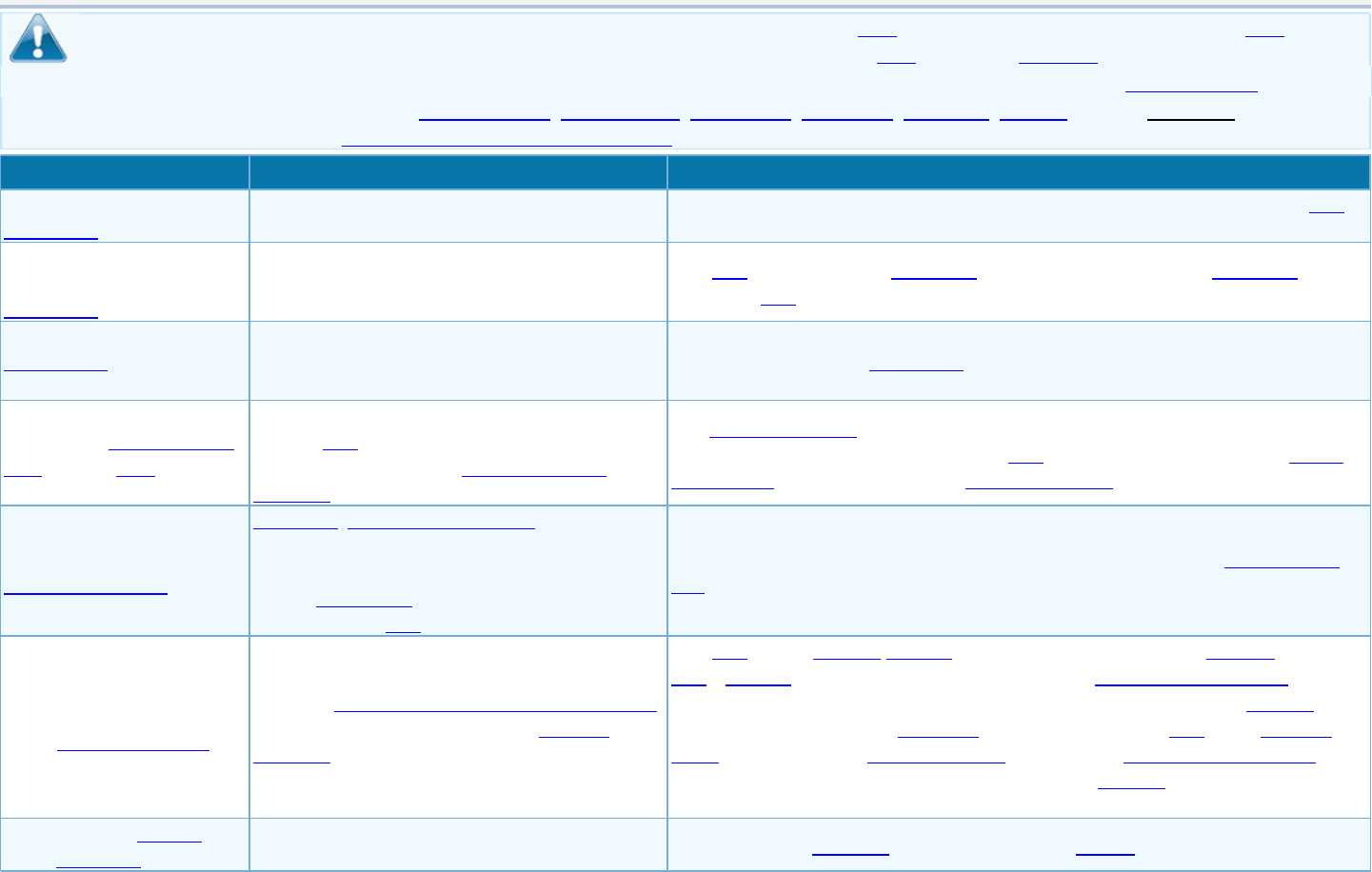

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services

Coverage Period: 01/01/2024 - 12/31/2024

HMSA: MED 734 / DRG 637, WALMART/SAMS CLUB STORES

Coverage for: Individual / Family | Plan Type: CompMED

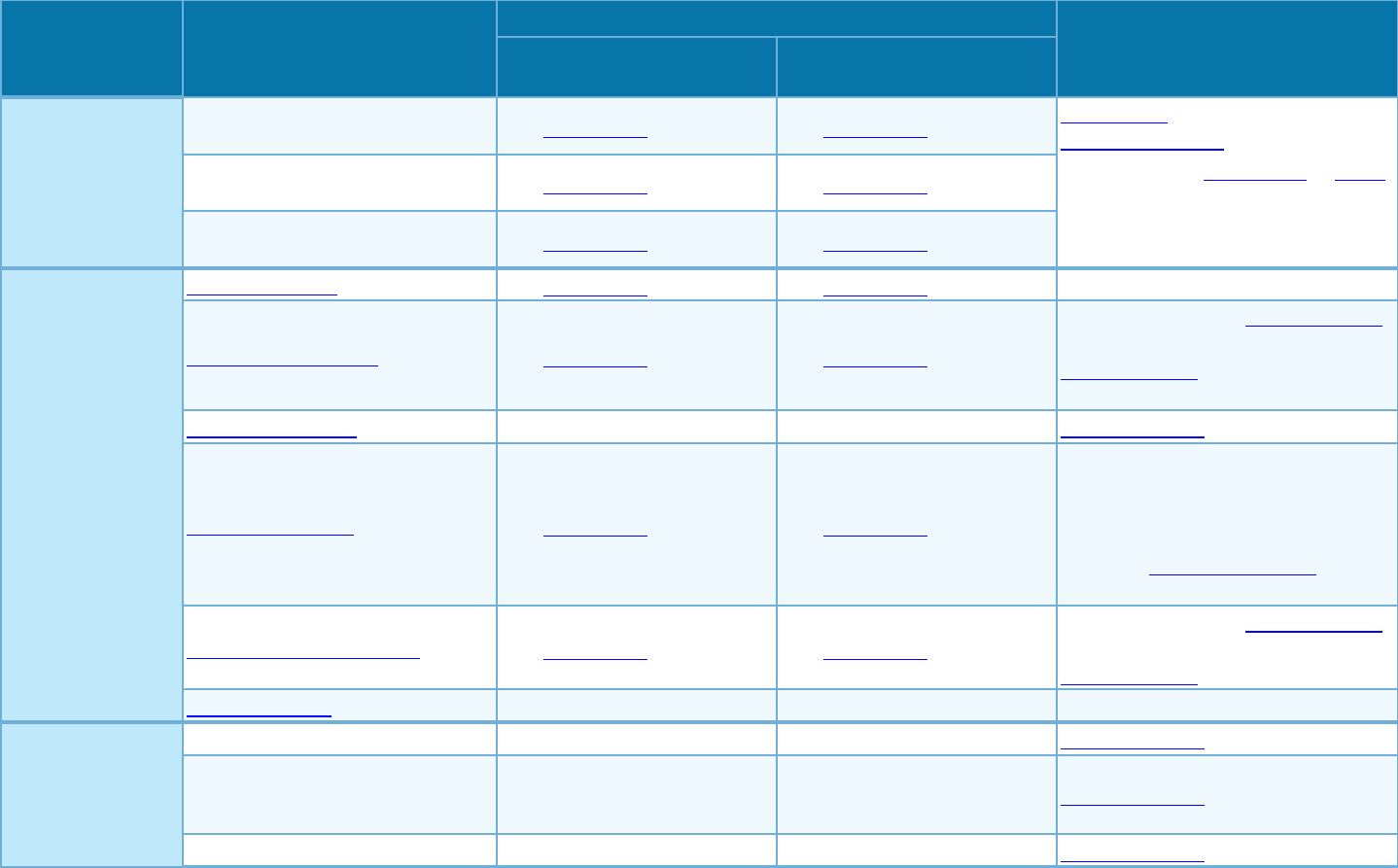

Important Questions

Answers

Why This Matters:

What is the overall

deductible?

$0

See the Common Medical Events chart below for your costs for services this plan

covers.

Are there services covered

before you meet your

deductible?

Not applicable.

This plan does not have a deductible. You do not have to meet a deductible amount

before the plan pays for any services.

Are there other

deductibles for specific

services?

No.

You don’t have to meet deductibles for specific services.

What is the out-of-pocket

limit for this plan?

$2,500 individual / $7,500 family (applies to

medical plan coverage). $3,600 individual /

$4,200 family (applies to prescription drug

coverage).

The out-of-pocket limit is the most you could pay in a year for covered services.

If you have other family members in this plan, they have to meet their own out-of-

pocket limits until the overall family out-of-pocket limit has been met.

What is not included in the

out-of-pocket limit?

Premiums, balance-billed charges, payments for

services subject to a maximum once you reach

the maximum, any amounts you owe in addition

to your copayment for covered services, and

health care this plan doesn’t cover.

Even though you pay these expenses, they don’t count toward the out-of-pocket

limit.

Will you pay less if you

use a network provider?

Yes. See http://www.hmsa.com/search/providers

or call 1-800-776-4672 for a list of network

providers.

This plan uses a provider network. You will pay less if you use a provider in the

plan’s network. You will pay the most if you use an out-of-network provider (unless

otherwise defined by federal law), and you might receive a bill from a provider for

the difference between the provider’s charge and what your plan pays (balance

billing). Be aware, your network provider might use an out-of-network provider for

some services (such as lab work). Check with your provider before you get

services.

Do you need a referral to

see a specialist?

No.

You can see the specialist you choose without a referral.

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would

share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.

This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.hmsa.com.

For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the

Glossary. You can view the Glossary at http://www.healthcare.gov/sbc-glossary/ or call 1-800-776-4672 to request a copy.

1 of 8

M165_7/12/2023_OE

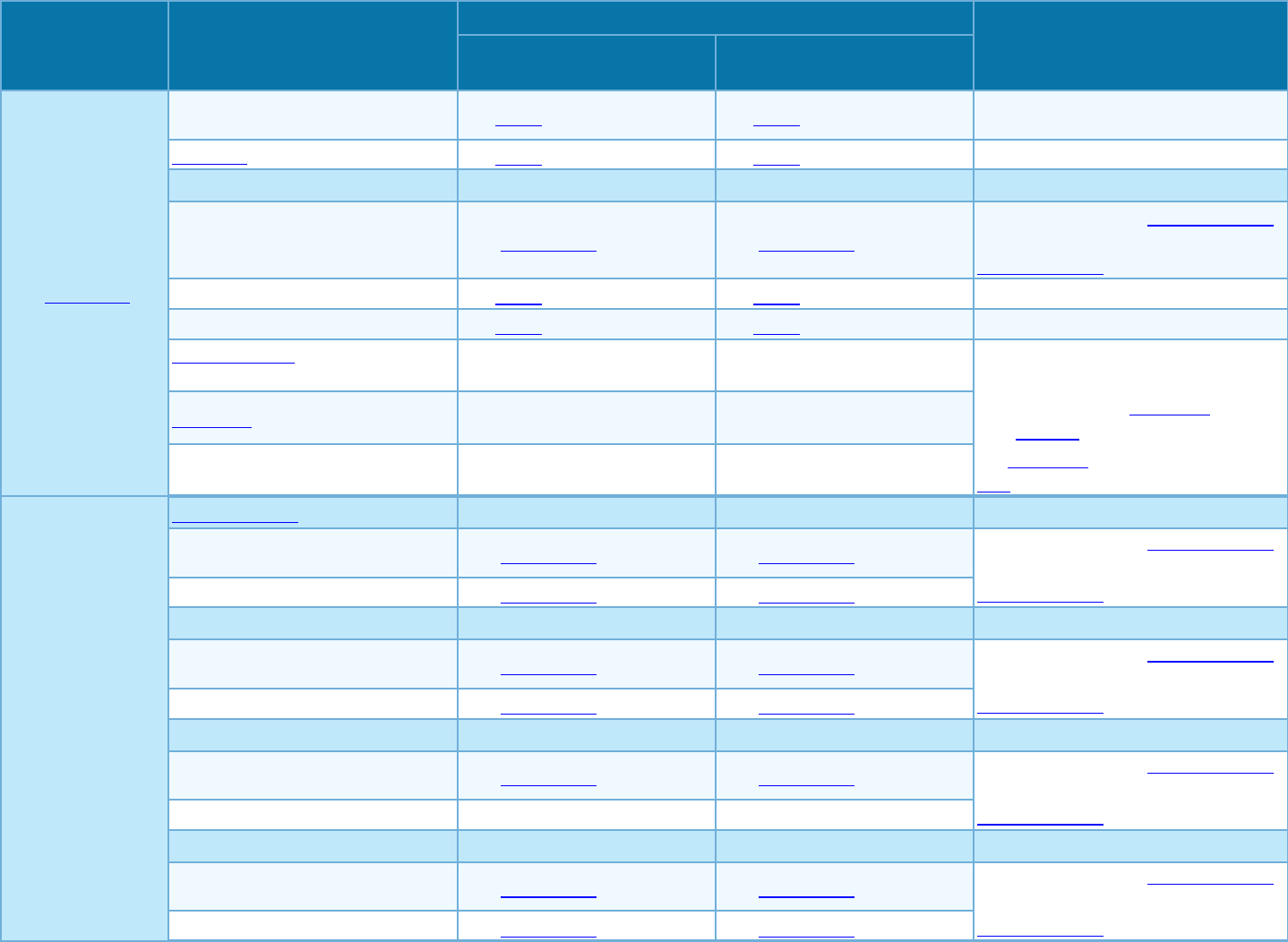

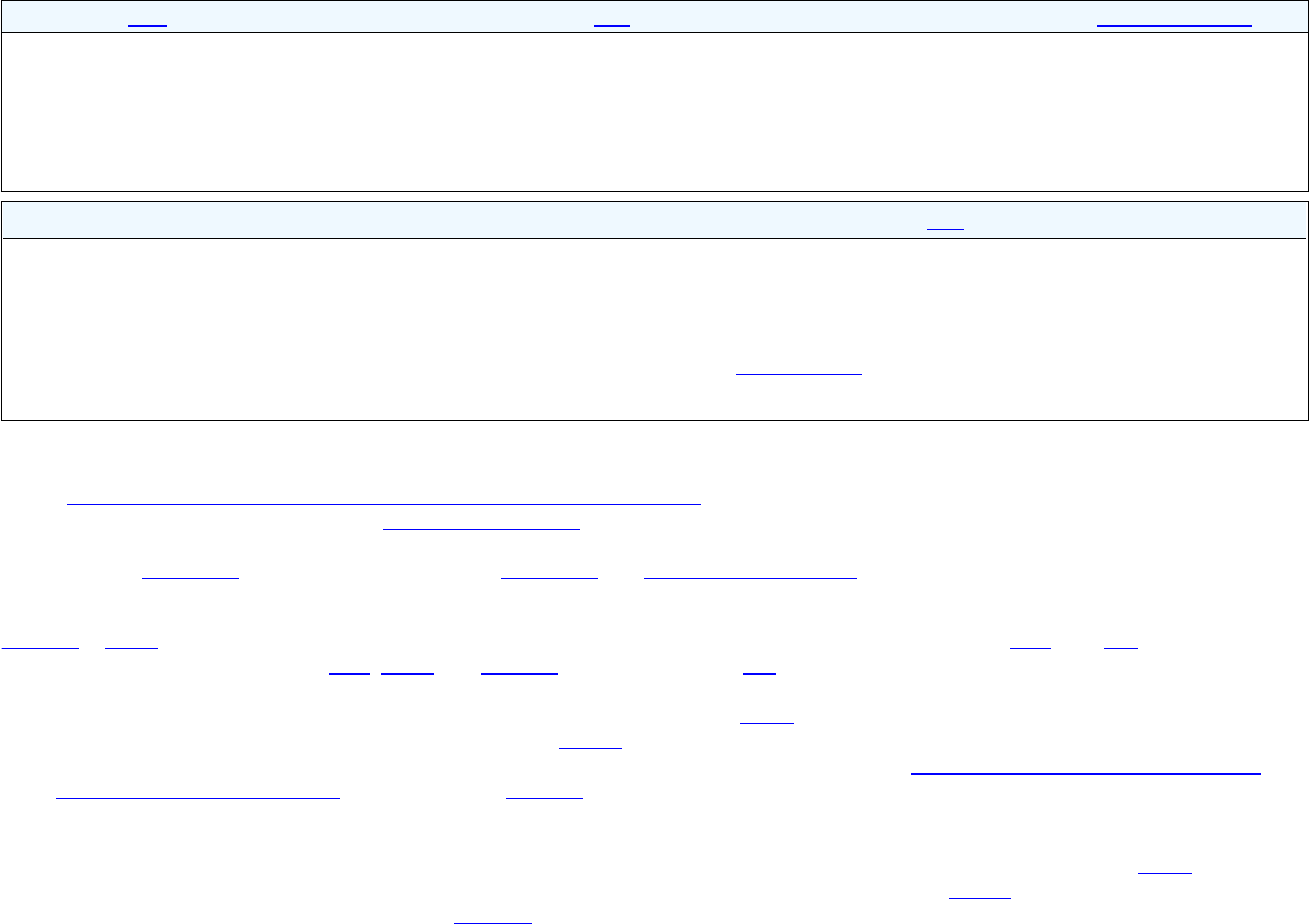

Common Medical

Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Event

Network Provider

(You will pay the least)

Out-of-Network Provider

(You will pay the most)

Important Information

If you visit a health

care provider's

office or clinic

Primary care visit to treat an injury

or illness

$14 copay/visit

$14 copay/visit

---none---

Specialist visit

$14 copay/visit

$14 copay/visit

---none---

Other practitioner office visit:

Physical and Occupational

Therapist

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

preauthorization is not obtained.

Psychologist

$14 copay/visit

$14 copay/visit

---none---

Nurse Practitioner

$14 copay/visit

$14 copay/visit

---none---

Preventive care (Well Child

Physician Visit)

No charge

No charge

Age and frequency limitations may

apply. You may have to pay for

Screening

No charge

No charge

services that aren't preventive. Ask

your provider if the services needed

Immunization (Standard and Travel)

No charge

No charge

are preventive. Then check what your

plan will pay for.

If you have a test

Diagnostic test

Inpatient

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

Outpatient

20% coinsurance

20% coinsurance

preauthorization is not obtained.

X-ray

Inpatient

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

Outpatient

20% coinsurance

20% coinsurance

preauthorization is not obtained.

Blood Work

Inpatient

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

Outpatient

No charge

No charge

preauthorization is not obtained.

Imaging (CT/PET scans, MRIs)

Inpatient

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

Outpatient

20% coinsurance

20% coinsurance

preauthorization is not obtained.

2 of 8

M165_7/12/2023_OE

Common Medical

Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Event

Network Provider

(You will pay the least)

Out-of-Network Provider

(You will pay the most)

Important Information

If you need drugs

to treat your

illness or

condition

More information

about prescription

drug coverage is

available at

www.hmsa.com.

Tier 1 - mostly Generic drugs (retail)

$7 copay/prescription

$7 copay and

20% coinsurance/prescription

One retail copay for 1-30 day supply,

two retail copays for 31-60 day supply,

and three retail copays for 61-90 day

supply.

Tier 1 - mostly Generic drugs

(mail order)

$11 copay/prescription

Not covered

One mail order copay for a 84-90 day

supply at a 90 day at retail network or

contracted mail order provider.

Tier 2 - mostly Preferred Formulary

Drugs (retail)

$50 copay/prescription

$50 copay and

20% coinsurance/prescription

One retail copay for 1-30 day supply,

two retail copays for 31-60 day supply,

and three retail copays for 61-90 day

supply.

Tier 2 - mostly Preferred Formulary

Drugs

(mail order)

$65 copay/prescription

Not covered

One mail order copay for a 84-90 day

supply at a 90 day at retail network or

contracted mail order provider.

Tier 3 - mostly Non-preferred

Formulary Drugs (retail)

$75 copay/prescription

$75 copay and

20% coinsurance/prescription

Cost to you for retail Tier 3 drugs: One

copay plus one Tier 3 Cost Share for 1-

30 day supply, two copays plus two

Tier 3 Cost Shares for 31-60 day

supply, and three copays plus three

Tier 3 Cost Shares for 61-90 day

supply.

Tier 3 - mostly Non-preferred

Formulary Drugs (mail order)

$65 copay/prescription

Not covered

In addition to your copay and/or

coinsurance, you will be responsible for

a $135 Tier 3 Cost Share per mail

order copay. Cost to you for mail

order Tier 3 drugs: One mail order

copay plus one mail order Tier 3 Cost

Share for an 84-90 day supply at a 90

day at retail network or contracted mail

order provider.

Tier 4 - mostly Preferred Formulary

Specialty drugs (retail)

$100 copay/prescription

Not covered

Retail benefits for Tier 4 and Tier 5

drugs are limited to a 30-day supply.

Available in participating Specialty

Tier 5 - mostly Non-preferred

Formulary Specialty drugs (retail)

$200 copay/prescription

Not covered

Pharmacies only.

3 of 8

M165_7/12/2023_OE

Common Medical

Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Event

Network Provider

(You will pay the least)

Out-of-Network Provider

(You will pay the most)

Important Information

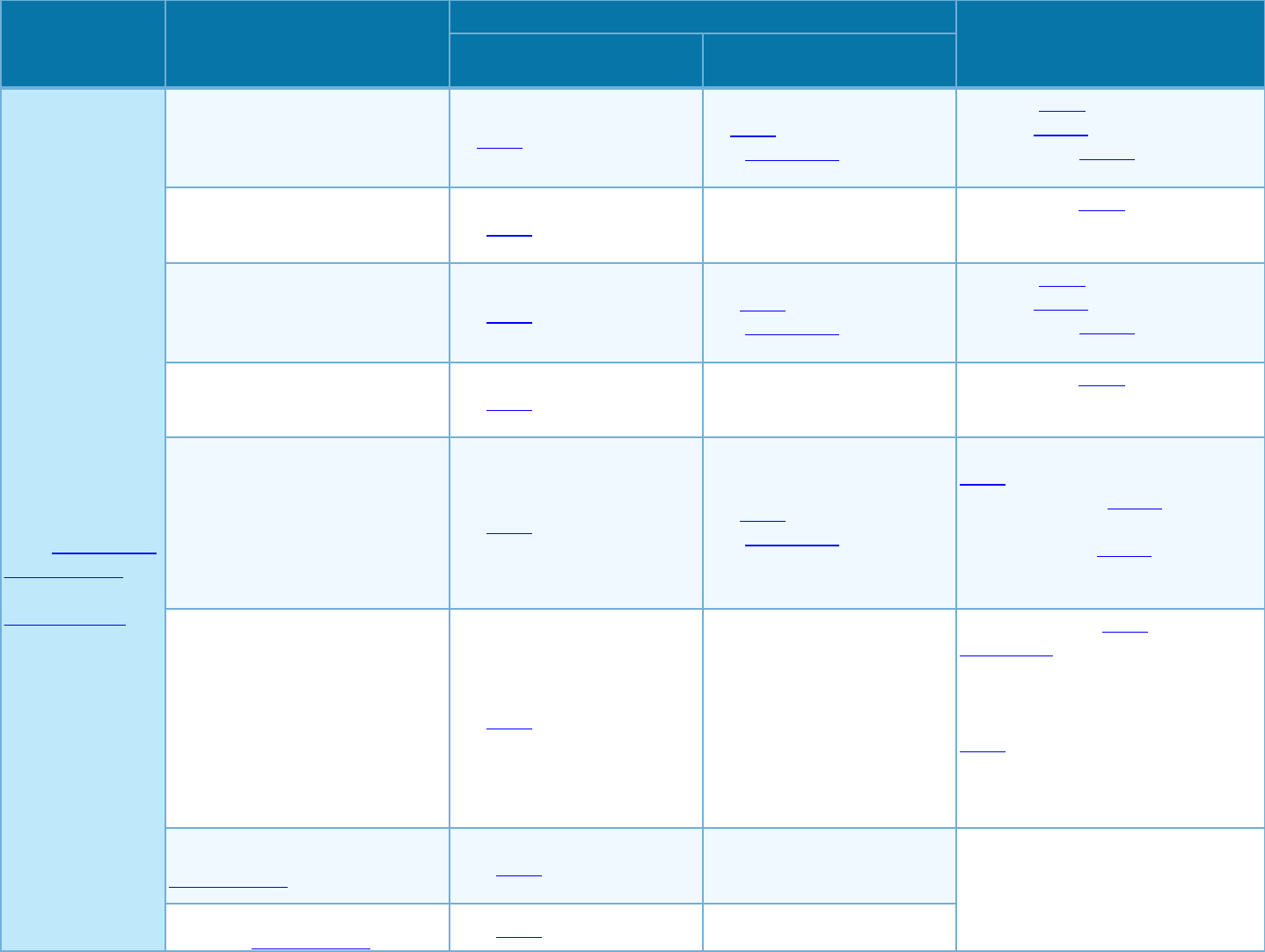

Tier 4 & 5 (mail order)

Not covered

Not covered

If you have

outpatient surgery

Facility fee (e.g., ambulatory

surgery center)

20% coinsurance

20% coinsurance

---none---

Physician Visits

$14 copay/visit

$14 copay/visit

---none---

Surgeon fees

20% coinsurance (cutting)

20% coinsurance (cutting)

---none---

20% coinsurance (non-cutting)

20% coinsurance (non-cutting)

---none---

If you need

immediate medical

attention

Emergency room care

Physician Visit

$20 copay/visit

$20 copay/visit

---none---

Emergency room

20% coinsurance

20% coinsurance

---none---

Emergency medical transportation

(air)

20% coinsurance

20% coinsurance

Limited to air transport to the nearest

adequate hospital within the State of

Hawaii, except in certain situations

when transportation to the continental

US is necessary for critical care in

accord with HMSA's medical policy.

Certain exclusions apply.

Emergency medical transportation

(ground)

20% coinsurance

20% coinsurance

Ground transportation to the nearest,

adequate hospital to treat your illness

or injury.

Urgent care

$14 copay/visit

$14 copay/visit

---none---

If you have a

hospital stay

Facility fee (e.g., hospital room)

20% coinsurance

20% coinsurance

---none---

Physician Visits

$20 copay/visit

$20 copay/visit

---none---

Surgeon fee

20% coinsurance (cutting)

20% coinsurance (cutting)

---none---

20% coinsurance (non-cutting)

20% coinsurance (non-cutting)

---none---

If you have mental

health, behavioral

health, or

substance abuse

needs

Outpatient services

Physician services

$14 copay/visit

$14 copay/visit

---none---

Hospital and facility services

20% coinsurance

20% coinsurance

---none---

Inpatient services

Physician services

20% coinsurance

20% coinsurance

---none---

Hospital and facility services

20% coinsurance

20% coinsurance

---none---

4 of 8

M165_7/12/2023_OE

Common Medical

Services You May Need

What You Will Pay

Limitations, Exceptions, & Other

Event

Network Provider

(You will pay the least)

Out-of-Network Provider

(You will pay the most)

Important Information

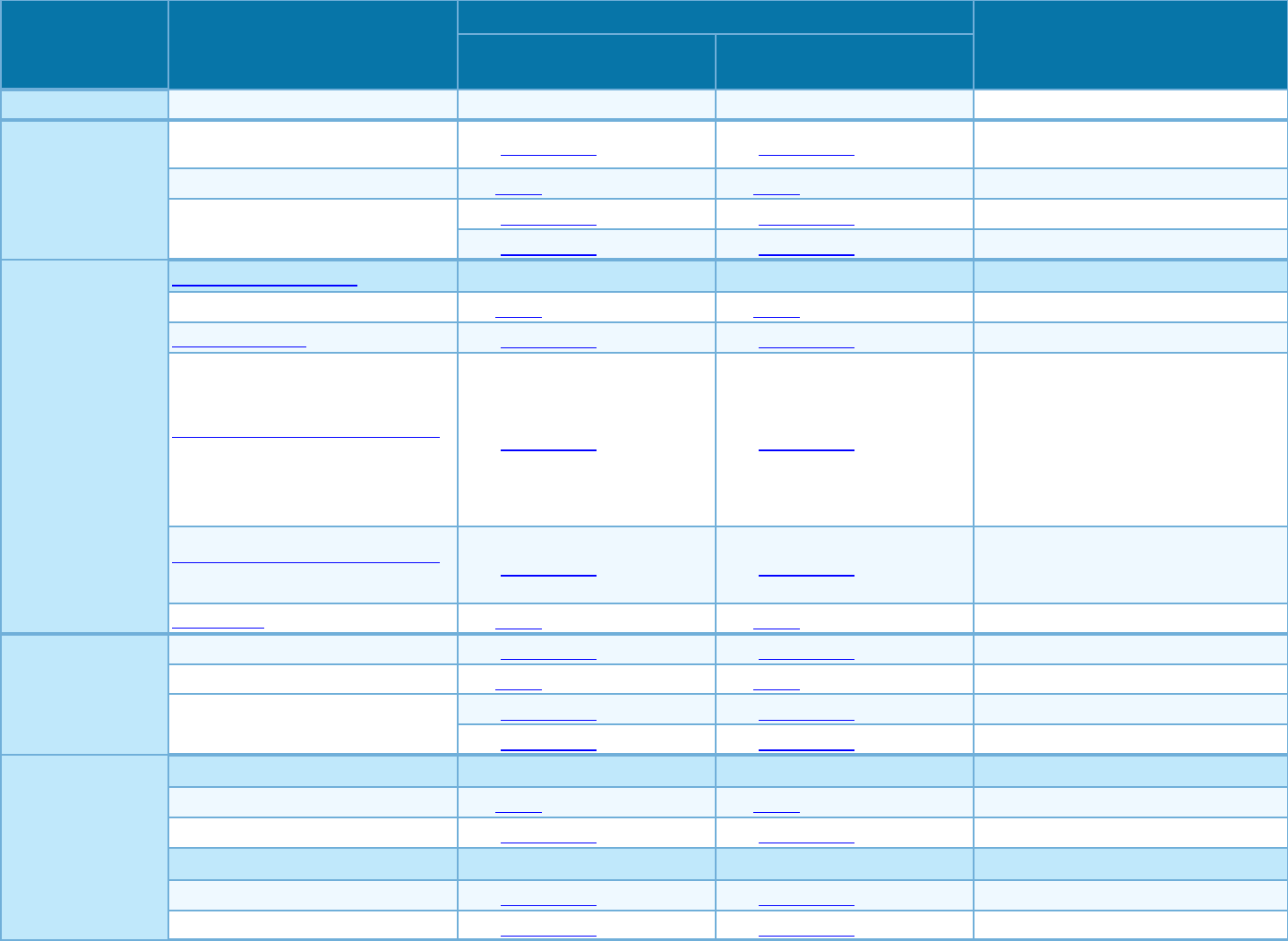

If you are pregnant

Office visit (Prenatal and postnatal

care)

20% coinsurance

20% coinsurance

Cost sharing does not apply to certain

preventive services. Depending on the

Childbirth/delivery professional

services

20% coinsurance

20% coinsurance

type of services, coinsurance or copay

may apply. Maternity care may include

Childbirth/delivery facility services

20% coinsurance

20% coinsurance

tests and services described elsewhere

in the SBC (i.e. ultrasound).

If you need help

recovering or have

other special

health needs

Home health care

20% coinsurance

20% coinsurance

150 Visits per Calendar Year

Rehabilitation services

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

preauthorization is not obtained.

Excludes cardiac rehabilitation.

Habilitation services

Not covered

Not covered

Excluded service

Skilled nursing care

20% coinsurance

20% coinsurance

120 Days per Calendar Year. Includes

extended care facilities (Skilled

Nursing, Sub-Acute, and Long-Term

Acute Care Facilities) to the extent

care is for Skilled nursing care, sub-

acute care, or long-term acute care.

Durable medical equipment

20% coinsurance

20% coinsurance

Services may require preauthorization.

Benefits may be denied if

preauthorization is not obtained.

Hospice services

No charge

No charge

---none---

If your child needs

dental or eye care

Children's eye exam

Not covered

Not covered

Excluded service

Children's glasses (single vision

lenses and frames selected within

designated group)

Not covered

Not covered

Excluded service

Children's dental check-up

Not covered

Not covered

Excluded service

5 of 8

M165_7/12/2023_OE

•

Bariatric surgery

•

Chiropractic care (e.g., office visits, x-ray films -

limited to services covered by this medical plan

and within the scope of a chiropractor's license)

•

Hearing aids (limited to one hearing aid per ear

every 60 months)

•

Infertility Treatment (Artificial Insemination and

In Vitro Fertilization. Please refer to your plan

document for limitations and additional details)

•

Non-emergency care when traveling outside the

U.S. For more information, see www.hmsa.com

Other Covered Services (Limitations may apply to these services. This isn't a complete list. Please see your plan document.)

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those

agencies is: 1) 1-800-776-4672 for HMSA; 2) (808) 586-2790 for the State of Hawaii, Dept. of Commerce and Consumer Affairs - Insurance Division; 3) 1-866-444-

3272 or http://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/affordable-care-act for the U.S. Department of Labor, Employee Benefits Security

Administration; or 4) 1-877-267-2323 x61565 or http://www.cciio.cms.gov for the U.S. Department of Health and Human Services. Church plans are not covered by

the Federal COBRA continuation coverage rules. Other coverage options may be available to you too, including buying individual insurance coverage through the

Health Insurance Marketplace. For more information about the Marketplace, visit http://www.HealthCare.gov or call 1-800-318-2596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called a

grievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also

provide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,

contact:

• For group health coverage subject to ERISA, you must submit a written request for an appeal to: HMSA Member Advocacy and Appeals, P.O. Box 1958,

Honolulu, Hawaii 96805-1958. If you have any questions about appeals, you can call us at (808) 948-5090 or toll free at 1-800-462-2085. You may also

contact the Department of Labor's Employee Benefits Security Administration at 1-866-444-EBSA (3272) or http://www.dol.gov/agencies/ebsa/laws-and-

regulations/laws/affordable-care-act. You may also file a grievance with the Insurance Commissioner. You must send the request to the Insurance

Commissioner at: Hawaii Insurance Division, ATTN: Health Insurance Branch - External Appeals, 335 Merchant Street, Room 213, Honolulu, Hawaii 96813.

Telephone: (808) 586-2804.

• For non-federal governmental group health plans and church plans that are group health plans, you must submit a written request for an appeal to: HMSA

Member Advocacy and Appeals, P.O. Box 1958, Honolulu, Hawaii 96805-1958. If you have any questions about appeals, you can call us at (808) 948-5090

or toll free at 1-800-462-2085. You may also file a grievance with the Insurance Commissioner. You must send the request to the Insurance Commissioner at:

Hawaii Insurance Division, ATTN: Health Insurance Branch - External Appeals, 335 Merchant Street, Room 213, Honolulu, Hawaii 96813. Telephone: (808)

Excluded Services & Other Covered Services:

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.)

•

Acupuncture

•

Cardiac rehabilitation

•

Cosmetic surgery

•

Dental care (Adult)

•

Dental care (Child)

•

Habilitation services

•

Long-term care

•

Private-duty nursing

•

Routine eye care (Adult)

•

Routine eye care (Child)

•

Routine foot care

•

Weight loss programs

6 of 8

M165_7/12/2023_OE

586-2804.

Does this Coverage Provide Minimum Essential Coverage? Yes

Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid,

CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.

Does this Coverage Meet the Minimum Value Standard? Yes

If your plan doesn't meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.

Language Access Services:

Spanish (Español): Para obtener asistencia en Español, llame al 1-800-776-4672.

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-776-4672.

Chinese (中文): 如果需要中文的帮助,请拨打这个号码 1-800-776-4672.

Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-800-776-4672.

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

7 of 8

M165_7/12/2023_OE

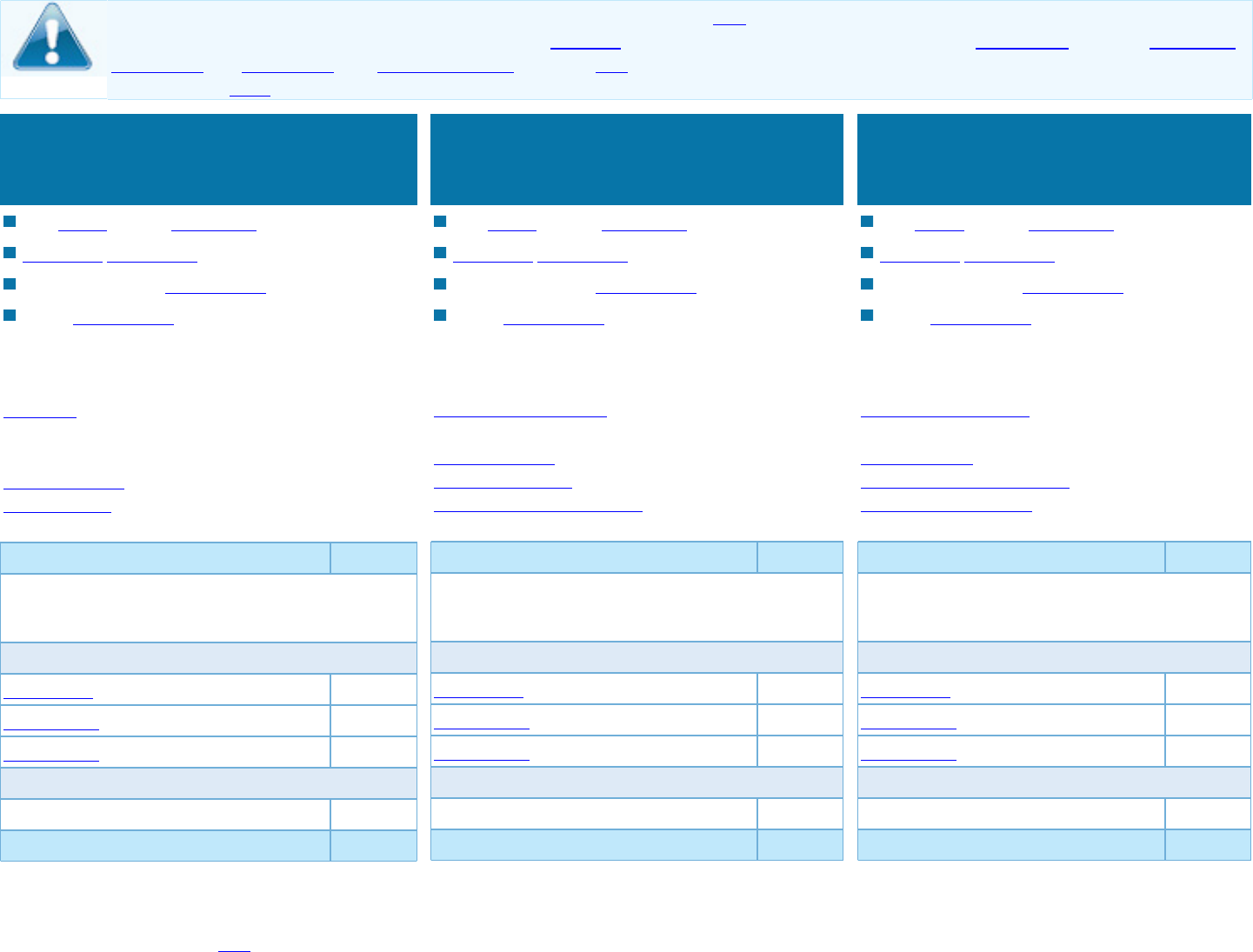

Peg is Having a Baby

(9 months of in-network pre-natal care and a hospital

delivery)

The plan's overall deductible

$0

Specialist copayment

$14

Hospital (facility) coinsurance

20%

Other coinsurance

20%

This EXAMPLE event includes services like:

Specialistoffice visits (prenatal care)

Childbirth/Delivery Professional Services

Childbirth/Delivery Facility Services

Diagnostic tests(ultrasounds and blood work)

Specialist visit(anesthesia)

Total Example Cost

$12,700

In this example, Peg would pay:

Cost Sharing

Deductibles

$0

Copayments

$30

Coinsurance

$2,000

What isn't covered

Limits or exclusions

$60

The total Peg would pay is

$2,090

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different

depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharing amounts (deductibles,

copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion of costs you might pay under

different health plans. Please note these coverage examples are based on self-only coverage.

Managing Joe's type 2 Diabetes

(a year of routine in-network care of a well-controlled

condition)

The plan's overall deductible

$0

Specialist copayment

$14

Hospital (facility) coinsurance

20%

Other coinsurance

20%

This EXAMPLE event includes services like:

Primary care physicianoffice visits (including

disease education)

Diagnostic tests(blood work)

Prescription drugs

Durable medical equipment(glucose meter)

Total Example Cost

$5,600

In this example, Joe would pay:

Cost Sharing

Deductibles

$0

Copayments

$400

Coinsurance

$200

What isn't covered

Limits or exclusions

$20

The total Joe would pay is

$620

Mia's Simple Fracture

(in-network emergency room visit and follow up

care)

The plan's overall deductible

$0

Specialist copayment

$14

Hospital (facility) coinsurance

20%

Other coinsurance

20%

This EXAMPLE event includes services like:

Emergency room care(including medical

supplies)

Diagnostic test(x-ray)

Durable medical equipment(crutches)

Rehabilitation services(physical therapy)

Total Example Cost

$2,800

In this example, Mia would pay:

Cost Sharing

Deductibles

$0

Copayments

$90

Coinsurance

$400

What isn't covered

Limits or exclusions

$0

The total Mia would pay is

$490

About these Coverage Examples:

8 of 8

The plan would be responsible for the other costs of these EXAMPLE covered services.

M165_7/12/2023_OE

Federal law requires HMSA to provide you with this

notice.

HMSA complies with applicable Federal civil rights laws

and does not discriminate on the basis of race, color,

national origin, age, disability, or sex. HMSA does not

exclude people or treat them differently because of

things like race, color, national origin, age, disability,

or sex.

Services that HMSA provides

Provides aids and services to people with disabilities

to communicate effectively with us, such as:

• Qualified sign language interpreters

• Written information in other formats (large print,

audio, accessible electronic formats, other formats)

Provides language services to people whose primary

language is not English, such as:

• Qualified interpreters

• Information written in other languages

• If you need these services, please call

1 (800) 776-4672 toll-free; TTY 711

How to file a discrimination-related grievance

or complaint

If you believe that we’ve failed to provide these

services or discriminated against you in some way, you

can file a grievance in any of the following ways:

• Phone: 1 (800) 776-4672 toll-free

• TTY: 711

• Email: Compliance_Ethics@hmsa.com

• Fax: (808) 948-6414 on Oahu

• Mail: 818 Keeaumoku St., Honolulu, HI 96814

You can also file a civil rights complaint with the U.S.

Department of Health and Human Services, Office for

Civil Rights, in any of the following ways:

• Online: ocrportal.hhs.gov/ocr/portal/lobby.jsf

• Phone: 1 (800) 368-1019 toll-free; TDD users,

call 1 (800) 537-7697 toll-free

• Mail: U.S. Department of Health and Human

Services, 200 Independence Ave. S.W., Room

509F, HHH Building, Washington, DC 20201

For complaint forms, please go to

hhs.gov/ocr/office/file/index.html.

Hawaiian: E NĀNĀ MAI: Inā hoʻopuka ʻoe i ka ʻŌlelo

Hawaiʻi, loaʻa ke kōkua manuahi iā ʻoe. E kelepona iā

1 (800) 776-4672. TTY 711.

Bisaya: ATENSYON: Kung nagsulti ka og Cebuano,

aduna kay magamit nga mga serbisyo sa tabang sa

lengguwahe, nga walay bayad. Tawag sa

1 (800) 776-4672 nga walay toll. TTY 711.

Chinese: 注意:如果您使用繁體中文,您可以

免費獲得語言援助服務。請致電

1 (800) 776-4672。TTY 711.

Ilocano: PAKDAAR: Nu saritaem ti Ilocano, ti serbisyo

para ti baddang ti lengguahe nga awanan bayadna, ket

sidadaan para kenyam. Awagan ti

1 (800) 776-4672 toll-free. TTY 711.

Japanese: 注意事項:日本語を話される場合、

無料の言語支援をご利用いただけます。

1 (800) 776-4672 をご利用ください。TTY 711.

まで、お電話にてご連絡ください.

Korean: 주의: 한국어를 사용하시는 경우, 언어

지원 서비스를 무료로 이용하실 수 있습니다.

1 (800) 776-4672번으로 연락해 주시기 바랍

니다. TTY 711 번으로 전화해 주십시오.

Laotian: ກະລ

ຸ

ນາສ

ັ

ງເກດ: ຖ

້

າທ

່

ານເວ

ົ

້

າພາສາລາວ,

ການຊ

່

ວຍເຫ

ຼ

ື

ອດ

້

ານພາສາ, ບ

ໍ

່

ມ

ີ

ຄ

່

າໃຊ

້

ຈ

່

າຍ,

ແມ

່

ນມ

ີ

ໃຫ

້

ທ

່

ານ. ໂທ 1 (800) 776-4672 ຟຣ

ີ

. TTY 711.

Marshallese: LALE: Ñe kwōj kōnono Kajin Ṃajōḷ,

kwomaroñ bōk jerbal in jipañ ilo kajin ṇe aṃ ejjeḷọk

wōṇāān. Kaalọk 1 (800) 776-4672 tollfree, enaj ejjelok

wonaan. TTY 711.

Pohnpeian: Ma ke kin lokaian Pohnpei, ke kak ale

sawas in sohte pweine. Kahlda nempe wet

1 (800) 776-4672. Me sohte kak rong call TTY 711.

Samoan: MO LOU SILAFIA: Afai e te tautala Gagana

fa'a Sāmoa, o loo iai auaunaga fesoasoan, e fai fua e

leai se totogi, mo oe, Telefoni mai: 1 (800) 776-4672 e

leai se totogi o lenei ‘au’aunaga. TTY 711.

Spanish: ATENCIÓN: si habla español, tiene a su

disposición servicios gratuitos de asistencia lingüística.

Llame al 1 (800) 776-4672. TTY 711.

Tagalog: PAUNAWA: Kung nagsasalita ka ng Tagalog,

maaari kang gumamit ng mga serbisyo ng tulong sa

wika nang walang bayad. Tumawag sa

1 (800) 776-4672 toll-free. TTY 711.

Tongan: FAKATOKANGA’I: Kapau ‘oku ke Lea-

Fakatonga, ko e kau tokoni fakatonu lea ‘oku nau fai

atu ha tokoni ta’etotongi, pea teke lava ‘o ma’u ia.

Telefoni mai 1 (800) 776-4672. TTY 711.

Trukese: MEI AUCHEA: Ika iei foosun fonuomw:

Foosun Chuuk, iwe en mei tongeni omw kopwe angei

aninisin chiakku, ese kamo. Kori 1 (800) 776-4672, ese

kamo. TTY 711.

Vietnamese: CHÚ Ý: Nếu bạn nói Tiếng Việt, có các

dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Gọi

số 1 (800) 776-4672. TTY 711.

NMM_1000_24715_1557_R