (for Profit Sharing Accounts only), your funds will be reinvested the next business day

after your investment direction is processed. If your account is invested in Walmart Common Stock and you wish

to transfer your money to another investment option, your funds will be reinvested two business days after the

day your investment direction is processed.

If you do not make an election as to how your Plan accounts will be invested, your accounts will be invested in

one of the myRetirement Funds in the myRetirement Fund series based on the year you were born. The Funds

in the myRetirement Fund series are customized target date funds created specifically for use in the Plan. For

more information, you should review the separate Qualified Default Investment Alternative (QDIA) Notice. You

may obtain a copy of the notice online at http://www.benefits.ml.com or by calling the Customer Service Center

at (888) 968-4015.

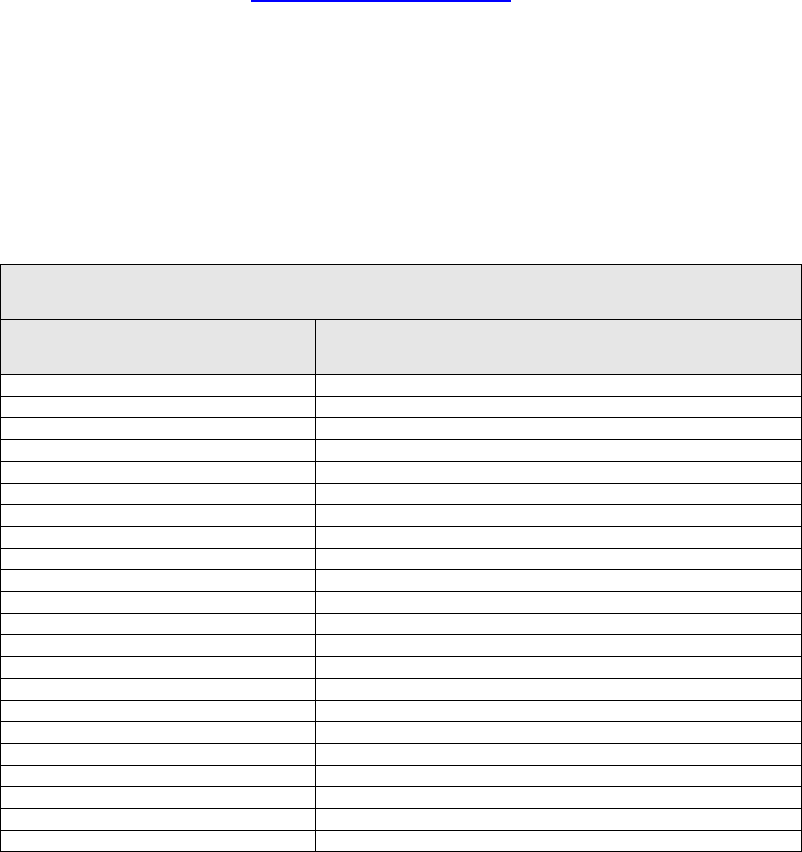

Your Investment Options

The chart below lists the investment options available under the Plan as of the date of this notice. You may

choose one of these investment options or you may spread your money among the various investment choices.

Whatever investment options you choose, it is important for you to have a well-balanced and diversified investment

portfolio. A diversified strategy could help you achieve more consistent returns because changes in the financial

markets often cause different types of investments to perform differently. If one investment option loses value,

the loss could potentially be offset by another investment option gaining in value. While diversification does not

ensure a profit or protect against loss, it can be an effective way to help you manage risk.

Walmart 401(k) Plan Investment Options

Asset Class

Investment Option

International Equity International Equity Fund

International Equity Index BlackRock International Equity Index Trust

US Large Cap Core Index BlackRock Russell 1000 Index Trust

US Large Cap Equity Large Cap Equity Fund

US Small Cap Core Index BlackRock Russell 2000 Index Trust

Small-Mid Cap Equity Small Mid Cap Equity Fund

Real Assets Real Assets Fund

Broad Market Fixed Income Bond Fund

Short-Term Fixed Income JPMorgan Short Term Bond Trust

Fixed Income Index BlackRock Bond Index Trust

Money Market BlackRock Money Market Trust

Mixed-Asset Target Date myRetirement Fund

Mixed-Asset Target Date myRetirement 2025 Fund

Mixed-Asset Target Date myRetirement 2030 Fund

Mixed-Asset Target Date myRetirement 2035 Fund

Mixed-Asset Target Date myRetirement 2040 Fund

Mixed-Asset Target Date myRetirement 2045 Fund

Mixed-Asset Target Date myRetirement 2050 Fund

Mixed-Asset Target Date myRetirement 2055 Fund

Mixed-Asset Target Date myRetirement 2060 Fund

Mixed-Asset Target Date myRetirement 2065 Fund

Employer Stock Walmart Common Stock

1

1

Because this option contains a single stock investment, it generally carries more risk than the other investment options offered through the

Plan. Walmart Common Stock is a current investment option only for legacy Profit Sharing Accounts.

Your Proxy Voting and Tender Rights

If you have shares of Walmart Common Stock in your Plan accounts, voting, tender or similar rights related to

Walmart Common Stock will be passed through to you. You will receive all of the materials generally distributed

to the shareholders of Walmart, including an instruction card to tell the Plan’s trustee how to vote your shares in

the Plan. The transfer agent who tabulates the votes will keep individual participant voting strictly confidential.

Neither Walmart nor the Benefits Investment Committee members will have access to your individual voting

- 3 -

instructions. If you do not instruct the trustee how to vote the shares of Walmart Common Stock in your Plan

accounts, the Benefits Investment Committee will vote these shares at its discretion. For all other Plan investment

options, the Benefits Investment Committee will direct the Plan’s trustee on any voting or similar rights or will

delegate these responsibilities to the investment managers.

Expense Information

It is important that you understand the costs of investing through the Plan. There are three basic types of expenses

that may be applicable to your accounts. These are explained below.

Plan-Wide Administrative Expenses

Plan-wide administrative expenses are expenses for Plan administrative services that are charged to your Plan

accounts and which are: (1) not reflected in the total operating expenses of any investment option and (2) not

indi

vidual expenses (as explained below). Plan administrative expenses include charges for the Plan’s day-to-

day operation, such as legal, accounting, recordkeeping, communication, investment advisory services and other

administrative expenses associated with maintaining account records, processing investment menu changes, and

providing customer service.

As of the date of this notice, the Plan expects to incur the following Plan-wide administrative expenses over the

next year:

• Fees for recordkeeping services of approximately $8.30 per participant per year, paid in four quarterly

installments.

• Fees for investment advisory and consulting services of approximately $0.06 per participant per quarter.

Other Plan-wide administrative expenses may also be incurred from time-to-time as necessary for the Plan’s

operations.

At the end of each Plan year quarter, the Plan-wide administrative expenses expected to be incurred or payable

by the Plan in the following quarter will be deducted directly from your Plan accounts. The amount of Plan-wide

administrative expenses may fluctuate from quarter to quarter as expenses are incurred or become payable.

The actual amount of Plan-wide administrative expenses that are charged to your Plan accounts each quarter will

appear on your quarterly statement under the “Contributions and Activity For This Period” section.

Individual Expenses

Individual expenses are those that are charged to your accounts on an individual basis and which are: (1) not

reflected in the total annual operating expenses of any investment option; and (2) not Plan-wide administrative

expenses (as explained above). Individual expenses include fees you may be charged for a particular transaction

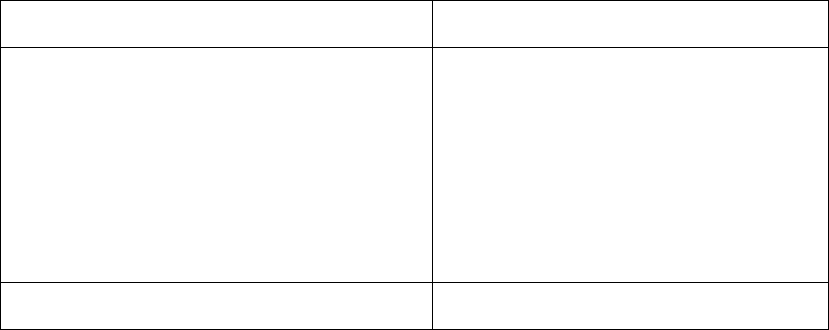

or service you select. The following individual fees may be charged to your Plan accounts:

Walmart Common Stock Transactions (as

described above)/Dividend Reinvestment

$0.028 per share

Participant Loan Fees:

• One-time loan origination fee at the time

the loan is taken

• Additional fee for review of residential loan

paperwork (charged each time paperwork

is reviewed)

• Fee for rejection of loan payment due to

insufficient funds (where paid from

individual bank account)

$50

$45

$25

Check Fee (applies to any distribution from

the Plan)

$15 per distribution

- 4 -

Overnight Check Service (applies if you

request a distribution from the Plan and wish

to have the check sent by overnight mail)

$25 per check

QDRO Processing Fees:

• QDRO Account Setup Fee (includes the

setup and review upon the Plan’s receipt

of the first order or draft order)

• Earnings Calculation Fee (applies in the

event the order requires calculation of

earnings for a historical period)

$425

$50

Individual expenses are deducted directly from your Plan accounts and are shown on your quarterly statement

under the “Contributions and Activity For This Period” section or as part of the transaction paperwork.

Asset-Based Fees

Asset-based fees reflect an investment option’s total annual operating expenses and include trustee/custodian,

management and other fees. Asset-based fees are deducted from an investment option’s assets, thereby

reducing its investment return. They are paid by all Plan participants invested in the investment option. Asset-

based fees applicable to the investment options available under the Plan are shown below in the Investment-

Related Information section of this notice.

Typically, asset-based fees are reflected as a percentage of assets invested in the option, and are referred to as

an “expense ratio.” Expense ratios can be shown in two ways:

• Gross expense ratio: reflects the investment option’s total annual operating expenses (before fee waivers).

• Net expense ratio: reflects the investment option’s total annual operating expenses after applicable fee

waivers or reimbursements. Applicable fee waivers or reimbursements may be mandated by contract (which

would have an expiration date) or may be voluntary, and may not remain in effect. The net expense ratio

approximates the expenses you could expect to incur when investing in the option.

The cumulative effect of fees and expenses can substantially reduce the growth of your retirement savings. For

an example showing the long-term effect of fees and expenses, visit the Department of Labor’s website at

http://www.dol.gov/ebsa/publications/401k_employee.html. Fees and expenses are only one of the many

factors to consider when you decide to invest in an option.

Investment-Related Information

This section includes important information to help you compare the investment options available under the Plan.

If you would like additional information about the investment options, including performance information as of the

most recently completed calendar month, you can go to the Plan’s website at http://www.benefits.ml.com or

you may contact the Customer Service Center at (888) 968-4015. A free paper copy of the information available

on the website can also be provided by a Customer Service Center representative.

NOTE: The Benefits Investment Committee, the Plan's trustee/custodian, and investment managers for the Plan

have claimed an exclusion from the definition of "commodity pool operator" under the Commodity Exchange Act

and, thus, are not subject to registration or regulation as a pool operator under the Act.

The table below provides the following information regarding each investment option available under the Plan:

• Historical Performance Information - The chart shows how each option has performed over time and allows

you to compare it with an appropriate benchmark for the same time periods. The performance data shown

here represents past performance as of December 31, 2022. Past performance is not necessarily an

indication of how an investment option will perform in the future. Your investment options could lose money.

- 5 -

Information about the option’s principal risks is available on the website. (Note that you cannot invest directly

in an index used as a benchmark.)

• Fee and Expense Information - The chart also shows fee and expense information for each investment

option. These are asset-based fees as described in the Plan-Related Information section above. The net

expense ratios shown approximate the expenses you could expect to incur when investing in the option.

These ratios change from time to time based on changes in investment management fees and asset

allocations. More current expense information may be obtained on the Plan's website at

http://www.benefits.ml.com.

For additional investment-related information regarding your Plan,

you may contact:

• Plan Sponsor:

Walmart Inc.

Attn: Benefits Customer Service

508 SW 8

th

Street

Bentonville, AR 72716-0295

(800) 421-1362

• Customer Service Center

(888) 968-4015; TDD (Hearing Impaired) (800) 637-1215

• Plan Website:

http://www.benefits.ml.com

Please visit http://www.benefits.ml.com for a glossary of investment terms

relevant to the investment options under the Plan. This glossary

is intended to help you better understand your options.

Investing in funds, which are intended as long-term investments, involves risk, including the possible loss of principal.

Investments in foreign securities are subject to substantial volatility due to the potential for adverse political, economic or other

developments and may carry additional risk. Funds that invest in small- or mid-capitalization companies experience a greater

degree of market volatility than those of large-capitalization stocks and are riskier investments. Bond funds have the same

interest rate, inflation, and credit risks associated with the underlying bonds owned by the fund. Generally, the value of bond

funds rises when prevailing interest rates fall and, conversely, the value falls when interest rates rise. There are ongoing fees

and expenses associated with investing. Bear in mind that higher return potential is accompanied by higher risk.

Investors should carefully consider the investment objectives, risks, charges and expenses of each investment option before

investing. For more information on the investment options, log on to

http://www.benefits.ml.com and refer to the fund

description or fact sheet, if available. Note that prospectuses are not available for collective trusts or for customized funds,

such as the myRetirement Fund series, that are offered only through the Walmart 401(k) Plan.

- 6 -

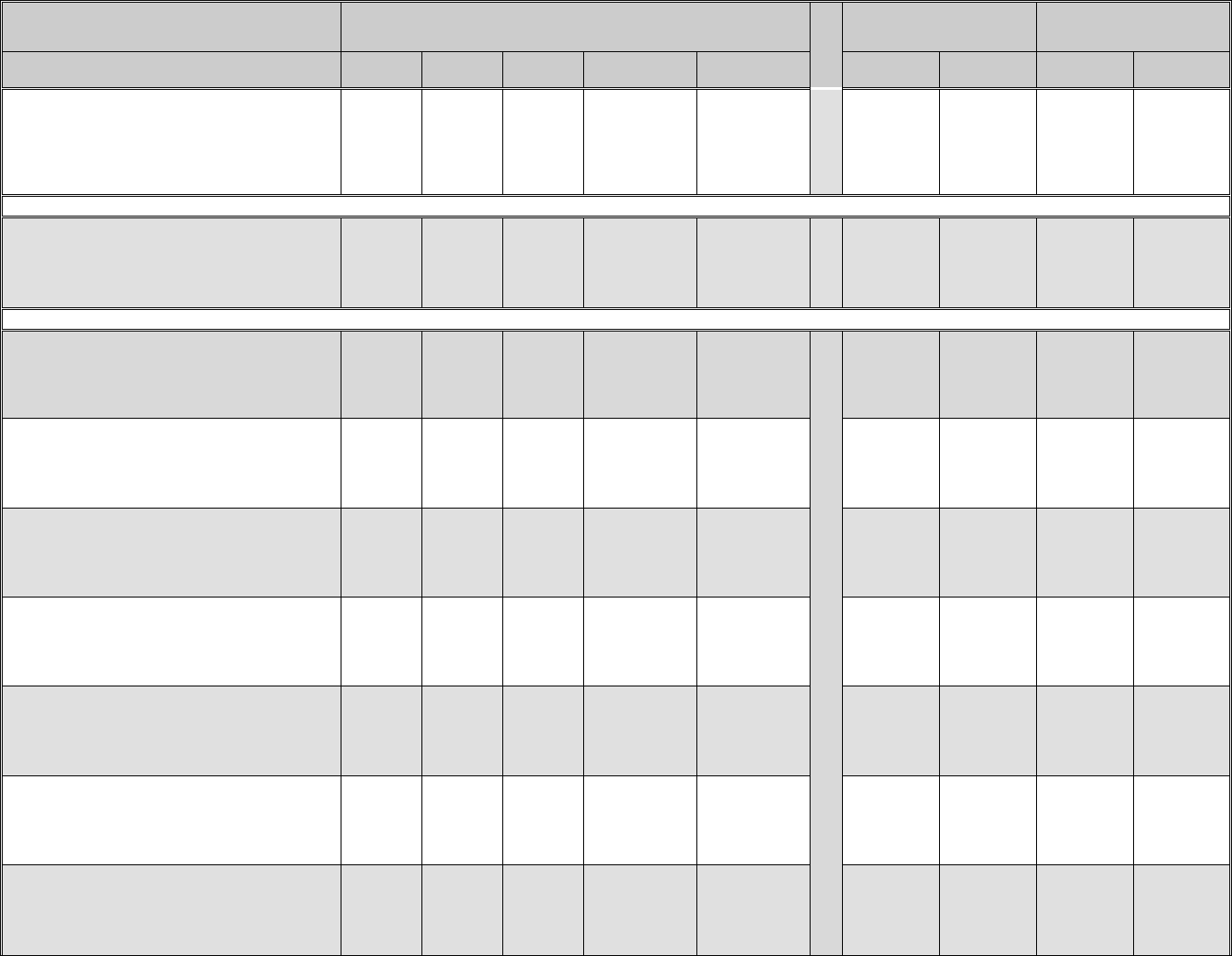

INVESTMENT OPTION AVERAGE ANNUAL TOTAL RETURN %

AS OF DECEMBER 31, 2022

ANNUAL GROSS

EXPENSE RATIO

1

ANNUAL NET

EXPENSE RATIO

1

1 YR 5 YR 10 YR SINCE

INCEPTION

INCEPTION

DATE

AS A

%

PER

$1,000

AS A

%

PER

$1,000

EQUITY/STOCK

Fund: BlackRock Russell 1000 Index Trust

Asset Class: Large Cap Core Funds

Benchmark: Russell 1000 Index

-19.09%

-19.13%

9.13%

9.13%

12.35%

12.37%

12.58%

8/2009

0.01% $0.10 0.01% $0.10

Fund: Large Cap Equity Fund

Asset Class: Large Cap Equity Funds

Benchmark: Russell 1000 Index

-15.73%

-19.13%

9.06%

9.13%

N/A 10.26% 3/2015 0.03% $0.30 0.03% $0.30

Fund: BlackRock Russell 2000 Index Trust

Asset Class: Small Cap Core Equity Funds

Benchmark: Russell 2000 Index

-20.46%

-20.44%

4.10%

4.13%

8.98%

9.01%

10.23% 8/2009 0.01% $0.10 0.01% $0.10

Fund: Small Mid Cap Equity Fund

Asset Class: Small-Mid Cap Equity Funds

Benchmark: Russell 2500 Index

-17.40%

-18.37%

5.26%

5.89%

N/A 6.43% 3/2015 0.38% $3.80 0.38% $3.80

Fund: BlackRock International Equity Index Trust

Asset Class: International Funds

Benchmark: MSCI ACWI Ex US IMI Index

-16.25%

-16.58%

1.09%

0.85%

N/A 3.01% 7/2017 0.03% $0.30 0.03% $0.30

Fund: International Equity Fund

Asset Class: International Funds

Benchmark: MSCI ACWI Ex US IMI Index

-14.11%

-16.58%

2.39%

0.85%

5.46%

3.98%

5.54% 8/2009 0.39% $3.90 0.39% $3.90

REAL ASSET

Fund: Real Assets Fund

Asset Class: Real Asset

Benchmark: FTSE Global All Cap Index

-6.42%

-17.87%

4.09%

5.48%

N/A 3.15% 10/2013 0.45% $4.50 0.45% $4.50

BOND/FIXED INCOME

Fund: Bond Fund

Asset Class: Broad Market Fixed Income

Benchmark: Barclays Aggregate Bond Index

-13.52%

-13.01%

0.55%

0.02%

1.64%

1.06%

3.29% 8/2009 0.10% $1.00 0.10% $1.00

Fund: BlackRock Bond Index Trust

Asset Class: Broad Market Fixed Income

Benchmark: Barclays Aggregate Bond Index

-13.09%

-13.01%

-0.02%

0.02%

N/A 0.22% 7/2017 0.02% $0.20 0.02% $0.20

1

The expense ratios reported are based on the managers, manager allocations and manager fees in effect as of the date of this notice. The operating expenses used to estimate the

expense ratios are based upon 2022 plan experience, where available. The expense ratios approximate the expenses you could expect to incur when investing in the fund. They do

not reflect the actual expenses of the fund for 2022. Expenses may change as managers, manager allocations and fees change, or if operating expenses are different than estimated.

More current expense information may be obtained on the Plan's website at http://www.benefits.ml.com..

- 7 -

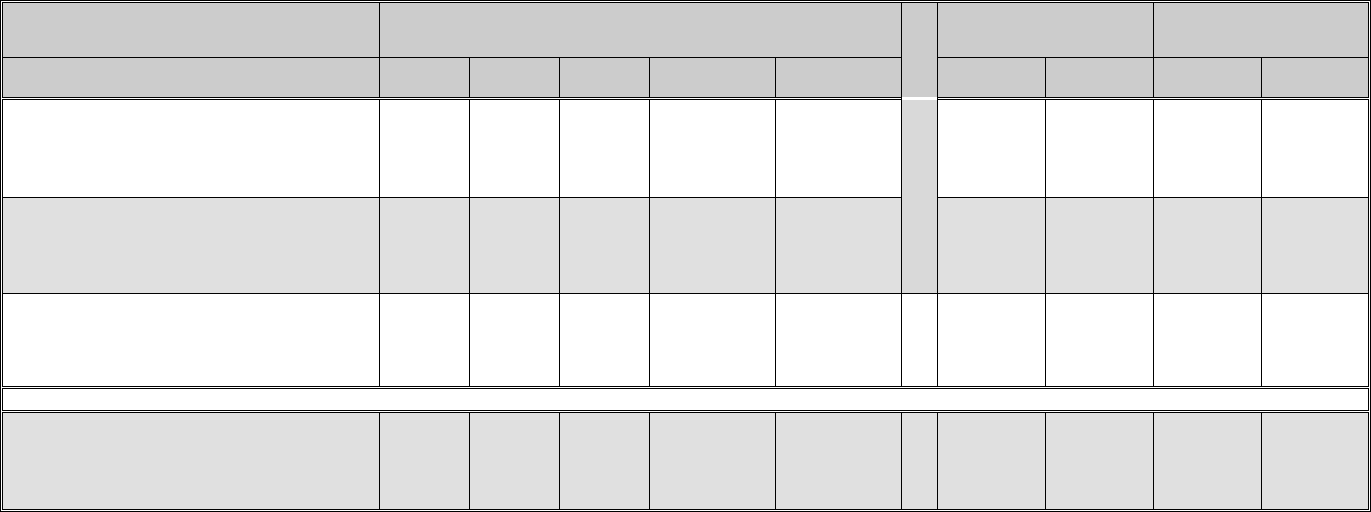

INVESTMENT OPTION AVERAGE ANNUAL TOTAL RETURN %

AS OF DECEMBER 31, 2022

ANNUAL GROSS

EXPENSE RATIO

1

ANNUAL NET

EXPENSE RATIO

1

1 YR 5 YR 10 YR SINCE

INCEPTION

INCEPTION

DATE

AS A

%

PER

$1,000

AS A

%

PER

$1,000

Fund: JPMorgan Short Term Bond Trust

Asset Class: Short Term Fixed Income

Benchmark: Barclays Capital 1-3 Year

Government/Credit Index

-3.40%

-3.69%

1.47%

0.92%

1.21%

0.88%

1.21% 10/2012 0.10% $1.00 0.10% $1.00

MONEY MARKET

Fund: BlackRock Money Market Trust

Asset Class: Money Market Funds

Benchmark: FTSE 1-Month T-Bill Index

1.61%

1.48%

1.22%

1.20%

0.72%

0.71%

0.71% 10/2012 0.05% $0.50 0.05% $0.50

ALLOCATION FUNDS

Fund: myRetirement Fund

Asset Class: Mixed-Asset Target Today Funds

Benchmark: Barclays Aggregate Bond Index

-13.41%

-13.01%

2.83%

0.02%

N/A 3.64% 10/2013 0.14% $1.40 0.14% $1.40

Fund: myRetirement 2025 Fund

Asset Class: Mixed Asset 2020 Funds

Benchmark: Barclays Aggregate Bond Index

-14.04%

-13.01%

3.62%

0.02%

5.69%

1.06%

6.52% 9/2009 0.16% $1.60 0.15% $1.50

Fund: myRetirement 2030 Fund

Asset Class: Mixed Asset 2025 Funds

Benchmark: Russell 1000 Index

-14.72%

-19.13%

4.24%

9.13%

6.50%

12.37%

7.17% 9/2009 0.20% $2.00 0.19% $1.90

Fund: myRetirement 2035 Fund

Asset Class: Mixed Asset 2030 Funds

Benchmark: Russell 1000 Index

-15.34%

-19.13%

4.76%

9.13%

7.19%

12.37%

7.71% 9/2009 0.23% $2.30 0.21% $2.10

Fund: myRetirement 2040 Fund

Asset Class: Mixed Asset 2035 Funds

Benchmark: Russell 1000 Index

-15.95%

-19.13%

5.05%

9.13%

7.70%

12.37%

8.07% 9/2009 0.24% $2.40 0.22% $2.20

Fund: myRetirement 2045 Fund

Asset Class: Mixed Asset 2040 Funds

Benchmark: Russell 1000 Index

-16.41%

-19.13%

5.15%

9.13%

7.97%

12.37%

8.29% 9/2009 0.25% $2.50 0.23% $2.30

Fund: myRetirement 2050 Fund

Asset Class: Mixed Asset 2045 Funds

Benchmark: Russell 1000 Index

-16.56%

-19.13%

5.18%

9.13%

8.06%

12.37%

8.31% 9/2009 0.25% $2.50 0.23% $2.30

- 8 -

INVESTMENT OPTION AVERAGE ANNUAL TOTAL RETURN %

AS OF DECEMBER 31, 2022

ANNUAL GROSS

EXPENSE RATIO

1

ANNUAL NET

EXPENSE RATIO

1

1 YR 5 YR 10 YR SINCE

INCEPTION

INCEPTION

DATE

AS A

%

PER

$1,000

AS A

%

PER

$1,000

Fund: myRetirement 2055 Fund

Asset Class: Mixed Asset 2050+ Funds

Benchmark: Russell 1000 Index

-16.64%

-19.13%

5.18%

9.13%

8.09%

12.37%

8.33% 9/2009 0.24% $2.40 0.22% $2.20

Fund: myRetirement 2060 Fund

Asset Class: Mixed Asset 2050+ Funds

Benchmark: Russell 1000 Index

-16.66%

-19.13%

5.26%

9.13%

N/A 6.34% 3/2015 0.24% $2.40 0.22% $2.20

Fund: myRetirement 2065 Fund

Asset Class: Mixed Asset 2050+ Funds

Benchmark: Russell 1000 Index

-16.68%

-19.13%

N/A N/A 3.73% 1/2020 0.24% $2.40 0.22% $2.20

EMPLOYER COMMON STOCK

Fund: Walmart Inc. Common Stock

Asset Class: Company Stock

Benchmark: S&P 500 Index

-0.47%

-18.11$

9.48%

9.42%

10.00%

12.56%

N/A N/A N/A N/A N/A N/A

Effective as of November 1, 2023

QUALIFIED DEFAULT INVESTMENT ALTERNATIVE (QDIA) NOTICE

This notice explains your investment rights under the Walmart 401(k) Plan (“Plan”) with respect to your monies in the Plan

and how those monies will be invested if you do not make an investment election. PLEASE READ THIS NOTICE

CAREFULLY. As a participant in the Plan, you have the right to direct the investment of Plan contributions (both your contributions

and Walmart’s contributions) at any time among various investment options available under the Plan. You can obtain information

about all of the investment options available under the Plan (including fees associated with each investment option), free of charge,

by accessing your account online at www.benefits.ml.com or by calling the Customer Service Center at (888) 968-4015. If you do

not ma

ke an election as to how your Plan contributions will be invested, your Plan contributions will be invested in one of the

myRetirement Funds

1

1

The myRetirement Funds are not mutual funds that are registered under the Investment Company Act of 1940. Prospectuses are

not available and shares are not publicly traded or listed on exchanges.

,2

2

The principal value of these funds is not guaranteed at any time, including at or after the target date. You may lose money by

investing in the myRetirement Funds series, including losses near and following the target retirement date, and there is no guarantee

that this investment will provide adequate retirement income. These funds, other than the myRetirement Fund, are designed to

become more conservative over time as the target date approaches.

,3

3

As a “fund of funds,” each of these funds, as a shareholder of underlying funds, will indirectly bear its pro rata share of the expenses

incurred by the underlying assets.

ba

sed on the year you were born, as indicated in the chart below. For instance, if you were born in 1971,

your Plan contributions will be invested in the myRetirement 2040 Fund.

The Year You Were Born

Your Account Will Be

Invested In The:

1995 to present

myRetirement 2065 Fund

1990 – 1994

myRetirement 2060 Fund

1985 – 1989

myRetirement 2055 Fund

1980 – 1984 myRetirement 2050 Fund

1975 – 1979 myRetirement 2045 Fund

1970 – 1974 myRetirement 2040 Fund

1965 – 1969

myRetirement 2035 Fund

1960 – 1964

myRetirement 2030 Fund

1955 – 1959

myRetirement 2025 Fund

1954 and prior

myRetirement Fund

The m

yRetirement Funds are a series of 10 customized investment options created solely for Plan participants by the Benefits

Investment Committee and are commonly known as “target retirement date” funds. Although the myRetirement Funds series is

designed for different age groups, you may choose to invest in any fund you wish. The myRetirement Funds series, other than the

myRetirement Fund, is a series of diversified investment options that automatically change their asset allocation over time to become

more conservative as a participant gets closer to retirement. This is done by shifting the amount of money that is invested in more

aggressive investments, such as stocks, to more conservative investments, such as bonds, as a participant nears his or her target

retirement date. The target retirement date for these funds is the approximate date a participant would access assets from his or her

retirement account for lump sum retirement benefits from the Plan. Solely for purposes of determining investment allocations, each

myRetirement Fund (other than the myRetirement Fund) uses a target retirement date identified in the name of the myRetirement

Fund, as listed in the table above. Shortly before a myRetirement Fund with a target retirement date identified in its name reaches

its target retirement date, its assets are automatically transferred to the myRetirement Fund.

The m

yRet

irement Fund is the last fund in the myRetirement Fund series and is intended to be the most conservative fund. Unlike

the other funds, the investment allocations for the myRetirement Fund no longer change simply because you get older.

For mo

re complete information about the investment options that are not mutual funds (non-registered investments), refer

to the fund description, or fact sheet if available.

This document is being provided exclusively by your Plan, which retains responsibility for the content.

| |

Please note, for plan years ending prior to February 1, 2006, all or a significant portion of Walmart’s profit sharing contribution was

invested in Walmart stock. Participants in the Plan prior to that date may have Walmart stock in their Profit Sharing Accounts. These

amounts may be reinvested in a different investment option(s) at your election, but if no election is made, they will remain invested

in Walmart stock

4

. These assets are not automatically invested in the myRetirement Funds series.

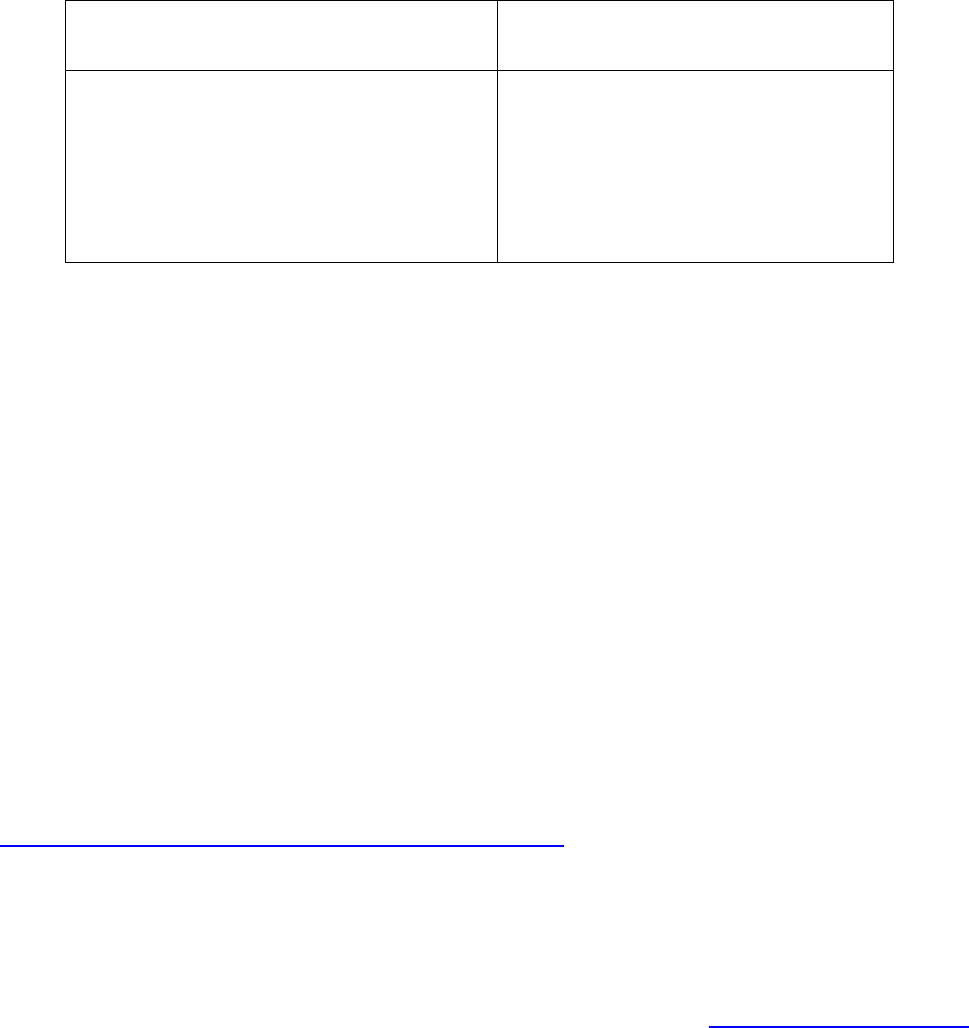

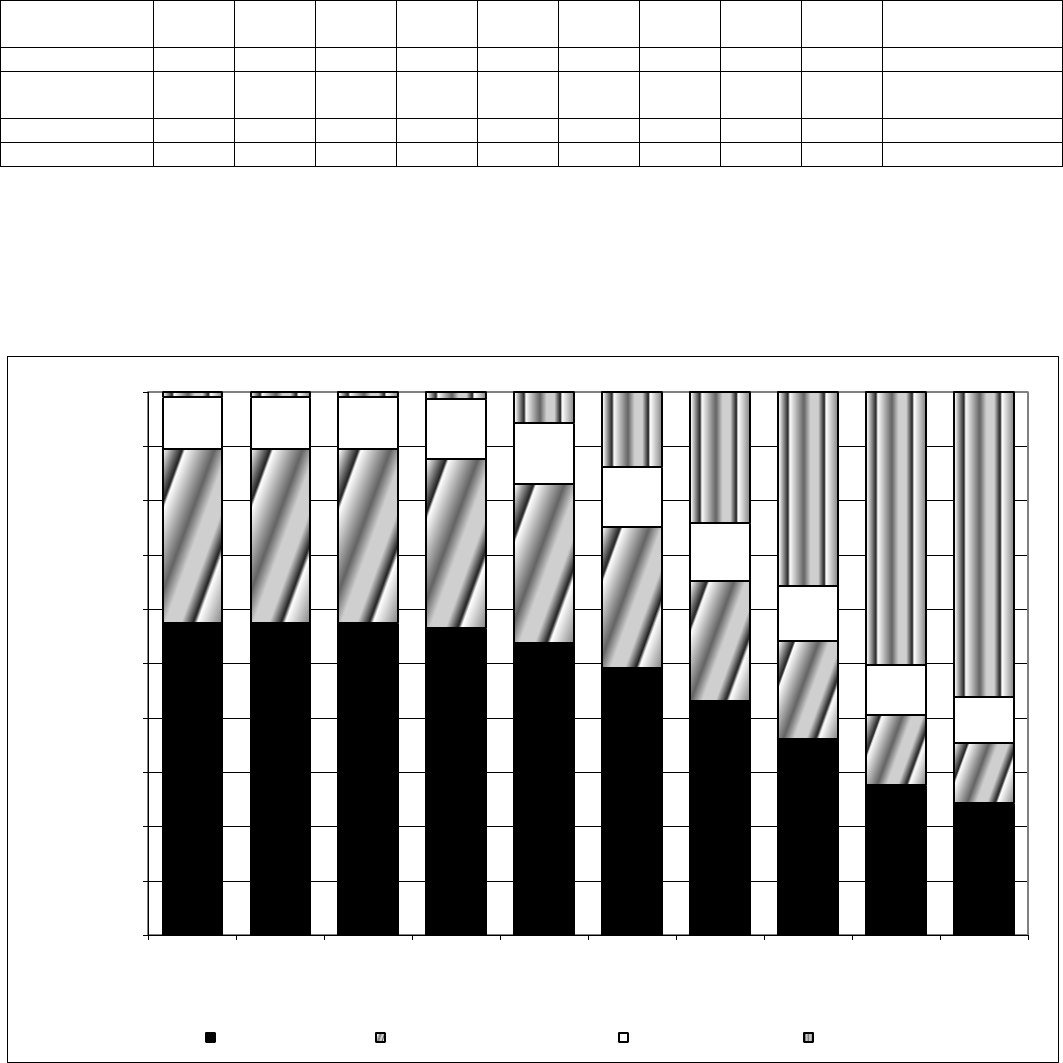

Target Asset Allocations as of November 1, 2023

As noted on page 1, the target asset allocations for the myRetirement Funds series change over time (other than the myRetirement

Fund). The table below outlines the specific target asset allocation for each myRetirement Fund as of November 1, 2023. Each fund

in the myRetirement Fund series, other than the myRetirement Fund, is adjusted quarterly to become more conservative, and is

rebalanced to the adjusted target asset allocation for the following quarter. The percentages below may be modified from time to

time. Percentages at any given time will vary from those listed below based on market performance, rounding, and timing of fund

rebalancing.

2065

2060

2055

2050

2045 2040

2035

2030

2025 myRetirement

Fund

US Equity

57.5%

57.5%

57.5%

56.5%

53.8%

49.3%

43.2%

36.2%

27.6%

24.4%

International

Equity

32.0%

32.0%

32.0% 31.2%

29.2% 25.9% 22.1%

18.0% 13.0% 11.0%

Real Assets

9.5%

9.5% 9.5% 11.0%

11.3% 11.0% 10.6% 10.2% 9.2%

8.5%

Fixed Income

1.0%

1.0%

1.0%

1.3%

5.7%

13.8%

24.1%

35.6% 50.2%

56.1%

The following chart illustrates the targeted investment mix of each myRetirement Fund as of November 1, 2023. Each fund, other

than the myRetirement Fund, becomes less invested in stocks and real assets and more invested in fixed income assets, such as bonds,

as participants in each 5-year age band approach the target retirement date. The chart below also illustrates generally how the asset

allocation of each fund in the myRetirement Fund series changes over time. For instance, if you were born in 1977 and invested in

the 2045 fund, the asset allocation of that fund in 10 years will generally look like the asset allocation of the 2035 fund. Similarly,

the asset allocation of the 2045 fund in 20 years will generally look like the asset allocation of the 2025 fund.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2065 2060 2055 2050 2045 2040 2035 2030 2025 myRetirement

Fund

Percent of Investment

myRetirement Fund

US Equity International Equity Real Assets Fixed Income

20232637-2 5807323 09/2023

| |

In the chart on the previous page, the US equity allocation consists of the BlackRock Russell 1000 Index Trust

5,6

, the Large Cap Equity Fund

6

,

and the Small-Mid Cap Equity Fund

6

. The international equity allocation consists of the International Equity Fund

6

and BlackRock International

Equity Index Trust

5,6

. The real assets allocation consists of the PIMCO All Asset Fund, and the underlying investment vehicles of the Real

Assets Fund

6

. The fixed income allocation consists of the JPMorgan Short Term Bond Trust

6

, the Blackrock Intermediate Government Bond

Index Trust

5,6

, the BlackRock Long Term Government Bond Index Trust

5,6

, the PGIM (Prudential) Long Duration Credit Trust

6

, and the Bond

Fund

6

. From time to time the Benefits Investment Committee may replace any of these holdings or investment managers, or add additional

underlying investment holdings or investment managers, in the myRetirement Funds series.

Expense Ratios

The expense ratios shown below are estimates of each fund’s total annual operating expenses (management fees and fund operational

expenses) as of November 1, 2023. Note that a fund’s actual expenses may vary slightly from that shown due to differences between

estimated and actual operational expenses and fee waivers or reimbursements by investment managers (which may be voluntary or

mandated by contract, and may not remain in effect).

7

7

Because percentages invested in the underlying funds will change from time to time, and the expense ratios of the underlying funds

also may change from time to time, the expense ratios for the myRetirement Funds will fluctuate and may be more or less than the

expense ratio shown. The expense ratios may also change if any underlying holdings of the funds are modified by the Benefits

I

nvestment Committee or as asset allocations within a fund are modified.

2065

2060

2055

2050

2045

2040

2035 2030

2025

myRetirement Fund

Gross Expense

Ratio

0.24% 0.24%

0.24%

0.25%

0.25%

0.24%

0.23%

0.20%

0.16%

0.14%

Important Information

If your Plan contributions are invested in one of the myRetirement Funds as described in this notice, you may move those funds into

any other investment options available under the Plan at any time either online at www.benefits.ml.com or by calling the Customer

Service

Center at (888) 968-4015.

8

8

You may not invest your 401(k) funds -- including your own salary deferral contributions, Walmart's contributions to your 401(k)

account and company matching contributions -- in Walmart stock.

There are no fees charged for transferring in or out of the myRetirement Funds.

For information on the other investment options available under the Plan, call the Customer Service Center at (888) 968-4015 or go

to www.benefits.ml.com to review the fund fact sheet for each option. (Note that prospectuses are not available for collective trusts

or for customized funds, such as the myRetirement Funds, which are offered only through the Walmart 401(k) Plan.) You may also

obtain information about your investment rights and options under the Plan by reviewing the Walmart 401(k) Plan Investment Guide

and the Walmart 401(k) Plan Annual Participant Fee Disclosure Notice, which you may obtain from the Customer Service Center

or website referenced above.

The Plan is intended to be an “ERISA Section 404(c) Plan.” This means that you assume all investment risks, including the increase

or decrease in market value, connected with the investment options you choose in the Plan or the investment of your accounts in the

myRetirement Funds if you fail to make an investment decision. Neither Walmart, the Benefits Investment Committee, nor the

Trustee are responsible for losses to your Plan accounts as a result of the investment decisions you make or as a result of the

investment of your account in a myRetirement Fund as explained in this notice.

Investors should carefully consider the investment objectives, risks, charges and expenses of each investment option before

investing.

Investing in funds, which are intended as long-term investments, involves risk, including the possible loss of principal. Investments

in foreign securities are subject to substantial volatility due to the potential for adverse political, economic or other developments

and may carry additional risk. Funds that invest in small- or mid-capitalization companies experience a greater degree of market

volatility than those of large-capitalization stocks and are riskier investments. Bond funds have the same interest rate, inflation, and

credit risks associated with the underlying bonds owned by the fund. Generally, the value of bond funds rises when prevailing interest

rates fall and, conversely, the value falls when interest rates rise. There are ongoing fees and expenses associated with investing.

Bear in mind that higher return potential is accompanied by higher risk.

Investing in commodities or global commercial real estate or the securities of companies operating in these markets involves a high

degree of risk, including leveraging strategies and other speculative investment practices that may increase the risk of investment

l

oss, including the principal value invested. Investments may be highly illiquid and subject to high fees and expenses.

4

Walmart stock gives you the potential for capital appreciation. As there are no other forms or types of investments in this option,

the value of the stock stands on its own. Because this option is a single stock investment, it generally carries more risk than the

other investment options offered through the Plan.

5

It is not possible to invest directly in an index.

6

This investment option is not a mutual fund, registered under the Investment Company Act of 1940, A prospectus is not available

and shares are not publicly traded or listed on an exchange.

2

0232637-2 580

7323 09/2023

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”)

makes available cerain investment products sponsored, managed, distributed or provided

by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a

registered broker-dealer, registered investment adviser, member SIPC, and a wholly owned

subsidiary of BofA Corp.

Investment products:

Are Not FDIC Insured Are Not Bank Guaranteed May Lose Value

The Walmar 401(k) Plan has a diverse selection of investment choices. Because people have different levels

of investment experience, the Plan offers a variety of options. The goal is to make it easy for you to choose an

investment mix that is right for you — whether you’re new to investing, an experienced investor, or somewhere

in between.

Through the Plan, you can select a:

• “One-choice” investment option based on the year you expect to retire

• Mix of individual investment options based on your retirement goals

This brochure explains the investment options available through Walmar’s 401(k) Plan. Information about your

Plan account and investment options is always available online and over the phone from Merrill.

Taking charge of your financial future now could help you fulfill your retirement goals. Review this information and

star planning for your retirement … your way.

Want to learn more?

Detailed information about all of the Walmar 401(k) Plan’s investment choices is available on the

Benefits OnLine® website or by calling Merrill.

• Online: Visit Benefits OnLine at www.benefits.ml.com.

• Customer Service Center: By calling (888) 968-4015, you can use the automated Interactive

Voice Response (IVR) system or speak with a customer service representative.

For more information about 401(k) plan features, please review your Summary Plan Description.

Walmar 401(k) Plan Investment Guide

M609450002

2

Make your investment choices

When it comes to investing, do you want to make just one choice? Or would you rather mix and manage your own

porfolio? It’s up to you.

*Diversification does not ensure a profit or protect against loss.

Make just one choice

A myRetirement Fund might be right

for you if:

• You want to simplify investing.

• You want a diversified portfolio with a

single investment choice.*

• You want a retirement strategy that will

automatically become more conservative

as you approach retirement age.

In general, this means:

• You select a fund that best coincides with the

year in which you expect to retire.

• Your fund is monitored and adjusted by

the Plan on a regular basis with the aid of

investment professionals.

• The fund mix automatically becomes

more conservative as you approach

retirement age.

However, you should monitor your account

regularly to make sure that your investment is

still right for you.

See page 3 for more details about the

myRetirement Funds.

Manage your own

investment mix

Creating your own investment mix might

be right for you if:

• You’re comfortable managing your 401(k)

investments.

• You feel confident in your ability to select

investment options that are right for your

retirement goals.

• You want to monitor your investments and

adjust them over time to meet your needs.

In general, this means:

• You choose your own investment mix from the

Plan’s investment menu, and you decide how

much to invest in each fund.

• You’re responsible for monitoring your

investments, and adjusting them as necessary.

• You may want to periodically adjust the mix

of stocks, bonds and cash equivalents in your

account as you approach retirement.

• Or, you may want to choose a new asset mix if

your goals and investment strategy change.

See page 5 for details about the Plan’s individual

investment options.

3

Make just one choice: select a myRetirement Fund

The myRetirement Funds are “target retirement date” funds that invest in several different types of stocks and bonds.

Their investment mix changes over time, so they become more conservative as you get closer to retirement. The funds

do this by moving money that’s invested in more aggressive investments, like stocks, to more conservative investments,

like bonds, as you get older. When you choose a myRetirement Fund, your savings will be invested by professional

investment managers in stocks, bonds, and other assets for you—so you won’t have all your eggs in one basket.

The myRetirement Fund is intended to be the most conservative fund in the series of myRetirement Funds. Unlike the

other funds, the investment allocations for the myRetirement Fund do not change as you get older. The myRetirement

Fund is designed for paricipants whose target retirement date was around the year 2020 or earlier, and seeks income

and capital appreciation in a diversified fund designed for retirement.

If retirement is many years away, your focus might be on building your account, which could involve taking more

investment risks. But as you move closer to retirement, you may want to become more conservative in your investment

risks, with a goal of preserving what you already have. Managing this process is what a myRetirement Fund can do for you.

How do you choose a myRetirement Fund?

If you decide that the myRetirement Funds are right for you, you generally would pick the year you think you will

retire, or will need to begin to withdraw the money from your account. Then, select the fund with a title closest

to that date. For example, John Doe was born in 1963, and plans to retire at age 67 in 2030. John would choose

the myRetirement 2030 Fund. However, you can choose any of the myRetirement Funds that you wish.

If you don’t make an investment election, your contributions and Walmar’s matching contributions will be

invested automatically in one of the myRetirement Funds based upon the year you were born, as shown below.

The myRetirement Funds are not mutual funds, registered under the Investment Company Act of 1940. Prospectuses are not available and shares are

not publicly traded or listed on exchanges.

The target date for each myRetirement Fund is the approximate date when investors plan to star withdrawing the assets from their retirement

account. The principal value of these funds is not guaranteed at any time, including at or after the target date. You may lose money by investing in

the myRetirement Funds, including losses near and following the target retirement date, and there is no guarantee that this investment will provide

adequate retirement income. These funds, other than the myRetirement Fund, are designed to become more conservative over time as the target date

approaches.

As a “fund of funds,” each of the myRetirement Funds, as a shareholder of underlying funds, will indirectly bear its pro rata share of the expenses

incurred by the underlying funds.

If you do not make an investment election, and

you were born in . . .

You will be invested in . . .

1995 or later myRetirement 2065 Fund

1990 — 1994 myRetirement 2060 Fund

1985 — 1989 myRetirement 2055 Fund

1980 — 1984 myRetirement 2050 Fund

1975 — 1979 myRetirement 2045 Fund

1970 — 1974 myRetirement 2040 Fund

1965 — 1969 myRetirement 2035 Fund

1960 — 1964 myRetirement 2030 Fund

1955 — 1959 myRetirement 2025 Fund

1954 or earlier myRetirement Fund

4

More about the myRetirement Funds

The enclosed Qualified Default Investment Alternative notice provides more details on the myRetirement Funds,

including:

• Target asset allocations.

• An illustration of how the funds change over time.

• Fund expenses.

For more up-to-date information, visit Benefits OnLine at www.benefits.ml.com.

A few principles to keep in mind

• Review your investment choices. No matter how you invest, you’re responsible for your investment

decisions. Because your goals and tolerance for risk may change over time, it’s wise to periodically review

your investments (at least annually) and make sure they are still appropriate for your goals.

• Investment performance isn’t guaranteed. None of the Plan’s investment options provide guaranteed

income in retirement.

• Diversify your account. Try to make sure your account is divided among different types of investment

options. That way, if one investment loses money, it may potentially be offset by another investment that

makes money. While diversification does not ensure a profit or protect against loss, it can be a good way

to manage risk. (A myRetirement Fund can diversify your account for you; however, like any investment,

the myRetirement Funds have the potential to lose money.)

5

The fund categories and risk/potential reward spectrum are based upon Lipper fund classifications (which are shown above the fund

names). These are intended to provide a general evaluation of the risk and potential reward of each investment option. They are not

meant to predict future perormance or the volatility of any investment option.

Investment option descriptions

Following are brief descriptions of the investment options available through the Plan. For more information about

these investment options, including perormance and fact sheets, visit Benefits OnLine at www.benefits.ml.com.

BlackRock Money Market Trust

This collective trust seeks as high a level of current income as is consistent with liquidity and stability of principal.

The porfolio invests in US Treasury bills, notes and obligations guaranteed by the US government and its agencies

and instrumentalities. Repurchase agreements are fully collateralized by such obligations. BlackRock is the

investment manager of this collective trust.

2,3

JPMorgan Shor Term Bond Trust

This collective trust, managed by JPMorgan, seeks current income consistent with preservation of capital

through investment in high-grade and medium-grade fixed income securities. Under normal conditions the fund

will primarily invest in high quality bonds, including taxable or tax-exempt municipal securities. It will generally

maintain an average weighted maturity of 3 years or less, taking into account expected amorization and

prepayment of principal on cerain investments.

2

Lower Risk/Lower Potential Reward Higher Risk/Higher Potential Reward

JPMorgan

Shor Term

Bond Trust

Shor-

Intermediate

Investment Grade

Debt Funds

Real Assets Fund

Global Flexible

Porfolio Funds

BlackRock

Money Market

Trust

Institutional

Money Market

Funds

BlackRock Russell

1000 Index Trust

1

Large Cap Equity

Fund

Small Mid Cap

Equity Fund

BlackRock Russell

2000 Index Trust

1

Large-Cap

Core Funds

BlackRock Bond

Index Trust

1

Bond Fund

Core Bond Funds

Small-Cap

Core Funds

Mid-Cap

Core Funds

BlackRock

International

Equity Index

Trust

1

International

Equity Fund

International

Large-Cap

Core Funds

Do it yourself: choose a mix of investments

Are you comforable choosing your own investments? The Plan offers a diverse menu of investment choices. You

can choose the ones you want, according to your investment goals and tolerance for risk.

Investment option overview

6

BlackRock Bond Index Trust

The BlackRock Bond Index Trust is a passively managed index porfolio that seeks to replicate the perormance

of the Bloomberg US Aggregate Bond Index by investing in intermediate term, high quality, U.S. treasury,

government agency, corporate, and morgage backed securities. The duration of this investment option will be

approximately 5-7 years. A typical investor in this fund seeks income and modest capital appreciation. This is a

conservative investment option; however, the investor remains exposed to both credit and interest rate risk.

1,2,3

Bond Fund

The Bond Fund was created by the Benefits Investment Committee solely for use by the Plan. The Fund may be

appropriate for investors who desire the additional porfolio diversification provided by fixed income investments.

The Fund provides bond exposure through the use of external investment managers, who in turn invest in fixed

income instruments of various maturities. The Fund aims to provide a favorable return relative to the Bloomberg

US Aggregate Bond Index. The Committee manages allocations to the underlying Fund managers, who are subject

to change without notice. Allocations to underlying managers fluctuate each quarer due to contributions and

perormance, but are rebalanced quarerly to the target allocation.

2,4

Real Assets Fund

The Real Assets Fund was created by the Benefits Investment Committee solely for use by the Plan. The Fund

seeks to provide investors with a way to diversify a stock and bond porfolio by combining external investment

managers, who in turn invest in real asset investments including commodities, global listed infrastructure

securities (service providers in the water, utility and related industries), global commercial real estate securities

and U.S. Treasury Inflation Protected Securities (TIPS). The Fund aims to provide a favorable return relative to a

blended benchmark including the Bloomberg Commodities Index, the FTSE/EPRA NAREIT Developed Index, the

S&P Global Listed Infrastructure Index, and the Barclays U.S. TIPS Index. The Committee manages allocations to

the underlying Fund managers, who are subject to change without notice. Allocations to underlying managers

fluctuate during each quarer due to contributions and perormance, but are rebalanced quarerly to the target

allocation.

2,3,5

BlackRock Russell 1000 Index Trust

BlackRock Institutional Trust Company, N.A. is the investment manager of this collective trust. This Trust seeks

to match the perormance of the Russell 1000 Index by investing in stocks that make up the index. The Russell

1000 Index is comprised of the 1,000 largest companies within the Russell 3000 Index. These 1,000 large-

capitalization companies represent approximately 93% of the total market capitalization of the Russell 3000 Index.

The Russell 3000 Index represents approximately 96% of the total US equity market capitalization. Investing in

large-capitalization stocks is the most efficient way to paricipate in earnings from large US companies. These

stocks have the potential for more stable earnings than that of small- or mid-capitalization stocks, and their prices

tend to be less volatile. This fund is intended for long-term investors seeking to capture the earnings and growth

potential of large US companies.

1,2

Large Cap Equity Fund

The Large Cap Equity Fund was created by the Benefits Investment Committee solely for use by the Plan. The

Fund is intended for investors seeking a diversified porfolio of large capitalization stocks. The Fund invests

through an external investment manager, who in turn invests in marketable equity securities of US Large Cap

companies. The Fund will include exposure to stocks across the equity style spectrum, including growth, value

and core investments. The Fund will use alternative index strategies to provide low-cost exposure to several

market factors, such as value, low volatility, quality, and momentum. The Fund aims to provide a favorable return

relative to the Russell 1000 Index. The Committee manages allocations to the underlying Fund strategies, which

are subject to change without notice. Allocations to underlying strategies fluctuate during each quarer due to

contributions and perormance, but are rebalanced quarerly to the target allocation.

2,4

7

Small Mid Cap Equity Fund

The Small Mid Cap Equity Fund was created by the Benefits Investment Committee solely for use by the Plan. The

Fund is intended for investors seeking a diversified porfolio of small and mid capitalization companies, who are

willing to accept increased volatility relative to larger companies. The Fund invests through the use of external

investment managers, who in turn invest in small and mid capitalization stocks across the equity style spectrum,

including growth, value and core investments. The Fund aims to provide a favorable return relative to the Russell

2500 Index. The Committee manages allocations to the underlying Fund managers, who are subject to change

without notice. Allocations to underlying managers fluctuate each quarer due to contributions and perormance,

but are rebalanced quarerly to the target allocation.

2,4

BlackRock Russell 2000 Index Trust

BlackRock Institutional Trust Company, N.A. is the investment manager of this collective trust. The Trust seeks

to match the perormance of the Russell 2000 Index by investing in a diversified sample of the stocks that make

up the index. The Index is comprised of the 2,000 smallest companies in the Russell 3000 Index and represents

approximately 7% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index represents

96% of the total US equity market capitalization. The Trust may be appropriate for long-term investors who are

willing to accept changes in the value of their investments due to the regular fluctuations of stock prices.

1,2

BlackRock International Equity Index Trust

The BlackRock International Equity Index Trust is a passively managed index porfolio that seeks to replicate

the perormance of the MSCI ACWI ex USA Investable Market Index by investing in large, mid, and small cap

stocks that make up the broad international equity universe. This investment option invests in over 6,000 stocks

in approximately 22 developed countries excluding the United States and 24 emerging market countries. The

investment option is intended for longer-term investors who are seeking growth potential and are willing to

accept increased volatility associated with stocks of small- and mid-capitalization international developed and

emerging market companies.

1,2

International Equity Fund

The Fund was created by the Benefits Investment Committee solely for the Plan. The Fund is intended for

investors seeking a diversified porfolio of international stocks. The Fund seeks long-term growth of capital

and invests primarily in pooled trusts and mutual funds, which in turn invest in marketable equity securities of

non-US and emerging markets companies. The Fund provides equity exposures across various regions and market

capitalization ranges, as well as equity growth and value investment styles. The Fund aims to provide a favorable

return relative to the MSCI All Country World ex-US IMI Index. The Committee manages allocations to Fund

holdings, which are subject to change without notice. The allocation fluctuates each quarer due to contributions

and perormance, but is rebalanced quarerly to the target allocation.

2,4

Changing your investment elections

You can change your investment choices at any time.

• How to make a change: Log on to www.benefits.ml.com or call the Customer Service Center at

(888) 968-4015.

• What happens next: If you call prior to 3:00 p.m. ET, your investment change will generally be made on

the day you call. If you call after 3:00 p.m. ET, your investment change will generally be made on the

next business day. You’ll get a confirmation statement after you change your investment choices. It’s

important to review this statement and make sure your changes were made correctly.

Investing through the Plan involves risk, including the possible loss of the principal value invested.

Merrill provides products and services to various employers, their employees and other individuals. Merrill makes available content on

websites on the internet, mobile device applications, and written brochures in order to provide you with information regarding your

plan. Under no circumstances should this content be considered an offer to sell or a solicitation to buy any securities, products, or

services from Merrill or any other person or entity.

Benefits OnLine is a registered trademark of Bank of America Corporation.

© 2023 Bank of America Corporation. All rights reserved. | 5807308 | 20232633-1 | 10/2023 | ADA

For information about plan fees

The Plan makes available the Walmar 401(k) Plan Annual Paricipant Fee Disclosure Notice, which contains

a list of fees associated with the Plan, including administrative fees and expenses that apply to each

investment option. You may obtain a copy of this document, as well as additional information about each

investment option, at www.benefits.ml.com or by calling the Customer Service Center at (888) 968-4015.

1

It is not possible to invest directly in an index.

2

This investment option is not a mutual fund registered under the Investment Company Act of 1940. A prospectus is not available and

shares are not publicly traded or listed on exchanges.

3

An investment in the Fund is neither insured nor guaranteed by the U.S. government.

4

As a “fund of funds,” this Fund, as a shareholder of underlying funds, will indirectly bear its pro rata share of the expenses incurred by

the underlying funds.

5

Investing in commodities or global commercial real estate or the securities of companies operating in these markets involves a high

degree of risk, including leveraging strategies and other speculative investment practices that may increase the risk of investment loss,

including the principal value invested. Investments may be highly illiquid and subject to high fees and expenses.

Investing involves risk, including possible loss of the principal value invested. Investments in foreign securities or real estate securities

are subject to substantial volatility due to adverse political, economic or other developments and may carry additional risk. Funds that

invest in small- or mid-capitalization companies experience a greater degree of market volatility than those of large-capitalization

stocks and are riskier investments. Bond funds have the same interest rate, inflation, and credit risks associated with the underlying

bonds owned by the fund. Generally, the value of bond funds rises when prevailing interest rates fall and, conversely, the value falls

when interest rates rise. There are ongoing fees and expenses associated with investing. Bear in mind that higher return potential is

accompanied by higher risk.

Investors should consider the investment objectives, risks, charges and expenses of investment options carefully before investing.

For more information about the investment options that are not mutual funds (non-registered investments), log on to Benefits OnLine at

www.benefits.ml.com and refer to the fund description or fact sheet, if available.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors

before making any financial decisions.