FISCAL YEAR ENDEDSEPTEMBER 3, 2023

ANNU AL REPORT

2023

December 7, 2023

Dear Costco Shareholders,

Forty years ago this past September, the first Costco warehouse opened in Seattle. We grew to nearly three

billion dollars in sales in less than six years. Our operating philosophy then and now remains simple: provide our

members quality merchandise and services at the lowest possible prices. We achieve this through our

commitment to carrying out our mission statement and adhering to our code of ethics.

The successes and challenges we faced in fiscal year 2023 reinforced the foundational business model of Costco,

focusing on the most productive items and bringing quality goods to market in volume. Although we experienced

inflationary pressures and general economic uncertainties, our buying and operations staff ensured that quality

and value remained priorities.

Net sales for the 53-week year totaled $237.7 billion, an increase of 7%, with a comparable sales increase of 3%.

Net income was $6.3 billion, or $14.16 per diluted share, an increase of 8%. Revenue from membership fees

increased 8% to $4.6 billion, and our membership base grew to nearly 128 million cardholders, with a 90%

renewal rate.

In fiscal year 2023, Costco’s expansion included opening 23 net new locations: 13 in the U.S., three in China, two

each in Japan and Australia and one in South Korea, in addition to our first warehouses in New Zealand

(Auckland) and Sweden (Stockholm).

This year we introduced new Kirkland Signature™ items, which illustrate our commitment to provide cost savings

and improve quality. Our new bakery items included a peanut-butter chocolate pie, a lemon blueberry loaf, and a

lemon meringue cheesecake; each was met with tremendous enthusiasm. Other new KS items included cat food,

garlic butter shrimp, barbecue grills and yellow golf balls, each showing significant savings over comparable brand

name products.

Our ecommerce business provides a broader selection of merchandise that complements our warehouses. This

includes appliances, home furnishings, consumer electronics, lawn and garden, health and beauty aids, apparel,

and 2-Day Grocery Delivery. Costco Next, a Costco marketplace that offers an additional selection of products,

has over 60 suppliers and continues to grow.

We are dedicated more than ever to operate in a sustainable manner. Our merchandise teams concentrated on

decreasing packaging and plastic use, utilizing post-consumer recycled content, and finding ways to increase sell

units on pallets, trucks and containers, which maximizes space and therefore reduces emissions and costs. We

also continue to focus on diversity through inclusion, employee development, community involvement and

supplier diversity. Embracing differences is important to the growth of our company, as it leads to opportunities,

innovation and employee satisfaction.

The coming months will see changes at the executive level. After nearly two years as Costco's President and

COO, Ron Vachris will transition to the role of CEO, with Craig Jelinek retiring from the CEO role after serving in

that capacity for more than twelve years. As has been the case since Ron became President and COO, we expect

a smooth and seamless transition, maintaining the culture and operational excellence that Costco has been

known for throughout many years.

As this letter was being finalized, we were saddened to learn that Charlie Munger had peacefully passed away,

just five weeks shy of his hundredth birthday. Charlie was a long-time fan of Costco, serving on our Board for

more than 26 years. No one loved Costco more than Charlie and our company benefited greatly from his wisdom,

his business acumen, his passion for our business, his strong moral ethos and his common sense. We will miss

Charlie dearly and will take with us the many fond memories that he bestowed on us, personally, and on our

company.

We extend our deepest gratitude and compliments to our more than 316,000 employees. Their exemplary service

to our members, dedication to maintaining our core values and culture, and support of one another is why our

employees are our greatest competitive advantage.

Finally, we would like to thank Costco members around the world. Thank you for your loyal support and trust in

Costco. May the year ahead bring you and your families good health, happiness, peace and prosperity.

Sincerely,

Craig Jelinek Ron Vachris

Chief Executive Officer President & COO

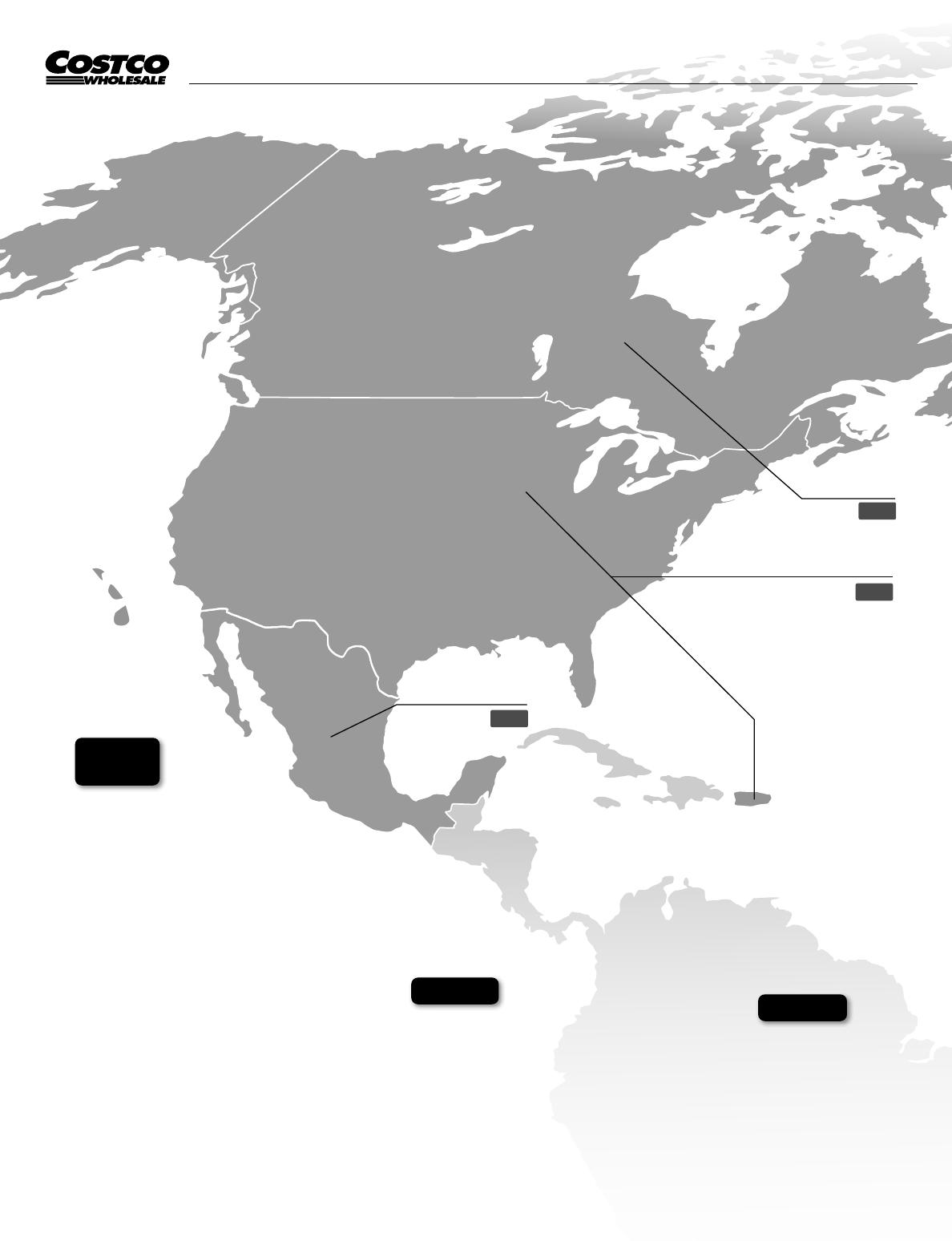

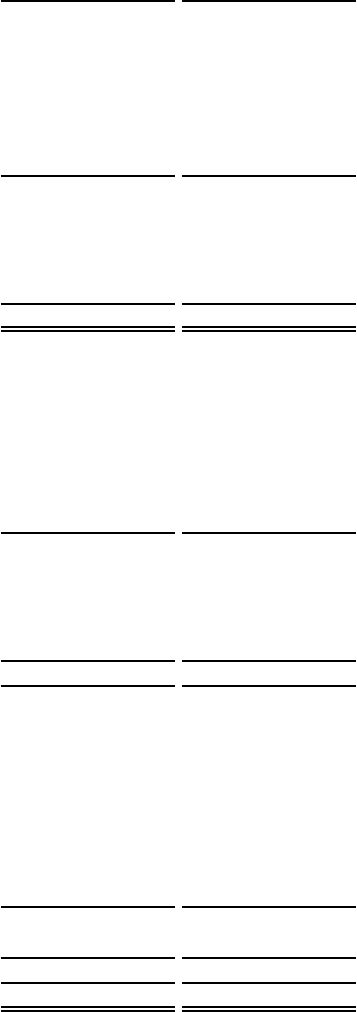

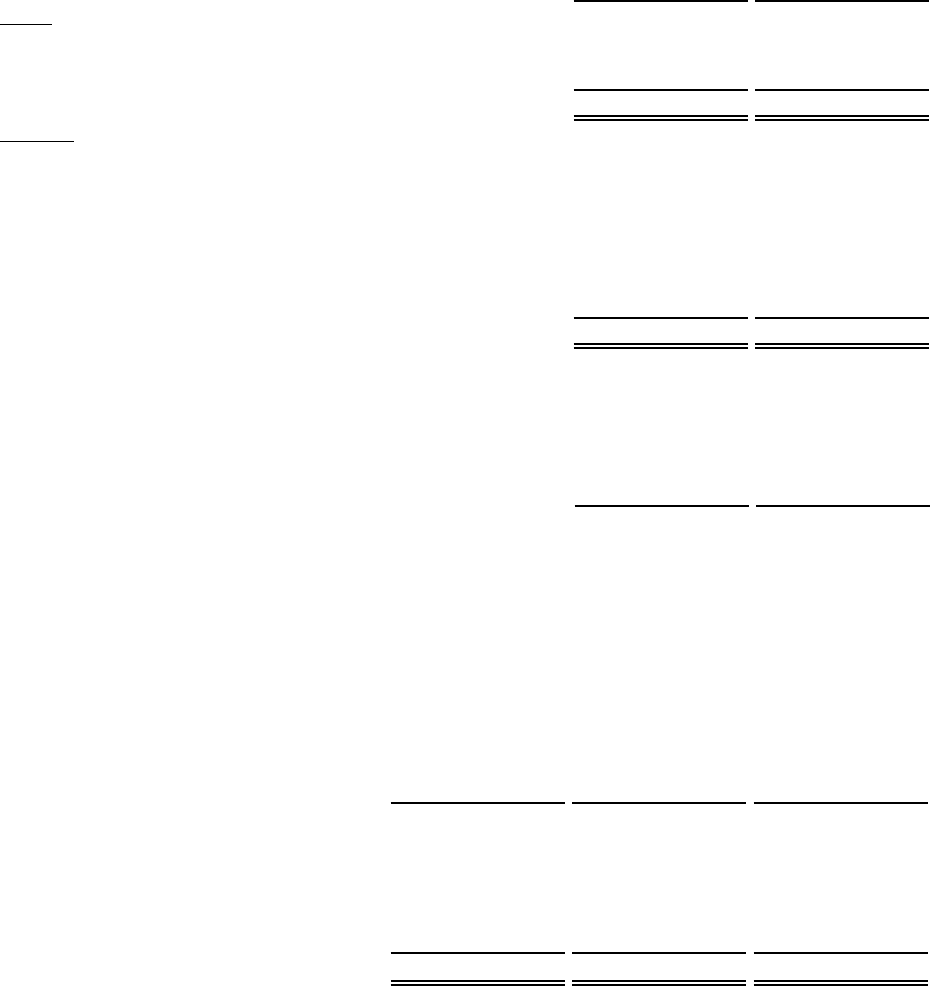

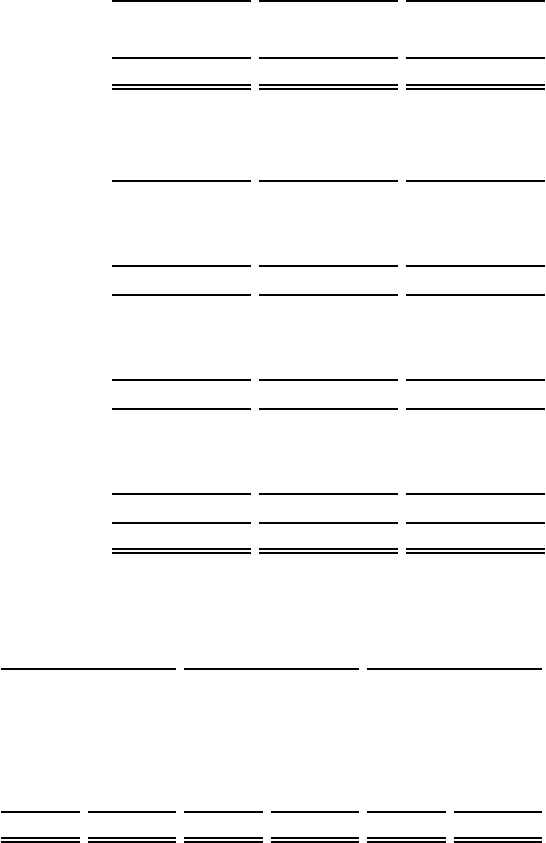

Canada

Puerto Rico

United States and

México

108

600

40

UNITED

STATES

COSTCO.COM

ALABAMA – 4

ALASKA – 4

ARIZ ONA – 20

ARKANSAS – 1

CALIFORNIA – 135

COLORADO – 16

CONNECTICUT – 8

DELA WARE – 1

FL ORIDA – 31

GEORGIA – 17

HA WAII – 7

ID AHO – 7

ILLINOIS – 23

INDIANA – 9

IOWA – 4

KANSAS – 3

KENTUCKY – 4

LOUISIANA – 3

MAINE – 1

MARYLAND – 11

MASSACHUSETTS – 6

MICHIGAN – 16

MINNESO TA – 13

MISSISSIPPI – 1

MISSOURI – 9

MONT ANA – 5

NEBRASKA – 3

NEV AD A – 8

NEW HAMPSHIRE – 1

NEW JERSEY – 21

NEW MEXICO – 3

NEW YORK – 19

NORTH CAROLINA – 10

NORTH DAKOTA – 2

OHIO – 13

OKLAHOMA – 4

OREGON – 13

PENNSYLVANIA – 11

SOUTH CAROLINA – 6

SOUTH DAKOTA – 1

TENNESSEE – 7

TEXAS – 38

UT AH – 14

VERMONT – 1

VIRGINIA – 17

WASHINGTON – 33

WISCONSIN – 11

WASHINGTON, D.C. – 1

PUERTO RICO – 4

871 loca tions as of December 31 , 2023

CANAD A

COSTCO.CA

ALBERTA – 19

BRITISH COLUMBIA – 14

MANIT OBA – 3

NEW BRUNSWICK – 3

NEWFOUNDLAND AND

LABRADOR – 1

NO VA SCOTIA – 2

ONTARIO – 40

QUÉBEC – 23

SASKATCHEW AN – 3

MÉXICO

COSTCO.COM.MX

AGUASCALIENTES – 1

BAJA CALIFORNIA – 4

BAJA CALIFORNIA SUR – 1

CHIHUAHU A – 2

CIUD AD DE MÉXICO – 5

COAHUILA – 1

GUANAJU ATO – 3

JALISCO – 3

MÉXICO – 5

MICHO ACÁN – 1

MOREL OS – 1

NUEV O LEÓN – 3

PUEBLA – 1

QUERÉT ARO – 1

QUINT ANA ROO – 1

SAN LUIS POTOSÍ – 1

SINAL OA – 1

SONORA – 1

TABASC O – 1

VERA CRUZ – 2

YUCA TÁN – 1

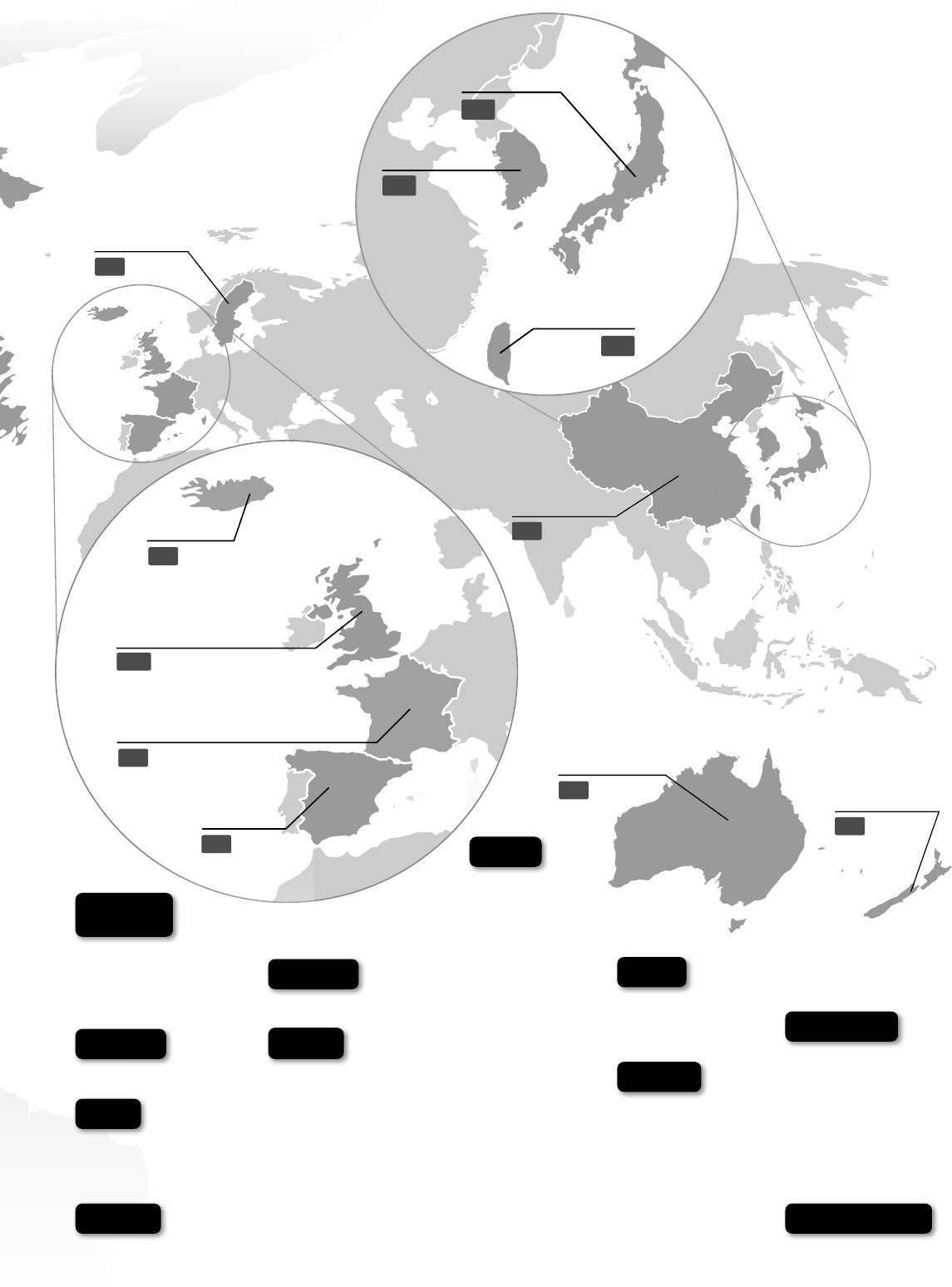

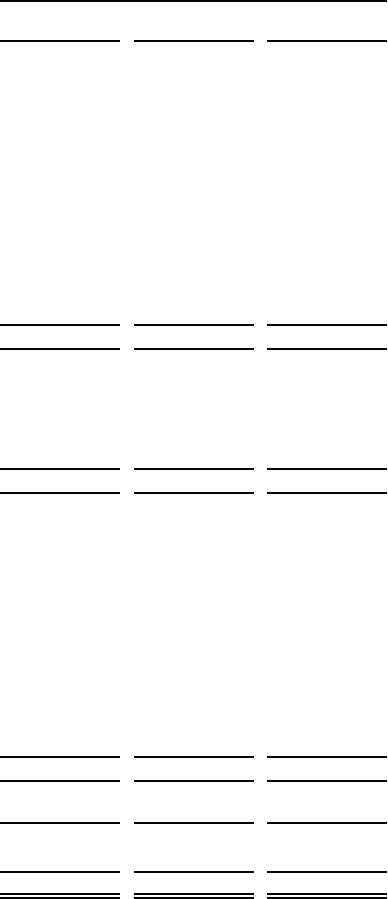

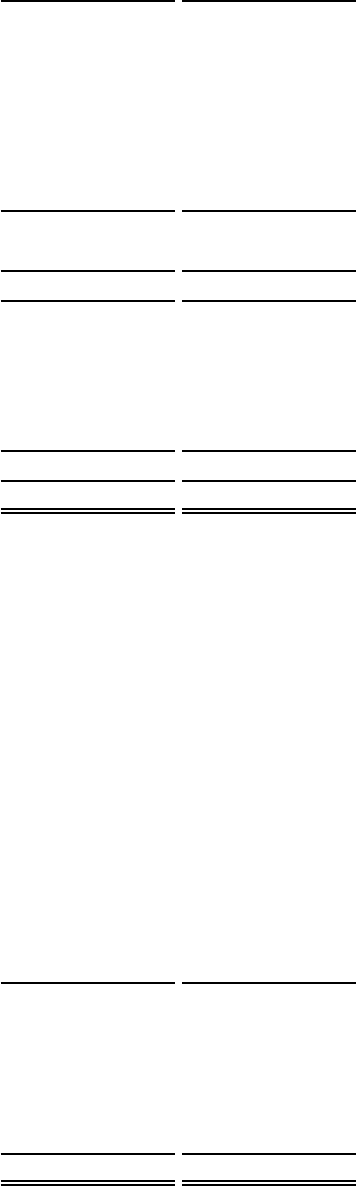

Australia

China

Spain

France

Iceland

United

Kingdom

4

2

1

29

15

Sweden

1

5

New

Zealand

1

Taiwan

Japan

Korea

14

18

33

COR000296 1623

AUSTRA LIA

COSTCO.COM.AU

AUSTRALIAN CAPIT AL

TERRIT ORY – 1

NEW SOUTH WALES – 4

QUEENSLAND – 3

SOUTH AUSTRALIA – 1

VICT ORIA – 4

WESTERN AUSTRALIA – 2

NEW ZEALAND

AUCKLAND – 1

SHANGHAI – 1

JAPAN

COSTCO.CO.JP

AICHI – 2

CHIBA – 3

FUKUOKA – 2

GIFU – 1

GUNMA – 2

HIROSHIMA – 1

HOKKAIDO – 2

HY OGO – 2

IBARAKI – 2

ISHIKAWA – 1

KANAGAWA – 3

KUMAMOTO – 1

KYOTO – 1

MIYAGI – 1

OSAKA – 2

SAIT AMA – 2

SHIZUOKA – 1

TOCHIGI - 1

TOKYO – 1

TOYAMA – 1

YAMA GA TA – 1

SWEDEN

STOCKHOLM – 1

KOREA

COSTCO.CO.KR

BUSAN – 1

CHEONAN – 1

DAEGU – 2

DAEJEON – 1

GIMHAE – 1

GYEONGGI-DO – 5

INCHEON – 1

SEJONG – 1

SEOUL – 4

ULSAN – 1

CHINA

SHANGHAI – 2

JIANGSU – 1

ZHEJIANG – 2

TAIW AN

COSTCO.COM. TW

CHIAYI CITY – 1

HSINCHU CITY – 1

KAOHSIUNG CITY – 2

NEW TAIPEI CITY – 3

TAICHUNG CITY – 2

TAINAN CITY – 1

TAIPEI CITY – 2

TAOYUAN CITY – 2

UNITED

KINGDOM

COSTCO.CO.UK

ENGLAND – 25

SCOTLAND – 3

WALES – 1

ICELAND

KAUPTÚN – 1

SPAIN

AND ALUCÍA – 1

BISCAY – 1

MADRID – 2

MADRID – 2

FRANCE

ÎLE-DE-FRANCE – 2

UNITEDSTATES

SECURITIES AND EXCHANGECOMMISSION

Washington, D.C. 20549

FORM 10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES

EXCHANGEACT OF 1934

For thefiscal year endedSeptember 3, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES

EXCHANGEACT OF 1934

Commission file number 0-20355

Costco WholesaleCorporation

(Exact nameofregistrant as specifiedinits charter)

Washington 91-1223280

(State or other jurisdiction of

incorporationororganization)

(I.R.S.EmployerIdentificationNo.)

999 Lake Drive, Issaquah, WA 98027

(Addressofprincipal executiveoffices)(ZipCode)

Registrant’s telephone number,including area code: (425) 313-8100

Securities registered pursuant to Section12(b) of theAct:

Titleofeach classTrading Symbol

Name of each exchange on

whichregistered

CommonStock,$.005 ParValue COST TheNASDAQ Global Select Market

Securities registered pursuanttoSection12(g) of theAct:None

Indicate by checkmarkifthe registrant is awell-knownseasoned issuer,asdefined in Rule 405 of the

Securities Act. Yes ☒ No ☐

Indicate by checkmarkifthe registrant is not requiredtofile reports pursuant to Section13or

Section15(d) of theAct.Yes ☐ No ☒

Indicate by checkmarkwhether theregistrant (1)has filedall reports requiredtobefiledbySection 13 or

15(d) of theSecuritiesExchange Actof1934 duringthe preceding 12 months (orfor such shorte rperiod

that theregistrant wasrequiredtofilesuchreports), and (2)has been subjecttosuchfilingrequirements

forthe past90days. Yes ☒ No ☐

Indicate by checkmarkwhether theregistrant has submittedelectronically everyInteractive Data File

requiredtobesubmitted pursuanttoRule405 of RegulationS-T (§ 232.405 of this chapter)duringthe

preceding 12 months (orfor such shorterperiodthat theregistrant wasrequiredtosubmit such files).Yes

☒ No ☐

Indicate by checkmarkwhether theregistrant is alarge acceleratedfiler, an acceleratedfiler, anon-

acceleratedfiler, asmaller reporting company,oranemerginggrowthcompany.See thedefinitions of

“large acceleratedfiler,”“acceleratedfiler,”“smallerreporting company,” and “emerginggrowthcompany”

in Rule 12b-2ofthe Exchange Act.

Large acceleratedfiler

☒

Acceleratedfiler ☐

Non-acceleratedfiler

☐

Smallerreporting company ☐

Emerging growth company ☐

If an emerging growth company,indicatebycheck mark if theregistrant has electednot to usethe

extended transitionperiodfor complyingwithany new or revisedfinancialaccountingstandards provided

pursuant to Section13(a) of theExchangeAct. ☐

Indicate by checkmarkwhether theregistrant has filedareportonand attestationtoits management’s

assessment of theeffectivenessofits internal controloverfinanc ialreporting under Section404(b) of the

Sarbanes-Oxley Act(15 U.S.C. 7262(b)) by theregistered public accountingfirmthatprepared or issued

itsauditreport. ☒

If securities areregistered pursuant to Section12(b) of theAct,indicate by checkmarkwhether the

financialstatementsofthe registrant included in thefilingreflect thecorrectionofanerror to previously

issued financials statements. ☐

Indicate by checkmarkwhether anyofthoseerror corrections arerestatementsthat requiredarecovery

analysisofincentive-based compensationreceivedbyany of theregistrant's executiveofficersduringthe

relevant recovery periodpursuant to §240.10D-1(b). ☐

Indicate by checkmarkwhether theregistrant is ashellcompany (asdefined in Rule 12b-2ofthe Act).

Yes ☐ No ☒

Theaggregatemarketvalue of thevotingstock heldbynon-affiliatesofthe registrant as of February12,

2023 was$221,351,787,419.

Thenumber of shares outstanding of theregistrant’scommonstock as of Octo ber 3, 2023, was

442,740,572.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of theCompany’s ProxyStatement forthe Annual MeetingofShareholderstobeheldon

January18, 2024, are incorporated by referenceintoPartIII of this Form 10-K.

COSTCO WHOLESALECORPORATION

ANNUAL REPORT ON FORM 10-KFOR THEFISCAL YEAR ENDEDSEPTEMBER 3, 2023

TABLEOFCONTENTS

Page

PART I

Item1.

Business ................................................................

4

Item1A.

RiskFactors .............................................................

9

Item1B.

Unresolved StaffComments ...............................................

18

Item2.

Properties ...............................................................

19

Item 3.

Legal Proceedings ........................................................

19

Item4.

Mine Safety Disclosures ...................................................

19

PART II

Item5.

Market forRegistrant’s CommonEquity,Related Stockholder Matters and Issuer

Purchases of Equity Securities ...........................................

19

Item6.

Reserved ................................................................

20

Item 7.

Management’s Discussion and AnalysisofFinancialCondition and Resultsof

Operations .............................................................

21

Item 7A.

Quantitativeand QualitativeDisclosures About Market Risk ....................

29

Item8.

FinancialStatementsand SupplementaryData ...............................

31

Item9.

Changesinand DisagreementswithAccountantsonAccountingand Financial

Disclosure .............................................................

61

Item9A.

Controls and Procedures ..................................................

61

Item9B.

Other Information .........................................................

62

Item9C.

DisclosureRegarding ForeignJurisdictions that Prevent Inspections ............

62

PART III

Item10.

Directors,Executive Officers and CorporateGovernance ......................

62

Item11.

ExecutiveCompensation ..................................................

62

Item 12.

Security Ownership of CertainBeneficialOwnersand Management and Related

Stockholder Matters .....................................................

62

Item13.

CertainRelationships and RelatedTransactions ,and DirectorIndependence .....

62

Item14.

Principal AccountingFees and Services .....................................

62

PART IV

Item15.

Exhibits,FinancialStatement Schedules .....................................

63

Item16.

Form 10-KSummary ......................................................

66

Signatures ...............................................................

67

3

INFORMATION RELATING TO FORWARD LOOKINGSTATEMENTS

Certainstatementscontained in this document constitute forward-lookingstatementswithinthe meaning

of thePrivate Securities LitigationReformAct of 1995. Forthesepurposes,forward-lookingstatements

arestatementsthat addressactivities, events, conditions or developmentsthatthe Company expects or

anticipates mayoccur in thefutureand mayrelatetosuchmatters as net salesgrowth, changes in

comparablesales,cannibalizationofexistinglocations by new openings,price or feechanges,earnings

performance, earnings per share, stock-based compensationexpense, warehouseopenings and

closures,capitalspending, theeffectofadoptingcertain accountingstandards,futurefinancialreporting,

financing, margins,returnoninvestedcapital,strategicdirection, expensecontrols,membership renewal

rates, shopping frequency, litigation, and thedemand forour products and services.Insomecases,

forward-lookingstatementscan be identifiedbecausethey containwords such as “anticipate,”“believe,”

“continue,”“could,”“estimate,” “expect,”“intend,”“likely,” “may,”“might,” “plan,”“potential,”“predict,”

“project,” “seek,” “should,”“target,” “will,”“would,”orsimilarexpressions and thenegatives of thoseterms.

Such forward-lookingstatementsinvolve risks and uncertainties that maycauseactual events, results, or

performancetodiffermateriallyfromthoseindicatedbysuchstatements, including, without limitation, the

factorsset forthinthe sectiontitled“Item1A-Risk Factors”,and other factorsnoted in thesection titled

“Item7-Management's Discussion and AnalysisofFinancialCondition and ResultsofOperations”and in

theconsolidated financialstatementsand relatednotes in Item8of this Report. Forward-looking

statements speakonlyasof thedatethey aremade, and we do not undertake to updatethese

statements, except asrequiredbylaw.

PART I

Item 1—Business

Costco WholesaleCorporation and itssubsidiaries(Costco or theCompany)began operations in 1983, in

Seattle, Washington. We areprincipally engaged in theoperationofmembership warehouses in the

United States (U.S.) and Puerto Rico, Canada, Mexico,Japan, theUnitedKingdom (U.K.),Korea,

Australia,Taiwan, China, Spain, France,Iceland, NewZealand, and Sweden. Costco operated 861, 838,

and 815 warehouses worldwideatSeptember 3, 2023, August28, 2022, and August29, 2021. The

Company operates e-commerce websites in theU.S., Canada, Mexico,the U.K.,Korea, Ta iwan, Japan,

and Australia.Our commonstock trades on theNASDAQGlobal Select Market,under thesymbol

“COST.”

We reportona52/53-week fiscalyear, consisting of thirteen four-week periods and ending on theSunday

nearestthe end ofAugust. Thefirst threequarters consistofthree periods each, and thefourthquarter

consists of four periods(five weeksinthe thirteenthperiodina53-week year). Thematerialseasonal

impactinour operations is increased net salesand earnings duringthe winterholiday season.

References to 2023 relate to the53-week fiscalyear ended September 3, 2023. References to 2022 and

2021 relate to the52-week fiscalyears ended August28, 2022, and August29, 2021.

General

We operatemembershipwarehousesand e-commercewebsites based on theconcept that offering our

memberslow prices on alimited selectionofnationally-branded and private-label products in awide

range of categorieswill producehighsales volumesand rapidinventoryturnover.When combined with

theoperatingefficienciesachievedbyvolumepurchasing, efficient distributionand reduced handlingof

merchandise in no-frills,self-servicewarehousefacilities, thesevolumes and turnover enableusto

operateprofitablyatsignificantly lowergross margins(net saleslessmerchandise costs) than most other

retailers.Weoften sell inventorybeforeweare requiredtopay forit, even while taking advantage of early

payment discounts.

4

We buymostofour merchandise directly from suppliers and routeittocross-docking consolidationpoints

(depots) or directly to our warehouses. Ourdepotsreceive largeshipmentsfromsuppliers and quickly

ship thesegoods to warehouses.Thisprocess creates freight volume and handlingefficiencies, lowering

costsassociatedwithtraditional multiple-stepdistributionchannels. Oure-commerceoperations ship

merchandise through our depotsand logisticsoperations,aswellasthrough drop-ship and other delivery

arrangementswithour suppliers.

Ouraverage warehousespace is approximately147,000 squarefeet,withnewer units being slightly

larger.Floor plansare designed foreconomyand efficiencyinthe useofsellingspace, thehandlingof

merchandise,and thecontrol of inventory. Becauseshoppersare attractedprincipally by thequalityof

merchandise andlow prices,our warehouses arenot elaborate.Bystrictlycontrollingthe entrances and

exitsand usingamembershipformat, we believe our inventorylosses(shrinkage) arewellbelow thoseof

typicalretailoperations.

Ourwarehousesonaverage operateonaseven-day,70-hour week.Gasolineoperations generally have

extended hours. Becausethe hoursofoperationare shorterthan many other retailers,and due to other

efficienciesinherent in awarehouse-type operation, labor costsare lowerrelativetothe volume of sales.

Merchandise is generally stored on racks abovethe salesfloor and displayedonpallets containing large

quantities, reducinglabor required.Ingeneral,withvariations by country,our warehouses accept certain

creditcards,including Costco co-branded cards, debitcards,cashand checks, Executivemember 2%

reward certificates,co-brand cardholder rebates,and our proprietary stored-valuecard(shop card).

Ourstrategy is to provideour memberswithabroad range of high-qualitymerchandise at prices we

believe areconsistently lowerthan elsewhere. We seek to limit most itemstofast-sellingmodels, sizes,

andcolors. We carrylessthan4,000 acti ve stockkeeping units (SKUs) per warehouseinour core

warehousebusiness, significantlylessthan other broadlineretailers.Weaverage anywherefrom9,000 to

11,000 SKUs online, some of whichare also availableinour warehouses.Many consumableproducts are

offeredfor sale in case,carton, or multiple-packquantitiesonly.

In keeping withour policy of member satisfaction, we generally accept returnsofmerchandise.Oncertain

electronicitems,wetypically have a90-day return policyand provide, free of charge, technicalsupport

services,aswellasanextended warranty. Additional third-party warrantycoverage is sold on certain

electronicitems.

We offermerchandise andservicesinthe followingcategories:

Core Merchandise Categories (orcorebusiness):

•Foods andSundries (including sundries, drygrocery,candy,cooler,freezer,deli, liquor,and

tobacco)

•Non-Foods (including majorappliances,electronics, health and beautyaids, hardware, garden

andpatio,sportinggoods,tires,toysand seasonal,officesupplies, automotivecare, postage,

tickets,apparel,small appliances,furniture,domestics, housewares,specialorder kiosk, and

jewelry)

•Fresh Foods (including meat,produce, servicedeli, and bakery)

Warehouse Ancillary (includes gasoline, pharmacy,optical,food court, hearingaids, and tire installation)

and OtherBusinesses (includes e-commerce

1

,businesscenters

1

,travel, and other)

Warehouseancillary businessesoperateprimarily withinornexttoour warehouses,encouraging

memberstoshop more frequently. Thenumber of warehouses withgas stations varies significantly by

country,and we have no gasolinebusinessinKorea, China, or Sweden. We operated 692 gas stations at

theend of 2023.Our gasoline business represented approximately13% of totalnet salesin2023.

5

1

E-commerceand businesscentersare allocatedtothe appropriate merchandise categoriesinthe NetSales portion of Item7.

Ourother businessessellproducts andservicesthat complement our warehouseoperations (coreand

warehouseancillary businesses).Our e-commerceoperations give membersconvenienceand abroader

selectionofgoods andservices. Netsales fore-commercerepresented approximately6%oftotal net

salesin2023. This figuredoes notinc lude other services we offeronlineincertain countries such as

businessdelivery, travel,same-day grocery, and various other services.Our businesscenterscarry items

tailoredspecifically forfood services,conveniencestoresand offices, and offerwalk-in shoppingand

deliveries. Business centersare included in our totalwarehousecount.CostcoTraveloffersvacation

packages,car rentals, cruises, hotels, and other travel products exclusivelyfor Costco members(offered

in theU.S., Canada, and theU.K.).

We havedirectbuyingrelationships withmanyproducersofbrand-namemerchandise.Wedonot obtain

asignificant portionofmerchandise from any one supplier. When sourcesofsupplybecomeunavailable,

we seek alternatives.Wealsopurchaseand manufacture private-label merchandise,aslong as quality

andmemberdemand arehighand thevalue to our membersissignificant.

Certainfinancialinformation forour segmentsand geographicareas is included in Note 11 to the

consolidated financialstatementsincludedinItem8of this Report.

Membership

Ourmembers mayutilizetheir membershipsatall of our warehouses and websites.GoldStar

membershipsare availabletoindividuals; Businessmemberships arelimited to businesses, including

individualswithabusinesslicense, retail saleslicense, or comparabledocument.Businessmembersmay

addadditional cardholders(affiliates),towhich thesameannual feeapplies. Affiliatesare not availablefor

Gold Star members. Ourannual feefor thesemembershipsis$60 in theU.S.and varies in other

countries.All paidmemberships include afreehouseholdcard.

Ourmember renewal rate was92.7% in theU.S.and Canada and 90.4% worldwideatthe end of 2023.

Themajorityofmembers renew withinsix months followingtheirrenewal date. Ourrenewal rate,which

excludes affiliatesofBusinessmembers,isatrailingcalculation that captures renewalsduringthe period

seventoeighteen months priortothe reporting date. Ourmembership countsinclude active memberships

as well as membershipsthathavenot renewed withinthe 12 months priortothe reporting date.

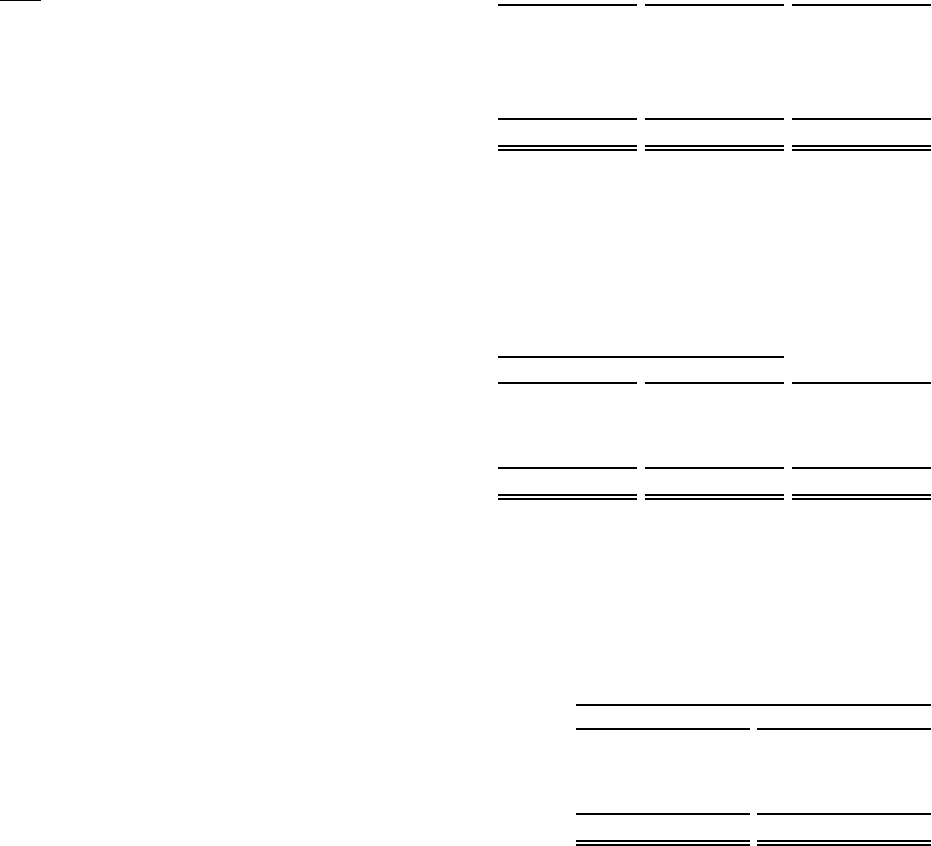

Ourmembership wasmadeupofthe following(in thousands):

2023 2022 2021

Gold Star ................................................

58,800 54,000 50,200

Business, includingaffiliates ................................

12,200 11,800 11,500

Totalpaidmembers .....................................

71,000 65,800 61,700

Householdcards .........................................

56,900 53,100 49,900

Totalcardholders .......................................

127,900 118,900 111,600

Paid cardholders (exceptaffiliates) areeligible to upgrade to an Executivemembership in theU.S., foran

additional annualfee of $60. Executivemembershipsare also availableinCanada, Mexico,the U.K.,

Japan, Korea, Taiwan,and Australia,for whichthe additional feevaries. Executivemembersearna2%

reward on qualifiedpurchases (generally up to amaximum reward of $1,000 per year), redeemableat

Costco warehouses.Thisprogram offers services that vary by stateand country and provideaccess to

additional savingsand benefitsonvarious businessand consumer services,suchasautoand home

insurance, theCostcoautopur chaseprogram,and checkprinting. Executivememberstotaled 32.3

millionand represented 45.4% of paidmembers.The salespenetration of Executivemembers

represented approximately72.8% of worldwidenet salesin2023.

6

HumanCapital

OurCodeofEthicsrequiresthatwe“Ta ke Care of OurEmployees,” whichisfundamental to the

obligationto“TakeCareofOur Members.”Wemustalsocarefully controlour selling, general and

administrative(SG&A) expenses,sothat we cansellhighqualitygoods and services at lowprices.

Compensationand benefits foremployees is our largestexpenseafterthe cost of merchandise and is

carefully monitored.

Employee Base

At theend of 2023, we employed 316,000 employees worldwide. Approximately95% areemployedinour

membership warehousesand distribution channels, and approximately5%are represented by unions.

We also utilizeseasonal employees.

Thetotal numberofemployees by segment was:

2023 2022 2021

United States ...............................

208,000 202,000 192,000

Canada ....................................

51,000 50,000 47,000

Other International ..........................

57,000 52,000 49,000

Totalemployees ............................

316,000 304,000 288,000

Growth andEngagement

We believe that ourwarehousesare among themostproductive in theretailindustry, owinglargelytothe

commitment and efficiencyofour employees.Weseek to providethem not merely withemployment but

careers. Many attributes of our business contributetothe objective.The more significant include:

competitivecompensationand benefitsfor thoseworking in our membership warehouses and

distributions channels;acommitment to promotingfromwithin; and atarget ratioofatleast50% of our

employee basebeing full-time employees.Theseattributes contributetowhat we consider,especially for

theindustry, ahighretention rate.In2023, in theU.S.that rate wasapproximately90% foremployees

whohavebeenwithusfor at leastone year.

Diversity,Equity andInclusion

Thecommitment to “TakeCareofOur Employees”isalsothe foundationofour approachtopromoting

diversity, equity andinclusion and creatinganinclusive and respectfulworkplace.Westriv efor an

environment whereall employees feel that they belong, areaccepted, included, respectedand supported

becauseofwho they are. We demonstrateleadership commitment to equity through consistent

communication, employee development and education, supportofdiversity and inclusioninitiatives within

theorganization, communityinvolvement,and supplierdiversity.Costcocontinues itsefforts to develop

future leaders,including throughthe supervisorintrainingprograms. In 2023, over 7,800 hourly

employees completedthe 6-week course.

Well Being

Costco strivestoprovide our employees withcompetitive wages and excellent benefits. In March2023,

we increased thetop of thewagescalesby85centsper hour in theU.S,Canada and Puerto Rico. In

September of2023, we increasedthe starting wage to at least$18.50 forall entry-level positions in the

U.S. We havealsoexpandedour benefits in theU.S.toinclude additional mental health support for

childrenand adults at littletono cost to our employees.Costcoisfirmlycommittedtoprotectingthe health

andsafetyofour membersand employees and to servingour communities.

7

Formoredetailedinformation regarding our programsand initiatives, see“Employees”withinour

SustainabilityCommitment (located on our website).The SustainabilityCommitment and other

information on our websiteare not incorporated by referenceintoand do not form any partofthisAnnual

Report.

Competition

Ourindustryishighlycompetitive,based on factorssuchasprice,mer chandise qualityand selection,

location, convenience, distribution strategy,and customer service. We competeonaworldwidebasis with

global,national,and regional wholesalersand retailers,including supermarkets, supercenters, online

retailers,gasolinestations, harddiscounters, department and specialtystores, and operatorssellinga

singlecategoryornarrowrange of merchandise.Walmart,Target,Kroger,and Amazon areamong our

significant general merchandise retail competitorsinthe U.S. We also competewithother warehouse

clubs,including Walmart’sSam’s Cluband BJ’s WholesaleClubinthe U.S. Many of themajor

metropolitan areas in theU.S.and certainofour Other International locations havemultiplecompeting

clubs.

IntellectualProperty

We believe that,tovarying degrees,our trademarks, tradenames,copyrights, proprietary processes,

trade secrets, tradedress,domainnames and similarintellectual property add significant valuetoour

businessand areimportant to our success. We haveinvestedsignificantly in thedevelopment and

protection of ourwell-recognizedbrands,including theCos tc oWholesaletrademarks and our private-

label brand, Kirkland Signature. We believe that Kirkland Signatureproducts arehighquality, offeredat

prices that aregenerally lowerthan national brands,and helplower costs, differentiate our merchandise

offerings,and generally earn higher margins. We expecttocontinue to increasethe salespenetration of

our private-label items.

We rely on trademarkand copyright laws,trade-secret pr otection, and confidentiality, licenseand other

agreementswithour suppliers,employees and otherstoprotect our intellectual property.The availability

and durationoftrademark registrations vary by country;however,trademarks aregenerally valid and may

be renewed indefinitelyaslong as they areinuse and registrations aremaintained.

AvailableInformation

OurU.S.websiteiswww.costco.com. We make availablethrough theInvestorRelations sectionofthat

site,freeofcharge, ourAnnualReports on Form 10-K, QuarterlyReports on Form 10-Q, Current Reports

on Form 8-K, ProxyStatementsand Forms 3, 4and 5, and any amendmentstothose reports,assoon as

reasonablypracticable afterfilingsuchmaterials withorfurnishingsuchdocumentstothe Securities and

Exchange Commission (SEC). Theinformation found on our websiteisnot partofthisorany other report

filedwithorfur nished to theSEC.The SEC maintainsasite that contains reports,proxy and information

statements, and other informationregarding issuers, such as theCompany,that file electronically withthe

SECatwww.sec.gov.

We haveacode of ethics forseniorfinancialofficers, pursuant to Section406 of theSarbanes-Oxley Act.

Copies of thecodeare availablefreeofcharge by writingtoSecretary,CostcoWholesaleCorporation,

999 LakeDrive,Issaquah, WA 98027.Ifthe Company makesany amendmentstothiscode (other than

technical, administrative, ornon-substantiveamendments) or grantsany waivers, including implicit

waivers, to theChief ExecutiveOfficer,Chief FinancialOfficer or principal accountingofficer and

controller, we will disclose(on our websiteorinaForm 8-Kreportfiledwiththe SEC)the natureofthe

amendment orwaiver, itseffective date, and to whom it applies.

8

Information about ourExecutive Officers

Theexecutive officers of Costco,their position, and ages arelistedbelow.All haveover25yearsof

servicewiththe Company,withthe exceptionofMr. Sullivan whohas 22 yearsofservice.

Name Position

Executive

Officer

SinceAge

W. CraigJelinek ............ ChiefExecutive Officer. Mr.Jelinek has been adirectorsince

February2010. Mr.Jelinek previously wasPresident and CEOfrom

January2012 to February2022. He wasPresident and Chief

OperatingOfficer from February2010 to December 2011. Priorto

that he wasExecutive Vice President,Chief OperatingOfficer,

Merchandising since2004.

1995 71

RonM.Vachris ............. President and ChiefOperating Officer. Mr.Vachris has been a

director sinceFebruary2022. Mr.Vachris previously served as

ExecutiveVicePresident of Merchandising from June 2016 to

January2022, as Senior Vice President,RealEstateDevelopment,

from August2015 to June 2016, and Senior Vice President,General

Manager,Northwest Region, from 2010 to July 2015.

2016 58

RichardA.Galanti .......... ExecutiveVicePresident and ChiefFinancialOfficer.Mr. Galanti

has been adirectorsince January1995.

1993 67

JimC.Klauer .............. ExecutiveVicePresident,Chief OperatingOfficer,Northern

Division. Mr.Klauer wasSenior Vice President,Non-Foods and E-

commerceMerchandise,from2013 to January2018.

2018 61

Russ D. Miller .............. Senior ExecutiveVicePresident,U.S.Operations.Mr. Millerwas

ExecutiveVicePresident,Chief OperatingOfficer,Southwest

Divisionand Mexico,fromJanuary2018 to May2022. Mr.Miller

wasSenior Vice President,Western Canada Region, from 2001 to

January2018.

2018 66

PatrickJ.Callans ........... ExecutiveVicePresident,Administration. Mr.Callans wasSenior

Vice President,Human Resourcesand RiskManagement,from

2013 to December 2018.

2019 61

YoramB.Rubanenko ....... ExecutiveVicePresident,Chief OperatingOfficer,Eastern Division.

Mr.Rubanenkowas Senior Vice President and General Manager,

SoutheastRegion, from 2013 to September 2021, and Vice

President,Regional Operations Manager forthe NortheastRegion,

from 1998 to 2013.

2021 59

John Sullivan .............. ExecutiveVicePresident,GeneralCounsel &CorporateSecretary.

Mr.Sullivan has been General Counsel since2016 and Corporate

Secretarysince 2010.

2021 63

Claudine E. Adamo ......... ExecutiveVicePresident,Merchandising. Ms.Adamowas Senior

Vice President,Non-Foods,from2018 to February2022, and Vice

President,Non-Foods,from2013 to 2018.

2022 53

CatonFrates ............... ExecutiveVicePresident,Chief OperatingOfficer,Southwest

Division. Mr.Frateswas Senior Vice President,Los Angeles

Region, from 2015 to May2022.

2022 55

Pierre Riel ................. ExecutiveVicePresident,Chief OperatingOfficer,International

Division. Mr.Rielwas Senior Vice President,Country Manager,

Canada, from 2019 to March2022, and Senior Vice President,

EasternCanada Region, from 2001 to 2019.

2022 60

Item 1A—RiskFactors

Therisks described below couldmaterially and adversely affect our business, financialcondition and

resultsofoperations.Wecouldalsobeaffectedbyadditional risks that applytoall companies operating

in theU.S.and globally,aswellasother risks that arenot presently knowntousorthat we currently

consider to be immaterial.These RiskFactors shouldbecarefully reviewed in conjunction with

Management'sDiscussion and AnalysisofFinancialCondition and ResultsofOperations in Item7and

our consolidated financialstatementsand relatednotes in Item8of this Report.

9

Business andOperating Risks

We arehighlydependent on thefinancial performanceofour U.S. andCanadianoperations.

Ourfinancialand operational performanceishighlydependent on our U.S. and Canadian operations,

whichcomprised 87% and 84% ofnet salesand operatingincomein2023. Within theU.S., we arehighly

dependent on our California operations,which comprised27% of U.S. net salesin2023. OurCalifornia

market,ingeneral,has alarger percentage of higher volume warehouses as compared to our other

domesticmarkets.Any substantialslowingorsustained declineintheseoperations couldmaterially

adversely affect our business and financialresults.Declines in financialperformanceofour U.S.

operations,particularlyinCalifornia, and our Canadian operations couldarise from,among other things:

slow growth or declines in comparablewarehousesales (comparablesales); negativetrends in operating

expenses,including increased labor, healthcare and energy costs; failingtomeet targetsfor warehouse

openings;cannibalizingexistinglocations withnew warehouses;shifts in salesmix toward lowergross

margin products;changes oruncertainties in economic conditions in our markets, including higher levels

of unemployment anddepressedhomevalues;and failingtoconsistently providehighqualityand

innovativenew products.

We maybeunsuccessful implementing ourgrowthstrategy, including expanding our business in

existing marketsand newmarkets,and integratingacquisitions,which couldhaveanadverse

impact on ourbusiness, financialcondition andresultsofoperations.

Ourgrowthisdependent, in part,onour abilitytoacquire property and build or leasenew warehouses

and depots. We competewithother retailers and businessesfor suitablelocations.Local land useand

other regulations restrictingthe construction and operationofour warehouses and depots, as well as local

community actionsopposed to thelocationofour warehouses or depotsatspecific sitesand theadoption

of locallawsrestricting our operations and environmental regulations,may impactour abilitytofind

suitablelocations and increasethe cost of sitesand of constructing, leasingand operatingwarehouses

and depots. We also mayhavedifficultynegotiating leases or purchaseagreementsonacceptableterms.

In addition, certainjurisdictions haveenactedorproposed laws and regulations that wouldprevent or

restrict theoperationorexpansionplans of certainlarge retailers and warehouseclubs,including us.

Failure to effectivelymanage theseand other similarfactors mayaffectour abilitytotimelybuild or lease

and operatenew warehousesand depots, whichcouldhaveamaterial adverse effect on our future

growth and profitability.

We seek to expand in existing marketstoattain agreater overallmarketshare. Anew warehousemay

draw membersawayfromour existing warehouses and adversely affect theircomparablesales

performance, member traffic, andprofitability.

We intend to continue to open warehouses in new markets. Associated risks include difficulties in

attracting membersdue to alackoffamiliarity withus, attracting membersofother wholesaleclub

operators, ourlesserfamiliarity withlocal member preferences, and seasonal differences in themarket.

Entryintonew marketsmay bringusintocompetition withnew competitorsorwithexistingcompetitors

withalarge, established market presence.Wecannot ensurethat new warehouses and new e-commerce

websites will be profitableand future profitabilitycouldbedelayed or otherwisematerially adversely

affected.

We have made and maycontinue to make investmentsand acquisitions to improvethe speed, accuracy

andefficiencyofour supplychainsand deliverychannels. Theeffectivenessoftheseinvestmentscan be

less predictablethanopeningnew locations and might not providethe anticipated benefitsordesired

ratesofreturn.

10

Ourfailure to maintain membership growth,loyalty andbrand recognition couldadverselyaffect

our resultsofoperations.

Membership loyaltyand growth areessentialtoour business. Theextent to whichweachieve growth in

our membership base,increasethe penetration of Executivemembership,and sustainhighrenewal rates

materially influences ourprofitability. Damage to our brands or reputationmay negativelyimpact

comparablesales,diminishmembertrust,and reducerenewal ratesand, accordingly, net salesand

membership feerevenue, negativelyimpacting our resultsofoperations.

We sell many products under ourKirkland Signaturebrand. Maintainingconsistent productquality,

competitivepricing,and availabilityoftheseproducts is essentialtodeveloping and maintainingmember

loyalty. Theseproducts also generallycarry higher marginsthan national brand products and represent a

growingportion of ouroverall sales. If theKirkland Signaturebrand experiences alossofmember

acceptanceorconfidence, our salesand grossmarginresults couldbeadversely affected.

Disruptions in merchandisedistributionorprocessing, packaging, manufacturing, andother

facilitiescould adverselyaffectsales andmembersatisfaction.

We depend on theorderly operationofthe merchandise receivingand distributionprocess,primarily

through our depots. We also rely upon processing, packaging, manufacturing and other facilitiesto

supportour business, whichincludesthe production of certainprivate-label items. Although we believe

that our operations are efficient, disruptions due to fires, tornadoes,hurricanes,earthquakes,pandemics

or other extremeweather conditions or catastrophicevents, labor issues or other shipping problemsmay

result in delaysinthe production and deliveryofmerchandise to our warehouses,which couldadversely

affect salesand thesatisfactionofour members. Oure-commerceoperations depend heavily on third-

partyand in-houselogistics providersand is negativelyaffectedwhen theseprovidersare unableto

provideservicesinatimely fashion.

We maynot timely identify or effectivelyrespondtoconsumer trends,which couldnegatively

affect our relationship withour members, thedemandfor our products andservices, andour

market share.

It is difficulttoconsistentlyand successfully predictthe products and services that our memberswill

desire.Our successdepends,inpart, on our abilitytoidentify and respond to trends in demographics and

consumer preferences. Failuretoidentify timely or effectivelyrespond to changing consumer tastes,

preferences(including thoserelatingtoenvironmental,socialand governancepractices)and spending

patternscouldnegativelyaffectour relationshipwithour members, thedemand forour products and

services,and our market share. If we arenot successful at predictingour salestrends and adjusting our

purchases accordingly, we mayhaveexcess inventory, whichcouldresultinadditional markdowns,orwe

mayexperienceout-of-stockpositions and deliverydelays, whichcould result in higher costs, bothof

whichwouldreduceour operatingperformance. This couldhaveanadverse effect on net sales, gross

margin and operatingincome.

Availabilityand performanceofour informationtechnology (IT) systemsare vitaltoour business.

Failure to successfully executeITprojectsand have IT systemsavailabletoour business would

adversely impact ouroperations.

IT systemsplayacrucialroleinconducting our business. Thesesystemsare utilized to processavery

high volume of transactions,conductpayment transactions,track and valueour inventoryand produce

reports critical formakingbusinessdecisions.Failure or disruptionofthesesystemscouldhavean

adverse impactonour abilitytobuy products and services from our suppliers,producegoods in our

manufacturing plants, move theproducts in an efficient manner to our warehouses and sell products to

our members. We areundertakinglarge technology and IT transformation projects.The failure of these

projects couldadversely impact our businessplans and potentially impairour day to day business

operations.Given thehighvolumeoftransactions we process, it is important that we build strong digital

resiliencytoprevent disruptionfromeventssuchaspower outages,computer and telecommunications

11

failures, viruses, internal orexternalsecuritybreaches,errors by employees,and catastrophicevents

such as fires, earthquakes,tornadoes and hurricanes.Any debilitatingfailure of our critical IT systems,

datacentersand backupsystemswould require significant investmentsinresourcestorestore IT

services and maycause serious impairment in our businessoperations including loss of business

services,increased cost of moving merchandise and failure to provideservice to our members. We are

currently making substantialinvestments in maintainingand enhancingour digitalresiliencyand failure or

delayinthese projects couldbecostly and harmful to our business. Failure to deliver IT transformation

effortsefficiently andeffectively couldresultinthe loss of our competitivepositionand adversely impact

ourfinancialcondition and resultsofoperations.Insufficient IT capacitycouldalsoimpactour capacityfor

timely,completeand accurate financialand non-financialreporting requiredbylaw.

We arerequiredtomaintainthe privacy andsecurity of personaland business information amidst

multiplyingthreatlandscapesand in compliance withprivacy anddataprotectionregulations

globally.Failure to do so coulddamageour business, including our reputationwithmembers,

suppliers andemployees, cause us to incursubstantialadditionalcosts,and become subject to

litigation andregulatoryaction.

Increased security threatsand more sophisticated cyber misconductposearisktoour systems,

networks, products andservices. We rely upon IT systemsand networks, some of whichare managed by

or belong to thirdparties,including suppliers,partners, vendors, and serviceproviders. Additionally,we

collect,store and processsensitive information relating to our business, members, employees,and other

thirdparties.Operatingthese IT systemsand networks, and processing and maintainingthisdata, in a

secure manner,iscriticaltoour businessoperations and strategy.Increased remote work has also

increased thepossibleattacksurfaces. Attempts to gainunauthorized access to systems, networks and

data,bothoursand thirdparties withwhom we work,are increasinginfrequencyand sophistication, and

in some cases, theseattemptsare successful.Cybersecurity attacks mayrange from random attempts to

coordinated and targeted attacks, including sophisticated computer crimes and advanced persistent

threats. Phishing attackshaveemerged as particularlyprominent,including as vectorsfor ransomware

attacks, whichhaveincreased in breadthand frequency. While we trainour employees as partofour

security efforts, that training cannot be completely effective. Thesethreatsposearisktothe security of

oursystemsand networksand theconfidentiality, integrity, and availabilityofour data. OurITsystems

and networks, or thosemanaged by thirdparties such as cloud providersorsuppliers that otherwisehost

or haveaccesstoconfidentialinformation, periodically havevulnerabilities, whichmay go unnoticed fora

period of time.Our loggingcapabilities, or thelogging capabilitiesofthird parties,are also not always

complete or sufficiently detailed,affecting our abilitytofully investigateand understand thescope of

security events. While ourcybersecurity and complianceefforts seek to mitigatesuchrisks, therecan be

no guarantee that theactions and controls we and our third-party serviceprovidershaveimplemented

and areimplementing, will be sufficient to protectour systems, information or other property.

Thepotentialimpacts of acybersecurity attack include reputational damage, litigation, government

enforcement actions, penalties, disruptiontosystemsand operations,unauthorized releaseofconfidential

or otherwiseprotected information, corruptionofdata, diminutioninthe valueofour investment in IT

systemsand increased cybersecurity protection and remediationcosts.Thiscouldadversely affect our

competitiveness, resultsofoperations and financialcondition and, critically in light of our businessmodel,

loss of member confidence. Further, theinsurancecoverage we maintain and indemnification

arrangementswiththird parties maybeinadequatetocover claims,costs,and liabilitiesrelatingto

cybersecurity incidents. In addition, datawecollect,store and processissubjecttoavariety of U.S. and

international laws and regulations,suchasthe European Union'sGeneral Data Protection Regulation,

CaliforniaConsumerPrivacy Act, He alth InsurancePortabilityand AccountabilityAct,and other privacy

and cybersecurity laws across thevarious states and around theglobe, whichmay carry significant

potentialpenalties fornoncompliance.

12

We aresubject to payment-related risks.

We accept paymentsusing avariety of methods,including select creditand debitcards,cashand checks,

co-brand cardholder rebates,Executive member 2% reward certificates,and our shop card.Asweoffer

new payment optionstoour members, we maybesubjecttoadditional rules, regulations,compliance

requirements, andhigher fraudlosses. Forcerta in payment methods,wepay interchange and other

relatedacceptancefees, along withadditional transaction processing fees.Werelyonthird parties to

providepayment transaction processing services forcreditand debitcards and our shop card.Itcould

disrupt our businessiftheseparties becomeunwillingorunabletoprovide theseservicestous. We are

also subjecttofee increases by theseservice providers.

We must comply withevolvingpayment card associationand network operatingrules,including data

security rules, certificationrequirementsand rulesgoverning electronicfunds transfers.For example, we

aresubjecttoPayment Card IndustryDataSecurityStandards,which containcomplianceguidelines and

standards withregardtoour security surrounding thephysicaland electronicstorage, processing and

transmission of individual cardholder data.Ifour internal systemsare breached or compromised, we may

be liablefor card re-issuancecosts,subjecttofines and higher transaction fees and lose our abilityto

accept card paymentsfromour members, and our businessand operatingresults couldbeadversely

affected. Ourfailure to offerpayment methods desired by our memberscouldcreateacompetitive

disadvantage.

We mightsellproducts that causeillness or injury to our members, harm to our reputation, and

exposeusto litigation.

If our merchandise,including food and prepared food products forhuman consumption, drugs,children's

products,pet products anddurablegoods,donot meet or areperceived not to meet applicablesafetyor

labelingstandards or our members' expectati ons ,wecouldexperiencelostsales,increased costs,

litigationorreputational harm. Thesaleoftheseitems involves theriskofillnessorinjurytoour members.

Such illnessesorinjuriescould result from tamperingbyunauthorized thirdparties,productcontamination

or spoilage, includingthe pr esenceofforeign objects,substances,chemicals, other agents, or residues

introducedduringthe growing, manufacturing, storage,handlingand transportation phases,orfaulty

design. Oursuppliers aregenerally contractually requiredtocomplywithproductsafetylaws, and we are

dependent on them to ensurethatthe products we buy comply withsafetyand other standards.While we

aresubjecttogovernmental inspection and regulations and work to comply in allmaterialrespects with

applicablelawsand regulations,wecannot be sure that consumptionoruse of our products will not cause

illnessorinjuryorthat we will not besubjecttoclaims, lawsuits,orgovernment investigations relating to

such matters,resulting in costly productrecalls and other liabilitiesthat couldadversely affect our

businessand resultsofoperations.Evenifaproduct liabilityclaim is unsuccessful or is not fully pursued,

negativepublicitycould adversely affect our reputationwithexistingand potentialmembersand our

corporateand brand image, and theseeffects couldbelong-term.

If we do not successfully develop andmaintainarelevantomnichannelexperiencefor our

members, ourresultsofoperations couldbeadverselyimpacted.

Omnichannel retailingisrapidlyevolving, and we must keep pacewithchanging member expectations

and new developmentsbyour competitors. Ourmembersare increasinglyusing mobile phones,tablets,

computers, andother devices to shop and to interact with us through social media. We aremaking

investmentsinour websites and mobile applications.Ifweare unabletomake, improve, or develop

relevant member-facingtechnology in atimelymanner,our abilitytocompeteand our resultsof

operations couldbeadversely affected.

Inabilitytoattract,train andretainhighlyqualifiedemployees couldadverselyimpact our

business, financialcondition andresultsofoperations.

Oursuccess depends onthe continued contributions of our employees,including membersofour senior

management andother keyoperations,IT, merchandising and administrativepersonnel.Failure to identify

13

and implement asuccessionplanfor senior management couldnegativelyimpactour business. We must

attract, trainand retain alarge and growingnumber of qualifiedemployees,while controllingrelated labor

costsand maintainingour core values.Our abilitytocontrollabor and benefit costsissubjectto

numerous internal andexternalfactors,including regulatorychanges,prevailingwage rates, union

relations andhealthcare and otherinsurancecosts.Wecompetewithother retail and non-retail

businessesfor theseemployees andinvestsignificant resourcesintrainingand motivating them.Thereis

no assurancethatwewill be abletoattract or retain highlyqualifiedemployees in thefuture, whichcould

haveamaterialadverse effect on ourbusiness, financialcondition and resultsofoperations.

We mayincur property,casualty or otherlosses notcovered by our insurance.

Claimsfor employee health care benefits, workers’ compensation, general liability, property damage,

directors’ and officers’liability, vehicleliability, inventoryloss, and other expos ures arefunded

predominantly through self-insurance. Insurancecoverageismaintained forcertain risks to limit

exposures arisingfromverylarge losses. Thetypes and amountsofinsurancemay vary from time to time

based on our decisionswithrespect to risk retentionand regulatoryrequirements. Significant claims or

events, regulatorychanges,asubstantialriseincosts of health care or coststomaintainour insuranceor

thefailure to maintain adequate insurancecoveragecouldhaveanadverse impactonour financial

condition and resultsofoperations.

Although we maintain specific coverages forcatastrophicproperty losses, we still bear asignificant

portion of theriskoflossesincurredasaresult of any physicaldamage to,orthe destruction of,any

warehouses,depots, manufacturing or homeofficefacilities, loss or spoilage of inventory, and business

interruption. Such lossescould materially impactour cash flowsand resultsofoperations.

Market andOther External Risks

We face strong competitionfromother retailersand warehousecluboperators,which could

adverselyaffect ourbusiness, financialcondition andresultsofoperations.

Theretailbusinessishighlycompetitive.Wecompete formembers, employees,sites,products and

services and in otherimportant respects withawiderange of local, regional and national wholesalersand

retailers,bothinthe United States and in foreigncountries,including other warehouse-club operators,

supermarkets, supercenters, online retailers,gasolinestations,harddiscounters, department and

specialtystoresand operatorssellingasinglecategoryornarrowrange of merchandise.Suchretailers

and warehousecluboperatorscompete vigorously and in avariety of ways, including pricing, selection

and availability, services,location, convenience, storehours, and theattractivenessand easeofuse of

websites and mobile applications.The evolutionofretailinginonlineand mobile channelshas improved

theabilityofcustomers to comparison shop, whichhas enhanced competition. Some competitorshave

greater financialresources and technology capabilities, betteraccess to merchandise,and greater market

penetration than we do.Our inabilitytorespond effectivelytocompetitivepressures,changes in theretail

marketsorcustomerexpectations couldresultinlostmarketshareand negativelyaffectour financial

results.

Generaleconomicfactors,domestically andinternationally,may adverselyaffect our business,

financialcondition, andresults of ope rations.

Higher energy andgasolinecosts,inflation, levels of unemployment,healthcare costs, consumer debt

levels,foreign-currencyexchange rates, unsettled financialmarkets,weaknessesinhousingand real

estate markets, reducedconsumerconfidence, changes and uncertainties relatedtogovernment fiscal,

monetaryand taxpoliciesincluding changes in interest rates, taxrates,duties, tariffs, or other restrictions,

sovereigndebt crises,pandemics and other health crises,and other economic factorscouldadversely

affect demand forour products andservices, require achange in productmix,orimpactthe cost of or

abilitytopurchaseinventory.Additionally,trade-relatedactions in various countries,particularlyChina and

theUnitedStates, haveaffectedthe costsofsomeofour merchandise.The degree of our exposureis

dependent on (among other things)the type of goods,rates imposed, and timing of thetariffs.The impact

14

to our net salesand grossmarginisinfluenced in partbyour merchandising and pricingstrategies in

responsetopotentialcostincreases.Higher tariffscouldadversely impactour results.

Prices of certaincommodities,including gasolineand consumablegoods used in manufacturing and our

warehouseretailoperations,are historically volatile and aresubjecttofluctuations arisingfromchanges in

domesticand international supplyand demand, inflationarypressures, labor costs, competition, market

speculation, gover nment regulations,taxes and periodicdelaysindelivery. Rapidand significant changes

in commodity prices and our abilityand desiretopassthem through to our membersmay affect our sales

andprofitmargins.These factorscould also increaseour merchandise costsand selling, general and

administrativeexpenses,and otherwiseadversely affect our operations and financialresults.General

economic conditions canalsobeaffectedbyeventslikethe outbreak of hostilities, including but not

limitedtothe Ukraineconflict, or acts of terrorism.

Inflationaryfactors such as increases in merchandise costsmay adversely affect our business, financial

condition and resultsofoperations.Wemay not be abletoadjustpricestosufficiently offset theeffectof

cost increases without negativelyimpacting consumer demand.

Suppliers maybeunabletotimelysupplyuswithqualitymerchandise at competitiveprices or

mayfailtoadhere to our high standards, resultinginadverse effectsonour business,

merchandise inventories, sales, and profit margins.

We depend heavily on ourabilitytopurchasequalitymerchandise in sufficient quantitiesatcompetitive

prices.Asthe quantitieswerequire continue to grow,wehavenoassurances of continued supply,

appropriate pricingoraccess to newproducts,and any supplierhas theabilitytochange theterms upon

whichthey sell to us or discontinue sellingtous. Member demands maylead to out-of-stockpositions

causingalossofsales andprofits.

We buy from numerous domestic and foreignsuppliers and importers.Our inabilitytoacquire suitable

merchandise on acceptableterms or thelossofkey suppliers couldnegativelyaffectus. We maynot be

abletodevelop relationships withnew suppliers,and products from alternativesources, if any,may be of

alesserqualityormoreexpensive. Becauseofour effortstoadheretohigh-qualitystandards forwhich

availablesupplymay be limited, particularly forcertain food items, thelarge volumeswedemand maynot

be consistently available. Ourefforts to secure supplycould lead to commitmentsthat provetobe

unsuccessful in theshort and long-term.

Oursuppliers (and thosethey depend upon formaterials and services)are subjecttorisks, including

labor disputes,union organizing activities,financialliquidity,natural disasters, extremeweather

conditions,public health emergencies, supplyconstraintsand general economic and political conditions

and other risks similartothosewefacethat couldlimit theirabilitytotimelyprovide us withacceptable

merchandise.One or more of oursuppliersmight not adheretoour qualitycontrol,packaging, legal,

regulatory, labor,environmental oranimalwelfare standards.Thesedeficienciesmay delay or preclude

deliveryofmerchandise to us and might not be identifiedbeforewesellsuchmerchandise to our

members. This failure couldleadtorecalls and litigationand otherwisedamage our reputationand our

brands,increasecosts,and otherwiseadversely impactour business.

Fluctuations in foreignexchange ratesmay adverselyaffect our resultsofoperations.

During 2023, ourinternational operations,including Canada, generated 27% and 34% of our net sales

and operatingincome. Ourinternational operations haveaccounted foranincreasingportion of our

warehouses,and we plan to continue international growth.Toprepareour consolidated financial

statements, we translate thefinancialstatementsofour international operations from localcurrenciesinto

U.S. dollars usingcurrent exchange rate s. Future fluctuations in exchange ratesthat areunfavorableto

us mayadversely affect thefinancialperformanceofour Canadian and Other International operations and

haveacorresponding adverse period-over-period effect on our resultsofoperations.Aswecontinue to

expand internationally,our exposuretofluctuations in foreignexchange ratesmay increase.

15

Aportion of theproducts we purchaseispaidfor in acurrencyother than thelocal currencyofthe country

in whichthe goods aresold. Currency fluctuations mayincreaseour merchandise costsand maynot be

passed on to membersand thus mayadversely affect our resultsofoperations.

Naturaldisasters, extremeweatherconditions,orother catastrophicevents couldnegatively

affect our business, financialcondition, andresultsofoperations.

Naturaldisaste rs and extremeweather conditions,including thoseimpactedbyclimatechange, such as

hurricanes,typhoons,floods,earthquakes,wildfires, droughts; acts of terrorism or violence, including

active shooter situations;and energy shortages;particularlyinCaliforniaorWashington state, whereour

centralized operatingsystemsand administrativepersonnel arelocated, couldnegativelyaffectour

operations and financialperformance. Such eventscouldresultinphysicaldamage to our properties,

limitations on storeoperatinghours, less frequent visits by memberstophysicallocations,the temporary

closureofwarehouses,depots, manufacturing or homeofficefacilities, thetemporary lack of an adequate

work force, disruptions to our IT systems, thetemporary or long-term disruptioninthe supplyofproducts

from some localoroverseas suppliers,the temporarydisruptioninthe transportofgoods to or from

overseas,delaysinthe deliveryofgoods to our warehouses or depots, and thetemporaryreduction in the

availabilityofproducts in our warehouses.Theseeventscouldalsoreducedemand forour products or

make it difficultorimpossibletoprocure products.Wemay be requiredtosuspend operations in some or

allofour locations, whichcould haveamaterialadverse effect on our business, financialcondition and

resultsofoperations.

Pandemics andother health crises, including COVID-19, couldaffect our business, financial

condition andresults of operations in many respects.

Theemergence, severity,magnitude and durationofglobal or regional health crises areuncertain and

difficulttopredict.Apandemic, such as COVID-19, couldaffectcertain businessoperations,demand for

our products andservices, in-stock positions,costs of doing business, availabilityoflabor,access to

inventory, supplychain operations,our abilitytopredict future performance, exposuretolitigation, and our

financialperformance, among other things.Other factorsand uncertainties include, but arenot limited to:

•The severity and durationofpandemics;

•Evolvingmacroeconomic factors, including general economic uncertainty,unemployment rates,

andrecessionarypressures;

•Changes in labor marketsaffecting us and our suppliers;

•Unknownconsequences on our businessperformanceand initiativesstemming from the

substantialinvestmentoftimeand other resourcestothe pandemic response;

•The paceofpost-pandemic recovery;

•The long-term impactofthe pandemic on our business, including consumer behaviors;and

•Disruptionand volatilitywithinthe financialand creditmarkets.

Factorsassociated wit hclimate change couldadverselyaffect our business.

We usenatural gas, diesel fuel,gasoline, and electricityinour distributionand warehouseoperations.

Government regulations limitingcarbon dioxideand other greenhousegas emissions and other

environmental restrictions mayincreasecomplianceand merchandise costs, and other regulation

affectingenergy inputscould materially affect our profitability. As theeconomytransitions to lowercarbon

intensitywecannot guaranteethatwewill make adequateinvestmentsorsuccessfully implement

strategies that will effectivelyachieve our climate-relatedgoals, whichcouldlead to negativeperceptions

among membersand other stakeholdersand result in reputational harm. Climatechange, extreme

weather conditions,wildfires, droughtsand rising sealevelscouldaffectour abilitytoprocure

commodities at costsand in quantitieswecurrently experience.

We also sell asubstantial amount of gasoline, thedemand forwhich couldbeimpactedbyconcerns

about climatechange and increased regulations.Morestringent fuel economystandards,changing public

policiesaim ed at increasing theadoptionofzero-emission and alternativefuel vehicles and other

16

regulations relatedtoclimatechange,and evolving consumer preferences will affect our future operations

and will adversely impact certainelementsofour profitabilityand require significant capitalexpenditures.

Failure to meet financialmarket expectations couldadverselyaffect themarket priceand volatility

of our stock.

We believe that theprice of our stockcurrently reflects high market expectations forour future operating

results. Anyfailure to meet ordelay in meetingtheseexpectations,including our warehouseand e-

commercecomparablesales growth rates, membership renewal rates, new member sign-ups,gross

margin,earnings,earnings per share, new warehouseopenings,ordividend or stockrepurchasepolicies

couldcausethe priceofour stocktodecline.

Legaland RegulatoryRisks

We aresubject to risks associated with thelegislative,judicial,accounting, regulatory, political

andeconomic factorsspecifictothe countries or regions in whichweoperate,which could

adverselyaffect ourbusiness, financialcondition andresultsofoperations.

At theend of 2023, we operated 270 warehouses outside of theU.S.(31% of allwarehouselocations),

and we plan to continue expandingour international operations.Futureoperatingresults internationally

couldbenegativelyaffectedbyavarietyoffactors,many similartothosewefaceinthe U.S.,certain of

whichare beyond our control. Thesefactors include political and economic conditions,regulatory

constraints, currencyregulations,policychanges,and other matters in any of thecountries or regions in

whichweoperate, noworinthe future.Other factorsthat mayimpactinternational operations include

foreigntrade (including tariffsand trade sanctions), monetaryand fiscalpoliciesand thelawsand

regulations of theU.S.and foreigngovernments, agenciesand similarorganizations,and risks associated

withhavingmajor facilitiesinlocations whichhavebeen historically less stablethan theU.S.Risks

inherent in internationaloperations also include, amongothers, thecosts and difficulties of managing

international operations,adverse taxconsequences,and difficulty in enforcing intellectual property rights.

Newreporting obligations globally areincreasingthe cost and complexity of doing business.

Changesinaccountingstandards andsubjectiveassumptions,estimates andjudgments by

management relatedtocomplex accountingmatters couldsignificantlyaffect our financial

condition andresults of operations .

Accountingprinciplesand relatedpronouncements, implementationguidelines,and interpretations we

applytoawiderange of mattersthatare relevant to our business, including self-insuranceliabilities, are

highlycomplex and involvesubjectiveassumptions,estimates and judgmentsbyour management.

Changesinrules or interpretation or changes in underlyingassumptions,estimates or judgmentsbyour

management couldsignificantly change our reportedorexpectedfinancialperformanceand havea

material impactonour consolidated financialstatements.

We areexposed to risks relating to evaluationsofcontrols requiredbySection404 of the

Sarbanes-OxleyAct andotherwise.

Section404 of theSarbanes-Oxley Actof2002 requiresmanagement assessmentsofthe effectiveness

of internal controloverfinancial reporting and disclosurecontrols and procedures.Ifweare unableto

maintain effectiveinternal controloverfinancialreporting or disclosurecontrols and procedures,our ability

to record,process and reportfinancialinformation accurately and to preparefinancialstatementswithin

requiredtimeperiods couldbeadversely affected, whichcouldsubjectustolitigationorinvestigations

requiring management resourcesand payment of legal and other ex penses,negativelyaffectinvestor

confidenceinour financialstatementsand adversely impactour stockprice.Uncertainties aroundour

developing systemsconcerningcontrolsfor non-financialreporting also createrisks.

17

Changesintax rates, newU.S.orforeign taxlegislation, andexposuretoadditionaltax liabilities

couldadverselyaffect ourfinancial condition andresultsofoperations.

We aresubjecttoavarietyoftaxes and taxcollectionand remittanceobligations in theU.S.and

numerous foreignjurisdictions.Additionally,atany point in time,wemay be under examinationfor value

added, sales-based, payroll, product, importorother non-income taxes. We mayrecognize additional tax

expense, be subjecttoadditional taxliabilities, or incurlossesand penalties,due to changes in laws,

regulations,administrativepractices,principles, assessmentsbyauthoritiesand interpretations relatedto

tax, including taxrules in variousjurisdictions.Wecomputeour income taxprovision based on enacted

taxrates in thecountries in whichweoperate. As taxrates vary among countries,achange in earnings

attributabletothe various jurisdictionsinwhich we operatecouldresultinanunfavorablechange in our

overalltax provision.Additionally,changes in theenactedtax ratesoradverse outcomesintax audits,

including transferpricing disputes,couldhaveamaterial adverse effect on our financialcondition and

resultsofoperations.

Changesinorfailure to comply withregulations relating to theuse, storage, dischargeand

disposal of hazardous materials, hazardousand non-hazardous wastes andother environmental

matters (suchasrecyclingand extendedproducer responsibilityrequirements) couldadversely

impact our business, financialcondition andresultsofoperations.

We aresubjecttoawideand increasinglybroad arrayoffederal,state,regional,local and international

laws and regulations relating to theuse,storage, discharge and disposal of hazardous materials,

hazardous and non-hazardous wastes and other environmental matters.Failure to comply withthese

laws couldresultinharmtoour members, employees or others, significant coststosatisfy environmental

compliance, remediationorcompensatoryrequirements, or theimpositionofseverepenalties or

restrictions on operations bygovernmental agenciesorcourts that couldadversely affect our business,

financialcondition and resultsofoperations.

Operations at our facilitiesrequire thetreatment and disposal of wastewater,stormwater and agricultural

and food processing wastes,the useand maintenanceofrefrigerationsystems, including ammonia-based

chillers, noise,odor and dustmanagement,the operationofmechanizedprocessing equipment,and

other operations that potentially couldaffectthe environment and public health and safety.Failure to

comply withcurrent and future environmental,health and safety standards couldresultinthe impositionof

fines and penalties,illnessorinjuryofour employees,and claims or lawsuits relatedtosuc hillnessesor

injuries,and temporaryclosuresorlimitsonthe operations of facilities.

We areinvolvedinanumber of legalproceedings andaudits andsomeofthese outcomescould

adverselyaffect ourbusiness, financialcondition andresultsofoperations.

Ourbusinessrequirescompliancewithmanylawsand regulations.Failure to achievecompliancecould

subjectustolawsuitsand other proceedings and lead to damage awards,fines,penalties,and

remediationcosts.Weare or maybecomeinvolvedinanumber of legal proceedings and audits,

including grand jury investigations,government and agencyinvestigations,and consumer,employment,

tort,unclaimed property laws,and other litigation. We cannot predict withcertainty theoutcomesofthese

proceedings and other contingencies, including environmental remediationand other proceedings

commenced by governmental authorities. Theoutcome of some of theseproceedings,audits,unclaimed

property laws,and other contingenciescould require us to take,orrefrain from taking, actions whichcould

negativelyaffectour operations or couldrequire us to pay substantialamountsofmoney,adversely

affectingour financialcondition andresults of operations.Additionally,defending againsttheselawsuits

and proceedings mayinvolve significant expenseand diversionofmanagement'sattentionand

resources.

Item 1B—Unresolved StaffComments

None.

18

Item 2—Properties

Warehouse Properties

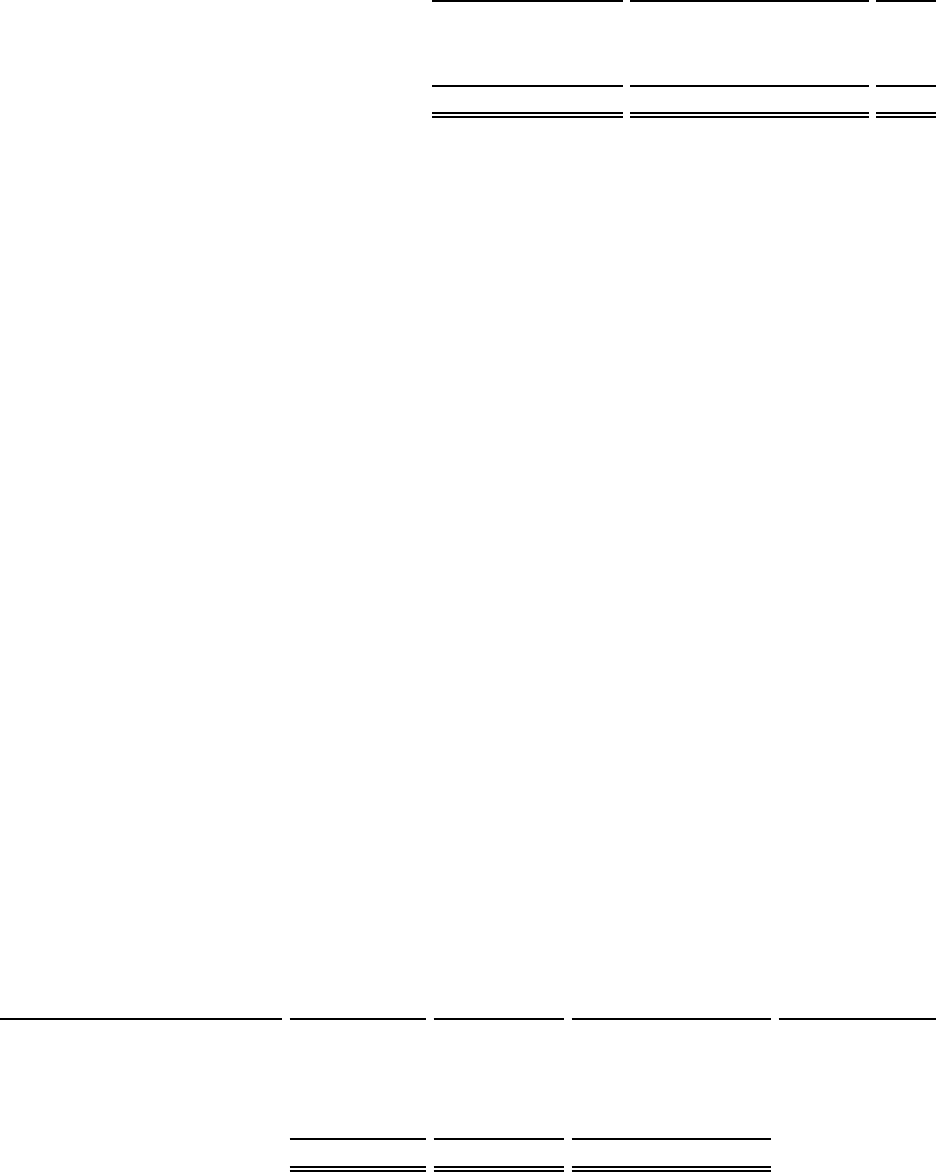

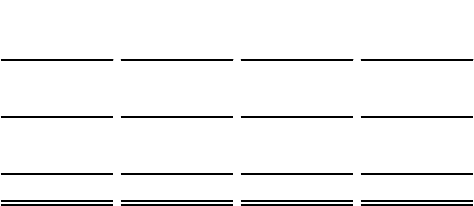

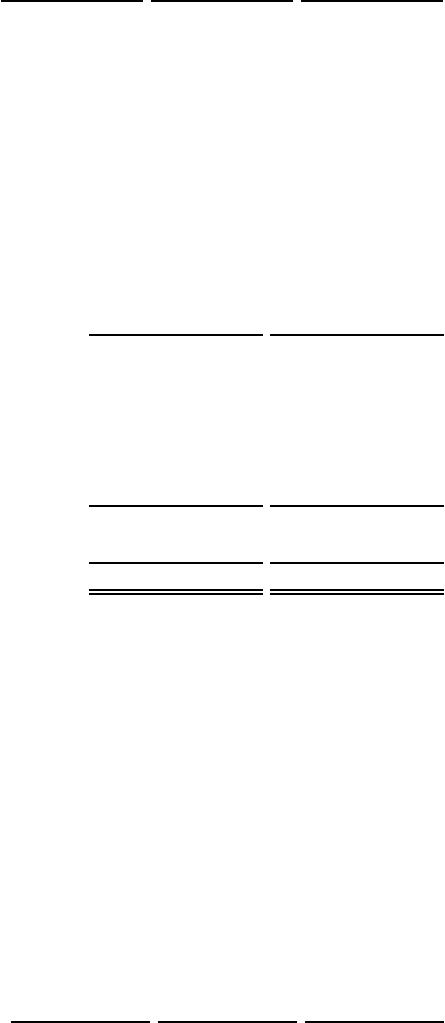

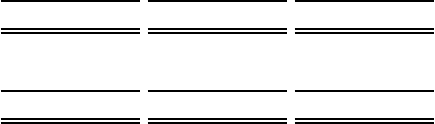

At September 3, 2023, we operated 861 membership warehouses:

Own Land andBuilding

Lease Land and/or Building

(1)

Total

United States andPuertoRico ...............

477 114 591

Canada ...................................

90 17 107

Other International .........................

110 53 163

Total ..................................

677 184 861

_______________

(1)132 of the184 leases areland-onlyleases,whereCostcoownsthe building.

At theend of 2023, ourwarehousescontained approximately126.3millionsquarefeet of operatingfloor

space: 87.6millioninthe U.S.;15.3millioninCanada; and 23.4millioninOther International.Total

squarefeet associated withdistributionand logisticsfacilitieswereapproximately33.1million.

Additionally,weoperatevarious processing, packaging, manufacturing and other facilitiestosupportour

business, whichincludes theproduction of certainprivate-label items.

Item 3—LegalProceedings

Seediscussion of Legal Proceedings in Note 10 to theconsolidated financialstatementsincluded in

Item8of this Report.

Item 4—Mine Safety Disclosures

Notapplicable.

PART II

Item 5—Market forRegistrant’sCommonEquity, RelatedStockholderMatters andIssuer

Purchases of Equity Securities

Market Information andDividendPolicy

Ourcommonstock is traded on theNASDAQGlobal Select Market under thesymbol “COST.”On

October 3, 2023, we had 10,331 stockholdersofrecord.

Payment of dividendsissubject to declaration by theBoardofDirectors.Factors considered in

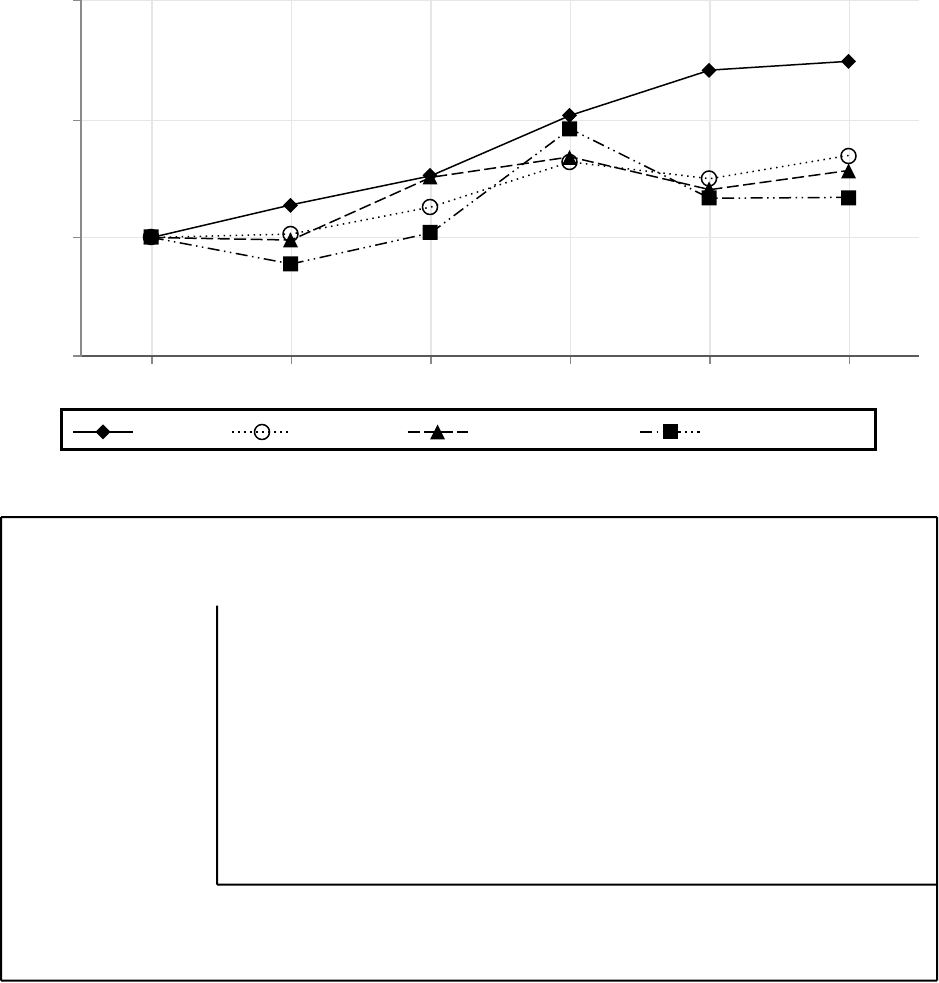

determining dividends includeour profitabilityand expectedcapitalneeds.Subjecttothesequalifications,