SEC ROUNDTABLE

MARKET RUMORS AND TRADING HALTS

February 19, 1986

@

U.S. Securities and Exchange Commission

450 Fifth Street, N.W.

Washington, D.C. 20549

J

The members of the Commission attending the Roundtable were Chairman John Shad and Com-

missioners Charles C. Cox, Aulana L. Peters, Joseph A. Grundfest, and Edward H. Fleischman.

Participants. from outside the agency were:

\

George W. Bermant, Partner

Gibson Dunn.~ Crutcher

Denver, Colorado

Ivan Boesky, Chief Executive Officer

The Boesky Corporation

New York, New York

Boyd L. Jefferies, Chairman

Jefferies Et Co.

Los Angeles, California

Arthur Levitt, Jr., Chairman

American Stock Exchange Inc.

New York, New York

Professor Daniel R. Fischel

University of Chicago

Chicago, Illinois

Royce Griffin, President

North American Securities

Administrators Association

Denver, Colorado

Gordon S. Macklin, President

National Association of Securities

Dealers, Inc.

Washington, D.C.

John J. Phelan, Chairman

New York Stock Exchange

New York, New York

William A. Schreyer, Chairman

Merrill Lynch ~ Company Inc.

New York, New York

SEC staff participants included:

Alan L. Dye

Special Counsel to the-Chairman

Richard G. Ketchum

Director

Division of Market Regulation

Gary G. Lynch

Director

Division of Enforcement

INTRODUCTION

The SEC Roundtable on Market Rumors and Trading Halts was convened to discuss disclosure

of merger negotiations, trading halts, and the origin and effects of rumors in the marketplace. Sudden

and dramatic movements in the price of public companies' stocks have become a source of con-

cern for investors, public companies, regulators, self-regulatory organizations, and other market

participants. The purpose of the Roundtable was to afford the members of the Commission and

senior staff the benefit of the views of outside authorities and experts on important issues and

to develop solutions to perceived problems.

Issues and Actions

With a view to the possibility of recommending regulations or legislation, the SEC staff is review-

ing the following issues discussed:

Safe Harbor

Whether issuers should be granted a "safe harbor" if disclosures are accurate when made, without

requiring further announcements as a result of subsequent developments.

Disclosure of Extraordinary Events

Whether certain "extraordinary events" should be identified for the purpose of requiring issuers

to make immediate or prompt disclosure of such events.

Trading Halts

Whether trading in all markets should be halted when trading is suspended by the primary market.

Rewards to Informants

Whether rewards should be offered to persons who provide information that leads to successful

prosecution of violations of the securities laws, specifically market manipulation and insider trading.

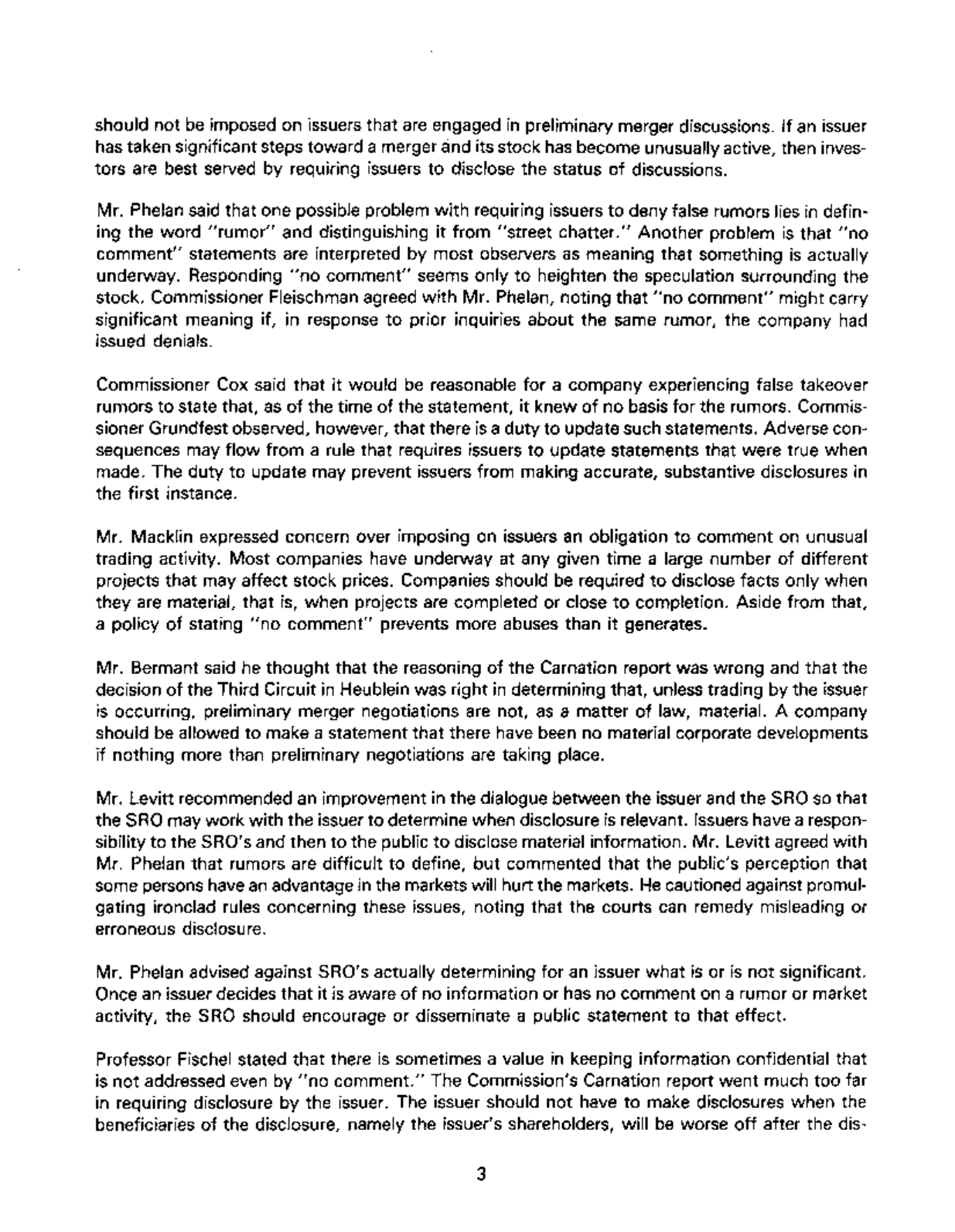

Chairman John Shad opened the

Roundtable by inviting additions to

the agenda.

Also pictured are William Schreyer

(right), Chairman of Merrill Lynch, and Alan Dye (left), Special Counsel to the Chairman.

Duty to Disclose

Issues

Whether and to what extent issuers should be required or permitted to disclose preliminary merger

negotiations or to respond to inquiries about market rumors affecting the market for the issuer's

stock.

Problem

Rumors of a pending merger or other material event, whether true or false, may cause substantial

movements in the price of an issuer's stock. Some observers have remarked that the Commis-

sion's recent Carnation report encourages companies to issue a

"no

comment" response to all

inquiries about market rumors rather than make substantive disclosures.

Views

Most participants agreed that issuers should make timely disclosure of material events, especially

when significant market activity in the issuer's stock suggests that word of the material event may

have leaked. There was concern, however, that issuers not be required to disclose information

prematurely, especially where disclosure might render the material event, e.g., a possible merger,

less likely to occur. Many participants stated that issuers should not be required to update state-

ments that, at the time they are made, are true, complete, and made in good faith. Others believed

that issuers should be required to update statements that continue to influence the marketplace.

Discussion

Mr. Lynch explained that the question whether an issuer has an affirmative duty to make disclosures

under the federal securities laws when its stock is the subject of rumors generally depends on an

interpretation of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5. The courts

have not imposed on issuers an affirmative duty to respond to market rumors unless the issuer

is offering, selling, or buying its own securities, or knows that the rumors are attributable to the

issuer itSelf. Mr. Lynch believed that the reluctance of issuers to confirm or deny rumors, coupled

with fewer and shorter trading halts, has contributed to the increased trading volatility in today's

markets.

Mr. Schreyer stated that takeover rumors are terribly disruptive to a company. Management's

first priority is to continue running the business and to assuage the fears and uncertainties of the

company's employees and shareholders. Management's primary obligation in dealing with false

rumors is to ensure that the company's public statements are true and not misleading. Counsel

for Merrill Lynch has advised the company that, based on the current state of the law, the compa-

ny should adopt a general policy of

"no

comment" in response to inquiries about rumors or mar-

ket activity and not issue a statement which may, as a result of subsequent developments, become

misleading or untrue and have to be amended. A policy of

"no

comment," however, does not

help calm the volatility of the stock or allay the concerns of employees and shareholders. Mr. Schreyer

said that he would like to have greater flexibility, in dealing with unfounded rumors, to state that

there is no truth to the rumors, without incurring a possible duty to update.

Mr. Boesky said that, as a general matter, more complete and accurate information for the mar-

ketplace is the desired result. For that reason, he said, the Commission reached the right result

in the Carnation report. Unless unusual trading activity is occurring, an affirmative duty to disclose

2

should not be imposed on issuers that are engaged in preliminary merger discussions. If an issuer

has taken significant steps toward a merger and its stock has become unusually active, then inves-

tors are best served by requiring issuers to disclose the status of discussions.

Mr. Phelan said that one possible problem with requiring issuers to deny false rumors lies in defin-

ing the word "rumor" and distinguishing it from "street chatter." Another problem is that

"no

comment" statements are interpreted by most observers as meaning that something is actually

underway. Responding

"'no

comment" seems only to heighten the speculation surrounding the

stock. Commissioner Fleischman agreed with Mr. Phelan, noting that

"no

comment" might carry

significant meaning if, in response to prior inquiries about the same rumor, the company had

issued denials.

Commissioner Cox said that it would be reasonable for a company experiencing false takeover

rumors to state that, as of the time of the statement, it knew of no basis for the rumors. Commis-

• sioner Grundfest observed, however, that there is a duty to update such statements. Adverse con-

sequences may flow from a rule that requires issuers to update statements that were true when

made. The duty to update may prevent issuers from making accurate, substantive disclosures in

the first instance.

Mr. Macklin expressed concern over imposing on issuers an obligation to comment on unusual

trading activity. Most companies have underway at any given time a large number of different

projects that may affect stock prices. Companies should be required to disclose facts only when

they are material, that is, when projects are completed or close to completion. Aside from that,

a policy of stating

"no

comment" prevents more abuses than it generates.

Mr. Bermant said he thought that the reasoning of the Carnation report was wrong and that the

decision of the Third Circuit in Heublein was right in determining that, unless trading by the issuer

is occurring, preliminary merger negotiations are not, as a matter of law, material. A company

should be allowed to make a statement that there have been no material corporate developments

if nothing more than preliminary negotiations are taking place.

Mr. Levitt recommended an improvement in the dialogue between the issuer and the SRO so that

the SRO may work with the issuer to determine when disclosure is relevant. Issuers have a respon-

sibility to the SRO's and then to the public to disclose material information. Mr. Levitt agreed with

Mr. Phelan that rumors are difficult to define, but commented that the public's perception that

some persons have an advantage in the markets will hurt the markets. He cautioned against promul-

gating ironclad rules concerning these issues, noting that the courts can remedy misleading or

erroneous disclosure.

Mr. Phelan advised against SRO's actually determining for an issuer what is or is not significant.

Once an issuer decides that it is aware of no information or has no comment on a rumor or market

activity, the SRO should encourage or disseminate a public statement to that effect.

Professor Fischel stated that there is sometimes a value in keeping information confidential that

is not addressed even by "no comment." The Commission's Carnation report went much too far

in requiring disclosure by the issuer. The issuer should not have to make disclosures when the

beneficiaries of the disclosure, namely the issuer's shareholders, will be worse off after the dis-

3

closure. If an issuer discloses preliminary merger negotiations, for example, the disclosure itself

may kill the deal. In that case, the shareholders will be substantially worse off because they will

lose the benefit of a value-increasing transaction. One can argue that "no comment" does not

sufficiently protect shareholders, and that something stronger is needed--perhaps even what might

otherwise be considered a misrepresentation. The value of the information can be realized only

if the issuer gives the impression that nothing is going on. Most shareholders, if asked, would

say that they would prefer for management to withhold information the disclosure of which would

destroy its value.

II

mm

,j.

\

i

i, )

t l,,J

From

left to right, NASD Chairman Gordon Macklin, Commissioner Aulana L. Peters, and George Bermant, a partner

of Gibson, Dunn ~ Crutcher.

Commissioner Peters stated that Professor Fischel's position seemed to be based on the assump-

tion that the body of shareholders remains static, which is incorrect. Shareholders are part of a

fluid marketplace where people buy and sell shares of a company all the time. Congress imposed

disclosure obligations because of such movement in the market. Changing disclosure obligations

to permit management to lie to the marketplace cannot be premised on the assumption that manage-

ment is protecting a static body of shareholders.

Mr. Griffin said that the protection of incumbent shareholders of a takeover target is not the primary

public policy behind the federal securities laws. There are other investors who would be harmed

by a policy that tolerated misstatements by management. The Commission did not go far enough

in the Carnation report and perhaps should promulgate a standard governing when preliminary

negotiations should or must be disclosed to the public.

4

Mr. Lynch stated that permitting management to mislead shareholders might lead to problems

in other contexts, such as financial disclosure. A company could argue that it should not disclose

that its sales are down because such a statement might diminish the company's sales even further

and thus hurt its shareholders.

Mr. Jefferies said that the marketplace is entitled to information, good, bad or indifferent. If the

market has the information, it will assess that information and appropriately determine the value

of the stock.

Chairman Shad asked whether a third party who has been identified in a false rumor as a potential

purchaser or bidder should be required to deny the rumor. Mr. Macklin responded that a regulato-

ry reach to third parties would be a major expansion of the securities laws which could be abused.

Commissioner Peters questioned whether a third party is ever really involved. There is a potential

target and a potential bidder, and Commission rules already establish the disclosure obligations

of bidders. It would be a drastic step to impose a disclosure obligation on a party merely because

its name appears in a newspaper article. Mr. Schreyer said that the law already requires adequate

disclosure and that additional disclosure obligations should not be imposed. Mr. Levitt comment-

ed that imposing a disclosure obligation on third parties would be unduly complicated. He sug-

gested that third parties are presently being held accountable through the efforts of the business

press, which has become sophisticated and probing enough to elicit a response or uncover infor-

mation.

Commissioner Grundfest asked Mr. Levitt what the law should require of a company whose em-

ployee in good faith denies the existence of negotiations when the company in fact is engaged

in preliminary negotiations known to only a few individuals in the company. In particular, should

the corporation have a duty to correct the unintentional misstatement? Mr. Levitt responded that

a duty to correct should not be imposed on the corporation. In large measure, this problem has

,4rbitrageur Ivan Boesky (left) stated his view that trading halts should be used sparingly. Also pictured are Commissioner

Edward H. Fleischman (center) and Arthur Levitt, Jr., Chairman of the American Stock Exchange.

5

corrected itself in the aftermath of Carnation. The press is now likely to ask company spokesmen

whether they are speaking of their personal knowledge or instead are speaking for the corporation.

Mr. Boesky said that there are identifiable "extraordinary events" the occurrence of which issuers

should have an obligation to disclose. Mr. Boesky and Mr. Griffin suggested that a rule be adopted

requiring such disclosure and listing the events considered extraordinary.

Commissioner Grundfest questioned whether it is possible to distinguish between an internal ex-

traordinary event, such as discovery of oil, and an external extraordinary event, such as negotia-

tions with third parties. Commissioner Fleischman suggested that there are two scenarios which

should be separated. Real merger negotiations give rise to the kind of question Mr. Boesky posed--

when is the information material? It is unlikely that the Commission could or would attempt to

craft a rule that defines materiality in the context of merger negotiations. As Mr. Phelan and Mr.

Levitt noted, however, there may be means available through the SRO's to elicit disclosure of

whatever information is available and thereby avoid harm.

Commissioner Fleischman said that the other scenario is where there are rumors of deals that do

not exist, and he asked the Roundtable participants to address this situation. Mr. Jefferies com-

mented that, because Wall Street profits from commission business, and stories generate com-

mission business, regulators will never be able to stop stories that affect the stock market, whether

these stories surface as rumors or research reports. Commissioner Fleishman said that research

reports are easily traceable, but questioned whether there are any mechanical means available

through the exchanges or the NASD to identify the sources of street chatter. Mr. Levitt said that

the relationship between the exchanges and their constituent companies allows the exchanges,

in questioning the companies, to determine whether a rumor is spurious.

Commissioner Fieischman asked whether the SRO's also have an obligation to go to their consti-

tuent members to find out what is happening on the floor when there is volatility in a stock. Mr.

Levitt said that the exchanges often do trace the trading in a volatile stock, but that the trail is

often very difficult to pursue. The individuals on the floor frequently do not know the origin and

nature of the rumor that has given rise to a particular trade. Mr. Macklin commented that, while

the NASD can persuade a company to make an announcement that rumors concerning the com-

pany are baseless, the NASD's reach is limited to its membership.

Chairman Shad concluded that the staff should review the possibility of granting a."safe harbor"

to issuers that respond accurately to rumors, without requiring further announcements as a result

of subsequent developments.

6

Trading Halts

Issue

Whether trading should be halted in all markets when the primary market suspends trading.

Problem

When an exchange suspends trading in a security or the NASD suspends the dissemination of

quotations through NASDAQ, many investors, particularly institutions and other sophisticated in-

vestors, continue to trade in the third market. The third market is not generally available to the

investing public, causing trading halts to have a disproportionate impact on public investors.

Moreover, partly as a result of third market activity, the NYSE has limited the duration of news

pending trading halts to thirty minutes.

Views

Most participants felt that trading halts are sometimes necessary but should be held to a minimum

in number and duration. During a trading halt, the issuer should be encouraged to confirm or deny

existing rumors or otherwise issue an announcement. Representatives of the American and New

York stock exchanges and the NASD contended that trading should be suspended in all markets

when suspended by the primary market. Other participants contended that sophisticated investors

should be permitted to trade in the third market, arguing that the competition provided by the

third market serves as an incentive to the primary market to react quickly to the problems that

necessitate trading halts.

Discussion

Mr. Phelan described the history of the NYSE's trading halt policies and practices. There are es-

sentially two types of trading halt. One results from an order imbalance, and the other, called a

regulatory halt, is imposed to permit an issuer to prepare and disseminate an announcement of

a material corporate development. In the early 1970's, regulatory halts lasted as long as several

days. With the subsequent increase in merger activity, the Exchange began to feel that it was be-

ing used as a tool by one or both parties to the transaction. At the same time, the market was

demanding increased liquidity in the subject stock. As a result, the duration of regulatory halts

has decreased over time to the present 30-minute period. During a trading halt, the Exchange makes

an inquiry of the issuer and publicizes its response, even if the response is

"no

comment." Current

market practices have given rise to two significant issues. First, when a regulatory halt is imposed,

should all markets halt trading for the duration of the trading halt? Second, when the market for

a stock becomes highly volatile, should a trading halt be imposed regardless of the issuer's willing-

ness to issue a statement?

Mr. Jefferies expressed philosophical opposition to trading halts, stating that investors should have

the opportunity to implement their investment decisions as soon as those decisions are made. Ideally,

the stock exchanges should be open twenty-four hours a day, seven days a week. Issuers them-

selves should never be permitted to request a trading halt, since they know the information giving

rise to the request and should disclose it rather than request a trading halt.

Mr. Phelan and Mr. Macklin stated that a news pending trading halt allows all market participants,

including small public investors, an opportunity to digest news before adjusting their trading deci-

sions. Mr. Phelan stated that the market includes investors of all levels of sophistication and that

7

¸

, ~/'11

Royce Griffin (left), President of the North Ametfcan Securities Administrators Association, and Commissioner Joseph

A. Grundfest.

all should have the benefit of the same information. Mr. Macklin suggested that trading halts for

material news may provide public customers an opportunity to adjust their pending market and

limit orders. In this connection, the NASD will soon propose a rule that will authorize the NASD

to halt trading in the over-the-counter market for material news. Mr. Levitt added that an across-

the-board prohibition of trading during a news pending situation would increase investor confi-

dence in the markets. Public investors lose confidence in the market when they witness institu-

tions trading during a trading halt; the perception is that institutions are unloading their stock at

a time when markets generally are inaccessible to public customers.

Commissioner Fleischman indicated that in a recent visit to the NYSE, he witnessed "trade dis-

continuity" caused by trading off the NYSE floor during a NYSE trading halt. Mr. Phelan noted

that prices frequently drop precipitously in such situations and said that this sort of volatility is

unacceptable in light of the unavailability of information in the market. Perhaps a trading halt should

be imposed in response to volatile trading regardless of whether news is pending. The NYSE is

considering the idea of halting trading briefly when the price of a stock drops by a certain percen-

tage, just to call attention to the circumstance.

Commissioner Grundfest questioned how a regulatory halt pending an announcement benefits in-

vestors, since the price of the stock after the announcement will be the same regardless of whether

there was a trading halt. Investors who do not want to trade on the basis of incomplete informa-

tion need only await the issuer's disclosure of the news and then trade at the same price they

would have received had there been a trading halt. During the interim, the only traders would be

those who wish to reduce or assume the risk associated with the period of uncertainty.

8

Mr. Phelan responded that smaller and less sophisticated investors are inclined to complain and

to lose confidence in the market when the issuer's eventual news release results in a decline in

the price of the stock. In those instances, investors tend to suspect that the persons trading during

the interim period enjoyed an informational advantage and, because a trading halt was not im-

posed, managed to avoid losses.

Commissioner Cox questioned whether investors are protected by a policy that prevents willing

buyers and sellers from trading. There is a wide spectrum of knowledge and sophistication among

investors, and market liquidity should not be eliminated in an effort to achieve parity of informa-

tion among all investors.

Professor Fischel stated that he understood trading halts to serve the interests of specialists and

market makers rather than investors. Specialists stand to lose a great deal of money if forced to

m.ake a market for customers who have better information than they do. Trading halts relieve

specialists of the obligation to make a market and give them time to gather more information about

the issuer. There is a cost to the specialists, however, if someone else is willing to make a market

during the trading halt. From the specialist's perspective, the ideal solution would be to prohibit

trading in other markets, thus preserving his customer base while relieving him of the risk of mak-

ing a market. Investors, on the other hand, are benefitted by third market activity in which the

most sophisticated investors establish a consensus on the value of information. The Commission

should not, therefore, allow any one exchange to force trading halts in other markets.

r AI

~i~!~ i! ~ ¸~¸ ~ili~i~, i~i ~ ...... i

John Phelan (center), Chairman of the New York Stock Exchange, discussed the difficulty of defining "rumors. " Profes-

sor Daniel Fischel (left) hypothesized that in some cases disclosure of information can reduce its value and thereby

diminish shareholder wealth. Commissioner Charles C. Cox is pictured at right.

9

Mr. Phelan responded that protection of the dealer has nothing to do with trading halts and that

a dealer has no involvement in the decision to halt trading. Since the mid-1970's, there has been

a regulatory thrust toward disseminating information to all of the investing public. If that goal is

still valid, all markets should be subject to the same rules to avoid placing any one market at a

competitive disadvantage.

Mr. Boesky commented that trading halts should be used sparingly. A more appropriate solution

to the problem is increased disclosure by issuers. Trading halts are unfair to less sophisticated in-

vestors, who do not have access to alternative markets. The threat of a trading halt may also serve

as a deterrent to institutional investors, who may be adversely affected by the elimination of li-

quidity. In those cases where a trading halt is appropriate, perhaps the Commission, under Sec-

tion 12(k) of the 1934 Act, could impose a tradinghalt on all markets.

Mr. Levitt agreed with Mr. Phelan that, if trading halts are not imposed across the board, competitive

pressures will cause the SRO's not to impose trading halts at all. Commissioner Peters observed

that the SRO's are subject to the conflicting pressures of competition and the obligation to ensure

the good conduct of their members. If trading halts are beneficial in some circumstances, then

perhaps the Commission should be one to impose them rather than require an SRO to do so at

the expense of that particular SRO's competitive position.

Professor Fischel argued that institutional and professional trading during trading halts benefits

the market by immediately reflecting the most sophisticated investors' pricing decisions. Trading

halts ultimately will not protect investors from adverse price volatility. While the pattern of trading

may differ in arriving at a price (depending on whether trading is or is not permitted during a news

pending situation), the ultimate market price will be the same after dissemination of the news.

Commissioner Grundfest agreed that news pending trading halts do not aid in the formulation of

the market price. Absent a trading halt, investors can avoid any volatility occurring as a result of

trading by simply holding their stock until after the news is disseminated. Commissioner Grundfest

questioned why those who have incurred costs to receive and react quickly to news should be

penalized by having to stop trading while others receive an extended opportunity to review the

situation.

Chairman Shad asked whether a uniform trading halt policy would be viable in view of the availa-

bility of foreign markets for U.S. securities. Mr. Boesky said that the interplay among world stock

markets is such that other countries are likely to cooperate in the development of an international

agreement on trading halts.

10

Rewards to Informants

Issue

Whether rewards should be offered to those who provide information that leads to successful

prosecutions and disgorgements.

Problem

Insider trading and market manipulation are difficult to detect and prove. Such cases are typically

based on circumstantial evidence. The detection and prosecution of violations could be facilitated

by informants, who identify wrongdoers and direct the staff to evidence of violations.

Views

Participants were divided on the question whether a reward program would be desirable or worka-

ble. Some who supported a reward program believed that the scope of such a program should

extend beyond market manipulation and insider trading to other types of violations, of which direct

rather than circumstantial evidence is difficult to obtain.

Discussion

Chairman Shad asked the participants whether the Commission should follow the lead of the In-

ternal Revenue Service and the Departments of Justice and Defense, which offer rewards to in-

formants, particularly in return for information regarding market manipulation and insider trading.

Mr. Levitt expressed his opposition to the idea of paying rewards to informants, stating that he

was against not onlythe SEC doing so, but also the reward program offered by the IRS. He com-

mented that the program would bring forward an enormous number of informants offering i~for-

mation of questionable value. Chairman Shad pointed out that the IRS has developed effective

methods of screening and qualifying informants. He suggested that the Commission might require

that the information be provided in writing and that informants sign acknowledgements that the

rewards are within the Commission's sole discretion.

Commissioner Cox supported the idea, noting that the Commission's present investigative tech-

niques usually result in prosecution of cases based on telephone records and other circumstantial

evidence. It would be more efficient to make a case using a credible witness providing direct evidence

of insider trading. Rewards are effective incentives to bring people forward with information. Chair-

man Shad added that it is especially difficult to trace and prove false and misleading rumors spread

for manipulative purposes.

Mr. Bermant expressed doubt whether a reward program would work and suggested that the SEC

would be provided with a lot of hearsay evidence. Chairman Shad stated that some of the SEC's

most important insider trading cases have been developed as a result of information provided by

informants.

Commissioner Peters suggested that another method of providing incentives to informants would

be to grant waivers of prosecution, or immunity. Any policy decision on the merits of adopting

a rewards program would have to take into account an analysis of benefits versus costs, and would

require a clear description of how the system would actually work. Chairman Shad noted that the

11

Commissioner Charles C. Cox (left) expressed support for exploring the feasibility of an informant reward program.

Also pictured is Boyd Jefferies, Chairman of Jefferies [t Co.

IRS recovered about $17 million last year, based on information for which it paid rewards of about

$400,000.

Mr. Griffin was of the view that paid informants would be useful, particularly in uncovering market

manipulation. Although he found the idea of paying informants philosophically distasteful, he recog-

nized that paid informants are used throughout the government and would be just as useful to

the SEC.

Professor Fischel opposed the concept of a reward program, stating that a reward program makes

more sense for the IRS than for the SEC. Tax fraud typically involves only one person and there-

fore is very difficult to observe and police. The absence of any "market check" in tax fraud may

justify the IRS's paying informants for information. Market manipulation, on the other hand, re-

quires action by the wrongdoer which convinces many other market participants to take action.

Among those market participants will be investors who lost money as a result of the manipulation.

Manipulation is therefore highly observable. In addition, when a stock price moves in one direction

then the other, it will always be in someone's interest to complain that he or she was the victim

of a manipulation. A reward program may merely increase the incentives unsuccessful traders al-

ready have to cry wolf to the SEC.

12

Mr. Lynch disagreed that market manipulation is easy to observe. Without the use of informants,

it is difficult to gather evidence that a person started a rumor. Informants can be helpful to a case

by appearing and testifying at trial, or by telling the Commission where to look for evidence of

a violation. A difficult issue is whether the Commission should pay for information from someone

who has played a role in the illegal conduct.

Commissioner Grundfest expressed the belief that a reward program could enhance market effi-

ciency if structured to target deceptive internal corporate activities that are otherwise difficult to

discover, e.g., cooked books. On the other hand, broadening the scope of a reward program would

increase the likelihood of attracting worthless tips rather than useful information. Commissioner

Grundfest suggested that the Commission narrowly focus the reward program to cover only those

violations that are almost universally viewed as harmful to market efficiency. This approach might

address some of the moral and practical concerns voiced by some of the participants and make

it easier to achieve a consensus that a reward program is appropriate.

Mr. Macklin remarked that an informant reward program may be an efficient way to deal with

the large volume of potential cases, and recommended further study. He also stated that, if the

SEC adopted a reward program, it should pay "cold cash for hard facts." Mr. Phelan suggested

that the Commission obtain further information from the IRS and others using reward programs

to determine possible harmful effects as well as potential benefits. Chairman Shad noted that the

GAO analyzed the IRS system and issued a positive report on the results.

Contrasting the Commission's situation with that of the I RS, Mr. Levitt asserted that any recovery

of revenue by the IRS is better than nothing, whereas in SEC disgorgement cases, paying infor-

mants from disgorged funds would deprive wronged investors of full compensation. Chairman Shad

pointed out that, without information from the informant in the first place, the SEC would not

have obtained disgorgement with which to recompense the victims. In addition, penalties paid

under the Insider Trading Sanctions Act are over and above the amount of disgorgement and are

payable to the U.S. Treasury rather than investors.

Commissioner Fleishman agreed that there is merit to the idea of a reward program. If~a program

is established to obtain information about clearly unlawful acts, it should not be limited to the in-

sider trading area. Financial fraud and other violations of the securities laws are susceptible to this

kind of approach.

13