Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

1

Wells Fargo Funding Loan number (required): Company name:

Borrower name: Contact for this file:

Subject property address: Phone number:

Fax number:

Email address:

The following checklist is designed as a reference tool only to highlight critical documentation requirements needed

to underwrite a Non-Conforming Loan for sale to Wells Fargo Funding.

Note:

This checklist includes requirements for Loans with LTVs up to 80%. For Loans with LTVs greater than

80%, refer to the Loans with LTVs greater than 80% section in this document.

This checklist does not include every document required; required documents vary by transaction. Using

the checklist does not ensure Loan approval.

Refer to Wells Fargo Funding Seller Guide and Newsflash notifications for complete details and policy

updates.

Credit Package: Provide a complete Credit Package. Follow standard Agency guidelines if a subject is not

addressed in Seller Guide Sections 825 or 820. This list is not intended to be all-inclusive.

Complete Fannie Mae 1008/Transmittal Summary

Complete Loan Application (1003)

Loan Estimate for all refinances

Loan Submission Summary Form 1 (LSS) in the Seller Guide

Cover letter addressing the 5 C’s (Cash/capital, capacity, credit, character and collateral) and 2 K’s (Know the

borrower, and know and understand the transaction.)

Credit report/ credit requirements

Credit reports:

Wells Fargo Funding underwrites Non-Conforming Loans based off credit reports/Loan Scores obtained from either

CoreLogic

Credco

or Equifax. If a CoreLogic Credco or Equifax credit report is not provided in the Credit Package,

Wells Fargo Funding will pull a new credit report for use in underwriting the Loan file.

Direct Express

SM

: Sellers may utilize our Direct Express

feedback tool (optional) to obtain a credit report from

CoreLogic

Credco

or Equifax. Refer to Seller Guide Section 805.09 for additional information.

Credit requirements:

Loan Score is the selected credit score of the borrower with the highest income and valid credit score. Refer to

Seller Guide Section 825.08(a) and Section 825.08(b) for complete credit and Loan Score requirements.

Loan Score minimum requirements:

700 for transactions that meet all of the following:

− Primary residence or second home

− Purchase or rate/term refinance

− Fixed rate product

740 for investment property transactions

720 for all other transactions

Borrower meets sufficient credit requirements. Insufficient credit is defined as any of the following:

Fewer than three tradelines

No tradeline with activity in the most recent 12 months

No tradeline with at least a 24-month history

Obtain a letter of explanation from the borrower regarding all inquiries that occurred within the last 180 days.

If any new debt was opened, verify the credit report includes the details.

Credit reports with FACTA Alerts: Provide Wells Fargo Funding’s FACTA Alert Validation (Form 16) or sufficient

evidence the alert was cleared in accordance with the Fair Credit Reporting Act requirements.

Obtain a letter of explanation from the borrower regarding any adverse credit.

Wells Fargo Funding Loan information Contact information for file

Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

2

Verification of all mortgages not reporting on the credit report

Property taxes, insurance, and homeowners association dues for all properties owned

Charge offs:

Individual, paid or unpaid account that was charged-off within two years of the application date for an

amount greater than $500 is not allowed.

Individual, unpaid account that was charged-off more than two years from the application date for an

amount greater than $500 is not allowed.

Bankruptcy, foreclosure, deed in lieu of foreclosure, short sale, repossession, and loan modification: Refer to

Seller Guide Section 825.08(b) for additional requirements and limitations.

Collections, judgments, judgment liens, and non-real estate settled for less: Refer to Seller Guide Section

825.08(b) for additional requirements and limitations.

Housing Payment History: Document the most recent 12-month housing payment history for each borrower.

Refer to Seller Guide Section 825.08(b) for additional guidelines.

VOM or VOR from a professional management company or individual landlord verifying no late payments.

If the landlord verification is from an individual party, cancelled checks, bank statements showing the

payment, money order receipts, or cash receipts are required.

Cash receipts are not allowed if the landlord is a relative of or has an established relationship with the

borrower.

If using cash receipts, the name, address, and telephone number of the individual receiving the payments

must be provided.

Income information

Salaried borrowers:

Salary and bonus income: Most recent year-to-date (YTD) pay stub, dated within 45 days of 1003 and

covering one month, a verbal VOE, and W-2s for the past two years. A written verification of employment

covering a two-year history may be acceptable in lieu of W-2s and pay stubs.

Commission income: Most recent YTD pay stub, most recent two years’ W-2s, and verbal VOE. A written

verification of employment covering a two-year history may be acceptable in lieu of W-2s and pay stubs.

Note: IRS W-2 Tax Return Transcripts obtained directly from the IRS, containing all information that would be

included on the actual W-2 form, may be provided in lieu of a W-2 form.

Self-employed borrowers:

Income calculation: The Wells Fargo Cash Flow Method is used to qualify the borrower in all transactions

taking into account any supported adjustments made during the analysis of income. Refer to Seller Guide

Section 825.06(d) for additional calculations and guidance.

Definition: Borrowers are considered self-employed when their income is derived from a business in which

they maintain a majority owner interest or can otherwise exercise control over the business activities.

Generally, a 25% or greater ownership interest in the business is considered a majority. There are

circumstances where borrowers may be considered self-employed if they own less than 25% of a business.

Documentation:

W2s, pay stub and 1099s.

If more than four months have lapsed since the last fiscal year end, include a YTD profit and loss (P&L)

statement and balance sheet.

Financial statements must be prepared by a certified public accountant, public accountant, or bookkeeper

and cannot be an immediate relative.

If tax returns are used to verify qualifying income, include one of the following:

Tax returns signed by the borrower(s), regardless of date

Tax returns with Form 8879 indicating that e-signatures are filed

Tax returns signed or stamped by the CPA

Tax returns with a cover letter prepared by the CPA

Tax returns with a Preparer Tax Identification Number (PTIN)

Sole Proprietorships: A balance sheet is required since the information is not included on Schedule C.

Most recent two years’ individual federal tax returns.

Most recent two years’ K-1’s for all businesses.

Most recent two years’ business tax returns for each business where the borrower is considered self-employed.

Self-employment income not used to qualify: Provide a copy of the first page of the most recent individual

federal tax return.

Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

3

Rental income (excludes departure residence – Refer to page four):

Rental income calculation must be based on the Wells Fargo Cash Flow Method.

Stability of rental income must be documented through two years of rental management

experience or rental income history with the most recent two years’ complete individual federal tax returns.

Refer to Seller Guide Section 825.06(c) for details on when this requirement may be waived.

Tax returns aged nine months or more from the date of the last tax year filed and rental income from the

subject property is used to qualify:

Provide current lease agreement and three months cancelled checks or

Document 10% post-closing liquidity (reserves) based on aggregate liens on the subject property, in

addition to the standard PCL, unless:

− The rental income makes up less than 25% of the total qualifying income; or

− Appraisal indicates that units generating rental income used to qualify are tenant-occupied.

When property is being purchased or has been owned less than 12 months and is not reflected on the

borrower’s most recent complete individual federal tax return the following is required:

Copies of the present, signed lease(s) may be used only if the borrower has a two-year history of

property management experience as evidenced by the most recent two years’ complete individual federal

tax returns, and

− For refinance transactions, three months canceled checks or bank statements verifying receipt of

rental income is required.

− For purchase transactions, existing tenant lease agreement may be used when transferred as part of

the sale of the property.

For subject property, rental income used to qualify must be supported by the Small Residential Income

Property Appraisal Report (Form 72/1025) or Comparable Rent Schedule (1000).

Commercial property rental income: Copies of most recent two years’ complete individual federal tax returns.

Gap in rental history/income greater than three months requires a written explanation from the borrower.

Subject property, rent loss insurance coverage equal to a minimum of six months of rental income is required

for investment properties and two- to four-unit primary residences where the borrowers are relying on rents

to qualify from the units they will not be occupying.

Verbal verification of employment

Verbal Verification of Employment on Wells Fargo’s Exhibit 3, or similar form that contains the same

information.

Earnest money:

Verification of earnest money deposit: copy of canceled check and bank statement showing funds have cleared

or other documentation as applicable.

Business funds:

Allowed if the borrower has 100% ownership in the business and impact is determined to be minimal.

Business average annual cash flow is greater than the amount to be withdrawn for down payment or reserves.

Cash on company year-end balance sheet for each of the previous three years is greater than the amount to

be withdrawn/reserves.

Business bank statements covering the most recent two-month period.

Reserves required for one unit primary residences (Refer to Seller Guide Section 950 for all other property

and transaction types.):

Combined loan amount ≤ $2,000,000 – 12 months PITI

Combined loan amount > $2,000,000 and ≤ $4,000,000 – 24 months PITI

Combined loan amount > $4,000,000 – 36 months PITI

When one of the combined mortgages is a HELOC, the outstanding balance (rather than the line limit)

is used to determine the combined loan amount.

Maximum first mortgage loan amount is $2,000,000 combined loan amount may exceed $2,000,000.

Aggregate financing/combined loan amount:

When aggregate financing/combined loan amount for all properties owned by the borrower exceeds

$3,000,000, one of the following is required:

Minimum 36 months PITI in reserves

Maximum 50% LTV/CLTV

Asset information: Review Seller Guide Section 825.07 for a list of acceptable assets that can be used for

down payment and reserves.

Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

4

Retirement accounts:

Retirement funds are valued as follows:

Tax deferred gross retirement assets must be reduced by 30% to account for tax consequences (less

outstanding loan balances).

There must be an additional 10% reduction if an early withdrawal penalty exists.

100% of the vested Roth IRA funds (less outstanding loan balances) may be used toward the retirement

portion of the reserve requirement.

Retirement funds may be used as follows:

Borrowers without penalty free access: Retirement funds may be used to meet up to 50% of the minimum

reserve requirements.

Borrowers with penalty free access: Retirement funds may be used to meet 100% of the minimum reserve

requirement

Tax advantaged college savings plans

Tax advantaged college savings plans (529 college saving plans) funds may be used to meet the retirement

portion of the reserve requirement.

The borrower must be the custodian on the account.

The balance must be reduced by 10% to account for tax consequences for drawing the funds for

noneducational purposes.

Suspicious activity related to deposits or payments:

Review for patterns of unusual payments, deposits, and/or gift funds, regardless of when they were provided to

the borrower that can be indicative of structuring to avoid compliance with laws and regulatory reporting

requirements of the United States or foreign countries. Unusual patterns can include, but are not limited to, large

cash deposits, large and numerous gifts, and any other unexplained activity not typical for the borrower. Any

indication of possible structuring and/or unsourced assets will result in an increased level of review from Wells

Fargo Funding.

Asset documentation:

Provide all pages of the most recent and consecutive two months asset statements dated within 45 days of the

1003.

Document any large deposits. Generally, single deposits that are greater than 50% of the borrower’s monthly

qualifying income should be explained and documented.

Maximum total debt-to-income (DTI) ratios

43% for primary fixed rate purchases and rate/term refinances

43% for occupant borrower’s DTI ratio with non-occupant co-borrower

38% for investment properties

40% for all other transactions

Departure residence

What are the plans for the departure residence?

Include the full PITI payment in DTI: Must have the greater of six months PITI for both properties or standard

post-closing reserve requirements.

Exclude the full PITI payment in DTI: Refer to Seller Guide Section 825.23 for requirements.

When the departure residence will not be sold at the time of closing and there is a negative equity position, the

following may be required to reduce the overall risk:

Additional reserves to cover the negative equity of the departure residence OR

Pay down the lien on the departure residence to eliminate the negative equity

Other information (Seller to provide)

All Mortgage Loans require a fully amortized principal and interest calculation for qualifying. Refer to Seller

Guide Section 825.09.

Sales contract signed by all parties (including all attachments and addendums)

Fully executed IRS Form 4506-T for all borrowers whose income was used to qualify.

Fully executed IRS Form 4506-T for each business tax return used in the Loan decision (box 6 must include the

tax return form number and box 6a and 6c must be checked).

IRS tax transcripts for the most recent year

Preliminary Title with a 24-month chain of title

Property or assets held in a Trust – complete trust documentation or Trust Certification, depending on the

State

Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

5

Flood zone certification

Document the benefit to borrower

Property and Appraisal Requirements: Appraisal requirements are determined by the total loan

amount provided by Wells Fargo. Refer to Section 825.11.

All valuation products obtained by the Seller must be ordered through and completed by a Wells Fargo

authorized-appraisal management company (AMC) that provides valuation products for Non-Conforming

Loans.

Refer to the following Seller Guide sections and exhibits:

− Section 800.10 for authorized AMCs and ordering requirements.

− Exhibit 7 for valuation product vendor contacts and other information.

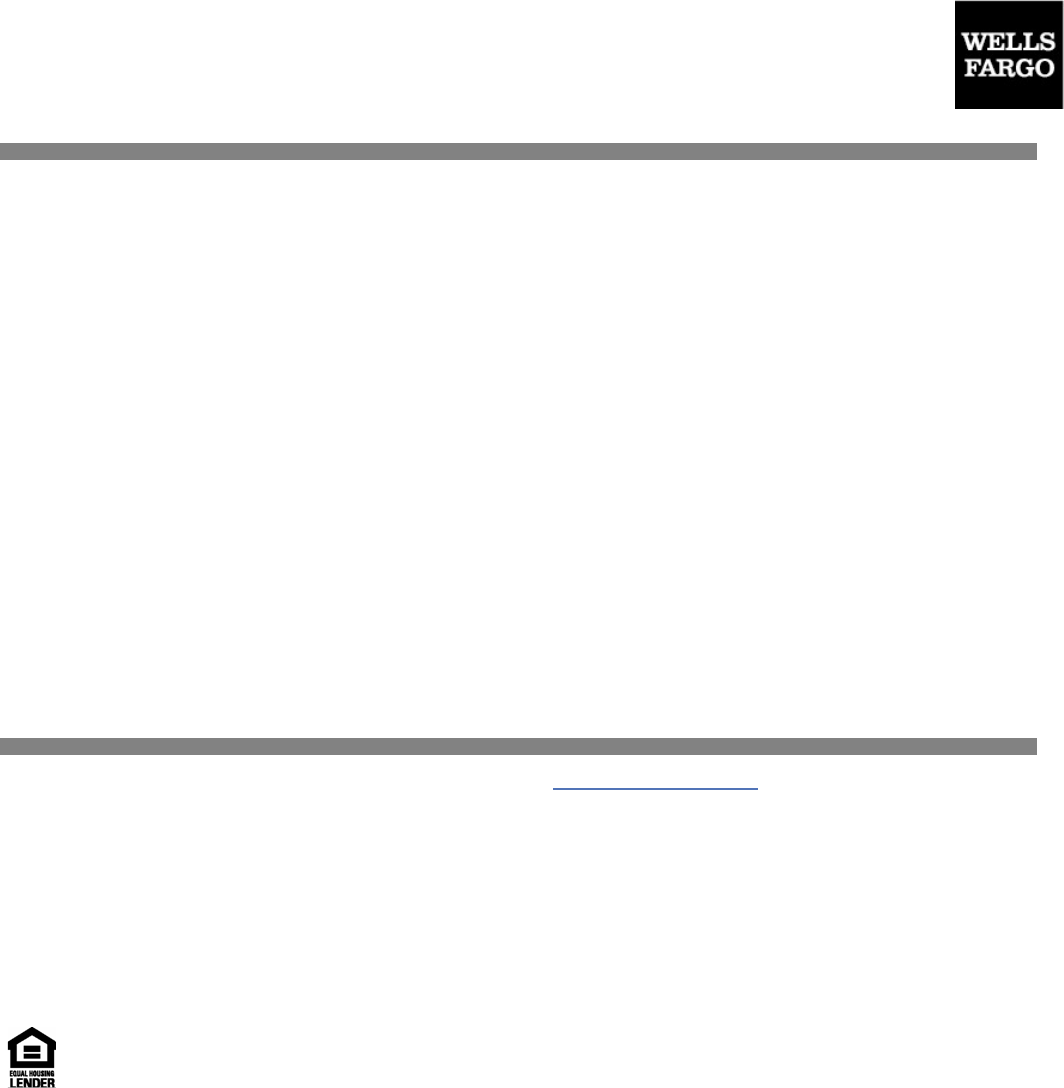

Total loan amount provided by

Wells Fargo

Appraisal documentation required

1

≤$1,000,000

One full appraisal

2

>$1,000,000 – $2,000,000

One full appraisal

2

completed by a certified appraiser

3

>$2,000,000

One full appraisal

2

completed by a certified appraiser

3

and one of the

following:

•

Second full appraisal

2

completed by a certified appraiser

3

•

Interior field review

1. A second level review, exterior field review, or interior field review may be required based on identified

collateral or valuation risks. The Seller may request reimbursement of the discretionary field review fees.

Refer to Reimbursement for discretionary field review below for additional details.

2. A full appraisal must be prepared on Form 1004/70, Form 2090, or Form 1073. An ACE/PIW, Form 2055,

Form 1075 or Form 2095 Summary Report is not acceptable.

3. When ordering the appraisal, Seller must specify that the appraisal be completed by a certified appraiser

and, upon receipt of the appraisal, Seller must confirm the appraisal was completed by a certified appraiser.

4. An interior field review must be prepared on Fannie Mae Form 2000/2000A or Freddie Mac Form 1032/1072.

LTV/CLTV determination

LTV/CLTV is determined as follows:

•

When two full appraisals are obtained, the LTV/CLTV is based on the lower of the appraised values or the sales

price.

•

When an interior field review is obtained, the LTV/CLTV is based on the lower of the field review value or the

sales price.

Reimbursement for discretionary field reviews

To be reimbursed for a discretionary field review product required by Wells Fargo, email a copy of the invoice and

wiring instructions to financialprocessing@wellsfargo.com

. Reimbursements will be processed within 24 – 48 hours

of receipt.

Note: Wells Fargo will not reimburse the Seller for policy required valuation products.

Appraisal order and delivery options

Sellers have two options for ordering and delivering appraisals to Wells Fargo:

− Option 1: Direct Order / Direct Deliver

o Order the appraisal directly from an authorized appraisal management company (AMC).

o Deliver the final version of the appraisal including the first generation PDF and industry-standard

XML, using the appraisal upload feature on wellsfargofunding.com

.

− Option 2: RealEC Exchange platform

o Order the appraisal from an authorized AMC using the RealEC Exchange platform. (Registration

with RealEC Exchange is required.)

o Deliver the final version of the appraisal using the Share functionality on the RealEC Exchange

platform.

OR

o Deliver the final version of the appraisal including the first generation PDF and industry standard

XML, using the appraisal upload feature on wellsfargofunding.com

.

Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

6

Additional information:

− Contact RealEC or the AMC to set up a Wells Fargo-specific account for ordering appraisals.

− For Sellers who already have an account with RealEC or an authorized AMC, setting up a Wells Fargo-

specific account with them ensures compliance with:

o The Appraiser List, now known as the Any Role Individual List. This list can be accessed in the

Wells Fargo Funding Validation List located on wellsfargofunding.com

.

o Other Wells Fargo Appraisal review requirements.

− The AMC Xome Valuation Services, LLC (formerly known as Assurant Valuations) is not available

through the RealEC Exchange platform

Note: We recommend that Sellers deliver the final appraisal at the same time as the Prior Approval Credit

Package is uploaded to wellsfargofunding.com.

Seller Guide resources

Refer to Section 800.10 for authorized AMCs and ordering requirements.

Refer to Exhibit 7 for valuation product vendor contacts and other information.

Condominiums (Condos)

If the condo project does not meet Wells Fargo Streamlined review requirements, include a completed Wells

Fargo HOA Certification Form (Form 25). Determine if additional documentation is required by comparing the

responses on Form 25 to the Wells Fargo Form 25A Answer Key. Refer to Seller Guide Section 825.12(b) for

complete information.

If the condo project has not been reviewed, submit the Wells Fargo Condominium Project Approval Request

(Exhibit 11) to NPRESPremier@wellsfargo.com

with the appropriate documentation. To ensure all required

documentation is included in the submission, refer to the Wells Fargo Condominium project review checklist

(Form 27).

Cooperatives (Co-ops)

Property location:

Loans without subordinate financing are eligible in the states of New York and New Jersey (Bergen and

Hudson counties only).

Loans with subordinate financing are eligible in the state of New York.

Obtain co-op project approval by submitting the Cooperative Project Approval and Validation Request form

(Form 22) to the Wells Fargo Co-op Project Approval Team (CPAT):

E-mail CPATPremier@wellsfargo.com

or fax 1-866-708-2131 (phone 1-866-708-2131)

Subordinate financing on co-ops is only allowed on properties located in the state of New York.

Note: Refer to Seller Guide Section 825.12(c) for complete information.

Solar panels

Solar panel systems leased or subject to a power purchase agreement:

Submit the Solar Panel System Approval Request (Exhibit 9) and required documentation to Wells Fargo’s

National Project Review and Eligibility Services (NPRES) team prior to delivering the Credit Package.

Submit the Solar Panel System Approval and any required NPRES conditions in the Credit Package.

LTV/CTLV Matrix

Refer to the matrices in the Seller Guide Section 950 for details on Loans with LTV up to 80%.

Primary Residences, Second Homes, and Investment Properties

Purchase, Rate/Term Refinance, and Cash-Out Refinance

Fixed Rate (15 – 30 year)

ARMs (5/1, 7/1 and 10/1 LIBOR ARMs)

Market Classification may impact LTV/CLTV. For the Wells Fargo Market Classification, refer to Exhibit 20 in the

Seller Guide. Refer to the matrices for additional restrictions when the CLTV exceeds 80%.

Wells Fargo Funding

Non-Conforming Initial Loan Submission Checklist

Exhibit 6

7

Loans with LTVs greater than 80%

Non-Conforming Loans with LTVs greater than 80% must be underwritten to the standards and guidelines stated

in Seller Guide Section 825.50. Where policy is not stated, refer to Seller Guide Section 825.

Program Eligibility criteria

Primary residences only.

Purchase transactions only.

Minimum Loan Score is 740.

Fixed-rate Mortgages, 7/1 ARMs, and 10/1 ARMs.

One-unit single-family detached or attached dwellings, condos, co-ops, and planned unit developments.

Eligible condominium project reviews: Wells Fargo Full Project Review or Final Condo Project Acceptance

through Fannie Mae Project Eligibility Review Service (PERS).

Loans with open collection accounts are ineligible.

Escrows for taxes and hazard insurance are required (subject to state law).

Gifts of cash, equity, or land are not allowed.

Multiple financed properties: The maximum number of financed properties for all borrowers on the Loan is two

(including the subject property).

Mortgage insurance is not required.

Refer to the LTV matrix in Seller Guide Section 825.50 for eligible maximum loan amount based on

metropolitan statistical area median home price (MSA MHP) and market classification.

Nonoccupant coborrowers are not allowed.

Refer to Seller Guide Section 825.50 for a complete list of property restrictions.

Subordinate financing is not allowed.

Qualifying ratios: Front-end ratio/Total debt-to-income

Fixed rate: 30%/35%

Adjustable rate: 30%/32%

Turn Times: Our turn times can be obtained by accessing wellsfargofunding.com

, or by calling 1-800-328-5074,

option 3.

Due to the increased complexity of these transactions and the higher Loan amounts allowed, additional reviews

may be required.

Questions?

Please contact a member of your regional sales team.

This information is for use by mortgage professionals only and should not be distributed to or used by consumers or other

third parties. Information is accurate as of date of printing and is subject to change without notice. Wells Fargo Funding is

a division of Wells Fargo Bank, N.A. © 2016 Wells Fargo Bank, N.A. All Rights Reserved. NMLSR ID 399801

Current as of: 09/04/19