1 ISE Regulatory Information Circular – April 1, 2008

STOCK EXCHANGE

Regulatory Information Circular

Circular

number:

2008-12 Contact: Russ Davidson

Date: April 1, 2008 Telephone: (646) 805-1857

Subject: CurrencyShares

Background Information on the Trusts

The Trusts are sponsored by Rydex Specialized Products LLC, d/b/a Rydex Investments

(the “Sponsor”). As more fully explained in the registration statements filed by the

Sponsor, on behalf of the Trusts, the Trusts are grantor trusts formed under the laws of

the State of New York pursuant to Depositary Trust Agreements. The Trusts are not

registered as investment companies under the Investment Company Act of 1940 (“1940

Act”) and, according to the registration statements, are not required to be registered

under the 1940 Act.

The shares (“Shares”) of each Trust represent beneficial ownership interests in the

underlying net assets of the issuing Trust, each consisting only of deposits of the

currency denoted by the name of the issuing Trust, less the expenses of the Trust.

According to the registration statements, the investment objective of each Trust is for the

Shares to reflect the price of the underlying currency. It is expected that Share prices will

fluctuate in response to fluctuations in the currency.

The Bank of New York is the trustee of the Trusts (“Trustee”), JPMorgan Chase Bank,

N.A., London Branch, is the depository for the Trusts (“Depository”), and Rydex

Distributors, Inc. is the distributor for the Trusts (“Distributor”).

As described more fully in the registration statements, the Trusts create and redeem

their Shares at their net asset value (“NAV”) only in aggregations of 50,000 Shares

(each, a “Basket”), in exchange for the amount of the underlying currency represented

by the Baskets being created or redeemed. The Shares are redeemable only in whole

Baskets, and in exchange for the underlying currency. Except when aggregated in

Baskets, the Shares may not be redeemed with the Trusts.

The registration statements for the Trusts describe the various fees and expenses for

the Shares.

For a more complete description of the Trusts and the underlying currencies, visit

www.CurrencyShares.com

.

ISE Regulatory Information Circular – April 1, 2008

2

Other Information about the Trusts

The Trusts are subject to various fees and expenses described in the registration

statements, and the amount of the underlying currencies required to create a Basket or

to be delivered upon a redemption of a Basket may gradually decrease over time in the

event that the Trusts are required to sell the underlying currencies to pay the Trusts’

expenses. The underlying currencies held by the Trusts will only be sold (i) if needed to

pay Trust expenses, (ii) in the event the Trust terminates and liquidates its assets or (iii)

as otherwise required by law or regulation.

The Shares will be evidenced by one or more global certificates that the Trustee will

issue to The Depository Trust Company (“DTC”). The Shares will be available only in

book-entry form; stock certificates will not be issued. DTC, or its nominee, is the record

or registered owner of all outstanding Shares.

The Trustee calculates the Trusts’ NAV every day that the New York Stock Exchange

(“NYSE”) is open for regular trading (a “Business Day”). When calculating NAV, the

Trustee values the underlying currencies held by the Trusts based on the Noon Buying

Rate, which is the USD/currency specific exchange rate as determined by the Federal

Reserve Bank of New York as of 12:00 p.m. (Eastern Standard Time) on each Business

Day. If, on a particular day, the Noon Buying Rate has not been determined and

announced by 2:00 p.m. (Eastern Standard Time), the Trustee will use the most recently

announced Noon Buying Rate to determine the Trusts’ NAV, unless the Trustee, in

consultation with the Sponsor, determines to apply an alternative basis for evaluation as

a result of extraordinary circumstances. The Trustee also determines the NAV per

Share, which equals the NAV of each Trust divided by the number of outstanding Shares

of each Trust.

The Sponsor publishes the NAV and NAV per Share each Business Day on the Trusts’

website, www.currencyshares.com

. In addition, NAV is available to National Securities

Clearing Corporation (“NSCC”) participants through data made available from NSCC.

Availability of Information Regarding Currency Prices

There is no regulated source of last sale information regarding the currencies and the

Securities and Exchange Commission (“SEC”) has no jurisdiction over the trading of the

currencies. Currently, the Consolidated Tape Association (“CTA”) does not provide for

the dissemination of the spot price of the underlying currencies over its facilities. The last

sale price for the Shares, however, will be disseminated over the CTA. Market prices for

the Shares will be available from a variety of sources, including brokerage firms,

financial information websites, and other information service providers.

Investors may obtain, on a 24-hour basis, foreign exchange pricing information based on

the currency spot price from various financial information service providers. Current

currency spot prices are generally available with bid/ask spreads from 2 foreign

exchange dealers. Complete realtime data for currency futures and options prices traded

on the Chicago Mercantile Exchange (“CME”) and the Philadelphia Stock Exchange

(“Phlx”) are available by subscription from information service providers. The CME and

Phlx also provide delayed futures and options information on current and past trading

sessions and market news free of charge on their respective websites.

ISE Regulatory Information Circular – April 1, 2008

3

There are a variety of other public websites that provide information on foreign currency,

such as Bloomberg www.bloomberg.com/markets/currencies/eurafr_currencies.html

),

which regularly reports current foreign exchange pricing for a fee. Other service

providers include CBS Market Watch

(www.marketwatch.com/tools/stockresearch/globalmarkets

) and Yahoo! Finance

(http://finance.yahoo.com/currency

). Many of these sites offer price quotations drawn

from other published sources, and as the information is supplied free of charge, it

generally is subject to time delays (typically, 15 to 20 minutes).

In addition to the NAV of the Trusts and the NAV per Share, the Trusts’ website, which is

publicly accessible at no charge, provides the following information: (i) the currency spot

prices, including the bid and offer and the midpoint between the bid and offer for each

currency spot price, updated every 5 to 10 seconds, (ii) an intraday indicative value

(“IIV”) per Share calculated by multiplying the indicative spot price of the underlying

currency by the quantity of the underlying currency backing each Share, on a 5 to 10-

second delayed basis; (iii) a 20-minute delayed basis indicative value, which is used for

calculating premium/discount information; (iv) premium/discount information, calculated

on a 20-minute delayed basis; (v) accrued interest per Share; (vi) the daily Noon Buying

Rate; (vii) the Basket Currency Amount; and (viii) the last sale price of the Shares as

traded in the U.S. market, subject to a 20-minute delay.

Purchases and Redemptions in Creation Unit Size

ISE Equity EAMs are hereby informed that procedures for purchases and redemptions of

Shares in Baskets are described in the prospectus for each Trust, and that Shares are

not individually redeemable but are redeemable only in Baskets or multiples thereof.

Principal Risks

Interested persons are referred to the discussion in the prospectus for a Trust of the

principal risks of an investment in that Trust. These include, but are not limited to, the

following:

• The value of the Shares relates directly to the value of the underlying currency held

by the Trust. Fluctuations in the price of the underlying currency could materially

and adversely affect the value of the Shares.

• The USD/foreign currency exchange rate, like foreign exchange rates in general,

can be volatile and difficult to predict. This volatility could materially and

adversely affect the performance of the Shares.

• The Shares are a new securities product. Their value could decrease if

unanticipated operational or trading problems were to arise.

• Shareholders will not have the protections associated with ownership of shares in

an investment company registered under the 1940 Act.

• The Shares may trade at a price which is at, above, or below the NAV per Share.

• The possible sale of the underlying currency by the Trusts to pay expenses, if

required, will reduce the amount of currencies represented by each Share on an

ongoing basis regardless of whether the price of a Share rises or falls in

response to changes in the price of the underlying currency.

• The sale of the Trusts’ deposited currency, if necessary, to pay expenses at a time

when the price of the currency is relatively low could adversely affect the value of

the Shares.

ISE Regulatory Information Circular – April 1, 2008

4

• Substantial sales of the underlying currency by the official sector could adversely

affect an investment in the Shares.

Exchange Rules Applicable to Trading in the Shares

Trading in the Shares on ISE is subject to ISE equity trading rules

.

Trading Hours

The Shares will trade on ISE between 9:00 a.m. and 4:00 p.m. Eastern Time.

Trading Halts

ISE will halt trading in the Shares of a Trust in accordance with ISE Rule 2101(a)(2)(iii)

.

The grounds for a halt under this Rule include a halt by the primary market because it

stops trading the Shares and/or a halt because dissemination of the IIV or applicable

currency spot price has ceased, or a halt for other regulatory reasons. In addition, ISE

will stop trading the Shares of a Trust if the primary market de-lists the Shares.

Delivery of a Prospectus

Consistent with the requirements of the Securities Act and the rules thereunder,

investors purchasing Shares in the initial public offering and anyone purchasing Shares

directly from the Trusts must receive a prospectus. In addition, Equity EAMs are required

to deliver a prospectus to all purchasers of newly-issued Shares (i.e. during the initial

public offering). Equity EAM s purchasing shares from the Trusts for resale to investors

will deliver a prospectus to such investors.

Prospectuses may be obtained through the Trust’s website at www.currencyshares.com

.

The prospectus does not contain all of the information set forth in the registration

statement (including the exhibits to the registration statement), parts of which have been

omitted in accordance with the rules and regulations of the SEC. For further information

about the Trusts, please refer to the registration statement.

Exemptive, Interpretive and No-Action Relief Under Federal Securities Regulations

The SEC has issued exemptive, interpretive or no-action relief from certain provisions of

rules under the Securities Exchange Act of 1934 (the “Act”) regarding trading in the

Shares. As this is only a summary of the relief granted by the SEC, interested members

should consult the Letter dated June 21, 2006 from Racquel L. Russell, Esq., Branch

Chief, Division of Market Regulation, to George T. Simon, Foley & Lardner LLP, and the

Letter dated January 19, 2006 from James A Brigagliano, Assistant Director, SEC

Division of Market Regulation to Michael Schmidtberger, Sidley, Austin, Brown & Wood,

for more complete information regarding the trading practices relief granted by the SEC.

Borrowing and Delivery Requirements

No Equity EAM shall accept, represent or execute for its own account or the account of

any other person an order to sell Shares on the ISE unless such Equity EAM complies

with Regulation SHO under the Exchange Act; provided, however, that transactions,

securities or persons exempted from Regulation SHO under the Exchange Act by

ISE Regulatory Information Circular – April 1, 2008

5

paragraph (d) of Rule 242.203 of Regulation SHO also are exempted from the

requirements of this paragraph.

Regulation M Exemptions

Generally, Rules 101 and 102 of Regulation M prohibit any "distribution participant" and

its "affiliated purchasers" from bidding for, purchasing, or attempting to induce any

person to bid for or purchase any security which is the subject of a distribution until after

the applicable restricted period, except as specifically permitted in Regulation M. The

provisions of the Rules apply to underwriters, prospective underwriters, brokers, dealers,

and other persons who have agreed to participate or are participating in a distribution of

securities, and affiliated purchasers of such persons.

The SEC has granted an exemption from paragraph (d) of Rule 101 under Regulation M

to permit persons who may be deemed to be participating in a distribution of Shares to

bid for or purchase Shares during their participation in such distribution. The SEC also

has granted an exemption from Rule 101 to permit the Distributor to publish research

during the applicable restricted period on the Trusts’ website.

Rule 102 of Regulation M prohibits issuers, selling security holders, or any affiliated

purchaser of such person from bidding for, purchasing, or attempting to induce any

person to bid for or purchase a covered security during the applicable restricted period in

connection with a distribution of securities effected by or on behalf of an issuer or selling

security holder. Rule 100 of Regulation M defines “distribution” to mean any offering of

securities that is distinguished from ordinary trading transactions by the magnitude of the

offering and the presence of special selling efforts and selling methods. The SEC has

granted an exemption from paragraph (e) of Rule 102 to permit the Trusts and their

respective affiliated purchasers to redeem Shares during the continuous offering of the

Shares.

Section 11(d)(1); SEC Rules 11d1-1 and 11d1-2

Section 11(d)(1) of the Exchange Act generally prohibits a person who is both a broker

and a dealer from effecting any transaction in which the broker-dealer extends credit to a

customer on any security which was part of a new issue in the distribution of which he or

she participated as a member of a selling syndicate or group within thirty days prior to

such transaction.

The SEC has taken a no-action position under Section 11(d)(1) of the Exchange Act if

broker-dealers (other than the Distributor) that do not create or redeem Shares but

engage in both proprietary and customer transactions in Shares exclusively in the

secondary market extend or maintain or arrange for the extension or maintenance of

credit on Shares in connection with such secondary market transactions.

The SEC has also taken a no-action position under Section 11(d)(1) of the Exchange Act

that broker-dealers (other than the Distributor) may treat Shares of the Trusts, for

purposes of Rule 11d1-2, as “securities issued by a registered . . . open-end investment

company as defined in the Investment Company Act” and thereby, extend credit or

maintain or arrange for the extension or maintenance of credit on the Shares that have

ISE Regulatory Information Circular – April 1, 2008

6

been owned by the persons to whom credit is provided for more than 30 days, in

reliance on the exemption contained in the rule.

The SEC has also taken a no-action position under Section 11(d) of the Exchange Act if

an Authorized Participant (“AP”) extends or maintains or arranges for the extension or

maintenance of credit on Shares in reliance on the class exemption granted in the Letter

re: Derivative Products Committee of the Securities Industry Association (“SIA”)

(November 21, 2005), provided (1) that the AP does not receive from the Trust, directly

or indirectly, any payment, compensation or other economic incentive to promote or sell

the Shares to persons outside the Trust, other than non-cash compensation permitted

under FINRA Rule 2830(I)(5)(A), (B), or (C); and (2) the AP does not extend, maintain or

arrange for the extension or maintenance of credit to or for a customer on Shares before

thirty days from the start of trading in the Shares (except as otherwise permitted

pursuant to Rule 11d1-1). (See letter from Catherine McGuire, Chief Counsel, SEC

Division of Market Regulation, to SIA Derivative Products Committee, dated November

21, 2005, available on http://www.sec.gov

.)

This Regulatory Information Circular is not a statutory prospectus. ISE Equity

EAMs should consult the prospectus for a Trust and the Trusts’ website at

www.currencyshares.com

for relevant information.

Please contact me with any inquiries regarding this Regulatory Information Circular.

ISE Regulatory Information Circular – April 1, 2008

7

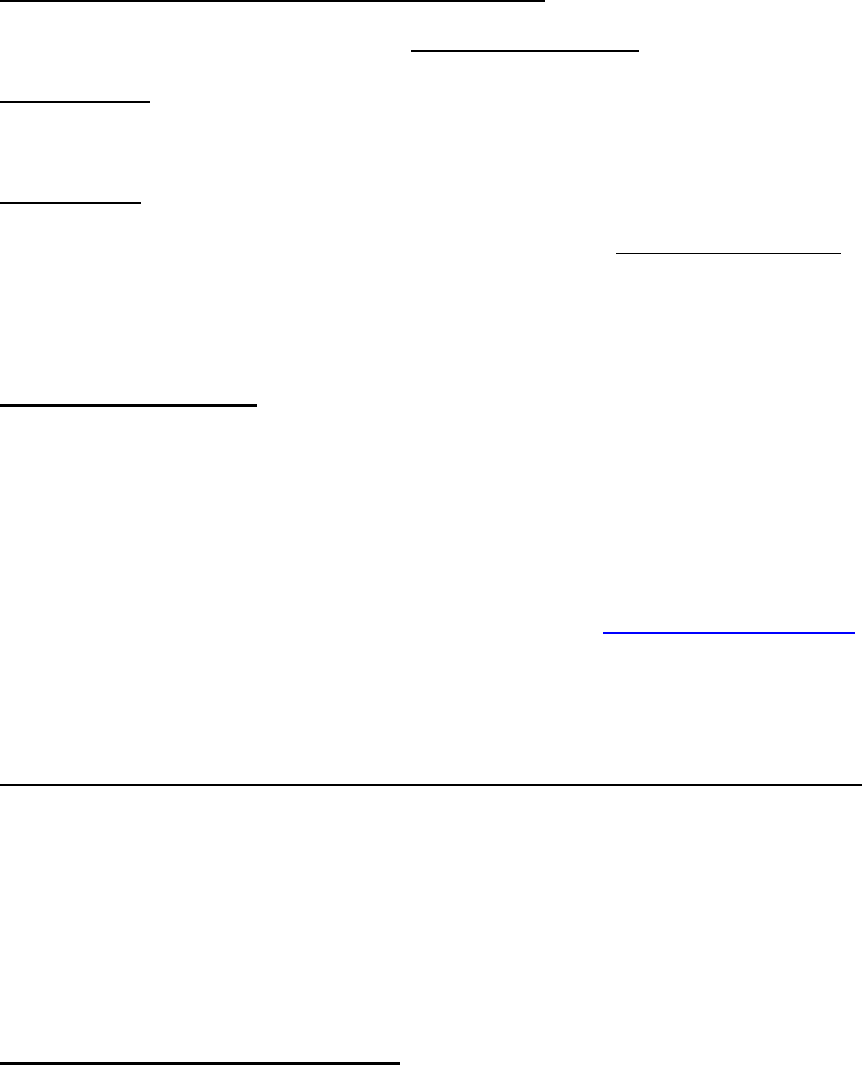

Appendix A

Exchange-Traded Fund Symbol CUSIP Number

Appendix A –CurrencyShares

Ticker Fund Name CUSIP

FXA CurrencyShares Australian Dollar Trust 23129U 10 1

FXB CurrencyShares British Pound Sterling Trust 23129S 10 6

FXC CurrencyShares Canadian Dollar Trust 23129X 10 5

FXE CurrencyShares Euro Trust 23130C 10 8

FXF CurrencyShares Swiss Franc Trust 23129V 10 9

FXM CurrencyShares Mexican Peso Trust 23130H 10 7

FXS CurrencyShares Swedish Krona Trust 23129R 10 8

FXY CurrencyShares Japanese Yen Trust 23130A 10 2