FISCAL YEAR ENDED AUGUST 28, 2022

ANNUAL REPORT

2022

December 7, 2022

Dear Costco Shareholders,

Through the years, Costco’s mission has stayed the same: providing our members with quality goods and services at the

lowest prices. We follow our Code of Ethics of obeying the law, taking care of our members and employees, respecting our

suppliers, and rewarding our shareholders. By staying true to our culture, Costco has continued to succeed, despite the

challenging business environment.

The past year presented many challenges due to inflationary pressures in commodities, labor and transportation. Our buying

staff around the world exhibited diligence and perseverance in developing and executing on strategies to minimize the impact

to both our members and the business. Our business model, including limiting SKU counts, focusing on the most productive

items, and bringing goods to market in high volumes, can not only sustain but provide opportunities in even challenging

circumstances.

We had strong operating results in fiscal 2022. Net sales for the 52-week fiscal year totaled $222.7 billion, an increase of 16%,

with a comparable sales increase of 14%. Net income for the 52-week fiscal year was $5.8 billion, or $13.14 per diluted share,

an increase of 17%. Revenue from membership fees increased 9% to $4.2 billion.

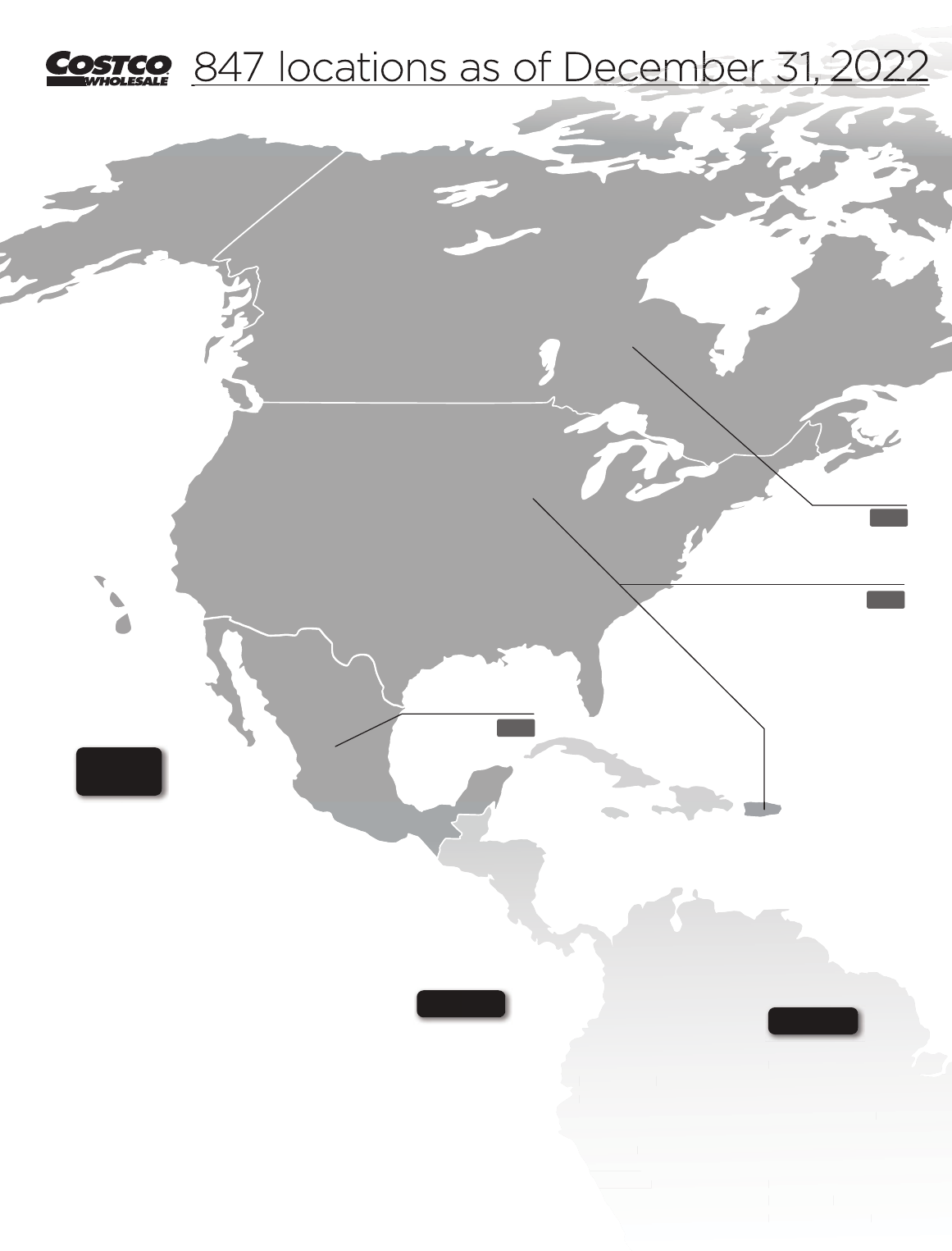

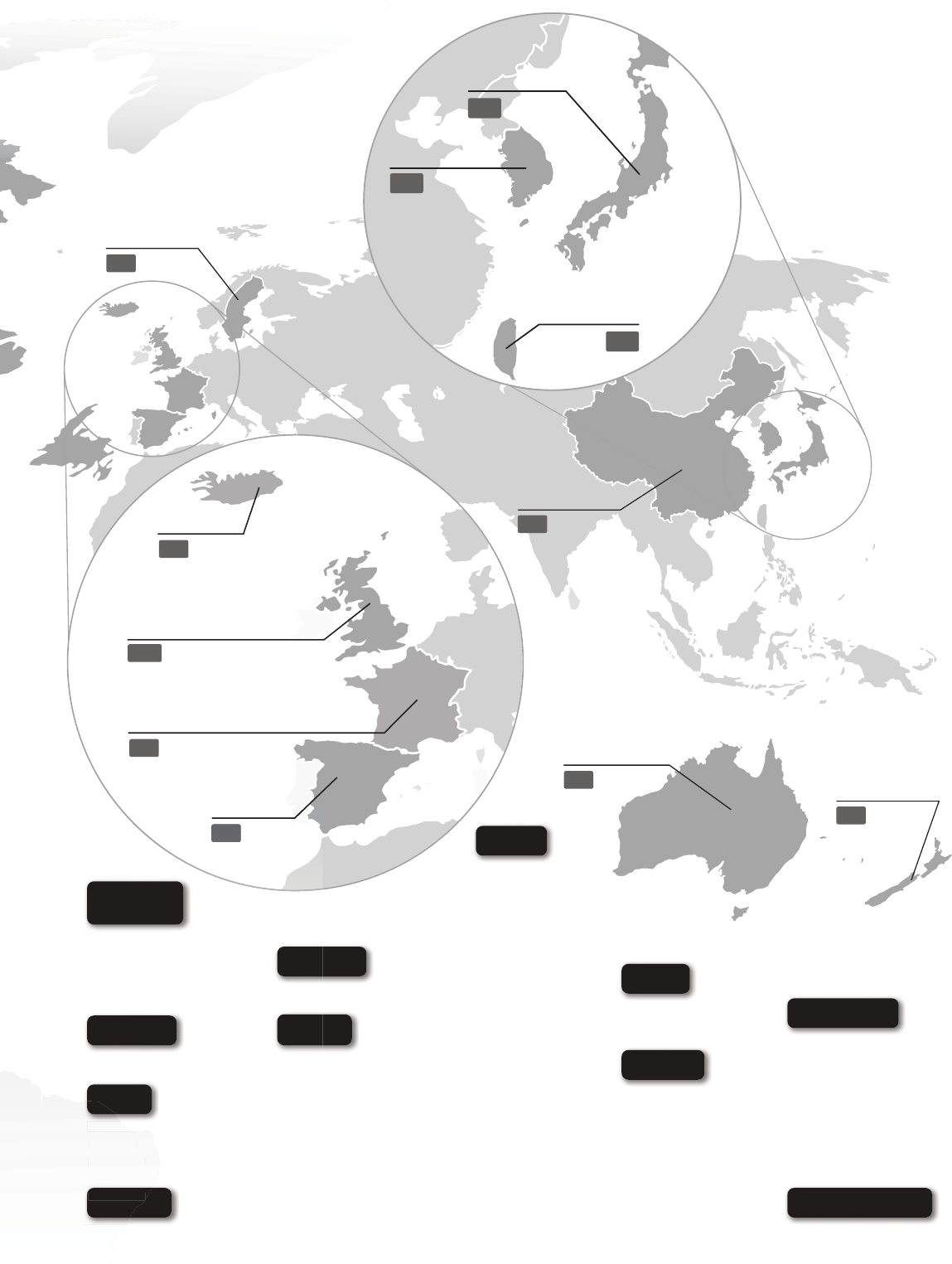

With the slowing of the pandemic, we were able to increase the pace of opening warehouses and business centers

domestically and internationally, including 23 net new locations: 14 in the U.S., two in Canada, and one each in Mexico, Korea,

Japan, Spain, France, Australia and China. Subsequent to the end of fiscal 2022, we expanded our operations to New Zealand

and Sweden. In June 2022, we purchased the equity interest of our Taiwan operations from our former joint venture partner.

Our Kirkland Signature™ brand realized strong global growth in fiscal 2022. As always, we kept our focus on the key priorities

of offering new items, providing cost savings and improving quality. New items included BBQ pellets, women’s jeans,

reformulated dog food, sauté pans, fresh mini cakes and chicken yakisoba.

Our eight e-commerce websites advanced globally with sales growth of 10% in fiscal 2022, on top of a 44% increase the prior

year. The majority of that sales growth is due to items such as furniture, TVs, mattresses, appliances, exercise and patio

equipment, where our expanded big and bulky delivery capacity improved our service and value. Costco continues to focus on

complementing the c ore warehouse business with e-commerce offerings, with expanded selection in home furnishings,

consumer electronics, lawn and garden, health and beauty, apparel and 2-Day Delivery. Costco Next provides members the

option to digitally purchase an expanded selection of products directly from vendors at a great value.

Our employees are the foundation of Costco’s business, the heart of the Company’s culture, and the driver for our success. In

the spirit of acknowledging and rewarding the excellence of our employees, in fiscal 2022, we instituted several wage

increases and provided additional benefits to the majority of our employees.

Costco is continuing work on sustainability initiatives, r eflected in our Sustainability Commitment on Costco.com. These

include continuing progress on our Climate Action Plan, decreasing packaging and plastics use, utilizing recycled content

when available, and being creative in arranging for more products per transport. We have redoubled our efforts related to

diversity and inclusion.

We extend our deepest appreciation to our more than 314,000 Costco employees and all our members worldwide, who are the

heart and soul of our company. Thank you for your continued support and trust in Costco. We wish for good health, happiness,

peace and prosperity for you and your families in the New Year.

Sincerely,

Craig Jelinek

Chief Executive Officer

Ron Vachris

President & COO

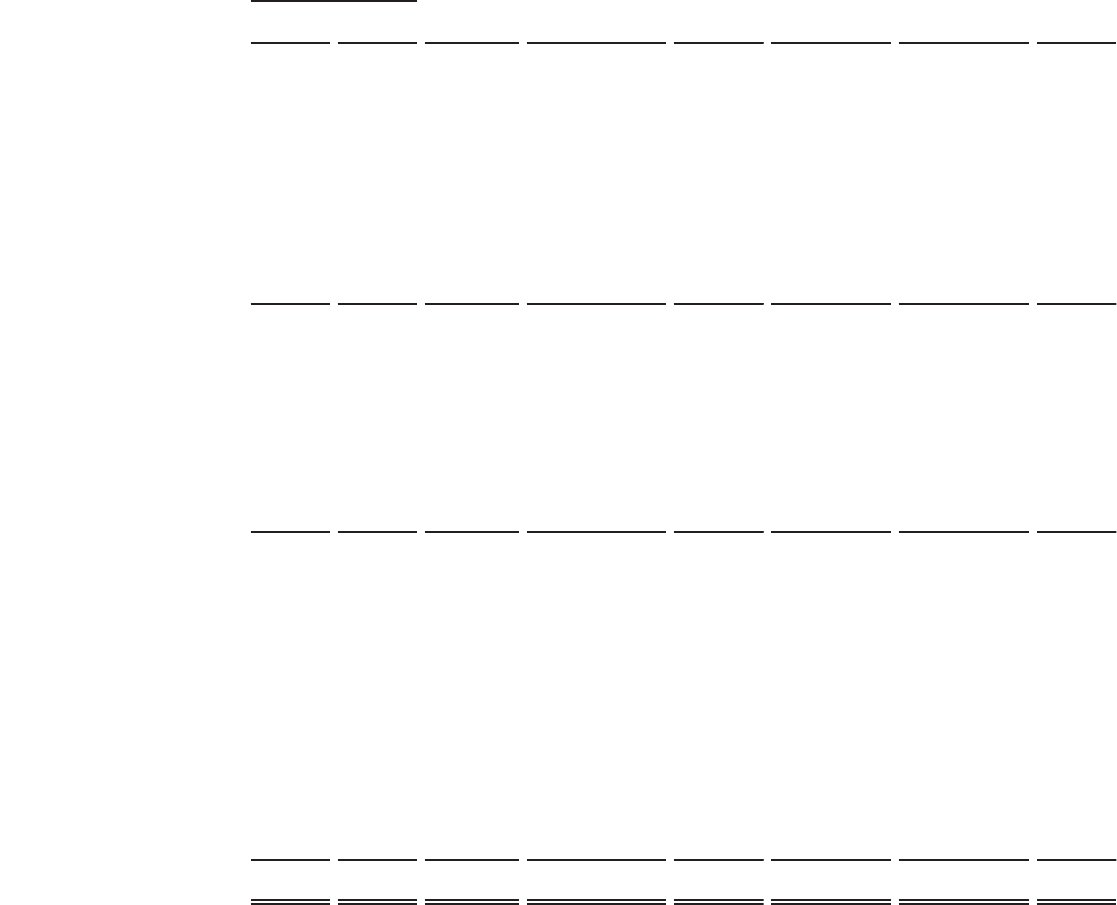

Canada

Puerto Rico

United States and

México

107

583

40

UNITED

STATES

C

OST CO .COM

A

L

A

B

A

M

A

–

4

ALA

S

KA – 4

ARIZ

O

NA – 18

ARKANSAS –

1

C

ALIF

O

RNIA – 133

CO

L

O

RAD

O

– 1

4

CO

NNE

C

TI

C

UT – 8

D

EL

AWA

RE –

1

F

L

O

RIDA –

30

G

E

O

R

G

IA – 1

6

HA

W

A

II – 7

IDAH

O

– 7

ILLINOIS – 2

3

INDIANA –

8

I

O

WA –

4

K

AN

S

A

S

–

3

K

ENTU

C

KY – 4

LO

UISIANA –

3

MA

RYL

A

ND –

1

1

M

ASSA

C

HUSETTS –

6

M

I

C

HI

G

AN – 1

6

M

INNES

O

TA – 1

3

M

ISSISSIPPI – 1

M

ISS

O

URI – 8

M

ONTANA – 5

N

EBRASKA –

3

N

EVADA –

8

N

EW HAMP

S

HIRE – 1

N

EW JERSEY – 2

1

N

EW MEXI

CO

–

3

N

EW Y

O

RK – 1

9

NO

RTH

C

AR

O

LINA – 1

0

N

ORTH DAKOTA – 2

O

HI

O

– 1

2

O

KLAH

O

MA

– 3

O

REGON – 13

P

ENNSYLVANIA – 1

1

SO

UTH

C

AR

O

LINA –

6

SO

UTH DAK

O

TA – 1

T

ENNESSEE –

6

T

EXAS – 3

6

U

T

A

H –

14

V

ERM

O

NT – 1

V

IRGINIA – 1

7

W

ASHIN

G

T

O

N –

33

W

IS

CO

NSIN – 1

0

W

ASHINGTON

,

D.C. – 1

P

UERT

O

RI

CO

–

4

CANADA

CO

ST

CO

.

CA

ALBERTA – 1

9

B

RITISH

CO

LUMBIA – 1

4

M

ANIT

O

BA –

3

N

EW BRUNSWI

C

K –

3

N

EWFOUNDLAND AND

L

ABRAD

O

R –

1

NO

VA S

CO

TIA – 2

O

NTARI

O

–

39

QU

É

BEC – 2

3

SASKATCHEWAN – 3

MÉXICO

CO

ST

CO

.

CO

M.M

X

A

G

UAS

C

ALIENTES –

1

BAJA

C

ALIF

O

RNIA –

4

BAJA

C

ALIF

O

RNIA SUR –

1

C

HIHUAHUA – 2

CIUDAD DE M

É

XICO – 5

COAHUILA –

1

G

UANAJUAT

O

–

3

JALIS

CO

–

3

MÉXI

CO

–

5

MI

C

H

O

A

CÁ

N –

1

MORELOS – 1

NUEVO LEÓN –

3

PUEBLA – 1

Q

UER

É

TARO –

1

Q

UINTANA ROO –

1

S

AN LUIS P

O

T

O

S

Í

– 1

S

INAL

O

A – 1

S

SONORA – 1

TA

ABASCO – 1

VER

RACRUZ – 2

YUCAT

ATÁN – 1

Australia

China

Spain

France

Iceland

United

Kingdom

4

2

1

29

14

Sweden

1

2

New

Zealand

1

Taiwan

Japan

Korea

14

18

31

Spain

4

CO

R000296 0822

AUSTRALIA

CO

ST

CO

.

CO

M.A

U

A

USTRALIAN CAPITAL

T

ERRIT

O

RY – 1

NEW S

O

UTH WALES –

4

Q

UEENSLAND – 2

SO

UTH AUSTRALIA – 1

V

I

C

T

O

RIA –

4

W

E

S

TERN A

US

TRALIA –

2

NEW ZEALAND

A

U

C

KLAND –

1

SHAN

G

HAI – 1

JAPAN

CO

ST

CO

.

CO

.J

P

AI

C

HI –

2

C

HIBA –

3

F

UKUOKA –

2

G

IFU –

1

G

UNMA – 1

H

IROSHIMA – 1

HO

KKAID

O

–

2

H

Y

OGO

– 2

IBARAKI –

2

ISHIKAWA –

1

K

ANAGAWA – 3

K

UMAM

O

T

O

– 1

K

Y

O

T

O

– 1

M

IYA

G

I – 1

O

SAKA – 1

S

AITAMA –

2

SHIZU

O

KA –

1

T

OC

HI

G

I - 1

TOKYO – 1

T

O

YAMA –

1

Y

AMA

G

ATA – 1

SWEDEN

O

LM – 1ST

OC

KH

O

KOREA

.CO

.K

R

CO

ST

CO.

1

BUS

AN –

A

N –

1

C

HE

O

N

A

2

D

AEGU –

N

–

1

D

AEJE

ON

–

1

G

IMHAE

–

GG

I-D

O

–

5

G

YE

O

N

G

N

– 1IN

C

HE

ON

– 1SEJ

O

N

G

4

SE

O

UL –

1

ULSAN –

CHINA

S

HANGHAI –

1

S

UZH

O

U -

1

TAIWAN

CO

ST

CO

.

CO

M.T

W

C

HIAYI

C

ITY –

1

HSIN

C

HU

C

ITY – 1

KA

O

HSIUN

G

C

ITY –

2

NEW TAIPEI CITY –

3

T

AI

C

HUN

G

C

ITY – 2

T

AINAN

C

ITY –

1

T

AIPEI

C

ITY –

2

T

A

O

YUAN

C

ITY –

2

UNITED

KINGDOM

CO

ST

CO

.

CO

.UK

E

N

G

LAND – 2

5

S

CO

TLAND –

3

WALE

S

– 1

ICELAND

K

A

U

PT

Ú

N –

1

SPAIN

LUCÍA – 1

ANDALUCÍA

B

IS

C

AY – 1

MADRID

–

2

2

MADRID – 2

FRANCE

E-FRANCE – 2

ÎLE-DE

-F

UNITED STATES

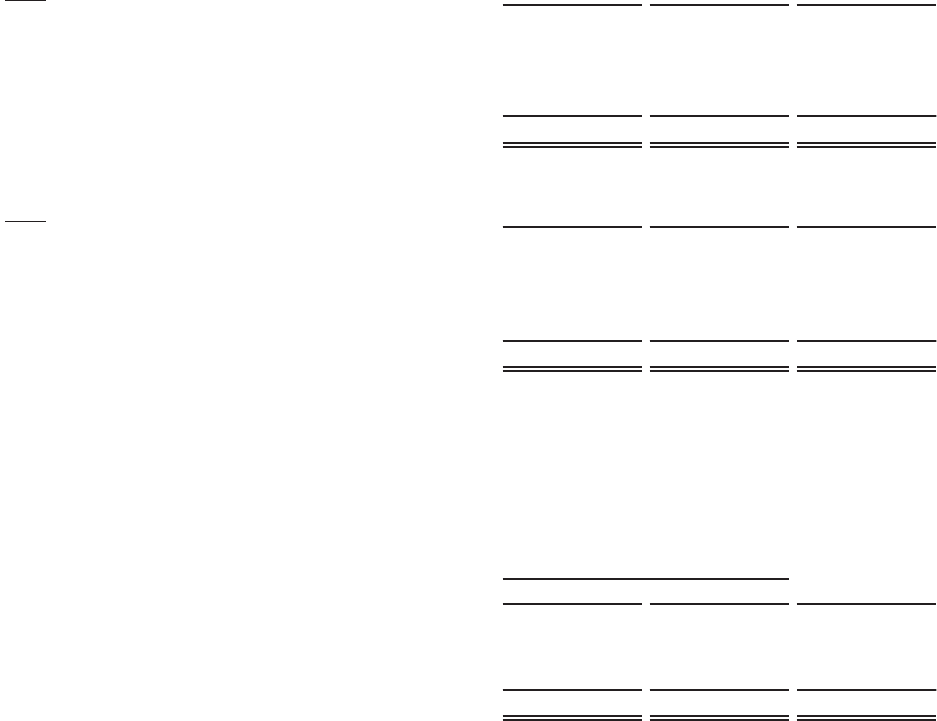

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended August 28, 2022

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Commission file number 0-20355

Costco Wholesale Corporation

(Exact name of registrant as specified in its charter)

Washington 91-1223280

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer Identification No.)

999 Lake Drive, Issaquah, WA 98027

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (425) 313-8100

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol

Name of each exchange on

which registered

Common Stock, $.005 Par Value COST The NASDAQ Global Select Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be

submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,”

“accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

☒

Accelerated filer ☐

Non-accelerated filer

☐

Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment

of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15

U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant as of February 13, 2022 was

$225,434,477,639.

The number of shares outstanding of the registrant’s common stock as of September 27, 2022, was 442,604,145.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the Annual Meeting of Shareholders to be held on January 19, 2023,

are incorporated by reference into Part III of this Form 10-K.

COSTCO WHOLESALE CORPORATION

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED AUGUST 28, 2022

TABLE OF CONTENTS

Page

PART I

Item 1.

Business ................................................................

3

Item 1A.

Risk Factors .............................................................

9

Item 1B.

Unresolved Staff Comments ...............................................

18

Item 2.

Properties ...............................................................

18

Item 3.

Legal Proceedings ........................................................

19

Item 4.

Mine Safety Disclosures ...................................................

19

PART II

Item 5.

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities ...........................................

19

Item 6.

Reserved ................................................................

20

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of

Operations .............................................................

21

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk ....................

30

Item 8.

Financial Statements and Supplementary Data ...............................

31

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure .............................................................

61

Item 9A.

Controls and Procedures ..................................................

61

Item 9B.

Other Information .........................................................

62

Item 9C.

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections ............

62

PART III

Item 10.

Directors, Executive Officers and Corporate Governance ......................

62

Item 11.

Executive Compensation ..................................................

62

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters .....................................................

62

Item 13.

Certain Relationships and Related Transactions, and Director Independence .....

62

Item 14.

Principal Accounting Fees and Services .....................................

62

PART IV

Item 15.

Exhibits, Financial Statement Schedules .....................................

62

Item 16.

Form 10-K Summary ......................................................

65

Signatures ...............................................................

66

2

INFORMATION RELATING TO FORWARD LOOKING STATEMENTS

Certain statements contained in this document constitute forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements

are statements that address activities, events, conditions or developments that the Company expects or

anticipates may occur in the future and may relate to such matters as net sales growth, changes in

comparable sales, cannibalization of existing locations by new openings, price or fee changes, earnings

performance, earnings per share, stock-based compensation expense, warehouse openings and

closures, capital spending, the effect of adopting certain accounting standards, future financial reporting,

financing, margins, return on invested capital, strategic direction, expense controls, membership renewal

rates, shopping frequency, litigation, and the demand for our products and services. In some cases,

forward-looking statements can be identified because they contain words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms.

Such forward-looking statements involve risks and uncertainties that may cause actual events, results, or

performance to differ materially from those indicated by such statements, including, without limitation, the

factors set forth in the section titled “Item 1A-Risk Factors”, and other factors noted in the section titled

“Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations” and in

the consolidated financial statements and related notes in Item 8 of this Report. Forward-looking

statements speak only as of the date they are made, and we do not undertake to update these

statements, except as required by law.

PART I

Item 1—Business

Costco Wholesale Corporation and its subsidiaries (Costco or the Company) began operations in 1983, in

Seattle, Washington. We are principally engaged in the operation of membership warehouses in the

United States (U.S.) and Puerto Rico, Canada, Mexico, Japan, United Kingdom (U.K.), Korea, Taiwan,

Australia, Spain, France, China, and Iceland. Costco operated 838, 815, and 795 warehouses worldwide

at August 28, 2022, August 29, 2021, and August 30, 2020, respectively. The Company operates e-

commerce websites in the U.S., Canada, Mexico, U.K., Korea, Taiwan, Japan, and Australia. Our

common stock trades on the NASDAQ Global Select Market, under the symbol “COST.”

We report on a 52/53-week fiscal year, consisting of thirteen four-week periods and ending on the Sunday

nearest the end of August. The first three quarters consist of three periods each, and the fourth quarter

consists of four periods (five weeks in the thirteenth period in a 53-week year). The material seasonal

impact in our operations is increased net sales and earnings during the winter holiday season.

References to 2022, 2021, and 2020 relate to the 52-week fiscal years ended August 28, 2022, August

29, 2021, and August 30, 2020, respectively.

General

We operate membership warehouses and e-commerce websites based on the concept that offering our

members low prices on a limited selection of nationally-branded and private-label products in a wide

range of categories will produce high sales volumes and rapid inventory turnover. When combined with

the operating efficiencies achieved by volume purchasing, efficient distribution and reduced handling of

merchandise in no-frills, self-service warehouse facilities, these volumes and turnover enable us to

operate profitably at significantly lower gross margins (net sales less merchandise costs) than most other

retailers. We often sell inventory before we are required to pay for it, even while taking advantage of early

payment discounts.

We buy most of our merchandise directly from manufacturers and route it to cross-docking consolidation

points (depots) or directly to our warehouses. Our depots receive large shipments from manufacturers

and quickly ship these goods to warehouses. This process creates freight volume and handling

3

efficiencies, lowering costs associated with traditional multiple-step distribution channels. For our e-

commerce operations we ship merchandise through our depots, our logistics operations for big and bulky

items, as well as through drop-ship and other delivery arrangements with our suppliers.

Our average warehouse space is approximately 146,000 square feet, with newer units being slightly

larger. Floor plans are designed for economy and efficiency in the use of selling space, the handling of

merchandise, and the control of inventory. Because shoppers are attracted principally by the quality of

merchandise and low prices, our warehouses are not elaborate. By strictly controlling the entrances and

exits and using a membership format, we believe our inventory losses (shrinkage) are well below those of

typical retail operations.

Our warehouses on average operate on a seven-day, 70-hour week. Gasoline operations generally have

extended hours. Because the hours of operation are shorter than many other retailers, and due to other

efficiencies inherent in a warehouse-type operation, labor costs are lower relative to the volume of sales.

Merchandise is generally stored on racks above the sales floor and displayed on pallets containing large

quantities, reducing labor required. In general, with variations by country, our warehouses accept certain

credit cards, including Costco co-branded cards, debit cards, cash and checks, Executive member 2%

reward certificates, co-brand cardholder rebates, and our proprietary stored-value card (shop card).

Our strategy is to provide our members with a broad range of high-quality merchandise at prices we

believe are consistently lower than elsewhere. We seek to limit most items to fast-selling models, sizes,

and colors. We carry less than 4,000 active stock keeping units (SKUs) per warehouse in our core

warehouse business, significantly less than other broadline retailers. We average anywhere from 10,000

to 11,000 SKUs online, some of which are also available in our warehouses. Many consumable products

are offered for sale in case, carton, or multiple-pack quantities only.

In keeping with our policy of member satisfaction, we generally accept returns of merchandise. On certain

electronic items, we typically have a 90-day return policy and provide, free of charge, technical support

services, as well as an extended warranty. Additional third-party warranty coverage is sold on certain

electronic items.

We offer merchandise and services in the following categories:

Core Merchandise Categories (or core business):

• Foods and Sundries (including sundries, dry grocery, candy, cooler, freezer, deli, liquor, and

tobacco)

• Non-Foods (including major appliances, electronics, health and beauty aids, hardware, garden

and patio, sporting goods, tires, toys and seasonal, office supplies, automotive care, postage,

tickets, apparel, small appliances, furniture, domestics, housewares, special order kiosk, and

jewelry)

• Fresh Foods (including meat, produce, service deli, and bakery)

Warehouse Ancillary (includes gasoline, pharmacy, optical, food court, hearing aids, and tire installation)

and Other Businesses (includes e-commerce, business centers, travel, and other)

Warehouse ancillary businesses operate primarily within or next to our warehouses, encouraging

members to shop more frequently. The number of warehouses with gas stations varies significantly by

country, and we have no gasoline business in Korea or China. We operated 668 gas stations at the end of

2022. Net sales for our gasoline business increased to approximately 14% of total net sales in 2022.

Our other businesses sell products and services that complement our warehouse operations (core and

warehouse ancillary businesses). Our e-commerce operations give members convenience and a broader

selection of goods and services. Net sales for e-commerce represented approximately 7% of total net

sales in 2022. This figure does not include other services we offer online in certain countries such as

4

business delivery, travel, same-day grocery, and various other services. Our business centers carry items

tailored specifically for food services, convenience stores and offices, and offer walk-in shopping and

deliveries. Business centers are included in our total warehouse count. Costco Travel offers vacation

packages, hotels, cruises, and other travel products exclusively for Costco members (offered in the U.S.,

Canada, and the U.K.).

We have direct buying relationships with many producers of brand-name merchandise. We do not obtain

a significant portion of merchandise from any one supplier. The COVID-19 pandemic created

unprecedented supply constraints, including disruptions and delays that have impacted and could

continue to impact the flow and availability of certain products. When sources of supply become

unavailable, we seek alternatives. We also purchase and manufacture private-label merchandise, as long

as quality and member demand are high and the value to our members is significant.

Certain financial information for our segments and geographic areas is included in Note 11 to the

consolidated financial statements included in Item 8 of this Report.

Membership

Our members may utilize their memberships at all of our warehouses and websites. Gold Star

memberships are available to individuals; Business memberships are limited to businesses, including

individuals with a business license, retail sales license, or comparable document. Business members may

add additional cardholders (affiliates), to which the same annual fee applies. Affiliates are not available for

Gold Star members. Our annual fee for these memberships is $60 in the U.S. and varies in other

countries. All paid memberships include a free household card.

Our member renewal rate was 93% in the U.S. and Canada and 90% worldwide at the end of 2022. The

majority of members renew within six months following their renewal date. Our renewal rate, which

excludes affiliates of Business members, is a trailing calculation that captures renewals during the period

seven to eighteen months prior to the reporting date. Our membership counts include active memberships

as well as memberships that have not renewed within the 12 months prior to the reporting date. At the

end of 2020, we standardized our membership count methodology globally to be consistent with the U.S.

and Canada, which resulted in the addition to the count of approximately 2.0 million total cardholders for

2020, of which 1.3 million were paid members. Membership fee income and the renewal rate calculations

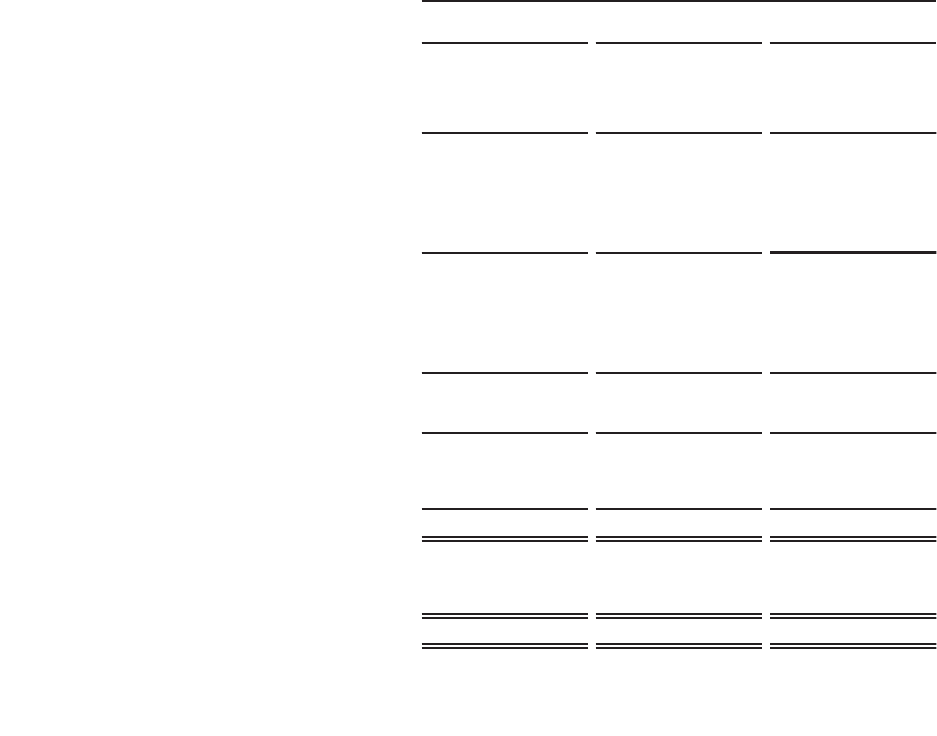

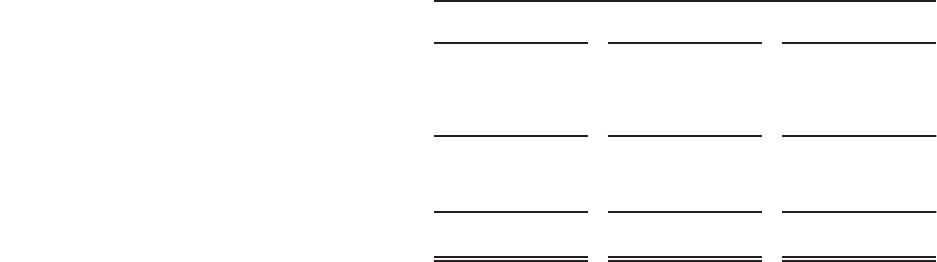

were not affected. Our membership was made up of the following (in thousands):

2022 2021 2020

Gold Star ................................................

54,000 50,200 46,800

Business, including affiliates ................................

11,800 11,500 11,300

Total paid members .....................................

65,800 61,700 58,100

Household cards .........................................

53,100 49,900 47,400

Total cardholders .......................................

118,900 111,600 105,500

Paid cardholders (except affiliates) are eligible to upgrade to an Executive membership in the U.S., for an

additional annual fee of $60. Executive memberships are also available in Canada, Mexico, the U.K.,

Japan, Korea, and Taiwan, for which the additional fee varies. Executive members earn a 2% reward on

qualified purchases (generally up to a maximum reward of $1,000 per year), redeemable at Costco

warehouses. This program also offers (except in Mexico and Korea) access to additional savings and

benefits on various business and consumer services, such as auto and home insurance, the Costco auto

purchase program, and check printing. These services are generally provided by third parties and vary by

state and country. Executive members totaled 29.1 million and represented 57% of paid members

(excluding affiliates) in the U.S. and Canada, and 22% of paid members (excluding affiliates) in our Other

International operations. The sales penetration of Executive members represented approximately 71% of

worldwide net sales in 2022.

5

Human Capital

Our Code of Ethics requires that we “Take Care of Our Employees,” which is fundamental to the

obligation to “Take Care of Our Members.” We must also carefully control our selling, general and

administrative (SG&A) expenses, so that we can sell high quality goods and services at low prices.

Compensation and benefits for employees is our largest expense after the cost of merchandise and is

carefully monitored.

Employee Base

At the end of 2022, we employed 304,000 employees worldwide. The large majority (approximately 95%)

is employed in our membership warehouses and distribution channels, and less than 10% are

represented by unions. We also utilize seasonal employees during peak periods. The total number of

employees by segment is:

Number of Employees

2022 2021 2020

United States ...............................

202,000 192,000 181,000

Canada ....................................

50,000 47,000 46,000

Other International ..........................

52,000 49,000 46,000

Total employees ............................

304,000 288,000 273,000

Growth and Engagement

We believe that our warehouses are among the most productive in the retail industry, owing in substantial

part to the commitment and efficiency of our employees. We seek to provide them not merely with

employment but careers. Many attributes of our business contribute to the objective; the more significant

include: competitive c ompensation and benefits for those working in our membership warehouses and

distributions channels; a commitment to promoting from within; and maintaining a ratio of at least 50% of

our employee base being full-time employees. These attributes contribute to what we consider, especially

for the industry, a high retention rate. In 2022, in the U.S. that rate was approximately 90% for employees

who have been with us for at least one year.

Diversity, Equity and Inclusion

The commitment to “Take Care of Our Employees” is also the foundation of our approach to diversity,

equity and inclusion and creating an inclusive and respectful workplace. In 2022, we appointed a new

Chief Diversity and Inclusion Officer. Embracing differences is important to the growth of our Company. It

leads to more opportunities, innovation, and employee satisfaction and connects us to the communities

where we do business.

Well Being

In October 2021, we provided an increase of a minimum of $0.50 per hour for U.S. and Canada wage

scales. In March 2022, we provided certain compensation increases, including a $0.75 per hour increase

to the top of the U.S. wage scales, increased the starting wage to $17.50, and granted our employees

one additional day of paid time off. In July 2022, we provided an additional increase to the top of the U.S.

wage scales of $0.50 per hour. Costco is firmly committed to helping protect the health and safety of our

members and employees and to serving our communities. As the global effect of COVID-19 continues to

evolve, we are closely monitoring the changing situation and complying with public health guidance.

For more detailed information regarding our programs and initiatives, see “Employees” within our

Sustainability Commitment (located on our website). This report and other information on our website are

not incorporated by reference into and do not form any part o f this Annual Report.

6

Competition

Our industry is highly competitive, based on factors such as price, merchandise quality and selection,

location, convenience, distribution strategy, and customer service. We compete on a worldwide basis with

global, national, and regional wholesalers and retailers, including supermarkets, supercenters, internet

retailers, gasoline stations, hard discounters, department and specialty stores, and operators selling a

single category or narrow range of merchandise. Walmart, Target, Kroger, and Amazon are among our

significant general merchandise retail competitors in the U.S. We also compete with other warehouse

clubs, including Walmart’s Sam’s Club and BJ’s Wholesale Club. Many of the major metropolitan areas in

the U.S. and certain of our Other International locations have multiple competing clubs.

Intellectual Property

We believe that, to varying degrees, our trademarks, trade names, copyrights, proprietary processes,

trade secrets, trade dress, domain names and similar intellectual property add significant value to our

business and are important to our success. We have invested significantly in the development and

protection of our well-recognized brands, including the Costco Wholesale trademarks and our private-

label brand, Kirkland Signature. We believe that Kirkland Signature products are high quality, offered at

prices that are generally lower than national brands, and help lower costs, differentiate our merchandise

offerings, and generally earn higher margins. We expect to continue to increase the sales penetration of

our private-label items.

We rely on trademark and copyright laws, trade-secret protection, and confidentiality, license and other

agreements with our suppliers, employees and others to protect our intellectual property. The availability

and duration of trademark registrations vary by country; however, trademarks are generally valid and may

be renewed indefinitely as long as they are in use and registrations are maintained.

Available Information

Our U.S. website is www.costco.com. We make available through the Investor Relations section of that

site, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K, Proxy Statements and Forms 3, 4 and 5, and any amendments to those reports, as soon as

reasonably practicable after filing such materials with or furnishing such documents to the Securities and

Exchange Commission (SEC). The information found on our website is not part of this or any other report

filed with or furnished to the SEC. The SEC maintains a site that contains reports, proxy and information

statements, and other information regarding issuers, such as the Company, that file electronically with the

SEC at www.sec.gov.

We have a code of ethics for senior financial officers, pursuant to Section 406 of the Sarbanes-Oxley Act.

Copies of the code are available free of charge by writing to Secretary, Costco Wholesale Corporation,

999 Lake Drive, Issaquah, WA 98027. If the Company makes any amendments to this code (other than

technical, administrative, or non-substantive amendments) or grants any waivers, including implicit

waivers, to the Chief Executive Officer, Chief Financial Officer or principal accounting officer and

controller, we will disclose (on our website or in a Form 8-K report filed with the SEC) the nature of the

amendment or waiver, its effective date, and to whom it applies.

7

Information about our Executive Officers

The executive officers of Costco, their position, and ages are listed below. All have over 25 years of

service with the Company, with the exception of Mr. Sullivan who has 21 years of service.

Name Position

Executive

Officer

Since Age

W. Craig Jelinek ............ Chief Executive Officer. Mr. Jelinek has been a director since

February 2010. Mr. Jelinek previously was President and

CEO from January 2012 to February 2022. He was

President and Chief Operating Officer from February 2010 to

December 2011. Prior to that he was Executive Vice

President, Chief Operating Officer, Merchandising since

2004.

1995 70

Ron M. Vachris ............. President and Chief Operating Officer. Mr. Vachris has been

a director since February 2022. Mr. Vachris previously

served as Executive Vice President of Merchandising from

June 2016 to January 2022, as Senior Vice President, Real

Estate Development, from August 2015 to June 2016, and

Senior Vice President, General Manager, Northwest Region,

from 2010 to July 2015.

2016 57

Richard A. Galanti .......... Executive Vice President and Chief Financial Officer.

Mr. Galanti has been a director since January 1995.

1993 66

Jim C. Klauer .............. Executive Vice President, Chief Operating Officer, Northern

Division. Mr. Klauer was Senior Vice President, Non-Foods

and E-commerce Merchandise, from 2013 to January 2018.

2018 60

Patrick J. Callans ........... Executive Vice President, Administration. Mr. Callans was

Senior Vice President, Human Resources and Risk

Management, from 2013 to December 2018.

2019 60

Russ D. Miller .............. Senior Executive Vice President, U.S. Operations. Mr. Miller

was Executive Vice President, Chief Operating Officer,

Southern Division and Mexico, from January 2018 to May

2022. Mr. Miller was Senior Vice President, Western Canada

Region, from 2001 to January 2018.

2018 65

James P. Murphy ........... Executive Vice President, Chief Operating Officer,

International Division. Mr. Murphy was Senior Vice

President, International, from 2004 to October 2010. Mr.

Murphy is retiring from the Company at the end of calendar

year 2022.

2011 69

Timothy L. Rose ............ Executive Vice President, Ancillary Businesses,

Manufacturing, and Business Centers. Mr. Rose was Senior

Vice President, Merchandising, Foods and Sundries and

Private Label, from 1995 to December 2012. Mr. Rose is

retiring from the Company effective November, 2022.

2013 70

Yoram B. Rubanenko ....... Executive Vice President, Chief Operating Officer, Eastern

Division. Mr. Rubanenko was Senior Vice President and

General Manager, Southeast Region, from 2013 to

September 2021, and Vice President, Regional Operations

Manager for the Northeast Region, from 1998 to 2013.

2021 58

John Sullivan .............. Executive Vice President, General Counsel & Corporate

Secretary. Mr. Sullivan has been General Counsel since

2016 and Corporate Secretary since 2010.

2021 62

Claudine E. Adamo ......... Executive Vice President, Merchandising. Ms. Adamo was

Senior Vice President, Non Foods, from 2018 to February

2022, and Vice President, Non Foods, from 2013 to 2018.

2022 52

Caton Frates ............... Executive Vice President, Chief Operating Officer, Southwest

Division. Mr. Frates was Senior Vice President, Los Angeles

Division, from 2015 to May 2022.

2022 54

Pierre Riel ................. Executive Vice President, Chief Operating Officer,

International Division. Mr. Riel was Senior Vice President,

Country Manager, Canada, from 2019 to March 2022, and

Senior Vice President, Eastern Canada Region, from 2001 to

2019.

2022 59

8

Item 1A—Risk Factors

The risks described below could materially and adversely affect our business, financial condition and

results of operations. We could also be affected by additional risks that apply to all companies operating

in the U.S. and globally, as well as other risks that are not presently known to us or that we currently

consider to be immaterial. These Risk Factors should be carefully reviewed in conjunction with

Management's Discussion and Analysis of Financial Condition and Results of Operations in Item 7 and

our consolidated financial statements and related notes in Item 8 of this Report.

Business and Operating Risks

We are highly dependent on the f inancial performance of our U.S. and Canadian operations.

Our financial and operational performance is highly dependent on our U.S. and Canadian operations,

which comprised 87% and 85% of net sales and operating income in 2022, respectively. Within the U.S.,

we are highly dependent on our California operations, which comprised 28% of U.S. net sales in 2022.

Our California market, in general, has a larger percentage of higher volume warehouses as compared to

our other domestic markets. Any substantial slowing or sustained decline in these operations could

materially adversely affect our business and financial results. Declines in financial performance of our

U.S. operations, particularly in California, and our Canadian operations could arise from, among other

things: slow growth or declines in comparable warehouse sales (comparable sales); negative trends in

operating expenses, including increased labor, healthcare and energy costs; failing to meet targets for

warehouse openings; cannibalizing existing locations with new warehouses; shifts in sales mix toward

lower gross margin products; changes or uncertainties in economic conditions in our markets, including

higher levels of unemployment and depressed home values; and failing to consistently provide high

quality and innovative new products.

We may be unsuccessful implementing our growth strategy, including expanding our business in

existing markets and new markets, and integrating acquisitions, which could have an adverse

impact on our business, financial condition and results of operations.

Our growth is dependent, in part, on our ability to acquire property and build or lease new warehouses

and depots. We compete with other retailers and businesses for suitable locations. Local land use and

other regulations restricting the construction and operation of our warehouses and depots, as well as local

community actions opposed to the location of our warehouses or depots at specific sites and the adoption

of local laws restricting our operations and environmental regulations, may impact our ability to find

suitable locations and increase the cost of sites and of constructing, leasing and operating warehouses

and depots. We also may have difficulty negotiating leases or purchase agreements on acceptable terms.

In addition, certain jurisdictions have enacted or proposed laws and regulations that would prevent or

restrict the operation or expansion plans of certain large retailers and warehouse clubs, including us.

Failure to effectively manage these and other similar factors may affect our ability to timely build or lease

and operate new warehouses and depots, which could have a material adverse effect on our future

growth and profitability.

We seek to expand in existing markets to attain a greater overall market share. A new warehouse may

draw members away from our existing warehouses and adversely affect their comparable sales

performance, member traffic, and profitability.

We intend to continue to open warehouses in new markets. Associated risks include difficulties in

attracting members due to a lack of familiarity with us, attracting members of other wholesale club

operators, our lesser familiarity with local member preferences, and seasonal differences in the market.

Entry into new markets may bring us into competition with new competitors or with existing competitors

with a large, established market presence. We cannot ensure that new warehouses and new e-commerce

websites will be profitable and future profitability could be delayed or otherwise materially adversely

affected.

9

We have made and may continue to make investments and acquisitions to improve the speed, accuracy

and efficiency of our supply chains and delivery channels. The effectiveness of these investments can be

less predictable than opening new locations and might not provide the anticipated benefits or desired

rates of return.

Our failure to maintain membership growth, loyalty and brand recognition could adversely affect

our results of operations.

Membership loyalty and growth are essential to our business. The extent to which we achieve growth in

our membership base, increase the penetration of Executive membership, and sustain high renewal rates

materially influences our profitability. Damage to our brands or reputation may negatively impact

comparable sales, diminish member trust, and reduce renewal rates and, accordingly, net sales and

membership fee revenue, negatively impacting our results of operations.

We sell many products under our Kirkland Signature brand. Maintaining consistent product quality,

competitive pricing, and availability of these products is essential to developing and maintaining member

loyalty. These products also generally carry higher margins than national brand products and represent a

growing portion of our overall sales. If the Kirkland Signature brand experiences a loss of member

acceptance or confidence, our sales and gross margin results could be adversely affected.

Disruptions in merchandise distribution or processing, packaging, manufacturing, and other

facilities could adversely affect sales and member satisfaction.

We depend on the orderly operation of the merchandise receiving and distribution process, primarily

through our depots. We also rely upon processing, packaging, manufacturing and other facilities to

support our business, which includes the production of certain private-label items. Although we believe

that our operations are efficient, disruptions due to fires, tornadoes, hurricanes, earthquakes, pandemics

or other extreme weather conditions or catastrophic events, labor issues or other shipping problems may

result in delays in the production and delivery of merchandise to our warehouses, which could adversely

affect sales and the satisfaction of our members. Our e-commerce operations depend heavily on third-

party and in-house logistics providers and is negatively affected when these providers are unable to

provide services in a timely fashion.

We may not timely identify or effectively respond to consumer trends, which could negatively

affect our relationship with our members, the demand for our products and services, and our

market share.

It is difficult to consistently and successfully predict the products and services that our members will

desire. Our success depends, in part, on our ability to identify and respond to trends in demographics and

consumer preferences. Failure to identify timely or effectively respond to changing consumer tastes,

preferences (including those relating to environmental, social and governance practices) and spending

patterns could negatively affect our relationship with our members, the demand for our products and

services, and our market share. If we are not successful at predicting our sales trends and adjusting our

purchases accordingly, we may have excess inventory, which could result in additional markdowns, or we

may experience out-of-stock positions and delivery delays, which could result in higher costs, both of

which would reduce our operating performance. This could have an adverse effect on net sales, gross

margin and operating income.

Availability and performance of our information technology (IT) systems are vital to our business.

Failure to successfully execute IT projects and have IT systems available to our business would

adversely impact our operations.

IT systems play a crucial role in conducting our business. These systems are utilized to process a very

high volume of transactions, conduct payment transactions, track and value our inventory and produce

reports critical for making business decisions. Failure or disruption of these systems could have an

adverse impact on our ability to buy products and services from our suppliers, produce goods in our

10

manufacturing plants, move the products in an efficient manner to our warehouses and sell products to

our members. We are undertaking large technology and IT transformation projects. The failure of these

projects could adversely impact our business plans and potentially impair our day to day business

operations. Given the high volume of transactions we process, it is important that we build strong digital

resiliency to prevent disruption from events such as power outages, computer and telecommunications

failures, viruses, internal or external security breaches, errors by employees, and catastrophic events

such as fires, earthquakes, tornadoes and hurricanes. Any debilitating failure of our critical IT systems,

data centers and backup systems would require significant investments in resources to restore IT

services and may cause serious impairment in our business operations including loss of business

services, increased cost of moving merchandise and failure to provide service to our members. We are

currently making substantial investments in maintaining and enhancing our digital resiliency and failure or

delay in these projects could be costly and harmful to our business. Failure to deliver IT transformation

efforts efficiently and effectively could result in the loss of our competitive position and adversely impact

our financial condition and results of operations.

We are required to maintain the privacy and security of personal and business information amidst

multiplying threat landscapes and in compliance with privacy and data protection regulations

globally. Failure to do so could damage our business, including our reputation with members,

suppliers and employees, cause us to incur substantial additional costs, and become subject to

litigation and regulatory action.

Increased security threats and more sophisticated cyber misconduct pose a risk to our systems,

networks, products and services. We rely upon IT systems and networks, some of which are managed by

third parties, in connection with virtually all of our business activities. Additionally, we collect, store and

process sensitive information relating to our business, members, suppliers and employees. Operating

these IT systems and networks, and processing and maintaining this data, in a secure manner, is critical

to our business operations and strategy. Increased remote work has also increased the possible attack

surfaces. Threats designed to gain unauthorized access to systems, networks and data, both ours and

third parties with whom we work, are increasing in frequency and sophistication. Cybersecurity attacks

may r ange from random attempts to coordinated and targeted attacks, including sophisticated computer

crimes and advanced persistent threats. Phishing attacks have emerged as particularly prominent,

including as vectors for ransomware attacks, which have increased in breadth and frequency. While we

train our employees as part of our security efforts, that training cannot be completely effective. These

threats pose a risk to the security of our systems and networks and the confidentiality, integrity, and

availability of our data. It is possible that our IT systems and networks, or those managed by third parties

such as cloud providers or suppliers that otherwise host confidential information, could have

vulnerabilities, which could go unnoticed for a period of time. While our cybersecurity and compliance

efforts seek to mitigate such risks, there can be no guarantee that the actions and controls we and our

third-party service providers have implemented and are implementing, will be sufficient to protect our

systems, information or other property.

The potential impacts of a material cybersecurity attack include reputational damage, litigation,

government enforcement actions, penalties, disruption to systems, unauthorized release of confidential or

otherwise protected information, corruption of data, diminution in the value of our investment in IT

systems and increased cybersecurity protection and remediation costs. This could adversely affect our

competitiveness, results of operations and financial condition and, critically in light of our business model,

loss of member confidence. Further, the insurance coverage we maintain and indemnification

arrangements with third-parties may be inadequate to cover claims, costs, and liabilities relating to

cybersecurity incidents. In addition, data we collect, store and process is subject to a variety of U.S. and

international laws and regulations, such as the European Union's General Data Protection Regulation,

California Consumer Privacy Act, Health Insurance Portability and Accountability Act, and other privacy

and cybersecurity laws across the various states and around the globe, which may carry significant

potential penalties for noncompliance.

11

We are subject to payment-related risks.

We accept payments using a variety of methods, including select credit and debit cards, cash and checks,

co-brand cardholder rebates, Executive member 2% reward certificates, and our shop card. As we offer

new payment options to our members, we may be subject to additional rules, regulations, compliance

requirements, and higher fraud losses. For certain payment methods, we pay interchange and other

related acceptance fees, along with additional transaction processing fees. We rely on third parties to

provide payment transaction processing services for credit and debit cards and our shop card. It could

disrupt our business if these parties become unwilling or unable to provide these services to us. We are

also subject to fee increases by these service providers.

We must comply with evolving payment card association and network operating rules, including data

security rules, certification requirements and rules governing electronic funds transfers. For example, we

are subject to Payment Card Industry Data Security Standards, which contain compliance guidelines and

standards with regard to our security surrounding the physical and electronic storage, processing and

transmission of individual cardholder data. If our internal systems are breached or compromised, we may

be liable for card re-issuance costs, subject to fines and higher transaction fees and lose our ability to

accept card payments from our members, and our business and operating results could be adversely

affected.

We might sell products that cause illness or injury to our members, harm to our reputation, and

expose us to litigation.

If our merchandise, including food and prepared food products for human consumption, drugs, children's

products, pet products and durable goods, do not meet or are perceived not to meet applicable safety or

labeling standards or our members' expectations, we could experience lost sales, increased costs,

litigation or reputational harm. The sale of these items involves the risk of illness or injury to our members.

Such illnesses or injuries could result from tampering by unauthorized third parties, product contamination

or spoilage, including the presence of foreign objects, substances, chemicals, other agents, or residues

introduced during the growing, manufacturing, storage, handling and transportation phases, or faulty

design. Our suppliers are generally contractually required to comply with product safety laws, and we are

dependent on them to ensure that the products we buy comply with safety and other standards. While we

are subject to governmental inspection and regulations and work to comply in all material respects with

applicable laws and regulations, we cannot be sure that consumption or use of our products will not cause

illness or injury or that we will not be subject to claims, lawsuits, or government investigations relating to

such matters, resulting in costly product recalls and other liabilities that could adversely affect our

business and results of operations. Even if a product liability claim is unsuccessful or is not fully pursued,

negative publicity could adversely affect our reputation with existing and potential members and our

corporate and brand image, and these effects could be long-term.

If we do not successfully develop and maintain a relevant omnichannel experience for our

members, our results of operations could be adversely impacted.

Omnichannel retailing is rapidly evolving, and we must keep pace with changing member expectations

and new developments by our competitors. Our members are increasingly using mobile phones, tablets,

computers, and other devices to shop and to interact with us through social media. We are making

investments in our websites and mobile applications. If we are unable to make, improve, or develop

relevant member-facing technology in a timely manner, our ability to compete and our results of

operations could be adversely affected.

12

Inability to attract, train and retain highly qualified employees could adversely impact our

business, financial condition and results of operations.

Our success depends on the continued contributions of our employees, including members of our senior

management and other key operations, IT, merchandising and administrative personnel. Failure to identify

and implement a succession plan for senior management could negatively impact our business. We must

attract, train and retain a large and growing number of qualified employees, while controlling related labor

costs and maintaining our core values. Our ability to control labor and benefit costs is subject to

numerous internal and external factors, including the continuing impacts of the pandemic, regulatory

changes, prevailing wage rates, union relations and healthcare and other insurance costs. We compete

with other retail and non-retail businesses for these employees and invest significant resources in training

and motivating them. There is no assurance that we will be able to attract or retain highly qualified

employees in the future, which could have a material adverse effect on our business, financial condition

and results of operations.

We may incur property, casualty or other losses not covered by our insurance.

Claims for employee health care benefits, workers’ compensation, general liability, property damage,

directors’ and officers’ liability, vehicle liability, inventory loss, and other exposures are funded

predominantly through self-insurance. Insurance coverage is maintained for certain risks to limit

exposures arising from very large losses. The types and amounts of insurance may vary from time to time

based on our decisions with respect to risk retention and regulatory requirements. Significant claims or

events, regulatory changes, a substantial rise in costs of health care or costs to maintain our insurance or

the failure to maintain adequate insurance coverage could have an adverse impact on our financial

condition and results of operations.

Although we maintain specific coverages for catastrophic property losses, we still bear a significant

portion of the risk of losses incurred as a result of any physical damage to, or the destruction of, any

warehouses, depots, manufacturing or home office facilities, loss or spoilage of inventory, and business

interruption. Such losses could materially impact our cash flows and results of operations.

Market and Other External Risks

We face strong competition from other retailers and warehouse club operators, which could

adversely affect our business, financial condition and results of operations.

The retail business is highly competitive. We compete for members, employees, sites, products and

services and in other important respects with a wide range of local, regional and national wholesalers and

retailers, both in the United States and in foreign countries, including other warehouse-club operators,

supermarkets, supercenters, internet retailers, gasoline stations, hard discounters, department and

specialty stores and operators selling a single category or narrow range of merchandise. Such retailers

and warehouse club operators compete in a variety of ways, including pricing, selection and availability,

services, location, convenience, store hours, and the attractiveness and ease of use of websites and

mobile applications. The evolution of retailing in online and mobile channels has improved the ability of

customers to comparison shop, which has enhanced competition. Some competitors have greater

financial resources and technology capabilities, better access to merchandise, and greater market

penetration than we do. Our inability to respond effectively to competitive pressures, changes in the retail

markets or customer expectations could result in lost m arket share and negatively affect our financial

results.

13

General economic factors, domestically and internationally, may adversely affect our business,

financial condition, and results of operations.

Higher energy and gasoline costs, inflation, levels of unemployment, healthcare costs, consumer debt

levels, foreign-currency exchange rates, unsettled financial markets, weaknesses in housing and real

estate markets, reduced consumer confidence, changes and uncertainties related to government fiscal

and tax policies including changes in tax rates, duties, tariffs, or other restrictions, sovereign debt crises,

pandemics and other health crises, and other economic factors could adversely affect demand for our

products and services, require a change in product mix, or impact the cost of or ability to purchase

inventory. Additionally, actions in various countries, particularly China and the United States, have

affected the costs of some of our merchandise. The degree of our exposure is dependent on (among

other things) the type of goods, rates imposed, and timing of the tariffs. The impact to our net sales and

gross margin is influenced in part by our merchandising and pricing strategies in response to potential

cost increases. Higher tariffs could adversely impact our results.

Prices of certain commodities, including gasoline and consumable goods used in manufacturing and our

warehouse retail operations, are historically volatile and are subject to fluctuations arising from changes in

domestic and international supply and demand, inflationary pressures, labor costs, competition, market

speculation, government regulations, taxes and periodic delays in delivery. Rapid and significant changes

in commodity prices and our ability and desire to pass them through to our members may affect our sales

and profit margins. These factors could also increase our merchandise costs and selling, general and

administrative expenses, and otherwise adversely affect our operations and financial results. General

economic conditions can also be affected by events like the outbreak of hostilities, including but not

limited to the Ukraine conflict, or acts of terrorism.

Inflationary factors such as increases in merchandise costs may adversely affect our business, financial

condition and results of operations. If inflation on merchandise increases beyond our ability to control we

may not be able to adjust prices to sufficiently offset the effect of the various cost increases without

negatively impacting consumer demand. Certain merchandise categories were impacted by inflation

higher than what we have experienced in recent years due to, among other things, the continuing impacts

of the pandemic and uncertain economic environment.

Suppliers may be unable to timely supply us with quality merchandise at competitive prices or

may fail to adhere to our high standards, resulting in adverse effects on our business,

merchandise inventories, sales, and profit margins.

We depend heavily on our ability to purchase quality merchandise in sufficient quantities at competitive

prices. As the quantities we require continue to grow, we have no assurances of continued supply,

appropriate pricing or access to new products, and any supplier has the ability to change the terms upon

which they sell to us or discontinue selling to us. Member demands may lead to out-of-stock positions

causing a loss of sales and profits.

We buy from numerous domestic and foreign manufacturers and importers. Our inability to acquire

suitable merchandise on acceptable terms or the loss of key suppliers could negatively affect us. We may

not be able to develop relationships with new suppliers, and products from alternative sources, if any, may

be of a lesser quality or more expensive. Because of our efforts to adhere to high quality standards for

which available supply may be limited, particularly for certain food items, the large volumes we demand

may not be consistently available.

14

Our suppliers (and those they depend upon for materials and services) are subject to risks, including

labor disputes, union organizing activities, financial liquidity, natural disasters, extreme weather

conditions, public health emergencies, supply constraints and general economic and political conditions

that could limit their ability to timely provide us with acceptable merchandise. One or more of our suppliers

might not adhere to our quality control, packaging, legal, regulatory, labor, environmental or animal

welfare standards. These deficiencies may delay or preclude delivery of merchandise to us and might not

be identified before we sell such merchandise to our members. This failure could lead to recalls and

litigation and otherwise damage our reputation and our brands, increase costs, and otherwise adversely

impact our business.

Fluctuations in foreign exchange rates may adversely affect our results of operations.

During 2022, our international operations, including Canada, generated 27% and 32% of our net sales

and operating income, respectively. Our international operations have accounted for an increasing portion

of our warehouses, and we plan to continue international growth. To prepare our consolidated financial

statements, we translate the financial statements of our international operations from local currencies into

U.S. dollars using current exchange rates. Future fluctuations in exchange rates that are unfavorable to

us may adversely affect the financial performance of our Canadian and Other International operations and

have a corresponding adverse period-over-period effect on our results of operations. As we continue to

expand internationally, our exposure to fluctuations in foreign exchange rates may increase.

A portion of the products we purchase is paid for in a currency other than the local currency of the country

in which the goods are sold. Currency fluctuations may increase our merchandise costs and may not be

passed on to members. Consequently, fluctuations in currency exchange rates may adversely affect our

results of operations.

Natural disasters, extreme weather conditions, public health emergencies or other catastrophic

events could negatively affect our business, financial condition, and results of operations.

Natural disasters and extreme weather conditions, including those impacted by climate change, such as

hurricanes, typhoons, floods, earthquakes, wildfires, droughts; acts of terrorism or violence, including

active shooter situations; energy shortages; public health issues, including pandemics and quarantines,

particularly in California or Washington state, where our centralized operating systems and administrative

personnel are located, could negatively affect our operations and financial performance. Such events

could result in physical damage to our properties, limitations on store operating hours, less frequent visits

by members to physical locations, the temporary closure of warehouses, depots, manufacturing or home

office facilities, the temporary lack of an adequate work force, disruptions to our IT systems, the

temporary or long-term disruption in the supply of products from some local or overseas suppliers, the

temporary disruption in the transport of goods to or from overseas, delays in the delivery of goods to our

warehouses or depots, and the temporary reduction in the availability of products in our warehouses.

Public health issues, whether occurring in the U.S. or abroad, could disrupt our operations, disrupt the

operations of suppliers or members, or have an adverse impact on consumer spending and confidence

levels. These events c ould also reduce demand for our products or make it difficult or impossible to

procure products. We may be required to suspend operations in some or all of our locations, which could

have a material adverse effect on our business, financial condition and results of operations.

The COVID-19 pandemic continues to affect our business, financial condition and results of

operations in many respects.

The continuing impacts of the COVID-19 pandemic are highly unpredictable and volatile and are affecting

certain business operations, demand for our products and services, in-stock positions, costs of doing

business, availability of labor, access to inventory, supply chain operations, our ability to predict future

performance, exposure to litigation, and our financial performance, among other things.

15

Other factors and uncertainties include, but are not limited to:

• The severity and duration of the pandemic, including future mutations or related variants of the

virus in areas in which we operate;

• Evolving macroeconomic factors, including general economic uncertainty, unemployment rates,

and recessionary pressures;

• Changes in labor markets affecting us and our suppliers;

• Unknown consequences on our business performance and initiatives stemming from the

substantial investment of time and other resources to the pandemic response;

• The pace of recovery when the pandemic subsides;

• The long-term impact of the pandemic on our business, including consumer behaviors; and

• Disruption and volatility within the financial and credit markets.

To the extent that COVID-19 continues to adversely affect the U.S. and global economy, our business,

results of operations, cash flows, or financial condition, it may also heighten other risks described in this

section, including but not limited to those related to consumer behavior and expectations, competition,

brand reputation, implementation of strategic initiatives, cybersecurity threats, payment-related risks,

technology systems disruption, supply chain disruptions, labor availability and cost, litigation, operational

risk as a result of remote work arrangements and regulatory requirements.

Factors associated with climate change could adversely affect our business.

We use natural gas, diesel fuel, gasoline, and electricity in our distribution and warehouse operations.

Government regulations limiting carbon dioxide and other greenhouse gas emissions may increase

compliance and merchandise costs, and other regulation affecting energy inputs could materially affect

our profitability. As the economy transitions to lower carbon intensity we cannot guarantee that we will

make adequate investments or successfully implement strategies that will effectively achieve our climate-

related goals, which could lead to negative perceptions among members and other stakeholders and

result in reputational harm. Climate change, extreme weather conditions, wildfires, droughts and rising

sea levels could affect our ability to procure commodities at costs and in quantities we currently

experience.

We also sell a substantial amount of gasoline, the demand for which could be impacted by concerns

about climate change and increased regulations. More stringent fuel economy standards and public

policies aimed at increasing the adoption of zero-emission and alternative fuel vehicles and other

regulations related to climate change will affect our future operations and may adversely impact our

profitability, and require significant capital expenditures.

Failure to meet financial market expectations could adversely affect the market price and volatility

of our stock.

We believe that the price of our stock currently reflects high market expectations for our future operating

results. Any failure to meet or delay in meeting these expectations, including our warehouse and e-

commerce comparable sales growth rates, membership renewal rates, new member sign-ups, gross

margin, earnings, earnings per share, new warehouse openings, or dividend or stock repurchase policies

could cause the price of our stock to decline.

16

Legal and Regulatory Risks

We are subject to risks associated with the legislative, judicial, accounting, regulatory, political

and economic factors specific to the countries or regions in which we operate, which c ould

adversely affect our business, financial condition and results of operations.

At the end of 2022, we operated 260 warehouses outside of the U.S., and we plan to continue expanding

our international operations. Future operating results internationally could be negatively affected by a

variety of factors, many similar to those we face in the U.S., certain of which are beyond our control.

These factors include political and economic conditions, regulatory constraints, currency regulations,

policy changes such as the withdrawal of the U.K. from the European Union, and other matters in any of

the countries or regions in which we operate, now or in the future. Other factors that may impact

international operations include foreign trade (including tariffs and trade sanctions), monetary and fiscal

policies and the laws and regulations of the U.S. and foreign governments, agencies and similar

organizations, and risks associated with having major facilities in locations which have been historically

less stable than the U.S. Risks inherent in international operations also include, among others, the costs

and difficulties of managing international operations, adverse tax consequences, and difficulty in enforcing

intellectual property rights.

Changes in accounting standards and subjective assumptions, estimates and judgments by

management related to complex accounting matters could significantly affect our financial

condition and results of operations.

Accounting principles and related pronouncements, implementation guidelines, and interpretations we

apply to a wide range of matters that are relevant to our business, including self-insurance liabilities, are