`

State Employment

Relations Board

HEALTH

INSURANCE

THE COST OF HEALTH INSURANCE

IN OHIO’S PUBLIC SECTOR

i

2023 HEALTH INSURANCE REPORT

Contents

WELCOME .................................................................................................................................... 1

REVISION NOTES .................................................................................................................... 1

SURVEY BACKGROUND ....................................................................................................... 2

SURVEY METHODS ................................................................................................................ 2

SURVEY RESPONSE RATE .................................................................................................... 3

MEDICAL INSURANCE – OVERVIEW ..................................................................................... 4

MEDICAL PLAN TYPES OFFERED ....................................................................................... 4

MEDICAL PREMIUM INCREASES COMPARED TO SALARY INCREASES .................. 5

MEDICAL PREMIUM INCREASES COMPARED TO INFLATION RATES ...................... 6

MEDICAL INSURANCE – ALL PLAN TYPES .......................................................................... 7

MEDICAL PREMIUMS ............................................................................................................ 7

EMPLOYER & EMPLOYEE SHARE OF MEDICAL PREMIUM ....................................... 11

TOTAL MONTHLY MEDICAL PREMIUMS BY PLAN TYPE .......................................... 14

FULLY-INSURED VS SELF-INSURED MEDICAL PLANS ............................................... 15

NETWORK DEDUCTIBLES .................................................................................................. 17

NON-NETWORK DEDUCTIBLES ........................................................................................ 19

COPAY AND COINSURANCE .............................................................................................. 21

OUT-OF-POCKET MAXIMUMS ........................................................................................... 23

MEDICAL INSURANCE – PPO PLANS ................................................................................... 25

PPO PREMIUMS ..................................................................................................................... 25

EMPLOYER & EMPLOYEE SHARE OF MEDICAL PREMIUM ....................................... 27

NETWORK DEDUCTIBLES .................................................................................................. 29

NON-NETWORK DEDUCTIBLES ........................................................................................ 31

OUT-OF-POCKET MAXIMUMS ........................................................................................... 32

MEDICAL INSURANCE – HDHPs ............................................................................................ 34

HDHP PREMIUMS .................................................................................................................. 34

EMPLOYER & EMPLOYEE SHARE OF MEDICAL PREMIUM ....................................... 36

NETWORK DEDUCTIBLES .................................................................................................. 38

NON-NETWORK DEDUCTIBLES ........................................................................................ 40

OUT-OF-POCKET MAXIMUMS ........................................................................................... 41

HEALTH SAVINGS ACCOUNT ............................................................................................ 43

PRESCRIPTION INSURANCE ................................................................................................... 44

PRESCRIPTION CARVE-OUT PREMIUMS......................................................................... 44

ii

2023 HEALTH INSURANCE REPORT

PRESCRIPTION COPAYS/COINSURANCE – ALL PLAN TYPES .................................... 45

DENTAL INSURANCE ............................................................................................................... 46

DENTAL CARVE-OUT PREMIUMS..................................................................................... 46

DENTAL MAXIMUM BENEFIT – ALL PLAN TYPES ....................................................... 47

DENTAL COMPOSITE RATES ............................................................................................. 49

VISION INSURANCE ................................................................................................................. 50

VISION CARVE-OUT PREMIUMS ....................................................................................... 50

VISION COMPOSITE RATES ................................................................................................ 51

LIFE INSURANCE ...................................................................................................................... 52

COST SAVINGS .......................................................................................................................... 53

CONSORTIUMS ...................................................................................................................... 53

WORKSITE WELLNESS PROGRAMS ................................................................................. 55

OPT-OUT INCENTIVES ......................................................................................................... 57

SPOUSAL RESTRICTIONS.................................................................................................... 58

DEPENDENT ELIGIBILITY AUDIT ..................................................................................... 60

DEFINITIONS .............................................................................................................................. 61

1

2023 HEALTH INSURANCE REPORT

WELCOME

WELCOME

The State Employment Relations Board (SERB) is pleased to present the Cost of Health Insurance in

Ohio’s Public Sector – 2023 Edition. This report provides a detailed look at trends in employer-sponsored

health coverage, including premiums, employee contributions, cost-sharing provisions, wellness

programs, and other aspects of health insurance for public entities in the State of Ohio. Thank you for

choosing SERB as your source of trusted information.

REVISION NOTES

The report format mirrors last year’s format with minor adjustments. Several years ago, the report was

updated to improve usability and make room for many new tables and figures. The overall goal of the

expansion was to provide a more detailed insurance report that included an in-depth analysis of the data at

the medical plan level. The insurance report was also expanded to offer a clear view of the employer and

employee contribution amounts towards the medical premium.

This venture involved a significant update to the insurance survey tool, a complete redesign of the

insurance report, and a thorough review and verification of the medical plan data submitted.

The report contains the following sections:

• Welcome

• Medical Insurance Overview

• Medical Insurance – All Plan Types

• Medical Insurance – PPO Plans

• Medical Insurance – HDHPs

• Prescription Insurance

• Dental Insurance

• Vision Insurance

• Life Insurance

• Cost Savings

• Definitions

2

2023 HEALTH INSURANCE REPORT

WELCOME

SURVEY BACKGROUND

The State Employment Relations Board (SERB), as mandated by section 4117.02 of the Ohio Revised

Code, is pleased to present the Annual Report on the Cost of Health Insurance in Ohio’s Public Sector

(2023 Edition). In its 31

st

year, this survey aims to collect data on various aspects of health insurance,

plan design, and cost for government entities. Our goal is to provide statistics that may be useful for both

the employer and employee organizations to promote orderly and constructive labor relationships between

public employers and their employees. This survey findings report provides a detailed look at employer-

offered health coverage for medical, prescription, dental, vision, and life insurance plans. The survey

collected information on various topics, including premiums, employer/employee contributions, plan

deductibles and out-of-pocket maximums, coinsurance, plan design, eligibility, wellness programs, and

other medical plan benefits.

SURVEY METHODS

The 2023 Health Insurance Survey was created and dispersed using Novi Survey, an online survey tool.

SERB emailed or mailed 1,346 links of the survey to public sector employers across the state during

January, requesting completion of the survey by March 2023. The target survey population included:

Government

Schools

Colleges/Universities

Special Districts

• State • School Districts (City, Local, Exempted Village) • Community Colleges • Fire Districts

• Counties • Joint Vocational Schools & Career Centers • State Colleges • Metro Housing Authorities

• Cities • Educational Service Centers (ESCs) • State Universities • Port Authorities

• Townships

• Regional Transit Authorities

This year SERB received 1,253 completed surveys that captured data from 1,993 health insurance plans

available to public sector employees in Ohio. All benefit information throughout this report includes

single and family coverage types. Please remember that the data collected represents public sector health

insurance plans that were in effect on January 1, 2023.

The survey instrument collects data from up to three medical and prescription plans per employer and a

single dental, vision, and life insurance plan. If employers offer more insurance plans than the survey can

collect, the employer reported the three insurance plans with the highest number of employees

participating.

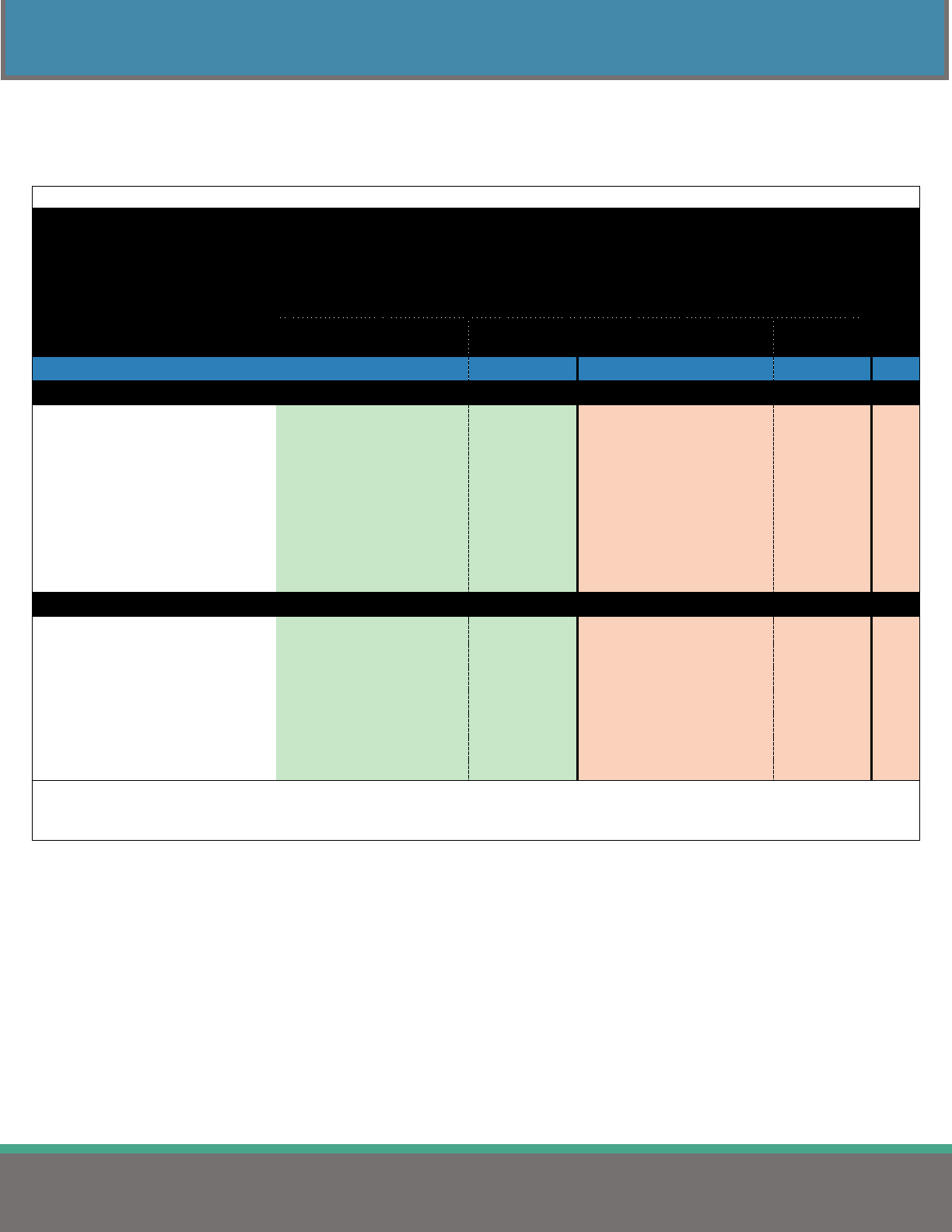

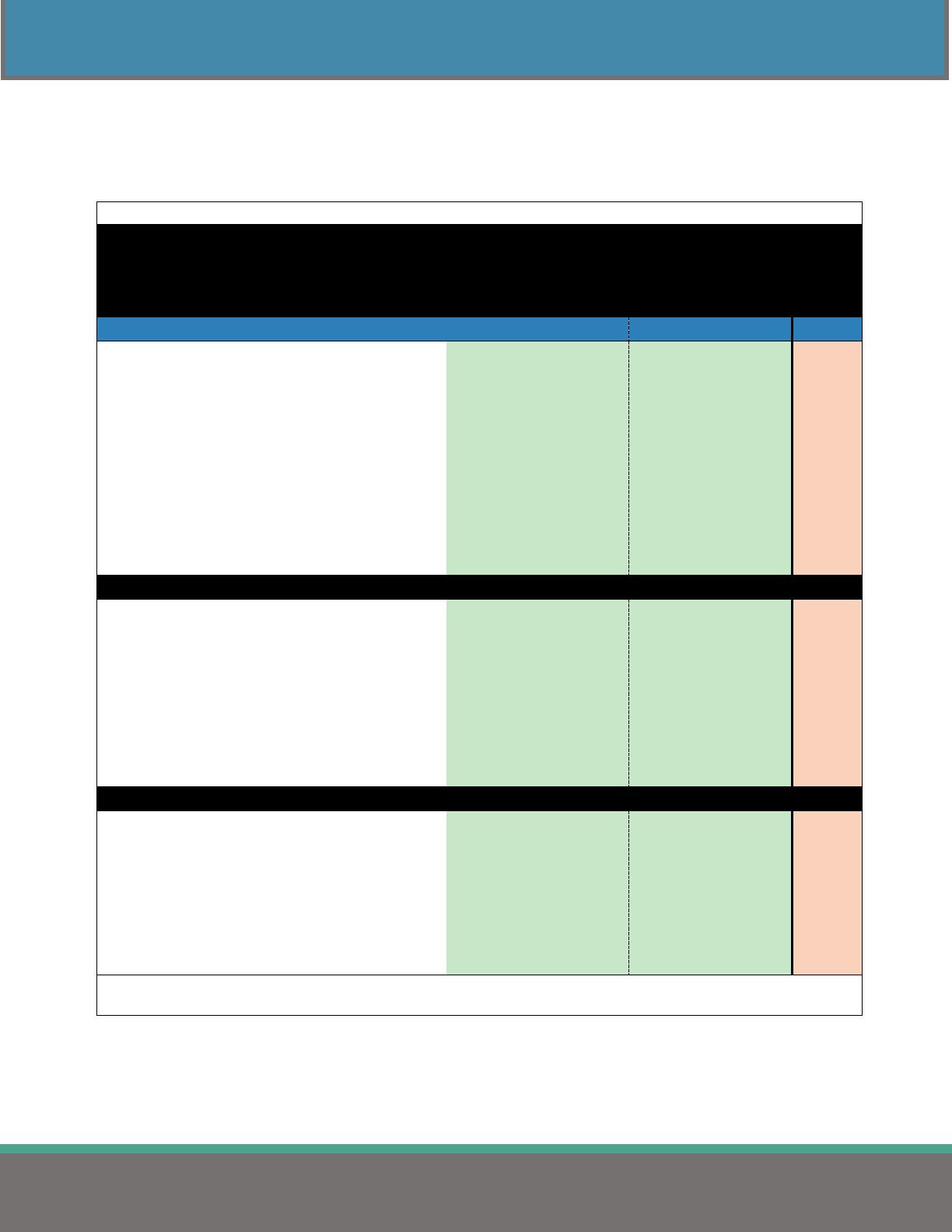

Table 1 displays the quantity of health insurance plans collected during the survey. The insurance plan

data appears in various formats throughout this report.

Table 1

Reported Number of Insurance Plans Offered Statewide

Medical

Prescription

Dental

Vision

Life

STATEWIDE

1,993

1,966

1,205

1,099

1,195

Note: Plans offered will vary depending on the response rate.

3

2023 HEALTH INSURANCE REPORT

WELCOME

SURVEY RESPONSE RATE

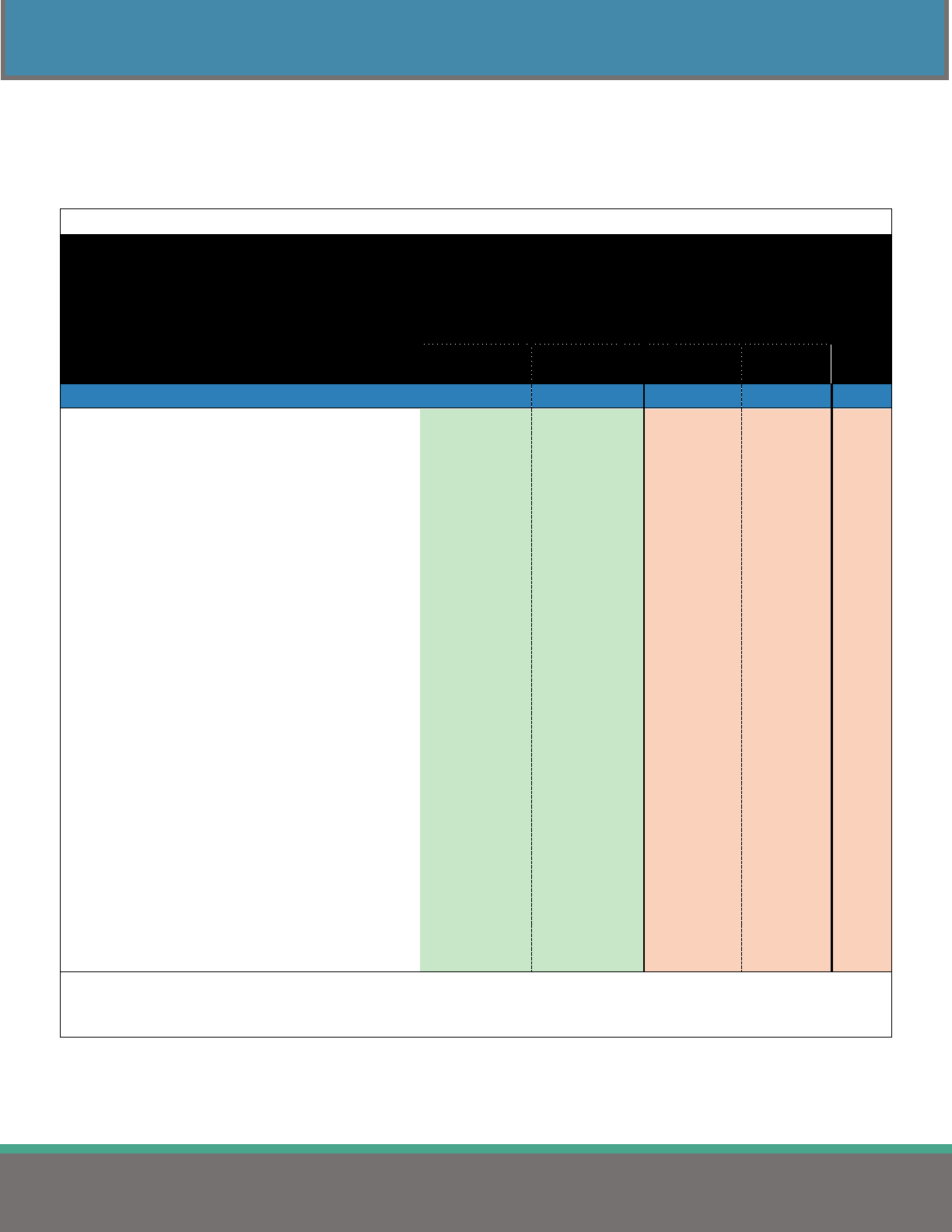

Table 2 displays the percent of public sector employers that completed and returned surveys for 2023 by

jurisdiction. This year’s response rate was 91.5%. Fifteen employers indicated that they do not offer

medical insurance. These employers have been omitted from all tables, except Table 2, in this report.

Table 2

Survey Response Rate

by Jurisdiction

Comparison Group

Surveys Sent

Surveys Completed

Response Rate

STATEWIDE

1,346

1,253

93.1%

State of Ohio 1 1 100.0%

Counties 88 85 96.6%

Cities

257

234

91.1%

Townships

169

137

81.1%

School Districts & ESCs

709

687

96.9%

Colleges & Universities

37

36

97.3%

Fire Districts 25 22 88.0%

Metro Housing Authorities 40 36 90.0%

Port Authorities 5 4 80.0%

Regional Transit Authorities 15 11 73.3%

Note: The number of surveys completed includes submissions from employers that do not offer insurance.

Note: Fifteen employers stated they do not offer medical insurance.

4

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – OVERVIEW

MEDICAL INSURANCE – OVERVIEW

MEDICAL PLAN TYPES OFFERED

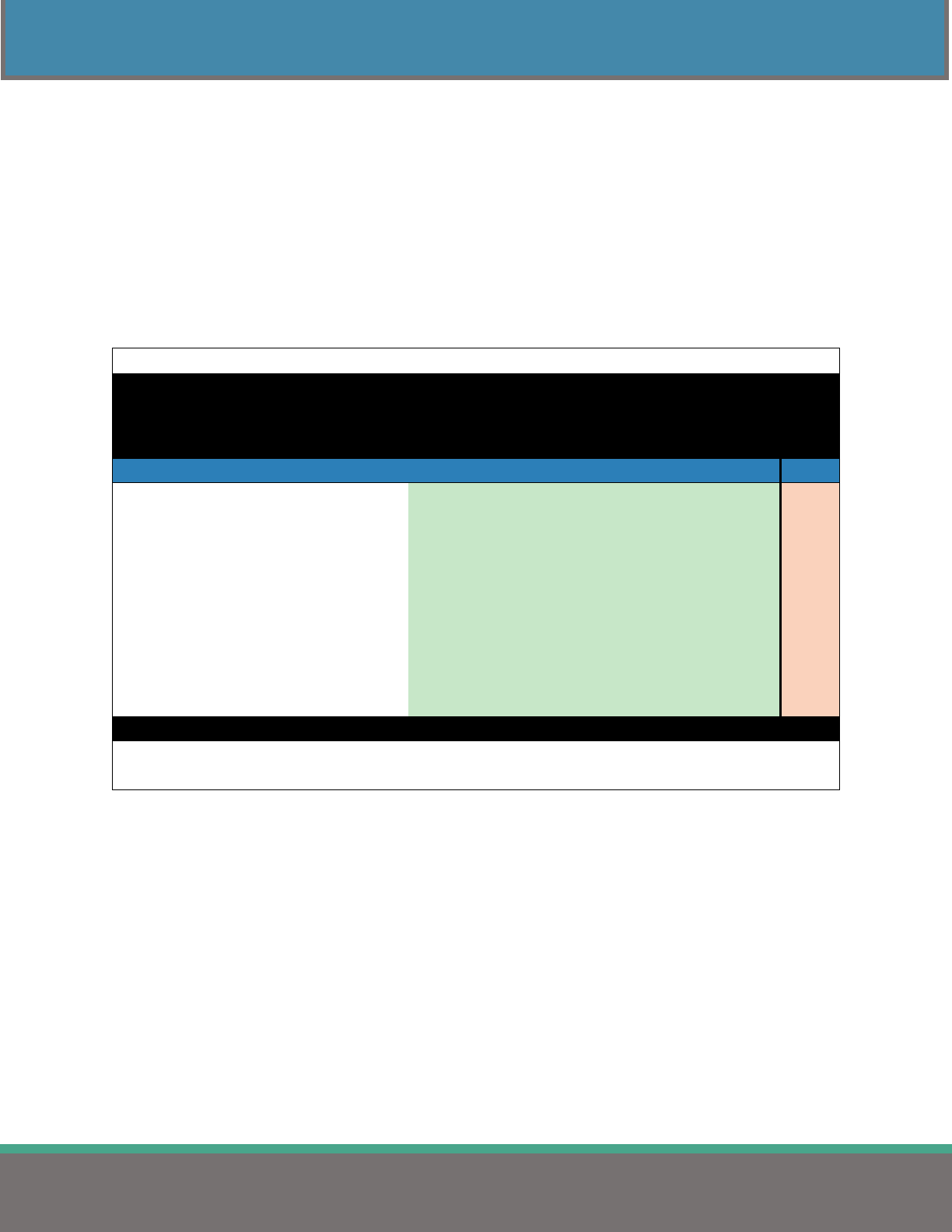

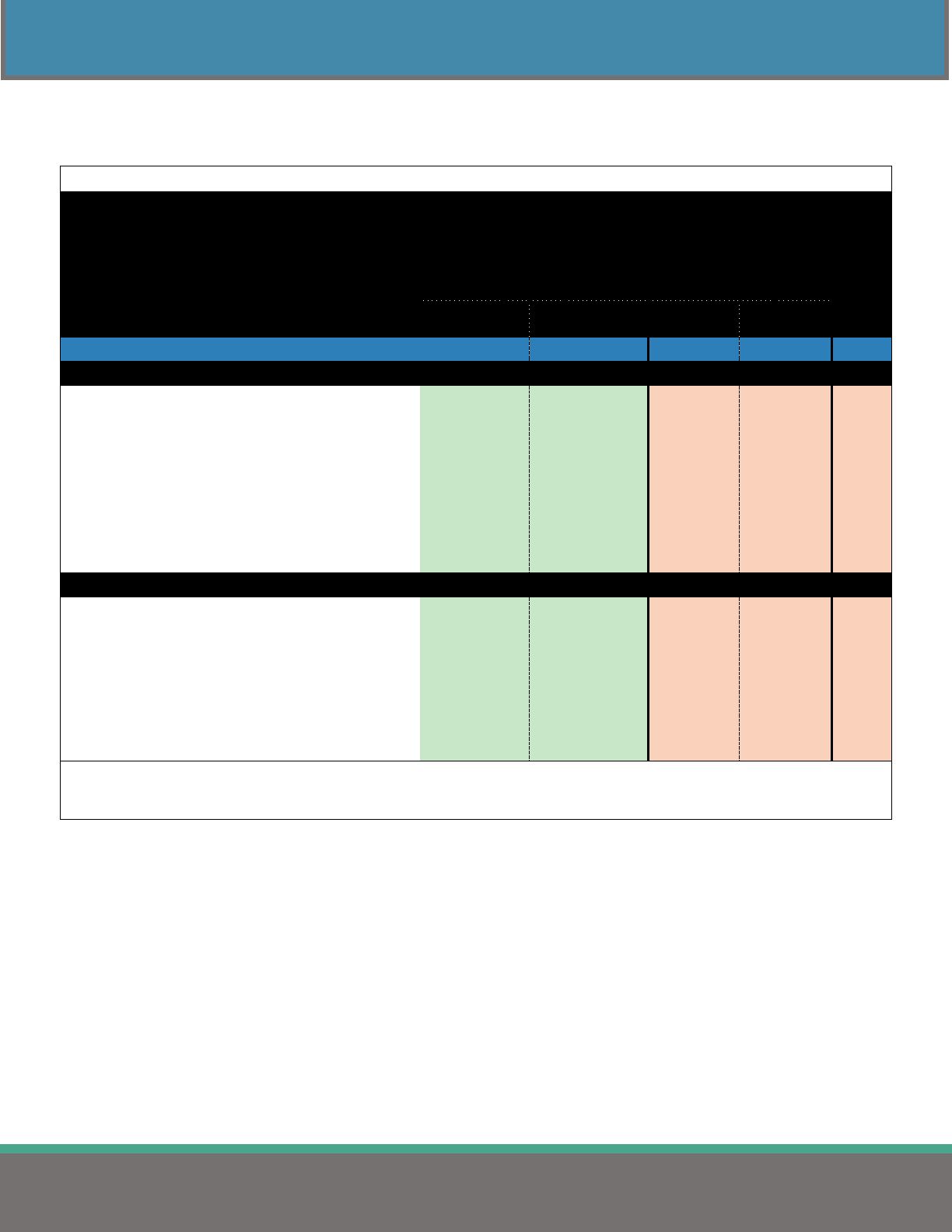

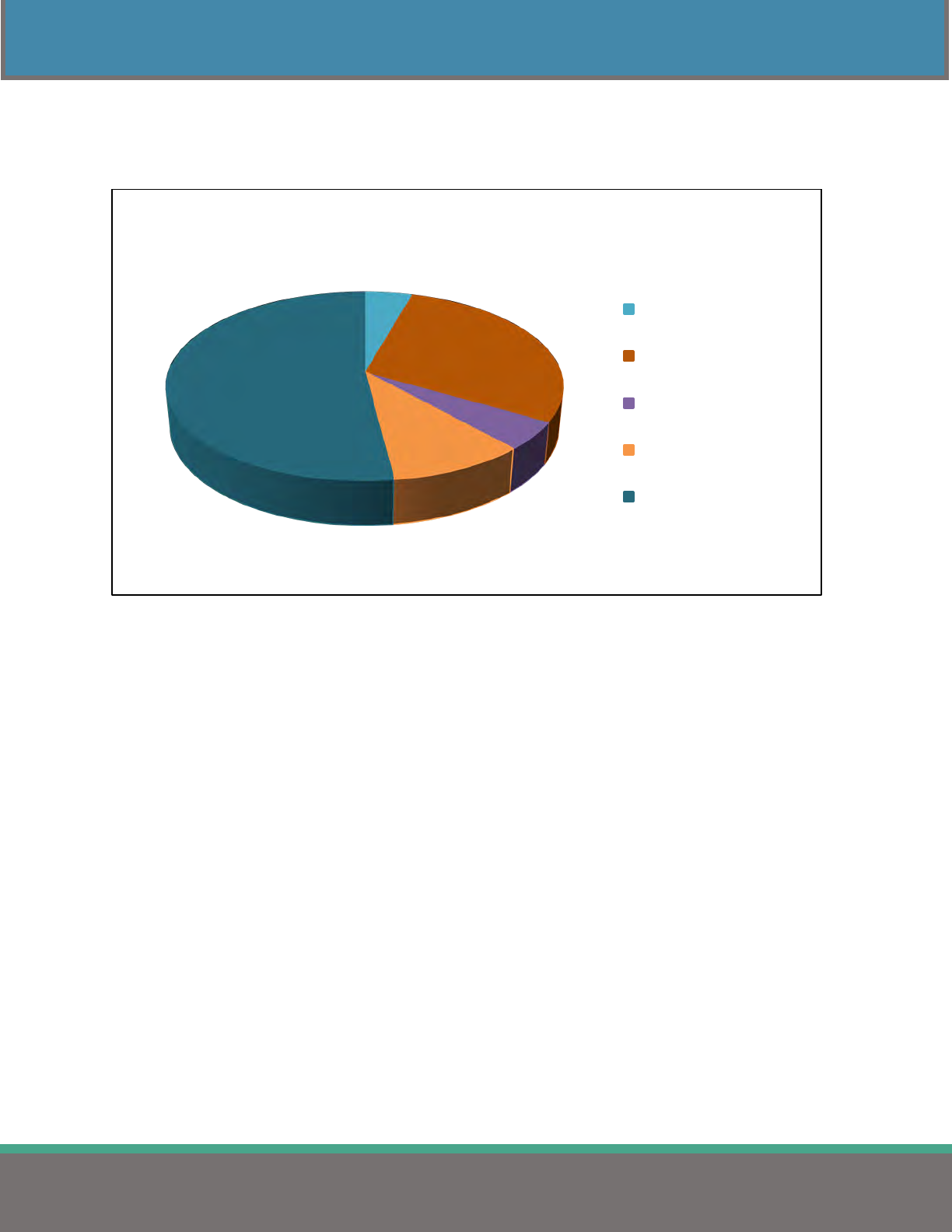

Table 3 displays the percentage of plan types offered by jurisdiction. Many employers offer more than

one type of medical plan to their employees. Therefore, the number of plans (n = 1,993) reported exceeds

the number of surveyed employers. The survey collected information for the following medical plan

types: Exclusive Provider Organization (EPO), Preferred Provider Organization (PPO), Point of Service

(POS), Health Maintenance Organization (HMO), and High Deductible Health Plan (HDHP). PPOs and

HDHPs are the two most utilized medical plan types.

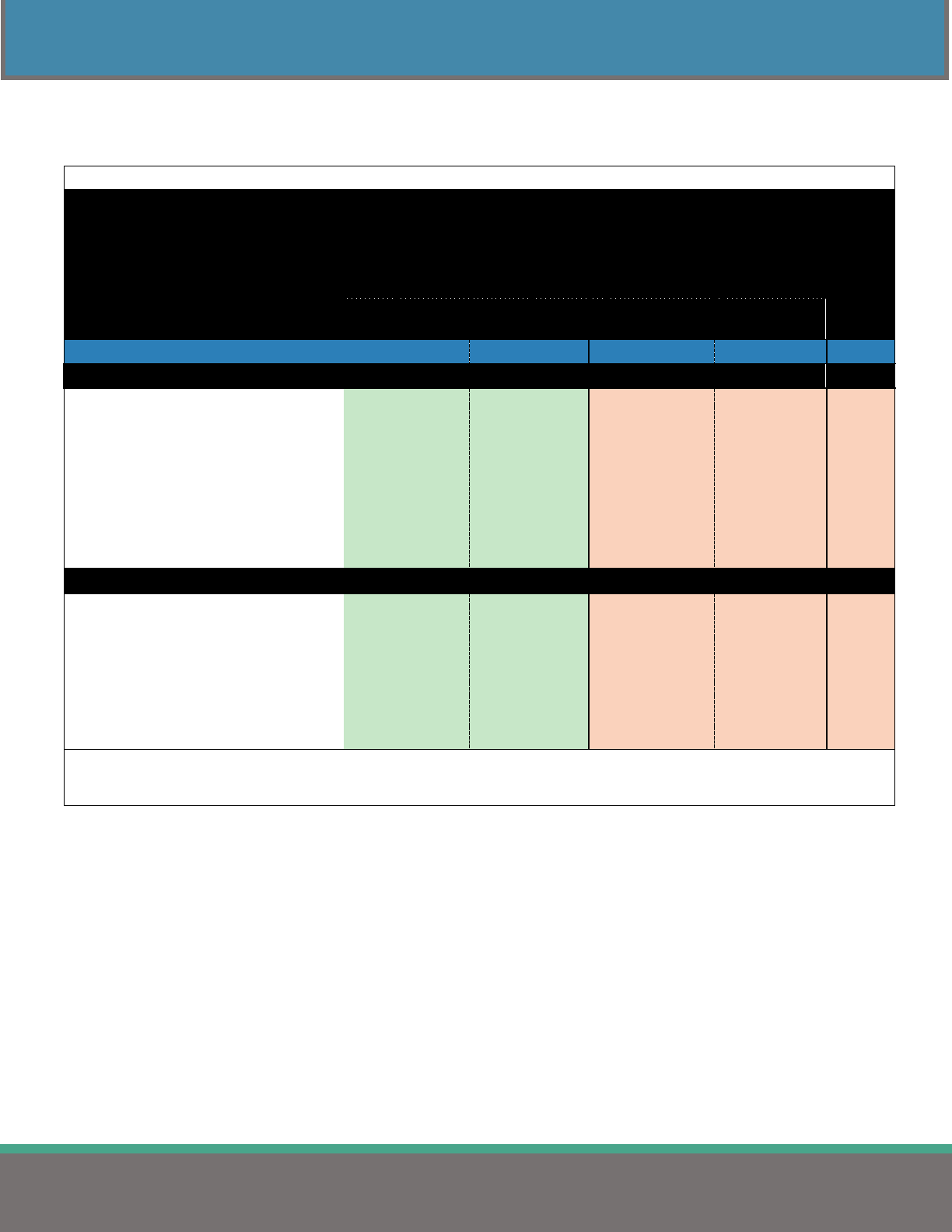

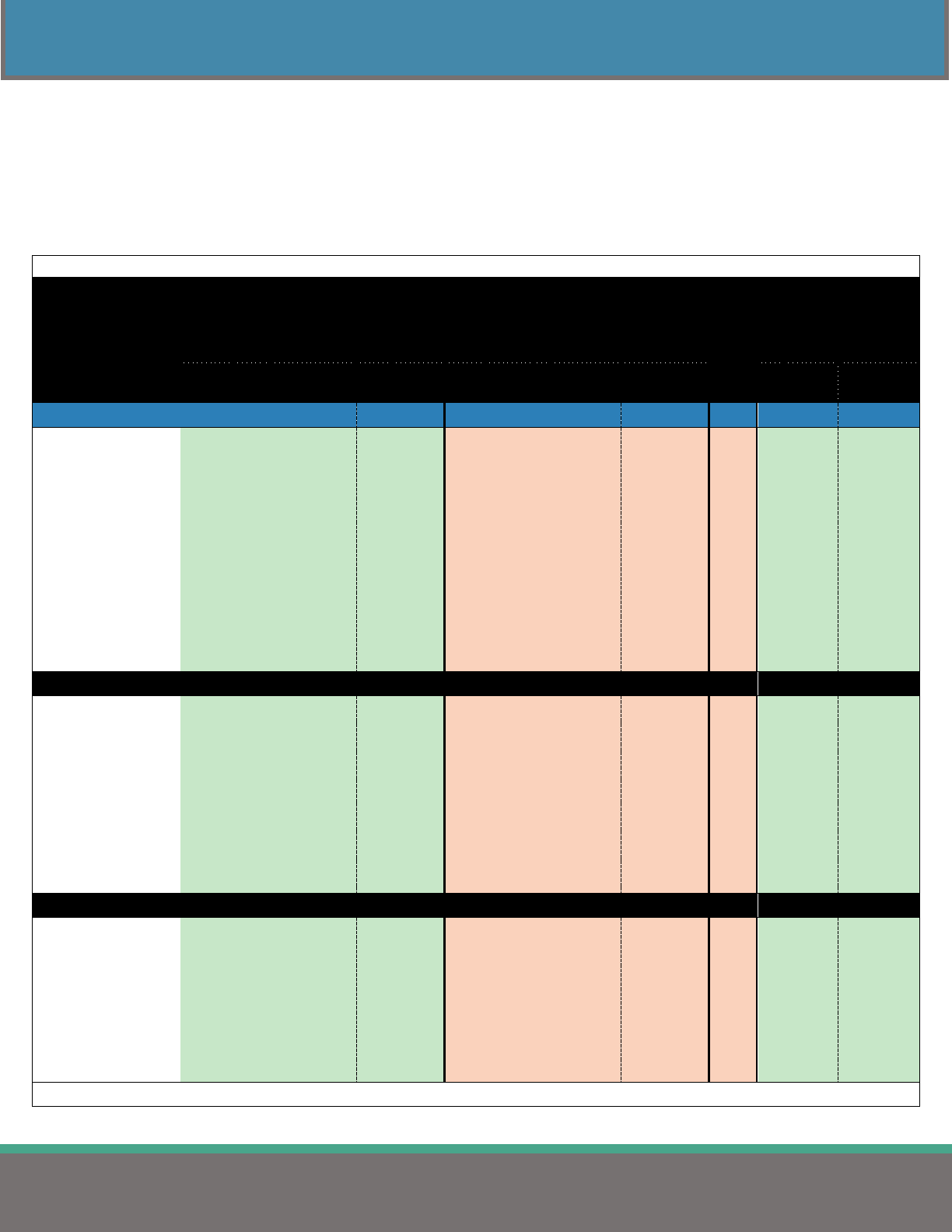

Table 3

Percentage of Plan Types Offered

by Jurisdiction

Comparison Group

EPO

PPO

POS

HMO

HDHP

n

STATEWIDE

0.6%

49.7%

1.1%

1.5%

47.1%

1,993

State of Ohio 0.0% 66.7% 0.0% 0.0% 33.3% 3

Counties 2.0% 53.0% 3.3% 2.0% 39.7% 151

Cities 0.5% 46.0% 1.6% 1.9% 50.0% 372

Townships 0.0% 25.9% 1.3% 1.3% 71.5% 151

School Districts & ESCs 0.3% 55.0% 0.6% 1.3% 42.8% 1,146

Colleges & Universities 4.1% 43.1% 0.0% 1.4% 51.4% 74

Fire Districts 0.0% 15.8% 0.0% 0.0% 84.2% 19

Metro Housing Authorities 0.0% 42.0% 2.0% 2.0% 54.0% 50

Port Authorities 0.0% 20.0% 0.0% 0.0% 80.0% 5

Regional Transit Authorities 4.5% 54.6% 0.0% 4.5% 36.4% 22

NUMBER OF PLANS (n)

12

991

21

30

939

Note: Plan Types - EPO: Exclusive Provider Organization; PPO: Preferred Provider Organization; POS: Point of Service;

HMO: Health Maintenance Organization; HDHP: High Deductible Health Plan.

Note: n: number of plans.

5

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – OVERVIEW

MEDICAL PREMIUM INCREASES COMPARED TO SALARY INCREASES

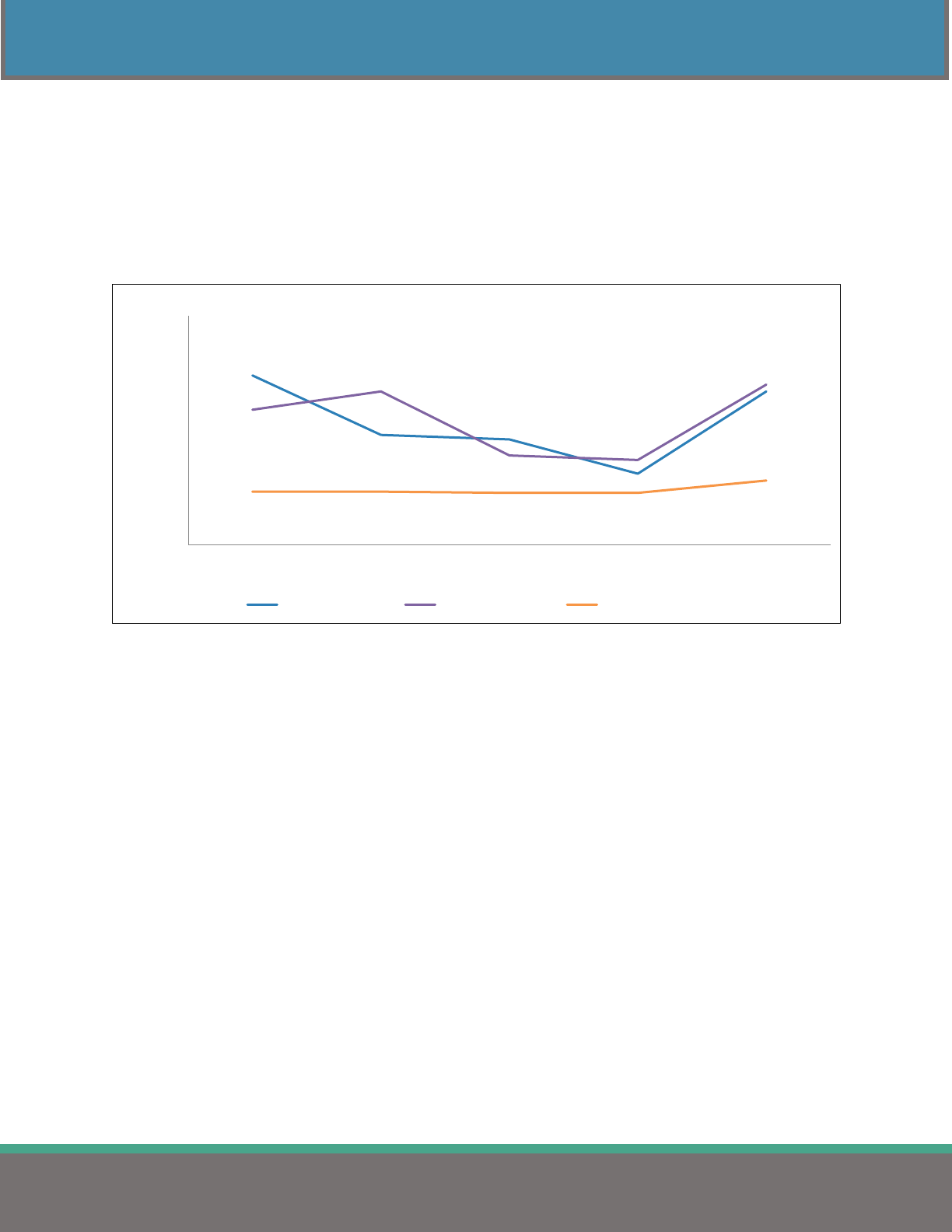

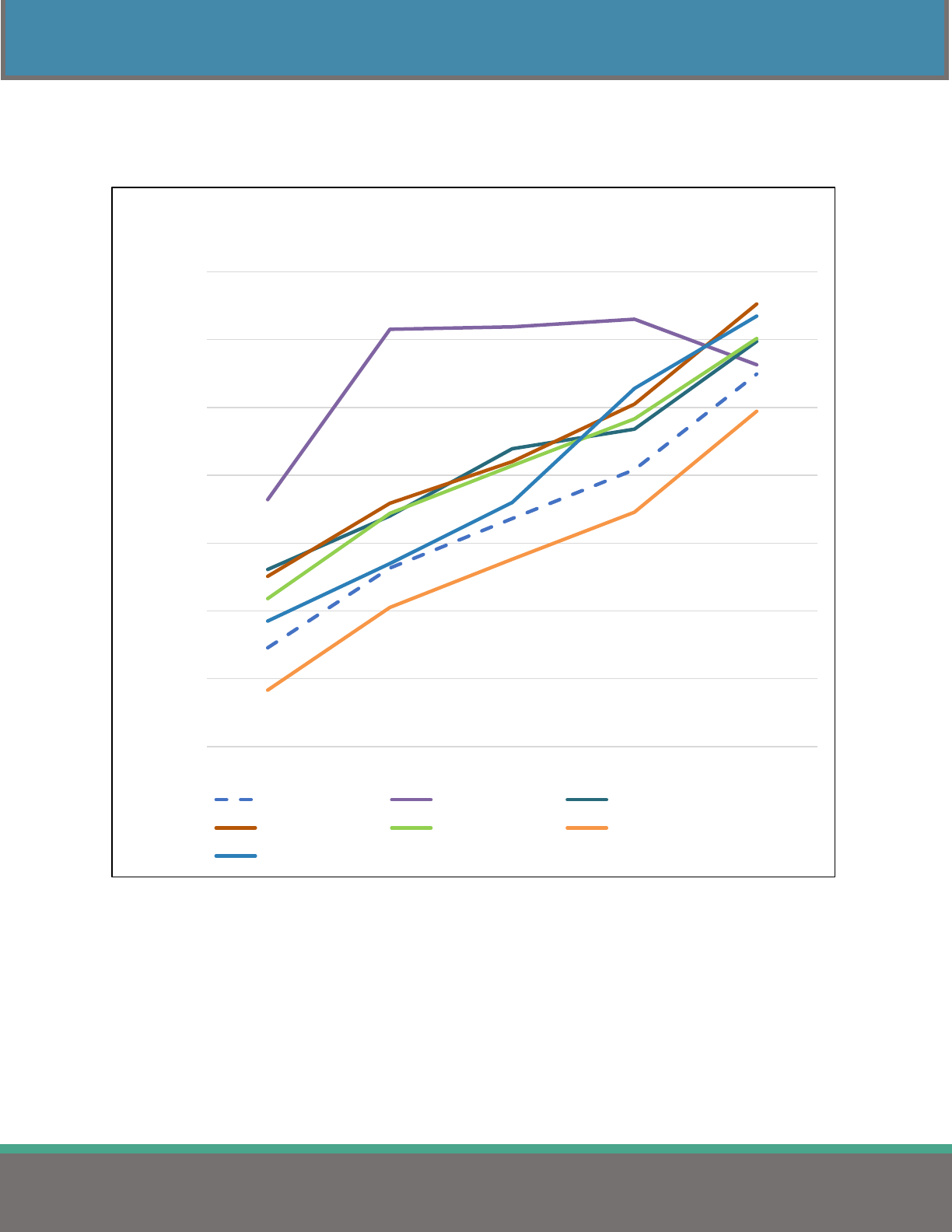

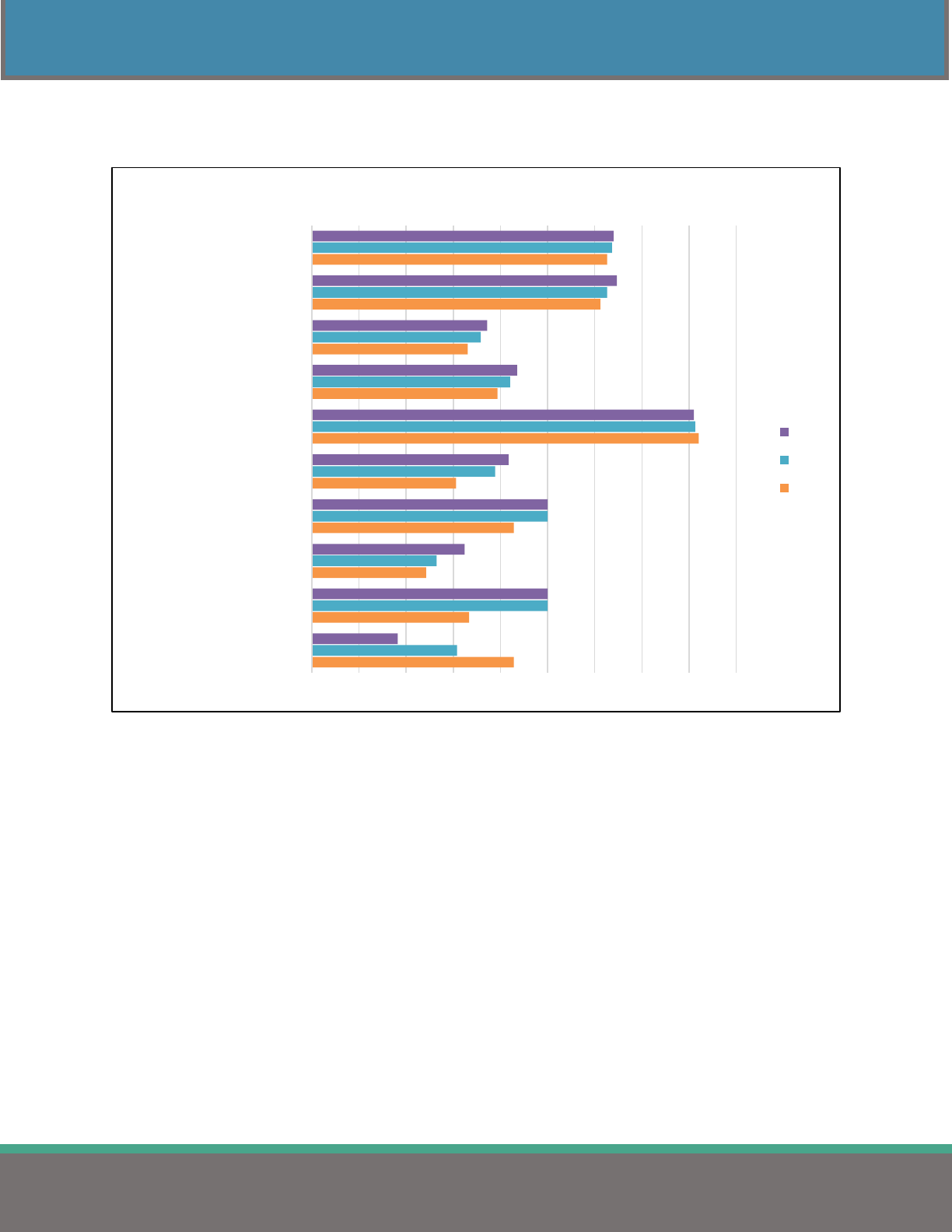

Figure 1 graphs the percent change in single and family medical premiums compared to the average

negotiated wage increase for public employees from SERB’s Annual Wage Settlement report. The

relatively flat line represents the average wage increases for public sector employees over the past five

years, ranging between 2.3% and 2.8%. Comparatively, medical insurance premiums have risen at a

higher rate.

Figure 1

7.4%

4.8%

4.6%

3.1%

6.7%

5.9%

6.7%

3.9%

3.7%

7.0%

2.3%

2.3%

2.3% 2.3%

2.8%

0%

2%

4%

6%

8%

10%

2019 2020 2021 2022 2023

Percent Increase

Statewide Annual Percent Increases in Medical Premiums

vs. Average Wage Increases

Single Premium Family Premium Average Wage Increase

6

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – OVERVIEW

MEDICAL PREMIUM INCREASES COMPARED TO INFLATION RATES

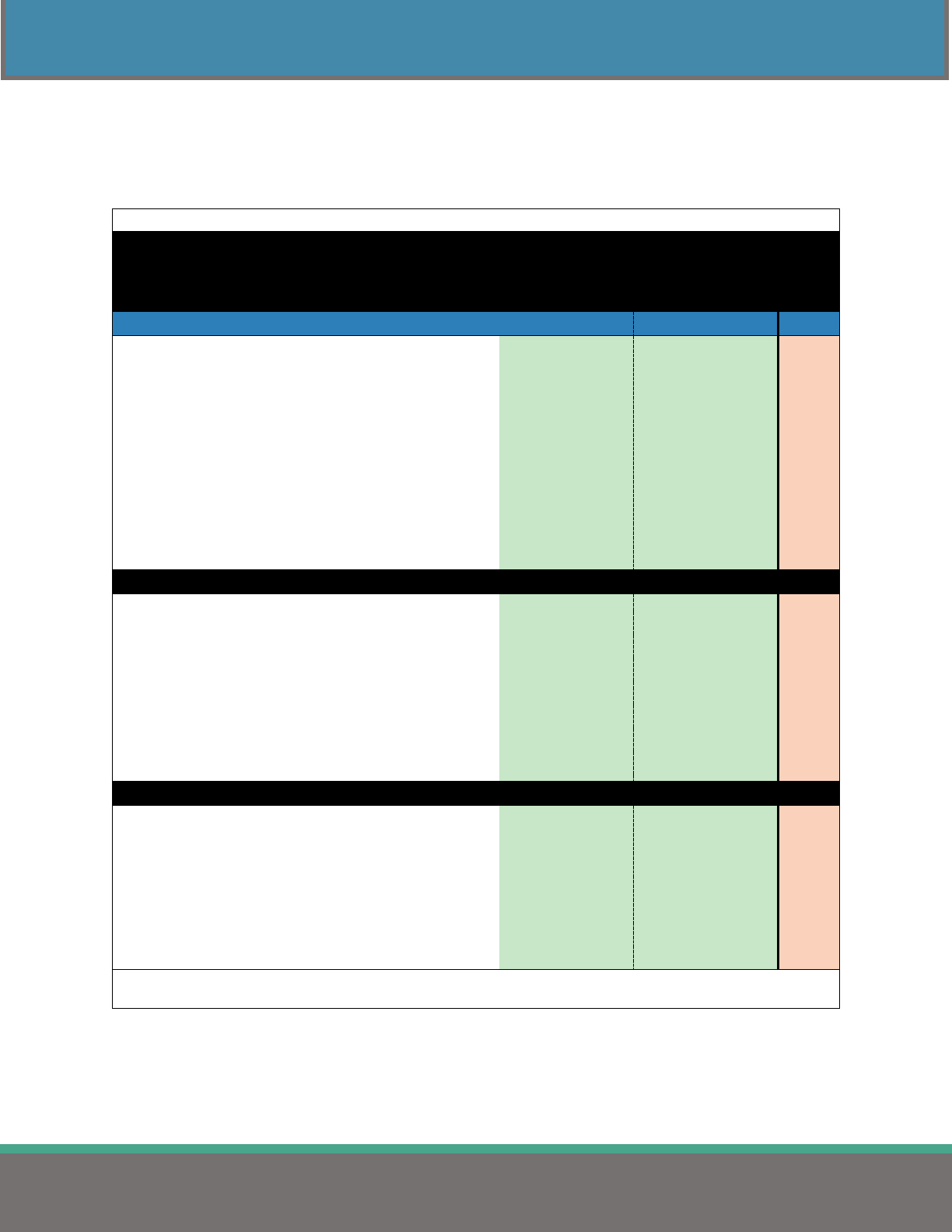

Table 4 compares the annual percent change in public sector medical premiums over the past ten years to

the overall national inflation and medical care inflation rates provided by the United States Bureau of

Labor Statistics. Premium rates for medical insurance in the State of Ohio increased at a higher

percentage rate than the overall national inflation and medical care inflation rates this past year.

Table 4

Annual Percent Change in Medical Care Costs,

Inflation, and Medical Care Inflation Rates

Statewide Public Sector

National

Year

Single Premium

Family Premium

n

Inflation Rate

Medical Care

2013

2.8%

2.3%

1,552

1.7%

3.2%

2014

5.0%

4.5%

1,598

1.5%

2.0%

2015

4.4%

4.3%

1,694

0.8%

3.0%

2016

1.6%

2.3%

1,753

0.7%

2.6%

2017

4.7%

4.6%

1,809

2.1%

4.1%

2018

4.6%

4.2%

1,863

2.1%

1.8%

2019

7.4%

5.9%

2,009

1.9%

2.0%

2020

4.8%

6.7%

1,952

2.3%

4.6%

2021

4.6%

3.9%

2,067

1.4%

1.8%

2022

3.1%

3.7%

2,046

7.0%

2.2%

2023

6.7%

7.0%

1,993

6.5%

4.0%

Note: National; includes both public and private sector employers nationwide.

Note: United States Bureau of Labor Statistics, Consumer Price Index, December 2022

https://www.bls.gov/news.release/archives/cpi_01122023.pdf

Note: n: number of plans.

7

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

MEDICAL INSURANCE – ALL PLAN TYPES

MEDICAL PREMIUMS

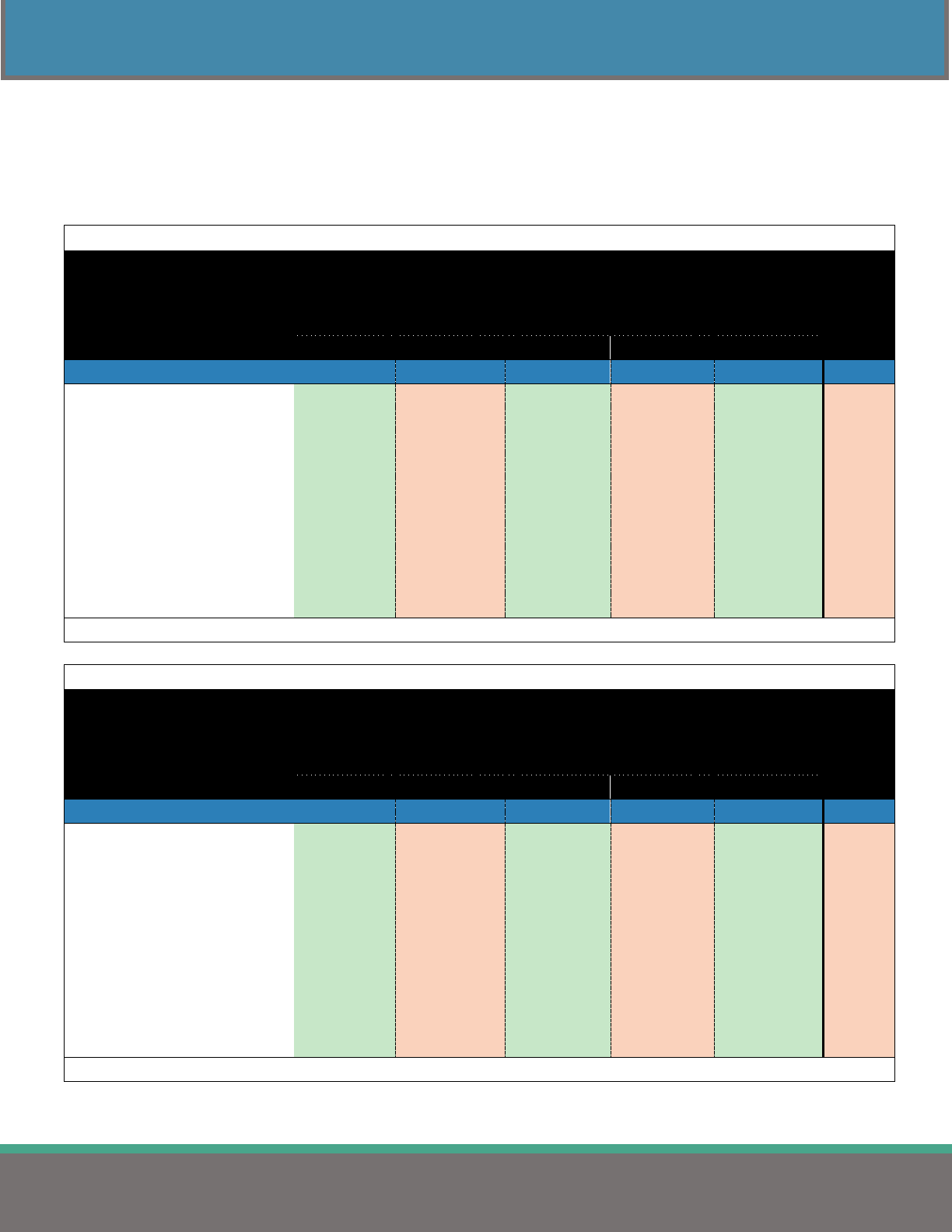

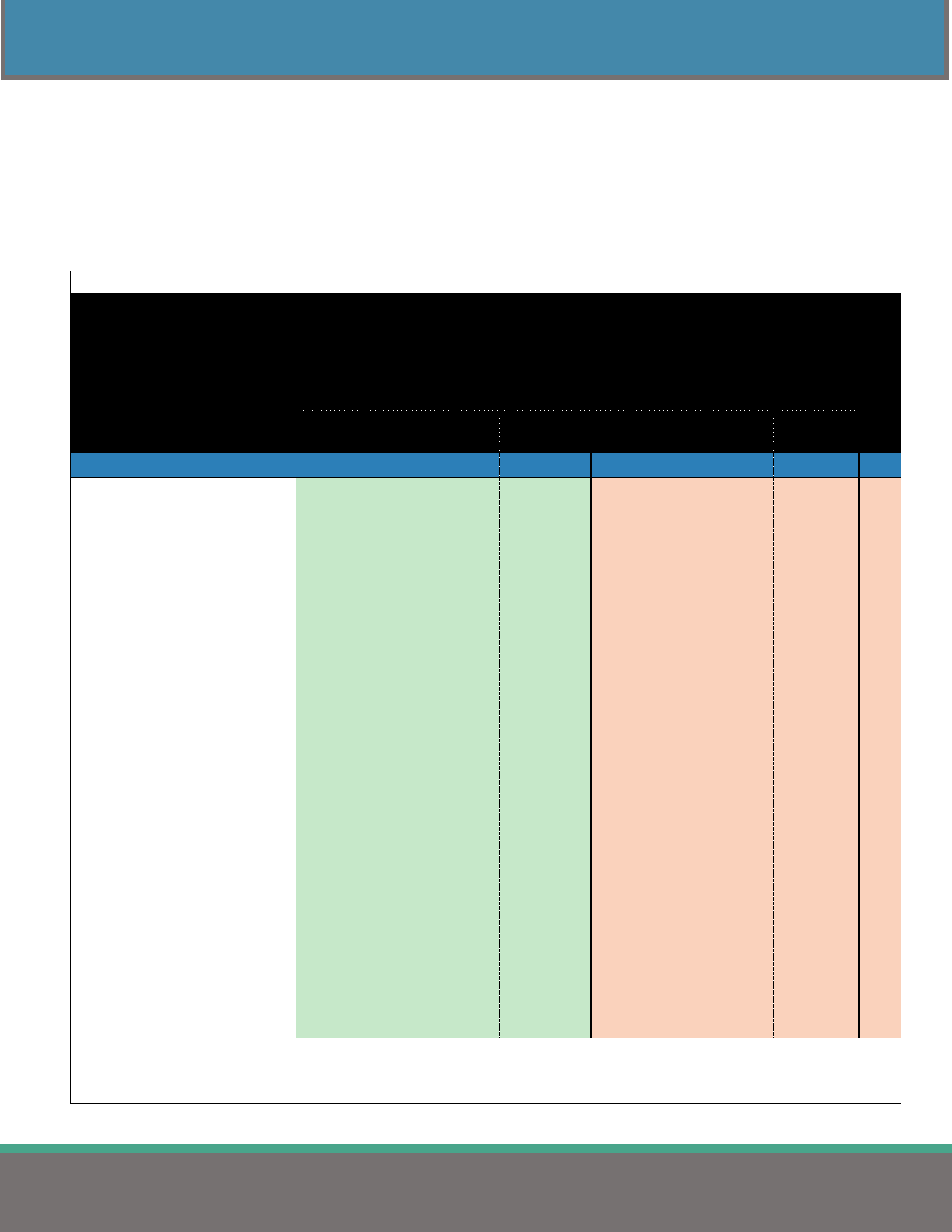

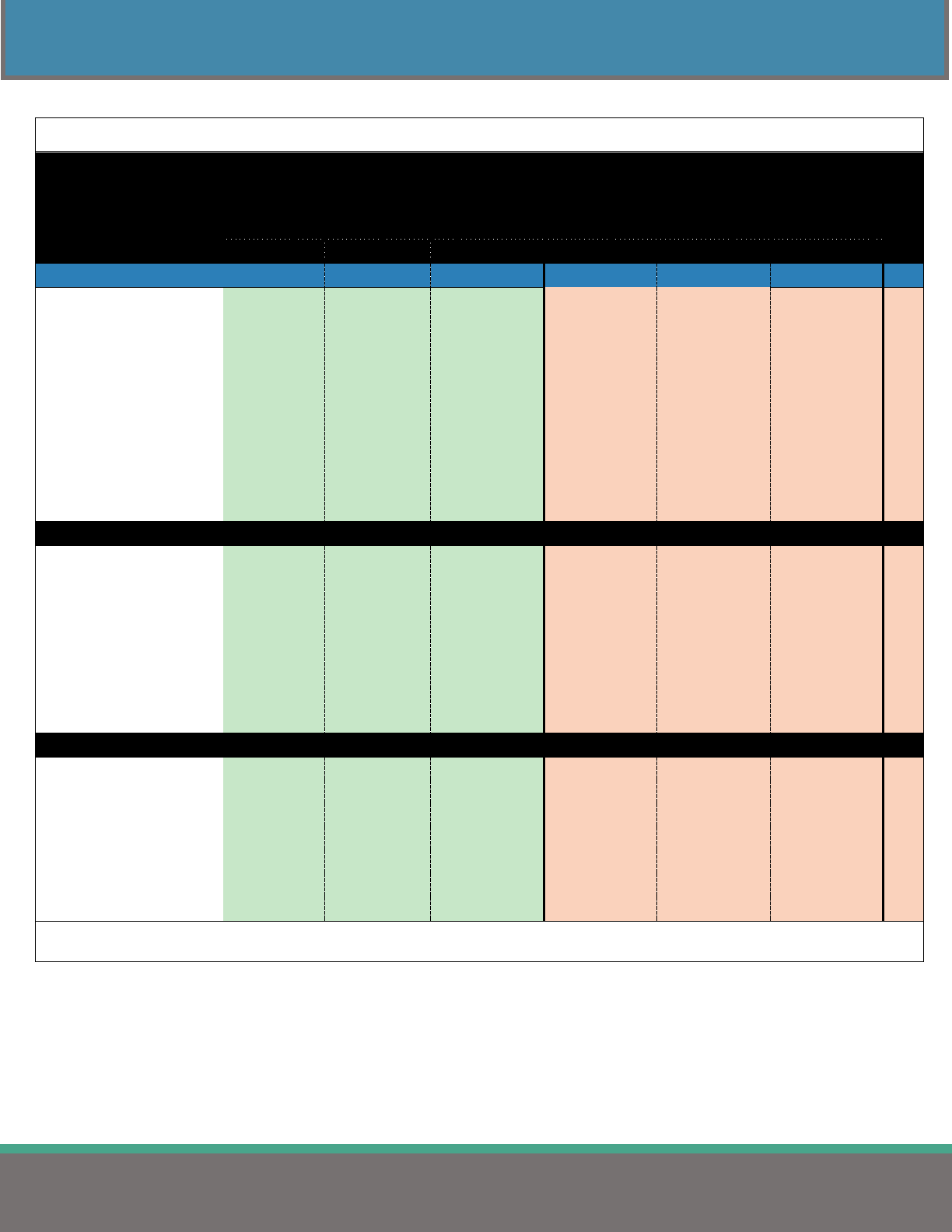

Table 5 breaks down the average medical premiums and the contribution amounts shared by the employer

and the employee. These averages include the costs of prescription, dental, and vision coverages when

included with the medical premiums. Averages presented in all tables in this report are not weighted,

meaning each reporting jurisdiction counts as one, regardless of size.

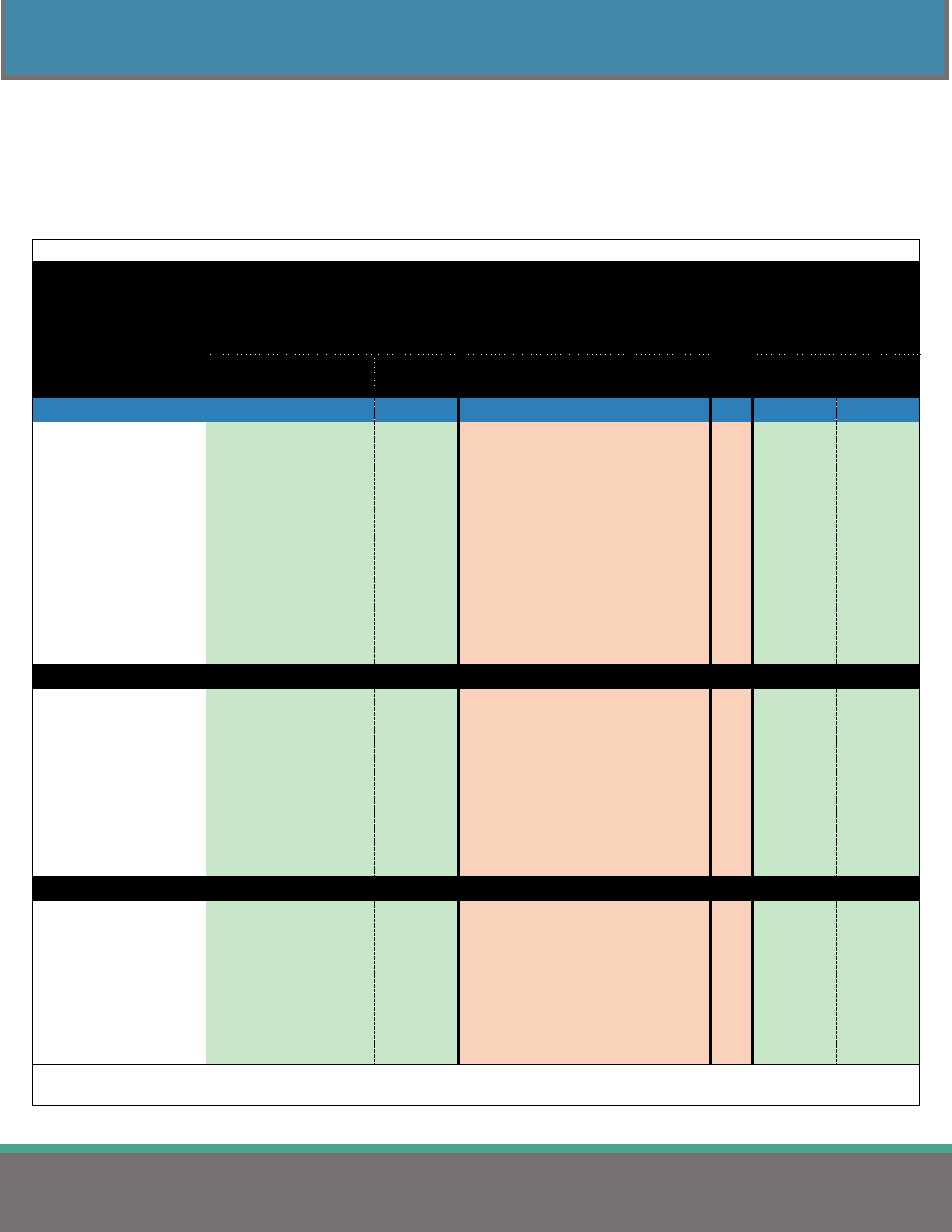

Table 5

Average Monthly Employer & Employee Contributions

Towards Medical Premium

(All Medical Plan Types)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Total

Employer

Share

Employee

Share

Total

n

STATEWIDE $ 710.80 $ 103.13 $ 813.93 $ 1,854.48 $ 294.68 $ 2,149.16 1,993

State of Ohio $ 669.67 $ 90.33 $ 760.00 $ 1,896.33 $ 266.67 $ 2,163.00 3

Counties $ 702.38 $ 103.29 $ 805.67 $ 1,892.24 $ 305.03 $ 2,197.27 151

Less than 50,000 $ 725.79 $ 107.78 $ 833.57 $ 1,946.44 $ 327.51 $ 2,273.95 57

50,000 - 149,999 $ 686.38 $ 106.98 $ 793.36 $ 1,908.55 $ 315.40 $ 2,223.95 54

150,000 or more $ 691.22 $ 92.04 $ 783.26 $ 1,794.33 $ 259.57 $ 2,053.90 40

Cities $ 726.00 $ 92.23 $ 818.23 $ 1,993.65 $ 258.74 $ 2,252.39 372

Less than 25,000 $ 719.60 $ 89.45 $ 809.05 $ 1,997.25 $ 256.98 $ 2,254.23 267

25,000 - 99,999 $ 744.04 $ 100.16 $ 844.20 $ 2,025.63 $ 266.95 $ 2,292.58 96

100,000 or more $ 726.74 $ 91.37 $ 818.11 $ 1,563.50 $ 225.07 $ 1,788.57 9

Townships $ 752.88 $ 67.14 $ 820.02 $ 2,005.46 $ 196.09 $ 2,201.55 151

Less than 10,000 $ 777.57 $ 55.96 $ 833.53 $ 2,064.90 $ 162.94 $ 2,227.84 75

10,000 - 29,999 $ 787.73 $ 75.07 $ 862.80 $ 2,040.59 $ 206.92 $ 2,247.51 54

30,000 or more $ 600.07 $ 83.52 $ 683.59 $ 1,742.98 $ 271.94 $ 2,014.92 22

School Districts & ESCs $ 706.30 $ 110.80 $ 817.10 $ 1,780.25 $ 314.08 $ 2,094.33 1,146

Less than 1,000 $ 711.78 $ 104.56 $ 816.34 $ 1,819.91 $ 287.09 $ 2,107.00 301

1,000 - 2,499 $ 713.75 $ 114.29 $ 828.04 $ 1,798.56 $ 313.67 $ 2,112.23 461

2,500 - 9,999 $ 679.23 $ 107.52 $ 786.75 $ 1,709.34 $ 306.48 $ 2,015.82 266

10,000 or more $ 722.12 $ 116.43 $ 838.55 $ 1,758.29 $ 453.07 $ 2,211.36 32

Educational Svc Centers $ 724.75 $ 122.46 $ 847.21 $ 1,770.73 $ 382.49 $ 2,153.22 86

Colleges & Universities $ 668.89 $ 118.44 $ 787.33 $ 1,877.56 $ 357.03 $ 2,234.59 74

Fire Districts $ 519.98 $ 61.43 $ 581.41 $ 1,574.77 $ 199.32 $ 1,774.09 19

Metro Housing Authorities $ 761.29 $ 103.02 $ 864.31 $ 2,137.87 $ 318.01 $ 2,455.88 50

Port Authorities $ 572.10 $ 78.93 $ 651.03 $ 1,689.55 $ 233.75 $ 1,923.30 5

Regional Transit Authorities $ 719.64 $ 102.34 $ 821.98 $ 1,798.40 $ 278.72 $ 2,077.12 22

Note: Rows formatted with bold font include all medical plans reported for the comparison group.

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans

8

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

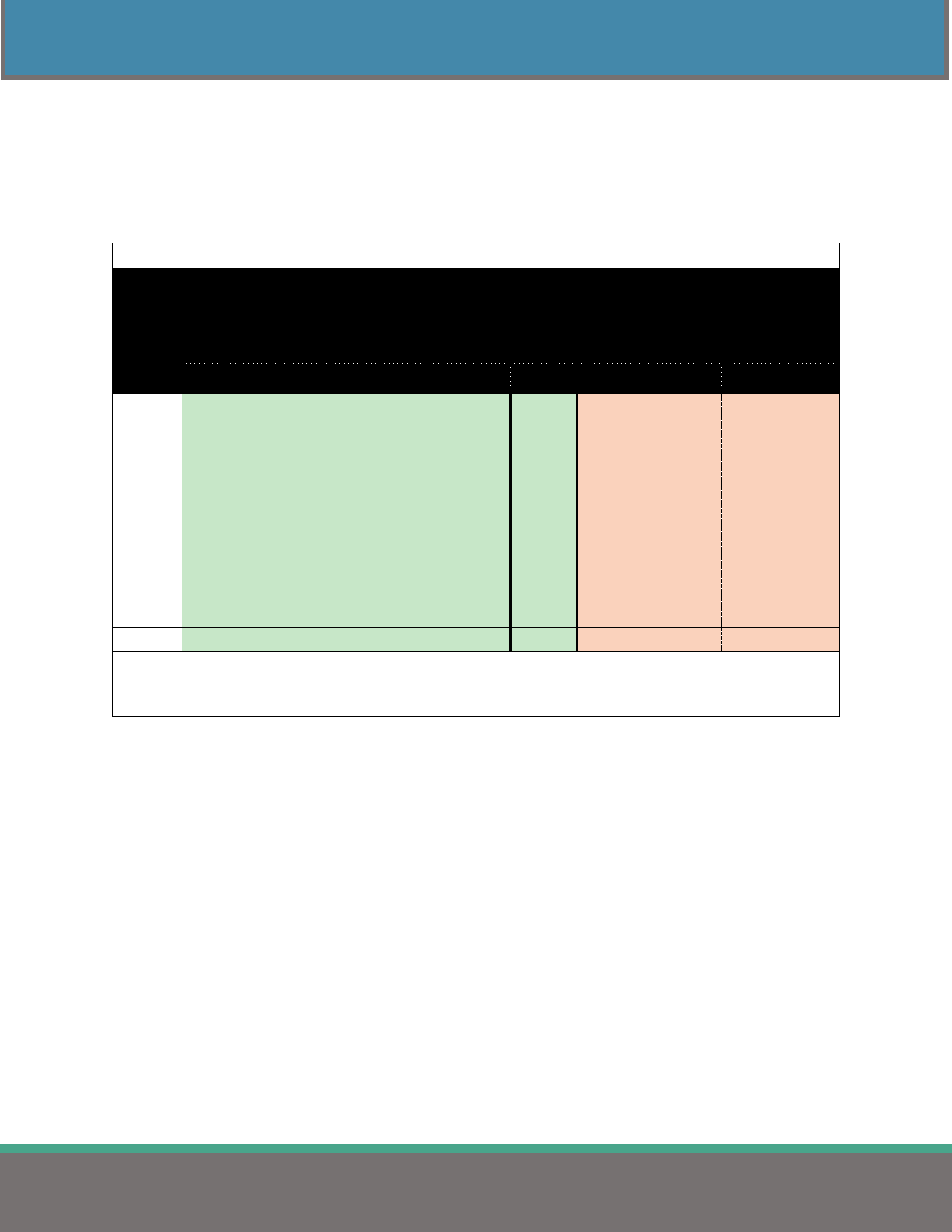

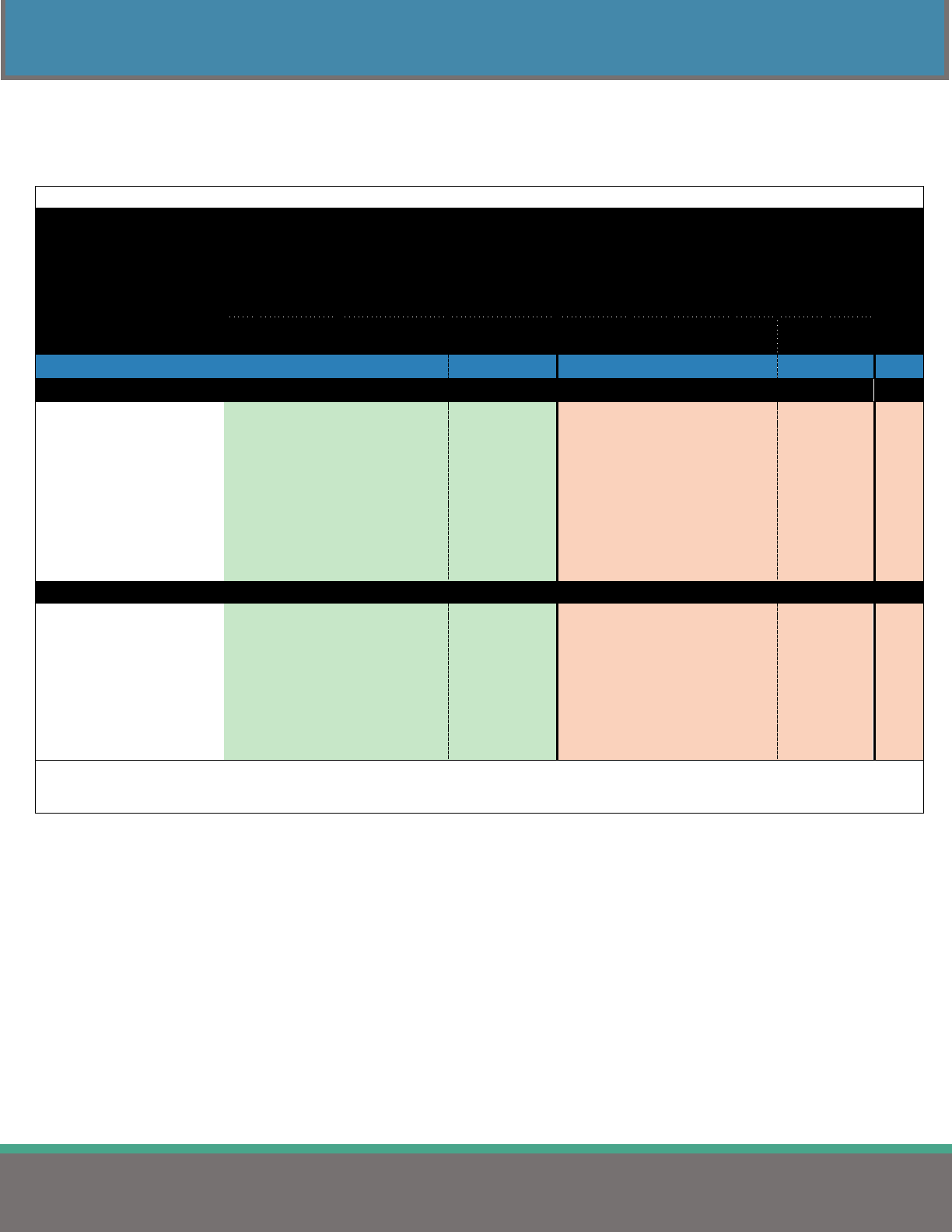

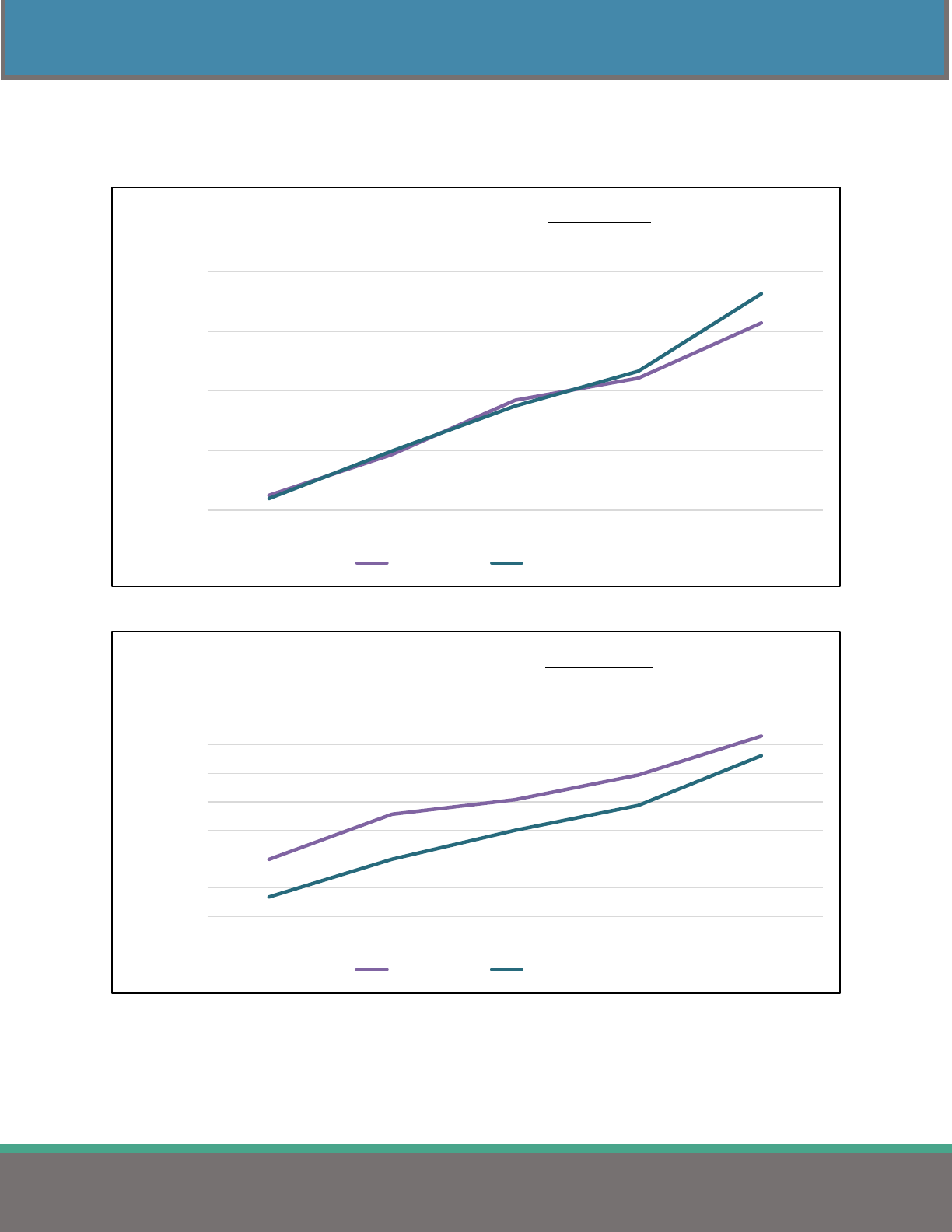

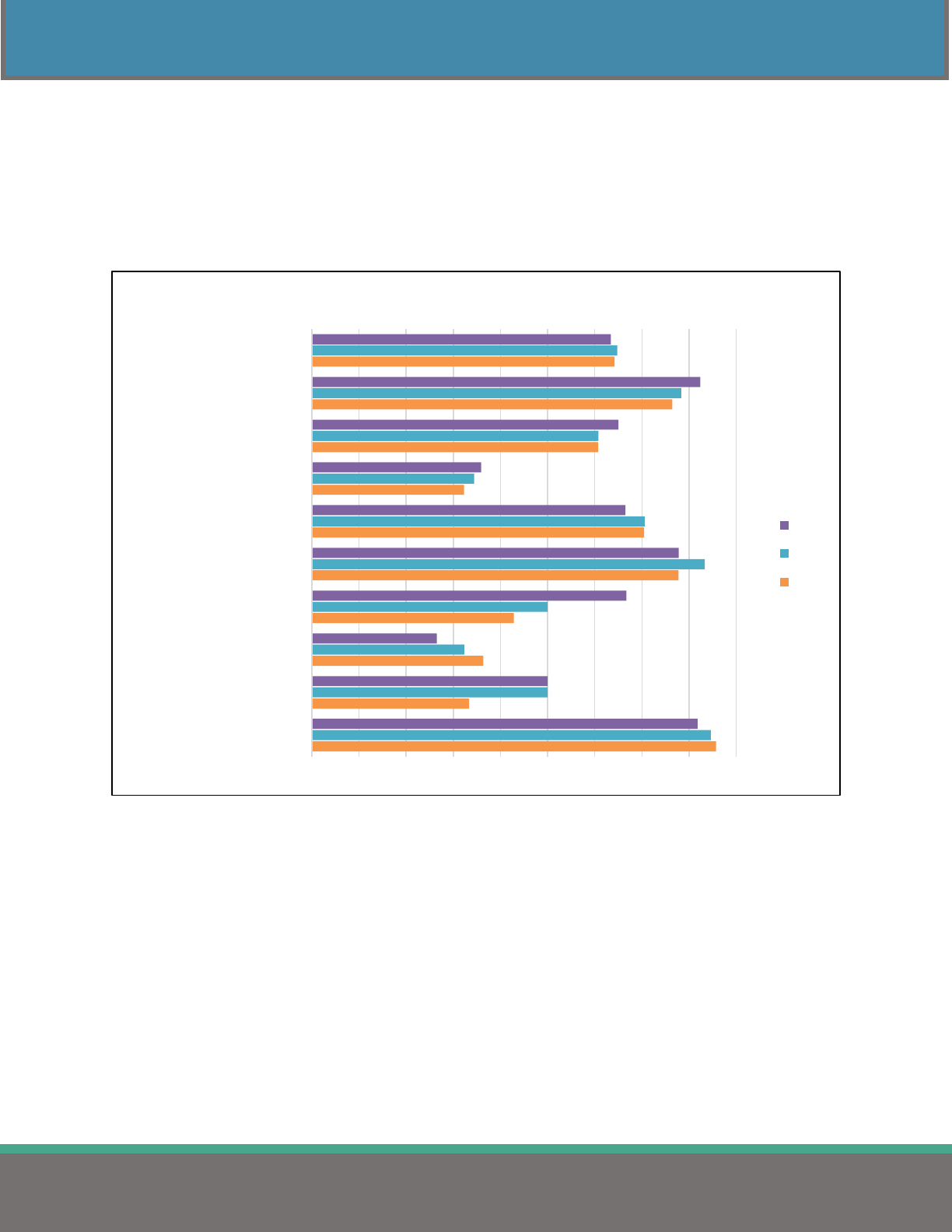

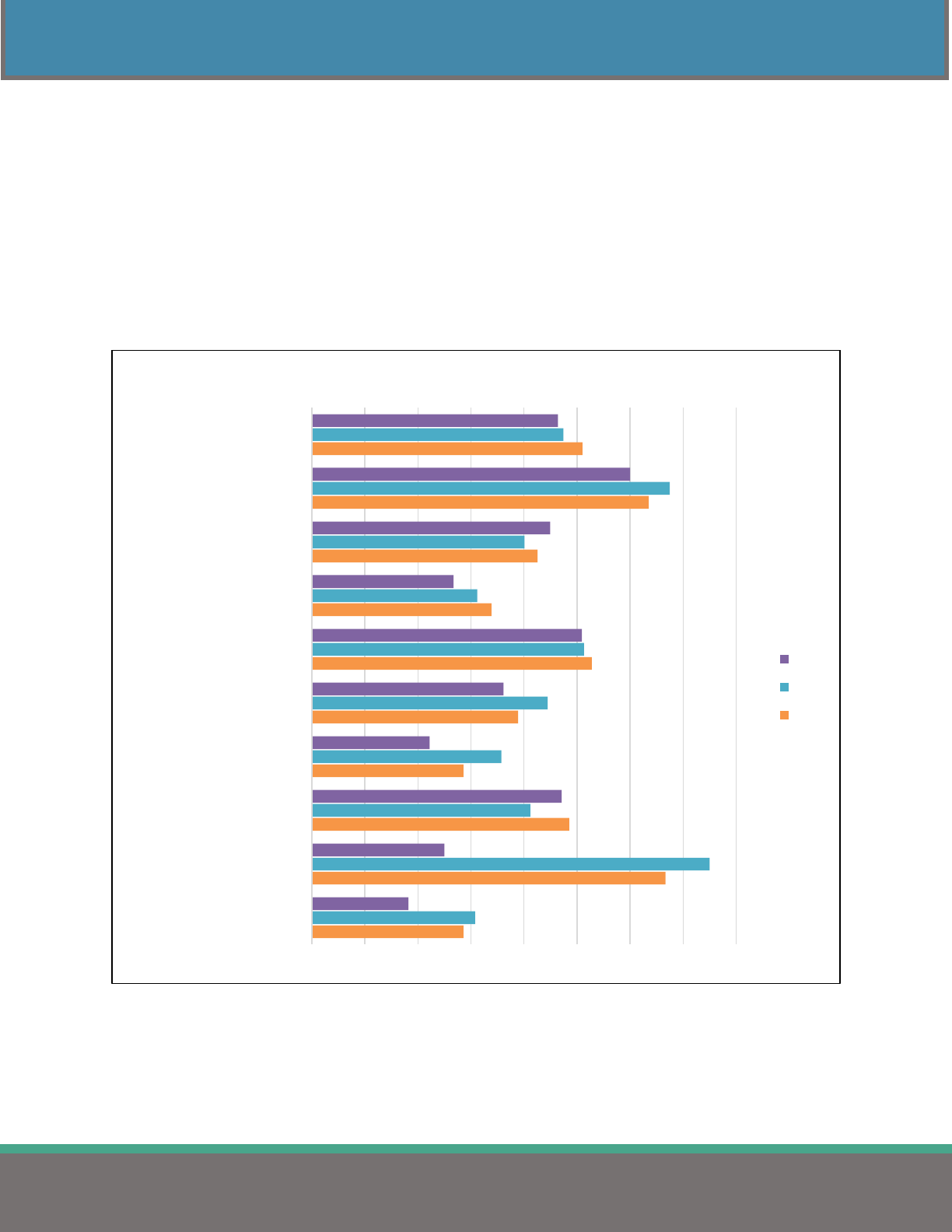

Figure 2 displays the average monthly employee contribution to family premiums in Table 5 over the past

five years. The chart illustrates that monthly family contributions have continued to increase over the last

few years while the employee percent contribution towards the premium remains almost unchanged, as

described in Figure 4 on page 12.

Figure 2

The statewide average, represented by the dotted line, shows that the employee contribution

towards the family premium increased by $62.00 or 26.4% over the last five years (2019-2023).

$150

$200

$250

$300

$350

$400

2019 2020 2021 2022 2023

Average Monthly Employee Contribution

Towards Family Medical Premium

(All Medical Plan Types)

Statewide Average State of Ohio Counties

Cities Townships School Districts & ESC

Colleges & Universities

9

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

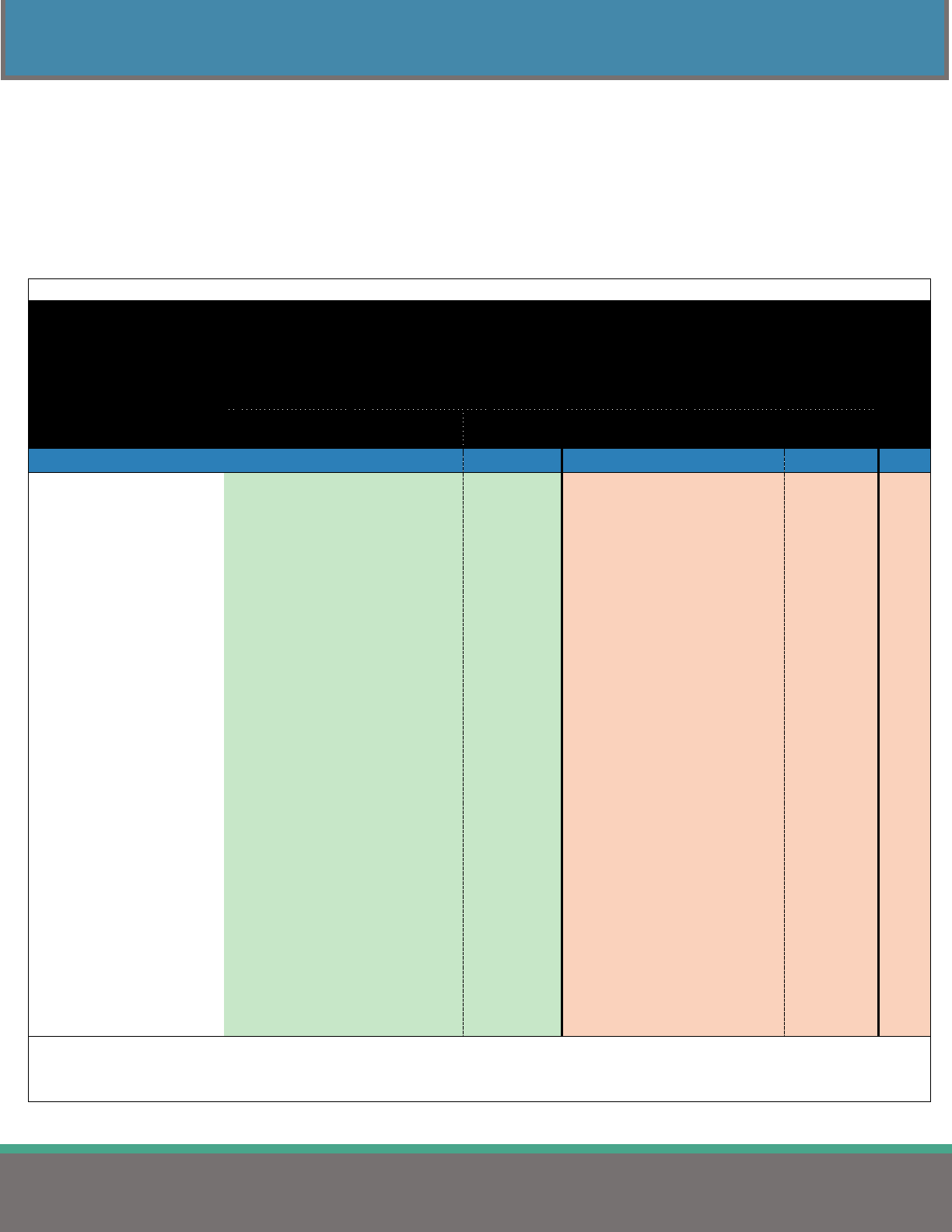

Figure 3 displays the statewide total monthly family premium in Table 5 over the past five years by

jurisdiction.

Figure 3

The statewide average, represented by the dotted line, shows that the family premium increased by

$403.44 or 23.1% over the last five years (2019-2023).

$1,600.00

$1,700.00

$1,800.00

$1,900.00

$2,000.00

$2,100.00

$2,200.00

$2,300.00

2019 2020 2021 2022 2023

Average Total Monthly Family Premium by Jurisdiction

(All Medical Plan Types)

Statewide State of Ohio County

City Township School Districts

College/Universities

10

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

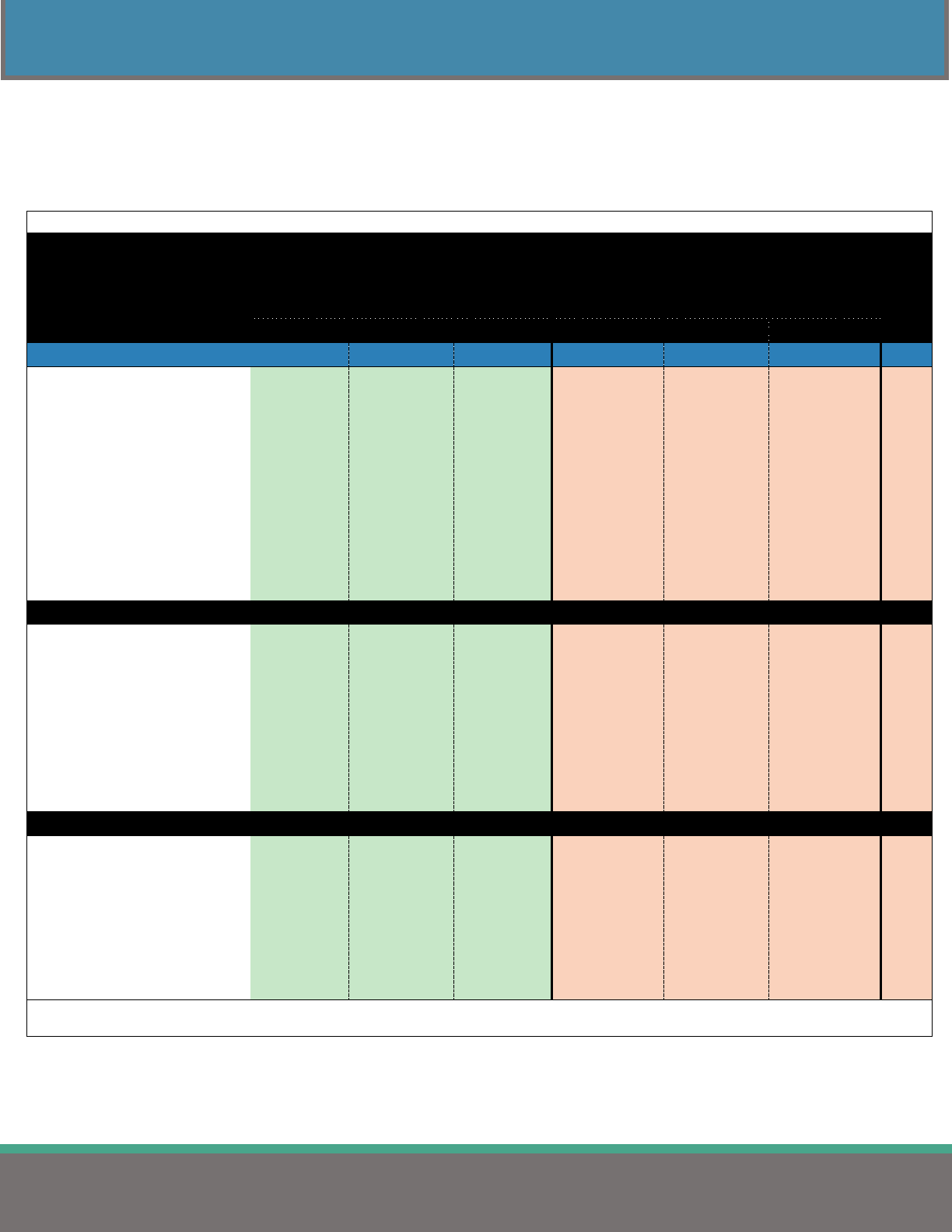

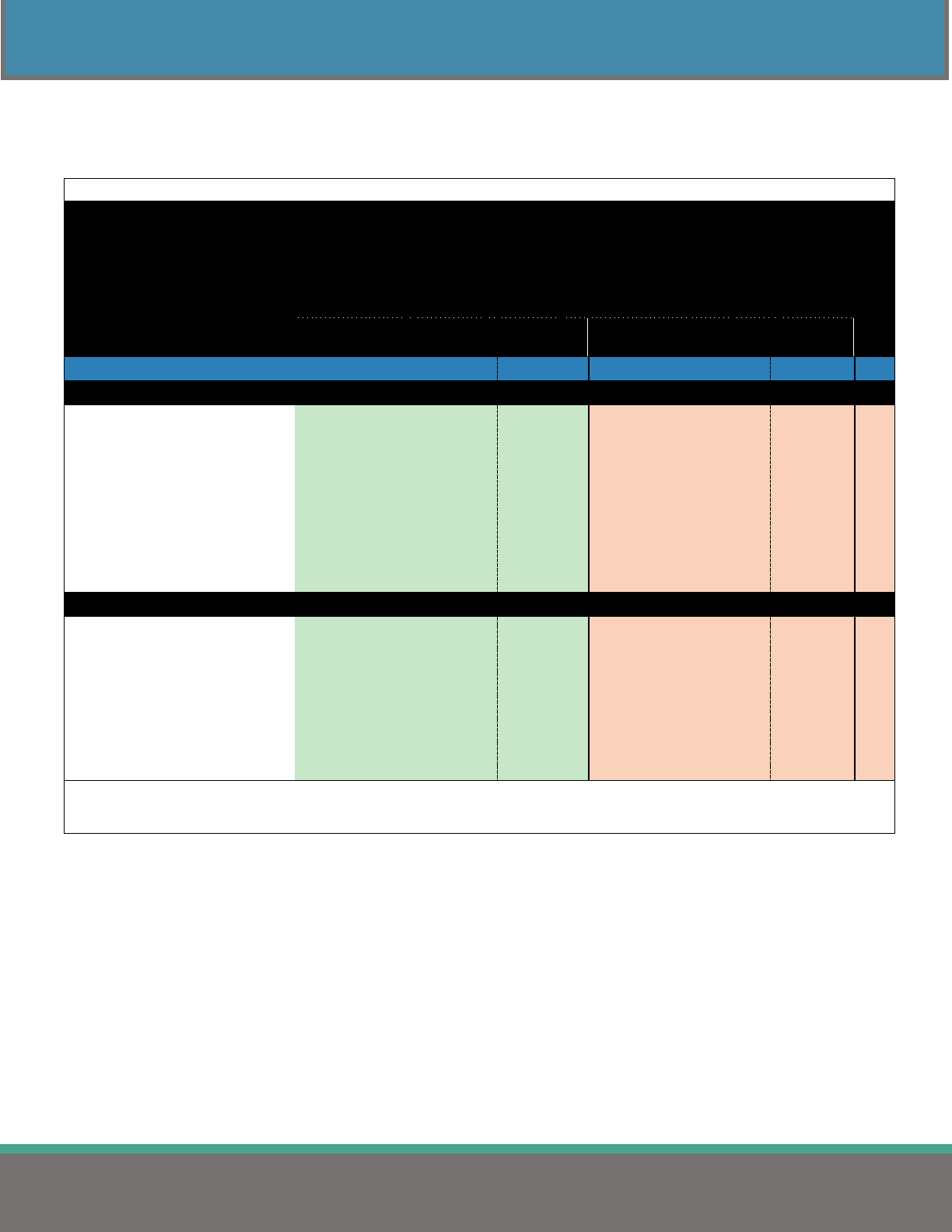

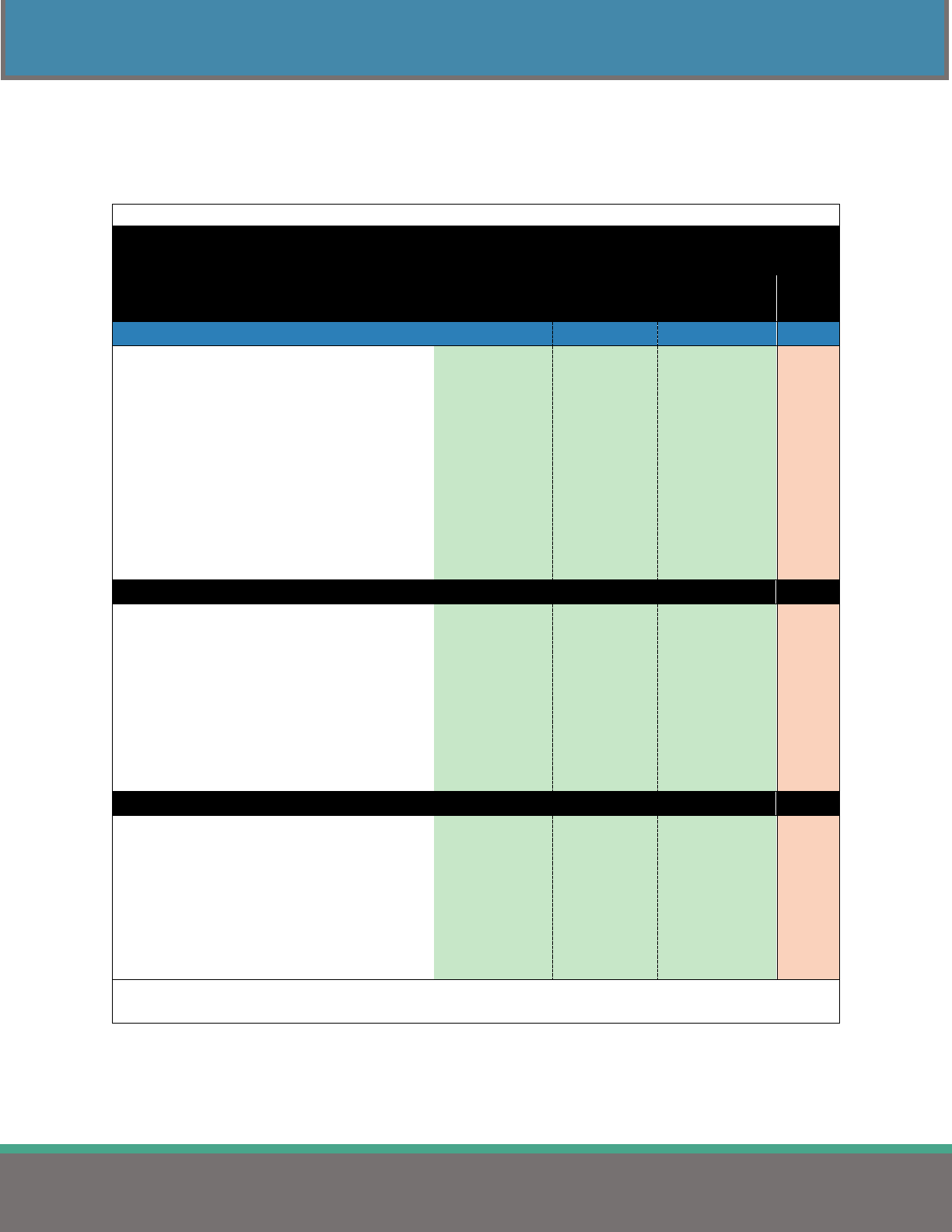

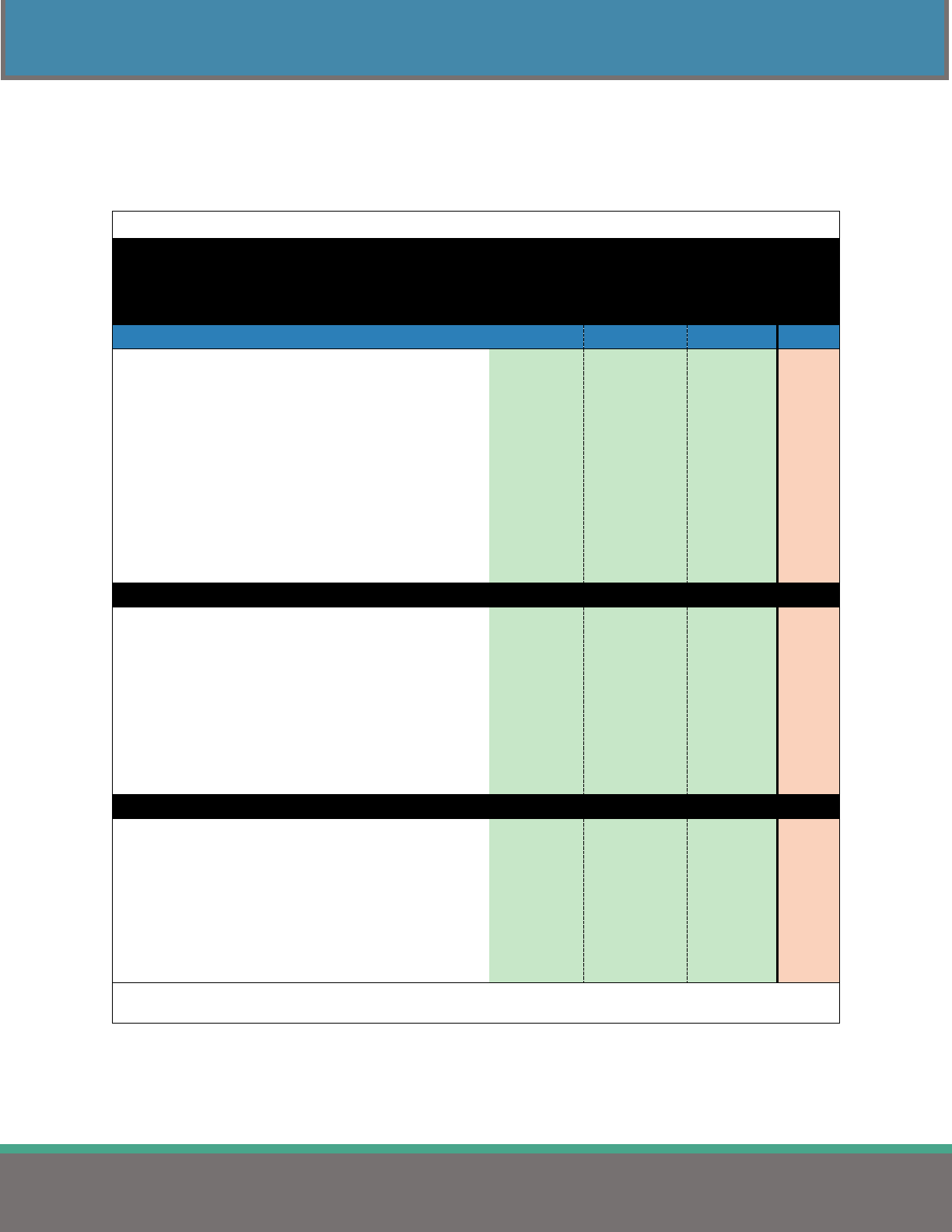

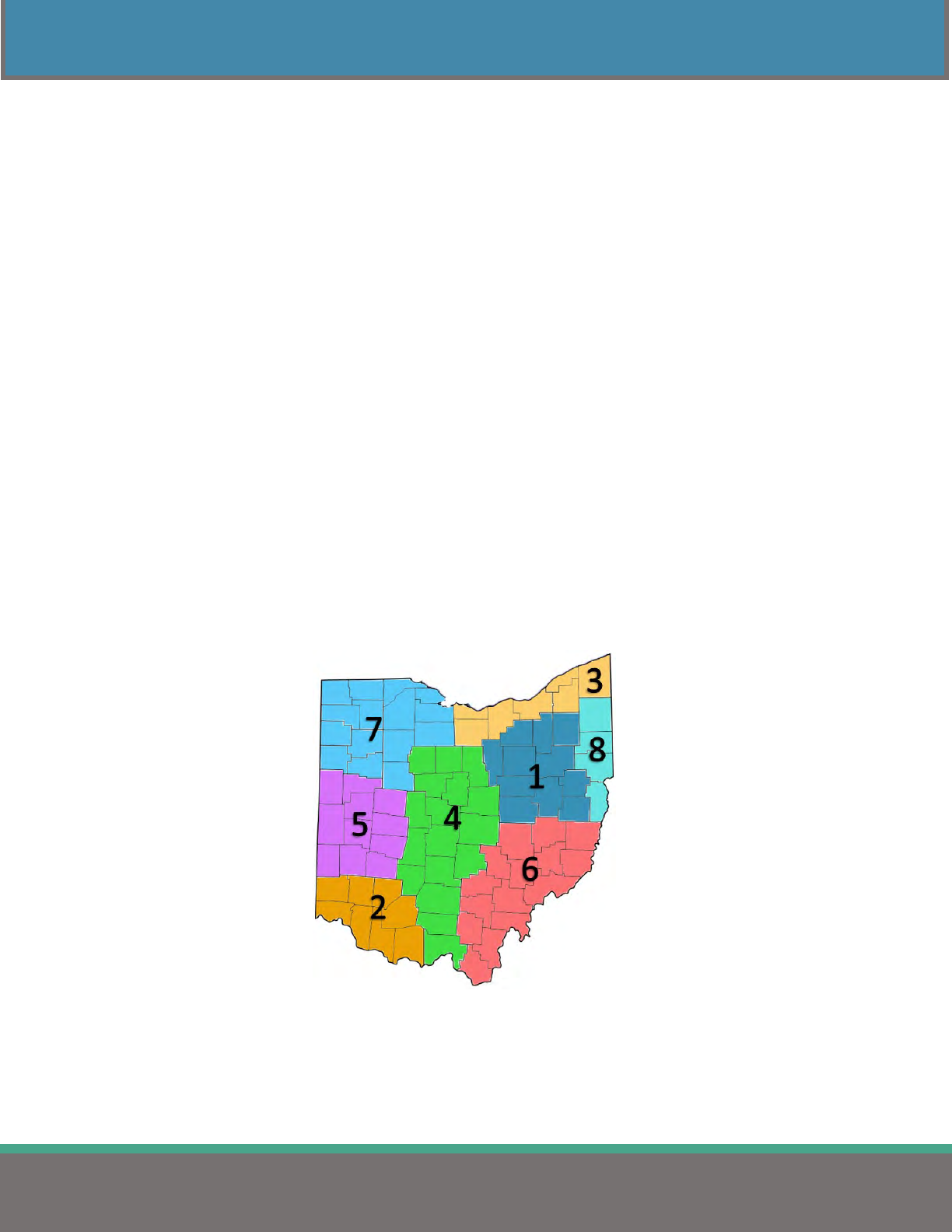

Table 6 organizes the same data in Table 5 by region and by the number of employees covered. These

averages include the costs of prescription, dental, and vision coverages when included with the medical

premiums. A breakdown of the regions is on page 61.

Table 6

Average Monthly Employer & Employee Contributions

Towards Medical Premium by Region

(All Medical Plan Types)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Total

Employer

Share

Employee

Share

Total

n

STATEWIDE $ 710.80

$ 103.13

$ 813.93 $ 1,854.48 $ 294.68 $ 2,149.16 1,993

REGION

1 - Akron/Canton $ 699.61

$ 96.55

$ 796.16 $ 1,846.37 $ 250.97 $ 2,097.34 230

2 - Cincinnati $ 650.16

$ 101.14

$ 751.30 $ 1,731.11 $ 298.61 $ 2,029.72 222

3 - Cleveland $ 683.15

$ 88.70

$ 771.85 $ 1,787.72 $ 228.55 $ 2,016.27 344

4 - Columbus $ 768.12

$ 117.39

$ 885.51 $ 1,949.34 $ 356.27 $ 2,305.61 354

5 - Dayton $ 691.61

$ 125.04

$ 816.65 $ 1,865.64 $ 361.70 $ 2,227.34 263

6 - Southeast Ohio $ 819.99

$ 110.52

$ 930.51 $ 2,017.59 $ 337.60 $ 2,355.19 167

7 - Toledo $ 675.85

$ 99.52

$ 775.37 $ 1,785.33 $ 291.58 $ 2,076.91 278

8 - Warren/Youngstown $ 724.05

$ 73.43

$ 797.48 $ 1,906.88 $ 191.46 $ 2,098.34 135

EMPLOYEES COVERED

1 - 49 $ 739.39

$ 86.54

$ 825.93

$ 1,981.95 $ 260.35 $ 2,242.30

333

50 - 99 $ 710.24

$ 95.19

$ 805.43

$ 1,896.47 $ 264.04 $ 2,160.51

334

100 - 149 $ 709.06

$ 104.51

$ 813.57

$ 1,837.11 $ 287.25 $ 2,124.36

388

150 - 249 $ 719.35

$ 115.18

$ 834.53

$ 1,847.94 $ 321.64 $ 2,169.58

415

250 - 499 $ 704.79

$ 103.81

$ 808.60

$ 1,813.05 $ 296.86 $ 2,109.91

298

500 - 999 $ 669.09

$ 117.11

$ 786.20

$ 1,707.28 $ 343.74 $ 2,051.02

133

1,000 or more $ 662.08

$ 106.73

$ 768.81

$ 1,716.50 $ 353.40 $ 2,069.90

92

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans.

11

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

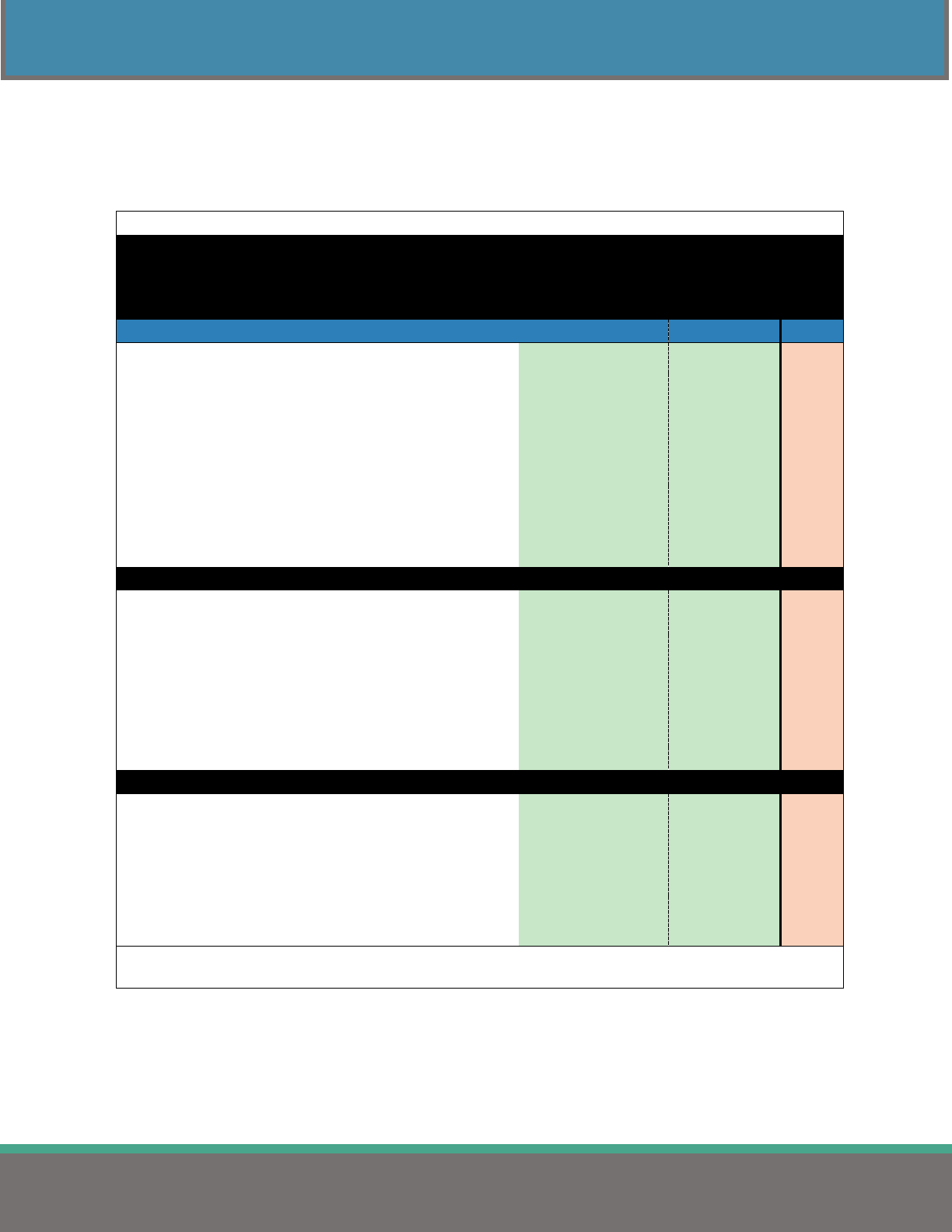

EMPLOYER & EMPLOYEE SHARE OF MEDICAL PREMIUM

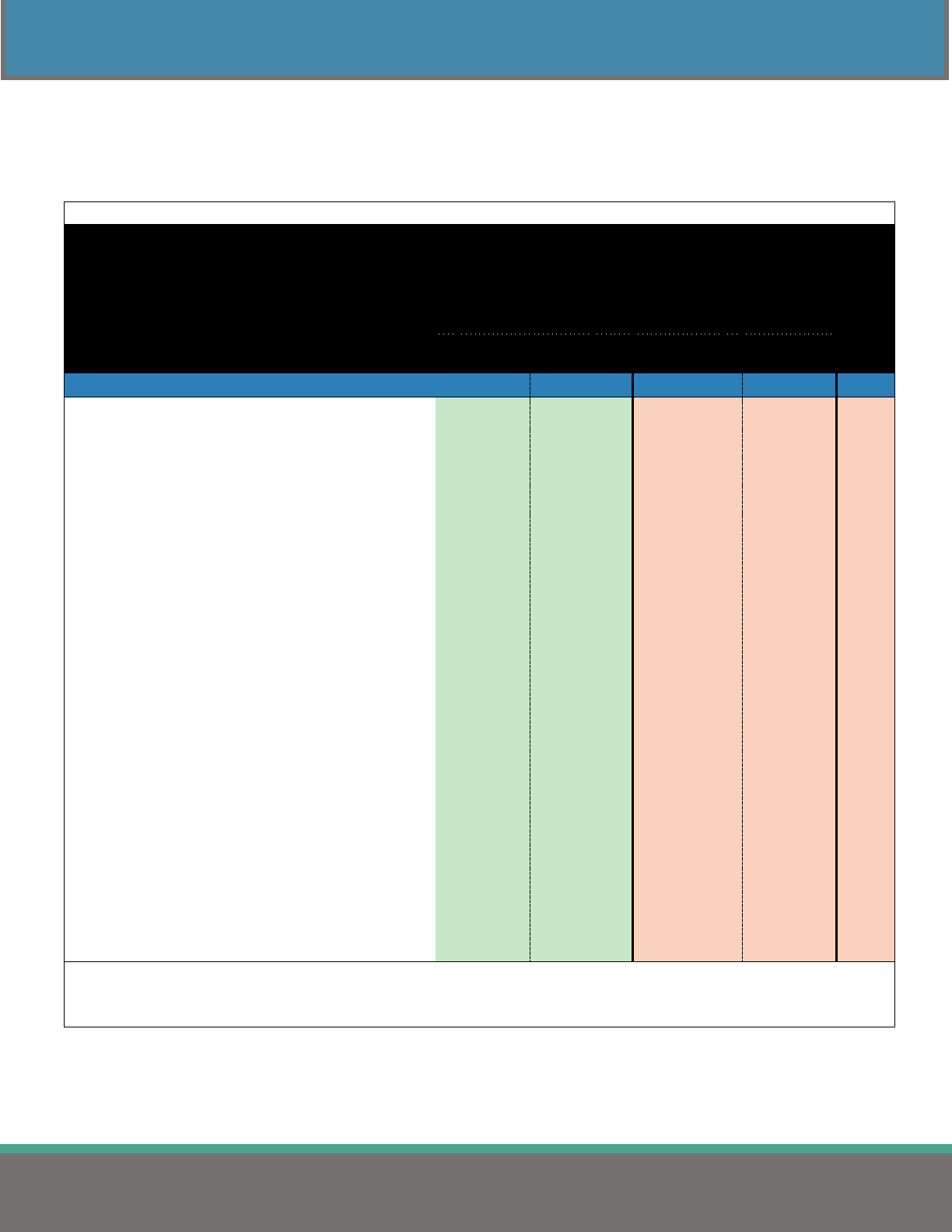

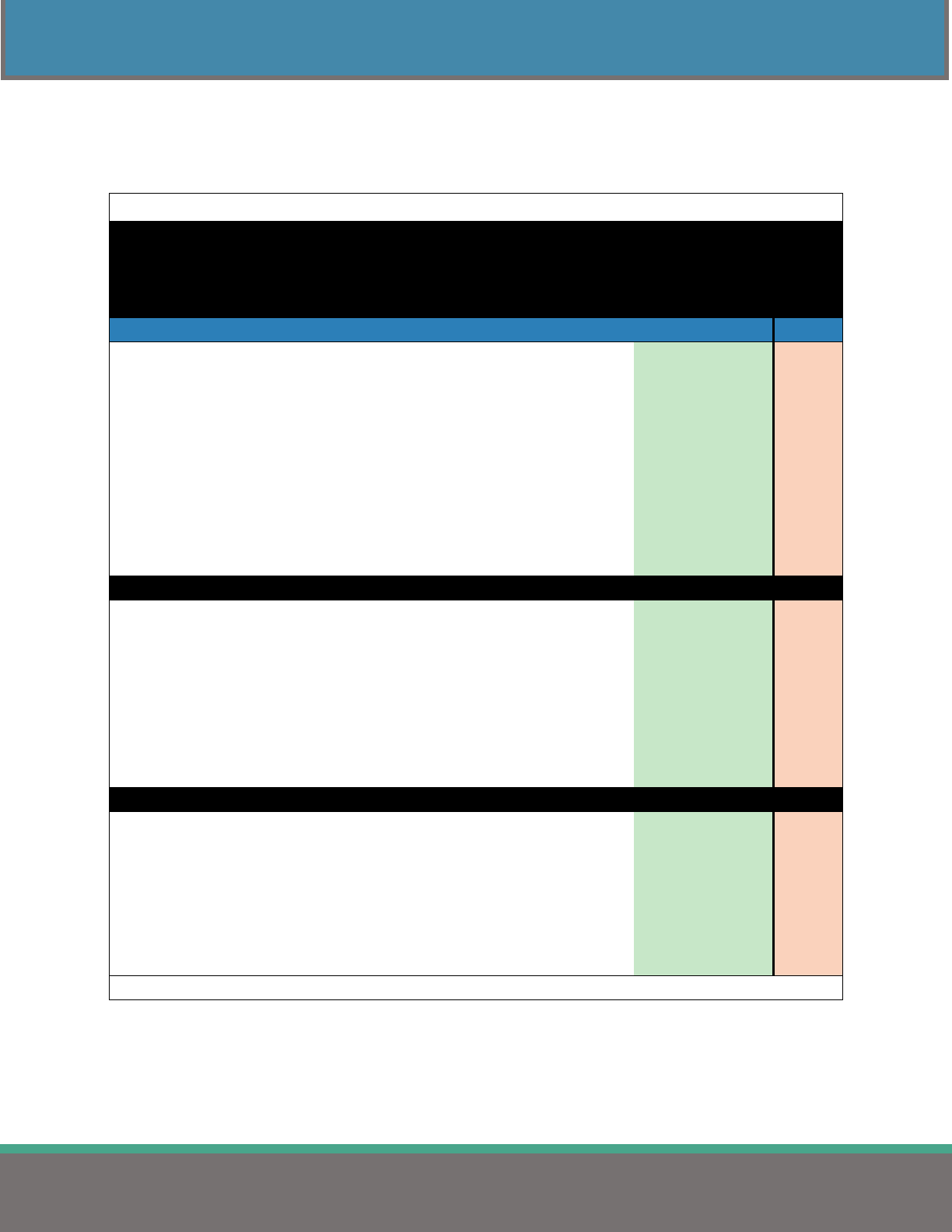

Table 7 displays the employer and employee share of the medical premium for single and family plans by

jurisdiction. This data corresponds with the data displayed in Table 5.

Table 7

Employer & Employee Cost Sharing Percentage

Towards Medical Premium

(All Medical Plan Types)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Employer

Share

Employee

Share

n

STATEWIDE

87.4%

12.6%

86.5%

13.5%

1,993

State of Ohio

88.1%

11.9%

87.6%

12.4%

3

Counties 87.2% 12.8% 86.4% 13.6% 151

Less than 50,000

86.9%

13.1%

85.8%

14.2%

57

50,000 - 149,999

86.7%

13.3%

86.1%

13.9%

54

150,000 or more 88.4% 11.6% 87.8% 12.2% 40

Cities

88.7%

11.3%

88.4%

11.6%

372

Less than 25,000 88.8% 11.2% 88.4% 11.6% 267

25,000 - 99,999

88.3%

11.7%

88.5%

11.5%

96

100,000 or more

88.5%

11.5%

86.4%

13.6%

9

Townships 91.5% 8.5% 91.5% 8.5% 151

Less than 10,000

92.5%

7.5%

93.3%

6.7%

75

10,000 - 29,999 91.4% 8.6% 91.0% 9.0% 54

30,000 or more

88.6%

11.4%

87.2%

12.8%

22

School Districts & ESCs

86.7%

13.3%

85.4%

14.6%

1,146

Less than 1,000 87.5% 12.5% 86.8% 13.2% 301

1,000 - 2,499

86.4%

13.6%

85.5%

14.5%

461

2,500 - 9,999 86.6% 13.4% 85.2% 14.8% 266

10,000 or more

86.1%

13.9%

80.4%

19.6%

32

Educational Svc Centers

85.7%

14.3%

82.7%

17.3%

86

Colleges & Universities 85.1% 14.9% 84.1% 15.9% 74

Fire Districts

89.6%

10.4%

88.9%

11.1%

19

Metro Housing Authorities 88.1% 11.9% 87.2% 12.8% 50

Port Authorities

87.9%

12.1%

87.9%

12.1%

5

Regional Transit Authorities

86.9%

13.1%

86.9%

13.1%

22

Note: Rows formatted with bold font include all medical plans reported for the comparison group.

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans

12

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

Figure 4 displays the statewide average percentages of the employee’s contribution toward the family

medical premium, found in Table 7, over the past five years. While medical premiums continue to rise, the

employee’s share of the premium cost has changed very little. The reported 2023 percent share is 13.5%,

which mirrors prior years.

Figure 4

13.2%

13.5%

13.4%

13.7%

13.5%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

2019 2020 2021 2022 2023

Statewide Family Premium Employee Percent Share

13

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

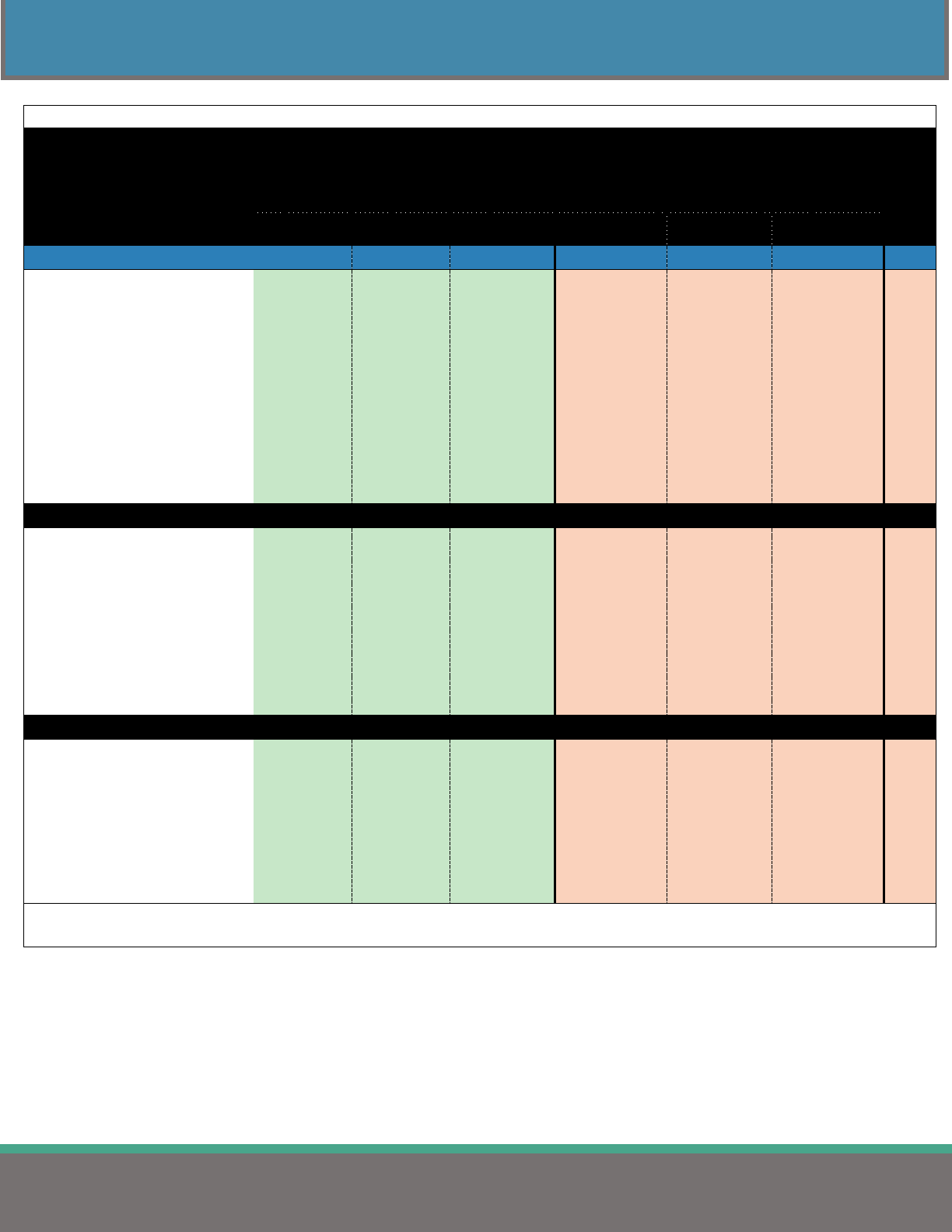

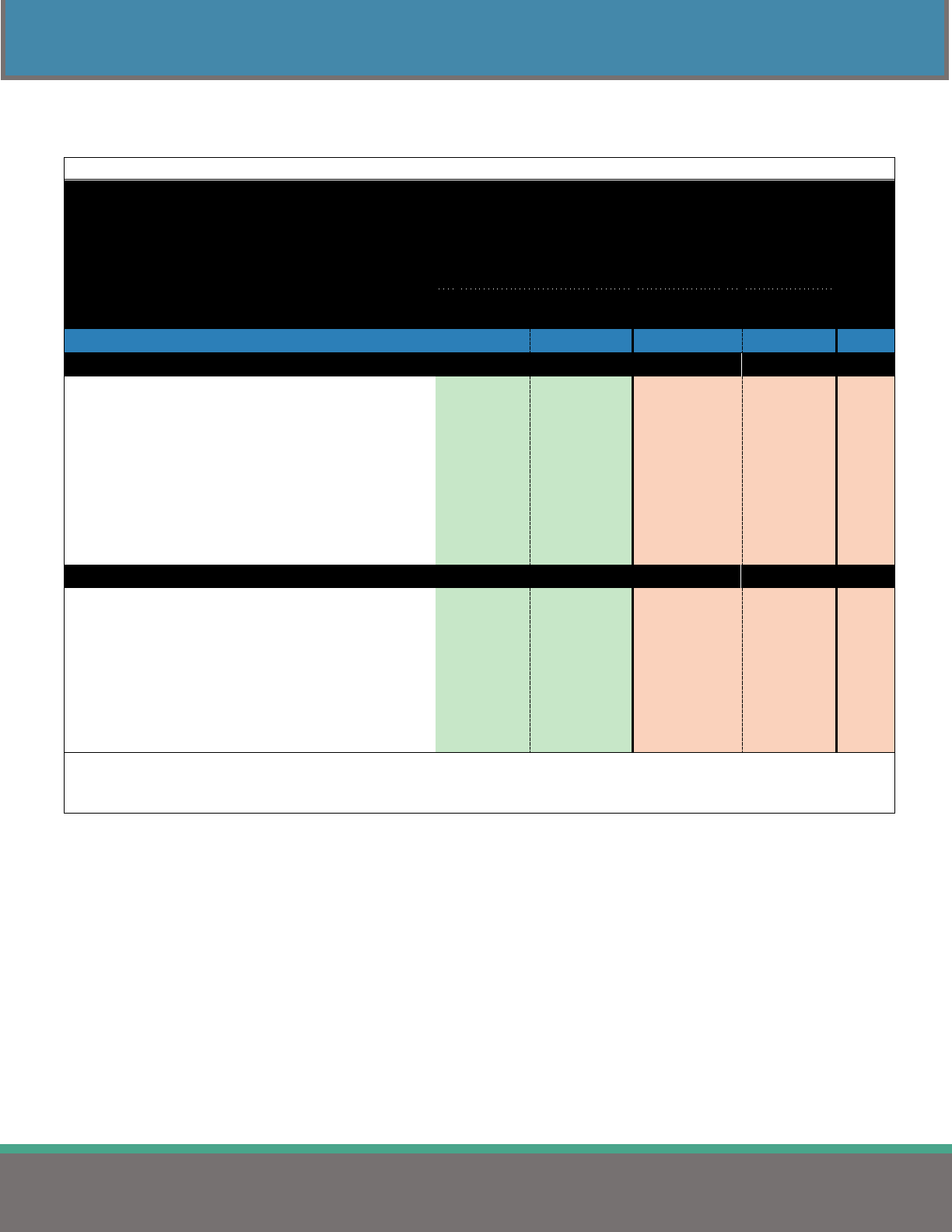

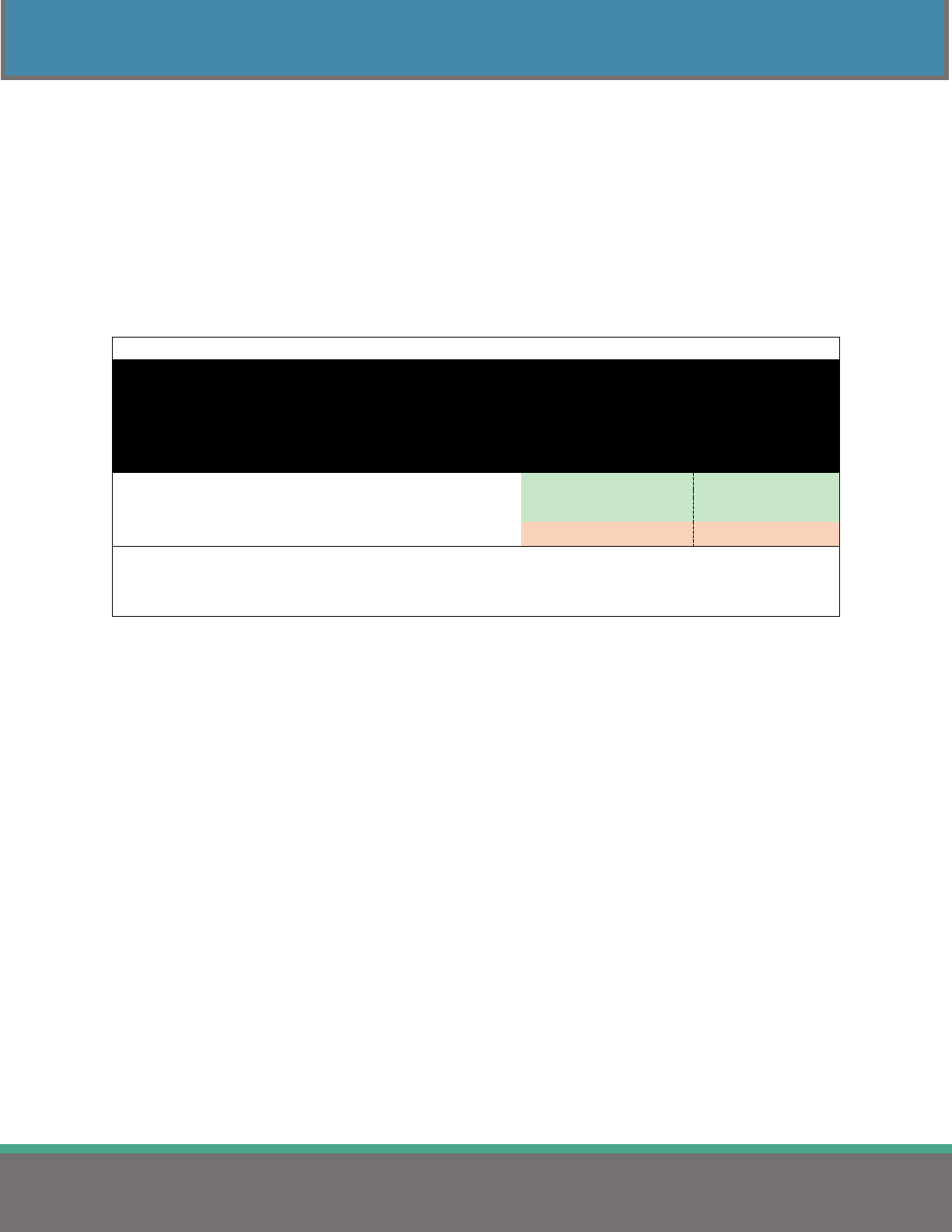

Table 8 is a continuation of Table 7 and breaks down the employer and employee percent share costs by

region and number of employees covered. This data corresponds with the data displayed in Table 6.

Table 8

Employer & Employee Cost Sharing Percentage

Towards Medical Premium by Region

(All Medical Plan Types)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Employer

Share

Employee

Share

n

STATEWIDE

87.4%

12.6%

86.5%

13.5%

1,993

REGION

1 - Akron/Canton 88.0% 12.0% 88.3% 11.7% 230

2 - Cincinnati

86.5%

13.5%

85.1%

14.9%

222

3 - Cleveland 88.5% 11.5% 88.7% 11.3% 344

4 - Columbus

86.7%

13.3%

84.6%

15.4%

354

5 - Dayton

85.0%

15.0%

84.1%

15.9%

263

6 - Southeast Ohio 88.0% 12.0% 85.8% 14.2% 167

7 - Toledo

87.6%

12.4%

86.5%

13.5%

278

8 - Warren/Youngstown 90.9% 9.1% 91.1% 8.9% 135

EMPLOYEES COVERED

1 - 49 89.3% 10.7% 88.7% 11.3% 333

50 - 99

88.2%

11.8%

87.7%

12.3%

334

100 - 149

87.4%

12.6%

86.9%

13.1%

388

150 - 249

86.5%

13.5%

85.5%

14.5%

415

250 - 499 87.4% 12.6% 86.2% 13.8% 298

500 - 999

85.3%

14.7%

83.6%

16.4%

133

1,000 or more

86.0%

14.0%

83.3%

16.7%

92

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans.

14

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

TOTAL MONTHLY MEDICAL PREMIUMS BY PLAN TYPE

Table 9 highlights the average costs of single and family plans related to specific plan types.

Table 9

Average Total Monthly Premium by Plan Type

Single

Family

n

ALL PLANS

$ 813.80

$ 2,148.00

1,993

EPO

$ 872.56

$ 2,090.23

12

PPO

$ 869.62

$ 2,236.49

991

POS

$ 779.63

$ 2,114.75

21

HMO

$ 731.94

$ 1,987.56

30

HDHP

$ 756.90

$ 2,059.94

939

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans.

The average total monthly premium for the “All Plans” category increased $51.05 for single and

$139.79 for family compared to last year’s report.

15

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

FULLY-INSURED VS SELF-INSURED MEDICAL PLANS

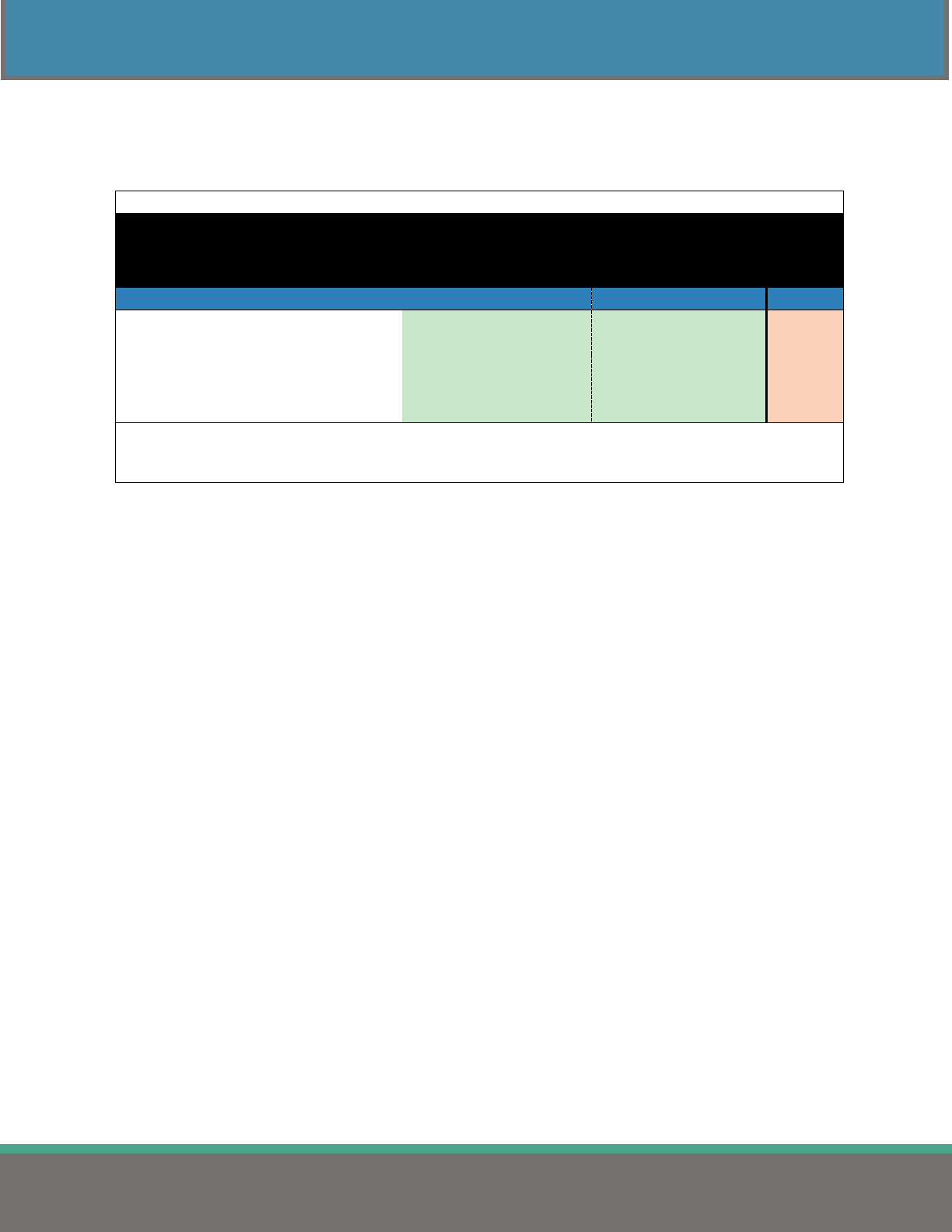

Tables 10 and 11 compare the annual cost of fully-insured medical plans to self-insured plans. The data

presented includes all plan types reported. The primary difference between the fully-insured and self-

insured health insurance plans is who assumes all the risks. With a fully-insured health insurance plan, the

risk falls on the insurance company. In a self-insured health insurance plan, most of the risk falls on the

employer.

Table 10

Statewide Average Annual Cost Per Year by Funding Type

(SINGLE)

Comparison Group

2019

2020

2021

2022

2023

n

Fully-Insured $ 8,124 $ 8,466 $ 8,922 $ 9,106 $ 9,570 447

Self-Insured $ 8,097 $ 8,496 $ 8,873 $ 9,165 $ 9,815 1,546

Note: n: number of plans.

The average annual cost for single plans rose 5.1% for fully-insured plans and 7.1% for self-

insured plans.

Table 11

Statewide Average Annual Cost Per Year by Funding Type

(FAMILY)

Comparison Group

2019

2020

2021

2022

2023

n

Fully-Insured $ 21,997 $ 23,571 $ 24,080 $ 24,940 $ 26,299 447

Self-Insured $ 20,685 $ 22,002 $ 23,009 $ 23,878 $ 25,614 1,546

Note: n: number of plans.

The average annual cost for family plans rose 5.4% for fully-insured plans and 7.3% for self-

insured plans.

16

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

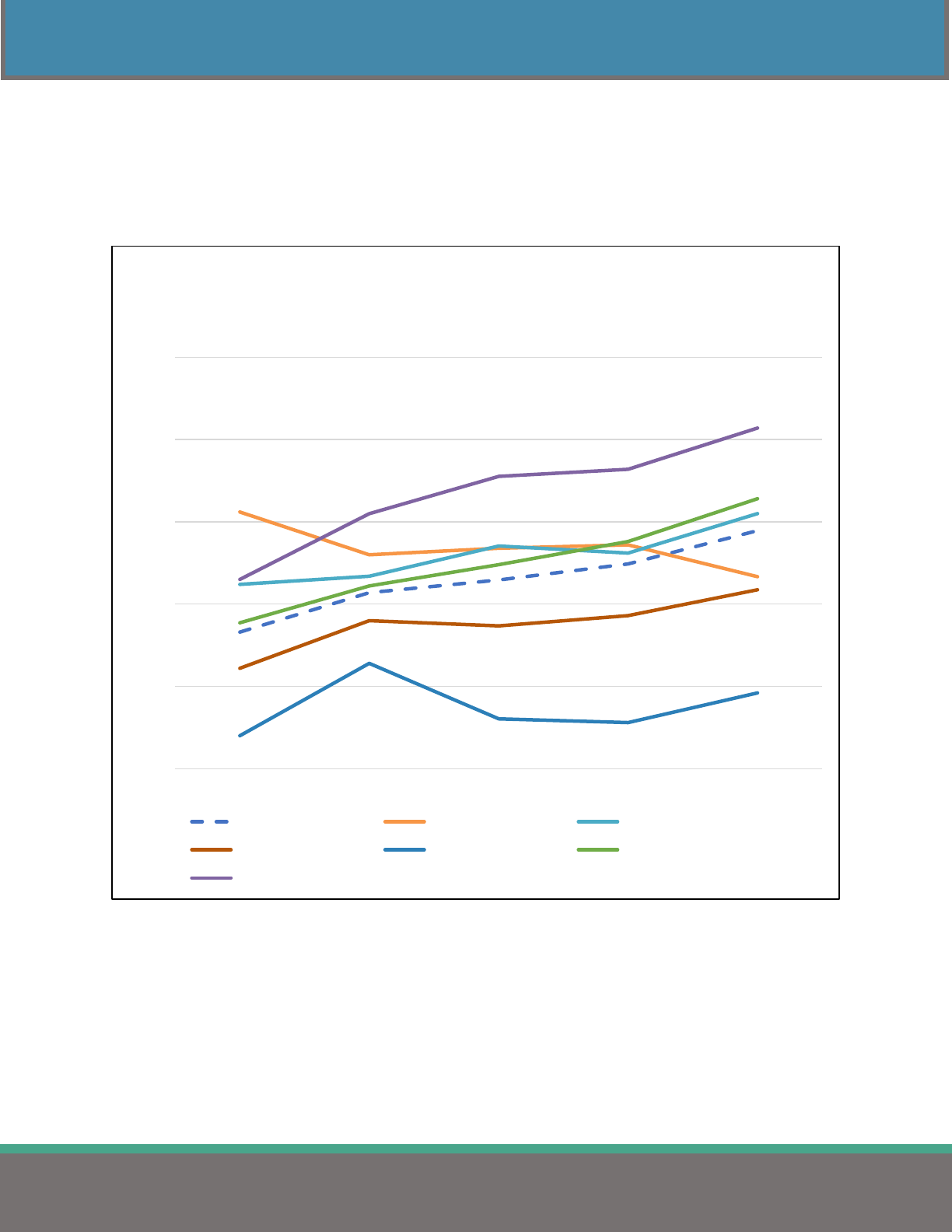

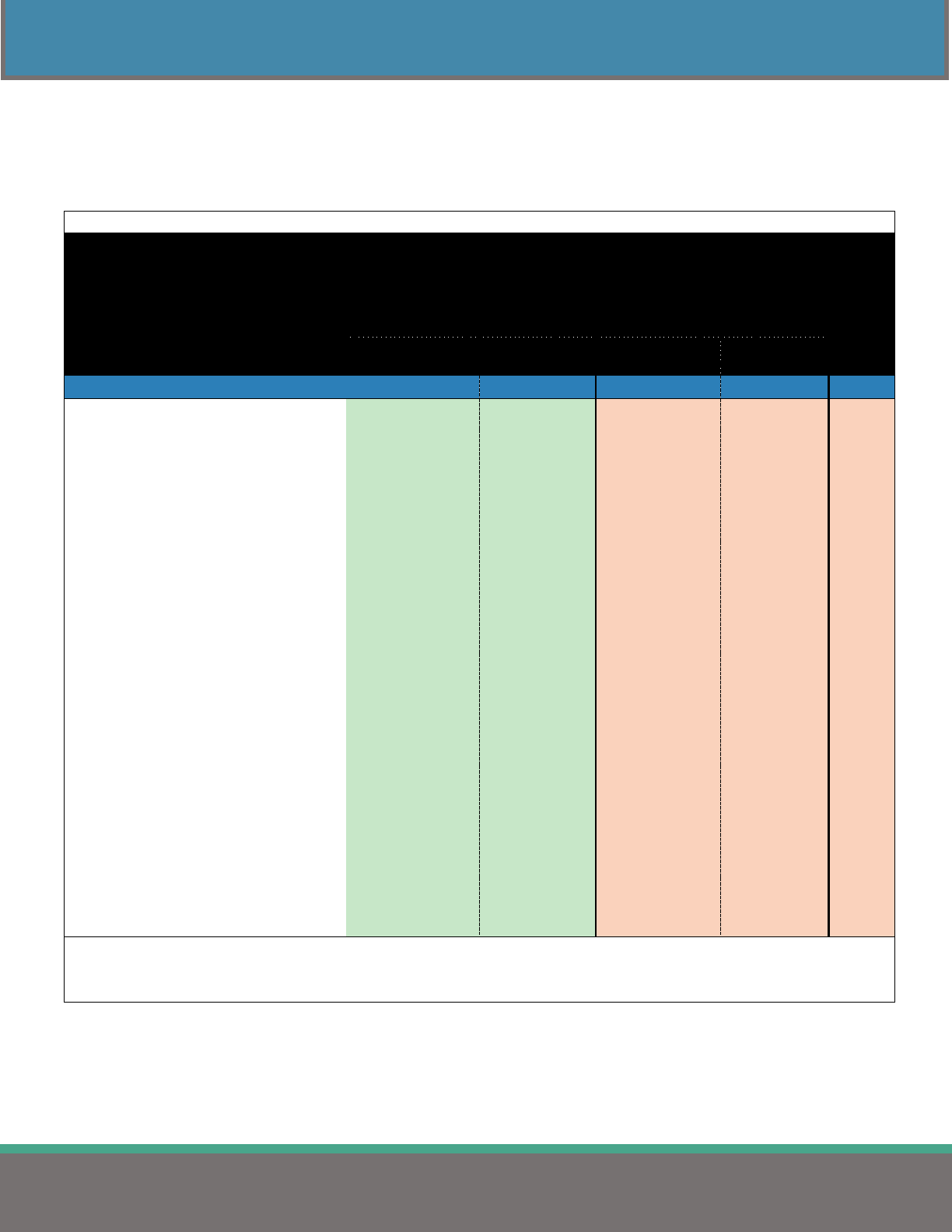

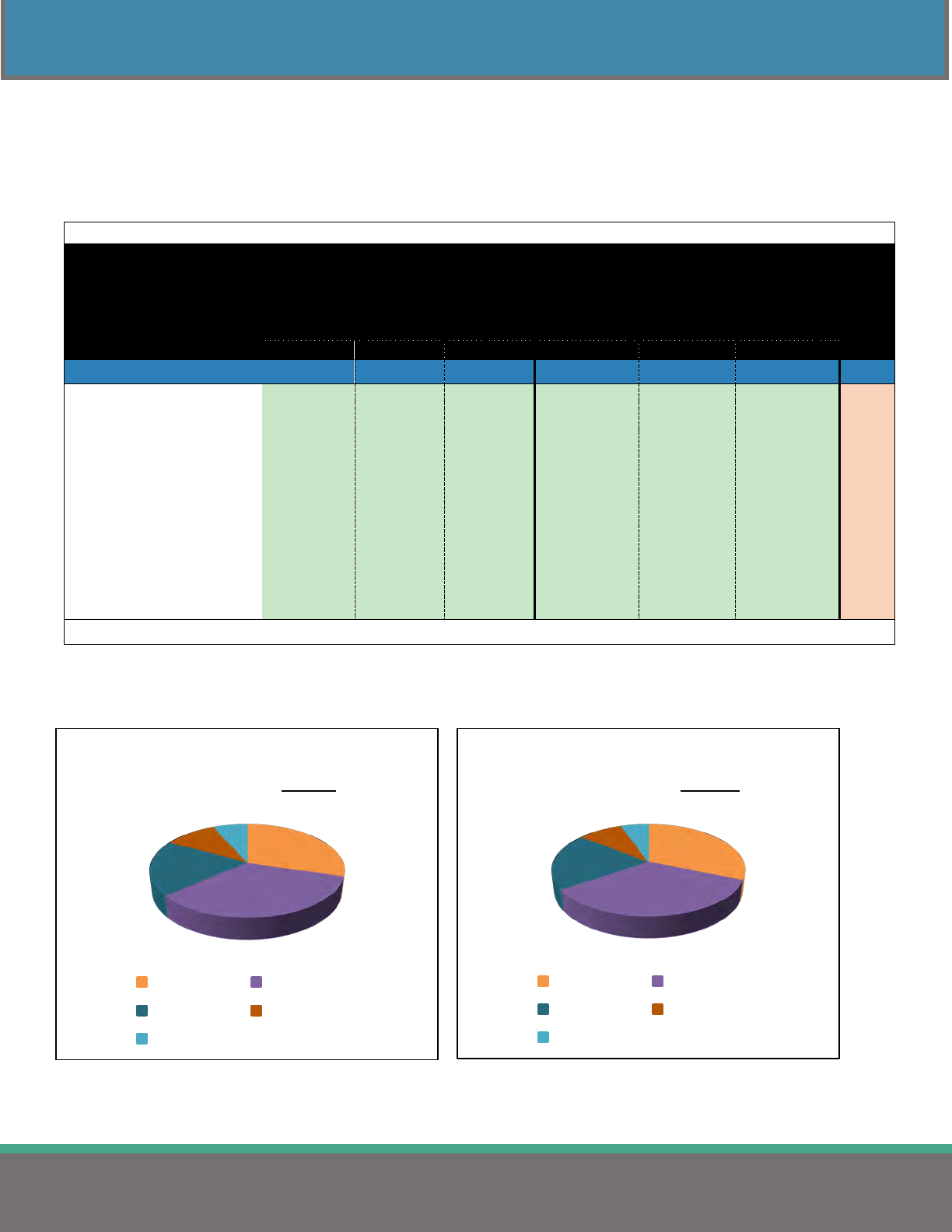

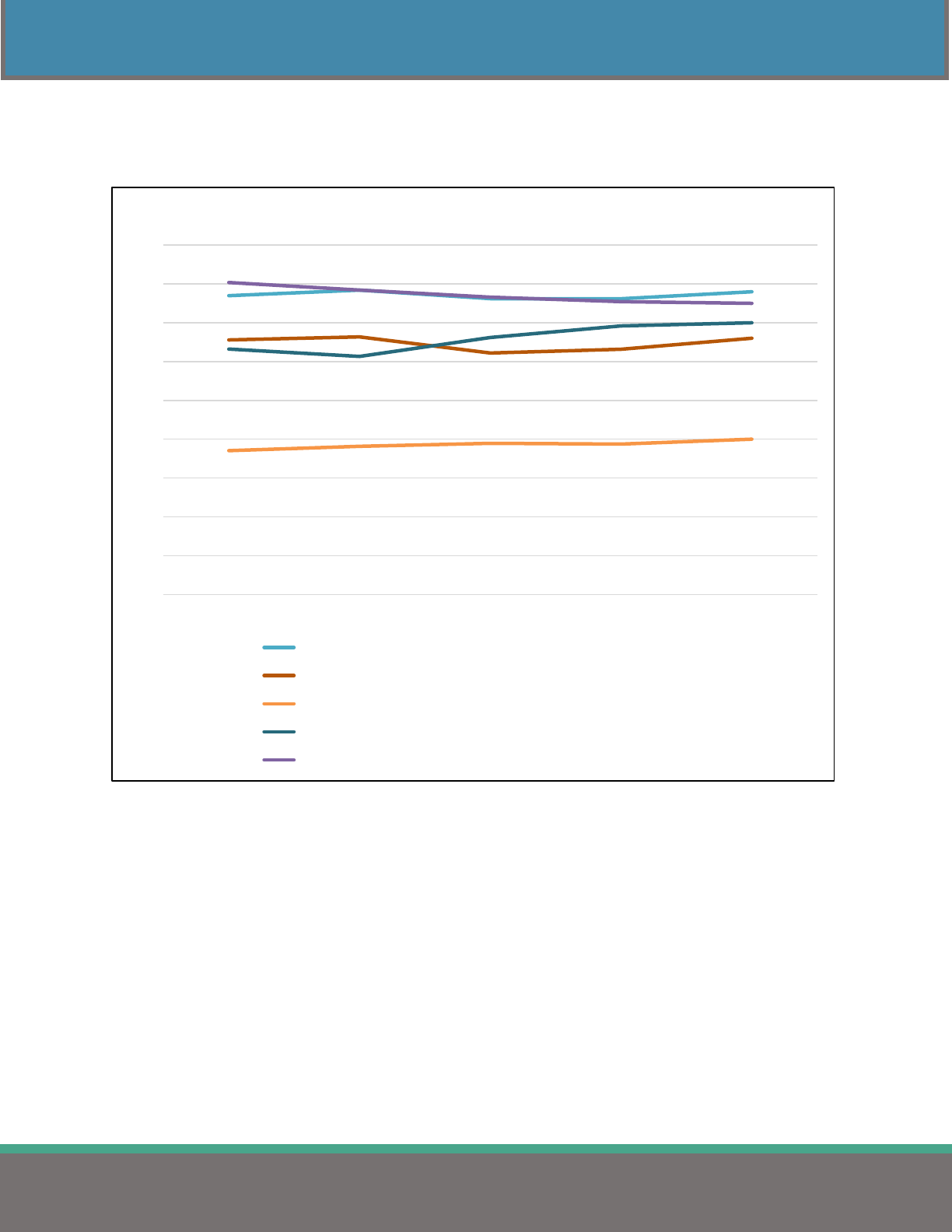

Figures 5 and 6 display the average statewide cost per employee per year for fully-insured and self-insured

medical plans found in Tables 10 and 11 (located on page 15).

Figure 5

Figure 6

$8,000.00

$8,500.00

$9,000.00

$9,500.00

$10,000.00

2019 2020 2021 2022 2023

Statewide Average Annual Cost Per Single Plan Per Year

by Funding Type

Fully-Insured Self-Insured

$20,000.00

$21,000.00

$22,000.00

$23,000.00

$24,000.00

$25,000.00

$26,000.00

$27,000.00

2019 2020 2021 2022 2023

Statewide Average Annual Cost Per Family Plan Per Year

by Funding Type

Fully-Insured Self-Insured

17

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

NETWORK DEDUCTIBLES

Table 12 shows the average deductibles for jurisdictions, regions, and the number of employees covered.

The rising number of High Deductible Health Plans significantly impacts the average deductible.

Table 12

Average In-Network Deductible Amount

(All Plan Types)

Comparison Group

Single

Family

n

STATEWIDE

$ 1,665

$ 3,286

1,993

State of Ohio

$ 933

$ 1,867

3

Counties $ 1,296 $ 2,600

151

Cities

$ 1,665

$ 3,326

372

Townships

$ 2,850

$ 5,713

151

School Districts & ESCs $ 1,522 $ 3,000

1,146

Colleges & Universities

$ 1,825

$ 3,392

74

Fire Districts $ 2,839 $ 5,679

19

Metro Housing Authorities

$ 2,018

$ 3,900

50

Port Authorities

$ 2,380

$ 3,660

5

Regional Transit Authorities $ 1,102 $ 2,227

22

REGION

1 - Akron/Canton $ 1,003 $ 2,052

230

2 - Cincinnati

$ 1,941

$ 3,881

222

3 - Cleveland

$ 1,466

$ 2,853

344

4 - Columbus $ 1,904 $ 3,740

354

5 - Dayton

$ 1,907

$ 3,797

263

6 - Southeast Ohio $ 1,640 $ 3,292

167

7 - Toledo

$ 1,899

$ 3,650

278

8 - Warren/Youngstown

$ 1,293

$ 2,583

135

EMPLOYEES COVERED

1 - 49

$ 2,290

$ 4,560

333

50 - 99 $ 1,719 $ 3,410

334

100 - 149

$ 1,573

$ 3,094

388

150 - 249

$ 1,543

$ 3,032

415

250 - 499 $ 1,416 $ 2,774

298

500 - 999

$ 1,552

$ 3,069

133

1,000 or more

$ 1,095

$ 2,173

92

Note: Average deductible amounts include plans where employees contribute $0 to the annual deductible.

Note: n: number of plans.

18

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

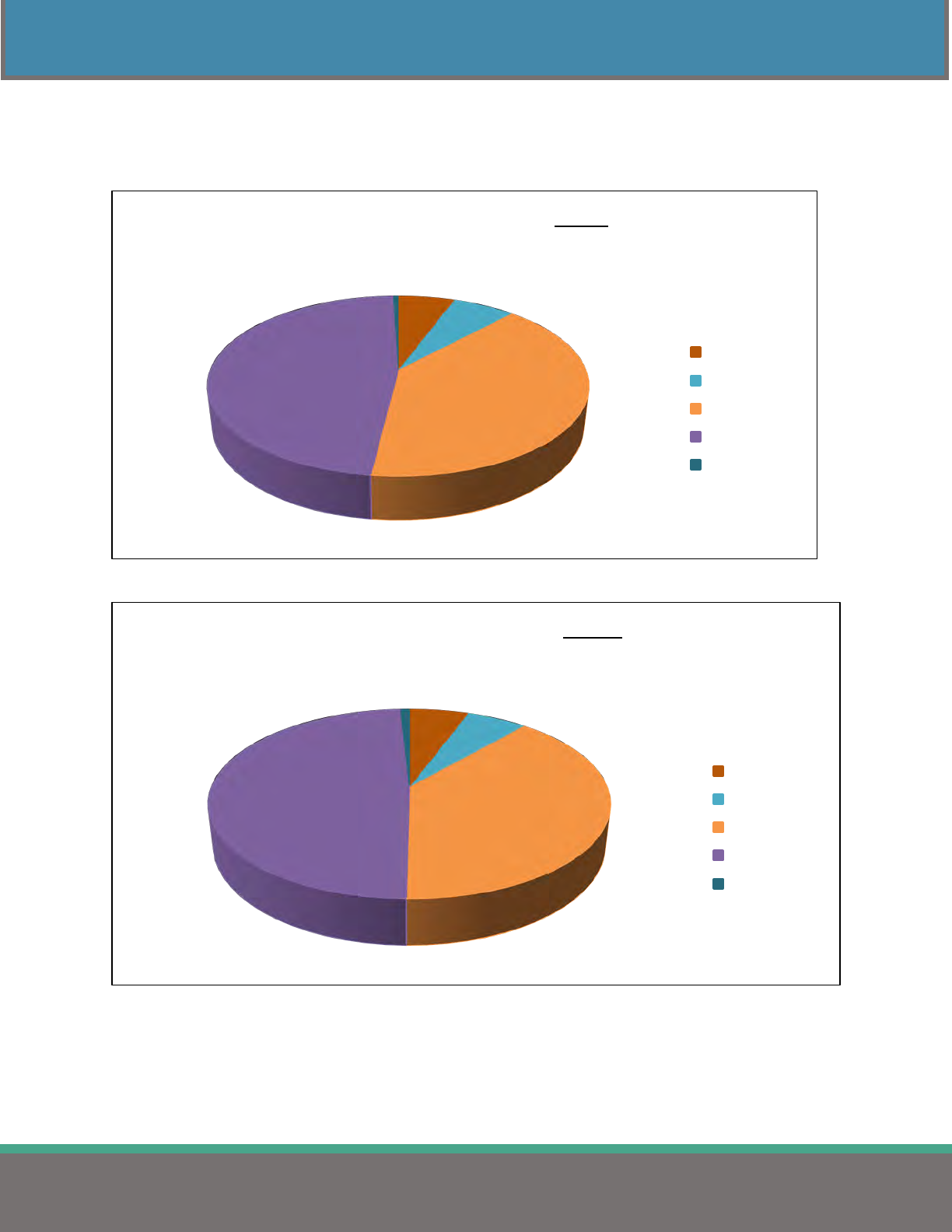

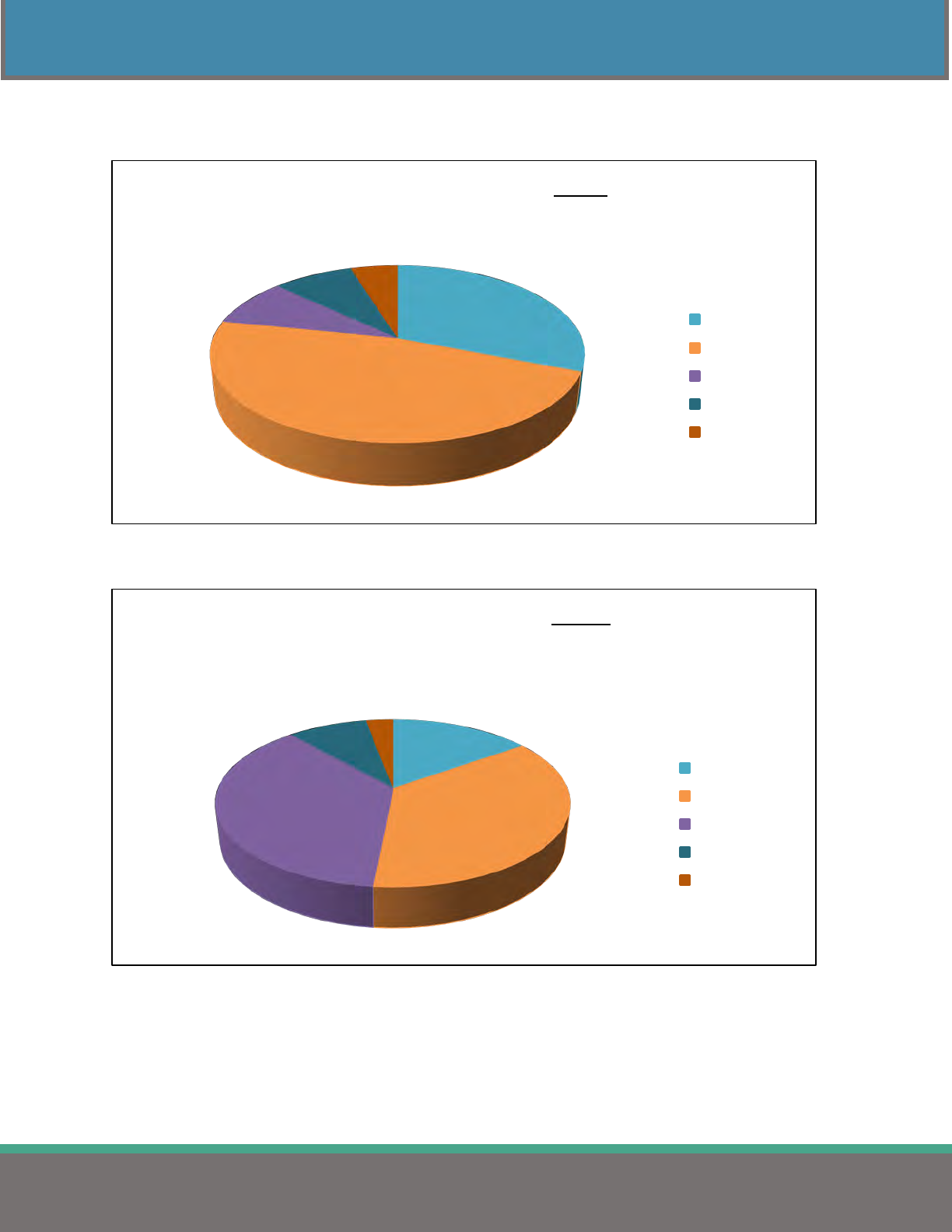

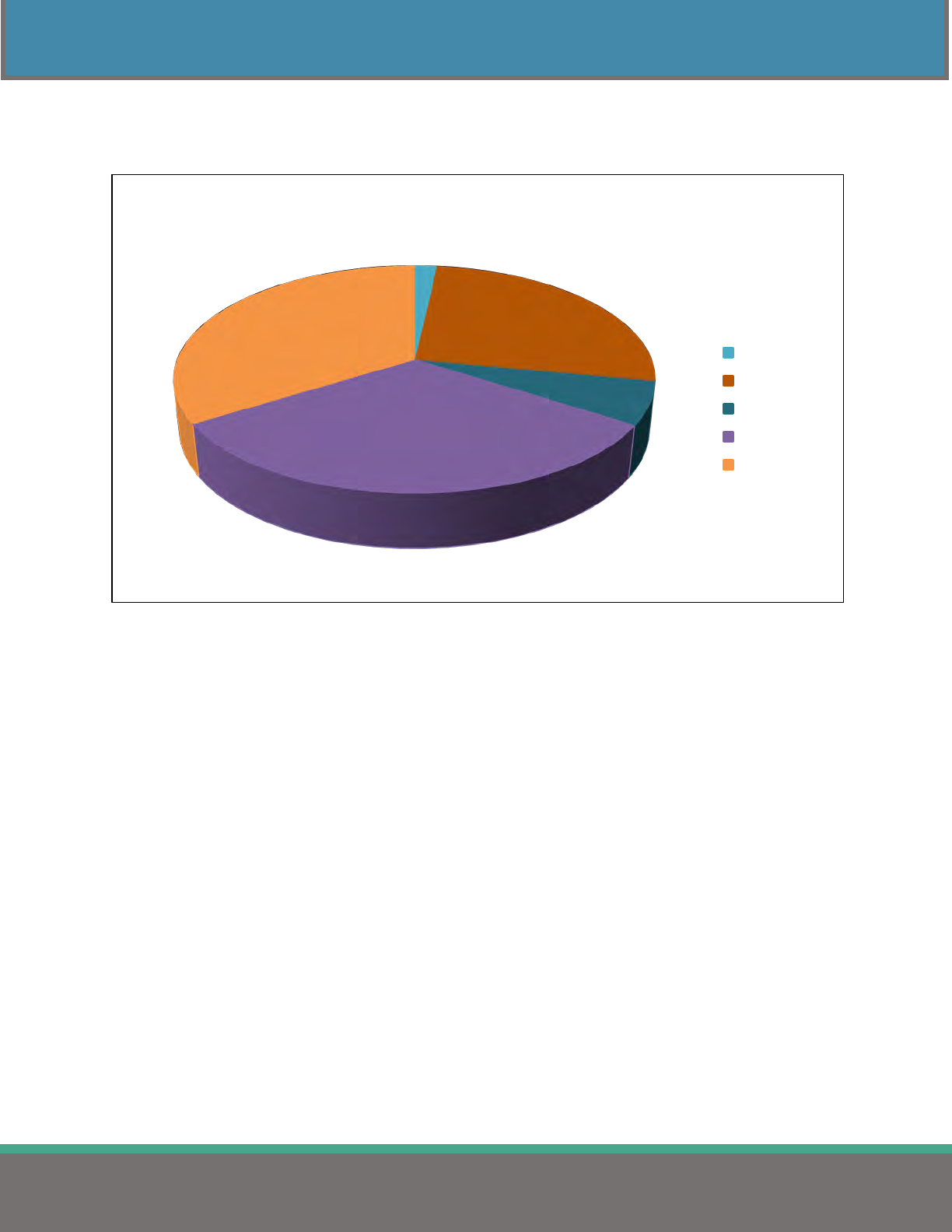

Figures 7 and 8 show the percent of plans in each deductible category for single and family coverage

displayed in Table 12. Each chart's highest category represents those plans eligible for a Health Savings

Account (HSA). Deductibles must be at least $1,400 for single and $2,800 for family coverage to qualify

for an HSA.

Figure 7

Figure 8

4.0%

3.2%

20.6%

24.7%

47.5%

Deductible Categories for Single

In-Network Medical Coverage

$0

$1-$124

$125-$499

$500-$1,399

$1,400 or more

4.0%

3.0%

20.0%

25.4%

47.6%

Deductible Categories for Family

In-Network Medical Coverage

$0

$1-$249

$250-$899

$900-$2,799

$2,800 or more

19

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

NON-NETWORK DEDUCTIBLES

Table 13 shows the average non-network deductibles for jurisdictions, regions, and the number of

employees covered.

Table 13

Average Non-Network Deductible Amount

(All Plan Types)

Comparison Group

Single

Family

n

STATEWIDE $ 3,335

$ 6,601

1,993

State of Ohio $ 1,867

$ 3,733

3

Counties

$ 2,701

$ 5,421

151

Cities

$ 3,558

$ 7,099

372

Townships $ 6,452

$ 12,993

151

School Districts & ESCs

$ 2,773

$ 5,484

1,146

Colleges & Universities $ 3,978

$ 7,480

74

Fire Districts $ 9,663

$ 18,327

19

Metro Housing Authorities $ 5,608

$ 11,104

50

Port Authorities $ 3,750

$ 7,500

5

Regional Transit Authorities $ 2,608

$ 5,244

22

REGION

1 - Akron/Canton

$ 2,213 $ 4,501 230

2 - Cincinnati

$ 3,989 $ 7,978 222

3 - Cleveland

$ 2,819 $ 5,509 344

4 - Columbus

$ 3,728 $ 7,329 354

5 - Dayton

$ 4,065 $ 8,050 263

6 - Southeast Ohio

$ 3,464 $ 6,893 167

7 - Toledo

$ 3,328 $ 6,497 278

8 - Warren/Youngstown

$ 2,869 $ 5,781 135

EMPLOYEES COVERED

1 - 49

$ 5,116 $ 10,163 333

50 - 99

$ 3,562 $ 7,072 334

100 - 149

$ 2,985 $ 5,860 388

150 - 249

$ 2,863 $ 5,663 415

250 - 499

$ 2,671 $ 5,249 298

500 - 999

$ 3,013 $ 6,043 133

1,000 or more

$ 2,401

$ 4,877

92

Note: Average deductible amounts include plans where employees contribute $0 to the annual deductible.

Note: n: number of plans.

20

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

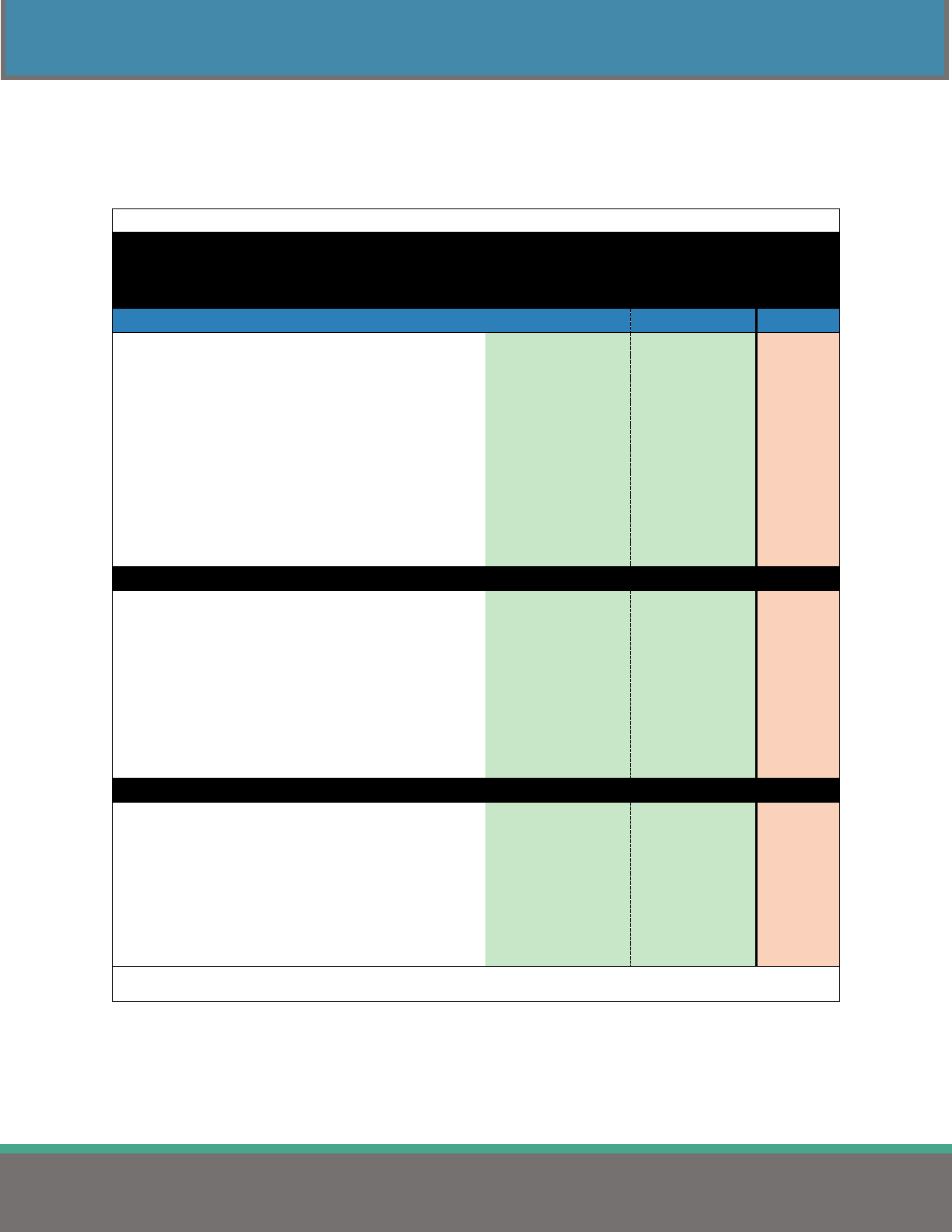

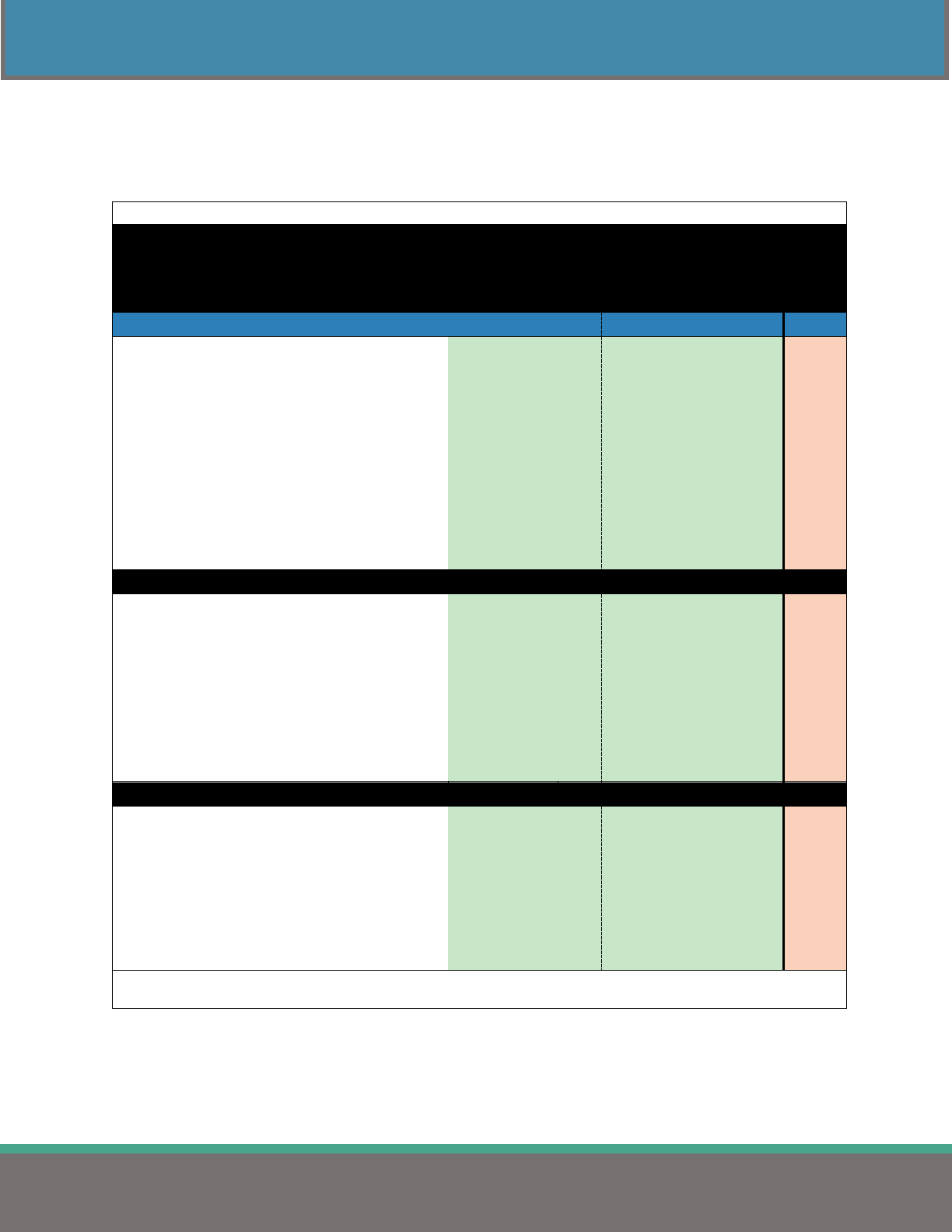

Figures 9 and 10 show the percent of plans in each non-network deductible category for single and family

coverage displayed in Table 13.

Figure 9

Figure 10

27.9%

22.8%

20.2%

23.1%

6.0%

Deductible Categories for Single

Non-Network Medical Coverage

$0-$999

$1,000-$2,499

$2,500-$4,999

$5,000-$9,999

$10,000 or more

37.7%

12.8%

20.9%

22.9%

5.7%

Deductible Categories for Family

Non-Network Medical Coverage

$0-$2,499

$2,500-$4,999

$5,000-$9,999

$10,000-$19,999

$20,000 or more

21

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

COPAY AND COINSURANCE

Table 14 shows the breakdown of the 1,993 medical plans submitted by the average copay and coinsurance

amounts for network and non-network plans covered by the employee.

Table 14

Statewide Average Medical Copay & Coinsurance Amounts

(Covered by Employee)

Network

n

Non-Network

n

COPAY

Office Visit

$ 17.70

1,362

$ 23.08

297

Emergency Room

$ 137.94

1,365

$ 147.81

1,025

Urgent Care

$ 37.02

1,317

$ 34.86

381

Hospital Stay - Admitted

$ 36.22

424

$ 45.37

162

COINSURANCE

Office Visit

13.0%

692

34.6%

1,602

Emergency Room

13.1%

792

24.4%

946

Urgent Care

13.0%

724

33.9%

1,493

Hospital Stay - Admitted

14.4%

1,445

34.3%

1,626

Note: n: number of plans.

Office Visit Copay

When a copay is required, 320 plans (16.1%) indicated that their office visit copay amount is $20.

When a copay is required, 265 plans (13.3%) indicated that their office visit copay amount is $25.

Emergency Room Copay

When a copay is required, 211 plans (10.6%) indicated that their emergency room copay amount

is $250.

When a copay is required, 823 plans (41.2%) indicated that their emergency room copay is

between $100 and $300.

Urgent Care Copay

When a copay is required, 223 plans (11.1%) indicated that their urgent care copay amount is $50.

When a copay is required, 153 plans (7.7%) indicated that their urgent care copay amount is $75.

22

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

The two tables below show the employee’s average co-insurance percentage of the medical claim for

network and non-network claims when admitted into the hospital. The employee would typically be

responsible for this percentage of the medical claim (medical bill) once the employee reached the

deductible. The employee would pay this percentage on all claims until they reached the out-of-pocket

maximum.

Table 15

Co-Insurance Categories for In-Network Medical Coverage by Jurisdiction

(All Plan Types)

Employee’s Co-Insurance Percentage

Comparison Group

0%

1-10%

11-19%

20%

>20%

n

STATEWIDE 15.8% 29.7% 3.2% 45.3% 6.0% 1,993

State of Ohio

0.0%

0.0%

0.0%

100.0%

0.0%

3

Counties

5.8%

18.2%

2.5%

56.2%

17.3%

151

Cities

25.4%

27.0%

0.8%

44.8%

2.0%

372

Townships

35.6%

12.3%

0.0%

45.2%

6.9%

151

School Districts & ESCs

12.6%

35.0%

4.2%

42.6%

5.6%

1,146

Colleges & Universities

9.8%

23.0%

4.9%

57.4%

4.9%

74

Fire Districts

87.5%

0.0%

0.0%

12.5%

0.0%

19

Metro Housing Authorities

21.2%

15.2%

0.0%

54.5%

9.1%

50

Port Authorities

0.0%

66.7%

0.0%

33.3%

0.0%

5

Regional Transit Authorities

11.1%

16.7%

5.6%

66.6%

0.0%

22

Note: n: number of plans.

Table 16

Co-Insurance Categories for Non-Network Medical Coverage by Jurisdiction

(All Plan Types)

Employee’s Co-Insurance Percentage

Comparison Group

0-19%

20%

21-30%

31-40%

>40%

n

STATEWIDE

3.0%

15.5%

29.8%

35.7%

16.0%

1,993

State of Ohio 33.3% 0.0% 0.0% 66.7% 0.0% 3

Counties 3.9% 8.5% 15.5% 53.5% 18.6% 151

Cities 2.8% 18.0% 33.9% 28.7% 16.6% 372

Townships 0.0% 16.0% 20.0% 27.0% 37.0% 151

School Districts & ESCs 3.3% 16.5% 32.2% 36.2% 11.8% 1,146

Colleges & Universities 1.7% 5.0% 33.3% 41.7% 18.3% 74

Fire Districts 10.0% 10.0% 20.0% 0.0% 60.0% 19

Metro Housing Authorities 0.0% 10.8% 16.2% 35.1% 37.9% 50

Port Authorities 0.0% 33.3% 33.3% 33.4% 0.0% 5

Regional Transit Authorities 0.0% 15.8% 15.8% 47.4% 21.0% 22

Note: n: number of plans.

23

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

OUT-OF-POCKET MAXIMUMS

Tables 17 and 18 display the average, minimum, and maximum out-of-pocket maximums for single and

family medical coverage for all plan types reported.

Table 17

Average In-Network Out-of-Pocket Maximums

(All Plan Types)

Single

Family

Comparison Group

Average

Minimum

Maximum

Average

Minimum

Maximum

n

STATEWIDE $ 3,390 $ 0

$ 12,000 $ 6,789 $ 0

$ 27,400 1,993

State of Ohio $ 2,833 $ 2,500 $ 3,500 $ 5,667 $ 5,000

$ 7,000 3

Counties $ 3,322 $ 400 $ 12,000 $ 6,690 $ 800

$ 24,000 151

Cities $ 3,101 $ 0

$ 8,700 $ 6,187 $ 0

$ 17,400 372

Townships $ 4,056 $ 0

$ 8,700 $ 8,276

$ 0

$ 27,400 151

School Districts & ESCs $ 3,322 $ 0

$ 9,100 $ 6,631

$ 0

$ 23,200 1,146

Colleges & Universities $ 3,953 $ 900 $ 8,150 $ 7,894 $ 1,800

$ 14,700 74

Fire Districts $ 5,132 $ 3,000 $ 8,000 $ 10,263 $ 6,000

$ 16,000 19

Metro Housing Authorities $ 4,043 $ 350 $ 8,500 $ 8,426 $ 700

$ 18,000 50

Port Authorities $ 4,510 $ 2,500 $ 6,350 $ 9,020 $ 5,000

$ 12,700 5

Regional Transit Authorities $ 2,630 $ 0

$ 7,500 $ 5,168

$ 0

$ 15,000 22

REGION

1 - Akron/Canton $ 2,305 $ 0

$ 8,700 $ 4,692

$ 0

$ 20,000 230

2 - Cincinnati $ 3,625 $ 170 $ 12,000 $ 7,270 $ 500

$ 24,000 222

3 - Cleveland $ 3,742 $ 0

$ 8,700 $ 7,546

$ 0

$ 23,200 344

4 - Columbus $ 3,576 $ 0

$ 9,100 $ 7,184

$ 0

$ 27,400 354

5 - Dayton $ 3,104 $ 0

$ 8,700 $ 6,131 $

0

$ 17,400 263

6 - Southeast Ohio $ 3,620 $ 200 $ 9,100 $ 7,254 $ 400

$ 18,200 167

7 - Toledo $ 3,600 $ 250 $ 9,100 $ 7,059 $ 500

$ 18,200 278

8 - Warren/Youngstown $ 3,301 $ 350 $ 8,700 $ 6,768 $ 400

$ 17,400 135

EMPLOYEES COVERED

1 - 49 $ 3,892 $ 0

$ 8,700 $ 7,898

$ 0

$ 27,400 333

50 - 99 $ 3,310 $ 0

$ 9,100 $ 6,600

$ 0

$ 18,200 334

100 - 149 $ 3,313 $ 50 $ 9,100 $ 6,628 $ 100

$ 18,200 388

150 - 249 $ 3,250 $ 0

$ 9,100 $ 6,477

$ 0

$ 23,200 415

250 - 499 $ 3,383 $ 0

$ 12,000 $ 6,781

$ 0

$ 24,000 298

500 - 999 $ 3,392 $ 0

$ 9,100 $ 6,732

$ 0

$ 18,200 133

1,000 or more $ 2,827 $ 0

$ 6,850 $ 5,672

$ 0

$ 13,700 92

Note: Excludes plans that have unlimited out-of-network maximums.

Note: n: number of plans.

24

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – ALL PLAN TYPES

Table 18

Average Non-Network Out-of-Pocket Maximums

(All Plan Types)

Single

Family

Comparison Group

Average

Minimum

Maximum

Average

Minimum

Maximum

n

STATEWIDE $ 6,829

$ 150

$ 40,000 $ 13,729 $ 300

$ 80,000

1,993

State of Ohio $ 5,667

$ 5,000

$ 7,000 $ 11,333 $ 10,000

$ 14,000

3

Counties $ 6,893

$ 800

$ 24,000 $ 14,089 $ 1,800

$ 50,000

151

Cities $ 7,244

$ 150

$ 22,050 $ 14,426 $ 300

$ 45,000

372

Townships $ 11,004

$ 1,500

$ 24,000 $ 22,833 $ 3,000

$ 60,000

151

School Districts & ESCs $ 5,781

$ 340

$ 40,000 $ 11,545 $ 500

$ 80,000

1,146

Colleges & Universities $ 7,892

$ 1,800

$ 32,600 $ 15,211 $ 3,600

$ 40,000

74

Fire Districts $ 15,898

$ 10,000

$ 24,000 $ 31,797 $ 20,000

$ 48,000

19

Metro Housing Authorities $ 10,749

$ 1,000

$ 22,500 $ 23,083 $ 3,000

$ 60,000

50

Port Authorities $ 8,463

$ 5,000

$ 12,500 $ 16,925 $ 10,000

$ 25,000

5

Regional Transit Authorities $ 5,931

$ 1,300

$ 22,500 $ 11,644 $ 2,500

$ 45,000

22

REGION

1 - Akron/Canton $ 4,854

$ 150

$ 22,050 $ 9,728 $ 300

$ 44,100

230

2 - Cincinnati $ 8,345

$ 340

$ 24,000 $ 16,969 $ 1,000

$ 48,000

222

3 - Cleveland $ 6,522

$ 400

$ 22,050 $ 13,158 $ 500

$ 60,000

344

4 - Columbus $ 7,498

$ 500

$ 40,000 $ 15,007 $ 800

$ 80,000

354

5 - Dayton $ 6,914

$ 1,000

$ 21,000 $ 13,652 $ 2,000

$ 42,000

263

6 - Southeast Ohio $ 7,287

$ 600

$ 21,000 $ 14,847 $ 1,200

$ 42,000

167

7 - Toledo $ 6,397

$ 500

$ 32,600 $ 12,635 $ 1,000

$ 50,000

278

8 - Warren/Youngstown $ 6,472

$ 900

$ 22,500 $ 13,525 $ 900

$ 60,000

135

EMPLOYEES COVERED

1 - 49 $ 9,841

$ 1,300

$ 24,000 $ 20,276 $ 2,600

$ 60,000

333

50 - 99 $ 7,387

$ 800

$ 22,050 $ 14,637 $ 1,200

$ 44,100

334

100 - 149 $ 6,081

$ 150

$ 32,600 $ 12,041 $ 300

$ 44,100

388

150 - 249 $ 5,891

$ 500

$ 40,000 $ 11,752 $ 1,000

$ 80,000

415

250 - 499 $ 5,718

$ 340

$ 24,000 $ 11,557 $ 700

$ 48,000

298

500 - 999 $ 6,044

$ 500

$ 15,000 $ 12,034 $ 500

$ 30,000

133

1,000 or more $ 5,433

$ 500

$ 12,000 $ 11,058 $ 1,000

$ 24,000

92

Note: Excludes plans that have unlimited out-of-network maximums.

Note: n: number of plans.

25

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

MEDICAL INSURANCE – PPO PLANS

PPO PREMIUMS

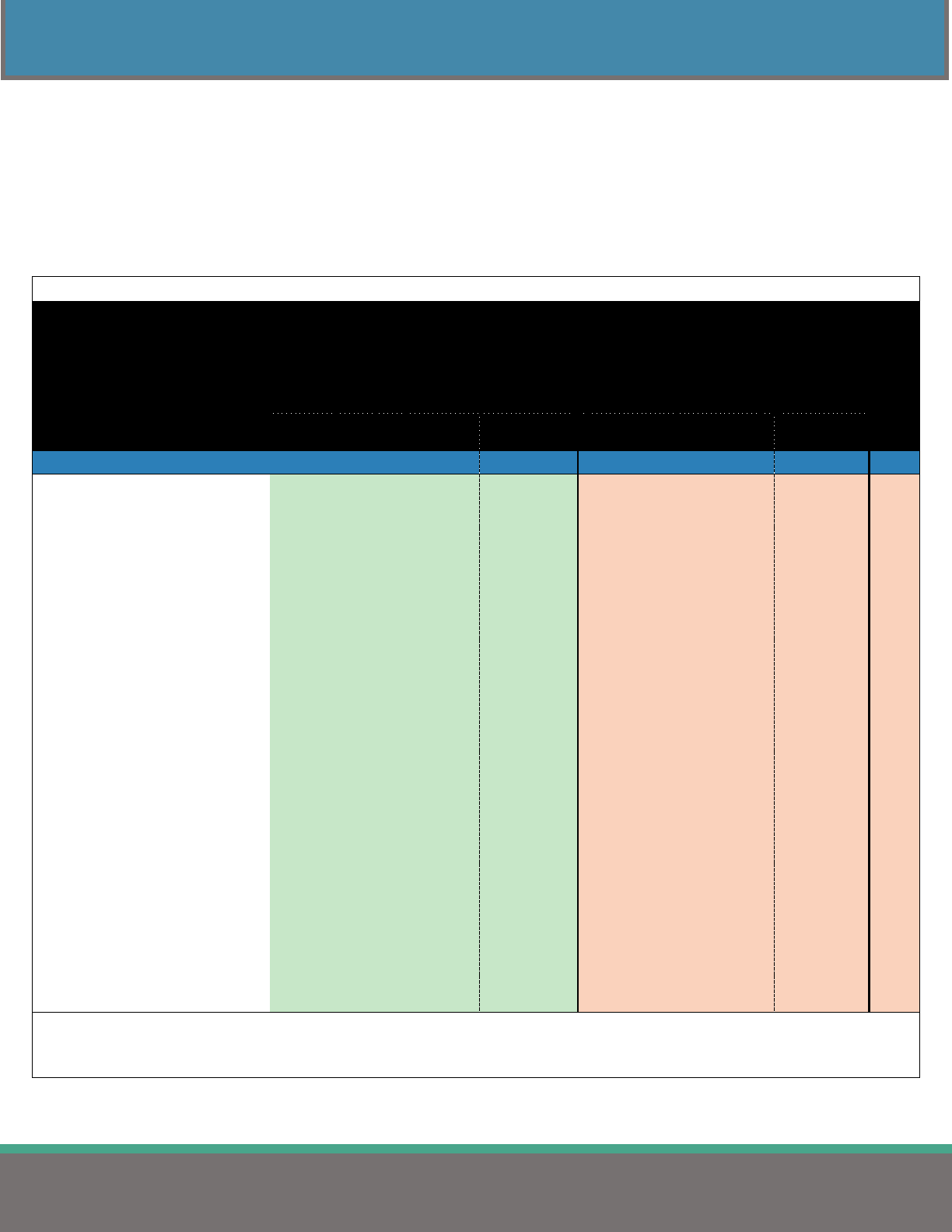

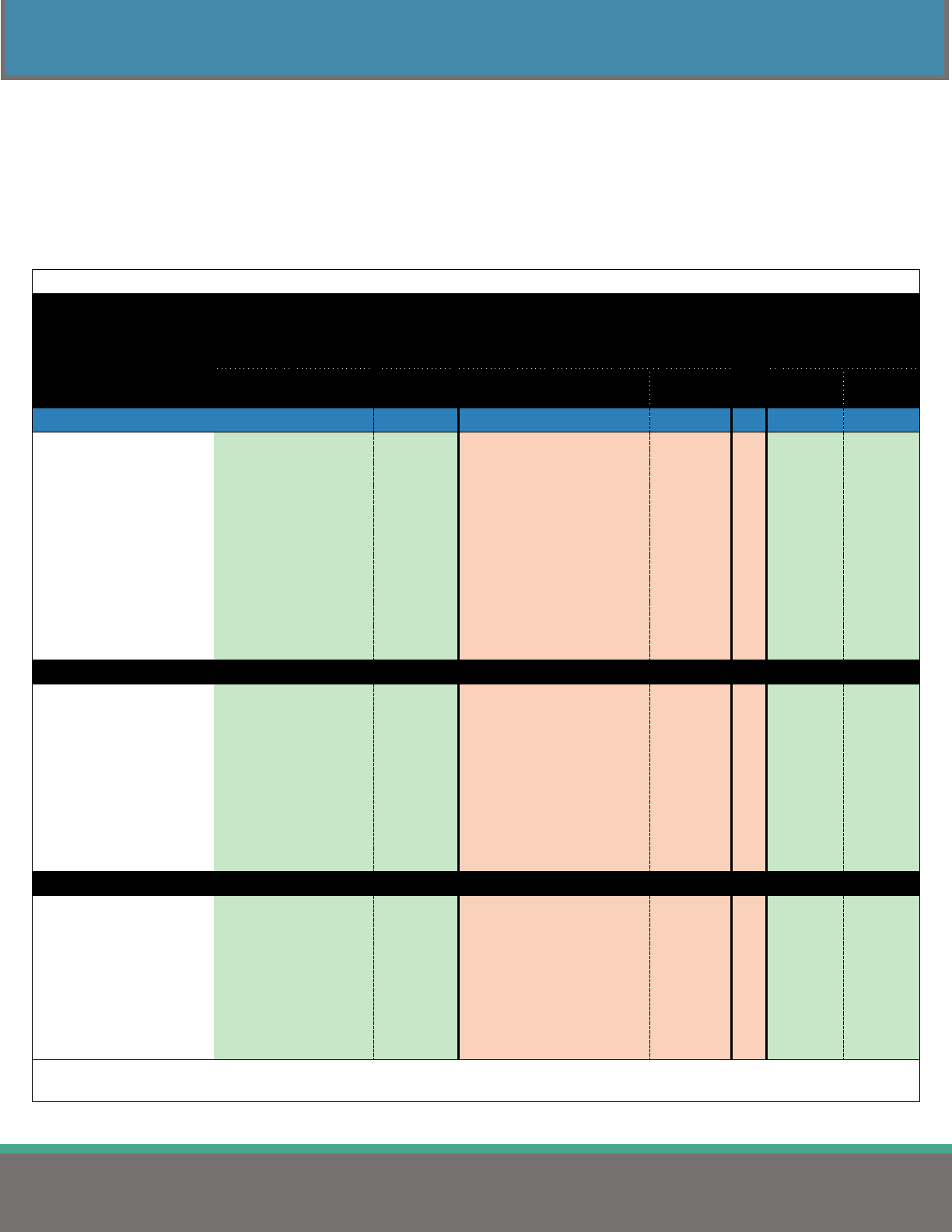

Table 19 breaks down the average PPO medical premiums and the contribution amounts shared by the

employer and the employee. These averages include the costs of prescription, dental, and vision

coverages when included in the medical premiums. PPO plans account for 49.7% of all medical plans

reported in 2023.

Table 19

Average Monthly Employer & Employee Contributions

Towards Medical Premium

(PPO Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Total

Employer

Share

Employee

Share

Total

n

STATEWIDE

$ 751.01

$ 118.74

$ 869.75

$ 1,908.29

$ 328.58

$ 2,236.87

991

State of Ohio $ 656.00 $ 96.50 $ 752.50 $ 1,800.00 $ 283.50 $ 2,083.50

2

Counties $ 744.23 $ 114.91 $ 859.14 $ 1,973.43 $ 328.44 $ 2,301.87

80

Less than 50,000 $ 722.20 $ 106.82 $ 829.02 $ 2,032.19 $ 309.21 $ 2,341.40

26

50,000 - 149,999 $ 693.85 $ 119.70 $ 813.55 $ 1,953.70 $ 351.73 $ 2,305.43

34

150,000 or more $ 793.51 $ 117.30 $ 910.81 $ 1,933.53 $ 312.87 $ 2,246.40

20

Cities $ 776.00 $ 105.98 $ 881.98 $ 2,068.51 $ 283.76 $ 2,352.27

171

Less than 25,000 $ 789.57 $ 105.36 $ 894.93 $ 2,100.32 $ 288.77 $ 2,389.09

111

25,000 - 99,999 $ 757.18 $ 107.47 $ 864.65 $ 2,059.24 $ 277.73 $ 2,336.97

54

100,000 or more $ 698.70 $ 103.68 $ 802.38 $ 1,579.34 $ 247.78 $ 1,827.12

6

Townships $ 988.49 $ 90.38 $ 1,078.87 $ 2,151.69 $ 243.28 $ 2,394.97

39

Less than 10,000 $ 1,004.33 $ 51.45 $ 1,055.78 $ 2,153.71 $ 148.17 $ 2,301.88

17

10,000 - 29,999 $ 1,064.21 $ 123.72 $ 1,187.93 $ 2,195.05 $ 309.95 $ 2,505.00

17

30,000 or more $ 720.18 $ 91.60 $ 811.78 $ 2,015.94 $ 309.60 $ 2,325.54

5

School Districts & ESCs $ 738.94 $ 124.34 $ 863.28 $ 1,840.92 $ 341.87 $ 2,182.79

630

Less than 1,000 $ 741.43 $ 119.15 $ 860.58 $ 1,865.03 $ 321.22 $ 2,186.25

163

1,000 - 2,499 $ 746.65 $ 127.60 $ 874.25 $ 1,848.10 $ 343.63 $ 2,191.73

257

2,500 - 9,999 $ 718.01 $ 119.57 $ 837.58 $ 1,799.66 $ 320.58 $ 2,120.24

153

10,000 or more $ 772.12 $ 131.34 $ 903.46 $ 1,899.26 $ 495.61 $ 2,394.87

14

Educational Svc Centers $ 746.93 $ 139.63 $ 886.56 $ 1,833.11 $ 439.36 $ 2,272.47

43

Colleges & Universities $ 687.04 $ 130.73 $ 817.77 $ 1,919.03 $ 391.30 $ 2,310.33

32

Fire Districts $ 597.95 $ 56.34 $ 654.29 $ 1,702.02 $ 174.84 $ 1,876.86

3

Metro Housing Authorities $ 700.53 $ 122.18 $ 822.71 $ 2,103.36 $ 411.13 $ 2,514.49

21

Port Authorities $ 456.54 $ 73.51 $ 530.05 $ 1,493.75 $ 240.18 $ 1,733.93

1

Regional Transit Authorities $ 751.20 $ 94.97 $ 846.17 $ 1,839.04 $ 260.21 $ 2,099.25

12

Note: Rows formatted with bold font include all PPO plans reported for the comparison group.

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans

26

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

Table 20 organizes the same data in Table 19 by region and by the number of employees covered. These

averages include the costs of prescription, dental, and vision coverages when included with the medical

premiums. A breakdown of the regions is on page 61.

Table 20

Average Monthly Employer & Employee Contributions

Towards Medical Premium by Region

(PPO Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Total

Employer

Share

Employee

Share

Total

n

STATEWIDE $ 751.01 $ 118.74

$ 869.75

$ 1,908.29 $ 328.58 $ 2,236.87 991

REGION

1 - Akron/Canton $ 721.20 $ 106.67

$ 827.87

$ 1,873.98 $ 274.68 $ 2,148.66 171

2 - Cincinnati $ 681.39 $ 125.40

$ 806.79

$ 1,699.49 $ 353.90 $ 2,053.39 85

3 - Cleveland $ 705.99 $ 102.73

$ 808.72

$ 1,813.00 $ 258.36 $ 2,071.36 218

4 - Columbus $ 835.77 $ 142.93

$ 978.70

$ 2,036.95 $ 409.59 $ 2,446.54 156

5 - Dayton $ 756.48 $ 163.09

$ 919.57

$ 1,991.08 $ 479.52 $ 2,470.60 87

6 - Southeast Ohio $ 892.19 $ 121.82

$ 1,014.01

$ 2,143.70 $ 373.69 $ 2,517.39 89

7 - Toledo $ 712.60 $ 123.67

$ 836.27

$ 1,840.30 $ 353.89 $ 2,194.19 102

8 - Warren/Youngstown $ 735.25 $ 79.47

$ 814.72

$ 1,942.48 $ 210.59 $ 2,153.07 83

EMPLOYEES COVERED

1 - 49 $ 821.78 $ 107.16

$ 928.94 $ 2,064.95 $ 312.50 $ 2,377.45 123

50 - 99 $ 756.24 $ 111.83

$ 868.07 $ 1,947.02 $ 307.52 $ 2,254.54 152

100 - 149 $ 748.26 $ 118.79

$ 867.05 $ 1,894.93 $ 317.50 $ 2,212.43 206

150 - 249 $ 747.09 $ 129.43

$ 876.52 $ 1,878.63 $ 356.80 $ 2,235.43 223

250 - 499 $ 736.60 $ 113.74

$ 850.34 $ 1,886.56 $ 315.36 $ 2,201.92 169

500 - 999 $ 711.07 $ 131.31

$ 842.38 $ 1,804.20 $ 345.43 $ 2,149.63 72

1,000 or more $ 703.62 $ 117.40

$ 821.02 $ 1,836.70 $ 371.62 $ 2,208.32 46

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans.

27

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

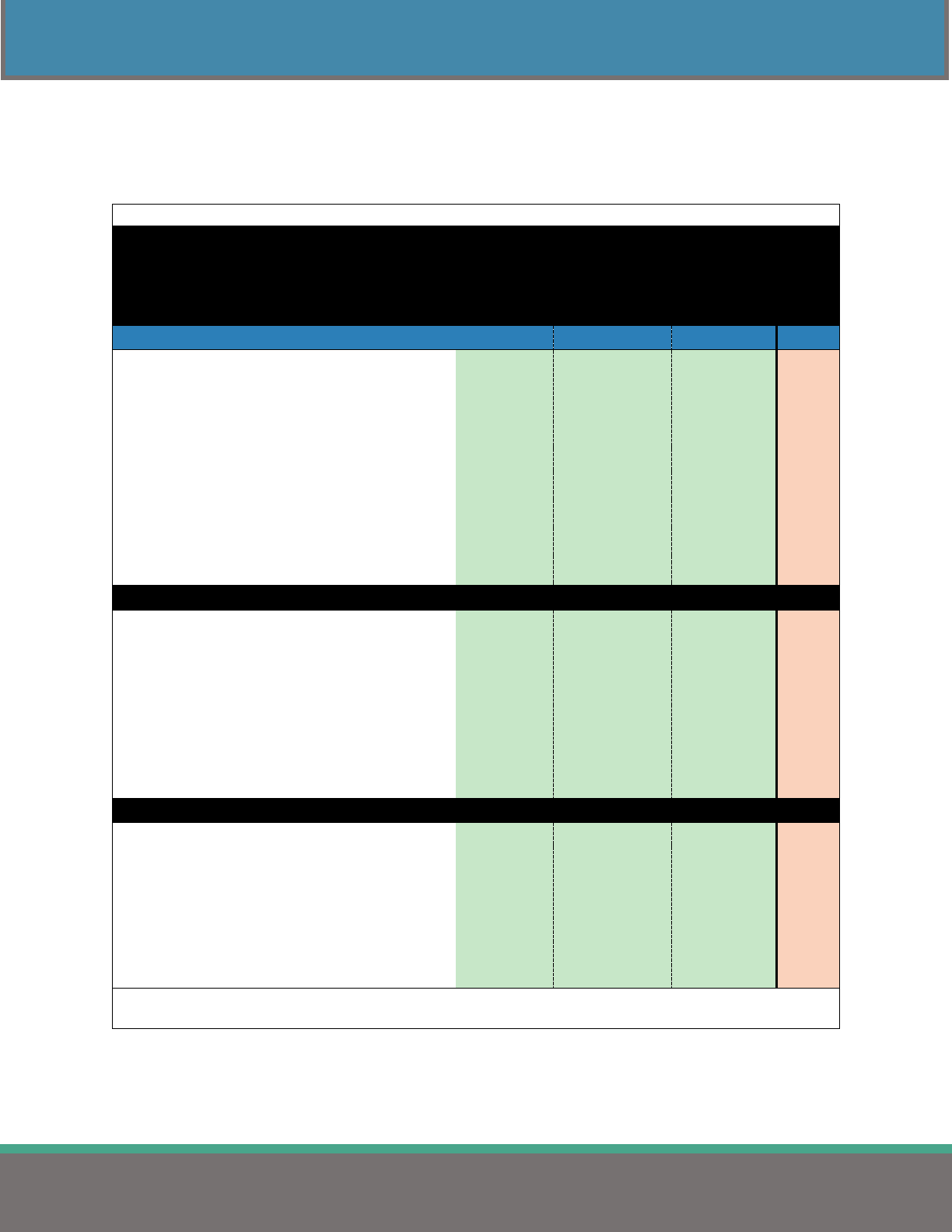

EMPLOYER & EMPLOYEE SHARE OF MEDICAL PREMIUM

Table 21 displays the employer and employee share of the medical premium for single and family plans

by jurisdiction. This data corresponds with the data displayed in Table 19 (located on page 25).

Table 21

Employer & Employee Cost Sharing Percentage

Towards Medical Premium

(PPO Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Employer

Share

Employee

Share

n

STATEWIDE

86.3%

13.7%

85.5%

14.5%

991

State of Ohio

87.2%

12.8%

86.5%

13.5%

2

Counties

86.5%

13.5%

86.0%

14.0%

80

Less than 50,000 87.8% 12.2% 87.2% 12.8%

26

50,000 - 149,999 85.4% 14.6% 84.8% 15.2%

34

150,000 or more 86.9% 13.1% 86.6% 13.4%

20

Cities

87.7%

12.3%

87.5%

12.5%

171

Less than 25,000 87.8% 12.2% 87.3% 12.7%

111

25,000 - 99,999 87.7% 12.3% 88.3% 11.7%

54

100,000 or more 86.7% 13.3% 85.0% 15.0%

6

Townships

91.0%

9.0%

90.4%

9.6%

39

Less than 10,000 94.0% 6.0% 93.7% 6.3%

17

10,000 - 29,999 88.8% 11.2% 88.5% 11.5%

17

30,000 or more 89.4% 10.6% 87.1% 12.9%

5

School Districts & ESCs

85.8%

14.2%

84.7%

15.3%

630

Less than 1,000 86.5% 13.5% 85.7% 14.3%

163

1,000 - 2,499 85.6% 14.4% 84.6% 15.4%

257

2,500 - 9,999 85.8% 14.2% 85.0% 15.0%

153

10,000 or more 85.3% 14.7% 80.3% 19.7%

14

Educational Svc Centers 84.2% 15.8% 81.4% 18.6%

43

Colleges & Universities

84.0%

16.0%

83.1%

16.9%

32

Fire Districts

91.0%

9.0%

90.8%

9.2%

3

Metro Housing Authorities 85.1% 14.9% 83.5% 16.5%

21

Port Authorities 86.1% 13.9% 86.1% 13.9%

1

Regional Transit Authorities 88.3% 11.7% 88.2% 11.8%

12

Note: Rows formatted with bold font include all PPO plans reported for the comparison group.

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans

28

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

Table 22 is a continuation of Table 21 and breaks down the employer and employee percent share costs

by region and number of employees covered. This data corresponds with the data displayed in Table 20.

Table 22

Employer & Employee Cost Sharing Percentage

Towards Medical Premium by Region

(PPO Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Employer

Share

Employee

Share

n

STATEWIDE

86.3%

13.7%

85.5%

14.5%

991

REGION

1 - Akron/Canton

87.2%

12.8%

87.2%

12.8%

171

2 - Cincinnati

83.9%

16.1%

82.4%

17.6%

85

3 - Cleveland

87.2%

12.8%

87.4%

12.6%

218

4 - Columbus

85.2%

14.8%

83.5%

16.5%

156

5 - Dayton

82.6%

17.4%

80.8%

19.2%

87

6 - Southeast Ohio

87.8%

12.2%

85.5%

14.5%

89

7 - Toledo

85.4%

14.6%

84.2%

15.8%

102

8 - Warren/Youngstown

90.2%

9.8%

90.2%

9.8%

83

EMPLOYEES COVERED

1 - 49

87.8%

12.2%

87.1%

12.9%

123

50 - 99

87.0%

13.0%

86.1%

13.9%

152

100 - 149

86.4%

13.6%

85.9%

14.1%

206

150 - 249

85.4%

14.6%

84.4%

15.6%

223

250 - 499

86.8%

13.2%

85.9%

14.1%

169

500 - 999

84.5%

15.5%

84.0%

16.0%

72

1,000 or more

85.7%

14.3%

83.7%

16.3%

46

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans.

29

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

NETWORK DEDUCTIBLES

Table 23 shows the average deductibles for jurisdictions, regions, and the number of employees covered

for PPO plans.

Table 23

Average In-Network Deductible Amount

(PPO Plans)

Comparison Group

Single

Family

n

STATEWIDE $ 496

$ 1,009

991

State of Ohio

$ 400

$ 800

2

Counties

$ 569

$ 1,184

80

Cities

$ 426

$ 872

171

Townships

$ 418

$ 910

39

School Districts & ESCs

$ 492

$ 1,012

630

Colleges & Universities

$ 814

$ 1,184

32

Fire Districts

$ 667

$ 1,333

3

Metro Housing Authorities

$ 561

$ 1,277

21

Port Authorities

$ 750

$ 1,500

1

Regional Transit Authorities

$ 433

$ 908

12

REGION

1 - Akron/Canton

$ 390

$ 791

171

2 - Cincinnati

$ 592

$ 1,224

85

3 - Cleveland

$ 526

$ 1,044

218

4 - Columbus

$ 463

$ 1,018

156

5 - Dayton

$ 437

$ 916

87

6 - Southeast Ohio

$ 477

$ 1,050

89

7 - Toledo

$ 724

$ 1,314

102

8 - Warren/Youngstown

$ 403

$ 814

83

EMPLOYEES COVERED

1 - 49

$ 544

$ 1,177

123

50 - 99

$ 464

$ 962

152

100 - 149

$ 502

$ 958

206

150 - 249

$ 456

$ 936

223

250 - 499

$ 523

$ 1,064

169

500 - 999

$ 547

$ 1,114

72

1,000 or more

$ 459

$ 921

46

Note: Average deductible amounts include plans where employees contribute $0 to the annual deductible.

Note: n: number of plans.

30

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

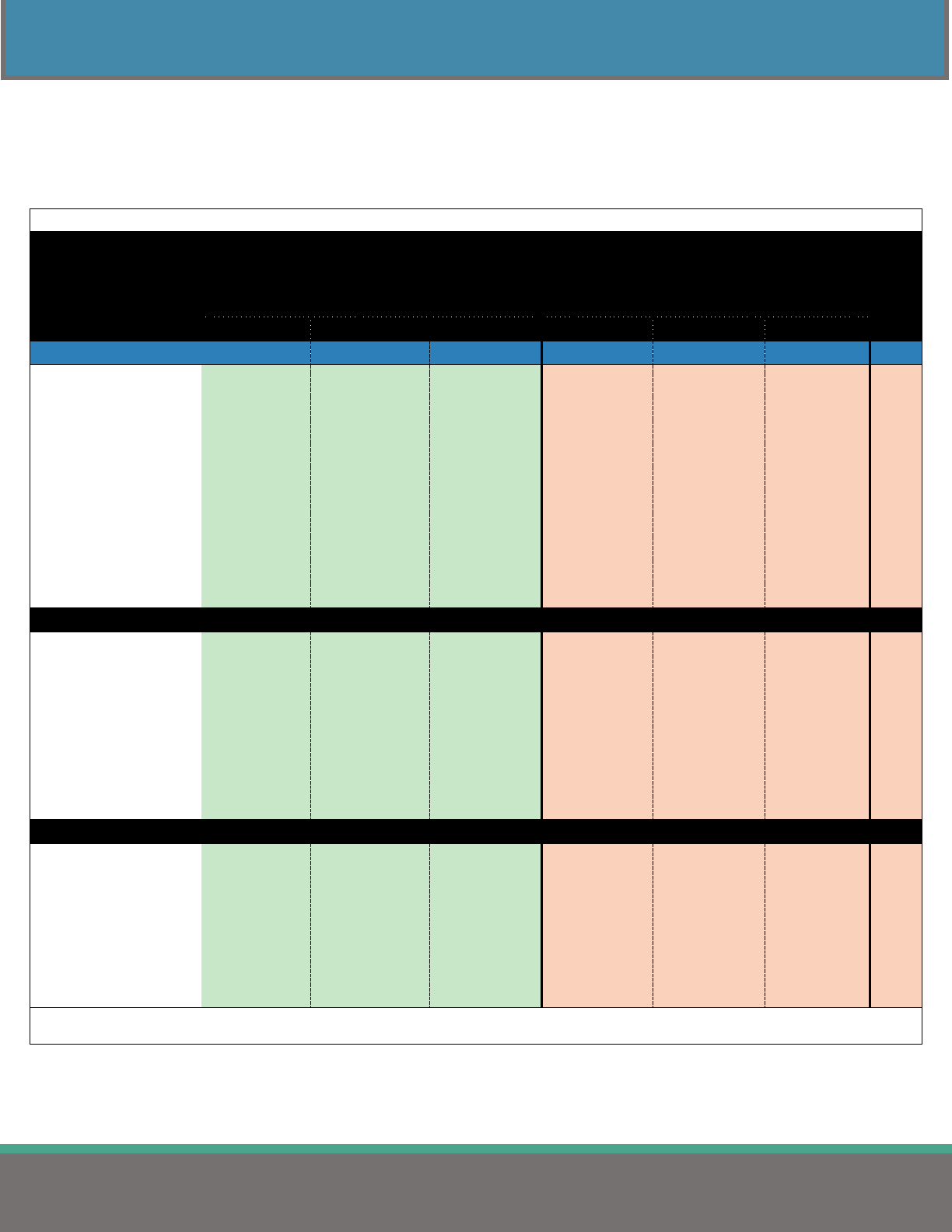

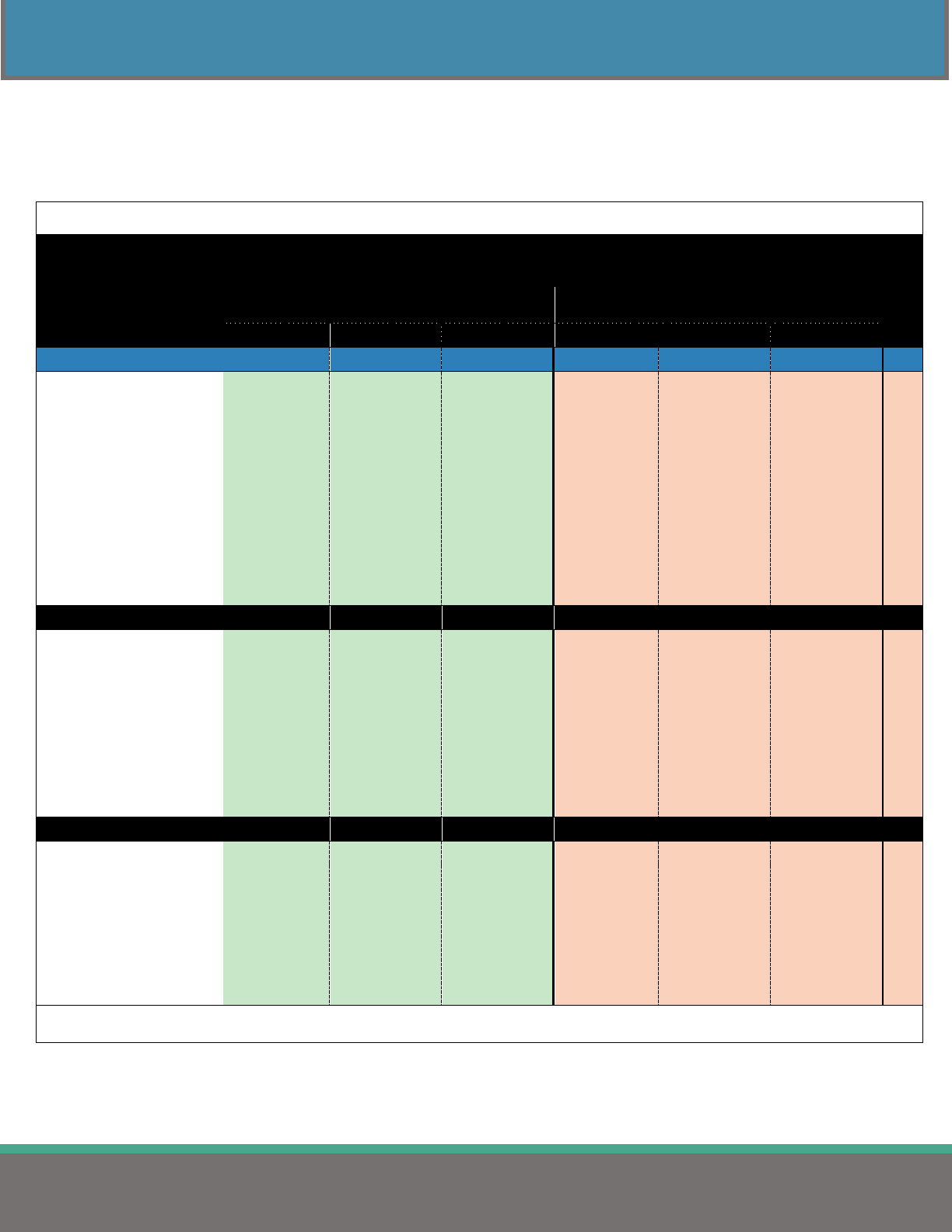

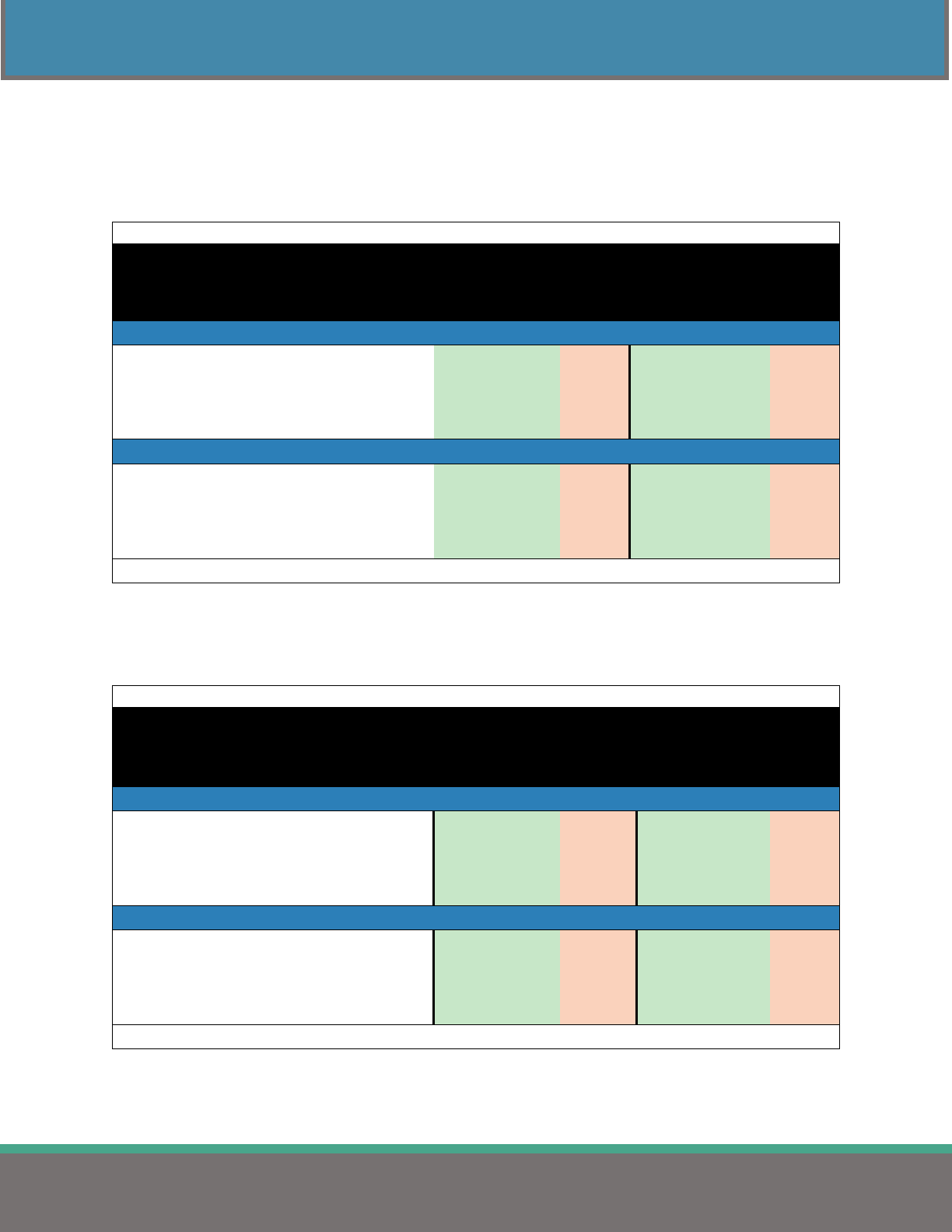

Figures 11 and 12 show the percent of plans in each deductible category for single and family coverage

displayed in Table 23.

Figure 11

Figure 12

5.6%

6.3%

40.0%

47.6%

0.5%

Deductible Categories for Single

In-Network Medical Coverage

$0

$1-$124

$125-$499

$500-$1,399

$1,400 or more

5.6%

5.8%

38.8%

49.0%

0.8%

Deductible Categories for Family

In-Network Medical Coverage

$0

$1-$249

$250-$899

$900-$2,799

$2,800 or more

31

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

NON-NETWORK DEDUCTIBLES

Table 24 shows the average non-network deductibles for jurisdictions, regions, and the number of

employees covered.

Table 24

Average Non-Network Deductible Amount

(PPO Plans)

Comparison Group

Single

Family

n

STATEWIDE $ 1,182

$ 2,403 991

State of Ohio

$ 800

$ 1,600

2

Counties

$ 1,211

$ 2,507

80

Cities

$ 1,119

$ 2,314

171

Townships

$ 2,372

$ 4,806

39

School Districts & ESCs

$ 1,026

$ 2,115

630

Colleges & Universities

$ 1,860

$ 2,817

32

Fire Districts

$ 12,750

$ 25,500

3

Metro Housing Authorities

$ 2,011

$ 4,259

21

Port Authorities

$ 2,250

$ 4,500

1

Regional Transit Authorities

$ 1,473

$ 2,991

12

REGION

1 - Akron/Canton

$ 917

$ 1,882

171

2 - Cincinnati

$ 1,802

$ 3,859

85

3 - Cleveland

$ 1,047

$ 2,071

218

4 - Columbus

$ 1,043

$ 2,257

156

5 - Dayton

$ 1,488

$ 3,090

87

6 - Southeast Ohio

$ 1,168

$ 2,399

89

7 - Toledo

$ 1,486

$ 2,703

102

8 - Warren/Youngstown

$ 1,050

$ 2,085

83

EMPLOYEES COVERED

1 - 49

$ 1,814

$ 3,747

123

50 - 99

$ 1,263

$ 2,626

152

100 - 149

$ 1,116

$ 2,130

206

150 - 249

$ 978

$ 1,980

223

250 - 499

$ 1,060

$ 2,172

169

500 - 999

$ 1,128

$ 2,401

72

1,000 or more

$ 1,094

$ 2,307

46

Note: Average deductible amounts include plans where employees contribute $0 to the annual deductible.

Note: n: number of plans.

32

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

OUT-OF-POCKET MAXIMUMS

Tables 25 and 26 give the average, minimum, and maximum out-of-pocket maximums for single and

family medical coverage.

Table 25

Average In-Network Out-of-Pocket Maximums

(PPO Plans)

Single

Family

Comparison Group

Average

Minimum

Maximum

Average

Minimum

Maximum

n

STATEWIDE $ 2,666

$ 0

$ 9,100

$ 5,365

$ 0

$ 18,200 991

State of Ohio $ 2,500 $ 2,500

$ 2,500

$ 5,000 $ 5,000 $ 5,000

2

Counties $ 2,630 $ 400

$ 7,900

$ 5,359 $ 800 $ 15,800

80

Cities $ 2,171

$ 0

$ 7,350

$ 4,359

$ 0

$ 14,700

171

Townships $ 2,309

$ 0

$ 7,150

$ 4,813

$ 0

$ 14,300

39

School Districts & ESCs $ 2,775

$ 0

$ 9,100

$ 5,555

$ 0

$ 18,200

630

Colleges & Universities $ 3,559 $ 900

$ 8,150

$ 7,005 $ 1,800 $ 14,700

32

Fire Districts $ 5,667 $ 3,000

$ 8,000

$ 11,333 $ 6,000 $ 16,000

3

Metro Housing Authorities $ 2,703 $ 350

$ 6,600

$ 6,299 $ 700 $ 15,000

21

Port Authorities $ 5,700 $ 5,700

$ 5,700

$ 11,400 $ 11,400 $ 11,400

1

Regional Transit

Authorities

$ 1,958 $ 200

$ 3,500

$ 3,750 $ 400 $ 6,500

12

REGION

1 - Akron/Canton $ 1,700

$ 0

$ 8,500

$ 3,416

$ 0

$ 17,100

171

2 - Cincinnati $ 3,110 $ 170

$ 8,000

$ 6,280 $ 500 $ 16,000

85

3 - Cleveland $ 3,345

$ 0

$ 8,700

$ 6,713

$ 0

$ 17,400

218

4 - Columbus $ 2,662

$ 0

$ 9,100

$ 5,491

$ 0

$ 18,200

156

5 - Dayton $ 2,060

$ 0

$ 6,600

$ 4,141

$ 0

$ 13,200

87

6 - Southeast Ohio $ 2,697 $ 200

$ 9,100

$ 5,285 $ 400 $ 18,200

89

7 - Toledo $ 2,976 $ 400

$ 9,100

$ 5,851 $ 1,038 $ 18,200

102

8 - Warren/Youngstown $ 2,671 $ 350

$ 8,150

$ 5,463 $ 400 $ 16,300

83

EMPLOYEES COVERED

1 - 49 $ 2,630

$ 0

$ 8,000

$ 5,391

$ 0

$ 16,000

123

50 - 99 $ 2,409

$ 0

$ 8,150

$ 4,943

$ 0

$ 16,300

152

100 - 149 $ 2,703 $ 50

$ 9,100

$ 5,359 $ 100 $ 18,200

206

150 - 249 $ 2,707

$ 0

$ 9,100

$ 5,417

$ 0

$ 18,200

223

250 - 499 $ 2,810

$ 0

$ 9,100

$ 5,623

$ 0

$ 18,200

169

500 - 999 $ 2,863

$ 0

$ 9,100

$ 5,769

$ 0

$ 18,200

72

1,000 or more $ 2,408 $ 500

$ 6,600

$ 4,883 $ 1,000 $ 13,200

46

Note: Excludes plans that have unlimited out-of-network maximums.

Note: n: number of plans.

33

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – PPO PLANS

Table 26

Average Non-Network Out-of-Pocket Maximums

(PPO Plans)

Single

Family

Comparison Group

Average

Minimum

Maximum

Average

Minimum

Maximum

n

STATEWIDE $ 4,244 $ 150

$ 32,600

$ 8,564

$ 300

$ 50,000

991

State of Ohio $ 5,000 $ 5,000

$ 5,000

$ 10,000

$ 10,000

$ 10,000

2

Counties $ 5,027 $ 800

$ 22,050

$ 10,727

$ 1,800

$ 50,000

80

Cities $ 4,335 $ 150

$ 22,050

$ 8,615

$ 300

$ 44,100

171

Townships $ 7,430 $ 1,500

$ 21,000

$ 15,030

$ 3,000

$ 42,000

39

School Districts & ESCs $ 3,737 $ 340

$ 16,000

$ 7,538

$ 500

$ 32,000

630

Colleges & Universities $ 6,417 $ 1,800

$ 32,600

$ 11,174

$ 3,600

$ 20,000

32

Fire Districts $ 21,000 $ 18,000

$ 24,000

$ 42,000

$ 36,000

$ 48,000

3

Metro Housing

Authorities

$ 4,781 $ 1,000

$ 12,000

$ 11,574

$ 3,000

$ 30,000

21

Port Authorities - - - - - - 1

Regional Transit

Authorities

$ 2,956 $ 1,300

$ 4,500

$ 5,633

$ 2,500

$ 9,000

12

REGION

1 - Akron/Canton $ 3,063 $ 150

$ 22,050

$ 5,995

$ 300

$ 44,100

171

2 - Cincinnati $ 6,421 $ 340

$ 24,000

$ 13,419

$ 1,000

$ 48,000

85

3 - Cleveland $ 3,603 $ 400

$ 22,050

$ 7,192

$ 500

$ 44,100

218

4 - Columbus $ 4,499 $ 500

$ 16,000

$ 9,107

$ 800

$ 32,000

156

5 - Dayton $ 4,478 $ 1,000

$ 18,000

$ 9,099

$ 2,000

$ 36,000

87

6 - Southeast Ohio $ 4,674 $ 600

$ 21,000

$ 9,400

$ 1,200

$ 42,000

89

7 - Toledo $ 4,704 $ 800

$ 32,600

$ 9,305

$ 1,998

$ 50,000

102

8 - Warren/Youngstown $ 3,713 $ 900

$ 20,700

$ 7,673

$ 900

$ 41,400

83

EMPLOYEES COVERED

1 - 49 $ 6,093 $ 1,300

$ 24,000

$ 12,820

$ 2,600

$ 50,000

123

50 - 99 $ 4,645 $ 800

$ 22,050

$ 9,437

$ 1,200

$ 44,100

152

100 - 149 $ 4,063 $ 150

$ 32,600

$ 7,767

$ 300

$ 26,400

206

150 - 249 $ 3,430 $ 500

$ 15,200

$ 6,814

$ 1,000

$ 30,400

223

250 - 499 $ 3,878 $ 340

$ 22,050

$ 7,835

$ 700

$ 44,100

169

500 - 999 $ 3,871 $ 500

$ 14,200

$ 8,149

$ 500

$ 28,400

72

1,000 or more $ 4,223 $ 500

$ 9,300

$ 8,752

$ 1,000

$ 18,600

46

Note: Excludes plans that have unlimited out-of-network maximums.

Note: n: number of plans.

34

MEDICAL INSURANCE – HDHPs

2023 HEALTH INSURANCE REPORT

MEDICAL INSURANCE – HDHPs

HDHP PREMIUMS

The second most frequently utilized plan type is the High Deductible Health Plan (HDHP). HDHPs

account for 47.1% of all plans reported this year. Table 27 breaks down the average HDHP medical

premiums and the contribution amounts shared by the employer and the employee. These averages include

the costs of prescription, dental, and vision coverages when included with the medical premiums.

Table 27

Average Monthly Employer & Employee Contributions

Towards Medical Premium

(HDHP Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Total

Employer

Share

Employee

Share

Total

n

STATEWIDE $ 669.27 $ 87.75

$ 757.02 $ 1,799.78 $ 262.13 $ 2,061.91 939

State of Ohio $ 697.00 $ 78.00

$ 775.00 $ 2,089.00 $ 233.00 $ 2,322.00 1

Counties $ 655.21 $ 91.51

$ 746.72 $ 1,838.48 $ 289.19 $ 2,127.67 60

Less than 50,000 $ 676.33 $ 112.35

$ 788.68 $ 1,863.79 $ 350.67 $ 2,214.46 30

50,000 - 149,999 $ 646.44 $ 82.92

$ 729.36 $ 1,850.22 $ 256.84 $ 2,107.06 19

150,000 or more $ 614.68 $ 51.42

$ 666.10 $ 1,749.17 $ 177.38 $ 1,926.55 11

Cities $ 679.22 $ 79.79

$ 759.01 $ 1,914.82 $ 237.96 $ 2,152.78 186

Less than 25,000 $ 668.61 $ 77.29

$ 745.90 $ 1,914.29 $ 234.50 $ 2,148.79 145

25,000 - 99,999 $ 713.76 $ 91.25

$ 805.01 $ 1,950.77 $ 257.16 $ 2,207.93 38

100,000 or more $ 782.81 $ 66.74

$ 849.55 $ 1,531.84 $ 179.65 $ 1,711.49 3

Townships $ 677.38 $ 61.27

$ 738.65 $ 1,961.18 $ 185.46 $ 2,146.64 108

Less than 10,000 $ 716.21 $ 58.42

$ 774.63 $ 2,034.56 $ 171.35 $ 2,205.91 56

10,000 - 29,999 $ 664.62 $ 53.65

$ 718.27 $ 1,971.07 $ 164.09 $ 2,135.16 36

30,000 or more $ 577.54 $ 86.22

$ 663.76 $ 1,705.67 $ 277.17 $ 1,982.84 16

School Districts & ESCs $ 665.16 $ 94.40

$ 759.56 $ 1,702.31 $ 280.29 $ 1,982.60 491

Less than 1,000 $ 675.81 $ 87.88

$ 763.69 $ 1,761.58 $ 245.35 $ 2,006.93 136

1,000 - 2,499 $ 665.96 $ 97.54

$ 763.50 $ 1,726.14 $ 277.39 $ 2,003.53 196

2,500 - 9,999 $ 632.06 $ 91.15

$ 723.21 $ 1,590.06 $ 290.72 $ 1,880.78 104

10,000 or more $ 671.13 $ 104.36

$ 775.49 $ 1,601.70 $ 435.58 $ 2,037.28 13

Educational Svc Centers $ 705.63 $ 106.23

$ 811.86 $ 1,709.44 $ 331.35 $ 2,040.79 42

Colleges & Universities $ 643.43 $ 110.29

$ 753.72 $ 1,878.39 $ 329.85 $ 2,208.24 38

Fire Districts $ 505.36 $ 62.39

$ 567.75 $ 1,549.32 $ 204.22 $ 1,753.54 16

Metro Housing Authorities $ 822.82 $ 91.08

$ 913.90 $ 2,211.01 $ 253.56 $ 2,464.57 27

Port Authorities $ 600.98 $ 80.29

$ 681.27 $ 1,738.50 $ 232.15 $ 1,970.65 4

Regional Transit Authorities $ 662.74 $ 105.51

$ 768.25 $ 1,628.91 $ 312.72 $ 1,941.63 8

Note: Rows formatted with bold font include all HDHP plans reported for the comparison group.

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans

35

MEDICAL INSURANCE – HDHPs

2023 HEALTH INSURANCE REPORT

Table 28 organizes the same data in Table 27 by region and by the number of employees covered. These

averages include the costs of prescription, dental, and vision coverages when included with the medical

premiums. A breakdown of the regions is on page 61.

Table 28

Average Monthly Employer & Employee Contributions

Towards Medical Premium by Region

(HDHP Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Total

Employer

Share

Employee

Share

Total

n

STATEWIDE $ 669.27 $ 87.75 $ 757.02 $ 1,799.78 $ 262.13 $ 2,061.91 939

REGION

1 - Akron/Canton $ 607.95 $ 65.85 $ 673.80 $ 1,726.01 $ 185.07 $ 1,911.08 50

2 - Cincinnati $ 634.36 $ 85.64 $ 720.00 $ 1,763.21 $ 262.79 $ 2,026.00 134

3 - Cleveland $ 636.55 $ 61.33 $ 697.88 $ 1,720.53 $ 164.16 $ 1,884.69 107

4 - Columbus $ 711.87 $ 97.21 $ 809.08 $ 1,883.01 $ 309.95 $ 2,192.96 193

5 - Dayton $ 658.74 $ 106.64 $ 765.38 $ 1,799.48 $ 304.65 $ 2,104.13 173

6 - Southeast Ohio $ 736.30 $ 97.38 $ 833.68 $ 1,868.85 $ 296.64 $ 2,165.49 77

7 - Toledo $ 661.90 $ 85.55 $ 747.45 $ 1,761.49 $ 259.88 $ 2,021.37 158

8 - Warren/Youngstown $ 684.40 $ 59.95 $ 744.35 $ 1,839.23 $ 154.69 $ 1,993.92 47

EMPLOYEES COVERED

1 - 49 $ 686.52 $ 74.99 $ 761.51 $ 1,931.66 $ 232.22 $ 2,163.88 203

50 - 99 $ 671.99 $ 81.47 $ 753.46 $ 1,852.04 $ 226.16 $ 2,078.20 177

100 - 149 $ 668.92 $ 89.80 $ 758.72 $ 1,776.28 $ 257.07 $ 2,033.35 170

150 - 249 $ 677.16 $ 98.37 $ 775.53 $ 1,797.31 $ 282.36 $ 2,079.67 185

250 - 499 $ 661.91 $ 89.86 $ 751.77 $ 1,711.18 $ 277.32 $ 1,988.50 115

500 - 999 $ 624.75 $ 102.30 $ 727.05 $ 1,592.07 $ 352.33 $ 1,944.40 57

1,000 or more $ 609.67 $ 95.15 $ 704.82 $ 1,536.21 $ 340.46 $ 1,876.67 32

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans.

36

MEDICAL INSURANCE – HDHPs

2023 HEALTH INSURANCE REPORT

EMPLOYER & EMPLOYEE SHARE OF MEDICAL PREMIUM

Table 29 displays the employer and employee share of the medical premium for single and family plans by

jurisdiction. This data corresponds with the data displayed in Table 27.

Table 29

Employer & Employee Cost Sharing Percentage

Towards Medical Premium

(HDHP Plans)

Single

Family

Comparison Group

Employer

Share

Employee

Share

Employer

Share

Employee

Share

n

STATEWIDE

88.5%

11.5%

87.5%

12.5%

939

State of Ohio

89.9%

10.1%

90.0%

10.0%

1

Counties

87.9%

12.1%

86.7%

13.3%

60

Less than 50,000

85.7%

14.3%

84.2%

15.8%

30

50,000 - 149,999 88.9% 11.1% 88.2% 11.8% 19

150,000 or more

91.9%

8.1%

90.8%

9.2%

11

Cities

89.5%

10.5%

89.0%

11.0%

186

Less than 25,000 89.6% 10.4% 89.1% 10.9% 145

25,000 - 99,999 88.7% 11.3% 88.4% 11.6% 38

100,000 or more 92.1% 7.9% 89.2% 10.8% 3

Townships 91.4% 8.6% 91.6% 8.4% 108

Less than 10,000 92.0% 8.0% 93.0% 7.0% 56

10,000 - 29,999 92.5% 7.5% 92.0% 8.0% 36

30,000 or more

87.6%

12.4%

86.4%

13.6%

16

School Districts & ESCs 87.8% 12.2% 86.2% 13.8% 491

Less than 1,000

88.7%

11.3%

88.1%

11.9%

136

1,000 - 2,499

87.5%

12.5%

86.4%

13.6%

196

2,500 - 9,999 87.7% 12.3% 85.2% 14.8% 104

10,000 or more 86.4% 13.6% 79.2% 20.8% 13

Educational Svc Centers 86.7% 13.3% 83.7% 16.3% 42

Colleges & Universities 85.8% 14.2% 85.3% 14.7% 38

Fire Districts

89.3%

10.7%

88.5%

11.5%

16

Metro Housing Authorities

90.3%

9.7%

90.0%

10.0%

27

Port Authorities

88.3%

11.7%

88.3%

11.7%

4

Regional Transit Authorities

85.4%

14.6%

84.3%

15.7%

8

Note: Rows formatted with bold font include all HDHP plans reported for the comparison group.

Note: Includes plans where employees contribute $0 to the medical premium.

Note: Includes plans where the medical premium includes the cost of prescription and dental.

Note: n: number of plans

37

MEDICAL INSURANCE – HDHPs

2023 HEALTH INSURANCE REPORT

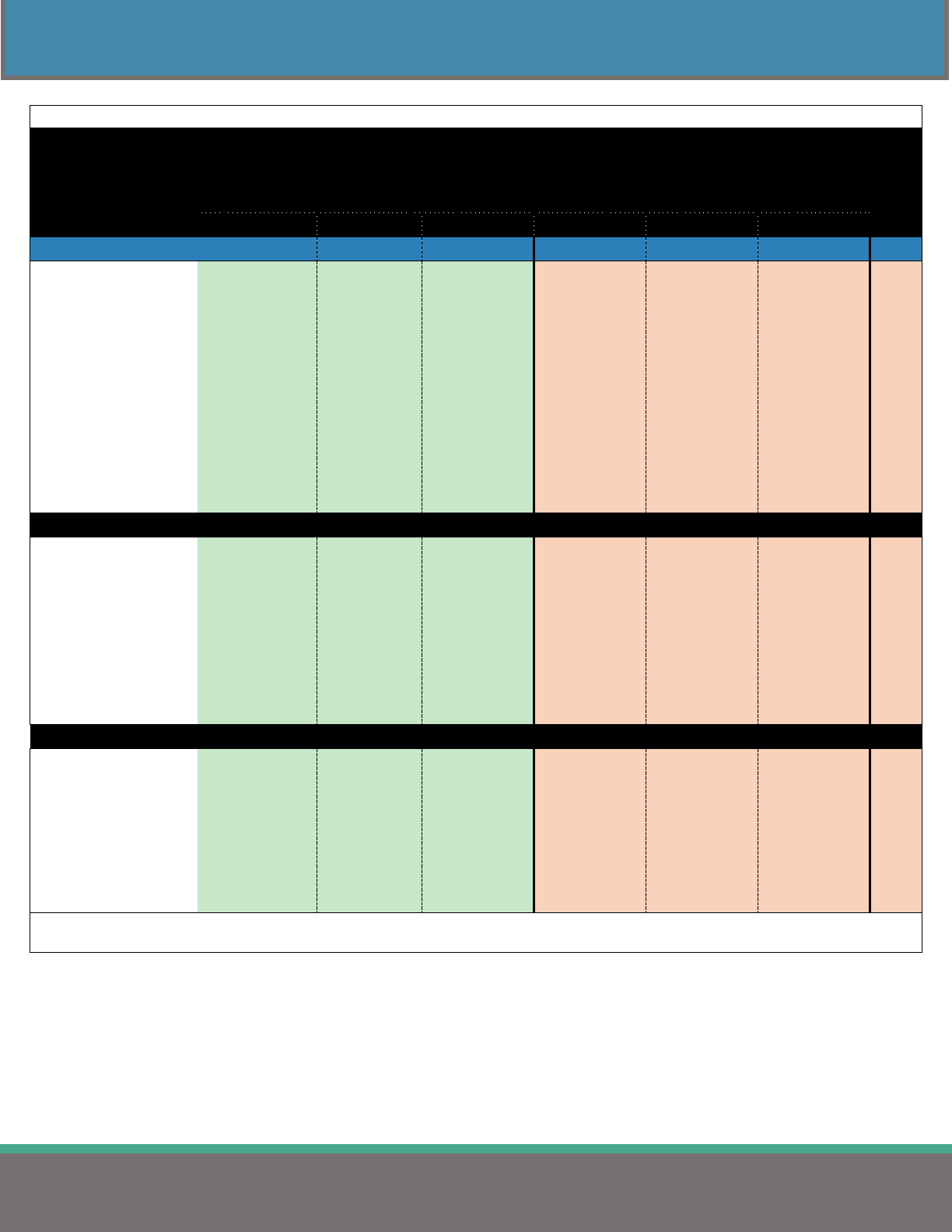

Table 30 is a continuation of Table 29 and breaks down the employer and employee percent share costs by

region and number of employees covered. This data corresponds with the data displayed in Table 28.

Table 30