REALTOR® short sale guide

1

What is a short sale?

A short sale is a work out program that allows the customer

to sell the home for less than the total amount owed. Upon

final approval, a short sale can help homeowners avoid fur-

ther collection activity or foreclosure action.

How to get started

• Homeowner is required to call the Short Sale Phone team

at 1-866-903-1053. Financial information is reviewed and

pre-foreclosure sale counseling is completed.

• The REALTOR® faxes the complete short sale package to

1-866-359-1975, Attn: Setup.

• If the property is located in Alaska call 1-888-833-6711.

Documents required to begin an application

From the REALTOR

• Fully executed listing agreement

From the Homeowner

• Signed and dated financial worksheet listing all monthly

expenses.

• Signed and dated hardship letter (why they are unable to

pay the mortgage).

• Letter authorizing the REALTOR access to information on

the account. It must be dated and include the last 4 digits

of the borrower’s Social Security Number, their signature,

the full account number and the property address.

Additional information

• Short sale approval is good for 30 days. If closing does not

occur within 30 days, the entire short sale package may

need to be resubmitted with updated information, or the

approval process may need to start over.

• REALTOR or homeowner inquiries should be directed to

the negotiator assigned to the file, whose information

will be communicated during the introduction call.

• REALTORS are generally allowed 5% to 6% commission

based on investor rules. If dual agency applies, maximum

commission is 5%. Some investors operate on a reduced

commission structure and the actual commission schedule

can be confirmed during the introduction call.

• This must be an “arms-length” transaction. The property

may not be sold to anyone the seller has a close personal or

business relationship with including family, friends or

neighbors.

• During the introduction call the following will be

addressed:

- Commissions

- Fees and costs

- Pricing of the property

- Timeline

• In order to reduce the 25 day response time the liquidation

team is strongly recommending that the homeowner and/or

REALTOR notify Wells Fargo Home Mortgage of their

intention to sell their property as soon as the listing

contract is signed. This will allow us to complete the

property valuation and borrower financial evaluation

prior to receiving an offer. This significantly reduces the

short sale decision time on a submitted offer.

• In some cases investors and/or PMI companies require the

mortgagers to sign an unsecured note for some or all of

the difference between the net proceeds from the sale and

the total amount due. This is communicated as part of the

response on a short sale offer.

Liquidation Contact Numbers

Loss Mitigation Phone Team · 1-866-903-1053

Loss Mitigation Setup Fax · 1-866-359-1975

Properties located in Alaska should call · 1-888-833-6711

This information is intended for real estate professionals only and is not for consumer distribution. Information is accurate as of date of printing

and is subject to change without notice. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2009 Wells Fargo Bank N.A. All

rights reserved. #104567 3/10

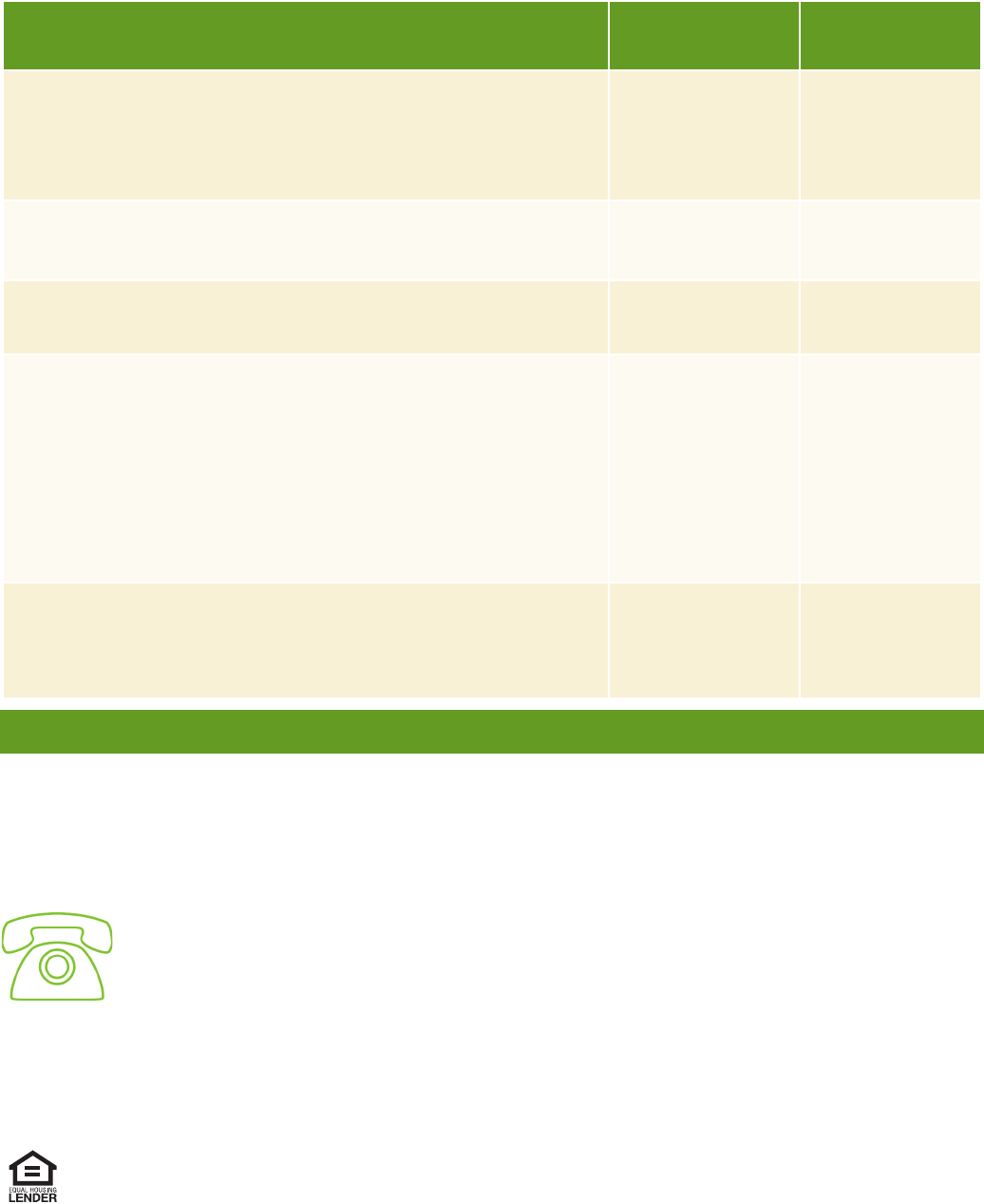

Event

Timeline

(Business Days)

Total Process

(Business Days)

• Complete short sale application received

• Short sale application activated

• Complete application assigned to negotiator

• Incomplete application will delay process

1-2 2

• Negotiator initial review

• Introduction call to REALTOR and homeowner

5 7

• Property evaluation completed (appraisal or interior BPO per

investor requirement)

8-13 13

Additional steps:

• Mortgage insurer approval

• Investor approval

• Additional liens negotiated by REALTOR

• A completed net sheet/HUD (our payoff is not necessary)

• Fully executed purchase contract with all pages initiated

by buyers(s) and seller(s).

• Buyer pre-qualification letter or proof of funds if cash offer.

10 23

All items above complete

• Application decision

• Decision letters issued

2 25

This is our estimated timeline based on business days and assuming all documents

are submitted in completed form and timely.

Timeline events may overlap and occur simultaneously

2