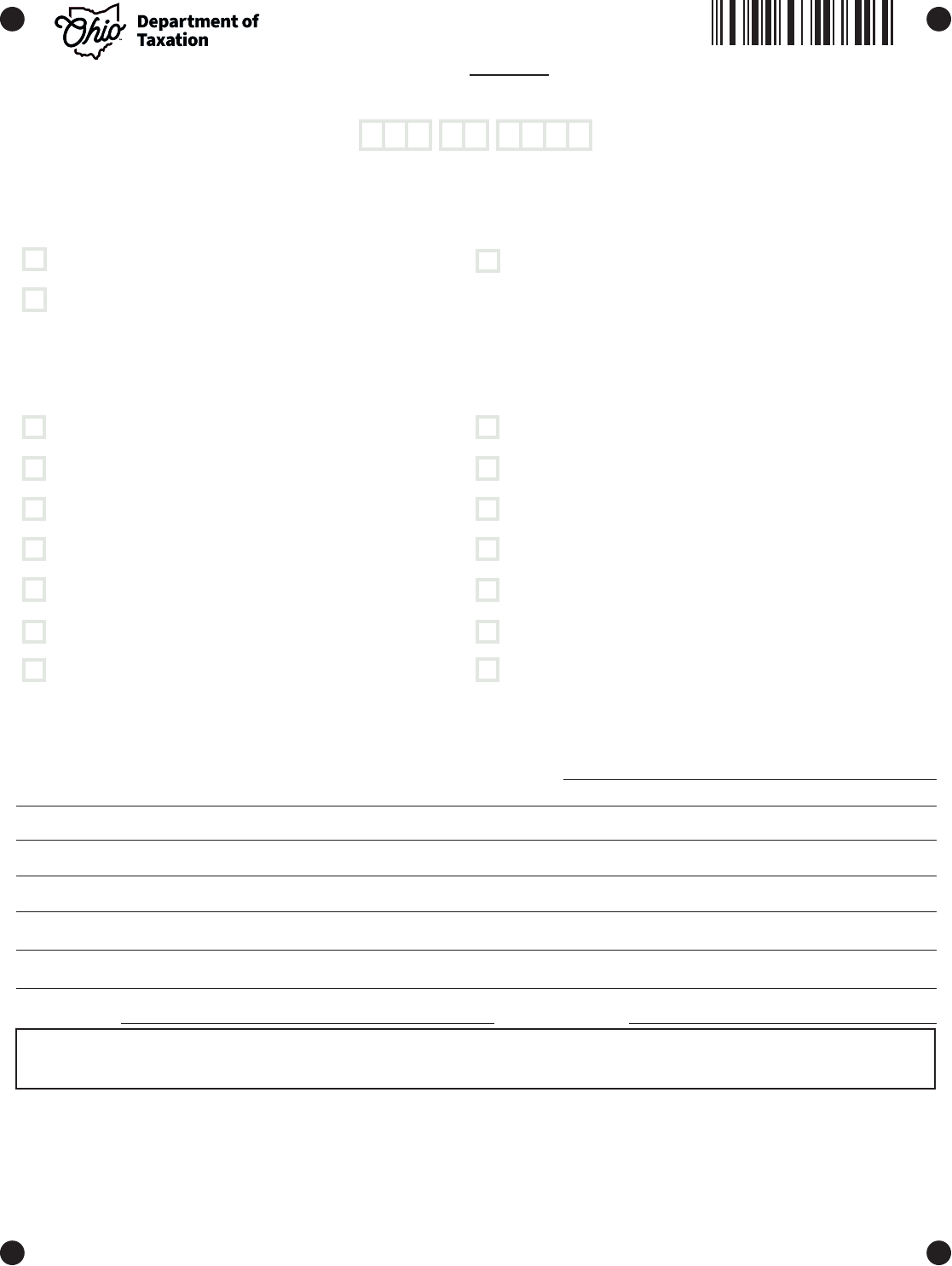

2023 Ohio IT RE

Explanation of Corrections

Note: For amended individual return only

Complete the Ohio IT 1040 and indicate that it is amended by checking the box at the top of page 1. You must include this form and

documentation to support the adjustments on your amended return.

Note: Include any worksheets and/or documentation necessary to support your changes. See the ling tips on the next page as well as

the Ohio Individual and School District income tax instructions.

Detailed explanation of adjusted items (include additional sheet[s] if necessary):

E-mail address Telephone number

Primary taxpayer's SSN

Federal adjusted gross income decreased Filing status changed

Exemptions increased (include Schedule of Dependents)

If you checked any of the boxes above, do not le your Ohio amended return until the IRS has accepted the changes on your federal

amended return.

Federal adjusted gross income increased

Exemptions decreased (include Schedule of Dependents

)

Residency status changed

Ohio Schedule of Adjustments, additions to income

Ohio Schedule of Adjustments, deductions from income

Ohio Schedule of Credits, nonrefundable credit(s) increased

Ohio Schedule of Credits, nonrefundable credit(s) decreased

Ohio Schedule of Credits, nonresident credit increased

Ohio Schedule of Credits, nonresident credit decreased

Ohio Schedule of Credits, resident credit increased

Ohio Schedule of Credits, resident credit decreased

Ohio Schedule of Credits, refundable credit(s) increased

Ohio Schedule of Credits, refundable credit(s) decreased

Other (describe the reason below)

Reason(s):

Federal Privacy Act Notice: Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing us

with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. We need your Social

Security number in order to administer this tax.

2023 IT RE – page 1 of 2

23270102

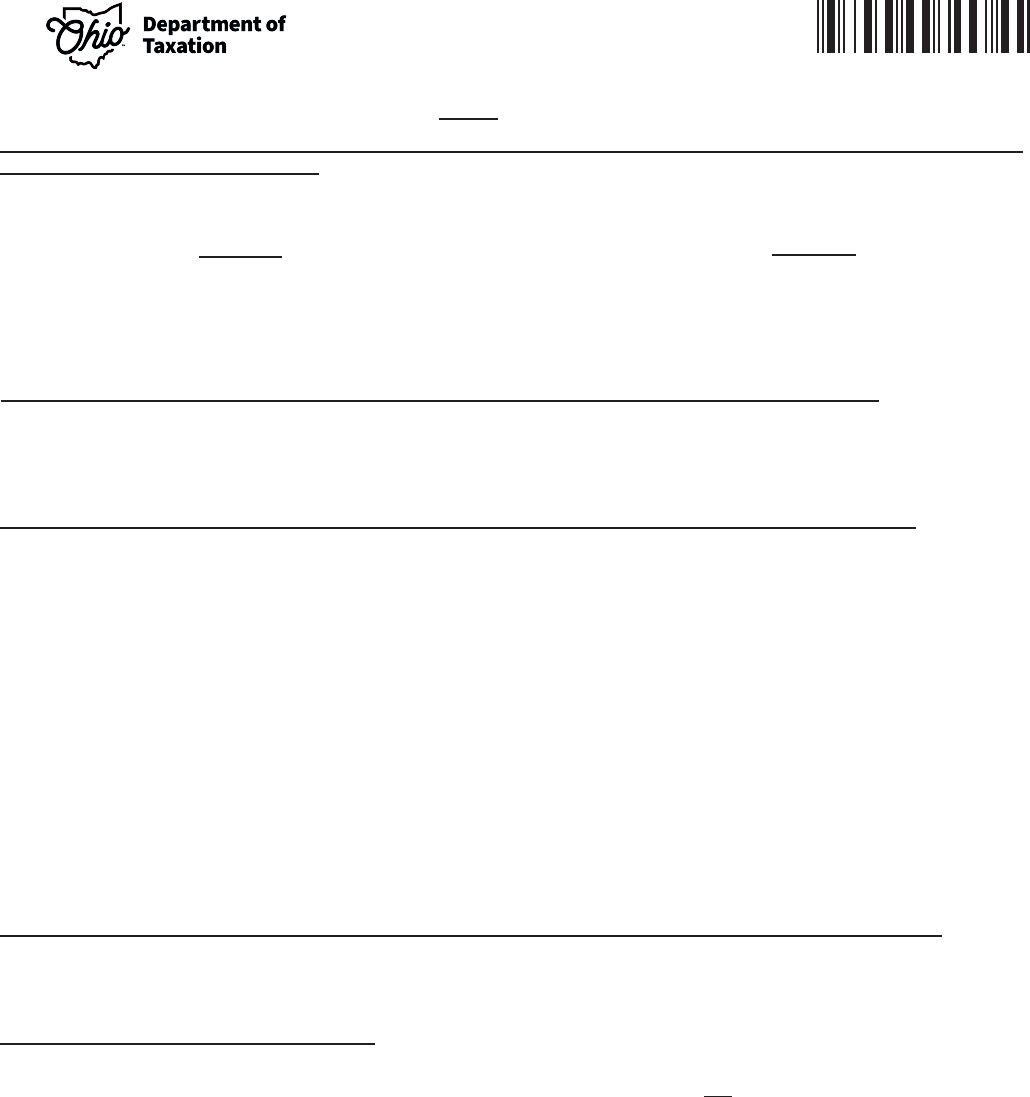

If your amended IT 1040 results in tax due, you should always include an OUPC payment coupon with your payment.

IT RE - Amended IT 1040

Filing Tips

When amending due to changes to my federal return, should I le my amended Ohio return(s) at the same time I le my

amended federal return with the IRS?

Refund: You should wait to le your amended Ohio IT 1040 and/or SD 100 until the IRS has approved the changes to your amended

federal return. When ling your amended returns, you must include:

Option #1

• A copy of your federal amended return (1040X), AND

• A copy of the IRS acceptance letter -or- refund check.

Option #2

• A copy of your updated IRS tax account transcript

reecting the changes to your federal return.

Tax Due: To reduce the amount of interest you will owe, you should le your amended Ohio IT 1040 and pay any tax due as soon as

possible.

What documentation should I include when amending to show a change in my Ohio residency status?

Submit any and all relevant information you believe supports your change in residency status from one state to another. Provide as

many relevant documents as possible. Relevant documents include, but are not limited to, the following: property records (mortgage

statements, lease agreements, etc.), driver's licenses or state IDs, voter registration, resident state tax returns, armed services records

and utility bills.

When should I NOT le an amended return?

Some common mistakes may not require an amended return. Instead, the Department of Taxation will either make the corrections or

contact you to request documentation. For example, the following mistakes generally do not require an amended return:

• Math errors;

• Missing return pages, schedules, or worksheets;

• Unclaimed withholding;**

• Missing credit certicate granted by the Ohio Department

of Development.

*Generally, unclaimed estimated and/or extension payments will automatically be added to your original return when led.

**If you have unclaimed withholding, please submit a detailed explanation along with legible copies of all income statements (W-2s and

1099s) showing the Ohio withholding amounts instead of ling an amended return.

For more information, see the FAQs at tax.ohio.gov/faq-Amended.

• Demographic errors (such as name, address or SSN

corrections);

• Unclaimed estimated and/or extension payments;*

What documentation should I include when amending to show a change to Ohio Schedule of Adjustments?

You should always include supporting documentation to substantiate your changes specic to the deduction. Some common deductions

and related documentation include, but are not limited to, the following:

Business income – Ohio Schedule of Business Income, page 1 and 2 of your federal return, the federal schedule(s) showing your

business income, federal K-1(s), wage and income statement(s), along with any other supporting documentation. Include a short state-

ment explaining your position on the amounts claimed as business income, along with all relevant facts and law used in making that

determination.

Disability/survivorship benets – A copy of your wages and income statements (such as 1099’s), page 1 and 2 of your federal return,

and your disability/survivorship plan. If you are deducting disability benets, you must also provide a letter from your employer from

when your disability was approved, your social security disability award letter, and your age at the time of disability.

Unreimbursed medical and health care expenses – A copy of Ohio's medical expense worksheet, federal Schedule A (if completed),

and proof of payments (cancelled checks, bank statements, credit card statements, etc.).

529 Plan Contributions – Proof of payments (cancelled checks, bank statements, credit card statements, etc.) and proof of an 529 ac-

count (by providing the plan year-end statement). If the statement is unavailable, (e.g. you are not the account holder), provide a list of

the beneciaries with the contribution dates and amounts. If the deduction is based on a prior year carryforward, provide proof of prior

year contributions for each beneciary.

What documentation should I include when amending to show a change to the nonresident or resident credit?

Nonresident credit: A copy of form IT NRC and all wage and income statements (W-2, 1099, K-1, etc.).

Resident credit: A copy of form IT RC, all other state returns and proof of taxes paid to other states (cancelled checks, transcripts).

2023 IT RE – page 2 of 2

10211411