Financial Ratio Analysis for Agricultural Cooperatives

Phil Kenkel

Bill Fitzwater Cooperative Chair

Financial statements contain information that describes the cooperative firm’s financial position

and performance. Cooperative leaders need to analyze and interpret that information in order to

make informed financial decisions. This process can be improved using the tools and techniques

of Financial Statement Analysis. Some of the common components of financial statement

analysis include:

Comparative Analysis

Common Size Analysis

Financial Ratio Analysis

Trend Analysis

Comparative Analysis

The development of comparative financial statements is one of the most commonly used

techniques for analyzing financial statements. This technique compares the financial statements

from two or more time periods or compares the current statement with the budgeted statement.

Comparative analysis is typically limited to the income statement and balance sheet. The

comparative balance sheet can be used to determine how the financial position of the firm has

changed. The comparative income statement can be used to examine how the cooperative’s

current performance compares with previous perdios.

Examples of comparative Balance Sheet and Income and Expense Statement are provided below.

We can note several changes in the cooperative. Total assets actually decreased and the

cooperative made significant reduction in its long term debt. The cooperative’s sales increased

over the previous year as did its cost of goods sold and operating expenses. The net result was a

decrease in local savings. A cooperative board of directors would likely use a more detailed

version of the financial statements. That would allow the comparison of individual expense

categories. The comparative statements would help them analyze the cooperative financial

situation and performance relative to the previous year or to a series of previous years.

Balance Sheet

2016 2015

Current Assets

Cash 23,047,115 13,369,337

Receivables 6,900,122 10,441,837

Inventory 23,307,346 34,088,821

Prepaid Expenses 2,957,753 6,167,646

Deferred Tax Asset 153,068 166,384

Total Current Assets 56,569,755 64,944,402

Non-Current Assets

land 8,257,699 8,222,498

Property Plant and Equipment 111,648,529 108,275,499

Accumulated Depreciation (60,538,441) (54,793,748)

Net Property Plant and Equipment 51,110,088 53,481,751

Investment in Cooperatives 14,425,588 13,938,756

Total Non-Current Assets 73,793,375 75,643,005

Total Assets 130,363,130 140,587,407

2016 2015

Current Liabilities

Accoounts Payable 29,034,680 33,927,221

Curren t Portion of Long Term Debt 3,296,379 3,429,202

Notes Payable 9,794,665 10,259,170

Accrued Expenses 3,369,112 2,506,119

Patronage Refunds Payable 556,940 1,124,461

Total Current Liabilities 46,051,776 51,246,173

Long Term Liabilities

Notes Payable 11,053,637 18,212,231

Members Equity

Membership Stock 4,961,411 1,982,883

Qualified Revolving Equity 20,100,202 21,297,892

Non-qualified Revolving Equity 20,000,000 23,703,808

Unallocated Equity 28,196,104 24,144,420

Total Member Equity 73,257,717 71,129,003

Total Liabilities and Equity 130,363,130 140,587,407

Income and Expense Statement 2016 2015

Sales 255,862,563 233,692,387

Cost of Goods Sold 226,668,114 205,804,496

Gross Margin 29,194,449 27,887,891

Other Revenue 12,952,545 12,702,659

Total Revenue 42,146,994 40,590,550

Operating Expenses 38,390,643 35,156,183

Local Savings 3,756,351 5,434,367

Patronage Dividend Income 2,101,955 2,100,129

Total Savings Before Taxes 5,858,306 7,534,496

Income Tax 444,509 499,727

Net Savfings after Taxes 5,413,797 7,034,769

Common Size Analysis

Comparing the financial statements with previous years or budget estimates can provide useful

insights. The analyzed of individual categories can be challenging if the cooperative’s sales

changed due to weather or other factors or if the cooperative’s asset based changed which is

typical for a growing firm. Common size analysis is an additional technique that can be used to

analyze and interpret financial statements. In common size analysis each line on the financial

statement is expressed as a percentage of the base for that period. In the case of the income

statement the base is the total sales for the period while the balance sheet entries are expressed as

a percent of total assets.

Common size analysis has several advantages. First, it further facilitates comparative analysis.

When a cooperative’s sales increase year over year, one would expect the cost of goods sold and

operating expenses to also increase. That raises the question as to whether changes in those

categories were simply due to the change in sales or if they indicate problems in expense control.

Expressing the comparative statements in a common size format adjusts for the change in sales

and allows the board and CEO to see what categories were changing relative to total sales.

Common size analysis also emphasized the contribution of each income and expense item to net

income and each balance sheet income to total assets. That helps cooperative leaders to focus on

areas where there are changes in categories that have significant impact. Finally, common size

analysis facilitates comparison with other firms of different sized.

Examples of common size balance sheet and income and expense statements are shown below.

The common size format makes it much easier to identify changes from the comparison year.

Examining the common size balance sheet, we can see that current assets now represent a

smaller portion of total assets and that long term debt decreased, relative to total assets.

Examining the common size income statement we can see that the cost of goods sold increased

relative to sales while the amount of other income and patronage income received from regional

cooperatives decreased. The result was a lower after tax profit margin. We can also note that

while operating expenses increased in dollar terms, the level of operating expense to sales was

constant.

Balance Sheet

2016 2015

Current Assets

Cash 17.7% 9.5%

Receivables 5.3% 7.4%

Inventory 17.9% 24.2%

Prepaid Expenses 2.3% 4.4%

Deferred Tax Asset 0.1% 0.1%

Total Current Assets 43.4% 46.2%

Non-Current Assets

land 6.3% 5.8%

Property Plant and Equipment 85.6% 77.0%

Accumulated Depreciation -46.4% -39.0%

Net Property Plant and Equipment 39.2% 38.0%

Investment in Cooperatives 11.1% 9.9%

Total Non-Current Assets 56.6% 53.8%

Total Assets 100.0% 100.0%

2016 2015

Current Liabilities

Accoounts Payable 22.3% 24.1%

Curren t Portion of Long Term Debt

2.5% 2.4%

Notes Payable 7.5% 7.3%

Accrued Expenses 2.6% 1.8%

Patronage Refunds Payable 0.4% 0.8%

Total Current Liabilities 35.3% 36.5%

Long Term Liabilities

Notes Payable 8.5% 13.0%

Members Equity

Membership Stock 3.8% 1.4%

Qualified Revolving Equity 15.4% 15.1%

Non-qualified Revolving Equity 15.3% 16.9%

Unallocated Equity 21.6% 17.2%

Total Member Equity 56.2% 50.6%

Total Liabilities and Equity 100.0% 100.0%

Income and Expense Statement 2016 2015

Sales 100.0% 100.0%

Cost of Goods Sold 88.6% 88.1%

Gross Margin 11.4% 11.9%

Other Revenue 5.1% 5.4%

Total Revenue 16.5% 17.4%

Operating Expenses 15.0% 15.0%

Local Savings 1.5% 2.3%

Patronage Dividend Income 0.8% 0.9%

Total Savings Before Taxes 2.3% 3.2%

Income Tax 0.2% 0.2%

Net Savfings after Taxes 2.1% 3.0%

Financial Ratio Analysis

Ratio analysis is one the important tools for financial statement analysis. Financial ratios

highlight the relationship between two or more entries on the financial statements. Financial

ratios can be tracked over time to determine if the cooperative is making progress toward its

financial goals and the ratios can be compared with industry benchmarks. A more advanced

analysis can be performed by examining the relationship between multiple financial ratios.

Financial ratios are typically classified based on their purpose. The common categories of

financial ratios are:

Liquidity Ratios

Solvency Ratios

Efficiency or Activity Ratios

Profitability Ratios

Liquidity Ratios

Liquidity relates to a firm’s ability to meet its short term obligations. In simple terms liquidity

measures determine if the firm has enough cash or assets that will be converted to cash to meet

the obligations that will require cash in the coming year.

One of the most common liquidity ratio is the current ratio which is defined as:

Current Ratio = Current Assets ÷Current Liabilities

At a minimum a cooperative would need to maintain a current ratio of 1:00 to be able to pay its

obligations as they come due. A common benchmark for the current ratio is a minimum of 2:00 .

Another measure of liquidity is working capital which is defined as:

Working capital = current assets – current liabilities.

Cooperative leaders can develop specific goals for the dollar amount of working capital. The

cooperative’s loan covenants often specify minimum working capital level. The appropriate

dollar amount of working capital changes as a cooperative grows. For that reason, working

capital is often measured with the working capital to sales ratio.

Working Capital to Sales = Working capital ÷total sales.

A common benchmark the working capital to sales ratio is a minimum of 1.5% of grain sales

plus 2.5% of farm supply sales. A diversified commodity marketing and farm supply

cooperative would therefore likely have a benchmark of 2.0% or higher.

Solvency Ratios

Solvency refers to the amount of debt the cooperative is employing relative to its assets and

owner’s equity. This category of ratios can also measure whether the firm’s cash flow are

sufficient to meet the required debt payments. Some of the common solvency ratios include:

Debt to Asset Ratio = Total Debt ÷Total Assets

In many cooperatives the seasonal debt or short term debt can be a significant part of the total

debt. There is also significant variation in the amount of short term debt during a normal year.

A good portion of the seasonal debt is used to finance inventory which is ordinarily converted to

cash within the year. For that reason, many cooperatives place more focus on solvency ratios

measuring long term debt.

Long term Debt to Asset Ratio = Long Term Debt ÷Total Assets

A common benchmark for the Long Term Debt to Asset Ratio is a maximum of 50%. Many

cooperatives strive for lower levels.

Some equivalent ratios are the Debt to Equity Ratio or Long Term Debt to Equity Ratio. A Debt

to Equity Ratio of 100% is equivalent to a Debt to Asset Ratio of 50%.

As opposed to measuring the amount of debt the Debt Coverage Ratio measures the

cooperative’s ability to meet the required debt payments. The calculation of the Debt Service

Ratio can be somewhat complex. In principle the ratio measures all of the funds the cooperative

has available to make debt and lease payments relative to the amount of those payments. One

definition of the Debt Coverage Ratio is:

Debt Coverage Ratio = Earnings before Interest, Taxes, Loan Principle and Lease Payments ÷

Loan Interest and Principle Payments + Lease Payments

A common benchmark for the Debt Coverage Ratio is 1.75 to 2.00 or higher.

Calculations for the Debt Service Coverage Ratio also often subtract the gain or loss on asset

sales and other non-typical items from the earnings side of the ratio. The adjustment would

make the ratio reflect the debt coverage that the cooperative would achieve in a typical year.

Activity and Efficiency Ratios

This category or ratios measures how efficiently the firm is employing its assets and how well it

is controlling expenses. A sub-set of these ratios is known as “turnover ratios which measure the

relationship between sales and particular asset categories. It is easy to visualize the concept of

turnover when we consider the inventory turnover ratio. When the average inventory is much

lower than the total annual sales then it is obvious that the inventory “turns over” (is replaced)

multiple time during the year. A high inventory turnover ratio indicates the firm is generating a

lot of sales from its inventory investment. Some common turnover ratio and common

benchmarks include:

Total Asset Turnover = Sales ÷ Total Assets

(A common benchmark is a minimum of 2.0

Fixed Asset Turnover – Total Sales ÷Total Assets

(A common benchmark is a minimum of 5.0 )

Inventory Turnover Ratio = Farm Supply Sales ÷Average Inventory

(Benchmark depends on the sales profit margin)

Accounts Receivable Turnover = Credit Sales ÷Average Accounts Receivable Balance

(A common benchmark is a minimum of 8:00, depending on the credit terms).

The Accounts Receivable Turnover ratio reflects how long on average it takes the cooperative to

collect each dollar of credit sales. A turnover ratio of 8:00 implies an average collection period

of 45 days. An equivalent ratio is:

Average Collection Period = Average Accounts Receivable ÷ Average Credit Sales per Day

The benchmarks for the Accounts Receivable Turnover Ratio and Average Collection Period

also depend on the credit terms being offered. Some cooperatives also calculate the percent of

the accounts receivable balance that is past the credit terms, for example many cooperatives

strive to keep the portion of accounts receivable past 60 days below 20%

Expense Control Ratios

Other efficiency ratios measure how well the cooperative is controlling expenses. Because the

level of expenses would be expected to change with the level of sales, expense ratios are

calculated as a percent of sales or percent of gross margin on sales. Many agricultural

cooperatives that are marketing bulk commodities or selling bulk inputs strive for a target profit

margin per unit. For example a grain marketing cooperative might strive for a $.50 margin per

bushel while a farm supply cooperative might try and achieve a $50 margin per ton. For that

reason, expense ratios for agricultural cooperatives are typically expressed as a percent of gross

margin. That removes the effects of volatile commodity prices from the expense ratio.

In the calculation of gross margin for expense ratios, other operating income such as grain

storage income or fertilizer application income that is typically included in the gross margin

calculation. Some common expense ratios include:

Total Expenses to Gross Margin - Total Expenses ÷Total Gross Margin

A common benchmark would be less than 80%

Personnel Expense to Gross Margin = Personnel Expense ÷Gross Margin

Common benchmarks would be less 35% for grain only cooperatives and less than 45% for farm

supply cooperatives.

Fixed Expense to Gross Margin = Fixed Expenses ÷Gross Margin

A common benchmark for the fixed expense ratio is not to exceed 25%=30%

Other Expense to Gross Margin = Other Expense ÷Gross Margin

A common benchmark for the other expense ratio is not to exceed 25%

Total Operating Expenses to Gross Margin = Total Operating Expenses

A common benchmark for the total expense ratio is not to exceed 80-85

Profitability Ratios%

Profitability ratios measures the cooperative’s success in generating a return for its user-

members. While there can be other dimensions of the cooperative value package, profitability is

a key objective. Many of the other characteristics of a firm, which are measured by the other

financial ratios, ultimately impact profitability. Profitability ratios reflect the level of sales

generated, the efficiency of asset utilization, expense control and the capital structure of the firm.

Profitability ratios include margin ratios and return ratios.

Margin ratio measure how profit is being generated from sales and gross revenues. Some of the

most common margin rations measure the relation of gross profit, operating profit and net profit

to total sales. Managers find margin ratios useful in comparing the cooperative’s performance

over time. They are more difficult to compare to industry benchmarks because different types of

products and services typically yield different profit margins. Margin ratios measure the profit

per dollar of sales but not the profitability of the firm. The profitability of the frim depends on

both the profit margin per sales dollars and the amount of total sales.

Return Ratios

As the names imply, profitability return ratios measure the financial return the firm is generating.

The two most common ratios are the Return on Assets which measures the return the firm is

generating from its total assets and the Return on Equity which measures the return to the

owner’s invested capital. Both of these return ratios combine information from the income

statement with information from the balance sheet.

Return on Assets= Net after Tax Savings ÷ Total Assets

The sole purpose of a cooperative investing in assets is to generate revenue and ultimately

produce profits. The return on total asset ratio measures how efficiently the cooperative is

utilizing and managing its assets to produce a profit during the current period. A common

benchmark for the Return on Total Assets is a minimum of 8%.

Return on Equity = Net Savings after Taxes ÷ Member Equity

The ultimate goal of the cooperative is to generate a return for its user-owners. The return on

equity ratio measures how much profit is being generated with each dollar of the owner’s equity

investment. The return on equity reflects both how well the firm is utilizing its assets and also

how the firm used debt and equity financing. When the cooperative is generating returns in

excess of the interest rate then the use of debt financing increases the return on equity. This is

often referred to as “financial leverage”. The use of debt financing also increases the risk of the

firm since the loan payments must be paid regardless of profitability. A common benchmark for

the return on equity is a minimum of 10%.

Return on Local Assets =:Local Savings ÷ Local Assets

(Where Local Assets =Total Assets – Investment in Regional Cooperatives)

Return on Local Equity = Local Savings ÷ Local Equity –

(Where Local Equity = Members equity -Investment in Regional Cooperatives)

Many local cooperatives are members of regional cooperatives. Under that two tier system the

local cooperative receives patronage in both cash and equity from the regional cooperative. The

members of the local cooperative are directly impacted by the performance of their local

cooperative and indirectly by the performance of the regional cooperative. Because the

performance of the regional cooperative is not under the control of the manager and board of the

local cooperative, lenders and other parties often look at local savings ratios. These ratios are

based on local savings (savings before regional patronage) and local assets (total assets minus

equity in regional cooperatives) and local equity (total equity minus equity in regional

cooperatives). The same typical benchmarks are used for the local savings ratios but they are

more stringent measures since poor performance at the local level cannot be offset by regional

patronage. The calculation of local savings is made before taxes so the effects of income taxes

are not considered. Agricultural cooperatives have traditionally had low taxable income because

they distributed tax deductible patronage refunds. For that reason, the omission of the tax

payment has little impact on the difference between local and total savings and the resulting

ratios.

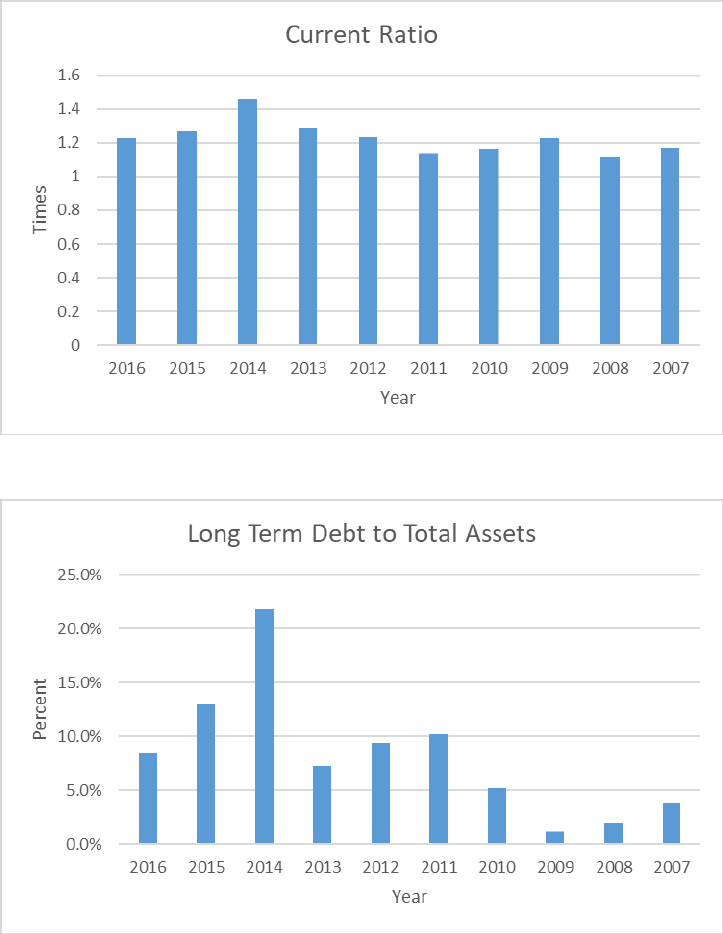

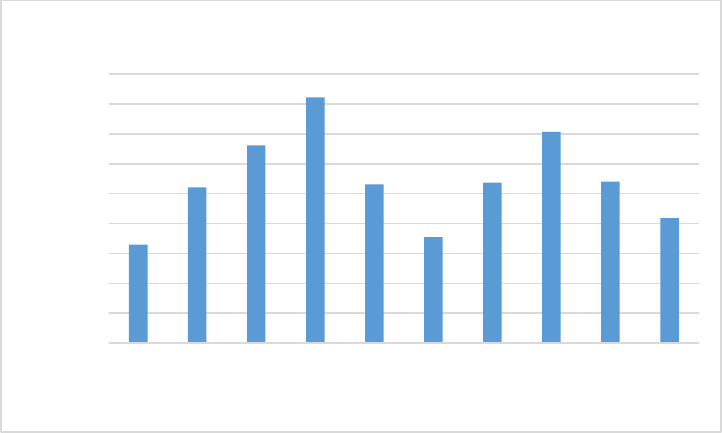

Trend Analysis

It is difficult to identify underlying issues with a cooperative’s financial condition or

performance from a single year’s financial statements. Agricultural cooperatives are impacted

by weather, commodity prices and the general agricultural economy. Cooperative leaders also

sometimes make strategical and financial decisions that temporarily impact the firm’s financial

position. One of the important steps in financial statement analysis is to examine ratios over

time and identify any positive or negative trends. The figures below illustrate a time series of

financial ratios from an actual mid-western grain and farm supply cooperative.

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Times

Year

Asset Turnover

In analyzing the trends in the financial ratios we see very little trend in liquidity. The

cooperative was able to improve its current ratio for a number of years and is now seeing a slight

decline. If the board is satisfied with this level of liquidity and the declining trend in the most

recent years does not continue, there are no alarming trends. The graph of Debt to Total Asset

Ratios shows that the cooperative has maintained very low leverage. The cooperative’s leverage

increased during 2014, perhaps because of a capital expenditure project. The cooperative

appears to be successfully working down their long term debt load.

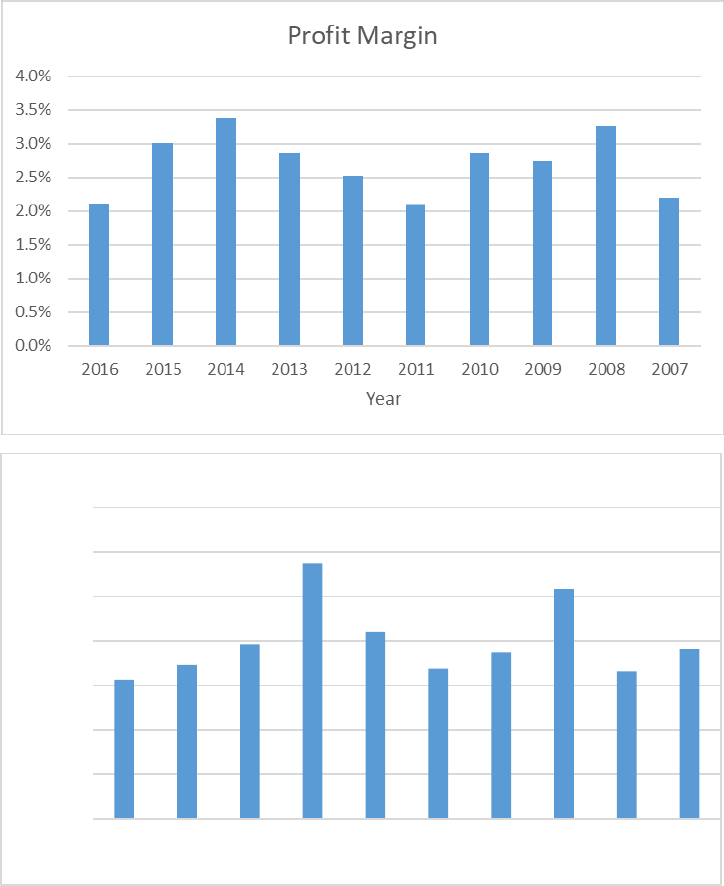

The income statement ratios tell a more interesting story. Over the most recent four years the

cooperative’s profit margin and total asset turnover have both declined. The cooperative is

generating less sales from its assets and capturing less profit from each dollar of sales. The result

is event in the last graph showing the trend in the Return on Assets. The cooperatives ROA is

declining and has in fact reached the lowest level in the ten year period. The trend analysis

identifies a negative trend in profitability and asset utilization that needs to be addressed.

Summary

The financial condition of your cooperative reflects both current decisions and longer run trends

and strategies. By closely analyzing your financial statements you will be able to assess the

financial position and performance of the cooperative firm and note any favorable or unfavorable

trends. Comparative analysis and common size analysis are useful tools to analyze and

understand changes from the previous period(s).

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Percemt

Year

Retun on Assets