© MDart10/Shutterstock.com

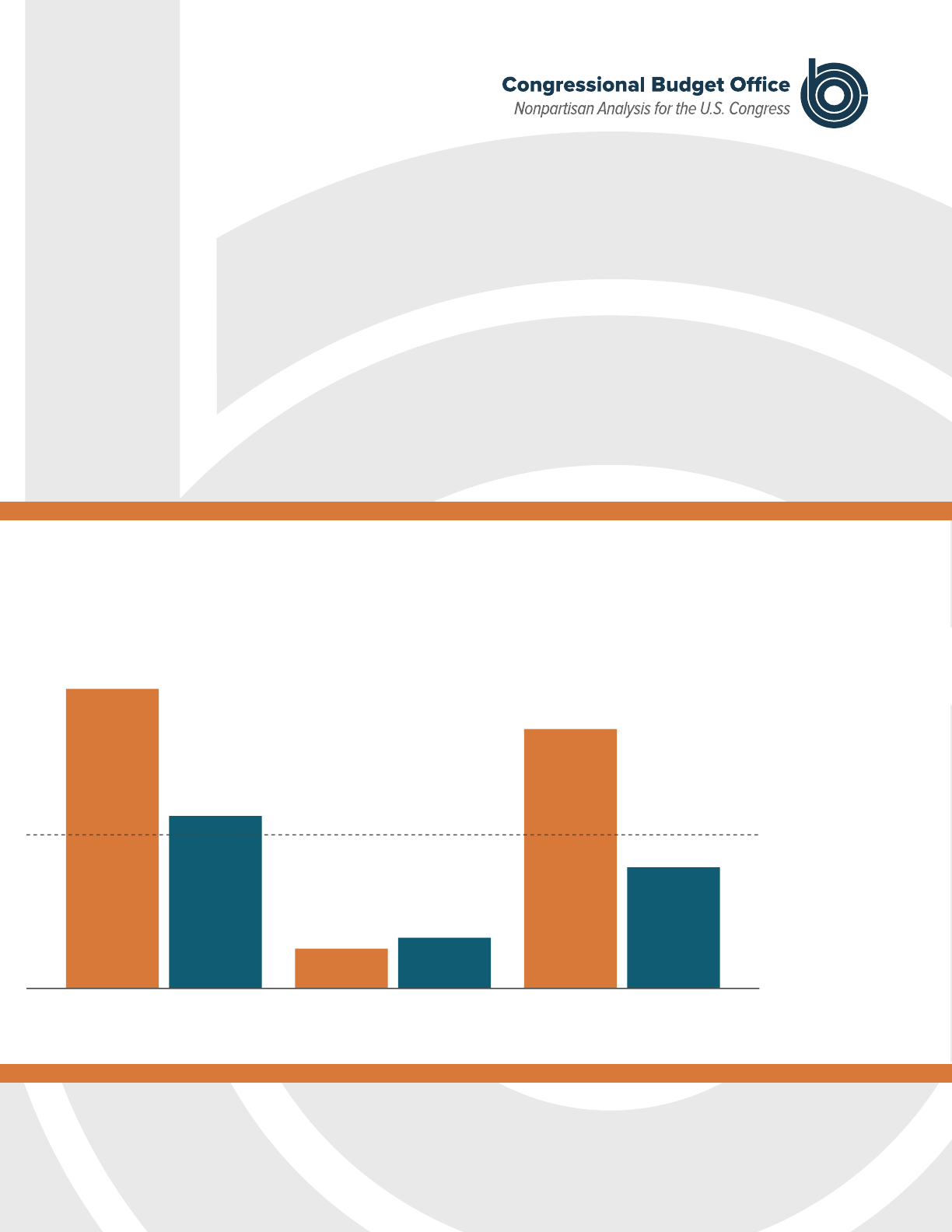

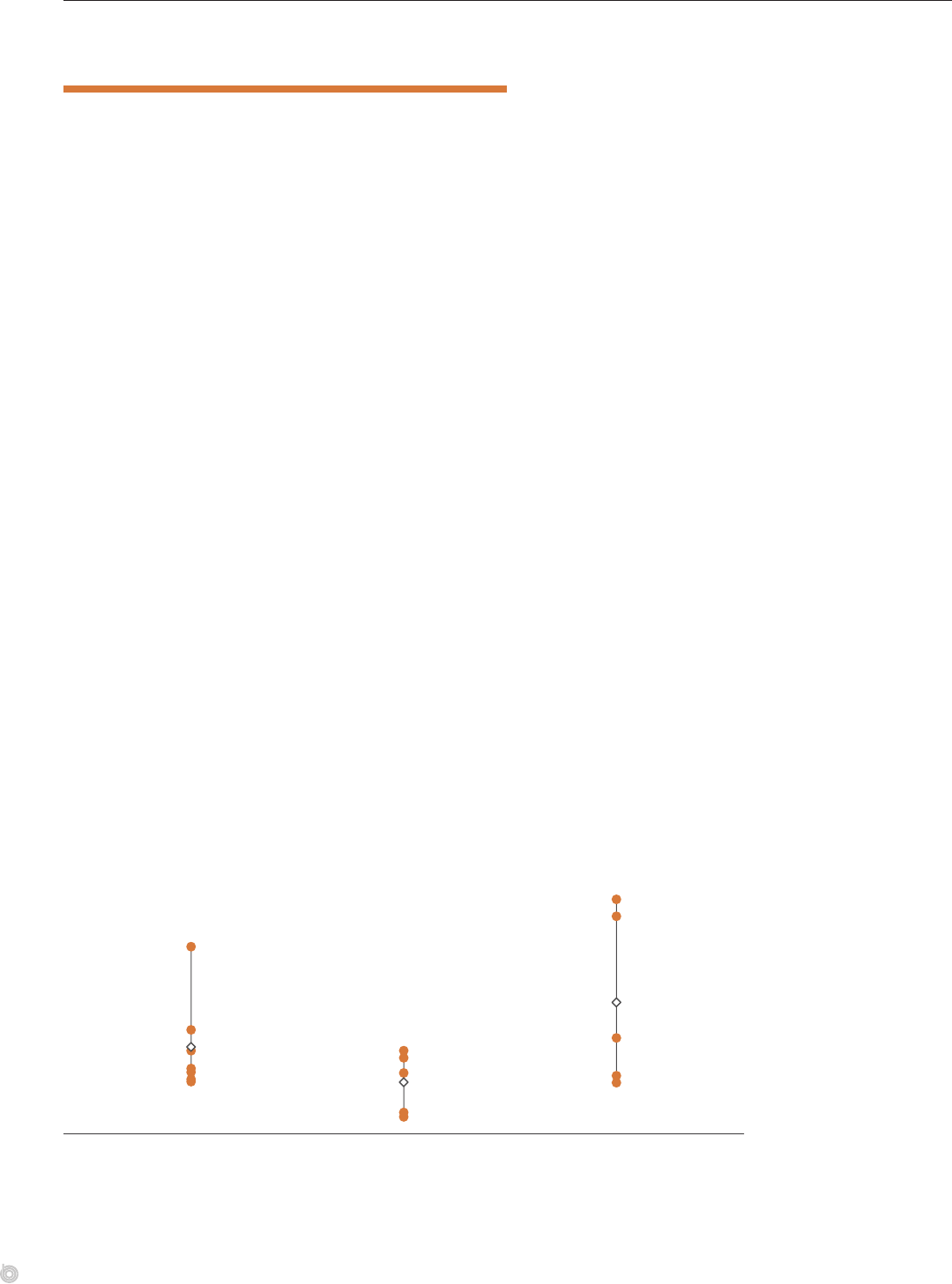

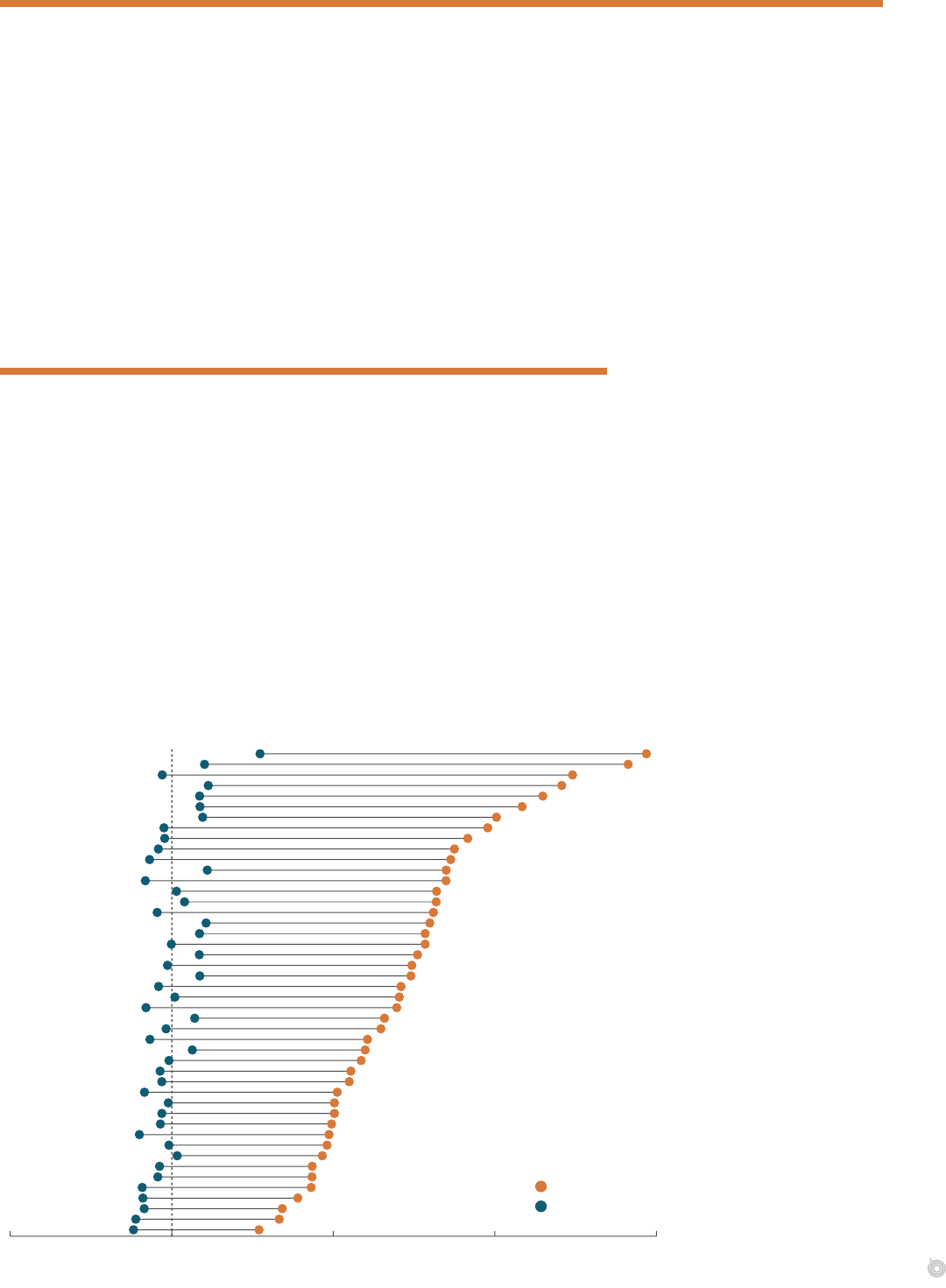

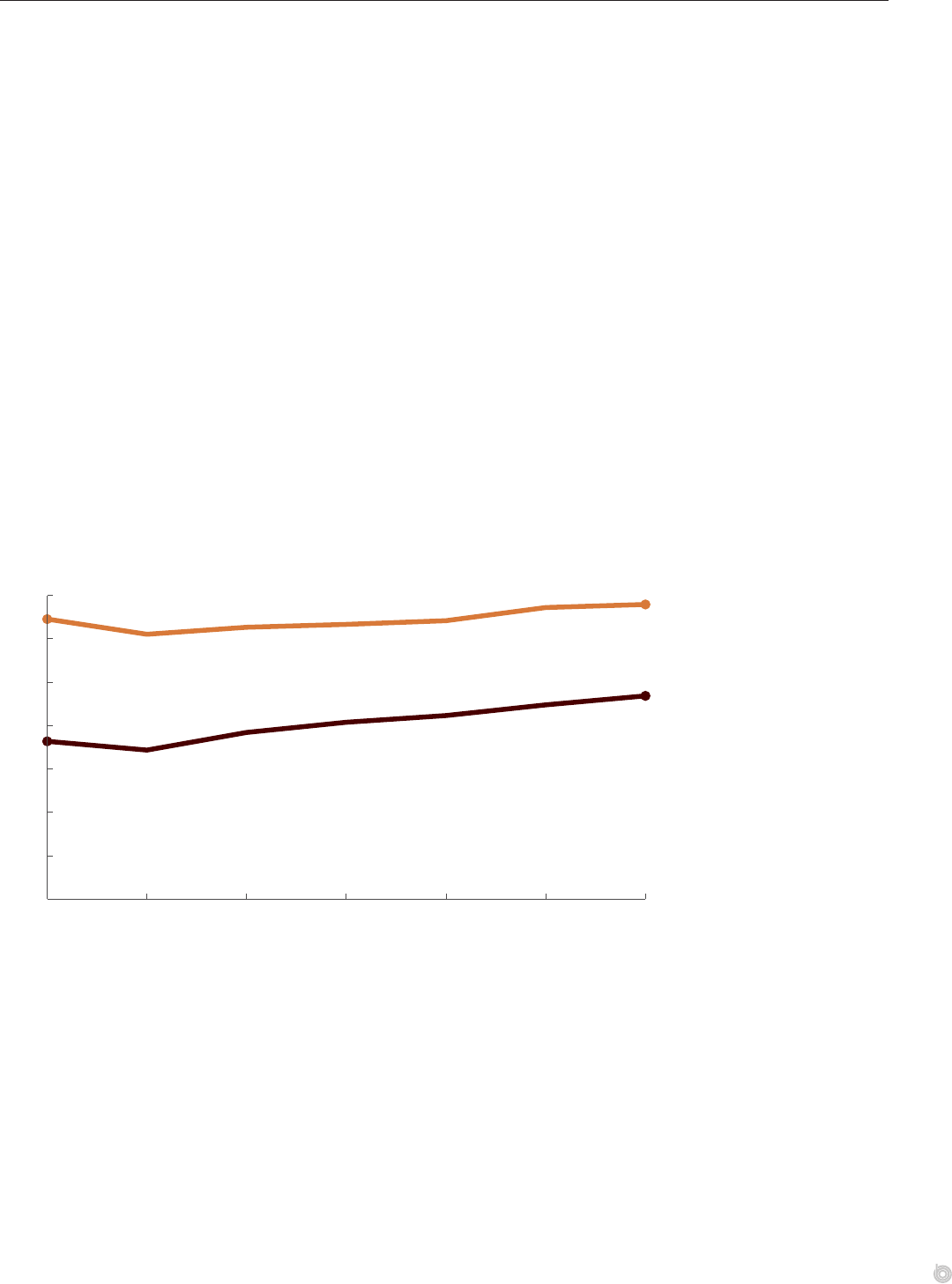

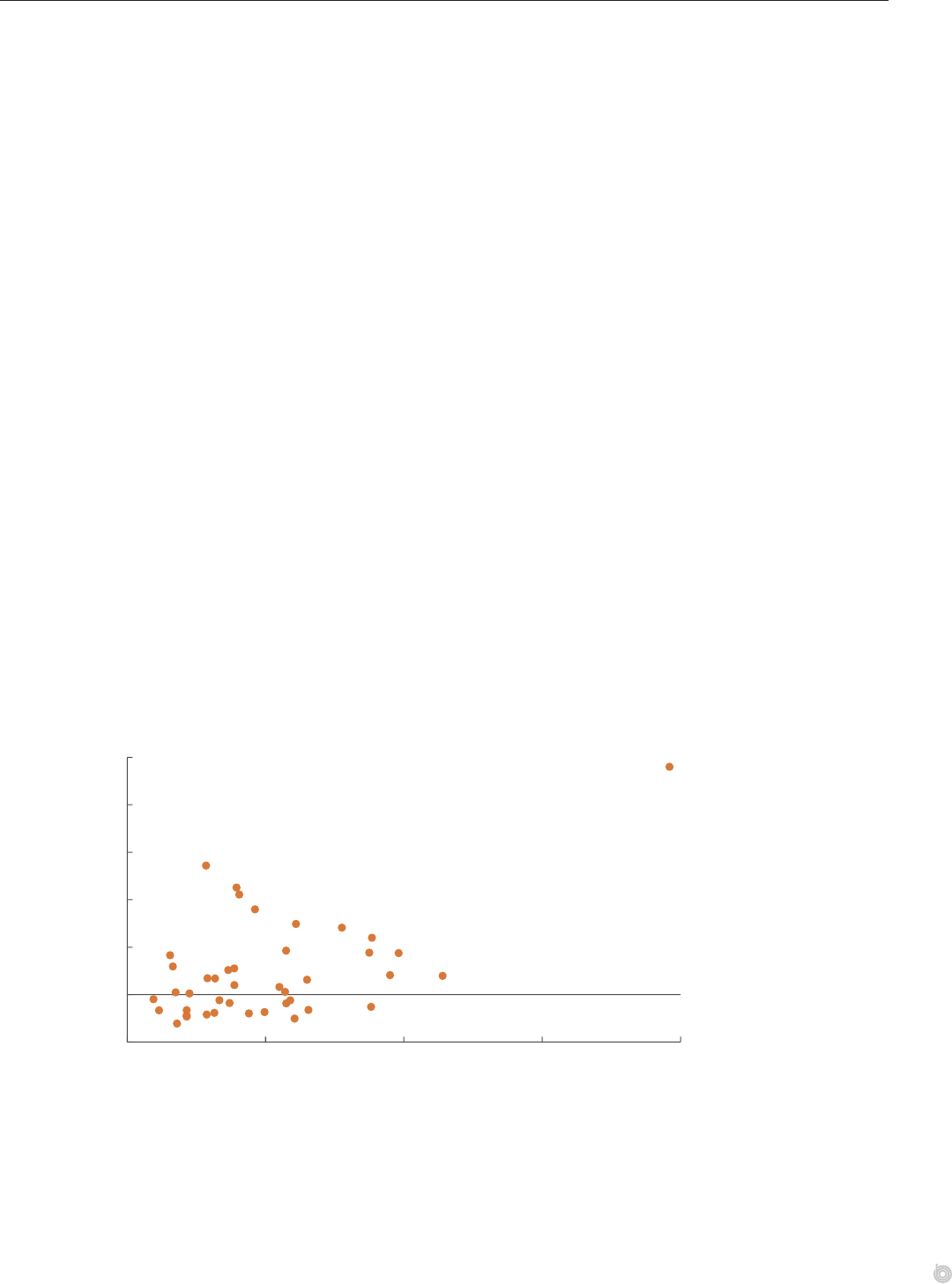

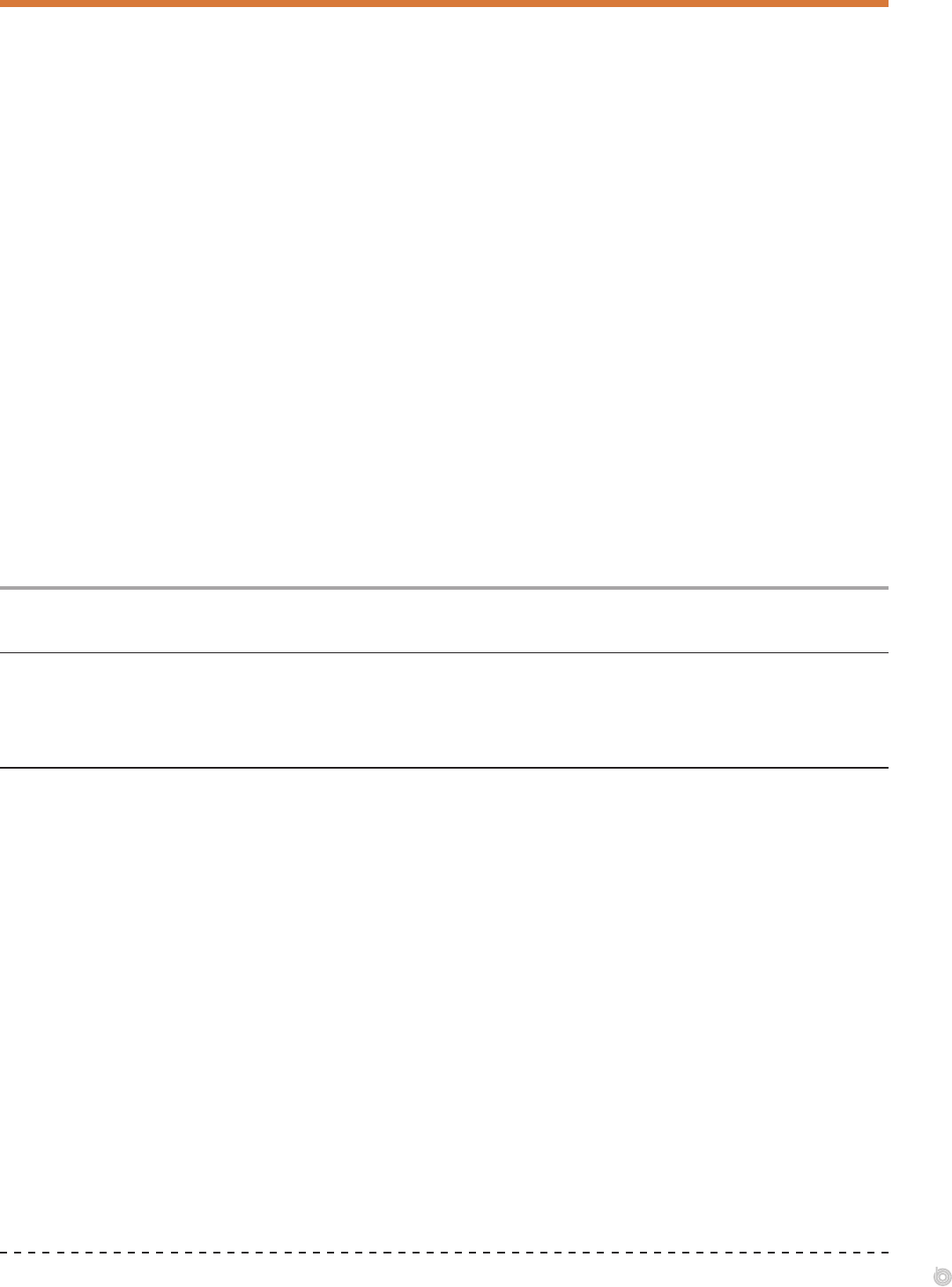

Average Annual Growth Rates of Spending, Utilization, and Prices for Hospitals’

and Physicians’ Services, 2013 to 2018

Percent

3.2

1.8

0.4

0.5

2.7

1.3

Spending per Person Utilization per Person Prices Paid to Providers

Inflation as

Measured by the

Gross Domestic

Product Price

Index (1.6)

Medicare Fee

for Service

Commercial

Insurers

JANUARY | 2022

The Prices That Commercial

Health Insurers and Medicare

Pay for Hospitals’ and

Physicians’ Services

At a Glance

Just over half of the total U.S. population receives health insurance through commercial plans that

are oered by employers or purchased by individuals. In recent years, commercial health insurers’

per-person spending on hospitals’ and physicians’ services has grown more quickly than analogous

spending by the Medicare fee-for-service (FFS) program, according to analysis by the Congressional

Budget Oce. e main reason for the growth of per-person spending by commercial insurers—and

for the dierence from the growth of per-person spending by Medicare FFS—has been rapid increases

in the prices that commercial insurers pay for hospitals’ and physicians’ services.

Prices paid by commercial insurers and Medicare FFS dier, and rise at dierent rates over time, in part

because of dierences in how the two sets of prices are determined. e prices that commercial insurers

pay for services from in-network health care providers result from negotiations between the insurers and

providers. Commercial insurers may try to obtain lower prices by excluding providers from their net-

works, but in many cases, their ability to do that is limited. e prices that Medicare FFS pays providers

are set administratively through laws and regulations, and providers can either take them or leave them.

CBO’s analysis and a review of the research literature found that commercial insurers pay much

higher prices for hospitals’ and physicians’ services than Medicare FFS does. In addition, the prices

that commercial insurers pay hospitals are much higher than hospitals’ costs. Paying higher prices

to providers can have several eects. First, it can increase insurers’ spending on claims, which may

lead to higher premiums, greater cost-sharing requirements for patients, reductions in the scope of

benets, or other adjustments to plans. Second, it can increase the federal government’s subsidies for

health care (that is, the government’s spending on health care plus forgone revenues from federal tax

preferences for health benets). And third, it can slow the growth of wages.

Compared with the prices paid by Medicare FFS, the prices paid by commercial insurers also vary

much more among and within geographic areas. Large variation in prices for similar services can be

evidence that markets are not operating eciently.

CBO examined potential explanations for why the prices paid by commercial insurers are higher

and more variable than those paid by Medicare FFS. CBO’s analysis and literature review suggest the

following conclusions:

•

Greater market power among providers consistently leads to prices for commercial insurers that

are higher than Medicare FFS’s prices and that vary more widely, both among and within areas.

Hospitals and physicians’ groups may have market power because they have a dominant share of

the market in an area or because an insurer sees them as essential to its network of providers.

•

Some of the variation in the prices that commercial insurers pay for hospitals’ and physicians’

services is explained by dierences in the prices of inputs needed to deliver those services.

•

Higher hospital quality is associated with higher prices paid by commercial insurers, although whether

there is a causal link between quality and prices, and the direction of any such link, is not clear.

•

e share of providers’ patients who are covered by Medicare and Medicaid is not related to higher

prices paid by commercial insurers. at nding suggests that providers do not raise the prices

they negotiate with commercial insurers to oset lower prices paid by government programs (a

concept known as cost shifting).

www.cbo.gov/publication/57422

Contents

Chapter 1: Levels of and Trends in Spending and Prices 1

Factors Driving the Growth of Per-Person HealthCareSpending 1

How Medicare’s Prices Are Determined 2

How Commercial Insurers’ Prices Are Determined 3

Sources of Upward and Downward Pressure on Prices 4

Average Prices for Hospitals’ Services 5

Average Prices for Physicians’ Services 6

How Payments to Hospitals Compare With Hospitals’ Costs 7

Chapter 2: The Implications of Price Increases 9

How Price Increases Aect People With Employment-Based Insurance 9

How Price Increases Aect Federal Subsidies for Commercial Health Insurance 10

Chapter 3: Variation in Prices Among and Within Geographic Areas 13

Prices for Hospitals’ Services: Variation Among States 13

Prices for Physicians’ Services: Variation Among States 14

Prices for Hospitals’ Services: Variation Within MetropolitanAreas 15

Prices for Physicians’ Services: Variation Within MetropolitanAreas 16

Chapter 4: Factors Aecting the Prices Paid by Commercial Insurers 17

Market Power and Commercial Insurers’ Prices 17

The Relationship Between Input Prices and Prices Paid toProviders 22

Quality of Care and Commercial Insurers’ Prices 24

Providers’ Administrative Spending and Commercial Insurers’Prices 25

Cost Shifting and Commercial Insurers’ Prices 26

Appendix A: Data Sources for Figures 29

Appendix B: Sources of Estimated Average Prices for Hospitals’ and Physicians’ Services 33

Appendix C: Studies Examining the Relationship Between Market Concentration for

Providers and Prices Paid by Commercial Insurers 39

About This Document 46

Notes

To produce this report, the Congressional Budget Oce adapted data and gures from a wide variety

of sources. Brief citations for the gures are included in the gures’ captions; full citations are listed in

Appendix A.

e Medicare data used in this report reect spending, utilization, and prices in the fee-for-service

(FFS) program. ey do not include data from the Medicare Advantage (MA) program, except

where noted. Although MA data are not as widely available as FFS data, published research suggests

that MA plans and the FFS program generally pay very similar prices for hospitals’ and physicians’

services. See Jared Lane K. Maeda and Lyle Nelson, “How Do the Hospital Prices Paid by Medicare

Advantage Plans and Commercial Plans Compare With Medicare Fee-for-Service Prices?” Inquiry,

vol. 55 (June 11, 2018), pp. 1–8, https://doi.org/10.1177/0046958018779654.

e prices paid by commercial insurers reect the actual amounts paid to providers, not providers’

billed charges (“list prices”). Depending on the data source, the prices paid by Medicare and com-

mercial insurers may or may not include cost-sharing amounts paid by patients. In most of the data

sources used in this report, spending and prices for physicians’ services also reect services provided

by other health care professionals, such as nurse practitioners and physician assistants.

Chapter 1: Levels of and Trends in

Spending and Prices

is chapter describes the growth of spending by commercial health insurers and Medicare’s fee-for-service (FFS)

program on hospitals’ and physicians’ services in recent years. It illustrates the role of price increases in fueling

thegrowth of spending by commercial insurers and describes how prices are determined for those insurers and

for Medicare. is chapter also discusses sources of upward and downward pressure on prices, compares prices for

Medicare and commercial insurers, and compares payments to hospitals with hospitals’ costs.

Factors Driving the Growth of Per-Person HealthCareSpending

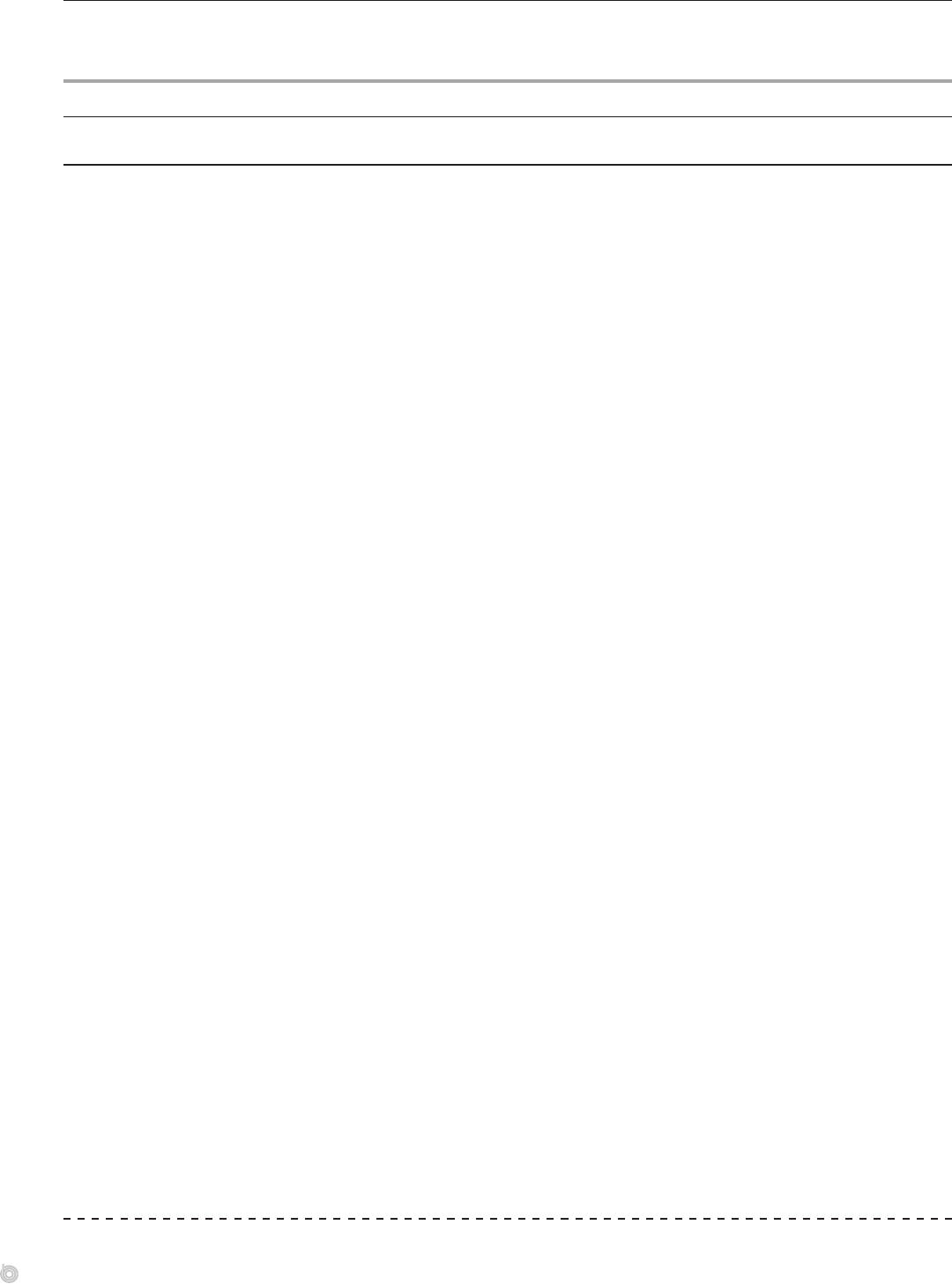

From 2013 to 2018, commercial insurers’ spending per person on inpatient and out-

patient hospital care and physicians’ services grew by an average of 3.2 percent a year, the

Congressional Budget Oce estimates. at spending growth was driven by increases in the

prices that commercial insurers paid for such services. Prices rose by an average of 2.7percent

a year—about 1 percentage point faster than average ination during that period, as mea-

sured by the change in the gross domestic product (GDP) price index.

1

CBO estimated the

increase in the prices paid by commercial insurers per unit of service (visits, procedures, and

admissions) from the growth of per-person spending and the quantity of services. at quan-

tity—“utilization” in the gure—was measured as the number of services provided, adjusted

for their intensity (the amount of resources or physicians’ eort used to provide them).

Utilization grew by less than 0.5 percent per year, on average, during the 2013–2018 period.

Per-person spending grew more slowly for the Medicare FFS program than for commerical

insurers—by 1.8 percent a year, on average—from 2013 to 2018. at spending growth also

stemmed mostly from price increases. e FFS program’s prices for hospitals’ and physicians’

services, which are updated regularly by statute and regulation, rose by an average of 1.3per-

cent a year. e quantity and intensity of services provided per person (which CBO esti-

mated from the growth of per-person spending and from price updates) increased by an

average of 0.5 percent a year during the 2013–2018 period.

Average Annual Growth Rates of Spending, Utilization, and Prices for Hospitals’ and Physicians’

Services, 2013 to 2018

Percent

GDP Price Index (1.6)

Medicare Fee

for Service

Commercial

Insurers

3.2

1.8

0.4

0.5

2.7

1.3

Spending per Person Utilization per Person Prices Paid to Providers

Increases in the prices paid

by commercial insurers and

Medicare FFS were the major

reason for growth in their per-

person spending on hospitals’

and physicians’ services.

Price increases were larger

for commercial insurers,

exceeding the rate of inflation.

(Source: CBO’s analysis

of data from MedPAC, the

Medicare trustees, and the

Health Care Cost Institute.)

2 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

How Medicare’s Prices Are Determined

e prices that the Medicare FFS program pays providers are set administratively through

laws and regulations. e program uses various payment schedules for dierent kinds of

services. For hospitals’ services that are covered by the inpatient or outpatient prospective

payment systems, the amount that Medicare pays hospitals is predetermined. at amount

is based on a at base-payment rate, which Medicare adjusts to account for geographic

dierences in input costs, for the intensity of services, and for patients’ health (in the case of

inpatient services). Rates are also adjusted for patients who are transferred to another hospital

paid under the inpatient prospective payment system or who are discharged to a post-acute

care setting (for certain diagnoses).

In addition, Medicare makes hospital-specic adjustments for inpatient services at hospitals

that operate residency training programs or that treat a disproportionate share of low-

income patients. Medicare also makes “outlier payments”—additional payments for cases

that are extraordinarily costly—for inpatient or outpatient services. (Some hospitals, such as

certain small hospitals that Medicare considers “critical access hospitals,” are not paid under

Medicare’s prospective payment systems.)

For services covered by Medicare’s physician fee schedule, Medicare pays a xed amount per

service, with adjustments for the relative amount of resources (physicians’ eort, practice

expenses, and liability insurance) typically used to provide a given service and for geographic

dierences in the costs of delivering care. Payments are further adjusted if multiple similar

services are furnished by the same provider on the same day or for certain characteristics of

providers. For example, Medicare reduces prices if a service is provided by a nonphysician

professional, such as a nurse practitioner or social worker, or if a physician is serving as an

assistant during a surgery.

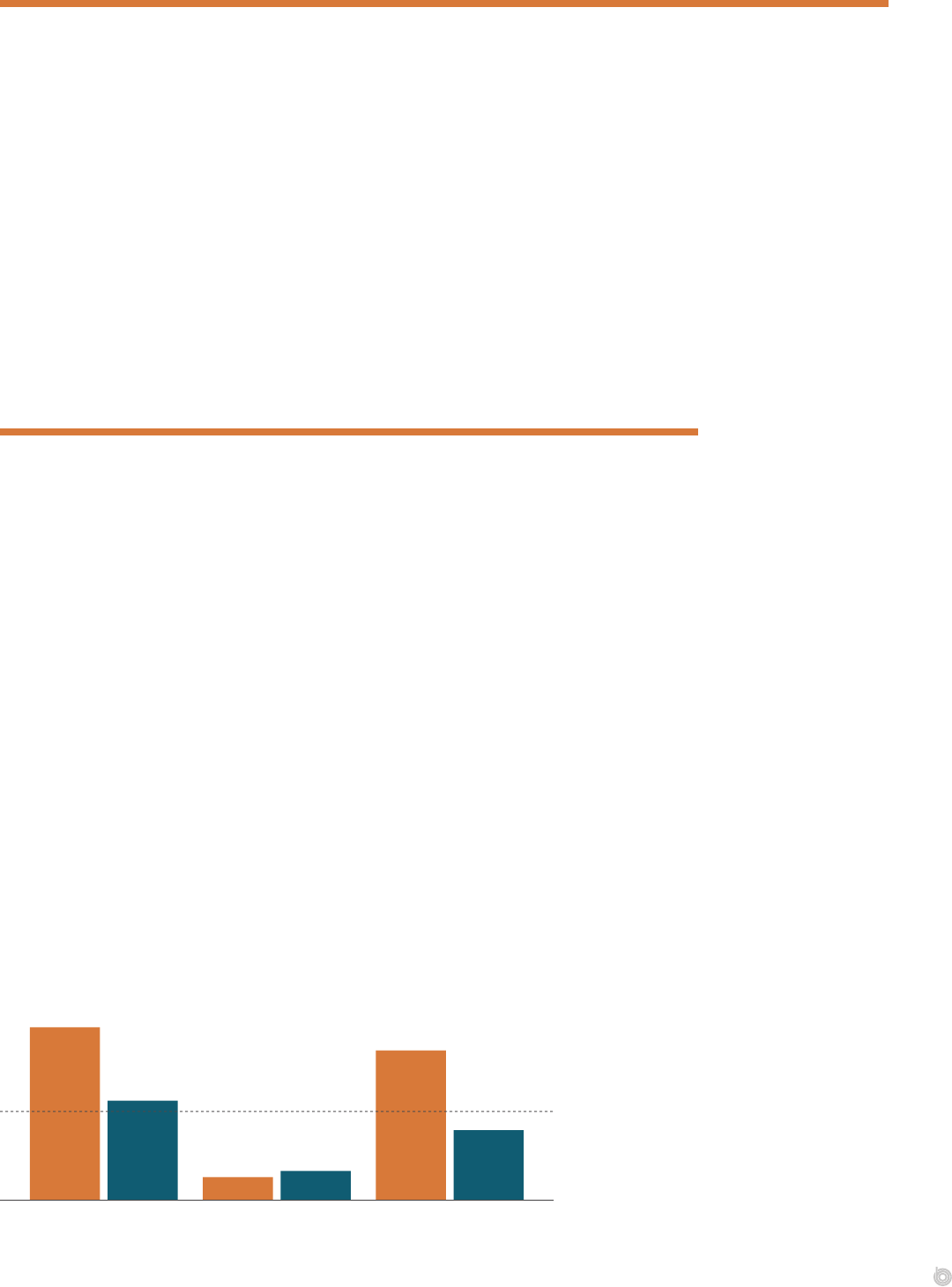

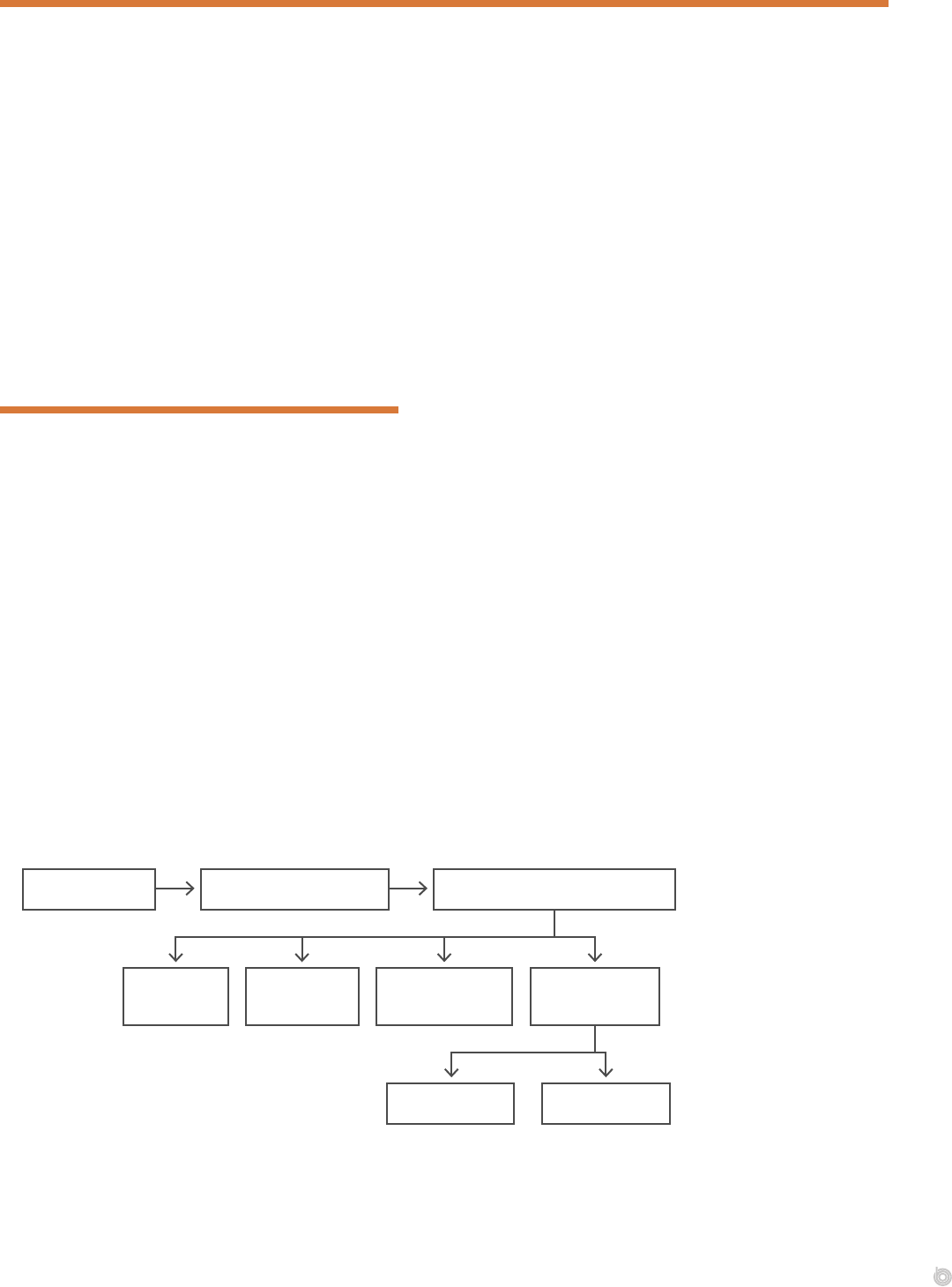

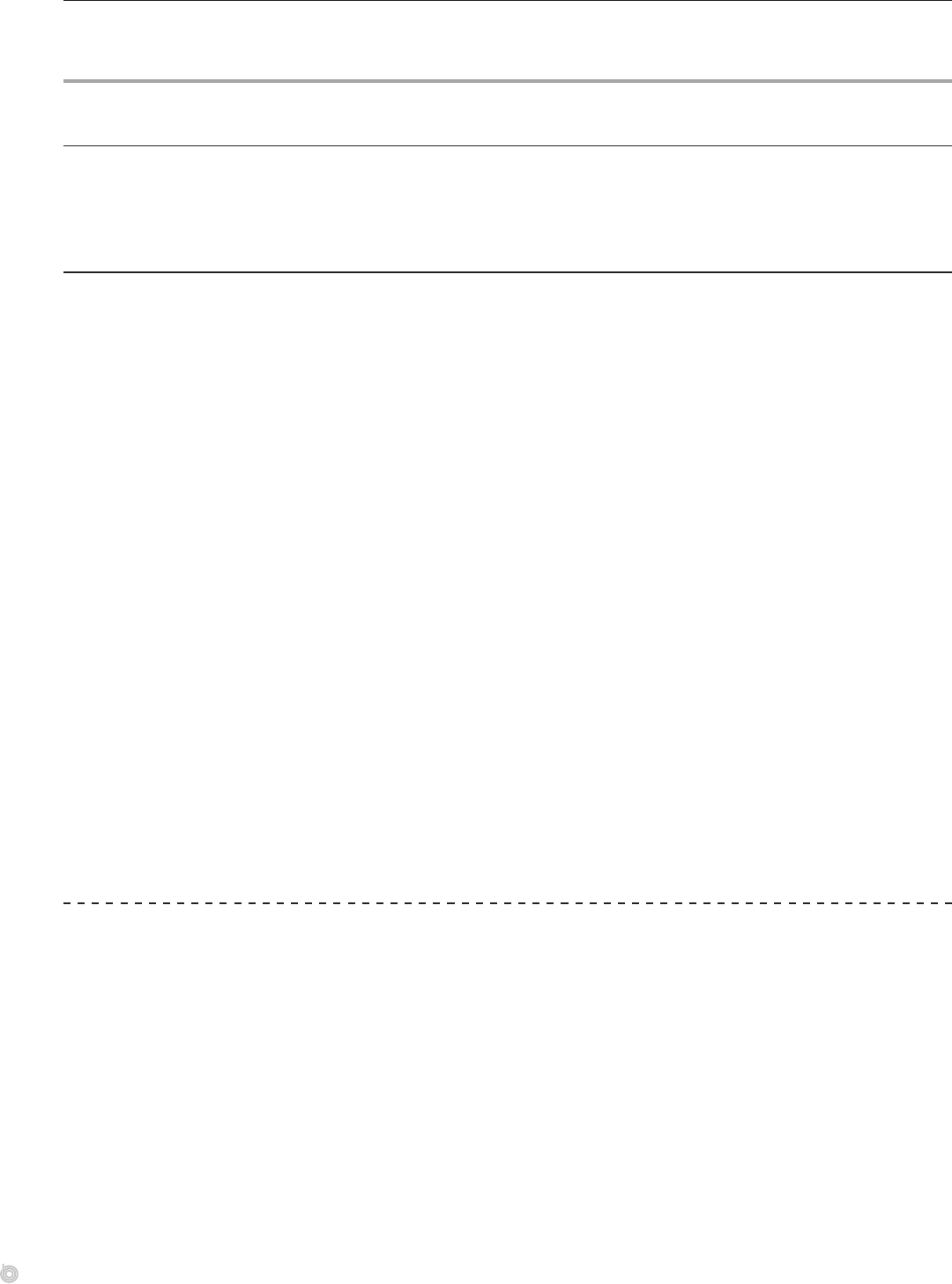

Stylized Illustration of How the Medicare FFS Program Determines Prices for Hospitals’ and

Physicians’ Services

’

’

Federal law

Final regulations

Base payment

(inpatient and

outpatient)

Intensity-

adjusted base

payment

Adjustment

for geographic

factors

Provider- or procedure-

specifi c adjustments

Price

Adjustment

for geographic

factors

× × ×

××

=

=

+

Adjustment for intensity of

services, patients’ health

(inpatient), and patients’

transfers (inpatient)

Hospital-

specifi c

adjustments

Price

Outlier

payment

The Medicare FFS

program’s prices for

inpatient, outpatient, and

physicians’ services are

set administratively by the

federal government. Base-

payment rates are adjusted

for specifics of the provider,

patient, orservice.

3CHAPTER 1 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

How Commercial Insurers’ Prices Are Determined

e prices that commercial health insurers pay in-network providers result from negotia-

tions between individual providers or provider groups and insurers. Providers agree to accept

lower in-network prices in exchange for having insurers steer patients to them and pay

claims promptly. In some instances, providers can negotiate higher prices by threatening to

stay out of an insurer’s network. at threat is more credible for providers that have a large

market share, provide high-quality services, or provide services that cannot be planned for in

advance. Such negotiations—and the contracts and prices that result from them—are often

considered trade secrets by both insurers and providers.

Insurers and providers also negotiate about the basis of payments. How hospitals are paid for

inpatient care can dier for each insurer and hospital. Methods include a at rate per stay

that varies by patients’ primary diagnosis and other health conditions (and may be set as a

percentage of the amount paid by Medicare for that service), a specied rate per day (known

as a per diem), or a specic discount from a hospital’s listed charges. Payments for hospitals’

outpatient care are frequently based on such discounts. Hospitals often prefer discounted

charges or per diems because a at rate can leave them at nancial risk for high-cost cases or

long stays. According to a recent study, hospitals with greater market power were more likely

to be paid on the basis of discounted charges.

2

Physicians are often paid by commercial insurers using the same structure as the Medicare

FFS program, but provider groups negotiate a multiplier that is applied to Medicare’s prices.

Some evidence suggests that physician groups with greater market power can negotiate

increases to that multiplier or have more ability to deviate from the Medicare FFS

paymentstructure.

3

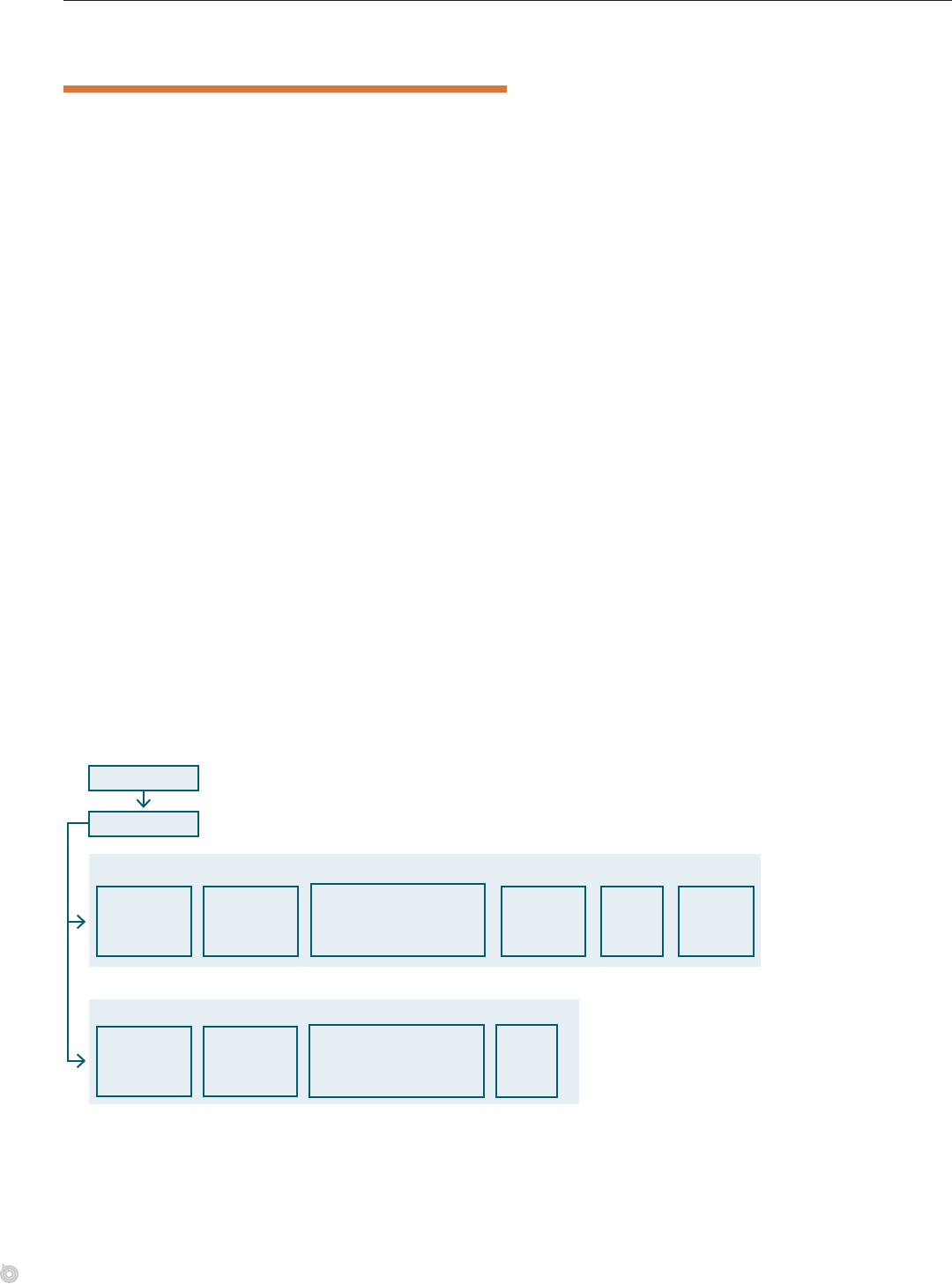

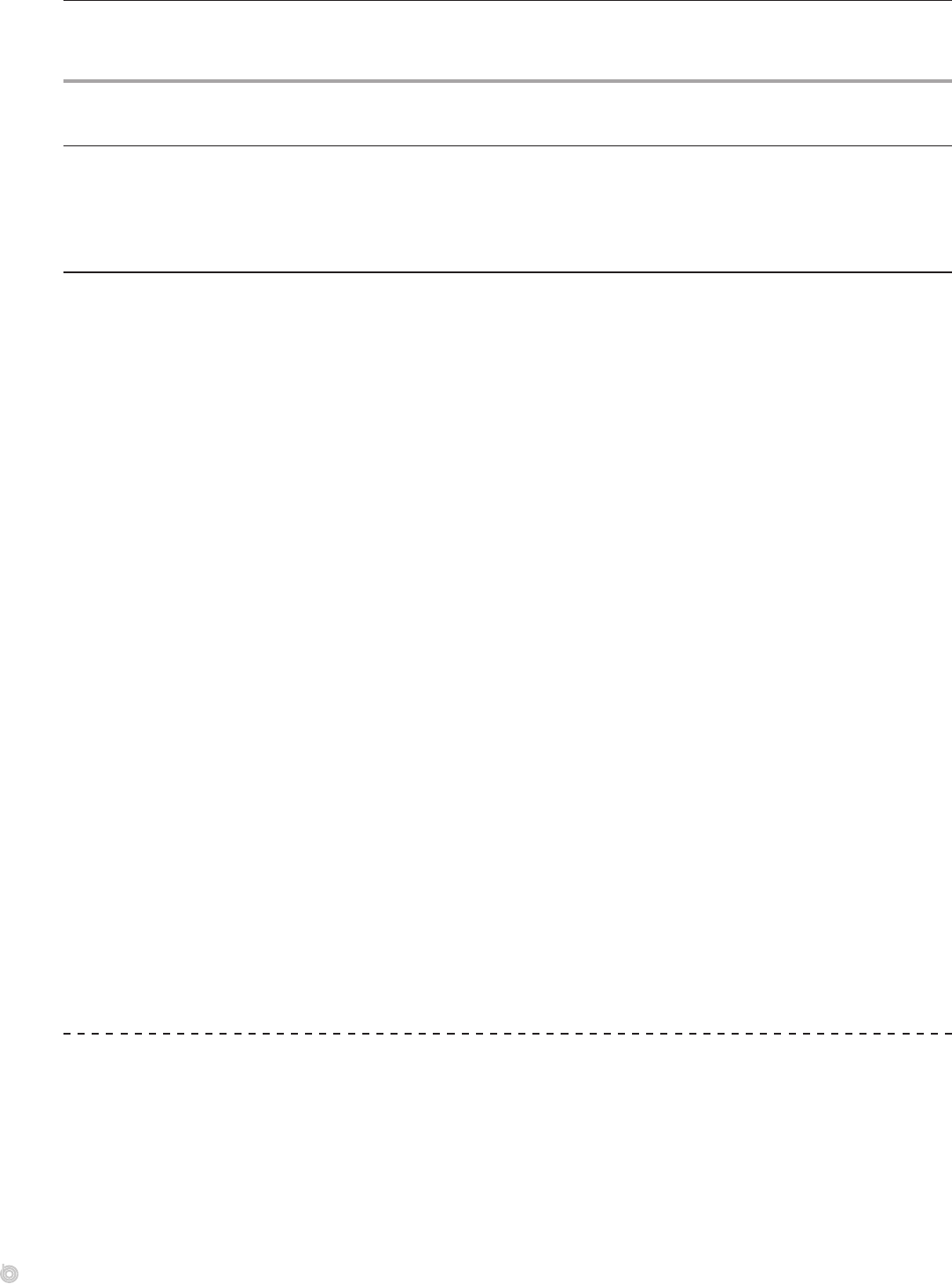

Stylized Illustration of How Commercial Insurers Determine Payments for Hospitals’ and

Physicians’Services

Providers Health insurers

Commercial insurers’ prices

Negotiations

Network contracts

The prices paid by

commercial insurers

are determined through

confidential negotiations

between individual insurers

and individual providers or

groups ofproviders.

4 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

Sources of Upward and Downward Pressure on Prices

e prices that commercial insurers pay for hospitals’ and physicians’ services are much

higher, and have grown much more rapidly in recent years, than the Medicare FFS program’s

prices. ose outcomes are the net result of competing factors that put upward or downward

pressure on prices. For commercial insurers, the upward pressures on prices are stronger than

the downward pressures. For Medicare FFS, prices do not rise as fast as commercial insurers’

prices because of factors that restrain their increases.

Compared with Medicare, commercial insurers are subject to fewer constraints on the prices

they pay. Private health insurance is mostly provided through employers, and private insur-

ers negotiate prices on employers’ behalf. Employers and insurers mainly try to negotiate

lower prices by threatening to exclude providers from their networks. eir ability to do

that is often limited, however, for several reasons: Providers’ market power is much greater

than employers’ in many markets; enrollees in employment-based plans tend to value having

access to broad networks; certain providers may be essential to a network in a given area; and

large insurers or employers may have enrollees in many locations with diverse medical needs,

making narrow-network plans hard to implement.

4

Employers have been slow to adopt other

methods to restrain price increases, such as reference pricing or other changes to the design of

insurance benets, because such designs are complex and could put enrollees at nancial risk.

5

In addition, the incentives for any one insurer or employer to push for lower prices are lim-

ited because the benets of doing so may not accrue directly to them. For example, insurers

have less incentive to negotiate lower prices because they can pass providers’ price increases

on to employers. A dominant insurer may even limit the discounts that a provider can oer

to other insurers, which can raise the prices paid by those other insurers and their premiums.

6

Negotiating lower prices may also involve trade-os for employers. For instance, employers

may be reluctant to reduce prices by adopting a plan with a narrower network or by reducing

health care benets if they use those benets to compete for high-value employees.

Conversely, one factor putting downward pressure on the prices paid by commercial insurers

is that employers may have to nance higher provider prices by raising premiums, limiting

wage increases, or reducing their plans’ benets. e strength of that downward pressure is

dampened, however, because premium contributions are generally excluded from federal

taxes and because the link between higher provider prices and lower wages or narrower bene-

ts is indirect, so most employees do not see it.

For Medicare FFS, price increases have been limited in part because annual updates to prices

are set through statute and regulation and have been modest in recent years. Prices for hos-

pitals’ inpatient and outpatient services are updated using a measure of changes in the prices

of hospitals’ key inputs, minus the increase in economywide productivity.

7

Price updates

for physicians’ services are set by law; those prices have risen by less than 0.5 percent a year

since 2015. In addition, Medicare oers payment rates to providers on a take-it-or-leave-it

basis. Providers that do not want to accept those rates can decline to participate. But because

Medicare accounts for a large share of U.S. health care spending, providers may have limited

nancial ability to opt out of the program.

Another source of downward pressure on Medicare’s prices is that, because Medicare is a fed-

eral program, proposals that would raise its spending must be nanced through higher taxes

or premiums, increases in federal debt, or cuts in Medicare benets or other spending. e

strength of that downward pressure is partly reduced, however, by concerns about providers’

nancial stability and Medicare beneciaries’ access to care.

5CHAPTER 1 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

Average Prices for Hospitals’ Services

CBO reviewed a range of studies published between 2010 and 2020 that compared com-

mercial insurers’ and the Medicare FFS program’s prices for hospitals’ services. On average,

the ve studies that looked at overall prices for hospitals’ services suggest that the prices paid

by commercial insurers were more than twice those paid by Medicare FFS.

8

(e combined

average price ratio for inpatient and outpatient services reported by those studies ranged from

167 percent of Medicare FFS’s prices to 250 percent.) ose studies also generally reported

substantial variation in prices for the same service in dierent areas, in dierent hospitals,

and within the same hospital.

e ratio of commercial insurers’ prices to Medicare FFS’s prices was generally much higher

for outpatient services than for inpatient services. Averaged across the 6 studies on outpa-

tient services and 11 studies on inpatient services that CBO reviewed, commercial insurers’

prices were 240 percent of Medicare FFS’s prices for outpatient services and 182 percent of

Medicare FFS’s prices for inpatient services. e reasons for the higher price ratio for out-

patient services are not fully understood. ose reasons could include contracting practices:

Contracts based on discounted charges are more common for hospitals’ outpatient services

than for inpatient services, and that type of contract may encourage higher prices.

In its literature review, CBO included studies that compared commercial insurers’ prices with

Medicare FFS’s prices or that reported payment-to-cost ratios both for private sources

(including uninsured people) and for Medicare. CBO then calculated a simple average of the

studies’ results. ose studies’ estimates may have diered because of dierences in the

locations, time periods, or types of data used in the studies. For instance, estimates can dier

depending on whether a data source includes patients’ total cost-sharing responsibilities or

the amounts that were actually collected from patients.

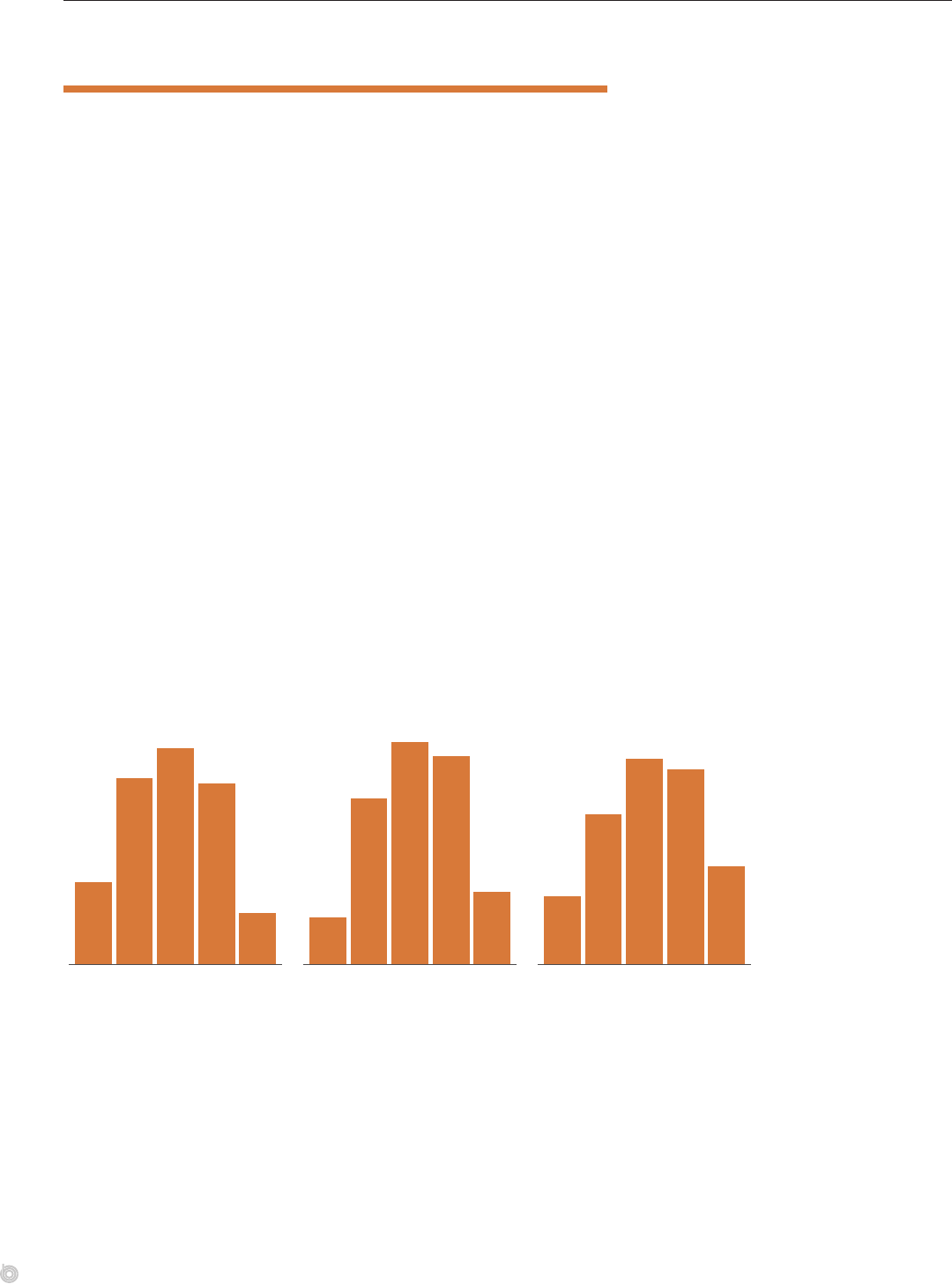

Studies’ Estimates of Commercial Insurers’ Prices for Hospitals’ Services as a Percentage of

MedicareFFS’s Prices

Hospitals’ Services Overall Outpatient Services Inpatient Services

Average (223%)

Average (182%)

Average (240%)

Bai and Anderson, 2018 (250%)

AHA, 2020 (167%)

Whaley and Others,

2020 (231%)

White and Whaley,

2019 (293%)

Selden, 2020 (155%)

Fronsdal and Others,

2020 (137%)

For hospitals’ services as a

whole, the prices paid by

commercial insurers were

more than double the prices

paid by Medicare FFS, on

average, in recent years.

(Source: CBO’s review of

published literature; see

Appendix B.)

6 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

Average Prices for Physicians’ Services

For physicians’ services overall, commercial insurers paid 129 percent of Medicare FFS’s

prices, on average, according to studies published between 2010 and 2020. (CBO reviewed

seven studies that looked at physicians’ services as a whole; their average price ratio ranged

from 118 percent of Medicare FFS’s prices to 163 percent.) ose studies also generally

reported substantial variation in prices for the same service among geographic areas, physi-

cian practices, and physician specialties.

Relative to Medicare FFS’s prices, the prices paid by commercial insurers for primary care

services and oce visits were generally lower than the prices paid for specialty services.

Among the ve studies of primary care services or oce visits and ve studies of specialty

services that CBO reviewed, commercial insurers’ prices were 117 percent of Medicare FFS’s

prices for primary care services or oce visits, on average, and 144 percent of Medicare

FFS’sprices for specialty services.

Higher prices for specialty services could stem from three factors: Fewer doctors provide any

one of those services; many doctors who do are employed in larger, multispecialty practices;

and more of those practices are aliated with hospitals. (In this analysis, average prices for

specialty services do not include emergency services or physicians’ services provided only in

inpatient settings.) Some of the variation in estimates among studies comes from dierences

in the types of physicians’ services included.

In its literature review, CBO looked only at studies that compared prices paid by commercial

insurers and Medicare FFS. CBO then calculated a simple average of the studies’ results. For

studies that reported prices separately for specic services or markets (such as employer-

sponsored plans versus individually purchased plans), CBO averaged those prices, weighting

them by the frequency of services or by estimates of premiums for dierent segments of the

market from CBO’s baseline budget projections. e studies’ estimates of relative prices for

physicians’ services may dier because of dierences in data sources, time periods, settings

ofservice (such as hospitals’ outpatient departments versus physicians’ oces), or the specic

services or markets included in the studies.

Studies’ Estimates of Commercial Insurers’ Prices for Physicians’ Services as a Percentage of

Medicare FFS’s Prices

Physicians’ Services Overall Primary Care Services

or Office Visits

Specialty Services

Average (129%)

Average (117%)

Average (144%)

Chernew and Others,

2020 (163%)

MedPAC, 2020 (128%)

Trish and Others,

2017 (179%)

Biener and Selden,

2017 (117%)

Pelech, 2020 (106%)

Ginsburg, 2010; Biener

and Selden, 2017 (118%)

On average, the prices paid

by commercial insurers for

physicians’ services as a

whole were about one-

quarter higher than the

prices paid by Medicare FFS

in recent years. (Source:

CBO’s review of published

literature; see Appendix B.)

7CHAPTER 1 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

How Payments to Hospitals Compare With Hospitals’ Costs

According to data from the American Hospital Association (AHA), Medicare’s total pay-

ments for inpatient and outpatient services are lower than hospitals’ costs to provide those

services. Private payers’ payments, by contrast, are much higher than hospitals’ costs. Between

2000 and 2018, private payers’ payments rose from 116 percent to 145 percent of hospitals’

costs, whereas Medicare’s payments fell from 99 percent to 87 percent of hospitals’ costs. (In

the AHA data, Medicare includes both the FFS program and Medicare Advantage plans, and

private payers consist of all nongovernment payment sources.)

e payment-to-cost ratios in the AHA data reect hospitals’ total costs for delivering care,

including stas’ salaries and the costs of buildings and equipment. ose total costs vary

because of external factors, such as local wages and utilities, and internal factors related to

hospitals’ behavior, such as how eciently they can manage their resources. Although pay-

ments by Medicare are lower than hospitals’ costs, on average, research suggests that hospi-

tals have some control over their cost structure and can adjust their expenses on the basis of

the nancial resources they have available.

9

e Medicare Payment Advisory Commission

(MedPAC) has identied a subset of hospitals as “ecient,” meaning that they perform well

in the areas of cost and quality. Such hospitals had positive Medicare margins from 2010

until about 2015, although they have had slightly negative Medicare margins since 2016.

10

Payments for hospitals’ services in the AHA data reect all payments made for care, not just

the prices negotiated by a subset of payers. Private payments, in particular, reect a wide

variety of sources—from uninsured people, who typically pay less than commercial payers, to

automobile liability insurance and workers’ compensation, which tend to pay more. Private

payments also reect patients’ unpaid debts, which tends to reduce private payers’ prices in the

AHA data relative to the prices reported in other studies. (CBO does not know of any regu-

larly updated source of data about costs or payment-to-cost ratios for physicians’ services.)

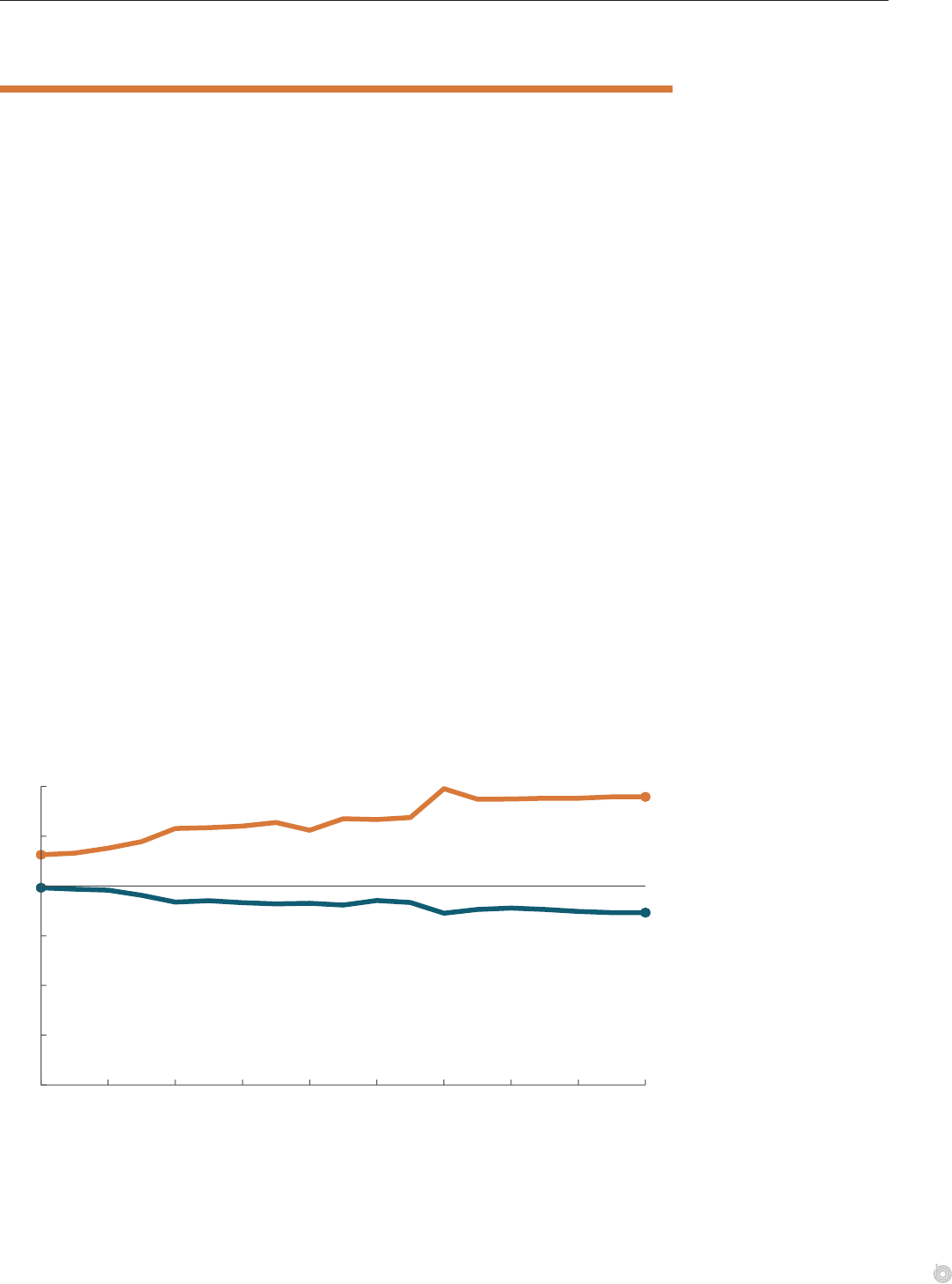

Payment-to-Cost Ratios for Hospitals, 2000 to 2018

Percent

0

25

50

75

100

125

150

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

86.6

144.8

99.1

115.7

Private Payers

Medicare FFS

Total payments for

hospitals’ services, as a

percentage of hospitals’

costs to deliver those

services, have increased

for private payers and

decreased for Medicare

since 2000. (Source: CBO’s

analysis of national-level

data from the AHA.)

8 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

1. CBO analyzed changes in per-person spending because they are not aected by growth in the number

of people with health insurance. Rather, changes in per-person spending among people with insurance

result from changes in utilization (including the amount and intensity of services), in prices, or in patients’

characteristics, such as age or sex (though the eect of those types of demographic changes is thought

to be limited). For information about the eects of demographic changes on Medicare spending, see

Laura M. Keohane, Lucas Stewart, and Melinda B. Buntin, e Slowdown in Medicare Spending Growth

for Baby Boomers and Older Beneciaries: Changes in Medicare Spending Levels and Growth by Age Group,

2007–2015(Commonwealth Fund, December 27, 2019), https://doi.org/10.26099/sy0d-xs78; and Michael

Levine and Melinda Buntin, Why Has Growth in Spending for Fee-for-Service Medicare Slowed? Working Paper

2013-06 (Congressional Budget Oce, August 2013), www.cbo.gov/publication/44513. e data from the

Health Care Cost Institute that CBO analyzed were weighted to be representative of the population with

employment-based insurance plans; thus, the eects of age and sex on those plans’ per-person spending

should be minimal.

2. See Zack Cooper and others, “e Price Ain’t Right? Hospital Prices and Health Spending on the

Privately Insured,” Quarterly Journal of Economics, vol. 134, no. 1 (February 2019), pp. 51–107,

https://doi.org/10.1093/qje/qjy020.

3. See Jerey Clemens, Joshua D. Gottlieb, and Tímea Laura Molnár, e Anatomy of Physician Payments:

Contracting Subject to Complexity, Working Paper 21642 (National Bureau of Economic Research, October

2015), www.nber.org/papers/w21642.

4. For comparisons of employers’ and providers’ market power, see Matthew D. Eisenberg and others, “Large

Self-Insured Employers Lack Power to Eectively Negotiate Hospital Prices,” American Journal of Managed

Care, vol. 27, no. 7 (July 2021), pp. 290–296, https://doi.org/10.37765/ajmc.2021.88702.

5. Reference pricing sets a benchmark price for certain services, and enrollees are responsible for the dierence

between providers’ negotiated price and the reference price. See Anna D. Sinaiko, Shehnaz Alidina, and Ateev

Mehrotra, “Why Aren’t More Employers Implementing Reference-Based Pricing Benet Design?” American

Journal of Managed Care, vol. 25, no. 2 (February 2019), pp. 85–88, https://tinyurl.com/ps7t2w93.

6. ose limits on the prices paid by rival insurers are the result of “most-favored nation” clauses in contracts.

See David Cutler and Leemore Dafny, “Designing Transparency Systems for Medical Care Prices,” New

England Journal of Medicine, vol. 364, no. 10 (March 10, 2011), pp. 894–895, https://doi.org/10.1056/

NEJMp1100540.

7. e Medicare FFS program’s adjustment for productivity reects the change in economywide multifactor

productivity in the private, nonfarm business sector. (Multifactor productivity measures the amount of goods

and services produced relative to the amount of inputs used to produce those goods and services.)

8. e estimate based on data from the AHA compared commercial insurers’ prices for hospitals’ services

with the prices paid by both the Medicare FFS program and Medicare Advantage (MA) plans. In CBO’s

assessment, the AHA’s estimate would be nearly unchanged if it only included FFS prices because MA plans’

prices for hospitals’ services are roughly equal to those paid by the Medicare FFS program, on average,

according to published research.

9. See Chapin White and Vivian Yaling Wu, “How Do Hospitals Cope With Sustained Slow

Growth in Medicare Prices?” Health Services Research, vol. 49, no. 1 (February 2014), pp. 11–31,

https://doi.org/10.1111/1475-6773.12101.

10. Medicare margins were calculated as total Medicare revenues minus total Medicare-allowable costs, divided

by revenues. Of the 1,878 hospitals that met MedPAC’s screening criteria over the 2015–2017 period, about

14 percent were found to be relatively ecient. See Medicare Payment Advisory Commission, “Hospital

Inpatient and Outpatient Services,” Chapter 3 in Report to the Congress: Medicare Payment Policy (March

2020), p. 92, https://tinyurl.com/yckkxfuy.

Chapter 2: The Implications of

PriceIncreases

is chapter describes how the high and rising prices that commercial insurers pay for hospitals’ and physicians’

servicesaect people with private health insurance and the federal budget.

How Price Increases Aect People

WithEmployment-BasedInsurance

A rise in providers’ prices would increase health insurers’ spending on claims, all else being

equal. Insurers could respond to such spending increases by raising premiums, increasing

cost-sharing requirements for patients, reducing the scope of benets, or making other

adjustments. In general, insurers’ greater spending would be passed on to employers that

purchase coverage on behalf of their employees.

1

Employers’ spending on health insurance

represents a large part of their employees’ nonwage compensation, so employers generally

take actions to oset increases in health insurance spending in order to maintain their prots.

A recent study found that price increases for hospitals’ services were associated with a rise in

employees’ out-of-pocket costs, an increase in the use of high-deductible health plans, and

slower wage growth for employees.

2

In addition, the Congressional Budget Oce analyzed

data from the Kaiser Family Foundation’s Employer Health Benets Survey and information

from the Bureau of Labor Statistics and found that between 2010 and 2020, average total

premiums rose by 55 percent for a family plan (from $13,770 to $21,342) and by 48 percent

for an individual plan (from $5,049 to $7,470), whereas median wages grew by only 32per-

cent over that period.

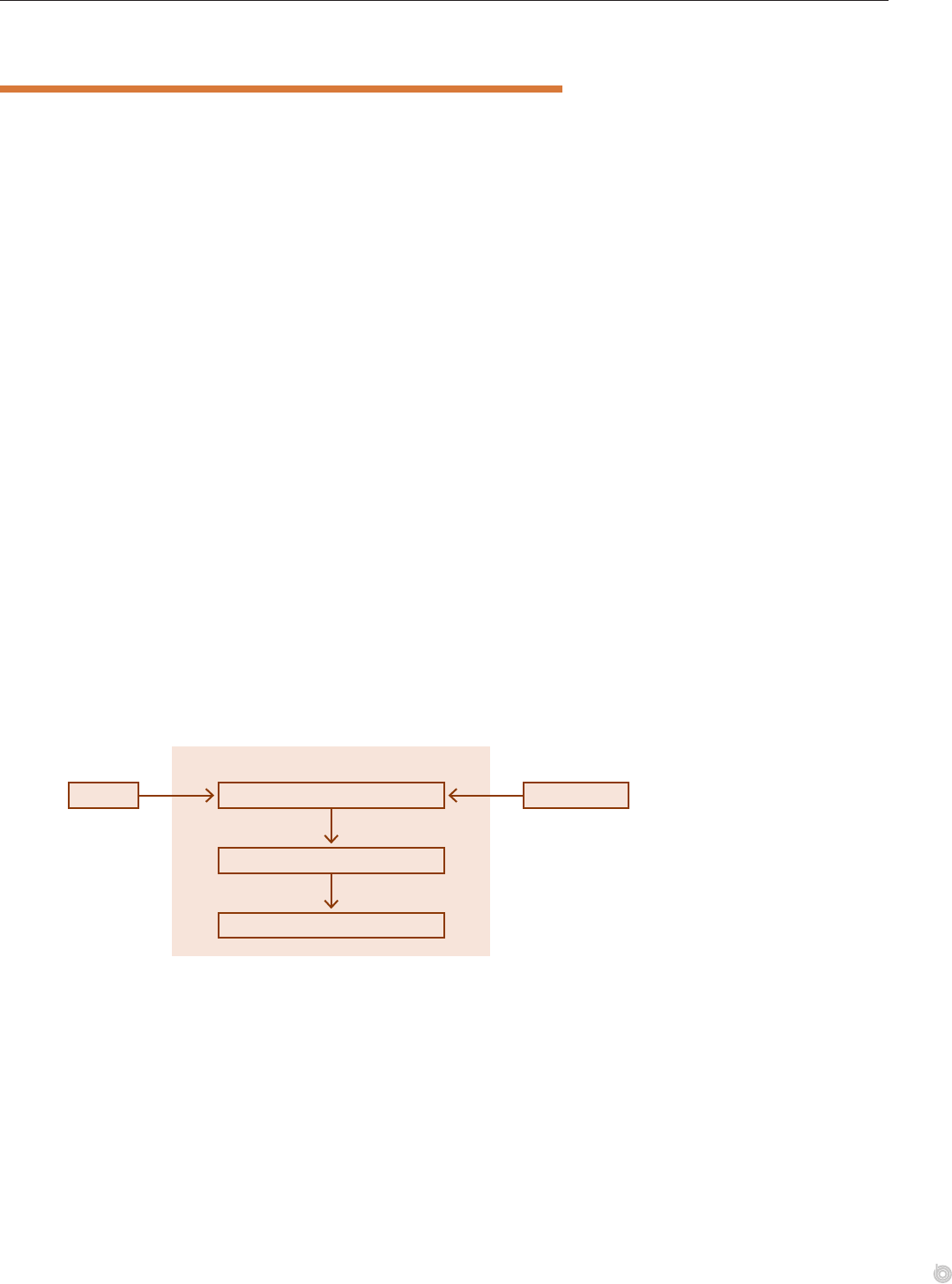

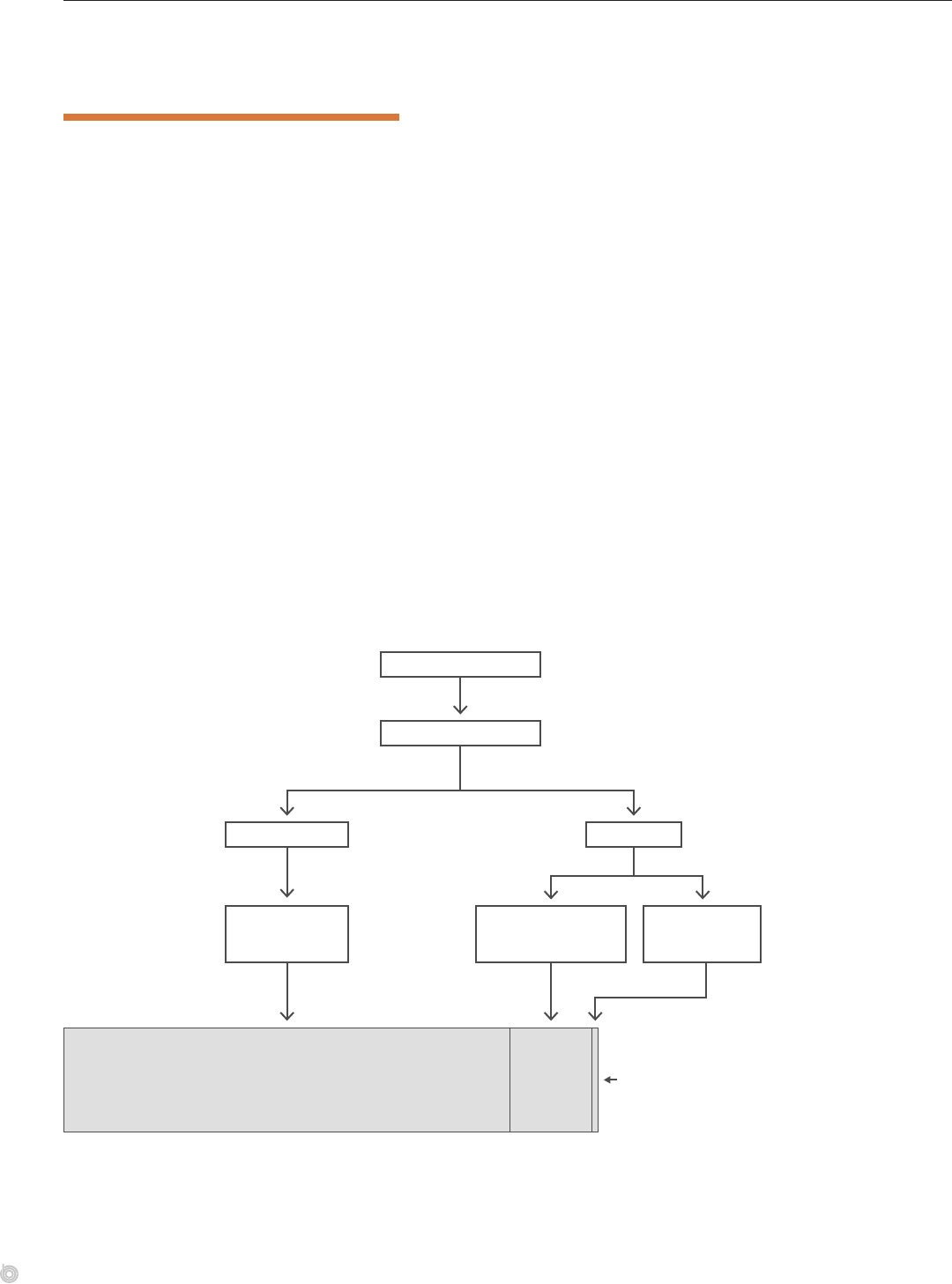

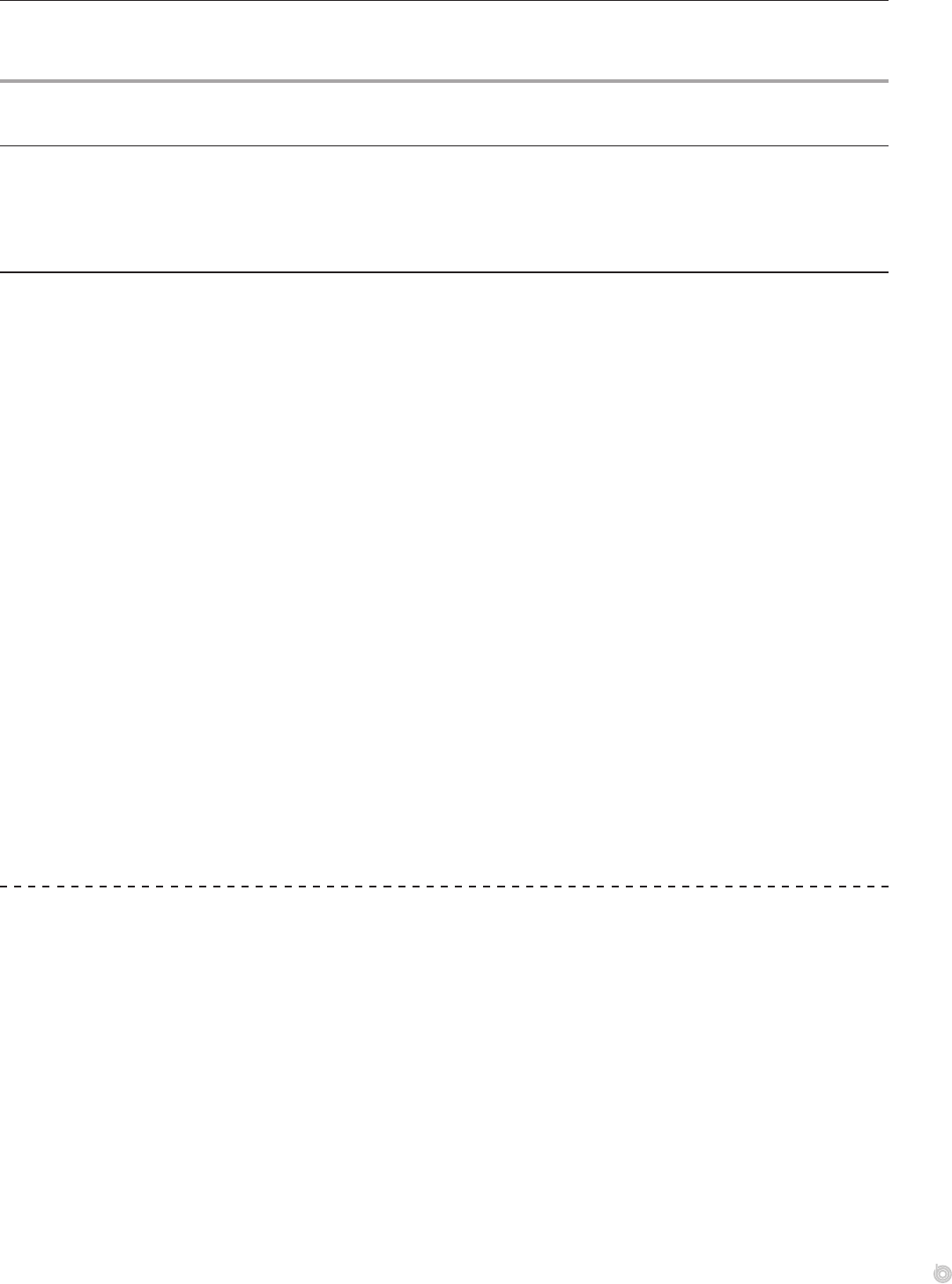

Eects of Higher Prices on Health Insurance Premiums and Benefits, Out-of-Pocket Costs, and Wages

When prices paid to

providers increase

Commercial health insurers’

spending on claims increases

Plans are adjusted in ways that have

one or more of the following results . . .

Employers’

premium payments

increase

Employees’ wages

grow more slowly

Firms’ profi ts

decline

Employees’

premium payments

increase

Covered

benefi ts are

narrowed

Patients’

out-of-pocket

costs increase

All else being equal,

increases in the prices

that commercial insurers

pay providers are

associated with increases

in premiums for employers

or employees, increases

in out-of-pocket costs

for enrollees, reductions

in covered benefits,

slowdowns in wage growth

for employees, or declines

in firms’ profits.

10 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

How Price Increases Aect Federal Subsidies for

CommercialHealthInsurance

e federal tax code contains various provisions that subsidize commercial health insur-

ance—both employment-based insurance and nongroup (individually purchased) plans.

For example, premiums for people with employment-based insurance are generally excluded

from federal income and payroll taxes. In addition, some out-of-pocket medical costs and

premium payments are subsidized through the tax deduction for itemized medical expenses.

efederal government also provides people who qualify with tax credits to reduce premiums

for nongroup health insurance purchased through the marketplaces established under the

Aordable Care Act. And the tax code allows some self-employed people who buy nongroup

insurance to deduct up to 100 percent of their premiums from their income. Because of

such provisions, increases in the prices that plans pay to providers aect federal subsidies for

commercial health insurance.

Insurers pass higher costs on to employers through premium increases or changes to plans’

benets. Since the tax code generally lets employers and employees contribute to the cost of

premiums with pretax dollars, higher premiums reduce taxable wages and increase federal

subsidies for employment-based insurance. Likewise, when premiums rise for the benchmark

plans oered in the federal or state health insurance marketplaces, tax credits for people who

buy insurance through those marketplaces rise as well.

Relationships Between Prices for Providers and Major Federal Subsidies for Commercial Health

Insurance in 2020

Federal subsidies for employment-based insurance

($288 Billion)

Marketplace

premium

subsidies

($53 Billion)

Subsidy for

self-employment

health insurance

($4 Billion)

Prices paid to providers

Health insurers’ costs

Employment-

Based Insurance

Nongroup

Plans

Premiums Premiums

Tax exclusion

for employment-

based insurance

Tax credit outlays and

revenue reductions

for nongroup plans

Tax deduction for

self-employment

health insurance

Major Federal Subsidies for

Commercial Health Insurance

Higher prices paid by

commercial insurers

to providers increase

federal subsidies for

health care because

of the tax preferences

for employment-based

insurance and premium

subsidies for nongroup

coverage. (Source: CBO.)

11CHAPTER 2 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

1. For people with nongroup insurance, increases in premiums or reductions in benets mainly aect the

covered individuals. e degree to which people with nongroup plans are aected by premium increases

depends on the size of the subsidies they receive from the federal government. ose who receive little or no

subsidy bear most of the cost of higher provider prices, whereas those who receive more subsidies are largely

shielded from price increases.

2. See Daniel Arnold and Christopher M. Whaley, Who Pays for Health Care Costs? e Eects of Health Care

Prices on Wages, Working Paper WR-A621-2 (RAND, July 2020), https://doi.org/10.7249/WRA621-2.

Chapter 3: Variation in Prices Among and

Within Geographic Areas

is chapter describes how prices for hospitals’ and physicians’ services vary among dierent areas, among hospitals

or provider groups in the same area, and within hospitals for the same or similar services. Prices can vary for many

reasons, but large variation in prices for similar services can be evidence of market ineciencies.

Prices for Hospitals’ Services: Variation Among States

e average prices that Medicare’s fee-for-service program and commercial employment-based

plans paid for hospitals’ inpatient services in 2018—relative to the national average price paid by

Medicare FFS—varied widely by state. e statewide average Medicare FFS price ranged from

24 percent lower than the program’s national average price in Arkansas to 55 percent higher

than the national average in Massachusetts. Prices for Medicare services diered among states

because of the location- and hospital-specic adjustments Medicare makes (see Chapter 1).

1

e degree of price variation was much greater for commercial insurers. e average state-level price

paid by commercial employment-based plans ranged from 54 percent higher than the national

average Medicare FFS price in Arkansas to 294 percent higher than that price in Massachusetts.

(e Congressional Budget Oce limited this analysis to employment-based plans because

price data are not as widely available for other types of commercial plans. Prices for inpatient

services are allowed amounts per stay, with stays adjusted to reect the intensity of the service.)

Average Prices for Hospitals’ Inpatient Services, by State, 2018

AR

NE

KY

KS

MO

MI

OK

PA

NV

MS

NM

CO

UT

LA

OH

TX

NC

NJ

ID

IL

CT

AL

AZ

IA

VT

WA

WY

MT

OR

RI

IN

DE

WI

SC

ME

FL

WV

VA

GA

CA

NH

AK

MN

TN

NY

MA

0 1x 2x 3x 4x

Price Relative to Medicare Fee-for-Service National Average

Commercial Insurers

Medicare FFS

Commercial insurers’ prices

for hospitals’ inpatient

services varied substantially

among states in 2018,

as did the gap between

commercial insurers’

and Medicare’s prices.

Commercial insurers’

prices were highest,

relative to Medicare’s, in

Massachusetts, New York,

and Tennessee. (Source:

CBO’s analysis of data from

Whaley and others,2020.)

14 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

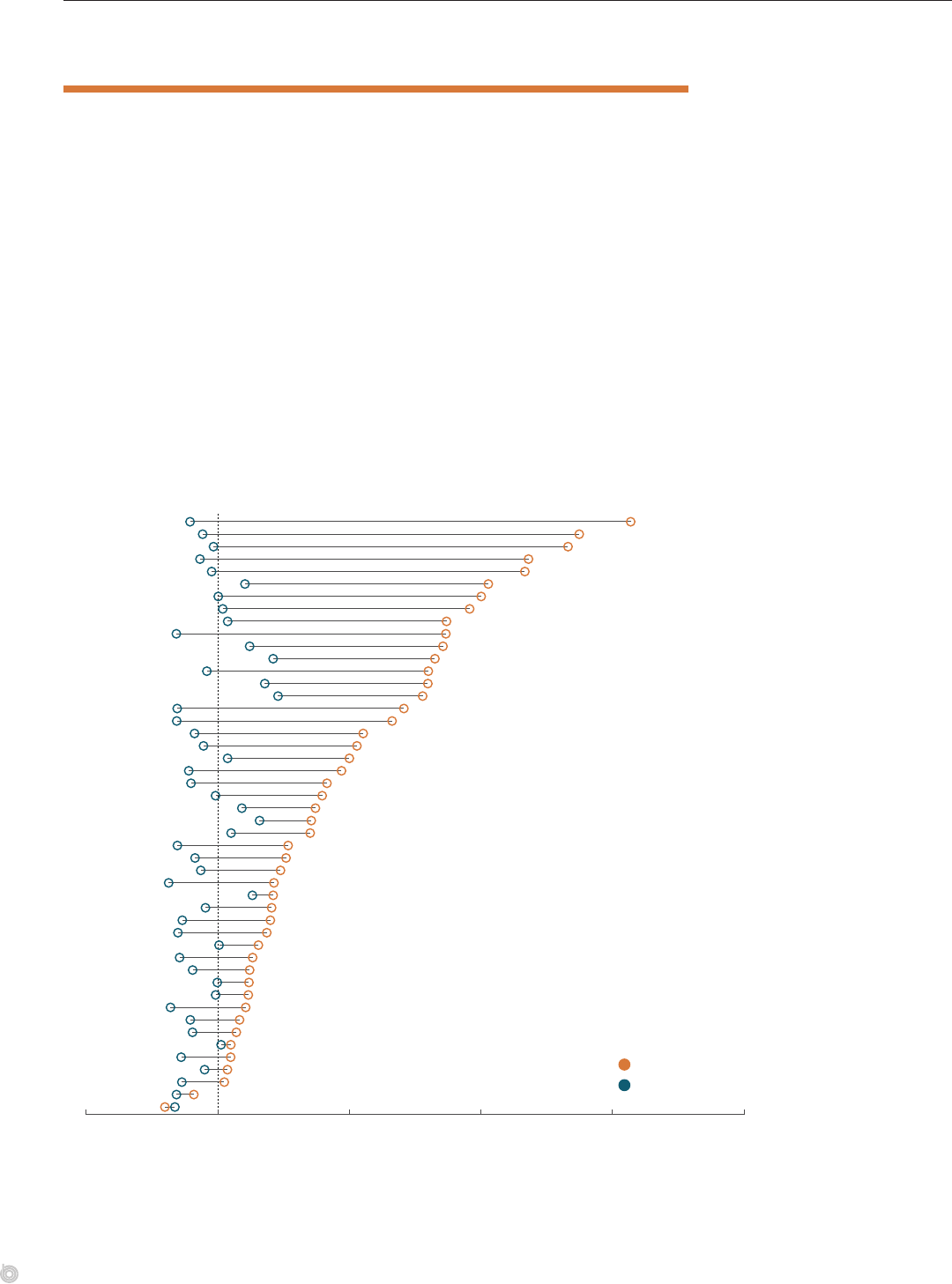

Prices for Physicians’ Services: Variation Among States

Relative to the national average Medicare FFS price for physicians’ services, the average price

paid by Medicare FFS and commercial insurers for a set of 500 common services in 2017

varied among states. (ose 500 services reect the service codes that appeared most often

in aggregate data drawn from employment-based plans in the claims database of the Health

Care Cost Institute, or HCCI. ey include services such as oce visits and knee replace-

ments.) e statewide average Medicare FFS price ranged from 9 percent lower than the

program’s national average price in Mississippi to 11 percent higher than the national average

in Washington, DC. In this analysis, average Medicare prices diered primarily because of

Medicare’s geographic adjustments for input prices.

e magnitude of the price variation was much larger for commercial insurers than for

Medicare FFS. e average state-level price paid by commercial insurers ranged from about

10 percent lower than the national average Medicare FFS price in Alabama to 78 percent

higher than that price in Wisconsin. Commercial insurers’ average price exceeded the average

state Medicare FFS price in every state except Alabama.

Average Prices for Physicians’ Services, by State, 2017

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

AL

KY

IN

AZ

KS

DE

MO

OH

AR

PA

FL

LA

OK

NV

WV

SC

MI

MD

MS

TX

UT

TN

VA

NJ

HI

CO

ME

NC

IL

GA

NM

IA

ID

DC

CA

VT

NY

CT

NE

WA

NH

MT

MA

WY

SD

OR

ND

WI

0.75x 1x 1.25x 1.5x 1.75x 2x

Price Relative to Medicare Fee−for−Service National Average

Commercial Insurers

Medicare FFS

Commercial insurers’ prices

for physicians’ services

varied substantially among

states in 2017. They

were highest, relative

to Medicare’s prices, in

Wisconsin, North Dakota,

and Oregon. (Source:

CBO’s analysis of data from

Johnson and others,2020.)

15CHAPTER 3 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

Prices for Hospitals’ Services:

VariationWithinMetropolitanAreas

Commercial insurers’ prices for hospitals’ services vary widely not only by state but also

within a given metropolitan statistical area, or MSA (a geographic area that generally con-

sists of one or more cities and the surrounding population). For example, the median price

that commercial insurers paid for a vaginal delivery of a baby—a well-dened and fairly

standardized service—in San Francisco in 2016 was $13,363. But the range of prices around

that median in the San Francisco area was quite broad: e price at the 90th percentile of

the distribution of prices ($23,880) was more than twice as high as the price at the 10th

percentile ($11,098). In Tucson, Arizona, the median price for a vaginal delivery was much

lower, $5,920, and the range of prices was much narrower: e price at the 90th percentile

($6,735) was only 50 percent higher than the price at the 10th percentile ($4,490).

Price variation within an MSA reects price dierences among hospitals in that area as well

as price dierences within the same hospital. e latter largely reect dierences in the

amounts that dierent commercial insurers pay for the same service at a particular hospital.

Price variation within and among hospitals could also reect dierences in patients’ health or

in the intensity of a service. However, most studies that examine price variation either control

for patients’ health or focus on variation for a relatively standardized service, such as mag-

netic resonance imaging (MRI) scans.

2

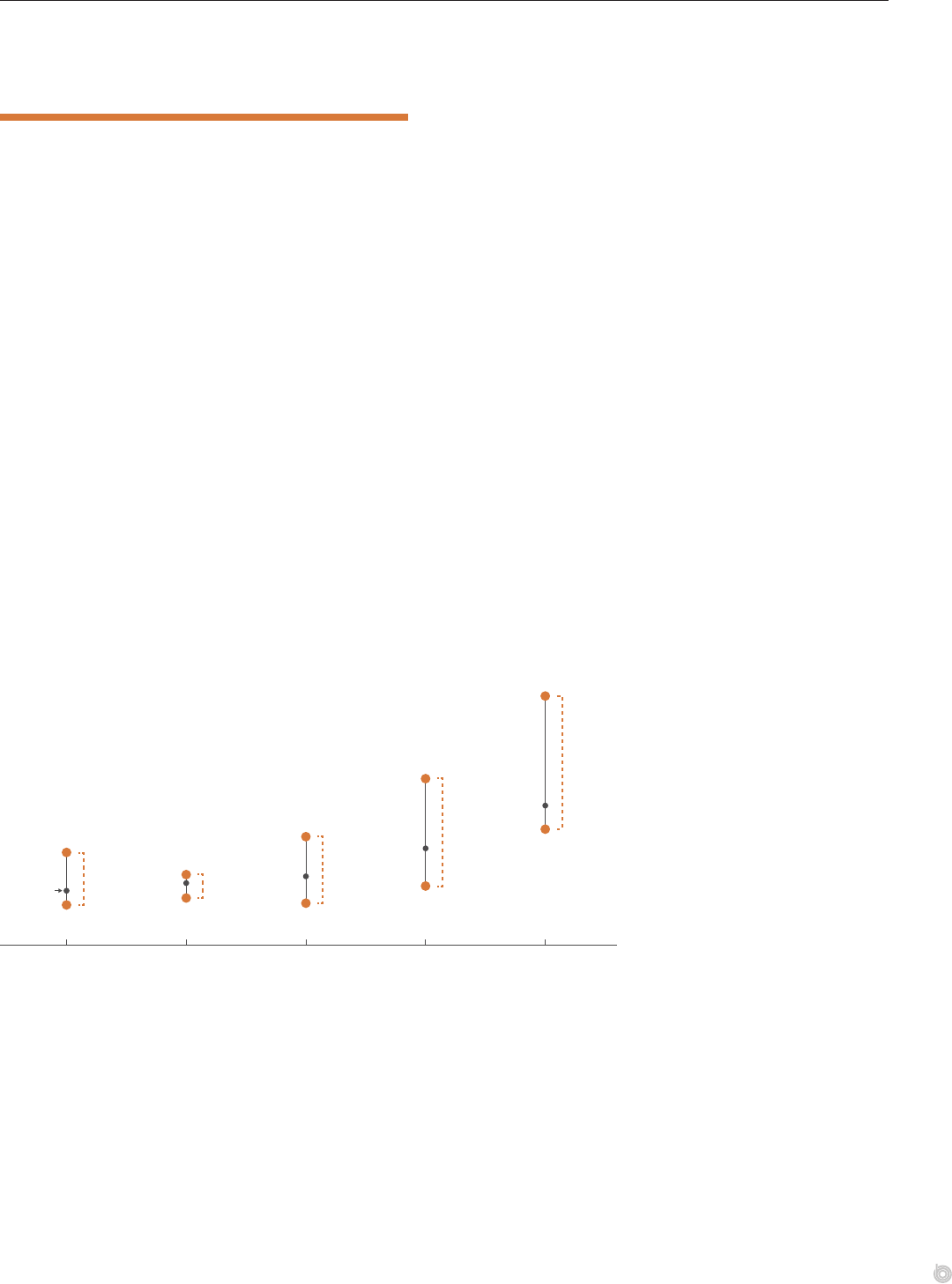

Commercial Insurers’ Prices for Vaginal Deliveries at Hospitals in Selected MSAs, 2016

Dollars

Median

The price for vaginal

deliveries at the 90th

percentile was 2.2

times the price at the

10th percentile

3,823

4,490

3,991

5,638

11,098

8,862

6,735

10,376

15,945

23,880

Kansas City, MO−KS Tucson, AZ Miami, FL Los Angeles, CA San Francisco, CA

2.8

2.6

1.5

2.3

Commercial insurers’

prices for the same hospital

service, such as a vaginal

birth, varied substantially

in 2016 within the same

geographic area. The extent

of the range of prices varied

among areas. (Source:

CBO’s analysis of data

fromKennedy and others,

2019.)

16 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

Prices for Physicians’ Services:

VariationWithinMetropolitanAreas

Recent analyses have found that commercial insurers’ prices for a given physicians’ service

varied widely among providers in the same metropolitan statistical area. For instance, CBO’s

analysis of data about a specic type of colonoscopy (Current Procedural Terminology code

45385) found a roughly twofold variation in commercial insurers’ prices for that service

within ve MSAs in 2014.

3

In the Chicago-Naperville-Elgin area of Illinois, for example, the

price for that procedure for the provider at the 90th percentile of the distribution of pro-

viders by price ($660) was twice as high as the price for the provider at the 10th percentile

($330).

CBO found similar variation in prices within MSAs for all 20 of the physicians’ services that

it examined—including fairly standardized and narrowly dened services, such as echocar-

diograms and MRIs. For instance, in more than 85 percent of the 218 MSAs included in

CBO’s analysis, the price for a cranial MRI for the provider at the 90th percentile was more

than 1.5 times the price for the provider at the 10th percentile.

Commercial Insurers’ Prices for Colonoscopies Performed by Providers in Selected MSAs, 2014

Dollars

The price of the 90th

percentile provider

was 2.8 times the

price of the 10th

percentile provider

2.1

2.3

1.7

2.0

330

302

361

219

265

660

524

830

460

740

Chicago−

Naperville−Elgin,

IL−IN−WI

Cincinnati,

OH−KY−IN

Dallas−

Fort Worth−

Arlington, TX

Miami−

Fort Lauderdale−

West Palm Beach, FL

New York−Newark−

Jersey City,

NY−NJ−PA

Commercial insurers’

prices for the same

physicians’ service, such

as a colonoscopy, varied

substantially among

dierent providers in the

same geographic area

in 2014. (Source: CBO’s

analysis of data from

Pelech, 2018.)

1. ose adjustments include changes to Medicare’s base-payment rates for such things as an area’s wages and

other input prices as well as certain hospitals’ spending on graduate medical education or their share of

patient days that are for low-income patients.

2. See Daria Pelech, An Analysis of Private-Sector Prices for Physicians’ Services, Working Paper 2018-01

(Congressional Budget Oce, January 2018), www.cbo.gov/publication/53441; and Zack Cooper and

others, “e Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured,” Quarterly

Journal of Economics, vol. 134, no. 1 (February 2019), pp. 51–107, https://doi.org/10.1093/qje/qjy020.

3. To ease interpretation, CBO converted the ratios of commercial insurers’ prices to Medicare FFS’s prices from

that analysis to prices in dollars by multiplying those ratios by the national median price for a given service.

Chapter 4: Factors Aecting the Prices

Paid by Commercial Insurers

is chapter describes possible reasons that commercial insurers’ prices for hospitals’ and physicians’ services are

higher and more variable than the prices paid by Medicare’s fee-for-service program. Potential explanations include

market concentration for hospitals and physicians, the prices of various inputs for care, the quality of care, providers’

administrative spending, and their possible cost shifting from public to private payers.

Market Power and Commercial Insurers’ Prices

Market power is the ability of rms to raise prices above the level that would exist in a per-

fectly competitive market. It occurs for many reasons. Hospitals and physicians’ groups may

have market power because they have a dominant share of a particular market or because

an insurer sees them as essential to its network of providers. Being seen as essential can give

providers substantial leverage in price negotiations with insurers. us, prices may vary among

areas because of dierences in the relative market power of providers and insurers in each area.

Dierences in market power can also contribute to price variation within a geographic area.

Prices may vary among providers because of dierences in providers’ and insurers’ relative bar-

gaining power, or they may vary within a hospital or physicians’ group because of dierences

in insurers’ bargaining power. One study found that, within the same provider group, nego-

tiated prices for physicians’ oce visits were 21 percent lower, on average, for insurers with a

market share of at least 15 percent than for insurers with a market share of 5 percent or less.

1

Market concentration (the extent to which only a few rms provide a large share of the goods

or services in a market) can confer market power to rms with larger market shares. Evidence

suggests that concentration in the markets for hospitals’ and physicians’ services has been

growing and that, in many areas, those markets are now moderately or highly concentrated.

e percentage of physicians’ practices that are owned by or aliated with hospitals has also

increased. Such vertical integration can increase concentration in the market for physicians’

services (by consolidating physicians into larger groups) and can increase hospitals’ mar-

ket power (by steering physicians’ referrals to the acquiring hospital). In addition, evidence

suggests that a growing number of health care providers have been acquired by private equity

rms, which may leverage providers’ market power to raise prices.

Most of the studies that the Congressional Budget Oce reviewed (see Appendix C) suggest

that consolidation increases prices in the markets for both hospitals and physicians, as does

vertical integration among hospitals and physicians’ groups. ere is also a well-documented

correlation, across many areas, between concentration in the provider market and prices,

suggesting that some of the dierence in prices in dierent areas is attributable to providers’

market power.

2

Most studies focus on market share as a measure of providers’ market power,

but there is growing evidence that providers can also derive market power from providing spe-

cialized services, high-quality services, or services that a patient cannot shop for in advance.

3

18 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

Concentration in Hospital Markets and Commercial Insurers’ Prices

CBO analyzed data from the Health Care Cost Institute for hospital markets in 42 states

and found that the percentage of metropolitan statistical areas with hospital markets that

were considered highly or very highly concentrated rose between 2010 and 2017. In 2010,

63percent of the 124 MSAs in the HCCI data had highly or very highly concentrated hospi-

tal markets. By 2017, that share had risen to 70 percent. (e MSAs that HCCI included in

that sample were selected on the basis of population, insurance coverage, and number of hos-

pitals.) Over that period, the average Herndahl-Hirschman index (HHI) for the MSAs in

that sample rose from 3,032, already in the “highly concentrated” range, to 3,338. (e HHI

is a common measure of market concentration; it indicates the extent to which a market is

dominated by one or a few participants.)

Greater market concentration has been linked to less price competition. CBO reviewed

13studies published since 2010 on the relationship between hospital market concentration

and prices for hospitals’ services (see Table C-1 in Appendix C). Of the four studies that

tested for correlations, three found a positive association between market concentration and

hospitals’ prices. Mergers between hospitals have also increased concentration and typically

led to higher prices. Of the ve studies that examined hospital mergers within a market, three

concluded that prices rose for insurers. (e other two studies showed price increases for

some insurers and decreases for others.) ere is also some recent evidence that mergers of

hospitals in dierent markets may result in price increases.

CBO focused on the research literature since 2010 because high-quality data on prices have

become more readily available since then. But a review of older studies also found a positive

association between market concentration and prices for hospitals’ services.

4

It also found

some evidence that growth in those prices is related to market concentration and that hospi-

tal mergers in concentrated markets typically result in much higher prices.

CBO also reviewed studies on the relationship between mergers and eciency gains for

hospitals.

5

e evidence about the relationship between mergers and hospitals’ costs is

inconsistent; some studies found that acquired hospitals have lower costs after their merger.

But lower costs do not necessarily translate into lower prices for hospitals’ services if hospitals

do not pass those eciency gains on to consumers.

Hospital Market Concentration, 2010 and 2017

Percentage of MSAs

10

6

27

24

52

61

11

9

2010 2017

Very Highly Concentrated

(HHI greater than 5,000)

Highly Concentrated

(HHI 2,501–5,000)

Moderately Concentrated

(HHI 1,500–2,500)

Competitive

(HHI less than 1,500)

The percentage of

metropolitan areas with

hospital markets that

were highly or very highly

concentrated (as measured

by a Herfindahl-Hirschman

Index of more than 2,500)

increased from 2010

to 2017. (Source: CBO’s

analysis of data from HCCI.)

19CHAPTER 4 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

Concentration in Physician Markets and Commercial Insurers’ Prices

Market concentration for physicians increased between 2010 and 2016, as measured by the

average of the Herndahl-Hirschman indexes for more than 370 metropolitan statistical

areas. During that period, the average HHI rose by nearly 29 percent for primary care phy-

sicians and by about 5 percent for four common types of specialist physicians (cardiologists,

oncologists or hematologists, radiologists, and orthopedists).

6

In addition, the percentage of

MSAs whose markets for primary care physicians were considered highly or very highly con-

centrated (an HHI of more than 2,500) increased from 20 percent in 2010 to 39 percent in

2016. Increases in market concentration were at least partly attributable to a rise in the share

of physicians employed by hospitals or hospital systems.

CBO reviewed eight studies on the relationship between market concentration for physicians

and prices for physicians’ services; all of the studies found that prices were related to market

structure in some way (see Table C-2 in Appendix C). Prices for most services were generally

higher in areas with more-concentrated physician markets, or increased more in areas with

higher initial levels of market concentration, or rose after mergers or acquisitions of physi-

cians’ practices. In addition, one of the studies found that an increase in the enforceability of

noncompete agreements for physicians (which make it harder for physicians to nd new

employment after leaving a practice) led to greater concentration among physicians’ groups

and higher prices.

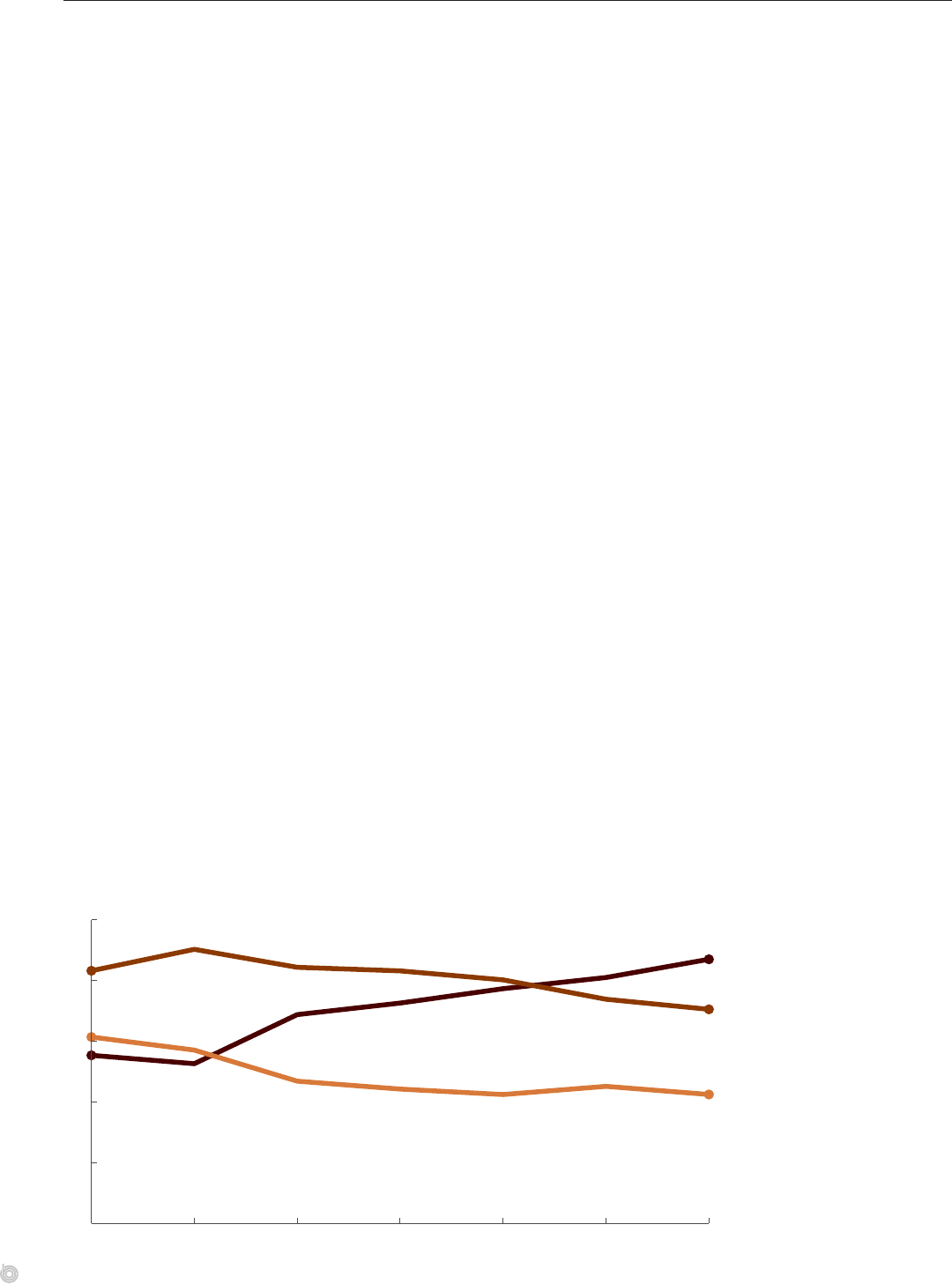

Average Herfindahl-Hirschman Indexes for Primary Care and Specialist Physicians in Metropolitan

Statistical Areas, 2010 to 2016

Specialist Physicians

Primary Care Physicians

1,819

3,228

2,343

3,397

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2010 2011 2012 2013 2014 2015 2016

Concentration in the

markets for specialist and

primary care physicians

has grown since 2010. An

HHI of 1,500 to 2,500 is

considered moderately

concentrated, and an

HHI of 2,501 to 5,000

is considered highly

concentrated. (Source:

CBO based on Exhibit 1 in

Fulton,2017.)

20 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

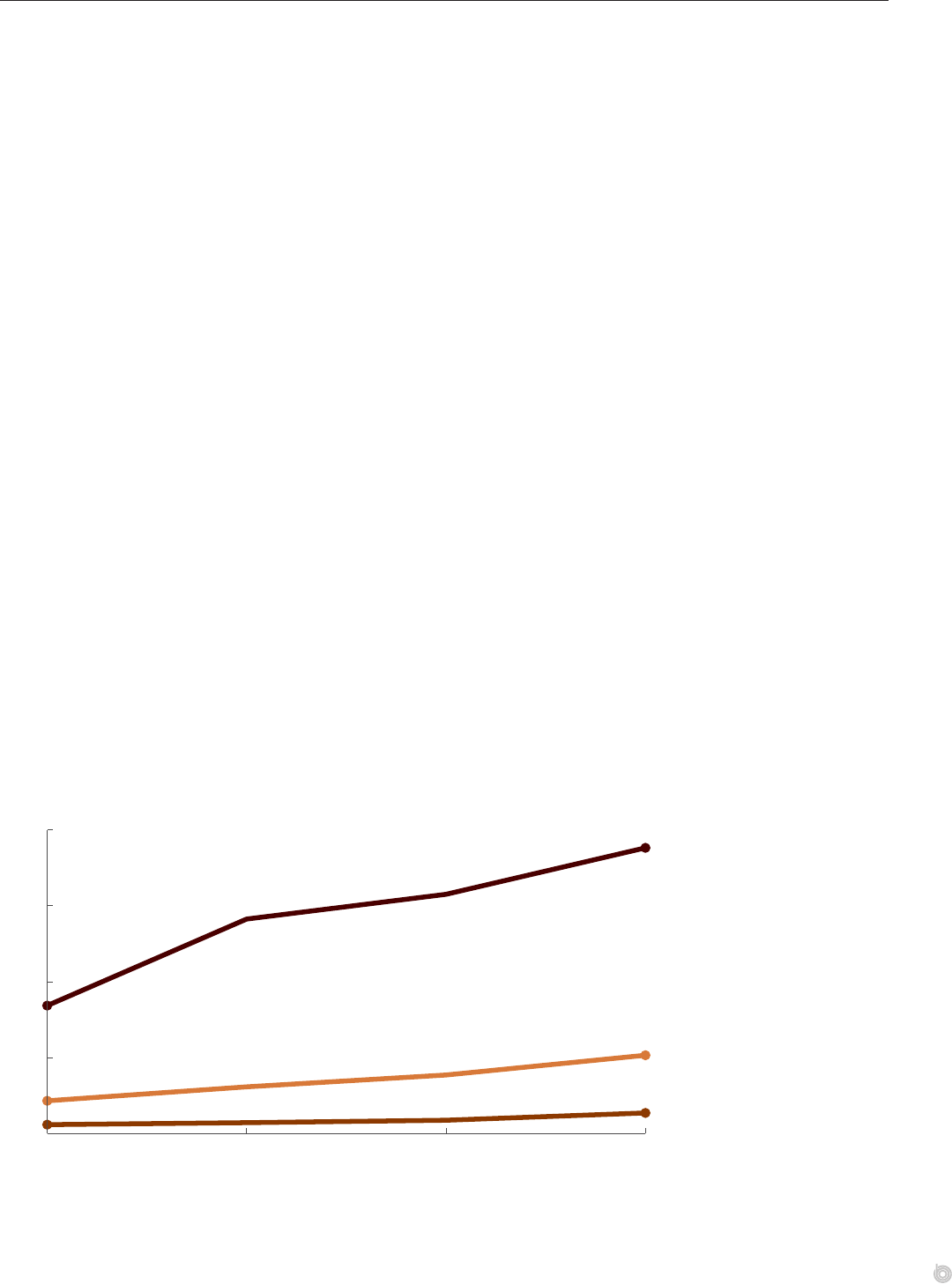

Employment of Physicians by Health Care Systems

Over the 2010–2016 period, the share of primary care physicians employed by a hospital

or health care system rose by 16 percentage points, from 28 percent to 44 percent.

7

At the

same time, the share of primary care physicians who were in a solo practice or were part of a

medical group declined. e trend of hospitals’ employing physicians may stem in part from

the fact that Medicare and many commercial insurers have tended to pay higher prices when

a service is billed in a hospital’s outpatient department rather than in a physician’s oce.

8

Physicians may also want to join larger, integrated practices to have more exible work

schedules, lower practice expenses per physician, access to expensive information technology

systems, or discounts on drugs they purchase for outpatient care.

Hospitals’ acquisitions of physicians’ practices have been found to result in greater use of

electronic health records and care management processes. Such acquisitions can also increase

hospitals’ market power in at least two ways. First, they increase the amount of care billed in

facilities owned by hospitals and reduce the amount billed in physicians’ oces. Second, they

lessen the ability of rival hospitals to refer patients to the acquired physicians’ practices and

increase the frequency of referrals within systems.

9

Such acquisitions can also increase market

concentration among physicians by consolidating them into larger groups.

CBO reviewed seven studies about whether vertical integration of providers relates to prices

for their services (see Table C-3 in Appendix C). Four of the studies looked at the relation-

ship between hospital-physician integration and prices for physicians’ services. All four

found that prices increased more in areas where vertical integration increased or that prices

rose after physicians’ practices were acquired by hospitals. (According to one of the studies,

almost half of those price increases were potentially attributable to the services’ being billed

as services provided in a facility and thus incurring a higher total fee.)

10

Another study looked

at integration between physicians of dierent specialties and found that prices for physicians’

services rose more in areas where that type of integration increased.

ree of the studies in CBO’s review examined the relationship between hospital-physician

integration and prices for hospitals’ services. Two found a signicant positive association

between increases in integration and hospitals’ prices. e other study’s ndings were incon-

clusive. (Although two of those studies used similar data sources, the three diered in their

time periods, measures of vertical integration, and methods.)

Share of Primary Care Physicians, by Ownership of Their Practice, 2010 to 2016

Percent

43.5

35.3

21.2

0

10

20

30

40

50

2010 2011 2012 2013 2014 2015 2016

Independent Solo Practice

Hospital or Health Care System

Medical Group

27.7

30.7

41.6

The percentage of primary

care physicians working

in a practice owned by

a hospital or health care

system rose during the

2010–2016 period. (Source:

CBO based on Exhibit 4 in

Fulton, 2017.)

21CHAPTER 4 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

Acquisition of Health Care Providers by Private Equity Firms

In recent decades, some physicians’ practices and hospitals have been bought by private

equity rms (companies that purchase and take over other companies to generate short-term

prots for their investors). Several recent studies have documented the volume of such acqui-

sitions. According to one study, only about 2 percent of physicians’ practices were acquired

by private equity rms between 2013 and 2016, but such acquisitions more than doubled

in frequency during that period.

11

Anesthesiologists, emergency medicine specialists, family

practitioners, and dermatologists were the most common types of physicians in acquired

practices. Another study found that roughly 7 percent of short-term acute care hospitals,

responsible for 11 percent of total patient discharges, were acquired by private-equity-backed

ventures between 2003 and 2017.

12

More than half of those acquisitions (161) occurred

in 2006, when Bain Capital purchased Hospital Corporation of America. (HCA became

publiclytraded again in 2011.)

Evidence about the eects on prices when private equity rms acquire medical providers has

been mostly anecdotal, until recently. A recent study found that after private equity rms

acquired hospitals, the ratio of those hospitals’ charges to costs rose by 7 percent overall, and

by 16 percent in emergency rooms, relative to otherwise-similar hospitals not bought by pri-

vate equity rms.

13

(Hospitals’ charges dier from the negotiated prices paid by commercial

insurers. But they are often correlated with those prices because, in some contracts, negoti-

ated prices are dened as a percentage of a hospital’s charges.)

For physicians and other providers, another study found that after a private equity rm that

employed emergency physicians entered into contracts with hospitals, the percentage of

emergency care billed out of network at those hospitals rose by 83 percentage points, and the

prices paid to those emergency physicians rose by 114 percent.

14

A recent study of dermatol-

ogists found that among practices acquired by private equity rms, prices for a few common

services rose by 3 percent to 5 percent relative to prices at nonacquired practices, although

prices for other services were not signicantly aected.

15

In addition, a study found that air

ambulance companies owned by private equity rms charged 68percent more in 2017 than

other air ambulance companies did.

16

Number of Physicians’ Practices Acquired Each Year by Private Equity Firms, 2013 to 2016

136

516

1,882

0

500

1,000

1,500

2,000

2013 2014 2015 2016

Physicians

Practice Sites

Practices

59

216

843

Private equity firms’

acquisitions of physicians’

practices grew each year

between 2013 and 2016.

(Source: CBO based on data

from Zhu and others, 2020.)

22 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

The Relationship Between Input Prices and

PricesPaidtoProviders

Commercial insurers’ prices for hospitals’ and physicians’ services are correlated with various

measures of the prices of inputs needed to deliver those services (such as providers’ wages,

rent, and malpractice insurance premiums). e strength of those relationships, however, is

sensitive to the inclusion of a few areas with particularly high measures of input prices.

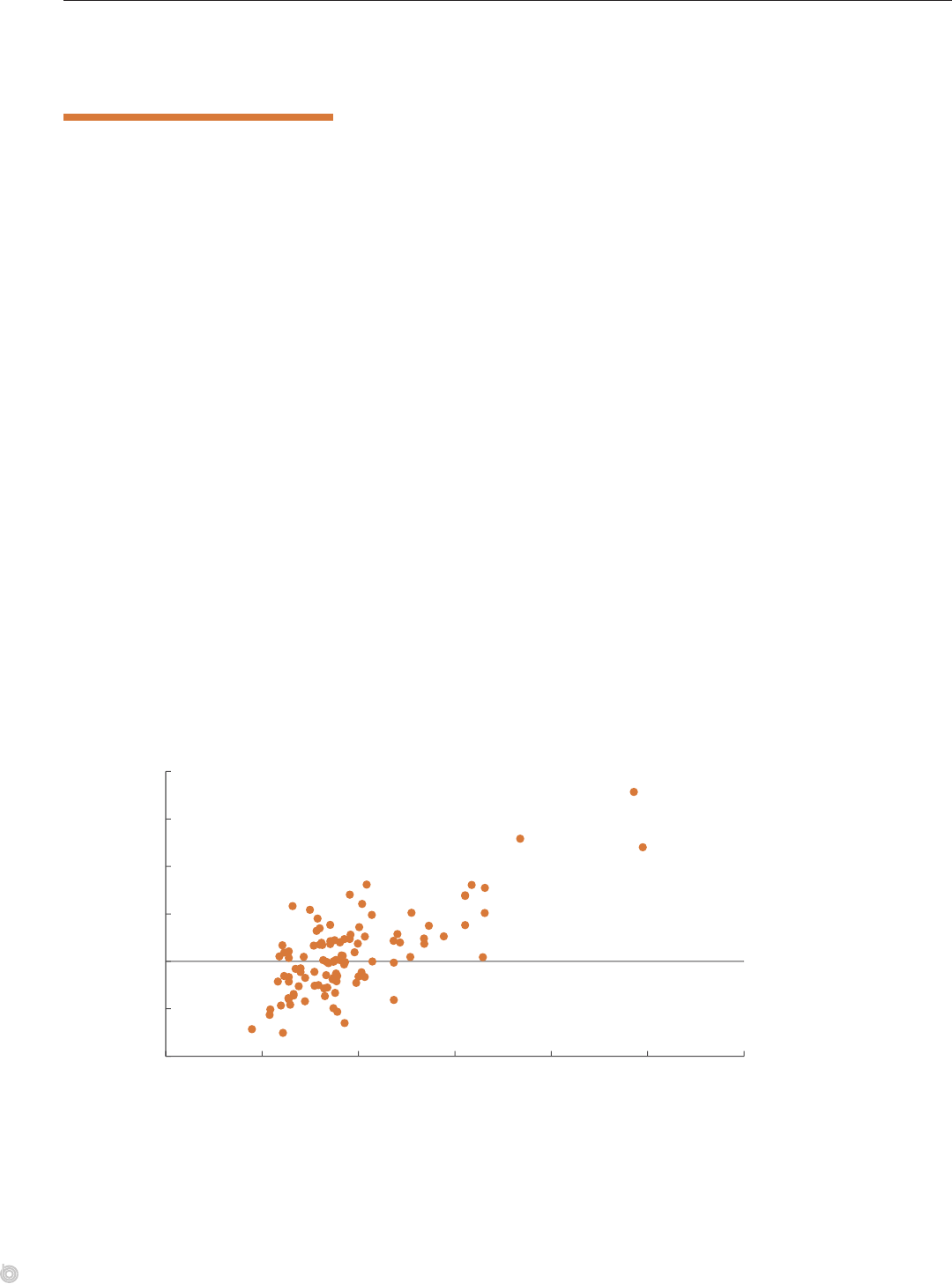

Hospitals’ Wages and Commercial Insurers’ Prices

Plotting an index of commercial insurers’ prices for hospitals’ inpatient services in a given

area against an index of hospitals’ wages in that area in 2017 shows a positive relation-

ship between wages and prices across 105 geographic areas. Of the variation in average

prices among those areas, 51 percent is explained by wages. at share falls to 33 percent

if the three outlier areas (Anchorage, Alaska; and San Francisco and San Jose, California)

areremoved.

In this analysis, the geographic areas are a subset of the nation’s core-based statistical areas

(CBSAs), which consist of metropolitan statistical areas and other areas with smaller popula-

tions, known as micropolitan statistical areas. Commercial insurers’ prices for inpatient

services are measured by a commercial price index, which represents the average price for a

basket of common services if people in each CBSA used services in the same proportions seen

at the national level. at index captures the percentage deviation from the national median

price paid by commercial insurers. Hospitals’ wages are measured by Medicare’s hospital wage

index. Medicare uses that index to adjust its prices for inpatient services to account for

geographic dierences in the wages that hospitals face in their local labor markets. Although

wages are a large part of hospitals’ input costs, Medicare adjusts its prices for other character-

istics of hospitals as well, such as whether they operate medical education programs or serve a

disproportionate share of low-income patients.

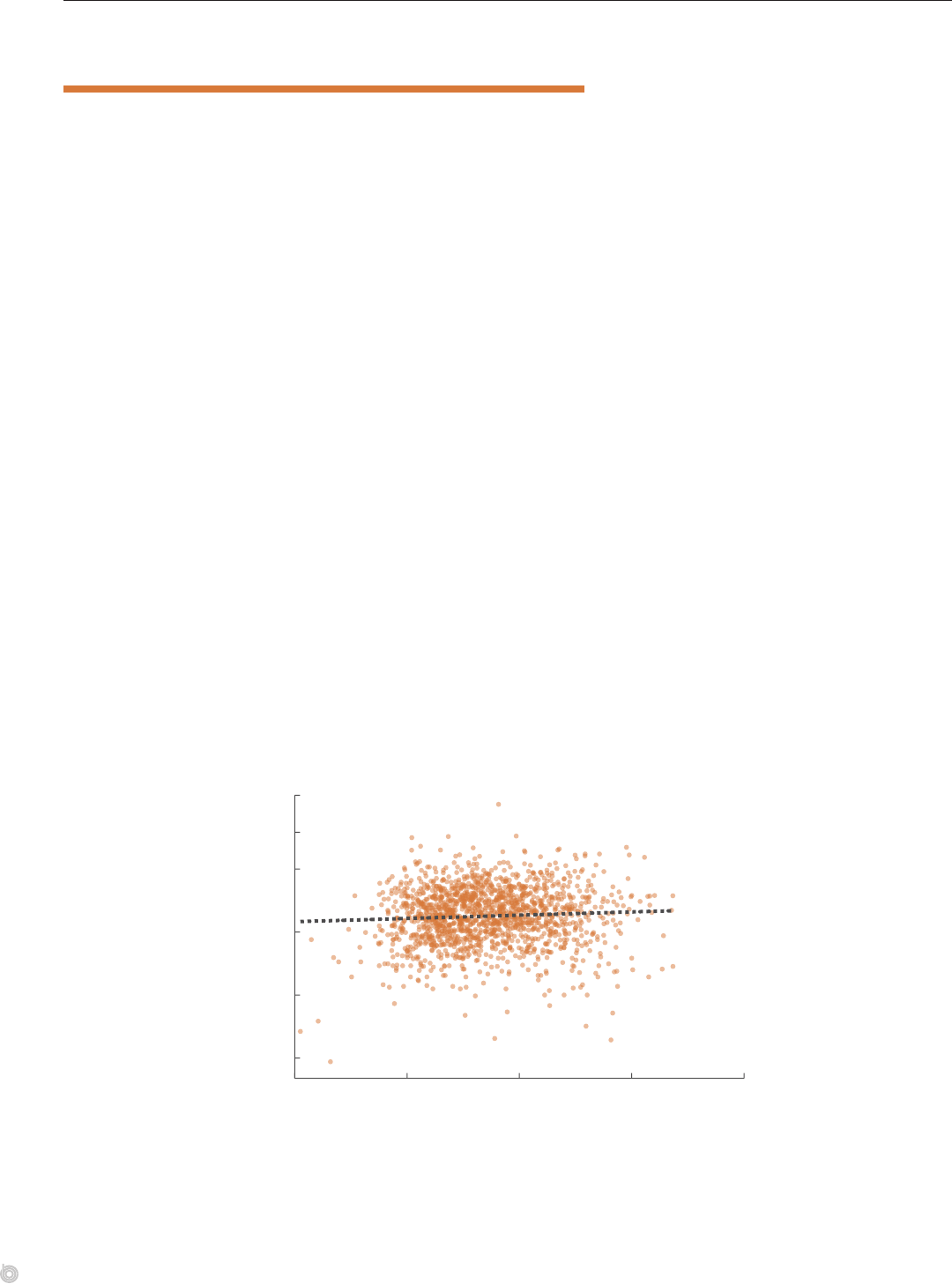

Relationship Between Hospitals’ Wages and Commercial Insurers’ Prices for Inpatient Services, 2017

-0.50

-0.25

0

0.25

0.50

0.75

1.00

0.50 0.75 1.00 1.25 1.50 1.75 2.00

Hospital Wage Index

Price

Index

Anchorage, AK

San Francisco, CA

San Jose, CA

Variation in the prices that

commercial insurers pay

for hospitals’ inpatient

services is associated

with variation in hospitals’

wages. (Source: CBO’s

analysis of aggregate

data from HCCI and the

Centers for Medicare &

MedicaidServices.)

23CHAPTER 4 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

Physicians’ Input Prices and Commercial Insurers’ Prices

Plotting an index of commercial insurers’ average prices for physicians’ services in each of

42states in 2017 against an index of average input prices for physicians’ services in those

states shows a positive relationship between input prices and the prices that commercial

insurers pay for physicians’ services. Dierences in input prices explain 27 percent of the

variation in commercial insurers’ prices among those states (the states for which the price

index that CBO used was available). However, that relationship is sensitive to the inclusion

of Alaska, which has high input prices. With Alaska excluded, only 3 percent of the variation

in commercial insurers’ prices is explained by dierences in input prices.

In this analysis, commercial insurers’ prices for physicians’ services are measured as the

state-level average commercial price index for a basket of 500 common physicians’ services

in 2017. As in the earlier discussion of how prices for physicians’ services vary by state, the

500 services included in that index reect the service codes most often seen in aggregate data

from HCCI’s database of claims by employment-based plans.

To measure input prices for physicians’ services, CBO used Medicare’s geographic adjustment

factor (GAF) as a proxy index for a state’s average input price for such services. at adjust-

ment factor accounts for geographic dierences in the prices of three inputs necessary for

delivering medical services: physicians’ wages (based on geographic dierences in the wages

of other professionals, such as architects, pharmacists, and computer scientists), practice

expenses (such as wages for administrative and clinical sta and rent), and malpractice

insurance premiums. For states with multiple geographic adjustment factors, CBO created a

state-level GAF by calculating a population-weighted average of the state’s factors. In addi-

tion, the Centers for Medicare & Medicaid Services (CMS) makes a number of legislatively

determined adjustments to the parts of the GAF that deal with physicians’ wages and practice

expenses, which aect the relationship between that measure and relative input prices.

Relationship Between Physicians’ Input Prices and Commercial Insurers’ Prices for

Physicians’Services, 2017

-0.2

0

0.2

0.4

0.6

0.8

1.0

0.9 1.0 1.1 1.2 1.3

Input Price Index (Measured by the GAF)

Physician

Price Index

Alaska

Variation in the prices that

commercial insurers pay

for physicians’ services is

associated with variation

in physicians’ estimated

input prices. (Source: CBO’s

analysis of aggregate data

from Johnson and others,

2020, and CMS.)

24 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES JANUARY 2022

Quality of Care and Commercial Insurers’ Prices

Analyzing 2016–2018 pricing data from RAND and 2018 quality information from CMS

for more than 1,500 hospitals, CBO found a small positive correlation between the average

prices that commercial insurers paid for hospitals’ inpatient and outpatient services, relative

to Medicare FFS’s prices, and a summary measure of hospitals’ quality. In addition, when

hospitals were ranked by commercial insurers’ prices as a percentage of Medicare’s prices,

41percent of hospitals in the top third of that ranking (those with commercial prices greater

than 276 percent of Medicare FFS’s prices) received four or ve stars on CMS’s overall qual-

ity rating, compared with 32 percent of hospitals in the bottom third of the price ranking

(those with commercial prices less than 216 percent of Medicare FFS’s prices). Even among

hospitals in the bottom third, however, more than 60 percent received a quality rating of

three or more stars.

It is unclear whether hospitals with higher quality can command higher prices from commer-

cial insurers or whether hospitals with more market power, and thus higher prices, can spend

more to improve their quality. In addition, correlations between prices and quality scores

could both be associated with some other, unmeasured factor—such as a hospital’s size or the

health of its patients—that causes the observed correlations.

In the case of physicians’ services, commercial insurers’ prices were not found to be associated

with measures of quality for those services, according to a recent research study.

17

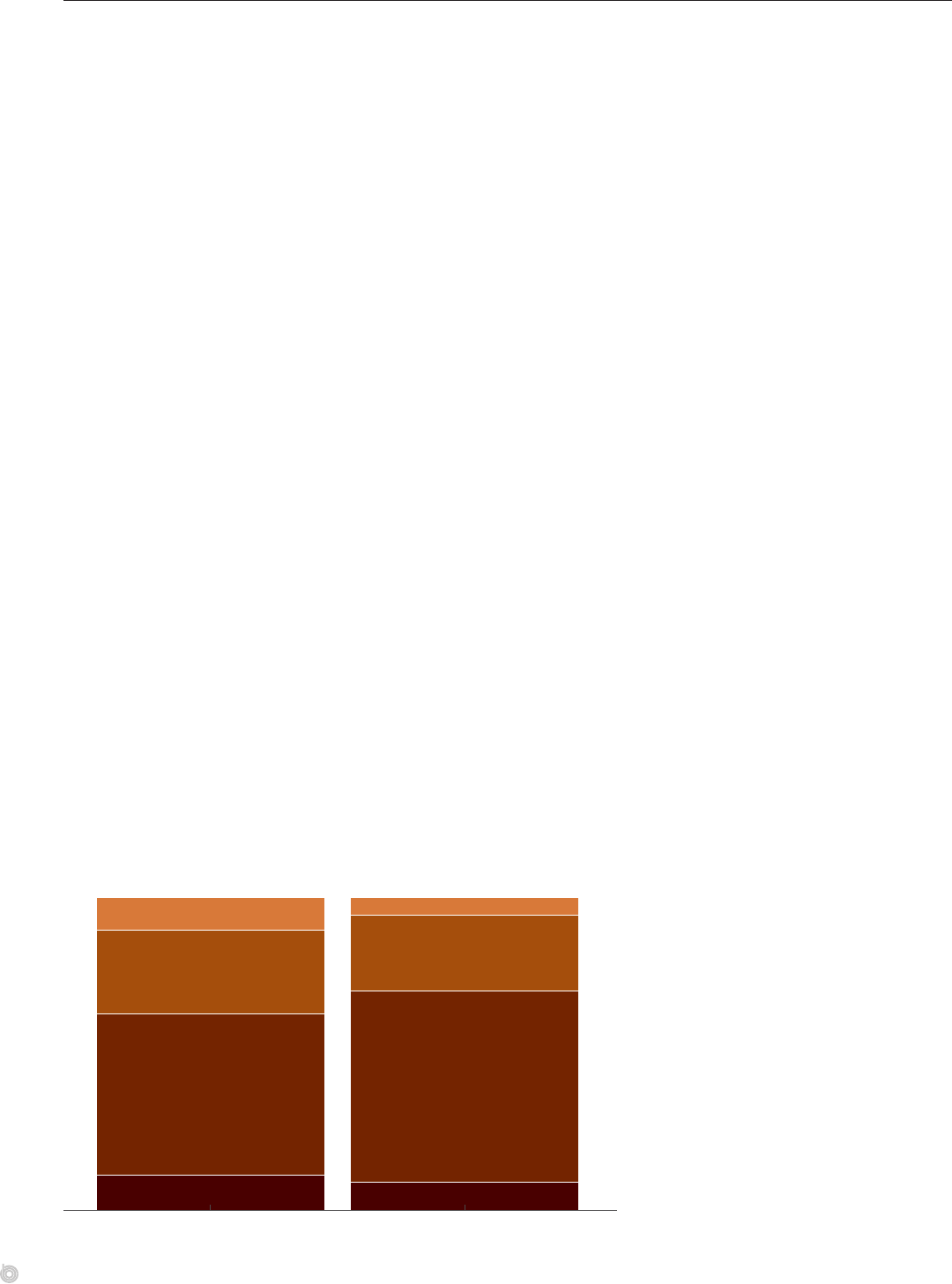

Quality Ratings for Hospitals, by Price Group, 2018

Percentage of Hospitals

12

26

30

25

7

7

23

31

29

10

10

21

29

27

14

Bottom Third

of Commercial Insurers' Prices

(<216% FFS)

Middle Third

(216−276% FFS)

Top Third

(>276% FFS)

1 2 3 4 5 1 2 3 4 5 1 2 3 4 5

Hospital Quality Rating (Number of stars)

Hospitals in the top third

when ranked by commercial

insurers’ average prices for

inpatient and outpatient

services, relative to

Medicare FFS’s prices, were

twice as likely to receive

the highest (five-star)

quality rating from CMS

in 2018 as hospitals in

the bottom third. (Source:

CBO’s analysis of hospital-

level data from Whaley and

others, 2020.)

25CHAPTER 4 THE PRICES THAT COMMERCIAL HEALTH INSURERS AND MEDICARE PAY FOR HOSPITALS’ AND PHYSICIANS’ SERVICES

Providers’ Administrative Spending and

CommercialInsurers’Prices

Many studies have documented the signicant costs of providers’ administrative activities,

which might contribute to higher prices for their services. Administrative spending can be

divided into spending on billing- and insurance-related (BIR) activities (such as processing

claims, updating patients’ medical records, and getting prior authorization from insurers) and

spending on non-BIR activities (such as general overhead, marketing, and eorts to monitor

and improve the quality of care).