FRAUD

Iris Ikeda, Commissioner

Division of Financial Institutions

Department of Commerce and Consumer Affairs

September 2016

Agenda

What is Fraud?

Types of Fraud

Sources of Information

Red Flags

Financial Analysis

What is Fraud – Detecting a Fraud

Conducting a “should of” after a fraud happens may show

that red flags were present. If the victim had only recognized

the warning signs, then that loss may not have occurred or

been substantially reduced.

Based on a recent survey by the Association of Certified Fraud

Examiners (ACFE), occupational fraud substantially increases

organizational costs.

Myth: fraud is a big scheme that should have been

uncovered sooner and is easy to detect.

Fraud starts small and just gets bigger and bigger, until

something becomes noticeably different or unusual.

What is Fraud – Fraud defined

“The use of one’s occupation for personal enrichment

through the deliberate misuse or misapplication of the

employing organization’s resources or assets.” (ACFE)

Five elements of fraud are:

A representation about a material fact, which is false,

And made intentionally, knowingly, or recklessly,

Which is believed,

And acted upon by the victim,

To the victim’s damage.

What is Fraud – Fraud defined

Fraud, like other crime, has three factors:

A supply of motivated

offenders/perpetrators;

The availability of suitable targets/victims;

The absence of capable guardians or a

control system to “mind the store.”

What is Fraud – Fraud defined

Four elements for a person or employee to

commit fraud:

Opportunity

Low chance of getting caught

Rationalization in the fraudsters mind, and

Justification that results from the

rationalization.

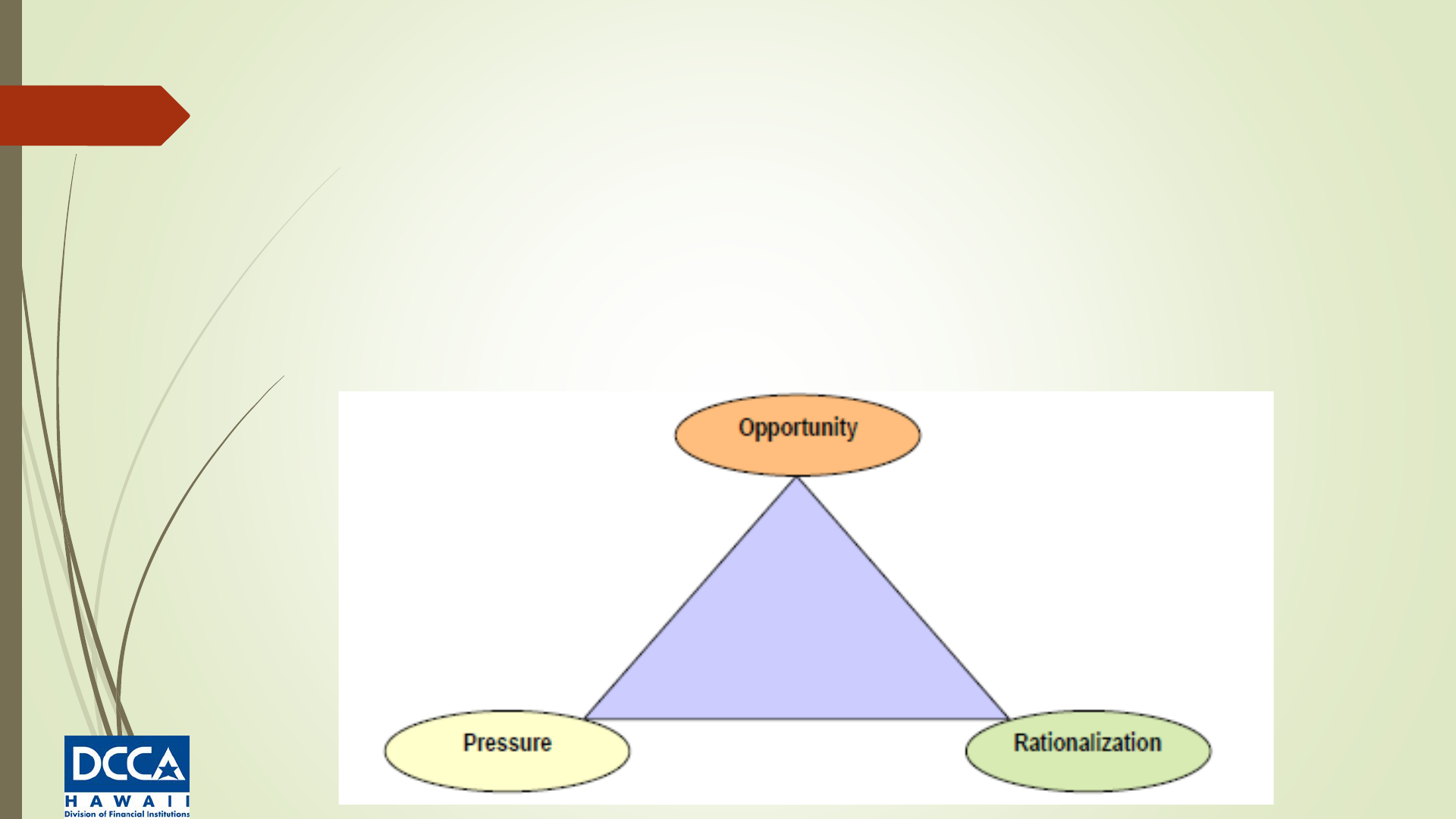

What is Fraud – Fraud Triangle

Classic model for fraudsters is to use other

peoples money or “I want something I

don’t have money for.”

What is Fraud – Fraud Triangle –

Opportunity

Opportunity is an open door for solving a non-shareable

problem in secret by violating a trust.

Opportunity is generally provided through weaknesses in the

internal controls which include inadequate or no:

Supervision and review

Separation of duties

Management approval

System controls

What is Fraud – Fraud Triangle –

Pressure

Pressure may be anything from unrealistic

deadlines and performance goals to

personal vices such as gambling or drugs.

What is Fraud – Fraud Triangle –

Rationalization

Rationalization is a crucial component because most

people/perpetrators need to believe their behavior meets

the commonly accepted notions of decency and trust.

Some examples include:

“I really need this money and I’ll put it back when I get

my paycheck”

“I’d rather have the company on my back than the IRS”

“I just can’t afford to lose everything – my home, car,

everything”

What is Fraud – Ingredients of Fraud

Poor internal controls

Management override of internal controls

Collusion between employees

Collusion between employees and third

parties

What is Fraud – Discovery

Detected through tips

Detected by new management

Detected by accident

Detected by internal audit

Types of Fraud – Telemarketing /

Phone

Callers claiming to be anyone from police

officers to disabled workers taking advantage of

the public’s sympathy and generosity

Offer miracle cures from baldness to cancer to

vacation time shares to sweepstakes and

investment opportunities.

Callers ask for money or personal information.

Callers use scare tactics (IRS or FBI agents).

Types of Fraud – Common Examples

Security and Fraud Department of your credit- or debit-card company

asks you for the 3-digit security number on the back of your credit card

to verify your possession of the card to aid it in a fraud investigation.

Medicare now requires a National ID Card and offers to provide one for a

fee. Or the caller says a card is being mailed, but he needs your bank

information.

U.S. Food and Drug Administration (FDA) agent or official and that you

must pay a fine because you have bought or attempted to buy

discounted prescription drugs from a foreign pharmacy.

Microsoft to warn you that your computer has a security problem and

offer a free security check. You are tricked into allowing access to your

computer, downloading malware, giving out credit card info, or buying

some software or services that you don’t need.

Types of Fraud – Internet

Do you visit websites by clicking on links within an e-mail?

Do you reply to e-mails from persons or businesses you are not

familiar with?

Have you received packages to hold or ship to someone you met

on the Internet?

Have you been asked to cash checks and wire funds to someone

you met on the Internet?

Would you cash checks or money orders received through an

Internet transaction without first confirming their legitimacy?

Would you provide your personal banking information in response

to an e-mail notification?

Types of Fraud – Email Scams

Cybercriminals use e-mail in clever ways to try to take

your money and identity, and disrupt your computer

operation, gather sensitive information, or gain

unauthorized access to your computer

Business opportunities to make cash fast

Chain letters involving money

Work at home schemes

Health & diet breakthroughs

Free goods offered to fee-paying members

Credit repair schemes

Types of Fraud – Online Shopping

Credit card limited liability to $50 for any unauthorized or

fraudulent charges made before you report the billing

error (EFTA)

Using a debit card for shopping – can empty an account

quickly

Examples:

Rental housing

Airline tickets

Concert tickets

Timeshare properties

Vacation properties

Types of Fraud – Appeals for help

Claims to be a family member who needs help

Grandparents are targeted

Examples:

Grandchild arrested or hospitalized

Military family members deployed overseas are injured

Types of Fraud – Auto Loan Mods

Companies which claim it can reduce your monthly

loan / lease payment

Companies might charge fees of several hundred

dollars up front, tout their relationships with lenders, and

bolster their claims to be able to significantly lower your

monthly payments with glowing testimonials from

"satisfied" customers.

Some give a “guarantee” that if they can't make a deal

with your lender, they'll refund your money.

Types of Fraud – Bankruptcy

Foreclosure Rescue

Target people whose home mortgages are in trouble and promise to take

care of your problem with your lender or get refinancing

Examples:

Unsolicited contact & uses high-pressure sales techniques

Calls itself a mortgage or foreclosure consultant, foreclosure prevention specialist

Says it knows a lot of people who have gone through foreclosure and just wants

to help you or contacts you because they saw a notice of default or a notice of

trustee’s sale in public records

Promises to find “loopholes” in your loan documents or violations of State/Federal

lending laws that can get you off the hook

Asks for a fee before performing a service

Asks you to make your home mortgage payments directly to them

Asks you to transfer your property deed or title to them.

Sources of Information

Consumer

Business records

Bank statements

Audit reports

Sources of Information – Means of

Obtaining

Voluntarily (from consumer or business)

Interview both consumer and perpetrator

Written requests

Subpoena

Red Flags – Importance of Red Flags

Red flag is a set of circumstances that are unusual in nature or vary from the

normal activity. It is a signal that something is out of the ordinary and may need

to be investigated further.

Remember that red flags do not indicate guilt or innocence but merely provide

possible warning signs of fraud.

According to ACFE, fraud cases consistently show that red flags were present,

but were either not recognized or were recognized but not acted upon by

anyone. Once a red flag has been noted, someone should take action to

investigate the situation and determine if a fraud has been committed.

Red flags should lead to some kind of appropriate action. Sometimes an error

is just an error and no fraud has occurred.

You need to be able to recognize the difference and remember that

responsibility for follow-up investigation of a red flag should be carefully

reviewed.

Red Flags – Types of Red Flags

The majority of loss committed by managers was $218,000, which is

almost three times greater than the loss resulting from an employee

scheme.

Approximately 61 percent of the fraud cases were committed by men.

The median loss from fraud by males was $250,000, which is more than

twice the median loss by women.

Nearly 40 percent of all fraud cases are committed by two or more

individuals.

The median loss in these cases is $485,000, which is almost five times

greater than the median loss in fraud cases involving one person.

Red Flags – Types of Red Flags

Most fraud perpetrators (87.9%) have never been charged or

convicted of a crime. Research showed that those who commit

occupational fraud are not career criminals.

The median loss attributable to fraud by older employees is greater

than that of their younger counterparts. The median loss by employees

over the age of 60 was $713,000. Employees 25 or younger, the

median loss was $25,000

Most costly abuses occur in companies with less than 100 employees.

Government and Not-for-Profit organizations have experienced the

lowest median losses.

Management ignores irregularities.

High turnover with low morale.

Staff lacks training.

Red Flags – Employee Red Flags

Employee lifestyle changes: expensive cars, jewelry,

homes, clothes

Significant personal debt and credit problems

Behavioral changes: these may be an indication of

drugs, alcohol, gambling, or just fear of losing the job

High employee turnover, especially in those areas which

are more vulnerable to fraud

Refusal to take vacation or sick leave

Lack of segregation of duties in the vulnerable area

Red Flags – Control Person Red Flags

Reluctance to provide information to

auditors

Managers engage in frequent disputes

with auditors

Management decisions are dominated

by an individual or small group

Managers display significant disrespect

for regulatory bodies

There is a weak internal control

environment

Accounting personnel are lax or

inexperienced

Decentralization without adequate

monitoring

Excessive number of checking accounts

Frequent changes in banking accounts

Frequent changes in external auditors

Company assets sold under market

value

Significant downsizing in a healthy

market

Continuous rollover of loans

Excessive number of year end

transactions

High employee turnover rate

Unexpected overdrafts or declines in

cash balances

Refusal by company to use serial or

duplicate receipts

Compensation program that is out of

proportion

Any financial transaction that doesn’t

make sense - either common or business

Service Contracts result in no product

Photocopied or missing documents

Red Flags – Behavior Changes

Borrowing money from co-workers

Creditors or collectors appearing at the workplace

Gambling beyond the ability to stand the loss

Excessive drinking or other personal habits

Easily annoyed at reasonable questioning

Providing unreasonable responses to questions

Refusing vacations or promotions for fear of detection

Bragging about significant new purchases

Carrying unusually large sums of money

Rewriting records under the guise of neatness

Red Flags – Company Behavior Changes

Excessive number of voids, discounts and returns

Unauthorized bank accounts

Sudden activity in dormant banking accounts

Taxpayer complaints that they are receiving non-payment notices

Discrepancies between bank deposits and posting

Abnormal number of expense items, supplies, or reimbursement to

the employee

Presence of employee checks in the petty cash for the employee in

charge of petty cash

Excessive or unjustified cash transactions

Large number of write-offs of accounts

Bank accounts that are not reconciled on a timely basis

Red Flags – Company Behavior Changes

Increasing number of complaints about products or service

Increase in purchasing inventory, but no increase in sales or

abnormal inventory shrinkage

Lack of physical security over assets/inventory

Charges without shipping documents

Payments to vendors who aren’t on an approved vendor list

High volume of purchases from new vendors

Purchases that bypass the normal procedures

Vendors without physical addresses

Vendor addresses matching employee addresses

Excess inventory and inventory that is slow to turnover

Purchasing agents that pick up vendor payments, not mailed

Red Flags – Lifestyle Fraud

Often committed by trusted employees.

Some embezzlers are secretive. They don’t want to be caught and

will “stash” stolen funds and be extremely careful with their

spending.

Other “aspiring” embezzlers want to use, enjoy, share, and show off

their fraudulently gained money. Explanations of “new found”

wealth may include:

“My husband/wife just got a great promotion.”

“I have a few little investments that have been doing really,

REALLY well.”

“Great Aunt Ethel passed away and I was totally surprised – she

left us quite a nice little nest egg.”

“I finally decided to get rid of some property that’s been in the

family for years.”

Red Flags – Dependency Fraud

Addictions. Someone who is dependent on drugs, alcohol, gambling or other

addictions typically experience a slow tightening noose of financial pressures.

Desperation fuels monetary needs and, therefore, the need arises to “borrow”

funds to ease the financial dilemma. Employees with addiction problems may

be tough to spot. Many people with addictions can function at fairly high or

normal levels of behavior during work hours.

Some patterns to look for:

Absenteeism

Regular ill health or “shaky” appearance

Easily making and breaking promises and commitments

Series of creative “explanations”

High level of self absorption

Inconsistent or illogical behavior

Forgetfulness or memory loss

Family problems

Evidence of deceit (small or large)

Red Flags – Financial Pressure Fraud

Faced by everyone at some period of time. Perhaps beyond their

control, employees may find themselves in financially stressful

situations due to a variety of factors. Not everyone who faces undue

pressure commits fraud, but the higher the stress level, the more

distracted and desperate an employee may become.

Medical bills

Family responsibilities

A spouse losing a job

Divorce

Debt requirements

Maintaining a current lifestyle

Car repairs

Financial Analysis – Bank Records

Using bank statements or other financial documents

Get the documents – discussed earlier

What can you use these documents to prove?

See financial trouble

Fraud

Skimming

Misappropriation

Unethical activity (bank personnel)

Lifestyle of a person

Financial Analysis – Financial

Profiling

Attempt to determine if a subject’s

(consumer’s) expenditures or

accumulated wealth exceed his/her

income

Look for:

Potential illegal income (i.e. gambling)

Do you need additional info

Financial Analysis – Net Worth

Analysis

Shows possible illegal income through

increases in accumulated wealth

Total assets 2012 $100,000

- Total liabilities 2013 $200,000

= Net Worth 2014 $300,000

Change in net worth $200,000

Financial Analysis – Net Worth

Analysis

Shows possible illegal income through increases in

accumulated wealth

Change in net worth $200,000

+ expenses $150,000

= total dollar outlay $250,000

THEN, compare the total dollar outlay with the reported

income $150,000

Shows target is spending more than their reported income

How to Detect Fraud – Financial

Statements

Financial statement analysis is a process that enables

readers of a company’s financial reports to develop and

answer questions regarding the data presented.

Financial statements express a company’s economic

condition in three ways:

1. The balance sheet reports assets, liabilities, and owners’ equity;

2. The income statement accounts for the profit or loss of the

company;

3. And the cash flow statement displays the sources and uses of

cash.

How to Detect Fraud – Financial

Statements

At the end of these statements, there is a section for

footnotes—a more detailed description of several items

on the financial statements including a discussion of

changes in accounting methods, related party

transactions, contingencies, and so on.

Annual and quarterly reports also typically include a

section titled Management’s Discussion and Analysis

(MD&A), which gives management’s perspective on the

financial results of the period in the report.

How to Detect Fraud – Unexpected

Deviations

Financial analysis techniques can help investigators

discover and examine unexpected relationships in

financial information.

These analytical procedures are based on the premise

that relatively stable relationships exist among

economic events in the absence of conditions to the

contrary

Unexpected deviations in relationships most likely

indicate errors, but also might indicate illegal acts or

fraud.

Therefore, deviations in expected relationships warrant

further investigation to determine the exact cause.

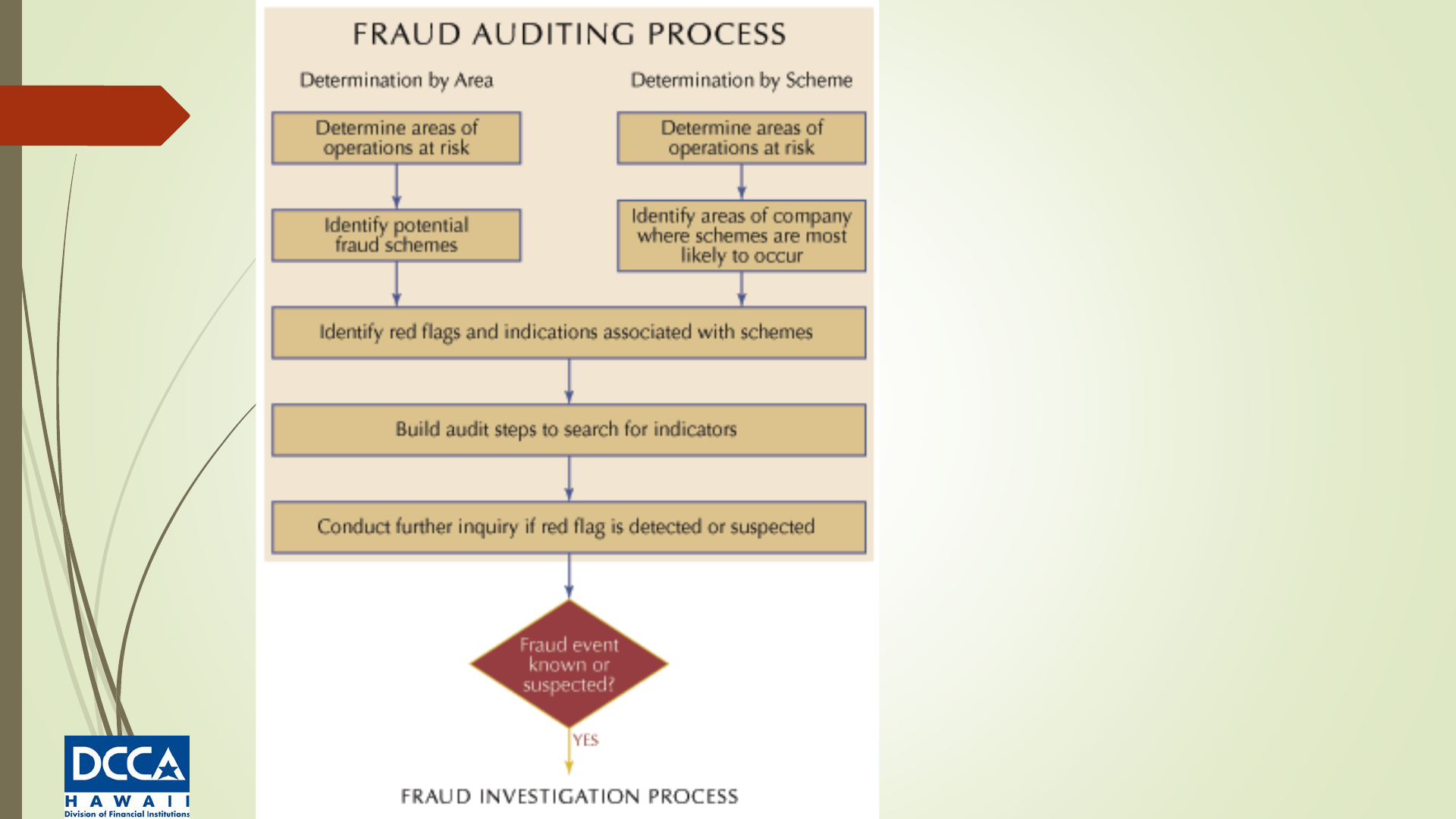

How to Detect Fraud – Analytical

Procedures

Used to detect and examine relationships of

financial information that do not appear

reasonable.

They are useful in identifying:

Differences that are not expected

The absence of differences that are expected

Potential errors

Potential fraud and illegal acts

Other unusual or non-recurring transactions or events

Analytical techniques assist

with the first steps in the

fraud auditing process by

enabling the fraud

examiner to identify areas

of high risk, highlight the

most likely schemes, and

identify the red flags that

warrant further investigation

How to Detect Fraud –

Comparative Techniques

Relationships among financial data that do not appear

reasonable should be investigated.

Fraud examiners can employ the following techniques to help

them identify such relationships:

Compare current-period financial information to prior-period

financial information, budgets, and forecasts.

Examine relationships among financial information. For instance,

cost of goods sold is expected to vary directly in relation to

sales.

Study relationships of financial information with related non-

financial information. For example, department store sales are

expected to vary with the square footage of the sales floor.

Compare information to that of other organizational units or the

industry.

How to Detect Fraud – Company’s

Financial Relationships

An understanding of general relationships between

certain financial statement balances is necessary to

identify relationships that appear unusual.

If sales increase, how should the cost of sales respond?

If commission expense decreases, what would be

expected of sales?

Answers to questions such as these are the foundation

of financial analysis.

The following relationships are general, and

traditionally occur between financial accounts;

however, unique circumstances may render different

results.

How to Detect Fraud – Company’s

Financial Relationships

A financially healthy company tries to maintain a consistent

balance between assets and liabilities.

By keeping a certain balance, the company displays its solidity to

lenders or equity investors and keeps financing costs down.

A sudden change from historical norms means something has

changed with management’s view of its business.

It also could indicate that management is trying to hide something.

A sudden increase in the ratio could mean that liabilities such as

long-term debt have been hidden in off balance sheet entities.

If the value of liabilities rises and the ratio spikes downward, it could

reveal that the company is borrowing heavily to finance operations

and that the risk of fraud is acute.

How to Detect Fraud – Company’s

financial relationships

The company generates sales because it sells its

merchandise.

This merchandise had to be purchased, manufactured, or

both, all of which entail a cash outlay for materials, labor, and

so on.

Therefore, for each sale, there must be a cost associated with

it.

If sales increase, then the cost of goods sold generally

increases proportionally.

Of course, there are cases where a company has adopted a

more efficient method of producing goods, thus reducing its

costs, but there still are costs associated with the sales that

are recognized upon the sale of the goods.

How to Detect Fraud – Company’s

Financial Relationships

When a company makes a sale to a

customer, the company generally ships

the merchandise to the customer before

the customer pays, resulting in an account

receivable for the company.

Therefore, the relationship between the

sales and the accounts receivable is

direct.

How to Detect Fraud – Company’s

Financial Relationships

A company’s inventory is merchandise that is ready to

be sold.

A company generally tries to anticipate future sales,

and in doing so, tries to meet these demands by

having an adequate supply of inventory.

Therefore, inventory usually reflects the growth in

sales.

If sales increase, then inventory should increase to

meet the demands of sales.

Inventory that grows at a faster pace than sales might

indicate obsolete, slow-moving merchandise or

overstated inventory.

How to Detect Fraud – Company’s

Financial Relationships

Companies generate sales revenue by selling products or providing

services.

Likewise, companies incur direct and indirect costs related to

producing or acquiring the products they sell, or providing the

services for their customers.

Gross, operating, and net profit margins are shown on the income

statement.

Over time, profit margins should stay consistent as the company

targets a certain profit in order to stay in business.

If the company encounters increased competition and must reduce

the price for its products, it will have to find ways to cut expenses.

Ongoing pressure on profit margins indicates pressure on

management, which could ultimately lead to fraud in the financial

reporting.

How to Detect Fraud – Company’s

Financial Relationships

When analytical procedures uncover an unexpected relationship among

financial data, the fraud examiner must investigate the results.

The evaluation of the results should include inquiries and additional

procedures.

Before asking the company’s employees and management about the

variations, the fraud examiner should first establish expectations for the

causes of the variances.

From expected causes, the fraud examiner will be better suited to ask

meaningful questions when interviewing company personnel.

Explanations derived from employees should then be tested through

examination of supporting evidence.

For example, if the sales manager indicates that the increase in sales is due

to a new advertising campaign, examine the advertising expense account

to verify that a campaign did occur.

If the advertising expense is similar to the prior year, the relationship is not

reasonable and fraud may exist.

Procedures for Analysis

Investigating relationships between numbers offers deep

insight into the financial well-being of an organization.

By comparing these relationships with other industries or

businesses within the same industry, an examiner can

extrapolate viable evidential matter and gain a greater

comprehension of the company’s financial condition.

Financial statement analysis includes the following:

Percentage analysis, including vertical and horizontal analysis

Ratio analysis

Cash flow analysis

Procedures for Analysis – Vertical

and Horizontal

Vertical analysis is a technique for analyzing the relationships

between the items on any one of the financial statements in

one reporting period.

The analysis results in the relationships between components

expressed as percentages that can then be compared

across periods.

This method is often referred to as “common sizing” financial

statements.

In the vertical analysis of an income statement, net sales is

assigned 100 percent; for a balance sheet, total assets is

assigned 100 percent on the asset side, and total liabilities

and equity is expressed as 100 percent on the other side.

All other items in each of the sections are expressed as a

percentage of these numbers.

Procedures for Analysis – Vertical

and Horizontal

Horizontal analysis is a technique for analyzing the percentage change in

individual financial statement items from one year to the next.

The first period in the analysis is considered the base, and the changes in

the subsequent period are computed as a percentage of the base period.

If more than two periods are presented, each period’s changes are

computed as a percentage of the preceding period.

The resulting percentages are then studied in detail.

It is important to consider the amount of change as well as the percentage

in horizontal comparisons.

A 5 percent change in an account with a very large dollar amount may

actually be much more of a change than a 50 percent change in an

account with much less activity.

Like vertical analysis, this technique will not detect small, immaterial frauds.

However, both methods translate changes into percentages, which can

then be compared to highlight areas of top concern.

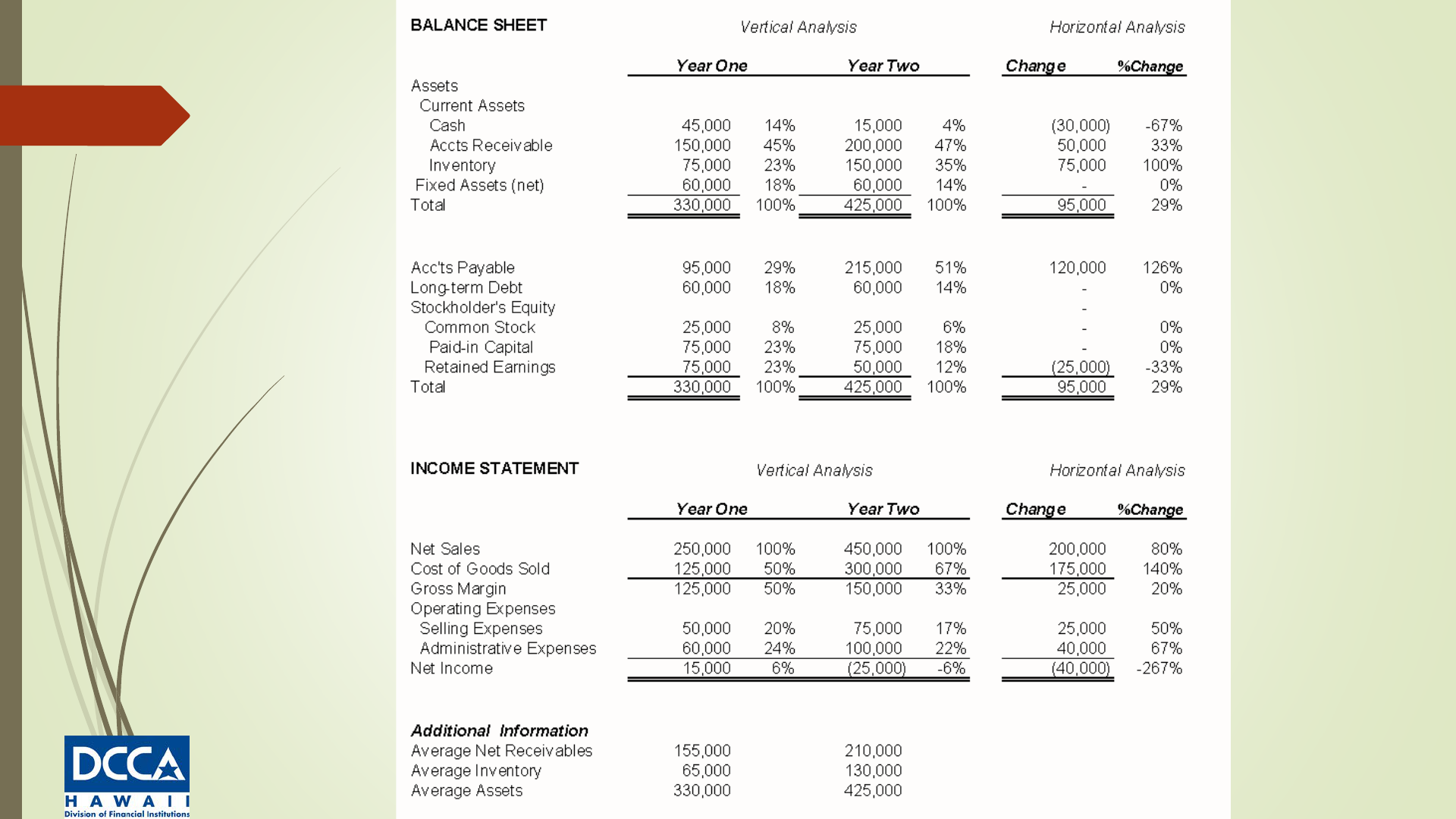

Procedures – Vertical Analysis

Vertical analysis of the income statement uses total sales as the base amount, and all other

items are then analyzed as a percentage of that total.

Vertical analysis emphasizes the relationship of statement items within each accounting period.

These relationships can be used with historical averages to determine statement anomalies.

In the above example, we observe that accounts payable is 29 percent of total liabilities and

stockholders’ equity.

Historically, we may find that this account averages slightly over 25 percent.

In year two, accounts payable rose to 51 percent.

Although the change in the account total may be explainable through a correlation with a rise

in sales, this significant rise might be a starting point in a fraud examination.

Source documents should be examined to determine the rise in this percentage.

With this type of examination, fraudulent activity may be detected.

The same type of change can be seen as selling expenses decline as a part of sales in year two

from 20 to 17 percent.

Again, this change may be explainable with higher volume sales or another bona fide

explanation. But close examination may possibly cause a fraud examiner to uncover fictitious

sales, since there was not a corresponding increase in selling expenses.

Procedures – Horizontal Analysis

Horizontal statement analysis uses percentage comparison across

accounting periods, or in a horizontal manner.

The percentage change is calculated by dividing the amount of increase or

decrease for each item by the prior-period amount.

In the previous example, cash declined by $30,000 from year one to year

two, a 67 percent drop.

Further analysis reveals that the 80 percent increase in sales has a much

greater corresponding increase in cost of goods sold, which rose 140

percent.

This is an unusual increase and displays a deteriorating financial condition.

If management employed fraudulent accounting in the period, it might

mean that revenues were understated for some reason.

Management might have wanted to avoid a high tax bill or to shift revenues

to the next period for some reason.

It might also mean that the cost of goods is rising, which might pressure

management to improve the appearance of the company’s financials by

engaging in fraudulent accounting in future periods.

Procedures – Ratio Analysis

Ratio analysis is a means of measuring the relationship between two

different financial statement amounts.

Ratios are calculated from current year numbers and are then

compared to previous years, other companies, the industry, or even

the economy to judge the performance of the company.

This form of financial statement analysis can be very useful in

detecting red flags for a fraud examination.

Many professionals, including bankers, investors, business owners,

and investment analysts, use this method to better understand a

company’s financial health.

Ratio analysis allows for internal evaluations using financial

statement data.

The relationship and comparison are the keys to the analysis.

For further insight, financial statement ratios are used in comparisons

to an entity’s industry averages.

Procedures – Ratio Analysis

As the financial ratios present a significant change from one

year to the next, or over a period of years, it becomes

obvious that there might be a problem.

As in all other analyses, specific changes are often explained

by changes in the business operations.

When a change in a specific ratio or several related ratios is

detected, the appropriate source accounts should be

researched and examined in detail to determine if fraud has

occurred.

For instance, a significant decrease in a company’s current

ratio might point to an increase in current liabilities or a

reduction in assets, both of which could be used to cover

fraud.

In the analysis of financial statements, each reader of the

statements will determine which portions are most important.

Procedures – Ratio Analysis

These ratios may also reveal frauds other than accounting frauds.

If an employee is embezzling from the company’s accounts, for

instance, the amount of cash will decrease disproportionately and

the current ratio will decline.

Liability concealment will cause a more favorable ratio.

Similarly, a check-tampering scheme will usually result in a

decrease in current assets, namely cash, which will, in turn,

decrease the current ratio.

In fact, these frauds might be more easily detected with ratio

analysis because employees other than management would not

have access to accounting cover-ups of non-accounting frauds.

Anomalies in ratios could point directly to the existence of

fraudulent actions.

Accounting frauds can much more subtle and demand extensive

investigation beyond the signal that something is out of the norm.

Procedures – Types of Ratio Analysis

Current Ratio

Current

Assets

Current Liabilities

The current ratio, current assets divided by current liabilities, is probably the

most frequently used ratio in financial statement analysis.

This comparison measures a company’s ability to meet short-term

obligations from its liquid assets.

The number of times that current assets exceed current liabilities has long

been a measure of financial strength.

In detecting fraud, this ratio can be a prime indicator of manipulation of

accounts involved.

Embezzlement will cause the ratio to decrease.

Liability concealment will cause a more favorable ratio.

In the preceding example, the drastic change in the current ratio from year

one (2.84) to year two (1.70) should cause an examiner to look at these

accounts in more detail.

For instance, a check-tampering scheme will usually result in a decrease in

current assets, or cash, which will in turn decrease the ratio.

Procedures – Types of Ratio Analysis

Acid Test Ratio

Cash+Securities+Receivables

Current Liabilities

Compares assets that can be immediately liquidated to liabilities that will be due in the next year.

This calculation divides the total cash, securities, and receivables by current liabilities.

This ratio is a measure of company’s ability to meet sudden cash requirements.

In turbulent economic times, it is used quite prevalently, giving the analyst a worst-case look at the

company’s working capital situation.

An examiner will analyze this ratio for fraud indicators.

In year one of the example, the company balance sheet reflects a quick ratio of 2.05. This ratio drops in

year two to 1.00.

In this situation, a closer review of accounts receivable shows that they are increasing at an unusual rate,

which could indicate that fictitious accounts receivable have been added to inflate sales.

Of more concern, perhaps, is the increase in accounts payable that might require, at a minimum, a

closer review to determine why.

If the drop in the ratio indicates a problem customer or significant slowing in the time to collection, it

might reflect a general decline in company prospects.

That, in turn, would be a red flag that management could feel pressured to report fraudulent financials.

Procedures – Types of Ratio Analysis

Debt to Equity Ratio

Total Liabilities

Total Equity

The debt-to-equity ratio is computed by dividing total liabilities by total equity.

It indicates the proportion of equity and debt a company uses to finance its assets. Because

the ratio provides a picture of the relative risk assumed by the creditors and owners, it is

heavily considered by lending institutions.

The higher the ratio, the more difficult it will be for the owners to raise capital by increasing

long-term debt, and the greater the risk assumed by creditors.

Debt-to-equity requirements are often included as borrowing covenants in corporate

lending agreements.

The example displays a year one ratio of 0.89. This is very favorable, as it shows that the

company is financed more by equity than by debt.

However, year two shows a ratio of 1.84, meaning that debt is greatly increasing relative to

equity.

In this case, the increase in the ratio corresponds with the rise in accounts payable.

Sudden changes in this ratio may signal an examiner to look for fraud.

Procedures – Types of Ratio Analysis

Profit Margin Ratio

Net Income

Net Sales

The profit margin ratio is net income divided by sales.

This ratio is often referred to as the efficiency ratio, in that it reveals profits earned per dollar of sales.

This percentage of net income to sales examines not only the effects of gross margin changes, but also

changes in selling and administrative expenses.

If fraud is committed, net income may be artificially overstated, resulting in a profit margin ratio that is

abnormally high compared to other periods.

False expenses will cause an increase in expenses and a decrease in the profit margin ratio.

This ratio should be fairly consistent over time.

In this example, the profit margin analysis is already calculated in the vertical and horizontal analyses.

While revenues increased by 80 percent, the cost of goods sold increased by 140 percent; this, in turn,

dropped profit margins from 6 percent to -6 percent.

Further investigation could uncover fraudulent accounting that shifted costs from one period to another,

or might reveal another type of fraud in which inventory is being stolen so costs appear to jump.

Procedures – Types of Ratio Analysis

Receivables Turnover Ratio

Net Sales on Account

Average Net Receivables

Receivable turnover is defined as net sales on account divided by average net

receivables.

It measures the number of times the receivables balance is turned over during the

accounting period.

In other words, it measures the time between sales on account and the collection of funds.

This ratio is one that uses both income statement and balance sheet accounts in its

analysis.

If fictitious sales have been recorded, this bogus income will never be collected.

As a result, the turnover of receivables will decrease.

If the fraud is caused from fictitious sales, this bogus income will never be collected.

In the example, the accounts receivable turnover jumps from 1.61 to 2.14.

The examiner can use this ratio as an indicator that revenues might be fake, thus requiring

further examination of source documents.

Procedures – Types of Ratio Analysis

Collection Ratio

365

Receivable turnover

Accounts receivable aging is measured by the collection ratio, which divides 365 days by

the receivable turnover ratio to arrive at the average number of days to collect

receivables.

In general, the lower the collection ratio, the faster receivables are collected.

A fraud examiner may use this ratio as a first step in detecting fictitious receivables or

larceny and skimming schemes.

Normally, this ratio will stay fairly consistent from year to year, but changes in billing

policies or collection efforts may cause a fluctuation.

The example shows a favorable reduction in the collection ratio from 226.3 in year one to

170.33 in year two.

This means that the company is collecting its receivables more quickly in year two than in

year one.

Procedures – Types of Ratio Analysis

Inventory Turnover Ratio

Cost of Goods Sold

Average Inventory

The relationship between a company’s cost of goods sold and its average

inventory is shown through the inventory turnover ratio.

This ratio measures the number of times the inventory is sold during the period.

This ratio is a good determinant of purchasing, production, and sales efficiency.

In general, a higher inventory turnover ratio is considered more favorable.

For example, if cost of goods sold has increased due to theft of inventory

(ending inventory has declined, but not through sales), then this ratio will be

abnormally high.

In the case example, inventory turnover increases in year two, signaling the

possibility that an embezzlement is buried in the inventory account.

An examiner should look at the changes in the components of the ratio to

determine a direction in which to discover possible fraud.

Procedures – Types of Ratio Analysis

Average Number of Days Inventory Ratio

365

Inventory Turnover

The average-number-of-days-inventory-is-in-stock ratio is a restatement of the inventory

turnover ratio expressed in days.

This rate is important for several reasons.

An increase in the number of days that inventory stays in stock causes additional

expenses, including storage costs, risk of inventory obsolescence, and market price

reductions, as well as interest and other expenses incurred due to tying up funds in

inventory stock.

Inconsistency or significant variance in this ratio is a red flag for fraud investigators.

Examiners may use this ratio to examine inventory accounts for possible larceny schemes.

Purchasing and receiving inventory schemes can affect the ratio.

Understating the cost of goods sold will result in an increase in the ratio as well.

Significant changes in the inventory turnover ratio are good indicators of possible

fraudulent inventory activity.

Conclusion

Red flags are warnings that something could be or

is wrong.

Auditors, employees, and management need to

be aware of red flags in order to monitor the

situation and then take corrective action as

needed.

Employees who notice that red flags are ignored

may mistakenly believe that it is okay to game the

system or that they won’t get caught.

A little fraud soon becomes a large one if left to

grow.

Contact Me

Iris Ikeda

[email protected]ii.gov or [email protected]ov

808.586.2815

Division of Financial Institutions

Department of Commerce and Consumer Affairs

(DCCA)

335 Merchant Street, Rm 221

Honolulu, Hawaii 96813